0000730263 False 0000730263 2024-06-05 2024-06-05 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 5, 2024

_______________________________

THOR Industries, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 1-9235 | 93-0768752 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

601 East Beardsley Avenue

Elkhart, Indiana 46514-3305

(Address of Principal Executive Offices) (Zip Code)

(574) 970-7460

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

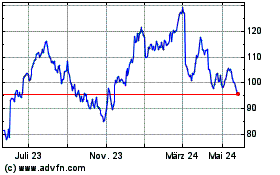

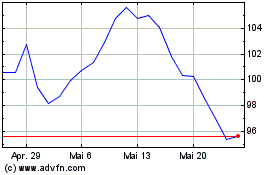

| Common Stock (Par value $.10 Per Share) | THO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On June 5, 2024, THOR Industries, Inc. (the “Company”) issued a press release announcing certain financial results for the third quarter ended April 30, 2024. A copy of the Company’s press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein. The Company also posted an updated investor slide presentation and a list of investor questions and answers to the “Investors” section of its website. A copy of the Company’s slide presentation and investor questions and answers are attached hereto as Exhibit 99.2 and 99.3, respectively, and are incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

The press release attached hereto as Exhibit 99.1 provides earnings guidance with updated information on industry and Company projections for the Company’s fiscal year 2024. The slide presentation attached hereto as Exhibit 99.2, and incorporated by reference herein, also provides earnings guidance as well as updated information on industry wholesale shipments and retail market share. The Company also posted an updated list of investor questions and answers to the “Investors” section of its website. A copy of the Company's investor questions and answers is attached hereto as Exhibit 99.3 and is incorporated by reference herein.

In accordance with general instruction B.2 to Form 8-K, the information set forth in Items 2.02 and 7.01 of this Form 8-K (including Exhibits 99.1, 99.2 and 99.3) shall be deemed “furnished” and not “filed” with the Securities and Exchange Commission for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference into any filing thereunder or under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | THOR Industries, Inc. |

| | | |

| | | |

| Date: June 5, 2024 | By: | /s/ Colleen Zuhl |

| | | Colleen Zuhl |

| | | Senior Vice President and Chief Financial Officer |

| | | |

EXHIBIT 99.1

THOR Industries Announces Third Quarter Fiscal 2024 Results

CONTINUES DISCIPLINED APPROACH IN SOFT RETAIL ENVIRONMENT, ADJUSTS GUIDANCE TO REFLECT CURRENT MARKET CONDITIONS

Fiscal Third Quarter 2024 Highlights

- Consolidated net sales for the third quarter were $2.80 billion.

- Consolidated gross profit margin for the third quarter was 15.1%.

- Net income attributable to THOR Industries, Inc. and diluted earnings per share for the third quarter of fiscal 2024 were $114.5 million and $2.13, respectively.

- The Company revised its full-year fiscal 2024 guidance to a consolidated net sales range of $9.8 billion to $10.1 billion, gross margin range of 13.75% to 14.0% and diluted earnings per share range of $4.50 to $4.75.

ELKHART, Ind., June 05, 2024 (GLOBE NEWSWIRE) -- THOR Industries, Inc. (NYSE: THO) today announced financial results for its third fiscal quarter ended April 30, 2024.

“We are proud of our teams’ performance as they have executed our variable cost model and driven operating efficiencies and enabled THOR to perform relatively well in a difficult market. Indicators of the long-term prospects for our industry remain very positive; accordingly, we remain very confident in the long-term outlook for our industry and for THOR,” offered Bob Martin, President and CEO of THOR Industries.

“In our fiscal third quarter, our independent dealers experienced increased retail activity during the Spring selling season; however, conversion to sales remained difficult in light of the economic pressures on retail buyers. Faced with elevated floor plan interest rates, our independent dealers remain understandably cautious with their ordering patterns; consequently, our independent dealer inventory levels remain suppressed. Given the macroeconomic conditions, we see this cautious approach as healthy for our industry and maintain our confidence in a robust return of our top and bottom line performance once macro pressures subside. Until a strong market does return, we will continue to be disciplined with production and will continue to work with our independent dealers to maintain a steady, albeit depressed, retail pull-through by focusing our production on floorplans and price points that resonate with consumers in the current environment. Our dealers have been great partners with us through this cycle and, together, we will continue to successfully navigate a prolonged challenging market,” added Martin.

Third-Quarter Financial Results

Consolidated net sales were $2.80 billion in the third quarter of fiscal 2024, compared to $2.93 billion for the third quarter of fiscal 2023.

Consolidated gross profit margin for the third quarter of fiscal 2024 was 15.1%, an increase of 30 basis points when compared to the third quarter of fiscal 2023.

Net income attributable to THOR Industries, Inc. and diluted earnings per share for the third quarter of fiscal 2024 were $114.5 million and $2.13, respectively, compared to $120.7 million and $2.24, respectively, for the third quarter of fiscal 2023.

THOR’s consolidated results were primarily driven by the results of its individual reportable segments as noted below.

Segment Results

North American Towable RVs

| ($ in thousands) | Three Months Ended April 30, | | %

Change

| | Nine Months Ended April 30, | | %

Change

|

| | | 2024 | | | 2023 | | | | 2024 | | | 2023 | |

| Net Sales | $ | 1,071,393 | | $ | 1,124,410 | | (4.7 | ) | | $ | 2,747,815 | | $ | 3,271,967 | | (16.0 | ) |

| Gross Profit | $ | 138,103 | | $ | 143,988 | | (4.1 | ) | | $ | 310,011 | | $ | 392,717 | | (21.1 | ) |

| Gross Profit Margin % | | 12.9 | | | 12.8 | | | | | 11.3 | | | 12.0 | | |

| Income Before Income Taxes | $ | 68,409 | | $ | 77,583 | | (11.8 | ) | | $ | 118,319 | | $ | 181,471 | | (34.8 | ) |

| | As of April 30, | | %

Change

|

| ($ in thousands) | | 2024 | | | 2023 | |

| Order Backlog | $ | 741,302 | | $ | 757,127 | | (2.1 | ) |

- North American Towable RV net sales were down 4.7% for the third quarter of fiscal 2024 compared to the prior-year period, driven by a 15.1% increase in unit shipments offset by a 19.8% decrease in the overall net price per unit. The decrease in the overall net price per unit was primarily due to the combined impact of a shift in product mix toward our lower-cost travel trailers and more moderately-priced units along with sales price reductions compared to the prior-year period.

- North American Towable RV gross profit margin was 12.9% for the third quarter of fiscal 2024, compared to 12.8% in the prior-year period. The increase in gross profit margin was primarily driven by a decrease in the material cost percentage due to the combined favorable impacts of lower discounting, cost-saving initiatives and product mix changes.

- North American Towable RV income before income taxes for the third quarter of fiscal 2024 was $68.4 million, compared to $77.6 million in the third quarter of fiscal 2023. This decrease was driven primarily by the decrease in North American Towable RV net sales.

North American Motorized RVs

| ($ in thousands) | Three Months Ended April 30, | | %

Change

| | Nine Months Ended April 30, | | %

Change

|

| | | 2024 | | | 2023 | | | | 2024 | | | 2023 | |

| Net Sales | $ | 646,948 | | $ | 795,940 | | (18.7 | ) | | $ | 1,928,531 | | $ | 2,658,042 | | (27.4 | ) |

| Gross Profit | $ | 71,753 | | $ | 93,307 | | (23.1 | ) | | $ | 211,866 | | $ | 386,254 | | (45.1 | ) |

| Gross Profit Margin % | | 11.1 | | | 11.7 | | | | | 11.0 | | | 14.5 | | |

| Income Before Income Taxes | $ | 33,172 | | $ | 48,186 | | (31.2 | ) | | $ | 96,684 | | $ | 234,163 | | (58.7 | ) |

| | As of April 30, | | %

Change

|

| ($ in thousands) | | 2024 | | | 2023 | |

| Order Backlog | $ | 925,829 | | $ | 1,263,071 | | (26.7 | ) |

- North American Motorized RV net sales decreased 18.7% for the third quarter of fiscal 2024 compared to the prior-year period. The decrease was primarily due to a 20.0% reduction in unit shipments, as current dealer and consumer demand has softened in comparison to the prior-year period, offset by a 1.3% increase in net sales due to changes in product mix and net price per unit.

