false

0000093556

DEF 14A

0000093556

2023-01-01

2023-12-30

0000093556

SWK:DonaldAllanJrMember

2023-01-01

2023-12-30

0000093556

SWK:JamesMLoreeMember

2022-01-02

2022-12-31

0000093556

SWK:DonaldAllanJrMember

2022-01-02

2022-12-31

0000093556

2022-01-02

2022-12-31

0000093556

SWK:JamesMLoreeMember

2021-01-03

2022-01-01

0000093556

2021-01-03

2022-01-01

0000093556

SWK:JamesMLoreeMember

2019-12-29

2021-01-02

0000093556

2019-12-29

2021-01-02

0000093556

SWK:DonaldAllanJrMember

ecd:PeoMember

SWK:ValueOfEquityAwardsReportedInTheSummaryCompensationTableMember

2023-01-01

2023-12-30

0000093556

ecd:NonPeoNeoMember

SWK:ValueOfEquityAwardsReportedInTheSummaryCompensationTableMember

2023-01-01

2023-12-30

0000093556

SWK:DonaldAllanJrMember

ecd:PeoMember

SWK:YearEndValueOfEquityAwardsGrantedIn2023ThatAreUnvestedAndOutstandingMember

2023-01-01

2023-12-30

0000093556

ecd:NonPeoNeoMember

SWK:YearEndValueOfEquityAwardsGrantedIn2023ThatAreUnvestedAndOutstandingMember

2023-01-01

2023-12-30

0000093556

SWK:DonaldAllanJrMember

ecd:PeoMember

SWK:ChangeInFairValueFromPriorYearEndOfPriorYearEquityAwardsThatAreUnvestedAndOutstandingMember

2023-01-01

2023-12-30

0000093556

ecd:NonPeoNeoMember

SWK:ChangeInFairValueFromPriorYearEndOfPriorYearEquityAwardsThatAreUnvestedAndOutstandingMember

2023-01-01

2023-12-30

0000093556

SWK:DonaldAllanJrMember

ecd:PeoMember

SWK:FairMarketValueOfEquityAwardsGrantedIn2023AndThatVestedIn2023Member

2023-01-01

2023-12-30

0000093556

ecd:NonPeoNeoMember

SWK:FairMarketValueOfEquityAwardsGrantedIn2023AndThatVestedIn2023Member

2023-01-01

2023-12-30

0000093556

SWK:DonaldAllanJrMember

ecd:PeoMember

SWK:ChangeInFairValueFromPriorYearEndOfPriorYearEquityAwardsThatVestedIn2023Member

2023-01-01

2023-12-30

0000093556

ecd:NonPeoNeoMember

SWK:ChangeInFairValueFromPriorYearEndOfPriorYearEquityAwardsThatVestedIn2023Member

2023-01-01

2023-12-30

0000093556

SWK:DonaldAllanJrMember

ecd:PeoMember

SWK:PriorYearEndFairValueOfPriorYearEquityAwardsThatFailedToVestIn2023Member

2023-01-01

2023-12-30

0000093556

ecd:NonPeoNeoMember

SWK:PriorYearEndFairValueOfPriorYearEquityAwardsThatFailedToVestIn2023Member

2023-01-01

2023-12-30

0000093556

SWK:DonaldAllanJrMember

ecd:PeoMember

SWK:DividendsAndDividendEquivalentPaymentsPaidDuring2023OnUnvestedEquityAwardsMember

2023-01-01

2023-12-30

0000093556

ecd:NonPeoNeoMember

SWK:DividendsAndDividendEquivalentPaymentsPaidDuring2023OnUnvestedEquityAwardsMember

2023-01-01

2023-12-30

0000093556

SWK:DonaldAllanJrMember

ecd:PeoMember

SWK:ChangeInPresentValueOfAccumulatedPensionPlanBenefitsReportedInTheSummaryCompensationTableMember

2023-01-01

2023-12-30

0000093556

ecd:NonPeoNeoMember

SWK:ChangeInPresentValueOfAccumulatedPensionPlanBenefitsReportedInTheSummaryCompensationTableMember

2023-01-01

2023-12-30

0000093556

SWK:DonaldAllanJrMember

ecd:PeoMember

SWK:ServiceCostForDefinedBenefitAndPensionPlansMember

2023-01-01

2023-12-30

0000093556

ecd:NonPeoNeoMember

SWK:ServiceCostForDefinedBenefitAndPensionPlansMember

2023-01-01

2023-12-30

0000093556

SWK:DonaldAllanJrMember

ecd:PeoMember

SWK:PriorServiceCostForDefinedBenefitAndPensionPlansMember

2023-01-01

2023-12-30

0000093556

ecd:NonPeoNeoMember

SWK:PriorServiceCostForDefinedBenefitAndPensionPlansMember

2023-01-01

2023-12-30

0000093556

ecd:PeoMember

SWK:DonaldAllanJrMember

2023-01-01

2023-12-30

0000093556

ecd:PeoMember

SWK:DonaldAllanJrMember

2022-07-01

2022-12-31

0000093556

ecd:PeoMember

SWK:JamesMLoreeMember

2022-01-02

2022-06-30

0000093556

ecd:PeoMember

SWK:JamesMLoreeMember

2021-01-03

2022-01-01

0000093556

ecd:PeoMember

SWK:JamesMLoreeMember

2019-12-29

2021-01-02

0000093556

1

2023-01-01

2023-12-30

0000093556

2

2023-01-01

2023-12-30

0000093556

3

2023-01-01

2023-12-30

0000093556

4

2023-01-01

2023-12-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities

Exchange Act of 1934 (Amendment No.)

| Filed by the Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

| |

| Check the appropriate box: |

| |

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting Material Under §240.14a-12 |

| Stanley Black & Decker, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

Payment of Filing Fee (Check all boxes that apply): |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

|

|

|

STANLEY BLACK & DECKER, INC. |

| |

|

March 8, 2024

Dear Fellow Shareholder:

You are cordially invited to attend the Annual

Meeting of Shareholders of Stanley Black & Decker, Inc. (“Stanley Black & Decker” or the “Company”) to

be held at 9:30 a.m. EDT on April 26, 2024, at the John F. Lundgren Center for Learning and Development, 1000 Stanley Drive, New Britain,

Connecticut 06053 (see directions at the end of this document).

This document includes the Notice of Annual Meeting

of Shareholders, a letter from the Chair of our Board of Directors and the Proxy Statement. The Proxy Statement describes the business

to be conducted at the Annual Meeting and provides other important information about the Company that you should be aware of when you

vote your shares.

In our 2024 letter to our shareholders, which is

included in our Annual Report, we describe our vision and purpose, strategic initiatives and our financial performance. We are committed

to providing our shareholders with long-term value, and we hope that you will find the letter and Annual Report informative. I would like

to personally thank you for your continued investment in our Company.

We appreciate and encourage your participation.

Whether or not you plan to attend the meeting, your vote is important to us, and we hope that your shares will be represented. PLEASE

VOTE BY TELEPHONE OR ON THE INTERNET, OR RETURN A PROPERLY COMPLETED PROXY CARD, AT YOUR EARLIEST CONVENIENCE.

| |

Very truly yours, |

| |

|

| |

Donald Allan, Jr.

President & Chief Executive Officer |

|

Letter to Shareholders

from the Chair of our Board |

| |

|

Dear Fellow Shareholder:

On behalf of Stanley Black & Decker’s

Board of Directors (the “Board”), I look forward to welcoming you to our 2024 Annual Meeting of Shareholders. In advance of

our meeting, and reflecting on our achievements in 2023, I write to share more about the Board’s continuing commitment to overseeing

the Company with integrity and strong corporate governance practices to generate long-term value for all of our shareholders.

