falseU S PHYSICAL THERAPY INC /NV000088597800008859782024-03-062024-03-06

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 6, 2024

U.S. PHYSICAL THERAPY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

001-11151

|

|

76-0364866

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

1300 WEST SAM HOUSTON PARKWAY,

SUITE 300,

HOUSTON, Texas

|

|

77043

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (713) 297-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions ( see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

USPH

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

◻

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Compensatory Arrangements of Executive Officers

Effective March 6, 2024 (“Effective Date”), the Compensation Committee of the Board of Directors (the “Committee”) as defined in Section 1.8 of

the U. S. Physical Therapy, Inc. (“USPH”) 2003 Stock Incentive Plan (the “2003 Plan”) approved and adopted the incentive plans for senior management as described below. Members of senior management who are eligible under the incentive plans include

Mr. Christopher Reading, Chief Executive Officer (“CEO”), Mr. Carey Hendrickson, Chief Financial Officer (“CFO”), Mr. Eric Williams, Chief Operating Officer - East (“COO East”), Mr. Graham Reeve, Chief Operating Officer – West (“COO West”), and Mr.

Rick Binstein, Executive Vice President, General Counsel and Secretary (“EVP”), (hereinafter collectively referred to as “Executives”).

Objective Long-Term Incentive Plan for Senior Management for 2024

(“Objective LTIP”): Under this Objective LTIP, Executives have an opportunity to receive Restricted Stock Awards (“RSAs”) under the 2003 Plan to be granted by the Committee in the first quarter of 2025 subject to the continuous

employment of the Executive by USPH or its affiliates from the Effective Date through the date of the grant of the RSA and the achievement of certain level of Adjusted EBITDA. All RSAs shall be granted subject to the terms of the 2003 Plan and the

specific terms and conditions (including without limitation, restrictions in transfer and substantial risk of forfeiture) as determined by the Committee in its sole discretion. The number of RSAs that may be granted under this Objective LTIP will

vest evenly over 16 quarters, beginning April 1, 2025, and ending January 1, 2029, subject to acceleration of vesting in the Committee's sole discretion and based on the occurrence of certain events, as more specifically defined in the applicable

Restricted Stock Agreement between the Executive and USPH and/or in the Executive's employment agreement with USPH. The number of RSAs that may be granted is subject to the

achievement of Adjusted EBITDA for the year 2024 and could be up to 100% of the maximum number of shares. The maximum number of RSAs that may be granted are as follows: CEO = 12,500 shares; CFO = 5,000 shares; COO East = 7,500 shares; COO West =

5,000 shares and EVP = 5,000 shares.

Discretionary Long-Term Incentive Plan for Senior Management for 2024

(“Discretionary LTIP”); In addition to any other awards under the 2003 Plan or any other long term incentive plan or bonus plan, policy, or program of USPH, and not in lieu of any other such award or payment, the Committee may, in its

judgment and at its sole discretion, grant RSAs under the 2003 Plan, based on its evaluation of an Executive's performance and the collective corporate performance for 2024. Any RSAs granted under this program shall be awarded in the first quarter of

2025 subject to the continuous employment of the Executive by USPH or its affiliates from the Effective Date through the date of the grant of the RSA. All RSAs granted shall be in writing and subject to the terms of the 2003 Plan and the specific

terms and conditions (including without limitation, restrictions in transfer and substantial risk of forfeiture) as determined by the Committee in its sole discretion. RSAs granted under this Discretionary LTIP will vest evenly over 16 quarters,

beginning April 1, 2025, and ending January 1, 2029, subject to acceleration of vesting based on the occurrence of certain events, as more specifically defined in the applicable Restricted Stock Agreement between the Executive and USPH and/or in the

Executive's employment agreement with USPH. The number of RSAs that may be granted is subject to the evaluation of the Executive’s performance and the collective corporate performance during 2024. The maximum number of RSAs that may be granted are

as follows: CEO = up to 12,500 shares; CFO = up to 5,000 shares; COO West = up to 5,000 shares; COO East = up to 7,500 shares, and EVP = up to 5,000 shares.