- North American Motorized RV gross profit margin was 11.1% for the third quarter of fiscal 2024, compared to 11.7% in the prior-year period. The decrease in the gross profit margin for the third quarter of fiscal 2024 was primarily driven by the decreased net sales volume along with increased sales discounts and chassis costs.

- North American Motorized RV income before income taxes for the third quarter of fiscal 2024 decreased to $33.2 million compared to $48.2 million in the prior-year period, driven by the decrease in net sales and the decline in the gross margin percentage.

European RVs

| ($ in thousands) | Three Months Ended April 30, | | %

Change

| | Nine Months Ended April 30, | | %

Change

|

| | | 2024 | | | 2023 | | | | 2024 | | | 2023 | |

| Net Sales | $ | 931,061 | | $ | 866,751 | | 7.4 | | $ | 2,421,556 | | $ | 2,017,991 | | 20.0 |

| Gross Profit | $ | 162,915 | | $ | 151,780 | | 7.3 | | $ | 405,068 | | $ | 312,075 | | 29.8 |

| Gross Profit Margin % | | 17.5 | | | 17.5 | | | | | 16.7 | | | 15.5 | | |

| Income Before Income Taxes | $ | 77,382 | | $ | 72,401 | | 6.9 | | $ | 144,206 | | $ | 77,948 | | 85.0 |

| | As of April 30, | | %

Change

|

| ($ in thousands) | | 2024 | | | 2023 | |

| Order Backlog | $ | 1,935,119 | | $ | 3,474,324 | | (44.3 | ) |

- European RV net sales increased 7.4% for the third quarter of fiscal 2024 compared to the prior-year period, driven by a 1.5% decrease in unit shipments and an 8.9% increase in the overall net price per unit due to the total combined impact of changes in product mix and price. The overall net price per unit increase of 8.9% includes no impact from foreign currency exchange rate changes as rates were consistent for the two periods.

- European RV gross profit margin remained constant at 17.5% of net sales for the third quarter of fiscal 2024 compared to the prior-year period, primarily due to slight improvements in labor and warranty cost percentages being mostly offset by a slight increase in material costs due to increased sales discounting.

- European RV income before income taxes for the third quarter of fiscal 2024 was $77.4 million compared to income before income taxes of $72.4 million during the third quarter of fiscal 2023, with the improvement driven primarily by the increased net sales compared to the prior-year period.

Management Commentary

“As anticipated, our third quarter of fiscal year 2024 experienced a similar inflection as compared to our third quarter of fiscal year 2023 as seasonality provided a boost to our top and bottom lines. On a year-over-year basis, our fiscal third quarter saw a consolidated net sales decline of 4.4% while net income before taxes decreased just 20 basis points as a percentage of sales,” said Todd Woelfer, Senior Vice President and Chief Operating Officer.

“In North America, our teams executed to plan by remaining prudent with production and continuing to maximize operating efficiencies as we leveraged our variable cost model, resulting in stronger than anticipated top and bottom line performance relative to the market. During the fiscal quarter, we continued to focus on aligning production with retail demand. Our teams have been successful in assisting dealers with driving down their inventory to levels that position both our independent dealers and THOR to be able to maintain performance during a prolonged down cycle and to excel when a stronger market inevitably returns. As we look ahead to our fiscal fourth quarter and the coming model year change, we will continue to be aggressive in working with our dealer partners to keep inventories fresh. Given the challenging retail environment that will persist in our fourth fiscal quarter, we anticipate that increased promotional activity will impact the quarterly margins but will also function to maintain the favorable dealer inventory conditions that we’ve worked hard to achieve during the prolonged down cycle.

“Our European team continues to perform well for the enterprise. As we reported last quarter, our European independent dealer inventories were right-sized by the end of our fiscal second quarter, making the successful third quarter from our European segment particularly meaningful. Fiscal third quarter net sales for our European segment increased 7.4% against a strong prior year quarter while net income before income taxes remained relatively consistent at 8.3% of net sales. The ability to sustain this level of profitability in a normalized inventory environment is a testament to our European team’s success at executing its plan to drive sustainable operating efficiency and to produce products that resonate with retail customers. Importantly over the third fiscal quarter, our European segment has shown positive signs of regaining Motorcaravan and Campervan market share that had been lost in the prior year due to a disproportionate impact from the chassis shortage. Through the first three months of calendar year 2024, our European Motorcaravan and Campervan market share stands at 25.6% as compared to 20.9% for the full calendar year 2023. Europe continues to buoy THOR’s consolidated performance through this down cycle which reaffirms the value of our geographic market diversification strategy that was central to our acquisition of the Erwin Hymer Group in fiscal 2019. This geographic diversification is an important element of THOR’s value proposition,” concluded Woelfer.

“Throughout the quarter, we had strong cash generation, exceeding $250.0 million of cash from operations. With the cash generated, we continued to execute our transparent capital allocation strategy as we paid down approximately $161.4 million in debt and repurchased 126,754 shares of our outstanding stock. Capital expenditures in the third fiscal quarter totaled $27.2 million, bringing our nine-month total to just over $106 million. In addition to maintenance, our capital expenditure spend has been focused on bringing the Poland operation of our European RV Segment fully online and adding capacity and expanding our product lineup at Airxcel. Importantly, as the challenging market lingers longer than expected, we have materially reduced our capital investments from our initial forecast and have focused on funding more time-sensitive initiatives like the aforementioned investments necessary to expand Airxcel’s product offerings. Our liquidity remains a unique strength within the industry. On April 30, 2024, we had liquidity of approximately $1.37 billion, including approximately $371.8 million in cash on hand and approximately $998.0 million available under our asset-based revolving credit facility. As we continue to navigate a dynamic market, our financial strength and robust cash generation profile continue to enable us to perform well relative to the market conditions and to execute on our long-term strategic plan,” said Colleen Zuhl, Senior Vice President and Chief Financial Officer.

Outlook

“As we discussed last quarter, we expected a seasonal lift to our top and bottom lines in our fiscal third quarter. As we exit that quarter, we are mindful that we also exit the prime selling season of our industry. Macroeconomic conditions remain a headwind to our markets. Additionally, this summer, consistent with normal industry practice, we will introduce a new model year lineup. As that happens, we will remain focused on ensuring that dealer inventory remains fresh. We are also going to maintain operational discipline and will not chase temporary market share gains that require excessive degradation to our margins and the value of our brands. Accordingly, the confluence of these factors will impact our fiscal fourth quarter,” said Martin.

“We have experienced many of these down cycles in our history. That history demonstrates that our experience in managing through cycles creates opportunity for THOR. This cycle is no different – challenging in the short-term with opportunity in the longer-term. At times like this, we also materially benefit from being purely an RV company which allows us to focus on maximizing our performance in our market without having to simultaneously face the challenges from other markets. We execute to our down cycle playbook and leverage our deep bench of talented and experienced teams when macro conditions present a challenging market. Our operating model enables us to generate cash even during a difficult market. As we have done that this year, we have returned value to our shareholders by staying true to our capital allocation strategy by investing in our business, managing our debt conservatively, buying back over 454,000 shares of our stock and raising our dividend,” added Woelfer.

“Although the near-term environment remains challenging, we continue to be very optimistic about global consumer interest in the RV lifestyle and long-term demand for our products. Our strong financial position and status as the global leader in the RV industry enables THOR to meet the challenges of the current market and positions the Company for success in the longer term. While we are realistic about the market we currently face, we are likewise realistic with our optimism for the future of the Company. That optimism is based in the fundamentals of our business, our people, our long-term strategies and an undeniably robust interest in the RV lifestyle on a global basis,” added Martin.

Fiscal 2024 Guidance

The Company’s fiscal 2024 guidance has been revised to reflect challenging market conditions that have persisted into the fourth quarter of fiscal 2024. Based on current North American order intake levels through the end of May, the Company is lowering its guidance ranges to reflect a lowered fiscal year 2024 North American industry wholesale shipment range of between 315,000 and 325,000 units, which is more conservative than our previous shipment range of between 330,000 and 340,000 units.

