0001439288false00014392882024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of Earliest Event Reported): February 6, 2024

| | |

| ZURN ELKAY WATER SOLUTIONS CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | 001-35475 | 20-5197013 |

| (State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | |

| 511 W. Freshwater Way | | | 53204 |

| Milwaukee, | Wisconsin | | | |

| (Address of Principal Executive Offices) | | | (Zip Code) |

(855) 480-5050

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock $.01 par value | ZWS | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Zurn Elkay Water Solutions Corporation (the "Company") is filing this Current Report on Form 8-K to furnish its earnings release dated February 6, 2024, regarding its financial results for the quarter ended December 31, 2023, which is furnished herewith as Exhibit 99.1.

The information in this Item, including Exhibit 99.1, is “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liability of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Inline XBRL data embedded within the Inline XBRL document |

* This exhibit is furnished pursuant to Item 2.02 and shall not be deemed to be “filed.”

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, Zurn Elkay Water Solutions Corporation has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized this 6th day of February, 2024.

| | | | | | | | |

| |

| ZURN ELKAY WATER SOLUTIONS CORPORATION | |

| |

| By: | /S/ Mark W. Peterson |

| | Mark W. Peterson | |

| | Senior Vice President and Chief Financial Officer | |

Exhibit 99.1

| | | | | |

| | Press Release |

| |

February 6, 2024 | Contact Information: |

| |

| For Immediate Release | Dave Pauli |

| | Vice President - Investor Relations |

| | 414.223.7770 |

Zurn Elkay Water Solutions Reports Fourth Quarter 2023 Financial Results

Investor call scheduled for Wednesday, February 7, 2024 at 8:30 a.m. Eastern Time

MILWAUKEE, WI (USA) - Zurn Elkay Water Solutions Corporation (NYSE:ZWS)

Fourth Quarter Highlights

•Net sales increased 5% to $357 million compared with $340 million in last year’s December quarter (+5% core sales(1)).

•Net income from continuing operations was $14 million (diluted EPS from continuing operations of $0.08) compared with net income from continuing operations of $10 million (diluted EPS from continuing operations of $0.06) in the year-ago quarter.

•Adjusted diluted EPS(1) was $0.26 compared with $0.16 in the year-ago quarter.

•Adjusted EBITDA(1) was $84 million (23.6% of net sales) compared with $65 million (19.0% of net sales) in last year's fourth quarter.

•Net debt leverage(1) of 1.1x as of December 31, 2023.

•Deployed $25 million to repurchase 0.8 million shares of common stock in the quarter.

•Prepaid $60 million of our outstanding Term Loan.

Calendar Year 2023 Highlights

•Net sales were $1,531 million and increased by 19% from the comparable $1,282 million in calendar year 2022 (-1% core sales(1) inclusive of a 400 basis point impact from planned product line exits, +20% from acquisitions)

•Net income from continuing operations was $104 million (diluted EPS from continuing operations of $0.59), compared with $57 million (diluted EPS from continuing operations of $0.37) in calendar year 2022.

•Adjusted diluted EPS(1) was $0.97, compared with $0.94 in the prior calendar year.

•Adjusted EBITDA(1) was $340 million (22.2% of net sales) compared with $265 million (20.6% of net sales) in calendar year 2022.

•Completed $125 million of common stock repurchases and paid $50 million in common stock dividends.

•Generated record free cash flow(1) of $233 million.

Todd A. Adams, Chairman and Chief Executive Officer of Zurn Elkay, commented, “2023 was a year focused on completing the integration of Elkay and capturing the related synergies while executing against our growth initiatives, with a priority on growing our clean drinking water platform. We are seeing the benefits of our efforts to build awareness around the need for clean filtered drinking water and targeted focus on K-12 schools and higher education pay off as our drinking water sales and orders both grew double-digits over the prior year. We also delivered on the $25 million of synergies we committed to as well as substantially completing the work to deliver another $25 million in 2024. We generated a record $233 million of free cash flow(1) and executed a balanced capital allocation strategy while ending the year with leverage at an all-time low."

Adams continued, "With respect to the fourth quarter, we had a strong finish to the year as we delivered sales, Adjusted EBITDA and margins above the expectations we communicated 90 days ago. Core sales(1) increased 5% year over year inclusive of a 400 basis point impact from product line exits. Excluding that impact, core sales(1) increased 9% from the prior year with growth across nearly all product categories as well as the benefit from the prior year fourth quarter comparable. Our

adjusted EBITDA margin expanded 460 bps over the prior year fourth quarter as the improved commodity and transportation cost environment coupled with our cost synergies read through our results as we had previously communicated.”

"As we look ahead to 2024, we believe we are well positioned to drive superior results in a variety of end market scenarios given the momentum we are building in our clean drinking water platform as well as our other growth initiatives and the $25 million of additional cost synergies we expect to deliver in 2024. Our strong balance sheet provides us with capital allocation flexibility going forward and the ability to execute against our funnel of proprietary acquisition targets while remaining balanced with share repurchase and dividends."

"In the coming weeks you will see us release our 2023 sustainability report that highlights the progress we continue to make with respect to sustainability. We continue to make enhancements to our sustainability program and our pursuit of helping our customers protect the vital resource of clean water has never been stronger. In the upcoming report you will see expanded discussion around our role as stewards of water, progress towards the various goals we have set as well as initiating several new goals focused on the environment and our people. We are excited to continue to build on the momentum we have around sustainability in our company."