Objective Bonus Plan for Senior Management for 2024 (“Objective Bonus

Plan”); Under this Objective Bonus Plan, Executives have an opportunity to receive either a “Cash Bonus” Award or RSAs having a value at the time of the Award of up to 75% of the Executive’s annual base salary as of the date of the

award as Performance Awards under the 2003 Plan. The Committee will, in its sole discretion, determine the amount and type of award to be made in the first quarter of 2025. No Executive will be entitled to any type of award or have a legally binding

right to an award until the Committee, in its sole discretion, determines an award will be made, the amount and the type of award to be made. No Executive will be entitled to elect between the Cash Bonus and RSA. Before any Cash Bonus is made or an

RSA is awarded under this Objective Bonus Plan, the Committee shall certify in writing that the performance goals (which in this case is the achievement of certain level of Adjusted EBITDA) have been obtained. Any Cash Bonus award made

hereunder shall be paid in a lump-sum amount, and any RSA granted, in each case no later than March 14, 2025. The Executive must be continuously employed by USPH or its affiliates from the Effective Date through December 31, 2024 to receive the Cash

Bonus or an RSA.

Discretionary Cash/RSA Bonus Plan for Senior Management for 2024,

("Discretionary Bonus Plan"); In addition to awards under any other plan or program at USPH for which such Executives are eligible and not in lieu thereof, each

Participant in this Discretionary Bonus Plan has the potential to be awarded of up to 50% of the Participant's annual base salary for 2024 (“Subjective Bonus”) subject to the achievement of individual goals established by the Committee. The

Subjective Bonus shall be made as either a Cash Bonus Award or RSAs, as determined in the sole discretion of the Committee. The Committee shall have the sole discretion to determine the amount and type of award (whether a Cash Bonus Award or an

RSA) will be made. No Participant shall be entitled to a Subjective Bonus and shall have no legally binding right to a Subjective Bonus until the Committee determines the amount and type of award to be made. No Participant will be entitled to

elect any type of award to be made.

The foregoing descriptions are qualified in its entirety by reference to the full text of each of the Objective LTIP, Discretionary LTIP,

Objective Bonus Plan, and Discretionary Bonus Plan, which are filed as Exhibits 99.1, 99.2, 99.3 and 99.4, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

| |

|

|

|

Exhibits

|

|

Description of Exhibits

|

| |

|

|

|

|

U. S. Physical Therapy, Inc. Objective Long-Term Incentive Plan for Senior Management for 2024, effective March 6, 2024.

|

|

|

|

U. S. Physical Therapy, Inc. Discretionary Long-Term Incentive Plan for Senior Management for 2024, effective March 6, 2024.

|

|

|

|

U. S. Physical Therapy, Inc. Objective Cash/RSA Bonus Plan for Senior Management for 2024, effective March 6, 2024.

|

|

|

|

U. S. Physical Therapy, Inc. Discretionary Cash/RSA Bonus Plan for Senior Management for 2024, effective March 6, 2024.

|

* Filed herewith

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

|

| |

|

|

|

U.S. PHYSICAL THERAPY, INC.

|

|

| |

|

|

|

|

|

Dated: March 7, 2024

|

|

|

|

By:

|

|

/s/ CAREY HENDRICKSON

|

|

| |

|

|

|

|

|

Carey Hendrickson

|

|

| |

|

|

|

|

|

Chief Financial Officer

|

|

| |

|

|

|

|

|

(duly authorized officer and principal financial and accounting officer)

|

|

Exhibit 99.1

U.S. PHYSICAL THERAPY, INC.

2024 OBJECTIVE LONG-TERM INCENTIVE PLAN

FOR SENIOR MANAGEMENT

(“OBJECTIVE LTIP”)

Purpose: To incentivize and retain Executives eligible for this Objective LTIP, to

achieve certain corporate earnings criteria and reward Executives when such criteria are achieved, and to align the long-term interests of Executives and shareholders of USPH by compensating the Executives in shares of USPH stock that vest over time,

thereby increasing the Executives' equity interest in USPH.

Effective Date: The effective date of this Objective LTIP and the establishment of performance goals and formula for the amount payable hereunder is March 6, 2024.