For fiscal 2024, the Company’s updated full-year guidance now includes:

- Consolidated net sales in the range of $9.8 billion to $10.1 billion (previously $10.0 billion to $10.5 billion)

- Consolidated gross profit margin in the range of 13.75% to 14.0% (previously 14.0% to 14.5%)

- Diluted earnings per share in the range of $4.50 to $4.75 (previously $5.00 to $5.50)

“The prolonged market downturn has persisted longer than we and most others in and around the industry anticipated as the macro challenges continue to impact our independent dealers and consumers. We believe that this persistence will restrict both our top and bottom lines for our fiscal fourth quarter. Our realistic view of our fiscal fourth quarter necessitates a reduction in our previous guidance forecasted after our fiscal second quarter,” concluded Martin.

Supplemental Earnings Release Materials

THOR Industries has provided a comprehensive question and answer document, as well as a PowerPoint presentation, relating to its quarterly results and other topics.

To view these materials, go to http://ir.thorindustries.com.

About THOR Industries, Inc.

THOR Industries is the sole owner of operating companies which, combined, represent the world’s largest manufacturer of recreational vehicles.

For more information on the Company and its products, please go to www.thorindustries.com.

Forward-Looking Statements

This release includes certain statements that are “forward-looking” statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks. These forward-looking statements are not a guarantee of future performance. We cannot assure you that actual results will not differ materially from our expectations. Factors which could cause materially different results include, among others: the impact of inflation on the cost of our products as well as on general consumer demand; the effect of raw material and commodity price fluctuations, and/or raw material, commodity or chassis supply constraints; the impact of war, military conflict, terrorism and/or cyber-attacks, including state-sponsored or ransom attacks; the impact of sudden or significant adverse changes in the cost and/or availability of energy or fuel, including those caused by geopolitical events, on our costs of operation, on raw material prices, on our suppliers, on our independent dealers or on retail customers; the dependence on a small group of suppliers for certain components used in production, including chassis; interest rates and interest rate fluctuations and their potential impact on the general economy and, specifically, on our independent dealers and consumers and our profitability; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share; the level and magnitude of warranty and recall claims incurred; the ability of our suppliers to financially support any defects in their products; legislative, regulatory and tax law (including recent and pending tax-law changes implementing new, widely adopted "Pillar II" tax principles) and/or policy developments including their potential impact on our independent dealers, retail customers or on our suppliers; the costs of compliance with governmental regulation; the impact of an adverse outcome or conclusion related to current or future litigation or regulatory investigations; public perception of and the costs related to environmental, social and governance matters; legal and compliance issues including those that may arise in conjunction with recently completed transactions; lower consumer confidence and the level of discretionary consumer spending; the impact of exchange rate fluctuations; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers; management changes; the success of new and existing products and services; the ability to maintain strong brands and develop innovative products that meet consumer demands; the ability to efficiently utilize existing production facilities; changes in consumer preferences; the risks associated with acquisitions, including: the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production and increasing labor costs and related employee benefits to attract and retain production personnel in times of high demand; the loss or reduction of sales to key independent dealers, and stocking level decisions of our independent dealers; disruption of the delivery of units to independent dealers or the disruption of delivery of raw materials, including chassis, to our facilities; increasing costs for freight and transportation; the ability to protect our information technology systems from data breaches, cyber-attacks and/or network disruptions; asset impairment charges; competition; the impact of losses under repurchase agreements; the impact of the strength of the U.S. dollar on international demand for products priced in U.S. dollars; general economic, market, public health and political conditions in the various countries in which our products are produced and/or sold; the impact of changing emissions and other related climate change regulations (including the Securities and Exchange Commission's ("SEC") final climate rules and litigation regarding its enforceabilty) in the various jurisdictions in which our products are produced, used and/or sold; changes to our investment and capital allocation strategies or other facets of our strategic plan; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt.

These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10-Q for the quarter ended April 30, 2024 and in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2023.

We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this release or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law.

| THOR INDUSTRIES, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| FOR THE THREE AND NINE MONTHS ENDED APRIL 30, 2024 AND 2023 |

| ($000’s except share and per share data) (Unaudited) |

| | | | | | | | | | | | | |

| | | Three Months Ended April 30, | | Nine Months Ended April 30, |

| | | | 2024 | | % Net Sales(1) | | | 2023 | | % Net Sales(1) | | | 2024 | | % Net Sales(1) | | | 2023 | | % Net Sales(1) |

| | | | | | | | | | | | | |

| Net sales | | $ | 2,801,113 | | | | $ | 2,928,820 | | | | $ | 7,509,241 | | | | $ | 8,383,539 | | |

| | | | | | | | | | | | | |

| Gross profit | | $ | 421,852 | | 15.1 | % | | $ | 432,637 | | 14.8 | % | | $ | 1,050,631 | | 14.0 | % | | $ | 1,202,048 | | 14.3 | % |

| | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 226,515 | | 8.1 | % | | | 210,044 | | 7.2 | % | | | 664,536 | | 8.8 | % | | | 660,411 | | 7.9 | % |

| | | | | | | | | | | | | |

| Amortization of intangible assets | | | 32,316 | | 1.2 | % | | | 35,113 | | 1.2 | % | | | 97,124 | | 1.3 | % | | | 105,531 | | 1.3 | % |

| | | | | | | | | | | | | |

| Interest expense, net | | | 21,830 | | 0.8 | % | | | 26,362 | | 0.9 | % | | | 70,256 | | 0.9 | % | | | 74,802 | | 0.9 | % |

| | | | | | | | | | | | | |

| Other income, net | | | 1,159 | | — | % | | | (5,667 | ) | (0.2 | )% | | | 3,111 | | — | % | | | 6,136 | | 0.1 | % |

| | | | | | | | | | | | | |

| Income before income taxes | | | 142,350 | | 5.1 | % | | | 155,451 | | 5.3 | % | | | 221,826 | | 3.0 | % | | | 367,440 | | 4.4 | % |

| | | | | | | | | | | | | |

| Income tax provision | | | 28,773 | | 1.0 | % | | | 35,722 | | 1.2 | % | | | 47,890 | | 0.6 | % | | | 84,482 | | 1.0 | % |

| | | | | | | | | | | | | |

| Net income | | | 113,577 | | 4.1 | % | | | 119,729 | | 4.1 | % | | | 173,936 | | 2.3 | % | | | 282,958 | | 3.4 | % |

| | | | | | | | | | | | | |

| Less: Net loss attributable to non-controlling interests | | | (934 | ) | — | % | | | (990 | ) | — | % | | | (1,357 | ) | — | % | | | (1,026 | ) | — | % |

| | | | | | | | | | | | | |

| Net income attributable to THOR Industries, Inc. | | $ | 114,511 | | 4.1 | % | | $ | 120,719 | | 4.1 | % | | $ | 175,293 | | 2.3 | % | | $ | 283,984 | | 3.4 | % |

| | | | | | | | | | | | | |

| Earnings per common share | | | | | | | | | | | | |

| Basic | | $ | 2.15 | | | | $ | 2.26 | | | | $ | 3.29 | | | | $ | 5.30 | | |

| Diluted | | $ | 2.13 | | | | $ | 2.24 | | | | $ | 3.26 | | | | $ | 5.27 | | |

| | | | | | | | | | | | | |

| Weighted-avg. common shares outstanding – basic | | | 53,310,318 | | | | | 53,425,379 | | | | | 53,309,546 | | | | | 53,534,746 | | |

| Weighted-avg. common shares outstanding – diluted | | | 53,722,154 | | | | | 53,820,400 | | | | | 53,742,146 | | | | | 53,854,542 | | |

| | | | | | | | | | | | | |

| (1)Percentages may not add due to rounding differences |

| SUMMARY CONDENSED CONSOLIDATED BALANCE SHEETS ($000’s) (Unaudited) |

| | | | | | | | | | | |

| | | April 30,

2024 | | July 31,

2023 | | | | April 30,

2024 | | July 31,

2023 |

| Cash and equivalents | | $ | 371,819 | | $ | 441,232 | | Current liabilities | | $ | 1,739,095 | | $ | 1,716,482 |

| Accounts receivable, net | | | 830,010 | | | 643,219 | | Long-term debt, net | | | 1,209,054 | | | 1,291,311 |

| Inventories, net | | | 1,578,147 | | | 1,653,070 | | Other long-term liabilities | | | 261,701 | | | 269,639 |

| Prepaid income taxes, expenses and other | | | 90,273 | | | 56,059 | | Stockholders’ equity | | | 4,008,347 | | | 3,983,398 |

| Total current assets | | | 2,870,249 | | | 2,793,580 | | | | | | |

| Property, plant & equipment, net | | | 1,379,541 | | | 1,387,808 | | | | | | |

| Goodwill | | | 1,777,335 | | | 1,800,422 | | | | | | |

| Amortizable intangible assets, net | | | 889,373 | | | 996,979 | | | | | | |

| Equity investments and other, net | | | 301,699 | | | 282,041 | | | | | | |

| Total | | $ | 7,218,197 | | $ | 7,260,830 | | | | $ | 7,218,197 | | $ | 7,260,830 |