Actively Engaging with Our Shareholders

During 2023, management and I, as Board Chair,

participated in valuable discussions with shareholders regarding several key matters including the Company’s strategy, risk management,

talent and executive compensation. In all, the Company reached out to shareholders representing greater than 60% of our shares outstanding

and had direct engagement with 40% of those shareholders. I greatly appreciate the opportunity to hear our shareholders’ perspectives,

which we share with the rest of the Board and with management and incorporate into our discussions and decision-making.

Oversight of Strategic Business Transformation,

Risk and Culture

Don Allan articulated the Company’s strategic

business transformation plan when he assumed the role of President and Chief Executive Officer in 2022, and the Company continued to meet

the plan’s milestones in 2023. The Board plays a critical role in overseeing this strategy. In nearly every Board meeting and executive

session, we discuss this strategy and the Company’s progress in achieving its transformation and strategic goals, allowing us to

challenge assumptions, oversee capital deployment and offer alternative perspectives based on the insights and collective, diverse experience

of our directors.

The Corporate Governance Committee annually reviews

and confirms that the Board and each of its committees maintains the experience and skills needed to adequately oversee the Company through

this time of transition, including through review of the results of our annual Board and Committee evaluation process. Our Audit Committee

works closely with our external auditors, financial management and legal counsel to oversee the Company’s financial, cybersecurity,

product safety, compliance and other risks. The Compensation and Talent Development Committee reviews executive compensation so that the

Company can incentivize ethical, accountable leadership that balances short-term results with long-term, sustainable growth and, together

with the full Board, regularly engages with senior management regarding a range of human capital management issues. The Finance and Pension

Committee works closely with management to be proactive regarding the Company’s capital structure to manage short-term liquidity

as well as long-term financial resilience.

Engagement on Executive Leadership

The Company needs the right leadership in order

to succeed in its transformation, and the Board plays an important role in overseeing the hiring of key senior executives. During 2023,

the Company hired three new, highly capable, seasoned and respected leaders that bring fresh and exciting perspectives: Chris Nelson,

Chief Operating Officer, Executive Vice President and President, Tools & Outdoor; Patrick Hallinan, Executive Vice President, Chief

Financial Officer; and John Lucas, Senior Vice President, Chief Human Resources Officer.

Most recently, Mr. Nelson served as President for

Carrier’s flagship HVAC segment, where he led the global commercial and residential product and service portfolio and was responsible

for driving profitable growth across that company’s global brands and where he led the business with a focus on innovating products

through a global platform approach, accelerating digital innovation and growing segment market share. Mr. Nelson’s track record

of successfully implementing growth strategies makes him an ideal leader to join Stanley Black & Decker at this point in our transformation.

Mr. Hallinan joined Stanley Black & Decker

from Fortune Brands Innovations where he served as Executive Vice President and Chief Financial Officer and led the firm’s

finance function. His career at Fortune Brands spanned 17 years, including various finance and technology leadership and general

management roles across business segments where he gained significant exposure to multiple facets of the consumer market. His deep track

record of delivering business performance, growth and value creation in complex, competitive industries makes him an ideal addition to

the Company as we execute our transformation to streamline and optimize around our core businesses and strong portfolio of global brands.

Mr. Lucas has more than 35 years of human resources

experience, serving for the last 10 years as the most senior HR executive for global multinational companies in the Fortune 50 and Fortune

150, including Lockheed Martin and Goodyear. He has also held senior human resources roles at Microsoft, Kodak and Merck. Mr. Lucas was

most recently the founder of True North Human Capital Consulting, LLC, where he provided counsel to Fortune 200 and private companies

across all areas of human capital strategies. Mr. Lucas brings a highly distinguished track record with world-class expertise in human

capital management that will be instrumental to enabling the success of our business and culture as the leadership team continues to elevate

the Company’s commitment to people and organizational effectiveness as they transform the business.

Oversight of Environmental Social and Governance

(“ESG”) Strategy

In 2023, the Corporate Governance Committee oversaw

the Company’s refresh of its ESG strategy. The Company updated and streamlined its ESG targets and further aligned them with its

business priorities and goals. The streamlined ESG priorities are intended to help the Company manage risks and support long-term value

creation.

Board Refreshment

In October 2023, as part of our ongoing commitment

to Board refreshment and providing the appropriate mix of skills, perspectives and experiences on the Board, we welcomed Susan K. Carter

as an independent director. Ms. Carter most recently served as Senior Vice President and Chief Financial Officer of Ingersoll Rand plc

(now Trane Technologies plc) until her retirement in 2020 and has considerable financial and operational expertise and global operations

oversight experience. Including Ms. Carter’s appointment, the Board has welcomed six independent directors in the last four years.

Patrick D. Campbell will be completing his tenure

as a member of the Board effective as of the Annual Meeting after more than fifteen years of distinguished service. I would like to thank

Pat for his years of wise counsel and many contributions.

Our Board reflects the diverse set of experiences,

perspectives and skills necessary to position the Company for the future. Nine of ten director nominees are independent, and the average

tenure of our director nominees is 3.9 years. Our director nominees include five women, two armed forces veterans, and two racially or

ethnically diverse men. Two of our director nominees have lived and worked around the world, providing the Company with insights and opinions

that are highly relevant to our global business.

My fellow directors and I value your ongoing investment

in the Company and thank you for the confidence you have placed in us.

| |

Sincerely,

|

| |

|

| |

Andrea J. Ayers

Chair of the Board |

STANLEY BLACK & DECKER, INC.

1000 Stanley Drive

New Britain, Connecticut 06053

Telephone: 860-225-5111

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

March 8, 2024

To the Shareholders:

The Annual Meeting of Shareholders (the “Annual

Meeting”) of Stanley Black & Decker, Inc. (the “Company”) will be held at the John F. Lundgren Center for Learning

and Development, 1000 Stanley Drive, New Britain, Connecticut 06053 on April 26, 2024, at 9:30 a.m. EDT for the following purposes:

| (1) | To elect the ten director nominees named in this Proxy Statement; |

| (2) | To approve, on an advisory basis, the compensation of the Company’s

named executive officers; |

| (3) | To approve the 2024 Omnibus Award Plan; |

| (4) | To approve the selection of Ernst & Young LLP as the Company’s

registered independent public accounting firm for fiscal year 2024; and |

| (5) | To transact such other business as may properly come before the

Annual Meeting or any adjournment or postponement thereof. |

Shareholders of record at the close of business

on February 26, 2024, are entitled to vote at the Annual Meeting and any adjournment or postponement thereof. This Proxy Statement,

the Annual Report, and the enclosed proxy card, or the Notice of Internet Availability of Proxy Materials, will first be mailed or made

available to our shareholders on or about March 8, 2024.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting of Shareholders to Be Held on April 26, 2024: This Proxy Statement, together with the

Proxy Card and our Annual Report, are available at www.proxyvote.com.

|

|

| |

Janet M. Link |

| |

Secretary |

(This page intentionally left blank.)