Eligibility: The Executives of USPH eligible for this Objective LTIP are the Chief Executive Officer (“CEO”), the Chief Financial Officer (“CFO”), the General Counsel (“EVP”), the Chief Operating Officer West (“COO West”)

and the Chief Operating Officer East (“COO East”). Terms not defined herein shall have the meaning of such term as defined in the U.S. Physical Therapy, Inc. 2003 Stock Incentive Plan (as amended) (the “2003 Plan”).

Vesting and Other Terms and Provisions: Under this Objective LTIP, Executives have an opportunity to receive Restricted Stock Awards (“RSAs”) under the 2003 Plan, to be granted by the Compensation Committee of the

Board of Directors of USPH (as the term “Committee” is defined in Section 1.8 of the 2003 Plan) in the first quarter of 2025. The Executive must be employed by USPH or its affiliates from the Effective Date through the date of the grant to receive

an RSA. All RSAs shall be granted subject to the terms of the 2003 Plan and the specific terms and conditions (including without limitation, restrictions in transfer and substantial risk of forfeiture) as determined by the Compensation Committee in

its sole discretion. RSAs that are granted under this Objective LTIP will vest evenly over 16 quarters, beginning April 1, 2025 and ending January 1, 2029, subject to acceleration of vesting in the Committee's sole discretion and based on the

occurrence of certain events, as more specifically defined in the applicable Restricted Stock Agreement between the Executive and USPH and/or in the Executive's employment agreement with USPH.

Administration: The Compensation Committee has authority to administer this Objective LTIP, grant awards and decide all questions of interpretation. The Compensation Committee shall set out the vesting and other terms of an

RSA in writing. The Compensation Committee's determinations and interpretations under this Objective LTIP.

Objective Goals And Amounts That May Be Awarded: The maximum amount of RSAs that may be granted under this this Objective LTIP based on achievement of the performance goals relating to 2024 are as follows: CEO = 12,500

shares; CFO = 5,000 shares; COO East = 7,500 shares; COO West = 5,000 shares and EVP = 5,000 shares.

Award Grant Date: Any RSAs granted under this program shall be granted under the 2003 Plan in the first quarter of 2025 after the Compensation

Committee determines the amount, if any, of the RSAs to be granted to each Participant. In addition, RSAs shall be granted only if the participant remains employed by USPH (or its affiliates) continuously from the Effective Date through the date of

the grant of the RSA. All RSAs shall be granted in writing and subject to the terms of the 2003 Plan and the specific terms and conditions (including without limitation, restrictions in transfer and substantial risk of forfeiture) as determined by

the Compensation Committee in its sole discretion. RSAs that are granted under this Objective LTIP will vest evenly over 16 quarters, beginning April 1, 2025 and ending January 1, 2029, subject to acceleration of vesting based on the occurrence of

certain events, as more specifically defined in the applicable Restricted Stock Agreement between the Executive and USPH and/or in the Executive's employment agreement with USPH.

|

2024 Performance Goals

Adjusted EBITDA

|

Objective

Amount of Shares

CEO, COOs, CFO, EVP

|

|

$78,500,000

|

30.0%

|

|

$78,870,592

|

34.0%

|

|

$79,241,184

|

38.0%

|

|

$79,611,776

|

42.0%

|

|

$79,982,368

|

46.0%

|

|

$80,352,960

|

50.0%

|

|

$80,908,848

|

56.0%

|

|

$81,464,732

|

62.0%

|

|

$81,893,212

|

68.0%

|

|

$82,214,572

|

74.0%

|

|

$82,535,932

|

80.0%

|

|

$82,857,292

|

86.0%

|

|

$ 83,178,652

|

92.0%

|

|

$83,500,000 AND OVER

|

100.0%

|

Adjusted EBITDA is defined as net income attributable to USPH shareholders before interest income, interest expense, taxes, depreciation,

and amortization, changes in revaluation of put-right liability, equity-based awards compensation expense, any impairment charges and other extraordinary or unusual items, and related portion for non-controlling interests.

Exhibit 99.2

U.S. PHYSICAL THERAPY, INC.

2024 DISCRETIONARY LONG-TERM INCENTIVE PLAN

FOR SENIOR MANAGEMENT

(“DISCRETIONARY LTIP”)

Purpose: To incentivize Executives eligible for this

Discretionary LTIP to achieve certain strategic, operational, business growth & development and other criteria and reward Executives when such criteria are achieved, and to align the long-term interests of Executives and shareholders of USPH by

compensating the Executives in shares of USPH stock that vest over time, thereby increasing the Executives' equity interest in USPH.

