Form 8-K - Current report

11 März 2024 - 9:15PM

Edgar (US Regulatory)

falseU S PHYSICAL THERAPY INC /NV000088597800008859782024-03-092024-03-09

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 9, 2024

U.S. PHYSICAL THERAPY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

001-11151

|

|

76-0364866

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

1300 WEST SAM HOUSTON PARKWAY,

SUITE 300,

HOUSTON, Texas

|

|

77043

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (713) 297-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions ( see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

USPH

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

◻

|

ITEM 8.01 Other Events.

On March 11, 2024 U.S. Physical Therapy, Inc. (“USPH" or the “Company”) (NYSE:

USPH), reported that the 3.5% reduction in the Medicare physician fee schedule for therapy services for 2024 (as compared to 2023 rates) has been addressed in the “Consolidated Appropriations Act, 2024” (“Act”) signed into law on March 9, 2024.

The Act decreased the Medicare reduction for the remainder of 2024; as a result, the Company now estimates that the Medicare rate reduction effective March 9, 2024, will be approximately 1.8% rather than 3.5%. The change in rate is not retroactive

to January 1, 2024.

A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K, including the exhibits, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the

Exchange Act, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

| |

|

|

|

Exhibits

|

|

Description of Exhibits

|

| |

|

|

|

|

Registrant's Press Release dated March 11, 2024

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

|

| |

|

|

|

U.S. PHYSICAL THERAPY, INC.

|

|

| |

|

|

|

|

|

Dated: March 11, 2024

|

|

|

|

By:

|

|

/s/ CAREY HENDRICKSON

|

|

| |

|

|

|

|

|

Carey Hendrickson

|

|

| |

|

|

|

|

|

Chief Financial Officer

|

|

| |

|

|

|

|

|

(duly authorized officer and principal financial and accounting officer)

|

|

CONTACT:

U.S. Physical Therapy, Inc.

Carey Hendrickson, Chief Financial Officer

Email: Chendrickson@usph.com

Chris Reading, Chief Executive Officer

(713) 297-7000

Three Part Advisors

Joe Noyons

(817) 778-8424

U.S. Physical Therapy Announces Change in

Medicare Rate Reduction for the Remainder of 2024

Houston, TX, March 11, 2024 –

U.S. Physical Therapy, Inc. (“USPH" or the “Company”) (NYSE: USPH), reported today that the 3.5% reduction in the Medicare physician fee schedule for therapy services for 2024 (as compared to 2023 rates) has been addressed in the “Consolidated

Appropriations Act, 2024” (“Act”) signed into law on March 9, 2024. The Act decreased the Medicare reduction for the remainder of 2024; as a result, the Company now estimates that the Medicare rate reduction effective March 9, 2024, will be

approximately 1.8% rather than 3.5%. The change in rate is not retroactive to January 1, 2024.

In the Company’s earnings announcement on February 28, 2024, management noted that the 3.5% reduction in Medicare rates was

expected to reduce the Company’s revenue by approximately $6.0 million for the full year of 2024 which would equate to an EBITDA reduction of approximately $5.3 million. Management estimates that today’s reported change in the Medicare rate will

increase its revenue by approximately $2.3 million versus its previous expectations, which would equate to an increase in EBITDA of approximately $2.0 million. Therefore, management now expects the Medicare rate reductions in 2024 (as compared to

2023 rates) to reduce revenue by approximately $3.7 million for full year 2024 (rather than $6.0 million), which would equate to an EBITDA reduction of approximately $3.3 million (rather than $5.3 million), all as compared to full year 2023.

Forward Looking Statements

This press release contains statements that are considered to be forward-looking within the meaning under Section 21E of the Securities Exchange Act

of 1934, as amended. These statements contain forward-looking information relating to the financial condition, results of operations, plans, objectives, future performance and business of our Company. These statements (often using words such as

“believes”, “expects”, “intends”, “plans”, “appear”, “should” and similar words) involve risks and uncertainties that could cause actual results to differ materially from those we expect. Included among such statements may be those relating to new

clinics, availability of personnel and the reimbursement environment. The forward-looking statements are based on our current views and assumptions and

actual results could differ materially from those anticipated in such forward-looking statements as a result of certain risks, uncertainties, and factors, which include, but are not limited to:

|

•

|

changes in Medicare rules and guidelines and reimbursement or failure of our clinics to maintain their Medicare certification and/or

enrollment status;

|

|

•

|

the impact of future public health crises and epidemics/pandemics, such as was the case with the novel strain of COVID-19 and its

variants;

|

|

•

|

revenue we receive from Medicare and Medicaid being subject to potential retroactive reduction;

|

|

•

|

changes in reimbursement rates or payment methods from third party payors including government agencies, and changes in the deductibles

and co-pays owed by patients;