TABLE

OF CONTENTS

SPECIAL

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Proxy Statement contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. All statements other than statements of historical fact are “forward-looking statements” for purposes

of federal and state securities laws, including, but not limited to, any projections or guidance of earnings, revenue or other financial

items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed

new products, services or developments; any statements regarding future economic conditions or performance; any statements relating to

initiatives concerning ESG matters, including environmental sustainability and DEI; any statements of belief; and any statements of assumptions

underlying any of the foregoing. Forward-looking statements may include, among others, the words “may,” “will,”

“estimate,” “intend,” “could,” “project,” “plan,” “continue,”

“believe,” “expect,” “anticipate,” “on-track,” “goal,” “target,”

“design,” “position,” “guidance,” or any other similar words, as well as statements regarding our

focus for the future. Each of the forward-looking statements we make in this Proxy Statement involves risks and uncertainties that could

cause actual results to differ materially from these forward-looking statements. Factors that might cause the Company’s actual results,

performance and achievements, or industry results to differ materially from estimates or projections contained in its forward-looking

statements include, but are not limited to, changes in macroeconomic conditions, changes in customer preferences and demand, changes in

technology, and those set forth in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, including under

the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and in the Consolidated Financial Statements and the related Notes. Undue reliance should not be placed on these forward-looking statements,

which speak only as of the date of this Proxy Statement. The Company does not undertake any obligation or intention to update or revise

any forward-looking statements, whether as a result of future events or circumstances, new information or otherwise, except as required

by law. Any standards of measurement and performance made in reference to our ESG and other sustainability plans and goals are developing

and based on assumptions that continue to evolve, and no assurance can be given that any such plan, initiative, projection, goal, commitment,

expectation, or prospect can or will be achieved. The inclusion of information related to our ESG goals and initiatives is not an indication

that such information is material under the standards of the Securities and Exchange Commission.

WEBSITE

REFERENCES

This Proxy Statement includes several website addresses

and references to additional materials found on those websites. These websites and materials, including the information on the Company’s

website, as may be referenced in this Proxy Statement, are provided for convenience only and not, and are not intended to be, part of

this Proxy Statement and are not incorporated by reference herein.

OUR

2023 HIGHLIGHTS

WHO

WE ARE AND HOW WE OPERATE

Stanley Black & Decker, Inc., an S&P 500

company, was founded in 1843 by Frederick T. Stanley and incorporated in Connecticut in 1852. In March 2010, the Company completed a merger

with The Black & Decker Corporation, a company founded by S. Duncan Black and Alonzo G. Decker and incorporated in Maryland in 1910.

At that time, the Company changed its name from The Stanley Works to Stanley Black & Decker, Inc. The Company is a global provider

of hand tools, power tools, outdoor products and related accessories, as well as a leading provider of engineered fastening solutions.

Over the past two years, the Company has re-shaped

its portfolio to focus on its leading positions in the tools & outdoor and engineered fastening markets. Leveraging the benefits of

a more focused portfolio, the Company initiated a business transformation in mid-2022 that includes reinvestment for faster growth as

well as a $2.0 billion Global Cost Reduction Program through 2025. The Company’s primary areas of multi-year strategic focus remain

unchanged as follows:

| ● | Advancing

innovation, electrification and global market penetration to achieve Organic Revenue Growth* of 2 to 3 times the market; |

| ● | Streamlining

and simplifying the organization, and investing in initiatives that more directly impact the Company’s customers and end users; |

| ● | Returning

Adjusted Gross Margins* to historical 35%+ levels by accelerating our operations and supply chain transformation to improve fill rates

and better match inventory with customer demand; and |

| ● | Prioritizing

cash flow generation and inventory optimization. |

The Company’s business transformation is

intended to drive strong financial performance over the long term, including:

| ● | Organic

Revenue Growth* at 2 to 3 times the market; |

| ● | 35%+ Adjusted

Gross Margins*; |

| ● | Free Cash

Flow* equal to, or exceeding, net income; and |

| ● | Cash Flow

Return On Investment (“CFROI”)* between 12-15%. |

In terms of capital allocation, the Company remains

committed, over time, to returning excess capital to shareholders through a strong and growing dividend as well as opportunistically repurchasing

shares. In the near term, the Company intends to direct any capital in excess of the quarterly dividend on its common stock toward debt

reduction and internal growth investments.

KEY

BUSINESS PERFORMANCE HIGHLIGHTS

For additional information, refer to the Annual

Report that accompanies this Proxy Statement.

During 2023, the Company continued to make significant

progress against its strategic priorities and delivered the following results:

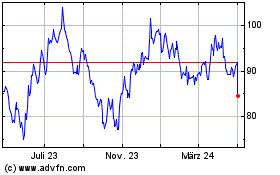

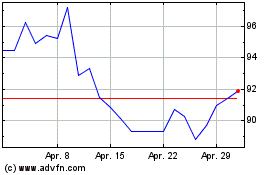

| ● | Delivered

2023 Total Shareholder Return (“TSR”) of 35%, which exceeded the growth of the S&P 500 TSR (+26%), and the S&P 500

Capital Goods Index (+19%). |

| ● | Realized

total revenue of $15.8 billion, down 7% versus the prior year as a result of lower consumer outdoor and do-it-yourself, or DIY, market

demand, softness in general industrial fastener markets, and the strategic divestiture of the Oil & Gas business, which was partially

offset by strength in professional tools and growth in automotive and aerospace. |

| ● | During

2023, and since the inception of the Global Cost Reduction Program in mid-2022, the Company has generated approximately $835 million

and $1.0 billion, respectively, of pre-tax run-rate savings driven by the supply chain transformation, lower headcount and indirect spend

reductions. This resulted in the fourth quarter Gross Margin rate approaching 30% with four consecutive quarters of improvement. The

Company believes that it is on-track to deliver approximately $2 billion of pre-tax run-rate savings by year-end 2025. |

| ● | GAAP earnings

per share from continuing operations was $(1.88) in 2023 compared to $1.06 in 2022. Excluding certain gains and charges, Adjusted EPS*

from continuing operations was $1.45 in 2023 compared to $4.62 in 2022. |

| ● | The Company

reduced $1.1 billion of inventory in 2023 bringing the total inventory reduction to $1.9 billion since mid-2022. |

| ● | Generated

cash from operating activities in 2023 of $1.2 billion and Free Cash Flow* of $852.6 million in 2023 as a result of the Company’s

focus on reducing inventory. |

| ● | This strong

cash flow advanced the Company’s capital allocation priorities and supported approximately $280 million of debt reduction in 2023,

as well as a modest increase to the dividend to $0.81 per share in July 2023. |

| ● | The Company

announced in December 2023 an agreement to divest STANLEY Infrastructure for $760 million in cash, which further demonstrates simplification

as a core tenet of the Company’s transformation, as well as the Company’s commitment to maximizing shareholder value through

active portfolio management. |

| ● | During

2023, the Company hired three new, highly capable, seasoned and respected leaders that bring fresh and exciting perspectives, who are

each key to driving the Company’s strategic transformation forward. Key hires include Chris Nelson, Chief Operating Officer, Executive

Vice President and President, Tools & Outdoor; Patrick Hallinan, Executive Vice President, Chief Financial Officer; and John Lucas,

Senior Vice President, Chief Human Resources Officer. |

| * | See Appendix A for an explanation and/or reconciliation of GAAP

to Non-GAAP measures used in this Proxy Statement. Organic Revenue Growth is also referred to as Organic Sales Growth in this Proxy Statement. |

BOARD

SKILLS AND QUALIFICATIONS

In evaluating candidates, including existing Board

members, the Corporate Governance Committee aims to create a Board comprised of a diverse group of members who are positioned to best

serve the needs of the Company and its shareholders. The Corporate Governance Committee takes reasonable steps to include diverse candidates

in the pool of potential director nominees with respect to gender, ethnicity, race, nationality, geographic origin and age as well as

personal, educational and professional experience and skills in the context of the needs of the Board. In addition, each candidate is

evaluated by the Corporate Governance Committee based on the criteria set forth under “Board of Directors” on page

12.