Effective Date: This Discretionary LTIP is established

effective March 6, 2024.

Description of Discretionary Awards Criteria: In addition to

any other awards under the U.S. Physical Therapy, Inc. 2003 Stock Incentive Plan (as amended) (the "2003 Plan") or any other long term incentive plan or bonus plan, policy or program of USPH, and not in lieu of any other such award or payment, the

Compensation Committee of the Board of Directors of USPH (as the term "Committee" is defined in Section 1.8 of the 2003 Plan) may, in its judgment and at its sole discretion, grant Restricted Stock Awards ("RSAs") under the 2003 Plan, based on its

evaluation of an Executive's performance and the collective corporate performance for 2024. The factors to be considered include:

Chris Reading – CEO

|

1.

|

Company and Board Leadership;

|

|

2.

|

Growth of the Company to include de novo, tuck in and acquired Physical Therapy partnerships and Industrial Injury Prevention

opportunities;

|

|

3.

|

Foster Compliance and Cybersecurity culture that is beneficial to our Company and shareholders;

|

|

4.

|

Oversee and support COO – East’s role in driving key Company objectives while strengthening our succession opportunities in key areas;

|

|

5.

|

Achievement of financial goals and objectives for 2024.

|

Carey Hendrickson - CFO

|

1.

|

Net rate improvements through strategic negotiations and revenue cycle management;

|

|

2.

|

Effective and accurate Board and shareholder communication, guidance, modeling, projections and planning;

|

|

3.

|

Maintain effective capital structure to allow continued growth;

|

|

4.

|

Improve efficiencies in Finance/Accounts Payable through technology improvements and staffing adjustments;

|

|

5.

|

Maintain effective cost discipline across the Company and within the corporate services area;

|

|

6.

|

Successful audit implementation.

|

Eric Williams – COO - East

|

1.

|

Ensure cost and revenue alignment to achieve Company’s operating plan in Physical Therapy and Industrial Injury Prevention business

segments;

|

|

2.

|

Execute Company-wide development plan for de novo as well as acquired partnerships ensuring integration and forward trajectory;

|

|

3.

|

Assist with improved operational execution across key corporate departments;

|

|

4.

|

Develop effective leadership and relationships across the entirety of the Company with partners as well as key corporate staff to

facilitate operational excellence, growth, and opportunity realization;

|

|

5.

|

Maintain effective compliance and cybersecurity culture.

|

Graham Reeve – COO- West

|

1.

|

Align cost and revenue growth for Physical Therapy;

|

|

2.

|

Create development plan for top partnerships to ensure organic as well as acquired growth;

|

|

3.

|

Work on Industrial Injury Prevention opportunities for sales and expansion and cost efficiency;

|

|

4.

|

Leadership development, succession and effective relationship integration to allow for seamless transitions to accommodate growth and

succession-related changes;

|

|

5.

|

Maintain effective compliance culture;

|

|

6.

|

Effective acquisition-related due diligence and integrated coordination and execution.

|

Rick Binstein - EVP/General Counsel

|

1.

|

Coordinate with CEO and other executives to facilitate growth through development;

|

|

2.

|

Assist in any compliance matters as needed to maintain an effective compliance culture and assist in any communications internally as

needed with CCO (“Chief Compliance Officer”) and executive team;

|

|

3.

|

Maintain legal department in a manner which successfully supports our partners as well as our corporate and infrastructure needs;

|

|

4.

|

Assist CEO and other executives in evaluating new opportunities for growth whether acquired or de novo;

|

|

5.

|

Coordinate and maintain corporate/board/shareholder meeting minutes and other records.

|

Participants: Executives who will have an opportunity to be

granted RSAs under this Discretionary LTIP shall be the Chief Executive Officer (“CEO”), the Chief Financial Officer (“CFO”), the Chief Operating Officer West (“COO West”), the Chief Operating Officer East (“COO East”) and Executive Vice President,

General Counsel (“EVP”). The following shall be the maximum amount of shares that may be awarded under this program to each specified participant: CEO= up to 12,500 shares; CFO= up to 5,000 shares; COO West= up to 5,000 shares; COO East= up to 7,500

shares, and EVP= up to 5,000 shares

Administration: The Compensation Committee shall administer

this Discretionary LTIP. The Compensation Committee shall have the exclusive authority to interpret and construe the terms of this Discretionary LTIP and make all determinations under this plan, and its decisions shall be final and binding in all

persons. The Compensation Committee shall set out the vesting and other terms of an RSA in writing.