Contact:

Jeff Tryka, CFA

Lambert Global

616-295-2509

jtryka@lambert.com

Exhibit 99.2

www.thorindustries.com THIRD QUARTER OF FISCAL 2024 FINANCIAL RESULTS

FORWARD - LOOKING STATEMENTS This presentation includes certain statements that are “forward - looking” statements within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward - looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks . These forward - looking statements are not a guarantee of future performance . We cannot assure you that actual results will not differ materially from our expectations . Factors which could cause materially different results include, among others : the impact of inflation on the cost of our products as well as on general consumer demand ; the effect of raw material and commodity price fluctuations, and/or raw material, commodity or chassis supply constraints ; the impact of war, military conflict, terrorism and/or cyber - attacks, including state - sponsored or ransom attacks ; the impact of sudden or significant adverse changes in the cost and/or availability of energy or fuel, including those caused by geopolitical events, on our costs of operation, on raw material prices, on our suppliers, on our independent dealers or on retail customers ; the dependence on a small group of suppliers for certain components used in production, including chassis ; interest rates and interest rate fluctuations and their potential impact on the general economy and, specifically, on our independent dealers and consumers and our profitability ; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share ; the level and magnitude of warranty and recall claims incurred ; the ability of our suppliers to financially support any defects in their products ; legislative, regulatory and tax law (including recent and pending tax - law changes implementing new, widely adopted "Pillar II" tax principles) and/or policy developments including their potential impact on our independent dealers, retail customers or on our suppliers ; the costs of compliance with governmental regulation ; the impact of an adverse outcome or conclusion related to current or future litigation or regulatory investigations ; public perception of and the costs related to environmental, social and governance matters ; legal and compliance issues including those that may arise in conjunction with recently completed transactions ; lower consumer confidence and the level of discretionary consumer spending ; the impact of exchange rate fluctuations ; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers ; management changes ; the success of new and existing products and services ; the ability to maintain strong brands and develop innovative products that meet consumer demands ; the ability to efficiently utilize existing production facilities ; changes in consumer preferences ; the risks associated with acquisitions, including : the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies ; a shortage of necessary personnel for production and increasing labor costs and related employee benefits to attract and retain production personnel in times of high demand ; the loss or reduction of sales to key independent dealers, and stocking level decisions of our independent dealers ; disruption of the delivery of units to independent dealers or the disruption of delivery of raw materials, including chassis, to our facilities ; increasing costs for freight and transportation ; the ability to protect our information technology systems from data breaches, cyber - attacks and/or network disruptions ; asset impairment charges ; competition ; the impact of losses under repurchase agreements ; the impact of the strength of the U . S . dollar on international demand for products priced in U . S . dollars ; general economic, market, public health and political conditions in the various countries in which our products are produced and/or sold ; the impact of changing emissions and other related climate change regulations (including the Securities and Exchange Commission's ("SEC") final climate rules and litigation regarding its enforceabilty) in the various jurisdictions in which our products are produced, used and/or sold ; changes to our investment and capital allocation strategies or other facets of our strategic plan ; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt . These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10 - Q for the quarter ended April 30 , 2024 and in Item 1 A of our Annual Report on Form 10 - K for the year ended July 31 , 2023 . We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward - looking statements contained in this presentation or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law . 2

THIRD QUARTER FISCAL 2024 SUMMARY THIRD QUARTER FISCAL 2024 HIGHLIGHTS ▪ Financial performance in line with expectations and reflects efforts to manage the near - term environment while continuing to support independent dealers in managing inventory levels ▪ European segment delivered another strong quarter with year - over - year top line growth and a steady bottom line driven by sustained operational improvements and market share gains ▪ Positioning operating companies and independent dealers for success amidst current macroeconomic headwinds ▪ Production levels appropriately aligned with retail trends ▪ Focus on fresh model year dealer lineups heading into model year 2025 changeover ▪ Dealers remain focused on managing inventory levels as higher interest rates and inflationary pressures persist NET SALES BY SEGMENT NET SALES $2.80B (4.4)% (1) GROSS MARGIN 15.1% +30 bps (1) DILUTED EPS (2) $2.13 (4.9)% (1) Segment Net Sales Net Sales Change (1) North American Towable $1,071.4M (4.7)% North American Motorized $646.9M (18.7)% European $931.1M +7.4% (1) As compared to the third quarter of fiscal 2023 (2) Attributable to THOR Industries, Inc. 3

$2,209.3 $14,324.0 $13,877.8 $5,494.5 $3,602.3 $857.9 $7,429.7 $6,899.7 $757.1 $741.3 $548.0 $3,550.3 $4,100.0 $1,263.1 $925.8 $803.5 $3,344.0 $2,878.1 $3,474.3 $1,935.1 4/30/20 4/30/21 4/30/22 4/30/23 4/30/24 European $931.1 33.2% NA Motorized $646.9 23.1% NA Towable $1,071.4 38.2% Other $151.7 5.5% 105,900 75,000 113,000 87,900 4/30/20 NORTH AMERICAN INDEPENDENT DEALER INVENTORY OF THOR PRODUCTS 135,500 RV BACKLOG OF $3.60 BILLION (34.4)% (1) Inventory Units (3) Includes units of Tiffin products subsequent to the December 2020 acquisition of the Tiffin Group NA Towables NA Motorized European (4) Includes Tiffin backlog subsequent to the December 2020 acquisition of the Tiffin Group (3) 4/30/24 (3) 4/30/23 THIRD QUARTER FISCAL 2024 RECAP GROSS MARGIN 15.1% +30 bps (1) DILUTED EPS (2) $2.13 (4.9)% (1) NET SALES $2.80 BILLION (4.4)% (1) (4) (4) (3) 4/30/22 UNIT SHIPMENTS 54,520 +5.8% (1) (1) As compared to the third quarter of fiscal 2023 (2) Attributable to THOR Industries, Inc. 4 (4) (3) 4/30/21 NET SALES ($ millions) (4)

($ in Millions) Third Quarter Fiscal 2024 Net Sales YOY Change Gross Profit YOY Change Gross Profit Margin YOY Change $1.07 billion (4.7)% $138.1 million (4.1)% 12.9% +10 bps NORTH AMERICAN TOWABLE SEGMENT 5 Key Drivers ▪ Unit shipments increased 15 . 1 % primarily due to heightened demand for lower - cost travel trailer units, which increased 28 . 2 % over the prior - year period ▪ Disciplined wholesale production assisted independent dealers in maintaining appropriate channel inventory levels ahead of the model year 2025 changeover ▪ Overall net price per unit decreased 19 . 8 % primarily due to the combined impact of a shift in product mix toward travel trailers and our more moderately - priced units ▪ CYTD March 31 , 2024 travel trailer and fifth wheel market share of 40 . 2 % ( - 190 bps y/y) ▪ Modest increase in gross profit margin primarily driven by a decrease in the material cost percentage, due to the combined favorable impacts of lower discounting, cost - saving initiatives, and product mix changes, partially offset by an increase in the labor cost percentage ▪ Order backlog of $ 741 . 3 million

($ in Millions) Third Quarter Fiscal 2024 Net Sales YOY Change Gross Profit YOY Change Gross Profit Margin YOY Change $646.9 million (18.7)% $71.8 million (23.1)% 11.1% (60) bps NORTH AMERICAN MOTORIZED SEGMENT 6 Key Drivers ▪ Unit shipments decreased 20 . 0 % due to subdued current dealer and consumer demand in comparison with the demand in the prior year ▪ Managed wholesale production to assist independent dealers in maintaining appropriate channel inventory levels as we head towards the conclusion of Spring selling season ▪ CYTD March 31 , 2024 market share of 47 . 9 % (no change y/y) ▪ Gross profit margin decreased primarily due to the combined impact of decreased net sales and higher sales discounting ▪ Order backlog of $ 925 . 8 million