BOARD

DIVERSITY

The Board considers and recognizes the diverse

attributes of its directors. The Board includes five women, two racially/ethnically diverse directors (an African American man and an

Asian man), two directors of diverse national origin and two armed services veterans. In addition, the Board has two women in leadership

roles, including the Chair of the Board who also serves as Chair of the Executive Committee, and the Chair of the Compensation and Talent

Development Committee. The following reflects certain information with respect to our director nominees named in this Proxy Statement:

| * | Director Nominee Self-Identification of Race/Ethnicity:

1

Asian and 1 African American |

| ** | Global Experience includes living outside the United States and/or

directors who hold dual citizenship. |

CORPORATE

GOVERNANCE HIGHLIGHTS

The Corporate Governance Committee and the Board

are committed to managing the Company with integrity and strong corporate governance to generate long-term value for all of our stakeholders.

In line with this commitment, our Corporate Governance Guidelines, Restated Certificate of Incorporation, as amended, and Bylaws are regularly

reviewed and updated to incorporate robust governance practices and regulatory updates, including the following practices:

| Governance Principle |

Corporate Governance Practice |

Accountability to

Shareholders |

● Only

one class of common stock, with one vote per share

● Annual

director elections, with majority standard for uncontested elections, and director resignation policy

● Proxy

access, allowing eligible long-term shareholders holding 3% or more of our outstanding shares of common stock to include nominations for

directors in the Company’s Proxy Statement

● No

shareholder rights (“poison pill”) plan

● Shareholder

right to act by written consent and to amend Bylaws by a majority vote

● Shareholders

representing 25% of voting power may call special meeting |

Robust Board

Independence |

● Independent

Board Chair

● All

directors are independent, other than our CEO

● Independent

directors meet in executive session at each regularly scheduled Board and committee meeting |

Comprehensive Board

Policies and Practices |

● Committed

to balanced Board refreshment with six new directors in the last four years and a mixture of director tenures.

● Director

overboarding policy that prevents directors from serving on more than four other public company boards (or one other public company board

for the CEO)

● Mandatory

director retirement at age 75 to support efficient succession planning

● Annual

Board and committee self-assessments to review effectiveness

● Full

Board reviews ESG strategies and goals as a component of our annual strategic plan review process while the Corporate Governance Committee

provides director oversight of the Company’s ESG policies, objectives and practices |

Alignment of Interests

with Long-term

Shareholders |

● Policy

adopted to prohibit the hedging or pledging of Company stock for all directors, executive officers and employees

● Robust

stock ownership guidelines for directors and executive officers |

Compensation Governance

aligns with Best Practices |

● Both

our 2022 equity plan and our proposed 2024 equity plan contain an annual limit on total director compensation

● No

excise tax gross-ups under change in control agreements with executive officers or our equity plans and no tax gross-ups on perquisites,

other than on relocation benefits

● Double

trigger vesting provisions requiring both a change in control and qualifying termination of employment under our equity plans

● Recoupment

(“clawback”) policies covering equity and cash incentive compensation of all Section 16 Officers, including in compliance

with Rule 10D-1 and related NYSE listing standards |

SHAREHOLDER

ENGAGEMENT EFFORTS

We are committed to regular, year-round proactive

engagement with our shareholders to better understand their perspectives about our Company and the market generally.

In 2023, the Company:

Offered engagement with shareholders representing

greater than 60% of outstanding shares |

|

Held formal discussions with shareholders representing

approximately 40% of outstanding shares |

These discussions with shareholders included topics

such as Company strategy, Board composition and skill set, risk management, ESG strategy, and our executive compensation program, among

others. This feedback was communicated to the Board and relevant Committees and informs their discussions and decisions.

The Board and Company are proud of the Company’s

track record of being responsive to shareholder feedback as outlined in the table below:

| |

Shareholder Feedback |

Board and Company Actions |

Corporate

Governance |

● Increase accountability and responsiveness

to shareholders

● Eliminate

supermajority vote requirements |

Amended governance documents to:

● Adopt

majority vote standard for uncontested director elections, including a director resignation policy

● Eliminate

supermajority voting requirements

● Permit

shareholder action by written consent

● Proactively

lower the minimum threshold for shareholders to call a special meeting from 35% to 25%

● Adopt

annual elections for all directors |

| ● Evaluate regular Board refreshment and appropriate composition, skills and expertise |

● Added

6 independent directors in the last

four years

● Recently

added board members bring perspectives critical to the Company’s transformation in areas such as finance and risk management, operations

and supply chain, sales and marketing, technology and analytics, digitization and innovation and capital allocation

● Elected

female Independent Board Chair

● 80%

of Board is diverse, and 3 of the 5 Board Committees are chaired by diverse Independent Directors |

| Executive Compensation |

● Increase

percentage of performance-based compensation pay elements

● Evaluate

incorporation of ESG metrics within executive compensation program

● Reinforce

execution of Global Cost Reduction Program in executive compensation program

● Evaluate

inclusion of Adjusted EPS as a metric in both MICP (annual bonus program) and LTIP

● Increase

focus on absolute amount of Free Cash Flow and balance sheet health |

● 90%

of CEO target pay was variable and tied to performance against preset goals or share price

● The

Compensation and Talent Development Committee (the “Compensation Committee”) continues to evaluate ESG-related metrics that

drive long-term value creation and their potential integration within our incentive compensation program

● Added

a transformation modifier to the MICP, based upon achievement against goals under our Global Cost Reduction Program

● Eliminated

the use of Adjusted EPS as a metric in the 2023–2025 LTIP PSUs and replaced it with Relative Organic Sales Growth versus Market

● Adopted

a Free Cash Flow metric (calculated as operating cash flow less capital expenditures) in place of the historical cash flow multiple of

net earnings metric |

| ESG |

● Enhance

workforce-related metric disclosures

● Incorporate

ESG strategy within the business model |

● Enhanced

disclosures relative to disaggregated employee diversity data and published our EEO-1 Report

● Refined

ESG goals to reflect current business portfolio and to align with the business strategy of a more focused company |

2024 Proxy Summary

This summary highlights information regarding the proposals and

other meeting matters contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should

consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting of Shareholders

| |

Time and Date: |

|

9:30 a.m. EDT, April 26, 2024 |

| |

|

|

|

| |

Place: |

|

John F. Lundgren Center for Learning and Development

1000 Stanley Drive

New Britain, Connecticut 06053 |

| |

|

|

|

| |

Record Date: |

|

February 26, 2024 |

| |

|

|

|

| |

Voting: |

|

Shareholders as of the record date are entitled to vote. Each share

of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on.

Voting in advance of the meeting

•

Over the internet at www.proxyvote.com;

• By

telephone at 1-800-690-6903; or

• By

mail—sign, date and return the proxy card or voting instruction form mailed to you. |

| |

|

|

|

This Proxy Statement, the accompanying Notice

of the Annual Meeting, the Annual Report and the enclosed proxy card are first being mailed or made available to our shareholders on or

about March 8, 2024.