First Quarter and Full Year Outlook

“Based on demand trends as we exited the fourth quarter and the month of January, we believe net sales for the first quarter will be up low single digits on a proforma basis and adjusted EBITDA(1) margin will be between 23.5% and 24.0%. As we look ahead to the full year we have confidence in our ability to drive growth and deliver approximately 150 bps of year over year adjusted EBITDA margin expansion. Additionally, we see our full year 2024 outlook for free cash flow(1) to be approximately $250 million."

Fourth Quarter 2023 Overview

Net sales were $356.8 million and $340.3 million during the three months ended December 31, 2023 and December 31, 2022, respectively, an increase of 5% year over year. Core sales(1) increased 5% year over year, inclusive of a 400 basis point impact from planned product line exits, driven by growth across nearly all of our product categories as well as the benefit from the prior year comparable that was impacted by channel partners reducing inventory levels.

During the three months ended December 31, 2023, income from operations was $32.8 million compared to income from operations of $19.8 million during the three months ended December 31, 2022. Income from operations as a percentage of net sales increased by 340 basis points year over year due to the benefits resulting from productivity synergies and restructuring actions related to the Elkay merger as well as lower material and transportation costs, partially offset by the loss on divestiture of asbestos liabilities and certain assets.

Adjusted EBITDA(1) was $84.1 million, or 23.6% of net sales, during the three months ended December 31, 2023 compared to $64.6 million, or 19.0% of net sales, during the three months ended December 31, 2022.

(1) Refer to "Non-GAAP Financial Measures" for a definition of this non-GAAP metric, as well as the accompanying reconciliations to GAAP.

Non-GAAP Financial Measures

The following non-GAAP financial measures are utilized by management in comparing our operating performance on a consistent basis. We believe that these financial measures are appropriate to enhance an overall understanding of our underlying operating performance trends compared to historical and prospective periods and our peers. Management also believes that these measures are useful to investors in their analysis of our results of operations and provide improved comparability between fiscal periods as well as insight into the compliance with our debt covenants. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information calculated in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures. A reconciliation of non-GAAP financial measures presented above to our GAAP results has been provided in the financial tables included in this press release.

Core Sales

Core sales excludes the impact of acquisitions (such as Elkay), divestitures and foreign currency translation. Management believes that core sales facilitates easier and more meaningful comparison of our net sales performance with prior and future periods and to our peers. We exclude the effect of acquisitions and divestitures because the nature, size and number of acquisitions and divestitures can vary dramatically from period to period and between us and our peers, and can also obscure underlying business trends and make comparisons of long-term performance difficult. We exclude the effect of foreign currency translation from this measure because the volatility of currency translation is not under management's control.

Adjusted Net Income and Adjusted Earnings Per Share

Adjusted net income and adjusted earnings per share (calculated on a diluted basis) exclude actuarial gains and losses on pension and other postretirement benefit obligations, restructuring and other similar charges, gains or losses on divestitures, discontinued operations, gains or losses on extinguishment of debt, the impact of acquisition-related fair value adjustments in connection with purchase accounting, amortization of intangible assets, the adjustment to state inventories at last-in first-out costs, and other non-operational, non-cash or non-recurring losses, net of their income tax impact. The tax rates used to calculate adjusted net income and adjusted earnings per share are based on a transaction specific basis. We believe that adjusted net income and adjusted earnings per share are useful in assessing our financial performance by excluding items that are not indicative of our core operating performance or that may obscure trends useful in evaluating our continuing results of operations.

EBITDA

EBITDA represents earnings from continuing operations before interest and other debt related activities, taxes, depreciation and amortization. EBITDA is presented because it is an important supplemental measure of performance and it is frequently used by analysts, investors and other interested parties in the evaluation of companies in our industry. EBITDA is also presented and compared by analysts and investors in evaluating our ability to meet debt service obligations. Other companies in our industry may calculate EBITDA differently. EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to net income as indicators of operating performance or any other measures of performance derived in accordance with GAAP. Because EBITDA is calculated before recurring cash charges, including interest expense and taxes, and is not adjusted for capital expenditures or other recurring cash requirements of the business, it should not be considered as a measure of discretionary cash available to invest in the growth of the business.

Adjusted EBITDA

“Adjusted EBITDA” is the term we use to describe EBITDA as defined and adjusted in our credit agreement, which is net income, adjusted for the items summarized in the Reconciliation of GAAP to Non-GAAP Financial Measures table below. Adjusted EBITDA is intended to show our unleveraged, pre-tax operating results and therefore reflects our financial performance based on operational factors, excluding non-operational, non-cash or non-recurring losses or gains. In view of our debt level, it is also provided to aid investors in understanding our compliance with our debt covenants. Adjusted EBITDA is not a presentation made in accordance with GAAP, and our use of the term Adjusted EBITDA varies from others in our industry. Adjusted EBITDA should not be considered as an alternative to net income, income from operations or any other performance measures derived in accordance with GAAP. Adjusted EBITDA has important limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for, analysis of our results as reported under GAAP. For example, Adjusted EBITDA does not reflect: (a) our capital expenditures, future requirements for capital expenditures or contractual commitments; (b) changes in, or cash requirements for, our working capital needs; (c) the significant interest expenses, or the cash requirements necessary to service interest or principal payments, on our debt; (d) tax payments that represent a reduction in cash available to us; (e) any cash requirements for the assets being depreciated and amortized that may have to be replaced in the future; or (f) the impact of earnings or charges resulting from matters that we and the lenders under our credit agreement may not consider indicative of our ongoing operations. In particular, our definition of Adjusted EBITDA allows us to add back

certain non-cash, non-operating or non-recurring charges that are deducted in calculating net income, even though these are expenses that may recur, vary greatly and are difficult to predict and can represent the effect of long-term strategies as opposed to short-term results. “Adjusted EBITDA Margin” is the term we use to describe Adjusted EBITDA divided by net sales.