EUROPEAN SEGMENT Key Drivers ▪ Net sales increase driven by a 1 . 5 % decrease in unit shipments and an 8 . 9 % increase in the overall net price per unit due to the total combined impact of changes in product mix and price ▪ 3 Q 24 product mix included higher concentration of sales of Motorcaravans and Campervans on improved supply of chassis compared to the prior - year period ▪ No impact of foreign currency exchange rate changes on net sales compared to the prior - year period ▪ Gross profit margin remained constant as slight improvements in labor and warranty percentages were offset by an increase in the material cost percentage due to increased sales discounting ▪ Independent dealer inventory levels of motorized products generally restocked to appropriate levels ▪ Order backlog of $ 1 . 94 billion ($ in Millions) Third Quarter Fiscal 2024 Net Sales YOY Change Gross Profit YOY Change Gross Profit Margin YOY Change $931.1 million 7.4% $162.9 million 7.3% 17.5% 0 bps 7

$1,369.8 NET DEBT / TTM EBITDA 1.2x NET DEBT / TTM ADJUSTED EBITDA 1.2x $1,263.8 STRONG FINANCIAL POSITION ($ millions) $288.8 $474.1 $251.7 $207.5 FY24 YTD OPERATING CASH FLOW TOTAL LONG - TERM DEBT (1) ($ millions) LIQUIDITY (2) ($ millions) SELECTED FINANCIAL RATIOS (2) (3) TLB $703.7 Senior Unsecured Notes $500.0 Other $60.1 Cash Equivalents $371.8 Available Credit Under ABL $998.0 Total Liquidity (1) Total gross debt obligations as of April 30, 2024 inclusive of the current portion of long - term debt (2) As of April 30, 2024 (3) See the Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures $106.1 3QFY23 FY23 YTD 3QFY24 Capital Expenditures ($ millions) $49.5 $150.5 $27.2 Total Long - Term Debt There were no outstanding borrowings on our ABL as of April 30, 2024 8

9 CAPITAL MANAGEMENT PRIORITIES AND FISCAL 2024 ACTIONS Invest in THOR’s business ▪ Capex spending of $106.1 million FYTD Pay THOR's dividend ▪ Increased regular quarterly dividend to $0.48 in October 2023 ▪ Represents 14 th consecutive year of dividend increases Reduce the Company's debt obligations ▪ Payments on term - loan credit facilities of $100.0 million for Fiscal Year 2024 (1) ▪ Committed to long - term net debt leverage ratio target of less than 1.0x; currently at 1.2x Repurchase shares on a strategic and opportunistic basis ▪ Repurchased $43.0 million FYTD ▪ $448.2 million available to be repurchased as of April 30, 2024 under current authorizations Support opportunistic strategic investments ( 1 ) Payments exclude the impact of the November 15 , 2023 term loan amendments, as discussed in Note 12 to the Condensed Consolidated Financial Statements of the Company’s Quarterly Report on Form 10 - Q for the period ended April 30 , 2024 .

FULL - YEAR FISCAL 2024 GUIDANCE OUTLOOK ASSUMPTIONS ▪ Full - year fiscal 2024 outlook has been revised to reflect the persistence of challenging market conditions affecting North American independent dealers and consumers into the fourth quarter of fiscal 2024 , resulting in reduced consolidated net sales and margin expectations as dealers are expected to maintain historically lean inventory levels ▪ North American industry wholesale shipment range between 315 , 000 and 325 , 000 units for fiscal 2024 , resulting in further destocking of channel inventory ( previous range of between 330 , 000 and 340 , 000 units ) ▪ Continued strong financial performance in our European segment driven by sustained efforts of our management team, favorable price - cost realization and operational efficiencies ▪ Will face tougher year - over - year comparisons in 4 Q 24 as we lap restocking volumes in 4 Q 23 OTHER FULL - YEAR MODELING ASSUMPTIONS ▪ SG&A expense as a % of sales: >8.0% ▪ Capital expenditures: $140.0 million ▪ Amortization of intangible assets expense: $129.3 million ▪ Tax rate: between 22.0% and 24.0%, before consideration of any discrete tax items $9.8 – $10.1B (previously $10.0 - $10.5B) NET SALES GROSS PROFIT MARGIN DILUTED EARNINGS PER SHARE 13.75 % – 14.0 % (previously 14.0% - 14.5%) $4.50 – $4.75 (previously $5.00 - $5.50) 10

KEY TAKEAWAYS Continue to align production and wholesale shipments to reflect current cautious dealer outlook to position THOR and its North American dealers with appropriate inventories as Spring selling season concludes and we approach the 2025 model year changeover Strong financial performance in our European segment driven by sustained efforts of our management team, favorable price - cost realization, market share gains and a resilient European customer base North American operating companies pursuing initiatives to enhance operations and through - cycle profitability, including brand and footprint rationalization, product portfolio optimization and cost management Full - year fiscal 2024 outlook adjusted, to reflect ongoing macro pressures affecting North American independent dealers and consumers, resulting in reduced consolidated net sales, gross profit margin and EPS expectations as dealers are expected to maintain historically lean inventory levels 11

APPENDIX 12

The Global RV Industry Leader THOR SNAPSHOT (1) (1) As of July 31, 2023 Founded 1980 Headquarters Elkhart, Indiana Countries with Distribution 25+ Team Members 24,900 Countries with Manufacturing 6 Facilities Worldwide >400 Independent Dealership Locations 3,500 NET SALES BY SEGMENT (1) NET SALES BY COUNTRY (1) United States, 66.9% Germany, 16.3% Other Europe, 11.0% Canada, 5.3% Other, 0.5% North American Towable 37.8% North American Motorized 29.8% European 27.3% Other, 5.1% EUROPEAN OTHER NORTH AMERICAN MOTORIZED NORTH AMERICAN TOWABLE 13

THOR’S PRODUCT LEADERSHIP ( 1 ) All retail information presented is for the CYTD period through March 31 , 2024 . ( 2 ) North American retail data is reported by Statistical Surveys, Inc . and is based on official state and provincial records . This information is subject to adjustment, is continuously updated and is often impacted by delays in reporting by various states or provinces . ( 3 ) European retail data is reported by the Caravaning Industry Association e . V . (“CIVD”) and the European Caravan Federation (“ECF ” ) . This information is subject to adjustment, continuously updated and is often impacted by delays in reporting by various countries (some countries, including the United Kingdom, do not report OEM - specific data and are thus excluded from the market share calculation) . EUROPEAN (3) All RV Segments NORTH AMERICAN (2) CATEGORY Class B Class C Class A Fifth Wheels Travel Trailers 23.7% 37.1% 52.7% 49.4% 41.3% 39.9% MARKET SHARE (1) #1 #1 #1 #1 #1 #1 MARKET POSITION (1) 14

120.8 121.1 156.5 176.5 201.3 194.3 192.2 199.5 229.1 249.7 239.1 207.6 250.6 258.9 298.3 323.0 334.5 298.1 208.6 152.4 217.1 227.6 257.6 282.8 312.8 326.9 442.0 426.1 376.0 359.4 389.6 544.0 434.9 267.3 301.5 343.5 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) (e) 173.1 163.1 203.4 227.8 259.5 247.2 247.5 254.6 292.7 321.2 300.1 256.8 311.0 320.9 370.0 384.5 390.4 353.5 237.0 165.6 242.3 252.4 285.7 321.1 430.7 356.7 374.2 504.6 483.7 406.1 430.4 600.2 493.3 313.2 344.0 391.4 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) (e) TOWABLE RV WHOLESALE MARKET TRENDS (UNITS 000's) YTD Shipments (Units) March 2024 March 2023 Unit Change 85,941 78,600 7,341 % Change +9.3% YTD Shipments (Units) March 2024 March 2023 Unit Change 75,525 65,208 10,317 % Change +15.8% 52.3 41.9 46.9 51.3 58.2 52.8 55.3 55.1 63.5 71.5 61.0 49.2 60.4 62.0 71.7 61.4 55.8 55.4 28.4 13.2 25.2 24.8 28.2 38.3 44.0 47.3 54.7 62.6 57.6 46.6 40.8 56.2 58.4 45.9 42.5 47.9 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) (e) YTD Shipments (Units) % Change Unit Change March 2023 March 2024 (22.2)% (2,976) 13,392 10,416 Historical Data: Recreation Vehicle Industry Association (RVIA) (e) Calendar year 2024 represents the most recent RVIA "most likely" estimate from their June 2024 issue of Roadsigns RV INDUSTRY OVERVIEW North America RV WHOLESALE MARKET TRENDS (UNITS 000's) MOTORIZED RV WHOLESALE MARKET TRENDS (UNITS 000's) 15