Voting Matters and Vote Recommendation

| Proposal No. |

|

Matter |

|

Board Vote Recommendation |

|

Page Reference

(for more detail) |

| 1 |

|

Election of ten director nominees |

|

FOR EACH NOMINEE |

|

1 |

| 2 |

|

Approve, on an advisory basis, the compensation of the Company’s named executive officers |

|

FOR |

|

74 |

| 3 |

|

Approve the Company’s 2024 Omnibus Award Plan |

|

FOR |

|

75 |

| 4 |

|

Approve the selection of Ernst & Young as the Company’s registered independent public accounting firm for the 2024 fiscal year |

|

FOR |

|

82 |

Board Nominees

The following table provides summary information

about each of the Company’s current directors (please see

“Item 1—Election of Directors” for more information). Because the election of directors is uncontested, directors

will be elected by the vote of the majority of votes cast, which means that the number of shares voted “for” a director nominee

must exceed the number of votes cast “against” that director. An incumbent director who fails to achieve a majority of the

votes cast for his or her election will offer to tender his or her resignation from the Board. The Corporate Governance Committee will

make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board

will act on the Corporate Governance Committee’s recommendation, considering all factors that the Board believes to be relevant,

and will publicly disclose its decision within 90 days from the date of the certification of the election results. The resignation, if

accepted by the Board, will be effective at the time of the Board’s determination to accept the resignation.

| Name |

|

Age |

|

Director Since |

|

Occupation |

|

Committee Memberships |

| Exec. |

Audit |

Corporate Governance |

Finance &

Pension |

Comp. &

Talent Dev. |

Andrea J. Ayers,

Chair of the Board |

|

60 |

|

2014 |

|

Retired President and

Chief Executive Officer,

Convergys Corporation |

|

C |

|

|

|

|

| Donald Allan, Jr. |

|

59 |

|

2022 |

|

President and Chief

Executive Officer,

Stanley Black & Decker, Inc. |

|

|

|

|

|

|

| Patrick D. Campbell |

|

71 |

|

2008 |

|

Retired Senior Vice President

and Chief Financial Officer,

3M Company |

|

|

C |

|

|

|

| Susan K. Carter |

|

65 |

|

2023 |

|

Retired Senior Vice President

and Chief Financial Officer,

Ingersoll Rand plc (now Trane

Technologies plc) |

|

|

|

|

|

|

| Debra A. Crew |

|

53 |

|

2013 |

|

Chief Executive, Diageo plc |

|

|

|

|

|

C |

| Michael D. Hankin |

|

66 |

|

2016 |

|

President and Chief Executive

Officer, Brown Advisory

Incorporated |

|

|

|

|

C |

|

| Robert J. Manning |

|

60 |

|

2022 |

|

Retired Chairman and Chief

Executive Officer, MFS

Investment Management |

|

|

|

|

|

|

| Adrian V. Mitchell |

|

50 |

|

2022 |

|

Chief Operating Officer

and Chief Financial Officer,

Macy’s, Inc. |

|

|

|

|

|

|

| Jane M. Palmieri |

|

54 |

|

2021 |

|

President, Industrial Intermediates

& Infrastructure, Dow Inc. |

|

|

|

|

|

|

| Mojdeh Poul |

|

61 |

|

2021 |

|

Former Executive Vice President,

Healthcare Business Group,

3M Company |

|

|

|

|

|

|

| Irving Tan |

|

53 |

|

2020 |

|

Executive Vice President, Global

Operations, Western Digital

Corporation |

|

|

|

C |

|

|

Committee

composition and Committee Chair designations are as of the date of this Proxy Statement. Committee memberships are indicated in

yellow, with Committee Chairs indicated by a “C”. In anticipation of Mr. Campbell transitioning off the Board at the

Annual Meeting, Mr. Manning will join the Audit Committee and replace Mr. Campbell as Audit Committee Chair effective March 9, 2024.

All current directors, other than Mr. Allan, are independent.

Executive Compensation Advisory Vote

The Board recommends shareholders vote to approve,

on an advisory basis, the compensation paid to the Company’s named executive officers as described in this Proxy Statement for the

reasons discussed in this Proxy Statement, including our commitment to our pay for performance philosophy:

| ● | Our executive

compensation philosophy is to provide performance-based and competitive compensation that rewards executives for actions that create

long-term shareholder value and allows us to attract, motivate and retain high-caliber executives. |

| ● | Our pay

for performance alignment is strong, with pay opportunities generally targeted at the market median. A majority of annual and long-term

compensation is performance-based, being directly linked to both absolute and relative Company performance against preset goals. |

| ● | Our 2023

compensation program reflects this philosophy, as performance results under the Company’s 2023 MICP were above target resulting

in a 132.5–163.8% bonus payout for named executive officers and our performance results under the 2021–2023 LTIP PSUs resulted

in payout at 20.4% of target as a result of above target performance for 2021 year Adjusted EPS, below threshold performance for all

other metrics in 2021, and below threshold performance for all metrics in 2022 and 2023. Notwithstanding our achievement of above the

maximum cost savings goal for the transformation modifier in the MICP, in light of the Company’s overall performance (inclusive

of TSR), management recommended, and the Compensation Committee agreed, not to apply the modifier to increase the bonus payouts for the

named executive officers or any of the other executive officers. The Compensation Committee applied no discretion in determining performance

and payouts under the 2021–2023 LTIP PSUs for our named executive officers. |

| ● | In each of the last three years, we received strong shareholder

support for our named executive officer compensation with the three-year average of approximately 91.2% of Say on Pay votes cast in support

of our executive compensation (90.9% of votes cast in 2023, 89.0% of votes cast in 2022, and 93.7% of votes cast in 2021). |

| ● | Our compensation

programs follow best practices, including: no tax gross-ups in severance arrangements and change in control agreements, no tax gross

ups on perquisites (other than relocation benefits), double trigger vesting provisions requiring a change in control and qualifying termination

of employment, comprehensive recoupment (“clawback”) policies relating to equity and cash incentive compensation for all

Section 16 officers, robust stock ownership guidelines for directors and executive officers and a policy against hedging or pledging

of Company stock. |

Please see “Item 2—Advisory Vote

to Approve Compensation of Named Executive Officers” for more information.

Stanley Black & Decker 2024 Omnibus Award

Plan

The Board has approved, and recommends the Company’s

shareholders approve, a new 2024 Omnibus Award Plan (the “2024 Plan”) to replace the Company’s existing 2022 Omnibus

Award Plan (the “2022 Plan”) in order for the Company to continue attracting, incentivizing and retaining top talent and to

continue to offer market competitive compensation opportunities. Please see “Item 3—Approval of 2024 Omnibus Award Plan”

for more information, including a summary of the material terms of the 2024 Plan.

Auditors

The Board recommends that the shareholders approve

the selection of Ernst & Young as our registered independent public accounting firm for fiscal year 2024. Please see “Item

4—Approval of Registered Independent Public Accounting Firm” for more information, including the amount of fees for services

provided by Ernst & Young in 2022 and 2023.

STANLEY BLACK & DECKER, INC.

1000 Stanley Drive

New Britain, Connecticut 06053

Telephone: 860-225-5111

PROXY

STATEMENT FOR THE APRIL 26, 2024 ANNUAL MEETING OF SHAREHOLDERS

GENERAL

INFORMATION

This Proxy Statement is furnished in connection

with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of Stanley

Black & Decker, Inc. (the “Company,” “we,” “us” or “our”), a Connecticut corporation,

to be voted at the 2024 Annual Meeting, and any adjournment or postponement thereof (the “Annual Meeting”), to be held on

the date, at the time and place, and for the purposes set forth in the foregoing Notice of Annual Meeting (the “Notice”).

No business may be transacted at the Annual Meeting other than the business specified in the Notice, business properly brought before

the Annual Meeting at the direction of the Board of Directors, and business properly brought before the Annual Meeting by a shareholder

who has properly given notice to the Company’s Secretary under our Bylaws. Management does not know of any matters to be presented

at the Annual Meeting other than the matters described in this Proxy Statement. If, however, other business is properly presented at the

Annual Meeting, the proxy holders named in the accompanying proxy will vote the proxy in their discretion.

ITEM

1—ELECTION OF DIRECTORS

The Board, based on the recommendation of the Corporate

Governance Committee, has nominated the ten nominees set forth below to the Board of Directors, each of whom will hold office until the

next Annual Meeting of Shareholders or until his or her successor shall have been elected and qualified. Patrick D. Campbell will be completing

his tenure as a member of the Board effective as of the Annual Meeting, at which time the size of the Board will be reduced to 10 directors.

Mr. Campbell and each of the nominees is currently a director of the Company and was most recently elected at the 2023 Annual Meeting

to hold office until the 2024 Annual Meeting or until his or her successor has been elected and qualified, except for Susan K. Carter.