Award Grant Date: Any RSAs granted under this program shall

be granted under the 2003 Plan in the first quarter of 2025 after the Compensation Committee determines the amount, if any, of the RSAs to be granted to each participant. In addition, RSAs shall be granted only if the participant remains employed by

USPH (or its affiliates) continuously from the Effective Date through the date of the grant of the RSA. All RSAs shall be granted in writing and subject to the terms of the 2003 Plan and the specific terms and conditions (including without

limitation, restrictions in transfer and substantial risk of forfeiture) as determined by the Compensation Committee in its sole discretion. RSAs that are granted under this Objective LTIP will vest evenly over 16 quarters, beginning April 1, 2025

and ending January 1, 2029, subject to acceleration of vesting based on the occurrence of certain events, as more specifically defined in the applicable Restricted Stock Agreement between the Executive and USPH and/or in the Executive's employment

agreement with USPH.

Certain Tax Considerations: Any awards actually granted under

this program shall be subject to Code Section 83(b).

Exhibit 99.3

U.S. PHYSICAL THERAPY, INC.

2024 OBJECTIVE CASH/RSA BONUS PLAN

FOR SENIOR MANAGEMENT

(“OBJECTIVE BONUS PLAN”)

Purpose: To incentivize and retain Executives eligible for this Objective

Bonus Plan to achieve certain corporate earnings criteria and reward Executive Officers of USPH when such criteria are achieved, and to align the long-term interests of Executives and shareholders of USPH.

Effective Date: The effective date of this Objective Bonus

Plan and the establishment of performance goals and formula for the amount payable hereunder is March 6, 2024.

Eligibility: The Executives of USPH eligible for this

Objective Bonus Plan are the Chief Executive Officer ("CEO"), the Chief Financial Officer ("CFO"), the Chief Operating Officer West ("COO West"), the Chief Operating Officer East ("COO East") and the Executive Vice President, General Counsel

("EVP")

Description. Conditions and Payment Date: Under this

Objective Bonus Plan, Executives have an opportunity to receive either a "Cash Bonus" Award or to be granted a Restricted Stock Award ("RSA") having a value at the time of the Award of up to 75% of the annual base salary for 2024 (“Base”) for the

CEO, COO West, COO East, CFO and EVP as Performance Awards under the 2003 Plan. The Compensation Committee of the Board of Directors of USPH (the "Compensation Committee") will, in its sole discretion, determine the amount and type of award to be

made in the first quarter of 2025. No Executive will be entitled to any type of award or have a legally binding right to an award until the Compensation Committee, in its sole discretion, determines an award will be made, the amount and the type of

award to be made. No Executive will be entitled to elect between the Cash Bonus and RSA. Before any Cash Bonus is made or an RSA is awarded under this Objective Bonus Plan, the Compensation Committee shall certify in writing that the performance

goals have been obtained. Any Cash Bonus award made hereunder shall be paid in a lump-sum amount, and any RSA granted, in each case no later than March 14, 2025. The Executive must be continuously employed by USPH or its affiliates from the

Effective Date through December 31, 2024 to receive the Cash Bonus or an RSA.

Administration: The Compensation Committee has authority to

administer this Objective Bonus Plan, grant awards, determine whether any such awards shall be made as a Cash Bonus Award or as an RSA, and decide all questions of interpretation. The Compensation Committee shall set out the vesting and other terms

of an RSA in writing. The Compensation Committee’s determinations and interpretations under this Objective Bonus Plan shall be final and binding on all persons.

