THOR Industries Announces Increased Regular Quarterly Dividend

08 Oktober 2024 - 2:16PM

THOR Industries, Inc. (NYSE: THO) today announced that its Board of

Directors approved, at its October 8, 2024 meeting, the payment of

a regular quarterly cash dividend of $0.50 per share. The new

quarterly dividend amount represents a 4.2% increase from the

previous quarterly dividend amount of $0.48.

The regular cash dividend is payable on November

15, 2024, to shareholders of record at the close of business on

November 1, 2024.

About THOR Industries, Inc.

THOR is the sole owner of operating companies

which, combined, represent the world's largest manufacturer of

recreational vehicles. For more information on the Company and its

products, please go to www.thorindustries.com.

Forward-Looking Statements

This release includes certain statements that

are “forward-looking” statements within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements are made based on management’s current expectations and

beliefs regarding future and anticipated developments and their

effects upon THOR, and inherently involve uncertainties and risks.

These forward-looking statements are not a guarantee of future

performance. We cannot assure you that actual results will not

differ materially from our expectations. Factors which could cause

materially different results include, among others: the impact of

inflation on the cost of our products as well as on general

consumer demand; the effect of raw material and commodity price

fluctuations, and/or raw material, commodity or chassis supply

constraints; the impact of war, military conflict, terrorism and/or

cyber-attacks, including state-sponsored or ransom attacks; the

impact of sudden or significant adverse changes in the cost and/or

availability of energy or fuel, including those caused by

geopolitical events, on our costs of operation, on raw material

prices, on our suppliers, on our independent dealers or on retail

customers; the dependence on a small group of suppliers for certain

components used in production, including chassis; interest rates

and interest rate fluctuations and their potential impact on the

general economy and, specifically, on our profitability and on our

independent dealers and consumers; the ability to ramp production

up or down quickly in response to rapid changes in demand while

also managing costs and market share; the level and magnitude of

warranty and recall claims incurred; the ability of our suppliers

to financially support any defects in their products; legislative,

regulatory and tax law (including recent and pending tax-law

changes implementing new, widely adopted "Pillar II" tax

principles) and/or policy developments including their potential

impact on our independent dealers, retail customers or on our

suppliers; the costs of compliance with governmental regulation;

the impact of an adverse outcome or conclusion related to current

or future litigation or regulatory investigations; public

perception of and the costs related to environmental, social and

governance matters; legal and compliance issues including those

that may arise in conjunction with recently completed transactions;

lower consumer confidence and the level of discretionary consumer

spending; the impact of exchange rate fluctuations; restrictive

lending practices which could negatively impact our independent

dealers and/or retail consumers; management changes; the success of

new and existing products and services; the ability to maintain

strong brands and develop innovative products that meet consumer

demands; the ability to efficiently utilize existing production

facilities; changes in consumer preferences; the risks associated

with acquisitions, including: the pace and successful closing of an

acquisition, the integration and financial impact thereof, the

level of achievement of anticipated operating synergies from

acquisitions, the potential for unknown or understated liabilities

related to acquisitions, the potential loss of existing customers

of acquisitions and our ability to retain key management personnel

of acquired companies; a shortage of necessary personnel for

production and increasing labor costs and related employee benefits

to attract and retain production personnel in times of high demand;

the loss or reduction of sales to key independent dealers, and

stocking level decisions of our independent dealers; disruption of

the delivery of units to independent dealers or the disruption of

delivery of raw materials, including chassis, to our facilities;

increasing costs for freight and transportation; the ability to

protect our information technology systems from data breaches,

cyber-attacks and/or network disruptions; asset impairment charges;

competition; the impact of losses under repurchase agreements; the

impact of the strength of the U.S. dollar on international demand

for products priced in U.S. dollars; general economic, market,

public health and political conditions in the various countries in

which our products are produced and/or sold; the impact of changing

emissions and other related climate change regulations in the

various jurisdictions in which our products are produced, used

and/or sold; changes to our investment and capital allocation

strategies or other facets of our strategic plan; and changes in

market liquidity conditions, credit ratings and other factors that

may impact our access to future funding and the cost of debt.

These and other risks and uncertainties are

discussed more fully in Item 1A of our Annual Report on Form 10-K

for the year ended July 31, 2024.

We disclaim any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statements contained in this release or to reflect any change in

our expectations after the date hereof or any change in events,

conditions or circumstances on which any statement is based, except

as required by law.

Contact

Todd Woelfer,

COOtwoelfer@thorindustries.com(574) 970-7460

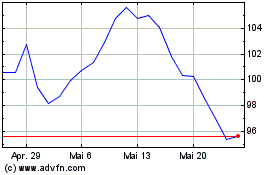

Thor Industries (NYSE:THO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Thor Industries (NYSE:THO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024