Ms. Carter was elected as a director by the Board of Directors effective October 23, 2023, and was recommended to the Corporate Governance

Committee by an independent third-party search firm. Each nominee has consented to serving as a nominee, being named in this Proxy Statement,

and serving on the Board until the 2025 Annual Meeting if elected. The Board expects that the ten nominees will be available to serve

as directors. However, if, for any reason, any nominee should not be a candidate for election at the time of the Annual Meeting, the proxies

may be voted, at the discretion of those named as proxies, for a substitute nominee or the Board may reduce its size.

The Board of Directors recommends a vote FOR

each nominee.

Information Concerning Nominees for Election as Directors

DONALD ALLAN, JR.

President and Chief Executive Officer of the Company |

|

Director Since

2022

Age

59

Committees Served:

● Executive |

|

Expertise

As CEO of the Company, Mr. Allan provides the Board with essential

experience and expertise gained from his service in several executive roles over his 20+ year tenure at the Company, including intimate

knowledge of the daily workings of the business. This expertise is critical to the Board when overseeing the execution of the Company’s

strategy.

Business Experience

Stanley Black & Decker

● President & Chief Executive Officer (July

2022 to present)

● President & Chief Financial Officer (February

2021 to July 2022)

● Executive Vice President & Chief Financial

Officer (2016 to February 2021)

● Senior Vice President & Chief Financial Officer

(2010 to 2016)

● Vice President & Chief Financial Officer (2009

to 2010)

● Vice President & Corporate Controller (2002

to 2009)

● Corporate Controller (2000 to 2002)

● Assistant Controller (1999 to 2000)

Loctite Corporation

● Mr. Allan held financial management positions

of increasing responsibility

Ernst & Young

● Mr. Allan held financial management positions

of increasing responsibility

Other Current Public Company Directorships

● None

Past Public Company Directorships (Last 5

Years)

● None |

| |

|

|

ANDREA J. AYERS

Retired President and Chief Executive Officer of Convergys Corporation |

|

Independent

Director Since

2014 (elected Chair in 2022)

Age

60

Committees Served:

● Compensation and Talent Development

● Executive (Chair)

● Finance and Pension |

|

Expertise

Ms. Ayers’ experience transforming Convergys Corporation from

a company with three business lines to a customer management solutions company with approximately 125,000 employees worldwide provides

critical insight as the Board navigates important strategic decisions related to the Company’s transformation and its global operations.

Her expertise in customer management analytics, technology, and human capital management provides an important and unique perspective

to the Board.

Business Experience

Convergys Corporation, a customer outsourcing services company

● President & Chief Executive Officer (November

2012 to October 2018)

● Chief Operating Officer of Convergys Customer

Management Group Inc. (2010 to 2012)

● President of Convergys Customer Management Group

Inc. (2008 to 2012)

Other Current Public Company Directorships

● United States Steel Corporation (2023 to present)

Past Public Company Directorships (Last 5

Years)

● Endurance International Group Holdings, Inc. (2019

to 2021) |

SUSAN K. CARTER

Retired Senior Vice President and Chief Financial Officer of Ingersoll Rand plc (now Trane Technologies plc) |

|

Independent

Director Since

2023

Age

65

Committees Served:

● Audit

● Corporate Governance |

|

Expertise

Ms. Carter brings more than 30 years of financial and leadership

experience to the Board. Ms. Carter has helped multiple public companies, including Ingersoll Rand plc (now Trane Technologies plc), deliver

long-term shareholder value by driving execution and optimizing business and financial performance. Ms. Carter’s extensive experience

in financial reporting, information technology, accounting, capital management, and global operations significantly enhances our Board’s

oversight of these matters.

Business Experience

Ingersoll Rand plc (now Trane Technologies plc), a diversified,

global industrial manufacturer of sustainable and efficient climate solutions for buildings, homes and transportation

● Senior Vice President & Chief Financial Officer

(2013 to 2020)

KBR, Inc.

● Executive Vice President & Chief Financial

Officer (2009 to 2013)

Lennox International Inc.

● Executive Vice President & Chief Financial

Officer (2004 to 2009)

Cummins Inc.

● Vice President & Chief Accounting Officer

(2002 to 2004)

Other Current Public Company Directorships

● Amcor plc (2021 to present)

● ON Semiconductor Corporation (2020 to present;

Chair of Audit Committee)

Past Public Company Directorships (Last 5

Years)

● Air Products and Chemicals, Inc. (2011 to 2021) |

DEBRA A. CREW

Chief Executive of Diageo plc |

|

Independent

Director Since

2013

Age

53

Committees Served:

● Compensation and Talent Development (Chair)

● Executive

● Finance and Pension |

|

Expertise

Ms. Crew brings a breadth of marketing, operations and strategy experience

to the Board, underscored by her executive roles at Diageo plc, Reynolds American, Inc., and PepsiCo, Inc. Ms. Crew’s global

perspective and exposure to world class innovation planning processes, combined with proven commercial excellence at leading consumer

products companies, provides the Board with critical insights.

Business Experience

Diageo plc, a global alcoholic beverage company

● Chief Executive (June 2023 to present)

● Interim Chief Executive (June 2023)

● Chief Operating Officer (October 2022 to June

2023)

● President, North America & Global Supply

(July 2020 to September 2022)

Reynolds American, Inc.

● President & Chief Executive Officer (January

2017 to December 2017)

R.J. Reynolds Tobacco Co.

● President & Chief Operating Officer (October

2015 to December 2016)

● President & Chief Commercial Officer (October

2014 to October 2015)

PepsiCo, Inc.

● Ms. Crew held roles of increasing responsibility

including, President, North America Nutrition; President, PepsiCo Americas Beverages; and President, Western Europe

Kraft Foods, Nestlé S.A. and Mars, Inc.

● Ms. Crew held roles of increasing responsibility

(1997 to 2010)

United States Army

● Captain (1993 to 1997)

Other Current Public Company Directorships

● Diageo plc (June 2023 to present)

Past Public Company Directorships (Last 5

Years)

● Mondelēz International, Inc. (2018 to 2021)

● Newell Brands Inc. (2018 to 2020)

● Diageo plc (2019 to 2020) |

MICHAEL D. HANKIN

President and Chief Executive Officer of Brown Advisory Incorporated |

|

Independent

Director Since

2016

Age

66

Committees Served:

● Audit

● Executive

● Finance and Pension (Chair) |

|

Expertise

Mr. Hankin’s experience building and running a complex global

financial company, evidenced by successfully growing Brown Advisory Incorporated from approximately $1.5 billion assets under management

to over $149 billion during his tenure, gives the Board a unique perspective on finance, capital allocation, global operations, and corporate

strategy. His familiarity with financial and investment planning and analysis, his understanding of capital structure and valuation issues,

and his experience with cybersecurity make him a valuable resource for the Board and management.

Business Experience

Brown Advisory Incorporated, an investment management and strategic

advisory firm

● President & Chief Executive Officer (1998

to present)

Alex Brown Investment Advisory & Trust Company

● Executive Vice President & Chief Operating

Officer (1993 to 1998)

Piper & Marbury (now DLA Piper)

● Partner, business and tax law

Other Current Public Company Directorships

● None

Past Public Company Directorships (Last 5

Years)

● None |

ROBERT J. MANNING

Retired Chairman and Chief Executive Officer of MFS Investment Management |

|

Independent

Director Since

2022

Age

60

Committees Served:

● Compensation and Talent Development

● Corporate Governance |

|

Expertise

Mr. Manning’s more than three decades of financial services,

investment stewardship, and leadership experience enables him to provide vital insights to the Board and management related to risk management,

capital allocation, financial planning, and ESG. The wealth of experience Mr. Manning has gained throughout his financial career provides

the Board with a more thorough understanding of investors’ perspectives and how to incorporate those perspectives into their oversight

of the Company’s long-term strategic plan.