Objective Bonus Calculation:

| |

|

|

|

2024 Adjusted EBITDA

|

Potential Bonus Value

(percentage of base salary)

|

|

|

$78,500,000

|

15.0

|

%

|

|

$78,870,592

|

17.0

|

%

|

|

$79,241,184

|

19.0

|

%

|

|

$79,611,776

|

21.0

|

%

|

|

$79,982,368

|

23.0

|

%

|

|

$80,352,960

|

25.0

|

%

|

|

$80,908,848

|

28.0

|

%

|

|

$81,464,732

|

31.0

|

%

|

|

$81,705,773

|

34.0

|

%

|

|

$82,027,161

|

38.0

|

%

|

|

$82,348,549

|

42.0

|

%

|

|

$82,669,937

|

46.0

|

%

|

|

$82,991,325

|

50.0

|

%

|

|

$83,312,713

|

54.0

|

%

|

|

$83,634,101

|

58.0

|

%

|

|

$83,955,489

|

62.0

|

%

|

|

$84,276,877

|

66.0

|

%

|

|

$84,598,265

|

70.0

|

%

|

|

$85,000,000

|

75.0

|

%

|

Adjusted EBITDA is defined as net income attributable to USPH shareholders before interest income, interest expense, taxes, depreciation, and

amortization, changes in revaluation of put-right liability, equity-based awards compensation expense, any impairment charges and other extraordinary or unusual items, and related portion for non-controlling interests.

No Trust or Fund: There shall be no separate trust or fund for

this Objective Bonus Plan. Any amount payable hereunder shall be an unfunded obligation of USPH and shall be payable out of the general assets of USPH and no amount payable shall be assignable by the participant.

All RSAs shall be granted subject to the terms of the 2003 Plan and the specific terms and conditions (including without limitation, restrictions

in transfer and substantial risk of forfeiture) as determined by the Compensation Committee in its sole discretion.

Exhibit 99.4

U.S. PHYSICAL THERAPY, INC.

2024 DISCRETIONARY CASH/RSA BONUS PLAN

FOR SENIOR MANAGEMENT

(“DISCRETIONARY BONUS PLAN”)

Purpose: The purpose of this Discretionary Bonus Plan is to

retain and incentivize the Executive Officers of USPH by providing an annual bonus opportunity to the Executives to reward them when certain individual and corporate subjective performance measures are achieved.

Participants: Executives of USPH who shall be "Participants"

in this Discretionary Bonus Plan are the Chief Executive Officer ("CEO"), Chief Financial Officer ("CFO"), Chief Operating Officer West ("COO West"), Chief Operating Officer East ("COO East") and Executive Vice President, General Counsel (EVP). In

addition to awards under any other plan or program at USPH for which such Executives are eligible and not in lieu thereof, each Participant in this Discretionary Bonus Plan has the potential to be awarded a "Subjective Bonus" of up to 50% of the

Participant's annual base salary for 2024 ("Base") pursuant to the subjective criteria as set forth below. The Subjective Bonus shall be made as either a "Cash Bonus" Award or a Restricted Stock Award ("RSA"), as determined in the sole discretion of

the Compensation Committee of the Board of Directors of USPH (the "Compensation Committee"). The Compensation Committee shall have the sole discretion to determine the amount and type of award (whether a Cash Bonus Award or an RSA) will be made. No

Participant shall be entitled to a Subjective Bonus and shall have no legally binding right to a Subjective Bonus until the Compensation Committee determines the amount and type of award to be made. No Participant will be entitled to elect any type

of award to be made.

Effective Date: This Discretionary Bonus Plan is established

effective March 6, 2024.

Administration: The Compensation Committee shall administer

this Discretionary Bonus Plan and shall have the sole authority to interpret and construe all of the terms of this Discretionary Bonus Plan, establish the criteria for awards, determine the amounts payable under this plan, and determine whether such

awards under this plan shall be made as a Cash Bonus Award or as an RSA. The amount, if any, of the Subjective Bonus payable to each participant in this Discretionary Bonus Plan shall be determined by the Compensation Committee in its sole discretion

based upon subjective criteria described below. All decisions of the Compensation Committee shall be final and binding on all persons.

Award and Payment Date: The Compensation Committee shall make

award determinations in the first quarter of 2025. After the Compensation Committee has determined that goals have been met and has calculated the awards to be made hereunder, the Cash Bonus Award shall be paid, and the RSA shall be granted to the

applicable Participant in the first quarter of 2025 but no later than March 14, 2025. A Subjective Bonus shall be payable only if the Participant remains continuously employed from the Effective Date through the date of the determination of the

amount payable by the Compensation Committee.