In addition, certain of these expenses can represent the reduction of cash that could be used for other corporate purposes. Further, although not included in the calculation of Adjusted EBITDA below, the measure may at times allow us to add estimated cost savings and operating synergies related to operational changes ranging from acquisitions to dispositions to restructurings and/or exclude one-time transition expenditures that we anticipate we will need to incur to realize cost savings before such savings have occurred. Further, management and various investors use the ratio of total debt less cash to Adjusted EBITDA (which includes a full pro-forma last-twelve-month impact of acquisitions), or "net debt leverage", as a measure of our financial strength and ability to incur incremental indebtedness when making key investment decisions and evaluating us against peers. Lastly, management and various investors use the ratio of the change in Adjusted EBITDA divided by the change in net sales (referred to as “incremental margin” in the case of an increase in net sales or “decremental margin” in the case of a decrease in net sales) as an additional measure of our financial performance and when making key investment decisions and evaluating us against peers.

Free Cash Flow

We define Free Cash Flow as cash flow from operations less capital expenditures, and we use this metric in analyzing our ability to service and repay our debt and to forecast future periods. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service our debt. We define Free Cash Flow Conversion as Free Cash Flow divided by net income.

Return on Invested Capital (“ROIC”)

ROIC is used because we believe it is an important supplemental measure of financial performance and it is also currently a performance measure under our long-term incentive plan. ROIC is frequently used by analysts, investors and other interested parties in the evaluation of companies in our industry. ROIC is also used by investors and analysts to evaluate management’s deployment of capital to create shareholder value. We define ROIC as tax-effected net operating income for the last 12 months divided by average total invested capital over a rolling four-quarter period. Total invested capital is defined as shareholders equity plus debt, less cash and cash equivalents. Other companies may not define or calculate ROIC in the same way.

About Zurn Elkay Water Solutions

Headquartered in Milwaukee, Wisconsin, Zurn Elkay Water Solutions is a growth-oriented, pure-play water management business that designs, procures, manufactures, and markets what we believe to be the broadest sustainable product portfolio of specification-driven water management solutions to improve health, human safety and the environment. Our product portfolio includes professional grade water safety and control products, flow system products, hygienic and environmental products, and filtered drinking water products for public and private spaces that deliver superior value to building owners, positively impact the environment and human hygiene and reduce product installation time. Additional information about Zurn Elkay Water Solutions can be found at www.zurnelkay.com.

Conference Call Details

Zurn Elkay Water Solutions will hold a conference call and webcast presentation on Wednesday, February 7, 2024, at 8:30 a.m. Eastern Time to discuss its fourth quarter 2023 results, provide a general business update and respond to investor questions. Zurn Elkay Water Solutions Chairman and CEO, Todd Adams, and Senior Vice President and CFO, Mark Peterson, will co-host the call and webcast. The conference call can be accessed via telephone as follows:

Domestic toll-free: 888-510-2359

International toll: 646-960-0215

Access Code: 7660247

A live webcast of the call will also be available on the Company's investor relations website. Please go to the website (investors.zurnelkay.com) at least 15 minutes prior to the start of the call to register, download and install any necessary audio software.

If you are unable to participate during the live teleconference, a replay of the conference call will be available two hours after the call's completion until 10:59 p.m. Central Time, February 14, 2024. To access the replay, please dial 800-770-2030 (domestic) or 647-362-9199 (international). The Conference ID for the replay is: 7660247. The replay will also be available as a webcast on the Company's investor relations website.

Cautionary Statement on Forward-Looking Statements

Information in this release may involve outlook, expectations, beliefs, plans, intentions, strategies or other statements regarding the future, which are forward-looking statements. These forward-looking statements involve risks and uncertainties. All forward-looking statements included in this release are based on information available to Zurn Elkay Water Solutions as of the date of this release, and Zurn Elkay Water Solutions assumes no obligation to update any such forward-looking statements. The statements in this release are not guarantees of future performance, and actual results could differ materially from current expectations. Numerous factors could cause or contribute to such differences. Please refer to “Risk Factors” and “Cautionary Notice Regarding Forward-Looking Statements” in our report on Form 10-K for the period ended December 31, 2023, as well as the Company’s subsequent annual, quarterly and current reports filed on Forms 10-K, 10-Q and 8-K from time to time with the Securities and Exchange Commission for a further discussion of the factors and risks associated with the business.