Europe (1) Source : European Caravan Federation; CYTD March 31, 2024 and 2023; European retail registration data available at www.CIVD.de % Change Total Three Months Ended March 31, 2024 2023 % Change Motorcaravans Three Months Ended March 31, 2024 2023 % Change Caravans Three Months Ended March 31, 2024 2023 Country 4.5 % 23,770 24,835 7.2 % 18,479 19,805 (4.9)% 5,291 5,030 Germany 3.6 % 7,911 8,193 8.8 % 5,780 6,287 (10.6)% 2,131 1,906 France 5.8 % 6,702 7,093 20.2 % 3,204 3,851 (7.3)% 3,498 3,242 U.K. 10.0 % 2,100 2,311 6.2 % 593 630 11.5 % 1,507 1,681 Netherlands (12.4)% 2,156 1,888 (9.4)% 1,757 1,592 (25.8)% 399 296 Switzerland (21.8)% 702 549 (16.9)% 419 348 (29.0)% 283 201 Sweden 12.4 % 1,882 2,116 17.3 % 1,668 1,956 (25.2)% 214 160 Italy (5.4)% 2,026 1,917 (5.6)% 1,754 1,655 (3.7)% 272 262 Belgium 13.9 % 1,710 1,948 15.8 % 1,388 1,607 5.9 % 322 341 Spain (10.7)% 4,475 3,994 (9.0)% 2,821 2,568 (13.8)% 1,654 1,426 All Others 2.6 % 53,434 54,844 6.4 % 37,863 40,299 (6.6)% 15,571 14,545 Total The Company monitors retail trends in the European RV market as reported by the European Caravan Federation, whose industry data is reported to the public quarterly Industry wholesale shipment data for the European RV market is not available 201 192 146 138 135 140 143 152 162 166 174 182 198 203 210 208 189 154 150 156 147 137 140 152 168 190 202 211 236 261 219 210 144 141 170 162 151 182 217 222 219 220 253 272 274 251 274 292 324 320 310 366 289 206 228 247 264 304 333 376 416 471 465 522 493 570 449 379 North America 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 FULL - YEAR COMPARISON OF NEW VEHICLE REGISTRATIONS BY CONTINENT (UNITS 000's) (1) (2) RV INDUSTRY OVERVIEW Europe EUROPEAN INDUSTRY UNIT REGISTRATIONS BY COUNTRY (1) (2) Source : Statistical Surveys; North American retail registration data available at www.statisticalsurveys.com 16

RVs are a preference for those who camp Strong interest in the RV lifestyle by consumers RV Owner future purchase intent is high Significant growth in RV usage 96 % increase in RV usage since 2014 (+6.4 million households) (2) CONSUMER TRENDS SUPPORT LONG - TERM RV INDUSTRY GROWTH Supported by Real Data from RVers 76 % of consumers who expressed interest in purchasing an RV at some point in the future are likely to do so within the next year ( 1 ) 47% of campers camped in an RV – the portion of campers who list RV or travel trailer as their primary camping type climbed 10.9% in 2023 (4) (1) THOR US 2024 RV Purchase Impact Study; (2) KOA 2024 Camping & Outdoor Hospitality Report; (3) THOR 2024 North American Path to 95 % of new RV owners plan to purchase another RV in the future ( 3 ) Purchase Study Travel Trailer Study; (4) The Dyrt 2024 Camping Report 17

18 QUARTERLY EBITDA RECONCILIATION ($ in thousands) TTM Fiscal Quarters TTM 3QFY24 2QFY24 1QFY24 4QFY23 3QFY23 $ 265,218 $ 113,577 $ 5,326 $ 55,033 $ 91,282 $ 119,729 Net Income Add Back: 92,901 21,830 28,229 20,197 22,645 26,362 Interest Expense, Net (1) 88,521 28,773 1,568 17,549 40,631 35,722 Income Taxes 277,650 68,151 68,119 67,278 74,102 68,151 Depreciation and Amortization of Intangibles $ 724,290 $ 232,331 $ 103,242 $ 160,057 $ 228,660 $ 249,964 EBITDA Add Back: 41,954 9,351 9,246 10,452 12,905 9,672 Stock - Based Compensation Expense (2,648) (5,000) (3,000) — 5,352 6,500 Change in LIFO Reserve Net (Income) Expense Related to Certain Contingent (18,633) (2,700) (4,200) (10,000) (1,733) (1,006) Liabilities 3,034 1,575 1,724 (979) 714 (295) Non - Cash Foreign Currency Loss (Gain) 6,296 (581) 530 2,871 3,476 2,682 Market Value Loss (Gain) on Equity Investments 18,075 2,890 3,502 5,935 5,748 4,688 Equity Method Investment Loss (Gain) 2,500 2,500 — — — — Weather - Related Losses 7,175 — 7,175 — — — Debt Amendment Expenses Other Loss (Gain), Including Sales of Property, Plant (20,260) (4,267) (9,533) (1,418) (5,042) (5,824) and Equipment $ 761,783 $ 236,099 $ 108,686 $ 166,918 $ 250,080 $ 266,381 Adjusted EBITDA $ 10,247,307 $ 2,801,113 $ 2,207,369 $ 2,500,759 $ 2,738,066 $ 2,928,820 Net Sales 7.4 % 8.4 % 4.9 % 6.7 % 9.1 % 9.1 % Adjusted EBITDA Margin (%) $ 1,263,795 Total Long - Term Debt as of April 30, 2024 (2) 371,819 Less: Cash and Cash Equivalents $ 891,976 Net Debt 1.2 x Net Debt / TTM EBITDA 1.2 x Net Debt / TTM Adjusted EBITDA Adjusted EBITDA is a non - GAAP performance measure included to illustrate and improve comparability of the Company's results from period to period . Adjusted EBITDA is defined as net income before net interest expense, income tax expense and depreciation and amortization adjusted for certain items and other one - time items . The Company considers this non - GAAP measure in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends . The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies . (1) Includes $7,566 of costs associated with the debt amendment for 2QFY24 as outlined in Note 12 of the 3QFY24 Notes to the Condensed Consolidated Financial Statements (2) Total debt obligations as of April 30, 2024 inclusive of the current portion of long - term debt

www.thorindustries.com INVESTOR RELATIONS CONTACT Jeff Tryka, CFA Lambert Global jtryka@lambert.com (616) 295 - 2509

Exhibit 99.3

THIRD QUARTER FISCAL 2024

INVESTOR QUESTIONS & ANSWERS

June 5, 2024

Forward-Looking Statements

Reference is made to the forward-looking statements disclosure provided

at the end of this document.