|

|

•

|

compliance with federal and state laws and regulations relating to the privacy of individually identifiable patient information, and

associated fines and penalties for failure to comply;

|

|

•

|

competitive, economic or reimbursement conditions in our markets which may require us to reorganize or close certain clinics and thereby

incur losses and/or closure costs including the possible write-down or write-off of goodwill and other intangible assets;

|

|

•

|

one of our acquisition agreements contains a put right related to a future purchase of a majority interest in a separate company;

|

|

•

|

the impact of future vaccinations and/or testing mandates at the federal, state and/or local level, which could have an adverse impact on

staffing, revenue, costs and the results of operations;

|

|

•

|

our debt and financial obligations could adversely affect our financial condition, our ability to obtain future financing and our ability

to operate our business;

|

|

•

|

changes as the result of government enacted national healthcare reform;

|

|

•

|

business and regulatory conditions including federal and state regulations;

|

|

•

|

governmental and other third party payor inspections, reviews, investigations and audits, which may result in sanctions or reputational

harm and increased costs;

|

|

•

|

revenue and earnings expectations;

|

|

•

|

some of our acquisition agreements contain contingent consideration, the value of which may impact future financial results;

|

|

•

|

legal actions, which could subject us to increased operating costs and uninsured liabilities;

|

|

•

|

general economic conditions, including but not limited to inflationary and recessionary periods;

|

|

•

|

actual or perceived events involving banking volatility or limited liability, defaults or other adverse developments that affect the U.S.

or international financial systems, may result in market wide liquidity problems which could have a material and adverse impact on our available cash and results of operations;

|

|

•

|

our business depends on hiring, training, and retaining qualified employees

|

|

•

|

availability and cost of qualified physical therapists;

|

|

•

|

competitive environment in the industrial injury prevention services business, which could result in the termination or non-renewal of

contractual service arrangements and other adverse financial consequences for that service line;

|

|

•

|

our ability to identify and complete acquisitions, and the successful integration of the operations of the acquired businesses;

|

|

•

|

impact on the business and cash reserves resulting from retirement or resignation of key partners and resulting purchase of their

non-controlling interest (minority interests);

|

|

•

|

maintaining our information technology systems with adequate safeguards to protect against cyber-attacks;

|

|

•

|

a security breach of our or our third-party vendors’ information technology systems may subject us to potential legal action and

reputational harm and may result in a violation of the Health Insurance Portability and Accountability Act of 1996 of the Health Information Technology for Economic and Clinical Health Act;

|

|

•

|

maintaining clients for which we perform management, industrial injury prevention related services, and other services, as a breach or

termination of those contractual arrangements by such clients could cause operating results to be less than expected;

|

|

•

|

maintaining adequate internal controls;

|

|

•

|

maintaining necessary insurance coverage;

|

|

•

|

availability, terms, and use of capital; and

|

|

•

|

weather and other seasonal factors.

|

Many factors are beyond our control. Given these uncertainties, you should not place undue reliance on our forward-looking statements. For

additional information regarding these and other risks and uncertainties, that could cause actual results to differ materially from those contained in our forward-looking statements, please refer to “Risk Factors” in our Annual Report on Form 10-K for

the year ended December 31, 2023, filed with the Securities and Exchange Commission (“SEC”) on February 29, 2024 and any risk factors contained in subsequent quarterly and annual reports we file with the SEC. Our forward-looking statements represent

our estimates and assumptions only as of the date of this report. Except as required by law, we are under no obligation to update any forward-looking statement as a result of new information, future events, or otherwise, except as required by law.

About U.S. Physical Therapy, Inc.

Founded in 1990, U.S. Physical Therapy, Inc. operates 672 outpatient physical therapy clinics in 42 states. The Company's

clinics provide preventative and post-operative care for a variety of orthopedic-related disorders and sports-related injuries, treatment for neurologically-related injuries and rehabilitation of injured workers. In addition to owning and operating

clinics, the Company manages 41 physical therapy facilities for unaffiliated third parties, including hospitals and physician groups. The Company also has an industrial injury prevention business which provides onsite services for clients’ employees

including injury prevention and rehabilitation, performance optimization, post-offer employment testing, functional capacity evaluations, and ergonomic assessments.

More information about U.S. Physical Therapy, Inc. is available at www.usph.com.

The information included on that website is not incorporated into this press release.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

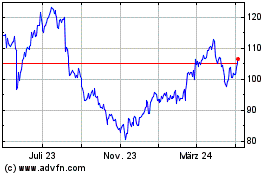

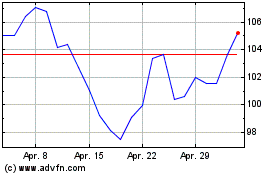

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

Von Apr 2023 bis Apr 2024