Zurn Elkay Water Solutions Corporation and Subsidiaries

Condensed Consolidated Statements of Operations

(in Millions, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net sales | $ | 356.8 | | | $ | 340.3 | | | $ | 1,530.5 | | | $ | 1,281.8 | |

| Cost of sales | 200.9 | | | 230.9 | | | 882.4 | | | 816.3 | |

| Gross profit | 155.9 | | | 109.4 | | | 648.1 | | | 465.5 | |

| Selling, general and administrative expenses | 93.6 | | | 72.4 | | | 371.3 | | | 309.0 | |

| Restructuring and other similar charges | 3.4 | | | 2.3 | | | 15.3 | | | 15.4 | |

| Loss on divestiture of asbestos liabilities and certain assets | 11.4 | | | — | | | 11.4 | | | — | |

| Amortization of intangible assets | 14.7 | | | 14.9 | | | 58.7 | | | 34.0 | |

| Income from operations | 32.8 | | | 19.8 | | | 191.4 | | | 107.1 | |

| Non-operating expense: | | | | | | | |

| Interest expense, net | (8.7) | | | (8.9) | | | (38.5) | | | (26.9) | |

| Loss on the extinguishment of debt | (0.9) | | | — | | | (0.9) | | | — | |

| Actuarial gain on pension and other postretirement benefit obligations | 2.0 | | | 1.9 | | | 2.0 | | | 1.9 | |

| Other income (expense), net | (3.9) | | | 1.4 | | | (7.2) | | | 1.7 | |

| Income before income taxes | 21.3 | | | 14.2 | | | 146.8 | | | 83.8 | |

| Provision for income taxes | (7.8) | | | (3.9) | | | (42.6) | | | (26.8) | |

| | | | | | | |

| Net income from continuing operations | 13.5 | | | 10.3 | | | 104.2 | | | 57.0 | |

| Income from discontinued operations, net of tax | 0.4 | | | 3.9 | | | 8.5 | | | 4.7 | |

| Net income | $ | 13.9 | | | $ | 14.2 | | | $ | 112.7 | | | $ | 61.7 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic net income per share: | | | | | | | |

| Continuing operations | $ | 0.08 | | | $ | 0.06 | | | $ | 0.60 | | | $ | 0.38 | |

| Discontinued operations | $ | — | | | $ | 0.02 | | | $ | 0.05 | | | $ | 0.03 | |

| Net income | $ | 0.08 | | | $ | 0.08 | | | $ | 0.65 | | | $ | 0.41 | |

| Diluted net income per share: | | | | | | | |

| Continuing operations | $ | 0.08 | | | $ | 0.06 | | | $ | 0.59 | | | $ | 0.37 | |

| Discontinued operations | $ | — | | | $ | 0.02 | | | $ | 0.05 | | | $ | 0.03 | |

| Net income | $ | 0.08 | | | $ | 0.08 | | | $ | 0.64 | | | $ | 0.40 | |

| Weighted-average number of shares outstanding (in thousands): | | | | | | | |

| Basic | 173,119 | | | 177,938 | | | 174,251 | | | 151,581 | |

| Effect of dilutive equity awards | 2,738 | | | 2,068 | | | 3,008 | | | 2,256 | |

| Diluted | 175,857 | | | 180,006 | | | 177,259 | | | 153,837 | |

Zurn Elkay Water Solutions Corporation and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Measures

Three Months Ended December 31, 2023

(in Millions) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| | Reported Results | | | | Adjustments | | | | Non-GAAP Results | | |

| | | | | | | | | | | | |

| Net Sales | | $ | 356.8 | | | | | $ | — | | | | | $ | 356.8 | | | |

| | | | | | | | | | | | |

| EBITDA | | 54.4 | | | | | 29.7 | | (a) | | | 84.1 | | | |

| Depreciation and amortization | | (21.6) | | | | | — | | | | | (21.6) | | | |

| Income from operations | | 32.8 | | | | | 29.7 | | (b) | | | 62.5 | | | |

| | | | | | | | | | | | |

| Income before income taxes | | 21.3 | | | | | 37.7 | | (c) | | | 59.0 | | | |

| Provision for income taxes and indicated rate | | (7.8) | | | 36.6 | % | | (5.8) | | | 15.4 | % | | (13.6) | | | 23.1 | % |

| | | | | | | | | | | | |

| Net income from continuing operations | | 13.5 | | | | | 31.9 | | | | | 45.4 | | | |

| | | | | | | | | | | | |

| Income from discontinued operations, net of tax | | 0.4 | | | | | (0.4) | | | | | — | | | |

| Net income | | $ | 13.9 | | | | | $ | 31.5 | | | | | $ | 45.4 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | EBITDA Adjustments (a) | | | | Income from Operations Adjustments (b) | | | | Income before Income Taxes Adjustments (c) | | |

| Restructuring and other similar charges | | $ | 3.4 | | | | | $ | 3.4 | | | | | $ | 3.4 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Last-in-first-out inventory adjustments | | 5.4 | | | | | 5.4 | | | | | 5.4 | | | |

| Stock-based compensation expense | | 9.5 | | | | | 9.5 | | | | | — | | | |

| Amortization of intangible assets | | — | | | | | — | | | | | 14.7 | | | |

| Other expense, net (1) | | — | | | | | — | | | | | 3.9 | | | |

| Actuarial gain on pension and other postretirement benefit obligations | | — | | | | | — | | | | | (2.0) | | | |

| Loss on the extinguishment of debt | | — | | | | | — | | | | | 0.9 | | | |

| Loss on divestiture of asbestos liabilities and certain assets | | 11.4 | | | | | 11.4 | | | | | 11.4 | | | |

| Total Adjustments | | $ | 29.7 | | | | | $ | 29.7 | | | | | $ | 37.7 | | | |

____________________

(1)Other expense, net for the periods indicated, consists primarily of gains and losses from foreign currency transactions, the non-service cost components of net periodic benefit costs associated with our defined benefit plans and other non-operational gains and losses.