Executive Overview

Fiscal Third Quarter 2024 Highlights

| • | Consolidated net sales for the third quarter were $2.80 billion. |

| • | Consolidated gross profit margin for the third quarter was 15.1%. |

| • | Net income attributable to THOR Industries, Inc. and diluted earnings per share for the third quarter

of fiscal 2024 were $114.5 million and $2.13, respectively. |

| • | The Company revised its full-year fiscal 2024 guidance to a consolidated net sales range of $9.8 billion

to $10.1 billion, gross margin range of 13.75% to 14.0% and diluted earnings per share range of $4.50 to $4.75. |

Quick Reference to Contents

| Current Market Conditions and Outlook Assumptions |

2 |

| |

|

|

|

| Q&A |

|

| |

|

|

|

| |

|

Market Update |

3 |

| |

|

Operations Update |

3 |

| |

|

Financial Update |

6 |

| |

|

|

|

| Segment Data |

|

| |

|

|

|

| |

|

Summary of Key Quarterly Segment Data – North American Towable RVs |

9 |

| |

|

Summary of Key Quarterly Segment Data – North American Motorized RVs |

10 |

| |

|

Summary of Key Quarterly Segment Data – European RVs |

11 |

| |

|

|

|

| Forward-Looking Statements |

12 |

Current Market Conditions and Outlook Assumptions

| • | Market demand conditions in North America |

Persistent macroeconomic headwinds continue to impact retail

sales in the RV industry. While we continue to believe that this impact on our market is temporary, the impact has been prolonged, and

we now expect that the headwinds will continue to significantly impact our performance through our fiscal year 2024 and into our fiscal

year 2025. Given the pressures on consumers, affordability continues to be an industry focus. The Recreational Vehicle Industry Association

(“RVIA”) recently updated their wholesale unit shipments forecast for calendar 2024 to reflect the current softness in market

demand trends. The RVIA forecast has been moderately reduced calling for a range of North American wholesale shipments of 328,900 units

to 359,100 units with a median point of 344,000 units, up from the wholesale shipment total for calendar 2023 of 313,174 units, but significantly

lower than both calendar year 2021 and calendar year 2022 and lower than earlier estimates for calendar year 2024. Looking ahead, the

early forecast from RVIA for calendar year 2025 calls for a wholesale shipment range of 374,200 to 408,600 units, with a median point

of 391,400 units, an increase of 13.8% over the median wholesale shipment total forecasted for calendar year 2024.

| • | Market demand conditions in Europe |

Similar to North America, European retail sales have been impacted

by current macroeconomic conditions; however, we continue see relative strength in retail registrations in Europe when compared to North

America. According to the European Caravan Foundation (“ECF”), total retail registrations for motorcarvans and campervans

in Europe for first quarter of calendar 2024 increased by 6.4% compared to the same quarter of calendar 2023, while retail registrations

for caravans decreased by 6.6% over the same periods. Retail sales of product produced by our European segment realized a growth of 24.8%

during the first quarter of calendar year 2024 compared to the same quarter of calendar year 2023. In Europe, we believe that independent

dealer inventory levels of Erwin Hymer Group (“EHG”) products have been restocked to normalized levels and are now generally

appropriate for seasonal consumer demand during the peak selling season.

Consolidated RV backlog was $3.60 billion as of April 30, 2024.

North American RV backlog was $1.67 billion as of April 30, 2024, a decrease of 17.5% compared to $2.02 billion as of April 30, 2023.

European RV backlog was $1.94 billion as of April 30, 2024, a decrease of 44.3% compared to $3.47 billion as of April 30, 2023.

| • | Near-term and long-term RV industry outlook in both North America and Europe |

The RV industry has experienced a slowdown in retail activity

as consumers have been impacted by higher interest rates, elevated unit prices, and overall inflation adversely impacting their budgets.

We remain cautious about our fourth quarter of fiscal year 2024 and fiscal year 2025 as relief from macroeconomic inhibitors remains elusive.

In the longer-term, we remain optimistic about the industry’s and THOR’s return to growth. Our optimism continues to be supported

by strong interest in the RV lifestyle and the secular shift in our market that has occurred just prior to and since the global pandemic

as the industry’s total addressable market grew materially during this time period. As we look beyond the current macroeconomic

environment, we believe that the growth in the addressable market will lead to strong future years for THOR and the RV industry.

Q&A

MARKET UPDATE

| 1. | How do you characterize the outlook and focus of your North American independent dealers? |

| a. | Overall, our North American independent dealers remain consistent in their views with recent quarters

as macroeconomic challenges persist. Faced with elevated floor plan interest rates and a soft retail environment, our dealers are understandably

reticent to fill their inventory. As we look ahead to our fourth quarter, we believe dealers will remain hesitant to hold any excess inventory

until a sustained positive inflection in retail demand takes hold. Consequently, we expect to see the continuation of cautious ordering

patterns in the wholesale channel consisting of smaller, more frequent orders as dealers operate in a higher interest rate environment.

Over the longer term, we view this as a positive development for the industry as we believe the proactive planning discussions taking

place between our operating companies and independent dealer partners will result in improved long-term profitability trends across the

industry. The inherent consequence of dealer prudence is better positioning for THOR and the industry as we continue to work through the

prolonged macroeconomic challenges. When the adverse economic factors clear, as they inevitably will, this prudence will position THOR

to perform very well as the market returns to growth. |

| 2. | What is your current near-term outlook on the North American retail demand environment? |

| a. | We believe that retail demand will remain depressed through our fiscal fourth quarter and likely through

the remainder of calendar 2024. Initially, we forecasted retail demand to be between 350,000 and 365,000 units for calendar year 2024.

That forecast assumed some easing of the macroeconomic headwinds, primarily in the form of five to six interest rate cuts that were widely

anticipated over the course of the calendar year. The lack of interest rate relief has negatively impacted retail sales. We currently

model 315,000 to 325,000 retail units for calendar year 2024. |

OPERATIONS UPDATE

| 1. | Can you comment on fiscal third quarter production and the cadence of North American wholesale shipments

for the remainder of fiscal 2024? |

| a. | As we have communicated, we are focused on aligning our production with retail sales to avoid undesired

inventory growth in the supply channel, particularly at the dealer level. Over the fiscal third quarter, our North American dealer inventories

remained flat sequentially, indicating that our operating companies aligned production well with retail pull-through. Furthermore, as

of April 30, 2024, North American dealer inventory levels of THOR products approximated 87,900 units compared to 113,000 as of April 30,

2023, a decrease of 22.2%. |

For the full-year of fiscal 2024, we currently

forecast an industry wholesale shipment range of between 315,000 and 325,000 units.

Consistent with our approach throughout the current down cycle,

THOR operating companies will continue to manage production in a disciplined manner with a high level of conservatism. Our teams will

also continue to work closely with our dealer partners in monitoring retail demand to ensure we respond quickly to shifts in market demand

and adjust our production plans appropriately.

| 2. | In North America, you have been operating in a down-cycle environment for well over a year now and

there is no clear end to the cycle at this point. Can you speak to THOR’s and its dealer partners’ wherewithal to withstand

the down cycle if it continues for an extended period of time going forward? |

| a. | THOR’s operating model positions it to perform relatively well in any cycle, and our long history

shows that not only does our model work, it is one of THOR’s core strengths, along with the talented and experienced teams we have

throughout the organization to execute this model. While a down cycle will inevitably impact THOR’s top and bottom line, THOR’s

operating model and conservative balance sheet strategy insulate it from significant threats from a down cycle. THOR’s market leadership

position has been underpinned by its fast and flexible variable cost model and long-term focus. During down cycles, THOR operates from

a position of strength given its operating model and strong liquidity and it adapts to evolving market conditions in a nimble fashion

while staying steadfast in its commitment to investing in its long-term growth. This down cycle is no different than those that have come

before it; THOR performs well through a challenging market because of our variable cost model, our conservative balance sheet strategy

and our experienced teams. |

| 3. | Can you comment on the third quarter fiscal 2024 performance and the outlook of THOR Industries’

European segment? |

| a. | The strong fiscal 2024 third quarter performance of our European segment once again demonstrated the successful

efforts of our European management team to implement strategies driving favorable price-cost realization and operational efficiencies.

In addition, improved chassis supply allowed us to fully complete the restocking of dealer inventory levels of motorized product and regain

Motorcaravan and Campervan market share that was lost due to the disproportionate impact of shortages in chassis supply. Through the first

calendar quarter of 2024, we have achieved a Motorcaravan and Campervan market share of 25.6%, an improvement upon our 20.9% market share

for the full calendar year 2023. |

As we enter our fourth quarter of fiscal year 2024, our European

independent dealer inventory is in balance with the market, and our European segment continues to execute on operational efficiency strategies

that maximize its performance. Given the current market conditions, we expect retail to soften on a year-over-year basis. Through the

first calendar quarter of 2024, total retail registrations in Europe have increased by 2.6%, with registrations of Motorcaravans and Campervans

increasing 6.4% while retail registrations of Caravans declined 6.6% compared to the first calendar quarter of 2023. Consequently, we

expect wholesale sales to moderate in line with the softer retail environment. The softer sales environment will put pressure on our European

segment’s margins as we expect fiscal fourth quarter margins to be slightly less than the strong prior-period margins.

| 4. | Can you comment on the weather event that impacted Airstream’s operations in the

third quarter? |

| a. | On

March 14, 2024, a weather event that included large damaging hail occurred at and around Airstream’s operations in Jackson Center,

Ohio. The hail caused significant damage to the roof of the motorized production facility and also caused significant damage to the raw

inventory of motorized chassis. The loss of the motorized chassis inventory impaired Airstream’s ability to produce motorized units

subsequent to the weather event; however, it is expected that production will return to normal levels late in our fourth quarter once

replacement chassis are received. Given the existence of appropriate and comprehensive insurance coverage, the loss did not materially

impact our third quarter operating results. Looking ahead, we expect chassis supply sufficient to have Airstream operating to plan by

the end of our fiscal fourth quarter. |

| 5. | Your backlogs for North American Motorized orders and European orders decreased materially year over

year. What caused this and is this a basis for concern? |

| a. | Our

North American Motorized backlog has decreased by 26.7% on a year-over-year basis. The cause for this decline is a combination of the

current retail market condition, elevated interest rates on our independent dealers’ floor plan financing credit facilities, and

our own work with the dealers to tightly manage inventory during this down cycle. Currently, the North American Motorized backlog is

approximately $925.8 million. Given the current conditions, we believe this level of backlog is appropriate. The decline is wholly attributable

to current market conditions. As such, we find this level of backlog healthy and not a cause for concern. |

In Europe, backlog decreased by 44.3% on a year-over-year basis.