Business Experience

MFS Investment Management, a global investment manager (“MFS”)

● Chairman (2010 to 2022)

○ Non-Executive Chairman (2021 to 2022)

○ Executive Chairman (2017 to 2021)

● Chief Executive Officer and Chief Investment Officer

(2004 to 2017)

○ Co-Chief Executive Officer (2015 to 2017)

● Mr. Manning joined MFS in 1984 as a Fixed Income

Research Analyst and held several positions with increasing responsibility within the firm’s Investment division, including Fixed

Income Portfolio Manager, Fixed Income Strategist and Director of Fixed Income Research

Other Current Public Company Directorships

● None

Past Public Company Directorships (Last 5

Years)

● None |

ADRIAN V. MITCHELL

Chief Operating Officer and Chief Financial Officer of Macy’s, Inc. |

|

Independent

Director Since

2022

Age

50

Committees Served:

● Audit

● Corporate Governance |

|

Expertise

Mr. Mitchell’s extensive background in corporate strategy and

finance, coupled with his operations experience and expertise in technology, digital, data, and advanced analytics make him a critical

resource for the Board and management team. Having served in multiple leadership positions at consumer product companies, including Macy’s,

Arhaus, and Crate and Barrel, Mr. Mitchell provides a unique industry-specific perspective to the Board.

Business Experience

Macy’s, Inc., an omni-channel fashion retailer

● Chief Operating Officer and Chief Financial Officer

(March 2023 to present)

● Executive Vice President and Chief Financial Officer

(November 2020 to March 2023)

Digital BCG and Consumer Practices of Boston Consulting Group,

a global consulting firm

● Managing Director and Partner (July 2017 to October

2020)

Arhaus LLC

● Chief Executive Officer (2016 to 2017)

Crate and Barrel

● Chief Financial Officer (2010 to 2015)

● Chief Operating Officer (2011 to 2015)

● Interim Chief Executive Officer (2014 to 2015)

Target Corporation

● Mr. Mitchell held management positions at Target

Corporation, including director of strategy and interactive design for target.com and director of innovation and productivity (2007 to

2010)

McKinsey & Company

● Mr. Mitchell spent approximately 10 years at

McKinsey & Company where he co-founded the North American Lean Operations Retail Practice

Other Current Public Company Directorships

● None

Past Public Company Directorships (Last 5

Years)

● None |

JANE M. PALMIERI

President, Industrial Intermediates & Infrastructure of Dow Inc. |

|

Independent

Director Since

2021

Age

54

Committees Served:

● Corporate Governance

● Finance and Pension |

|

Expertise

Ms. Palmieri’s demonstrated record leading global industrial

operating segments, in addition to her experience in sales, digital marketing innovation, mergers and acquisitions, and operations, helps

the Board oversee the broad array of challenges the Company faces. Ms. Palmieri’s engineering background and expertise in product

design, with a focus on sustainability and energy efficiency, makes her an important resource for the Board and management team.

Business Experience

Dow Inc., a materials science corporation

● President, Industrial Intermediates & Infrastructure;

Asia Pacific oversight (2017 to present)

● Business President, Dow Building & Construction

(2013 to 2017)

● Ms. Palmieri has also held a variety of business

roles throughout her career, spanning marketing, sales, new business development and business operations in several Dow businesses, including

Dow Automotive, Dow Specialty Chemicals, Dow Coating Solutions, and Dow Solar

Other Current Public Company Directorships

● None

Past Public Company Directorships (Last 5

Years)

● None |

MOJDEH POUL

Former Executive Vice President, Health Care Business Group of 3M Company |

|

Independent

Director Since

2021

Age

61

Committees Served:

● Audit

● Compensation and Talent Development |

|

Expertise

Ms. Poul brings a wide range of experience to the Board, including

corporate strategy, global operations and profit and loss management, mergers and acquisitions, product engineering and development, sales

and marketing, and government relations. Throughout her career, Ms. Poul has built and led high-performing teams across different functions,

businesses, and geographies, including in highly regulated industries and businesses requiring strong market development expertise.

Business Experience

3M Company, a diversified global manufacturer, technology innovator

and marketer of a wide variety of products and services

● Group President & Executive Vice President,

Health Care Business Group (2019 to 2022)

● Group President & Executive Vice President,

Safety & Graphics Business Group (2018 to 2019)

● President and General Manager of 3M Canada (2016

to 2018)

● Ms. Poul held global Division President roles

in the Food Safety and Infection Prevention businesses (2013 to 2016)

● Global Marketing Leader for the Critical and Chronic

Care Solutions Division (2011 to 2013)

Medtronic & Boston Scientific

● Ms. Poul held several leadership roles of increasing

responsibility with Medtronic and Boston Scientific

General Electric Plastics

● Ms. Poul held multiple engineering positions

Other Current Public Company Directorships

● Align Technology (December 2023 to present)

● iRhythm Technologies, Inc. (June 2023 to present)

Past Public Company Directorships (Last 5

Years)

● None |

IRVING TAN

Executive Vice President, Global Operations of Western Digital Corporation |

|

Independent

Director Since

2020

Age

53

Committees Served:

● Audit

● Corporate Governance (Chair)

● Executive |

|

Expertise

Mr. Tan’s expertise in digitization and innovation, and in

developing and implementing a global operating strategy, is critical to the Board as it oversees the Company’s innovation efforts.

Mr. Tan’s global perspective and deep knowledge of Asian markets, in addition to his expertise in operating strategy, are critical

to the Board as it oversees the Company’s long-term strategy.

Business Experience

Western Digital Corporation, a computer drive manufacturer and

data storage company

● Executive Vice President, Global Operations (March

2022 to present)

Cisco Systems, Inc., a multinational digital communications technology

conglomerate corporation

● Chairman, Asia-Pacific Japan & China (2020

to February 2022)

● Executive Vice President and Chief of Operations

(2018 to 2020)

● Mr. Tan also held positions of increasing responsibility,

including serving as the leader of Cisco Asia-Pacific and Japan (APJ), leader of Cisco ASEAN, leader of Cisco Singapore and Brunei, and

senior manager in both Enterprise Sales Operations and Managed Services

Hewlett-Packard

● Business-unit leader for the APJ Communications

and Media Solutions Group (2008 to 2009)

A.T. Kearney

● Principal, mergers and acquisitions and merger

integration in IT and communication (2000 to 2006)

Other Current Public Company Directorships

● None

Past Public Company Directorships (Last 5

Years)

● None |

Board of Directors

Nomination Process. All candidates

for Board membership are evaluated by the Corporate Governance Committee. In evaluating candidates, including existing Board members,

the Corporate Governance Committee considers an individual candidate’s personal and professional responsibilities and experiences,

the composition of the Board, including diversity with respect to gender, ethnicity, race, nationality, geographic origin, age, experience

and skills, and the challenges and needs of the Company so that the Board is comprised of a diverse group of members who are positioned

to best serve the needs of the Company and its shareholders. In addition to recommendations from directors, management and shareholders,

the Corporate Governance Committee may also consider recommendations from third-party search firms retained to assist in identifying qualified

candidates. In general, and in giving due consideration to the composition of the Board at the time a candidate is being considered, the

Corporate Governance Committee considers a potential nominee’s or director’s:

| ● | integrity and demonstrated high ethical standards; |

| ● | experience with business administration processes and principles and risk management; |

| ● | ability to express opinions, raise difficult questions, and make informed, independent judgments; |

| ● | knowledge, experience, and skills in one or more specialty areas (such as accounting or finance, legal, regulatory or governmental

affairs, human capital management, sustainability and climate-related risks, product development, manufacturing, technology, digitization

and cybersecurity, global operations, real estate or corporate strategy, among others); |

| ● | ability to devote sufficient time to prepare for and attend Board meetings; |

| ● | willingness and ability to work with other members of the Board in an open and constructive manner; |

| ● | ability to communicate clearly and persuasively; and |

| ● | diversity with respect to other characteristics, which may include gender, age, ethnicity, race, nationality, geographic origin, skills

and experience. |

Shareholder Nominations and Recommendations

of Candidates. Shareholders who wish to recommend individuals to be considered by the Corporate Governance Committee may do so

by writing to us at: Stanley Black & Decker, Inc., Attention: Secretary, 1000 Stanley Drive, New Britain, CT 06053.