Zurn Elkay Water Solutions Corporation and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Measures

Year Ended December 31, 2023

(in Millions) (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, 2023 |

| | Reported Results | | | | Adjustments | | | | Non-GAAP Results | | |

| | | | | | | | | | | | |

| Net Sales | | $ | 1,530.5 | | | | | $ | — | | | | | $ | 1,530.5 | | | |

| | | | | | | | | | | | |

| EBITDA | | 279.3 | | | | | 60.2 | | (a) | | | 339.5 | | | |

| Depreciation and amortization | | (87.9) | | | | | — | | | | | (87.9) | | | |

| Income from operations | | 191.4 | | | | | 60.2 | | (b) | | | 251.6 | | | |

| | | | | | | | | | | | |

| Income before income taxes | | 146.8 | | | | | 85.0 | | (c) | | | 231.8 | | | |

| Provision for income taxes and indicated rate | | (42.6) | | | 29.0 | % | | (17.1) | | | 20.1 | % | | (59.7) | | | 25.8 | % |

| | | | | | | | | | | | |

| Net income from continuing operations | | 104.2 | | | | | 67.9 | | | | | 172.1 | | | |

| | | | | | | | | | | | |

| Income from discontinued operations, net of tax | | 8.5 | | | | | (8.5) | | | | | — | | | |

| Net income | | $ | 112.7 | | | | | $ | 59.4 | | | | | $ | 172.1 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | EBITDA Adjustments (a) | | | | Income from Operations Adjustments (b) | | | | Income before Income Taxes Adjustments (c) | | |

| Restructuring and other similar charges | | $ | 15.3 | | | | | $ | 15.3 | | | | | $ | 15.3 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Last-in-first-out inventory adjustments | | (6.5) | | | | | (6.5) | | | | | (6.5) | | | |

| Stock-based compensation expense | | 40.0 | | | | | 40.0 | | | | | — | | | |

| Amortization of intangible assets | | — | | | | | — | | | | | 58.7 | | | |

| Other expense, net (1) | | — | | | | | — | | | | | 7.2 | | | |

| Actuarial gain on pension and other postretirement benefit obligations | | — | | | | | — | | | | | (2.0) | | | |

| Loss on the extinguishment of debt | | — | | | | | — | | | | | 0.9 | | | |

| Loss on divestiture of asbestos liabilities and certain assets | | 11.4 | | | | | 11.4 | | | | | 11.4 | | | |

| Total Adjustments | | $ | 60.2 | | | | | $ | 60.2 | | | | | $ | 85.0 | | | |

____________________

(1)Other expense, net for the periods indicated, consists primarily of gains and losses from foreign currency transactions, the non-service cost components of net periodic benefit costs associated with our defined benefit plans and other non-operational gains and losses.

Zurn Elkay Water Solutions Corporation and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Measures

Three Months Ended December 31, 2022

(in Millions) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2022 |

| | Reported Results | | | | Adjustments | | | | Non-GAAP Results | | |

| | | | | | | | | | | | |

| Net Sales | | $ | 340.3 | | | | | $ | — | | | | | $ | 340.3 | | | |

| | | | | | | | | | | | |

| EBITDA | | 43.4 | | | | | 21.2 | | (a) | | | 64.6 | | | |

| Depreciation and amortization | | (23.6) | | | | | — | | | | | (23.6) | | | |

| Income from operations | | 19.8 | | | | | 21.2 | | (b) | | | 41.0 | | | |

| | | | | | | | | | | | |

| Income before income taxes | | 14.2 | | | | | 23.3 | | (c) | | | 37.5 | | | |

| Provision for income taxes and indicated rate | | (3.9) | | | 27.5 | % | | (5.6) | | | 24.0 | % | | (9.5) | | | 25.3 | % |

| | | | | | | | | | | | |

| Net income from continuing operations | | 10.3 | | | | | 17.7 | | | | | 28.0 | | | |

| | | | | | | | | | | | |

| Income from discontinued operations, net of tax | | 3.9 | | | | | (3.9) | | | | | — | | | |

| Net income | | $ | 14.2 | | | | | $ | 13.8 | | | | | $ | 28.0 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | EBITDA Adjustments (a) | | | | Income from Operations Adjustments (b) | | | | Income before Income Taxes Adjustments (c) | | |

| Restructuring and other similar charges | | $ | 2.3 | | | | | $ | 2.3 | | | | | $ | 2.3 | | | |

| Acquisition-related fair value adjustment | | 3.7 | | | | | 3.7 | | | | | 3.7 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Stock-based compensation expense | | 9.5 | | | | | 9.5 | | | | | — | | | |

| Last-in-first-out inventory adjustments | | 5.7 | | | | | 5.7 | | | | | 5.7 | | | |

| Amortization of intangible assets | | — | | | | | — | | | | | 14.9 | | | |

| Other income, net (1) | | — | | | | | — | | | | | (1.4) | | | |

| Actuarial gain on pension and other postretirement benefit obligations | | — | | | | | — | | | | | (1.9) | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Adjustments | | $ | 21.2 | | | | | $ | 21.2 | | | | | $ | 23.3 | | | |

____________________

(1)Other income, net for the periods indicated, consists primarily of gains and losses from foreign currency transactions, the non-service cost components of net periodic benefit costs associated with our defined benefit plans.