This decrease is primarily attributable to an elevated level of orders in the prior year that was driven by pent up demand created by

the chassis shortage. While the drop on a year-over-year basis is significant, the current levels are appropriate for the current market

conditions. For additional context, current backlog levels remain more than 180% higher than backlog levels from April 2019, prior to

the impact on the supply chain caused by the global pandemic. We view the current backlog levels at our European segment to be healthy

and appropriate.

Our relationships with our independent dealer partners have grown

stronger as we have partnered together through this down cycle. We remain confident that as the market returns, our top and bottom lines

will follow accordingly. As has been true with prior down cycles, upon return, it is our expectation that we will realize share gains.

Given the current economic conditions and our relationships with our independent dealers, we are not concerned about the lower year-over-year

backlogs.

FINANCIAL UPDATE

| 1. | North American Towable gross profit margin for the third quarter of fiscal year 2024 was 12.9% compared

to 12.8% for the third quarter of fiscal year 2023 and 7.4% for the second quarter of fiscal year 2024. What drove this improvement in

your margins? Do you foresee these margins sustaining at the same level through the fiscal fourth quarter? |

| a. | Our relatively strong gross margins from our North American Towable segment

were driven by two key factors: |

| (1) | The Spring selling season brought an increase to our top line, enabling our

companies to realize better operating leverage. Compared to our second quarter where our total wholesale shipments were limited to 21,958

units, our third quarter saw a material increase in wholesale shipments as we shipped 34,193 towable

units to our dealer partners. Compared to the third quarter of fiscal 2023 when we shipped 29,716 towable

units, our year-over-year increase for the third quarter was 15.1%. The large increase over the third

quarter of fiscal year 2023 was offset by lower net sales caused by lower average selling prices and product mix trending towards lower-priced

units; and |

| (2) | Increased retail activity driven by the selling season allowed for some moderation of promotional activity.

The current quarter also benefited from our work to assist our independent dealers to reduce their inventory levels. |

As we look to our fourth quarter, we anticipate lower top line

sales which will impact margins from the North American Towable segment as we will lose a portion of the improved operating leverage that

buoyed our fiscal 2024 third quarter margins.

| 2. | The North American Motorized segment’s net sales and gross margins declined materially on a fiscal

year-to-date basis. Can you explain? |

| a. | In

North America, our motorized net sales have decreased 27.4% over the first three quarters of our fiscal year 2024 when compared to the

same period of fiscal year 2023. Motorized chassis continue to be elevated in price, negatively impacting affordability at a time when

it is at a premium to the North American consumer. This had a material impact on both our top and bottom lines for the segment. Over

the first three quarters of fiscal year 2024, our gross profit as a percentage of sales for the North American Motorized segment decreased

to 11.0% from 14.5% realized in the prior-year period. The combination of the high input costs and the decrease in operating leverage

drove the decline in gross margins for the segment. |

We are working aggressively with our chassis manufacturers and

our other suppliers to drive costs in line with current market conditions. As we gain relief from the elevated input costs, we anticipate

that retail activity will pick up and the segment’s net sales and gross margins will return to more normalized levels.

| 3. | The Company revised full-year financial guidance for fiscal 2024 in its press release today. What are

the key assumptions driving your updated outlook? |

| a. | The Company revised its full-year fiscal 2024 guidance, which now includes: |

| • | Consolidated net sales in the range of $9.8 billion to $10.1 billion (previously $10.0 billion to $10.5

billion) |

| • | Consolidated gross profit margin in the range of 13.75% to 14.0% (previously 14.0% to 14.5%) |

| • | Diluted earnings per share in the range of $4.50 to $4.75 (previously $5.00 to $5.50) |

Consolidated Net Sales. As our independent dealer

partners and retail consumers continue to navigate persistent macro pressures, namely higher interest rates and inflation, THOR remains

focused on operating the business in a disciplined manner that maximizes profitability across the business cycle. We have seen more aggressive

pricing from our competition which may contribute to a lower top line in the short term as we remain disciplined. As a result, we lowered

our full-year fiscal 2024 consolidated net sales target primarily to reflect our continued production discipline and focus on inventory

management in our North American segments. Despite our independent dealers currently operating with historically lean inventory levels,

we expect to produce at levels equal to or lower than retail demand in the near-term as we believe dealers will remain hesitant to hold

excess inventory until a sustained positive inflection in retail demand takes hold. The Company’s North American operating plan

for fiscal 2024 was revised to reflect an industry wholesale shipment range of between 315,000 and 325,000 units with wholesale

shipments slightly under-pacing retail demand. In our European segment, our top line continues to meet expectations given resilient retail

activity to date in our fiscal year. Despite relatively solid retail demand in Europe, having completed restocking efforts in the second

quarter of fiscal 2024, we expect a 1:1 wholesale-retail relationship and anticipate tougher year-over-year net sales comparisons for

our fourth quarter of fiscal 2024 as we lap restocking volumes seen in the fourth quarter of fiscal 2023.

Consolidated Gross Profit Margin. Despite a material

reduction in our consolidated top line, we have successfully maintained consolidated margin through our third quarter of fiscal year 2024

due to our continued production discipline and focus on operational efficiencies. Given the further reduction in our fiscal fourth quarter

consolidated top line expectations, a moderate reduction in our full-year consolidated margin forecast is appropriate given the loss of

operating leverage.

Capital Expenditures and Innovation. While we remain

committed to making incremental investments in automation and innovation strategies to drive long-term growth, we have reduced our planned

investments to align with our financial performance. Our current estimate of committed and internally approved capital spend for fiscal

2024 is $140.0 million, a decrease of $120.0 million from the original $260.0 million planned at the onset of fiscal 2024. Given the impact

of operating leverage and incremental R&D expenses, we continue to expect SG&A to be approximately 8.0% of consolidated net sales.

Tax Rate. For fiscal 2024, we plan for our annual

effective income tax rate to remain essentially flat to fiscal 2023 with an estimated range between 22.0% and 24.0% before consideration

of any discrete tax items.

| 4. | The RVIA recently updated its calendar year 2024 wholesale shipment forecast for North America. Can

you reconcile the RVIA’s unit shipment forecast with your revised fiscal year 2024 wholesale shipment forecast? |

| a. | The Company’s North American operating plan for fiscal 2024 reflects an industry wholesale shipment

range of between 315,000 and 325,000 units. With a fiscal year end date of July 31, 2024, our forecast is closely aligned

with the lower end of the RVIA’s projected 12-month moving total unit shipment range of between 311,100 and 324,100 units at June

30, 2024. Similar to our forecast, the RVIA expects year-over-year shipment growth throughout calendar 2024 as the industry enters

its recovery and growth phase. |

Also, while we note that the exact timing of accelerating unit

shipment growth will ultimately depend on the timing of easing macroeconomic pressures, we are in agreement with the RVIA’s most

recent calendar year 2024 forecast of between 328,900 and 359,100 units.

Summary of Key Quarterly Segment Data – North American Towable RVs

Dollars are in thousands

| NET SALES: | |

Three Months Ended

April 30, 2024 | |

Three Months Ended

April 30, 2023 | |

% Change |