All shareholder recommendations for director candidates

are evaluated in the same manner as other director candidates.

Shareholders wishing to nominate a director should

follow the specific procedures and requirements set forth in the Company’s Bylaws (which incorporate the requirements of Rule 14a-19

of the Exchange Act), as discussed below.

Proxy Access. The Company’s Bylaws

permit a shareholder, or a group of up to 20 shareholders, owning 3% or more of the outstanding common stock of the Company continuously

for at least three years to nominate and include in the Company’s proxy materials director nominees constituting up to two individuals

or 20% of the Board (whichever is greater), provided that the shareholder(s) and the nominee(s) satisfy the procedures and requirements

specified in the Company’s Bylaws.

Qualifications of Directors and Nominees. The

Board is committed to maintaining a diverse and well-rounded membership, complete with qualifications, skills and experience that support

not only the Company’s business needs, but that also provide independent and objective oversight of the Company’s strategy

and business model. Over the years, the Board has developed a deep and varied skill set, with a membership that we believe reflects a

comprehensive spectrum of both professional and personal experiences. The Board continues to focus its efforts on identifying candidates

that add to, or otherwise complement, the skills and qualifications of its existing members.

The Board is committed to diversity and inclusion

at the Board level and throughout the Company, and its leadership. The Board assesses its effectiveness in this regard as part of the

annual board and director evaluation process. Specifically, the Corporate Governance Committee will take reasonable steps to include diverse

candidates with respect to gender, ethnicity, race, nationality, geographic origin, age, skills and experience in the context of the needs

of the Board in the pool of potential candidates under consideration.

The Corporate Governance Committee and the Board

carefully considered the qualifications, skills and experience of each nominee when concluding that this year’s nominees should

serve on the Board. The chart below highlights skills, knowledge, background and experience that are represented by each of the director

nominees named in this Proxy Statement.

| |

|

|

|

|

|

|

|

|

|

|

| Skills

and Experience |

|

|

|

|

|

|

|

|

|

|

| Current

Executive (non-CEO) Experience provides current insight into the best practices and challenges of leading a complex organization. |

|

|

|

|

|

|

ü |

ü |

|

ü |

| CEO

experience (current and former) Provides insight into effectively leading a complex organization like ours with transparency

and integrity. |

ü |

ü |

|

ü |

ü |

ü |

|

|

|

|

| Corporate

Social Responsibility Experience is important in managing risk and furthering long-term value creation for shareholders by operating

in a sustainable and responsible manner. |

|

ü |

ü |

|

ü |

ü |

|

ü |

ü |

ü |

| Digital

Experience is relevant to understanding and evaluating the Company's efforts in areas such as eCommerce and data and analytics. |

|

ü |

|

|

|

ü |

ü |

ü |

ü |

ü |

| Finance/Accounting/Capital

Allocation Experience enables effective monitoring of the Company's financial reporting and control environment; assessment of

its financial performance; and supporting appropriate shareholder returns. |

ü |

ü |

ü |

|

ü |

ü |

ü |

|

ü |

ü |

| Legal/Regulatory/Government

Affairs Experience enhances understanding of the impact and risks of legal and regulatory matters and public policy issues. |

|

|

ü |

ü |

ü |

ü |

|

|

ü |

ü |

| Product

Development Experience provides insight into ideation, research and development, and commercialization of products and services. |

|

|

|

ü |

|

ü |

|

ü |

ü |

|

| Manufacturing/

Logistics/Supply Chain/Global Operations Experience enhances the Board's ability to oversee cost-effective, technology-driven

manufacturing and logistics processes and facilitates assessment of the Company's complex, international operations. |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

| Risk

Management Experience is important to the identification, oversight and mitigation of significant risks. |

|

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

ü |

| Innovation/Technology

Experience enhances the Board's ability to appraise our progress in executing the strategy of becoming known as one of the world's

leading innovators. |

|

ü |

ü |

ü |

ü |

ü |

ü |

|

ü |

ü |

| Cybersecurity

Experience Provides insight to the Board as it oversees the Company's cyber risk management program in an evolving environment. |

|

|

ü |

|

ü |

ü |

ü |

|

|

ü |

| Sales/Marketing/Brand

Management Experience provides insights into the sales and marketing process and increasing the perceived value of our brands

in the marketplace. |

|

|

|

ü |

ü |

ü |

ü |

ü |

ü |

ü |

| Sustainability

and Climate-Related Risk Experience strengthens the Board's oversight of environmental policies, initiatives and reporting. |

|

|

ü |

|

ü |

ü |

|

ü |

|

ü |

Director Nominee Tenure and Age and Board

Refreshment. The tenure of our director nominees ranges from less than a year to more than 10 years, and the Board believes maintaining

varying lengths of service provides a balance between new ideas and longstanding Company knowledge and valuable insight. Our director

nominees reflect a wide age range, providing a range of experience and expertise. See more information below:

Corporate Governance

Board Leadership Structure. Our Board

regularly evaluates its leadership structure upon the resignation, removal, or election of a new Chair or CEO and at such other times

as the Board may deem appropriate. As part of this evaluation, the Board weighs the input from its shareholder engagement in determining

whether any changes to its leadership structure, depending on the circumstances of the Company, would be in the best interests of the

Company and its shareholders. The Board believes the current structure, characterized by an independent Chair and the CEO serving as a

member of the Board, provides a management perspective, gives our Board a strong leadership and corporate governance structure with well-defined

governance duties and best serves the needs of the Company and its shareholders in light of the Company’s current strategy and focus

on business transformation.

Andrea J. Ayers was elected as the independent

Chair of the Board effective as of April 22, 2022. The Chair’s duties and responsibilities focus on promoting strong corporate governance

and effective Board oversight. More specifically, the Chair’s responsibilities include:

| ● | Presiding over shareholder meetings, director meetings and meetings of independent directors; |

| ● | Ensuring all views, opinions and suggestions of other independent directors are heard; |

| ● | Providing input on the composition of the Board and the membership and leadership of the Board Committees to the Corporate Governance

Committee; |

| ● | Promoting and facilitating effective communication between the Board and members of management; |

| ● | Establishing agenda subjects to be discussed during the year and the schedule and agenda for each Board meeting jointly with the CEO;

and |

| ● | Representing the Board in shareholder engagement efforts if such engagement is appropriate. |

Stock Ownership Guidelines

for Non-Employee Directors. Non-employee directors are required to comply with our Stock Ownership Guidelines for Non-Employee

Directors, which requires the acquisition of shares having a value equal to 500% of the annual retainer within five years of such person

becoming a director and the maintenance of such ownership level during their tenure in accordance with the policy. Shares held by directors

under the Company’s Deferred Compensation Plan for Non-Employee Directors and shares subject to outstanding restricted stock units

(“RSUs”) count towards satisfaction of the ownership requirements. A copy of this policy can be found on the “Governance

Documents” section of the Company’s website at www.stanleyblackanddecker.com (which appears under the “Investors”

heading and the “Governance” subheading). For information about the stock ownership guidelines for executive officers, please