Zurn Elkay Water Solutions Corporation and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Measures

Year Ended December 31, 2022

(in Millions) (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, 2022 |

| | Reported Results | | | | Adjustments | | | | Non-GAAP Results | | |

| | | | | | | | | | | | |

| Net Sales | | $ | 1,281.8 | | | | | $ | — | | | | | $ | 1,281.8 | | | |

| | | | | | | | | | | | |

| EBITDA | | 161.6 | | | | | 103.0 | | (a) | | | 264.6 | | | |

| Depreciation and amortization | | (54.5) | | | | | — | | | | | (54.5) | | | |

| Income from operations | | 107.1 | | | | | 103.0 | | (b) | | | 210.1 | | | |

| | | | | | | | | | | | |

| Income before income taxes | | 83.8 | | | | | 108.4 | | (c) | | | 192.2 | | | |

| Provision for income taxes and indicated rate | | (26.8) | | | 32.0 | % | | (21.1) | | | 19.5 | % | | (47.9) | | | 24.9 | % |

| | | | | | | | | | | | |

| Net income from continuing operations | | 57.0 | | | | | 87.3 | | | | | 144.3 | | | |

| | | | | | | | | | | | |

| Income from discontinued operations, net of tax | | 4.7 | | | | | (4.7) | | | | | — | | | |

| Net income | | $ | 61.7 | | | | | $ | 82.6 | | | | | $ | 144.3 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | EBITDA Adjustments (a) | | | | Income from Operations Adjustments (b) | | | | Income before Income Taxes Adjustments (c) | | |

| Restructuring and other similar charges | | $ | 15.4 | | | | | $ | 15.4 | | | | | $ | 15.4 | | | |

| Acquisition-related fair value adjustment | | 18.9 | | | | | 18.9 | | | | | 18.9 | | | |

| Stock-based compensation expense | | 25.0 | | | | | 25.0 | | | | | — | | | |

| Last-in-first-out inventory adjustments | | 9.7 | | | | | 9.7 | | | | | 9.7 | | | |

| Merger costs | | 33.7 | | | | | 33.7 | | | | | 33.7 | | | |

| Other, net (1) | | 0.3 | | | | | 0.3 | | | | | 0.3 | | | |

| Other income, net (2) | | — | | | | | — | | | | | (1.7) | | | |

| Amortization of intangible assets | | — | | | | | — | | | | | 34.0 | | | |

| Actuarial gain on pension and other postretirement benefit obligations | | — | | | | | — | | | | | (1.9) | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Adjustments | | $ | 103.0 | | | | | $ | 103.0 | | | | | $ | 108.4 | | | |

____________________

(1)Other, net includes the gains and losses from the sale of long-lived assets.

(2)Other income, net for the periods indicated, consists primarily of gains and losses from foreign currency transactions, the non-service cost components of net periodic benefit costs associated with our defined benefit plans and other non-operational gains and losses.

Zurn Elkay Water Solutions Corporation and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Measures

Three and Twelve Months Ended December 31, 2023 and December 31, 2022

(in Millions, except share and per share amounts) (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| Adjusted EBITDA | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net income | $ | 13.9 | | | $ | 14.2 | | | $ | 112.7 | | | $ | 61.7 | |

| Income from discontinued operations, net of tax | (0.4) | | (3.9) | | (8.5) | | (4.7) |

| Provision for income taxes | 7.8 | | 3.9 | | 42.6 | | 26.8 |

| Actuarial gain on pension and other postretirement benefit obligations | (2.0) | | (1.9) | | (2.0) | | (1.9) |

| Other (income) expense, net (1) | 3.9 | | | (1.4) | | | 7.2 | | | (1.7) | |

| Loss on the extinguishment of debt | 0.9 | | | — | | | 0.9 | | | — | |

| Interest expense, net | 8.7 | | | 8.9 | | | 38.5 | | | 26.9 | |

| Income from operations | $ | 32.8 | | | $ | 19.8 | | | $ | 191.4 | | | $ | 107.1 | |

| | | | | | | |

| Adjustments | | | | | | | |

| Depreciation and amortization | $ | 21.6 | | | $ | 23.6 | | | $ | 87.9 | | | $ | 54.5 | |

| Restructuring and other similar charges | 3.4 | | 2.3 | | 15.3 | | 15.4 |

| Acquisition-related fair value adjustment | — | | 3.7 | | — | | 18.9 |

| Stock-based compensation expense | 9.5 | | 9.5 | | 40.0 | | 25.0 |

| Merger costs | — | | — | | — | | 33.7 |

| Last-in first-out inventory adjustments | 5.4 | | 5.7 | | (6.5) | | 9.7 |

| Loss on divestiture of asbestos liabilities and certain assets | 11.4 | | — | | 11.4 | | — |

| Other, net (2) | — | | — | | — | | 0.3 |

| Subtotal of adjustments | 51.3 | | | 44.8 | | | 148.1 | | | 157.5 | |

| Adjusted EBITDA | $ | 84.1 | | | $ | 64.6 | | | $ | 339.5 | | | $ | 264.6 | |

____________________

(1)Other (income) expense, net for the periods indicated, consists primarily of gains and losses from foreign currency transactions, the non-service cost components of net periodic benefit costs associated with our defined benefit plans and other non-operational gains and losses.