Subjective Bonus Calculation: The Subjective Bonus criteria

that have been established by the Compensation Committee and shall be used in the Compensation Committee's sole discretion to grant an award of a Subjective Bonus having a value as of the date of the award of up to 50% of Base for CEO, COO West, COO

East, CFO and EVP are as follows:

Chris Reading – CEO

|

1.

|

Company and Board Leadership;

|

|

2.

|

Growth of the Company to include de novo, tuck in and acquired Physical Therapy partnerships and Industrial Injury Prevention

opportunities;

|

|

3.

|

Foster Compliance and Cybersecurity culture that is beneficial to our Company and shareholders;

|

|

4.

|

Oversee and support COO – East’s role in driving key Company objectives while strengthening our succession opportunities in key areas;

|

|

5.

|

Achievement of financial goals and objectives for 2024.

|

Carey Hendrickson - CFO

|

1.

|

Net rate improvements through strategic negotiations and revenue cycle management;

|

|

2.

|

Effective and accurate Board and shareholder communication,

guidance, modeling, projections and planning;

|

|

3.

|

Maintain effective capital structure to allow continued growth;

|

|

4.

|

Improve efficiencies in Finance/Accounts Payable through technology improvements and staffing adjustments;

|

|

5.

|

Maintain effective cost discipline across the Company and within the corporate services area;

|

|

6.

|

Successful audit implementation.

|

Eric Williams – COO - East

|

1.

|

Ensure cost and revenue alignment to achieve Company’s operating plan in Physical Therapy and Industrial Injury Prevention business

segments;

|

|

2.

|

Execute Company-wide development plan for de novo as well as acquired partnerships ensuring integration and forward trajectory;

|

|

3.

|

Assist with improved operational execution across key corporate departments;

|

|

4.

|

Develop effective leadership and relationships across the entirety of the Company with partners as well as key corporate staff to

facilitate operational excellence, growth, and opportunity realization;

|

|

5.

|

Maintain effective compliance and cybersecurity culture.

|

Graham Reeve – COO- West

|

1.

|

Align cost and revenue growth for Physical Therapy;

|

|

2.

|

Create development plan for top partnerships to ensure organic as well as acquired growth;

|

|

3.

|

Work on Industrial Injury Prevention opportunities for sales and expansion and cost efficiency;

|

|

4.

|

Leadership development, succession and effective relationship integration to allow for seamless transitions to accommodate growth and

succession-related changes;

|

|

5.

|

Maintain effective compliance culture;

|

|

6.

|

Effective acquisition-related due diligence and integrated coordination and execution.

|

Rick Binstein - EVP/General Counsel

|

1.

|

Coordinate with CEO and other executives to facilitate growth through development;

|

|

2.

|

Assist in any compliance matters as needed to maintain an effective compliance culture and assist in any communications internally as

needed with CCO (“Chief Compliance Officer”) and executive team;

|

|

3.

|

Maintain legal department in a manner which successfully supports our partners as well as our corporate and infrastructure needs;

|

|

4.

|

Assist CEO and other executives in evaluating new opportunities for growth whether acquired or de novo;

|

|

5.

|

Coordinate and maintain corporate/board/shareholder meeting minutes and other records.

|

No Trust or Fund: There shall be no separate trust or fund for

this Objective Bonus Plan. Any amount payable hereunder shall be an unfunded obligation of USPH and shall be payable out of the general assets of USPH and no amount payable shall be assignable by the participants:

All RSAs shall be granted subject to the terms of the 2003 Plan and the specific terms and conditions (including without limitation, restrictions

in transfer and substantial risk of forfeiture) as determined by the Compensation Committee in its sole discretion.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

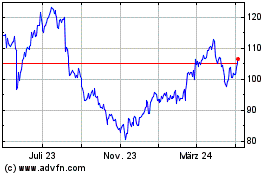

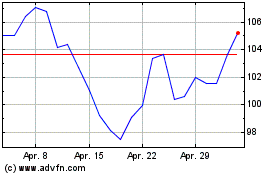

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

Von Apr 2023 bis Apr 2024