(2)Other, net includes the gains and losses from sale of long-lived assets.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| Adjusted Net Income and Earnings Per Share | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net income | $ | 13.9 | | | $ | 14.2 | | | $ | 112.7 | | | $ | 61.7 | |

| | | | | | | |

| | | | | | | |

| Income from discontinued operations, net of tax | (0.4) | | | (3.9) | | | (8.5) | | | (4.7) | |

| | | | | | | |

| Loss on the extinguishment of debt | 0.9 | | | — | | | 0.9 | | | — | |

| Amortization of intangible assets | 14.7 | | | 14.9 | | | 58.7 | | | 34.0 | |

| Restructuring and other similar charges | 3.4 | | | 2.3 | | | 15.3 | | | 15.4 | |

| | | | | | | |

| Acquisition-related fair value adjustment | — | | | 3.7 | | | — | | | 18.9 | |

| Merger costs | — | | | — | | | — | | | 33.7 | |

| Last-in first-out inventory adjustment | 5.4 | | | 5.7 | | | (6.5) | | | 9.7 | |

| Actuarial gain on pension and other postretirement benefit obligations | (2.0) | | | (1.9) | | | (2.0) | | | (1.9) | |

| Other (income) expense, net (1) | 3.9 | | | (1.4) | | | 7.2 | | | (1.7) | |

| Other, net (2) | — | | | — | | | — | | | 0.3 | |

| Loss on divestiture of asbestos liabilities and certain assets | 11.4 | | | — | | | 11.4 | | | — | |

| Tax effect on above items | (5.8) | | | (5.6) | | | (17.1) | | | (21.1) | |

| Adjusted net income | $ | 45.4 | | | $ | 28.0 | | | $ | 172.1 | | | $ | 144.3 | |

| | | | | | | |

| GAAP diluted net income per share from continuing operations | $ | 0.08 | | | $ | 0.06 | | | $ | 0.59 | | | $ | 0.37 | |

| Adjusted earnings per share - diluted | $ | 0.26 | | | $ | 0.16 | | | $ | 0.97 | | | $ | 0.94 | |

| | | | | | | |

| Weighted-average number of shares outstanding (in thousands) | | | | | | | |

| GAAP basic weighted-average shares | 173,119 | | 177,938 | | 174,251 | | 151,581 |

| Effect of dilutive equity securities | 2,738 | | 2,068 | | | 3,008 | | 2,256 |

| Adjusted diluted weighted-average shares | 175,857 | | 180,006 | | 177,259 | | 153,837 |

____________________

(1)Other (income) expense, net for the periods indicated, consists primarily of gains and losses from foreign currency transactions, the non-service cost components of net periodic benefit costs associated with our defined benefit plans and other non-operational gains and losses.

(2)Other, net includes the gains and losses from the sale of long-lived assets.

| | | | | | | | | | | | | | | | | | |

| | | | Twelve Months Ended |

| | | | | | December 31, 2023 | | December 31, 2022 |

| Cash provided by operating activities | | | | | | $ | 253.9 | | | $ | 97.0 | |

| Expenditures for property, plant and equipment | | | | | | (21.3) | | | (7.6) | |

| Free cash flow | | | | | | $ | 232.6 | | | $ | 89.4 | |

Zurn Elkay Water Solutions Corporation and Subsidiaries

Condensed Consolidated Statements of Comprehensive Income

(in Millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net income | $ | 13.9 | | | $ | 14.2 | | | $ | 112.7 | | | $ | 61.7 | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustments | 2.2 | | | (0.1) | | | 3.6 | | | (4.2) | |

| | | | | | | |

| | | | | | | |

| Change in pension and other postretirement defined benefit plans, net of tax | 3.7 | | | 4.1 | | | 3.7 | | | 4.1 | |

| Other comprehensive income (loss), net of tax | 5.9 | | | 4.0 | | | 7.3 | | | (0.1) | |

| | | | | | | |

| Total comprehensive income | $ | 19.8 | | | $ | 18.2 | | | $ | 120.0 | | | $ | 61.6 | |

Zurn Elkay Water Solutions Corporation and Subsidiaries

Condensed Consolidated Balance Sheets

(in Millions, except share amounts)

| | | | | | | | | | | | | | |

| | (Unaudited) | | |

| | December 31, 2023 | | December 31, 2022 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 136.7 | | | $ | 124.8 | |

| Receivables, net | | 210.2 | | | 219.7 | |

| Inventories | | 277.6 | | | 366.7 | |

| Income taxes receivable | | 17.0 | | | 18.3 | |

| Other current assets | | 26.3 | | | 28.0 | |

| Total current assets | | 667.8 | | | 757.5 | |

| Property, plant and equipment, net | | 180.3 | | | 183.8 | |

| Intangible assets, net | | 952.4 | | | 1,009.7 | |

| Goodwill | | 796.0 | | | 777.0 | |

| Insurance for asbestos claims | | — | | | 72.1 | |

| Other assets | | 70.5 | | | 63.9 | |

| Total assets | | $ | 2,667.0 | | | $ | 2,864.0 | |

| Liabilities and stockholders' equity | | | | |

| Current liabilities: | | | | |

| Current maturities of debt | | $ | 0.9 | | | $ | 5.7 | |

| Trade payables | | 56.4 | | | 116.9 | |

| Compensation and benefits | | 30.5 | | | 19.2 | |

| Current portion of pension and other postretirement benefit obligations | | 1.3 | | | 1.6 | |

| Other current liabilities | | 131.8 | | | 145.9 | |

| Total current liabilities | | 220.9 | | | 289.3 | |

| | | | |

| Long-term debt | | 494.4 | | | 530.2 | |

| Pension and other postretirement benefit obligations | | 36.6 | | | 50.5 | |

| Deferred income taxes | | 210.0 | | | 221.4 | |

| Operating lease liability | | 37.3 | | | 34.2 | |

| Reserve for asbestos claims | | — | | | 79.0 | |

| Other liabilities | | 65.0 | | | 44.4 | |

| Total liabilities | | 1,064.2 | | | 1,249.0 | |

| | | | |

| Stockholders' equity: | | | | |

Common stock, $0.01 par value; 200,000,000 shares authorized; shares issued and outstanding: 172,262,163 at December 31, 2023 and 176,876,406 at December 31, 2022 | | 1.7 | | | 1.8 | |

| | | | |

| Additional paid-in capital | | 2,847.0 | | | 2,853.1 | |

| Retained deficit | | (1,178.2) | | | (1,164.9) | |

| Accumulated other comprehensive loss | | (67.7) | | | (75.0) | |

| | | | |

| | | | |

| | | | |

| Total stockholders' equity | | 1,602.8 | | | 1,615.0 | |

| Total liabilities and stockholders' equity | | $ | 2,667.0 | | | $ | 2,864.0 | |

Zurn Elkay Water Solutions Corporation and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(in Millions)

(Unaudited) | | | | | | | | | | | | | | |

| | Twelve Months Ended |

| | December 31, 2023 | | December 31, 2022 |

| Operating activities | | | | |

| Net income | | $ | 112.7 | | | $ | 61.7 | |

| Adjustments to reconcile net income to cash provided by operating activities: | | | | |

| Depreciation | | 29.2 | | | 20.5 | |

| Amortization of intangible assets | | 58.7 | | | 34.0 | |

| | | | |

| Non-cash asset impairment | | 2.5 | | | — | |

| | | | |

| Loss on divestiture of asbestos liabilities and certain assets | | 9.3 | | | — | |

| Divestiture of asbestos liabilities and certain assets | | (13.0) | | | — | |

| Loss (gain) on dispositions of long-lived assets | | (2.7) | | | 0.3 | |

| Deferred income taxes | | (4.2) | | | 0.5 | |

| Other non-cash expenses | | 1.9 | | | 4.8 | |

| Actuarial gain on pension and other postretirement benefit obligations | | (2.0) | | | (1.9) | |

| Loss on the extinguishment of debt | | 0.9 | | | — | |

| Stock-based compensation expense | | 40.0 | | | 25.0 | |

| Changes in operating assets and liabilities: | | | | |

| Receivables, net | | 10.1 | | | 15.5 | |

| Inventories | | 65.0 | | | (17.6) | |

| Other assets | | 2.5 | | | 36.5 | |

| Accounts payable | | (60.8) | | | (18.3) | |

| Accruals and other | | 3.8 | | | (64.0) | |

| Cash provided by operating activities | | 253.9 | | | 97.0 | |

| | | | |

| Investing activities | | | | |

| Expenditures for property, plant and equipment | | (21.3) | | | (7.6) | |

| Acquisitions, net of cash acquired | | — | | | (44.8) | |

| Proceeds from dispositions of long-lived assets | | 7.7 | | | 1.3 | |

| | | | |

| Proceeds from insurance claims | | 9.0 | | | 9.5 | |

| Proceeds associated with divestiture of discontinued operations | | — | | | 35.0 | |

| Cash used for investing activities | | (4.6) | | | (6.6) | |

| | | | |

| Financing activities | | | | |

| Proceeds from borrowings of debt | | 13.0 | | | 102.0 | |

| Repayments of debt | | (77.9) | | | (107.7) | |

| | | | |

| | | | |

| | | | |

| Proceeds from exercise of stock options | | 4.3 | | | 2.5 | |

| Taxes withheld and paid on employees' share-based payment awards | | (3.1) | | | (0.7) | |

| Repurchase of common stock | | (125.1) | | | (24.7) | |

| Payment of common stock dividends | | (50.4) | | | (32.5) | |

| | | | |

| Cash used for financing activities | | (239.2) | | | (61.1) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | | 1.8 | | | (1.1) | |

| Increase in cash, cash equivalents and restricted cash | | 11.9 | | | 28.2 | |

| Cash, cash equivalents and restricted cash at beginning of period | | 124.8 | | | 96.6 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 136.7 | | | $ | 124.8 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

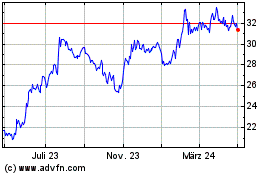

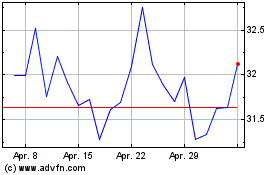

Zurn Elkay Water Solutions (NYSE:ZWS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Zurn Elkay Water Solutions (NYSE:ZWS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024