0001496963FALSE00014969632024-08-022024-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 2, 2024

Squarespace, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

Delaware (State or Other Jurisdiction of Incorporation) | 001-40393 (Commission File Number) | 20-0375811 (IRS Employer Identification No.) |

| | | | | |

225 Varick Street,12th Floor New York,New York (Address of Principal Executive Offices) | 10014 (Zip Code) |

(646) 580-3456

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value | | SQSP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (P30.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 2.02 Results of Operations and Financial Condition.

On August 2, 2024, Squarespace, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein. The press release may contain hypertext links to information on the Company’s website. The information on the Company’s website is not incorporated by reference into this Current Report on Form 8-K and does not constitute a part of this Form 8-K.

The press release is furnished under this Item 2.02 and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, whether made before or after today's date, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific references in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SQUARESPACE, INC. |

| | |

Dated: August 2, 2024 | By: | /s/ Courtenay O’Connor |

| | | Courtenay O’Connor |

| | | General Counsel and Secretary |

Squarespace Announces Second Quarter 2024 Financial Results

NEW YORK, August 2, 2024 — Squarespace, Inc. (NYSE: SQSP), the design-driven platform helping entrepreneurs build brands and businesses online, today announced results for the second quarter ended June 30, 2024.

Second Quarter 2024 Financial Highlights

•Total revenue grew 20% year over year to $296.8 million in the second quarter, compared with $247.5 million in the second quarter of 2023, and 20% in constant currency.

◦Presence revenue grew 25% year over year to $215.4 million and 26% in constant currency.

◦Commerce revenue grew 8% year over year to $81.4 million and 8% in constant currency.

•Net income totaled $6.1 million, compared with a net income of $3.7 million in the second quarter of 2023.

•Basic and diluted earnings per share was $0.04 and $0.03 for the second quarter of 2024 and 2023, respectively. Basic earnings per share was based upon 137,760,693 and 135,302,409 weighted average shares outstanding in the second quarter of 2024 and 2023, respectively. Diluted earnings per share was based upon 142,143,018 and 138,771,613 fully diluted weighted average shares outstanding in the second quarter of 2024 and 2023, respectively.

•Cash flow from operating activities increased 15% to $60.6 million for the three months ended June 30, 2024, compared with $52.5 million for the three months ended June 30, 2023.

•Cash and cash equivalents of $270.4 million; investments in marketable securities of $52.0 million; total debt of $545.0 million, of which $57.1 million is current, debt net of cash and investments totaled $222.6 million.

•Total bookings grew 25% year over year to $319.8 million in the second quarter, compared to $256.1 million in the second quarter of 2023.

•Unlevered free cash flow increased 19% to $65.4 million representing 22% of total revenue for the three months ended June 30, 2024, compared with $54.8 million for the three months ended June 30, 2023.

•Adjusted EBITDA decreased to $72.1 million in the second quarter, compared with $73.4 million in the second quarter of 2023.

•Total unique subscriptions increased 21% year over year to over 5.2 million in 2024, compared to 4.3 million in 2023.

•Average revenue per unique subscription (“ARPUS”) increased 3% year over year to $225.45 in 2024, compared to $219.42 in 2023.

•Annual run rate revenue (“ARRR”) grew 20% year over year to $1,179.5 million in 2024, compared to $983.3 million in 2023.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

Transaction with Permira

As announced on May 13, 2024, Squarespace entered into a definitive agreement to go private by Permira. In light of this transaction, Squarespace will not be hosting an earnings conference call or live webcast to discuss its second quarter 2024 financial results and Squarespace will not be providing guidance for the third quarter and is suspending its financial guidance for the full fiscal year 2024.

Transaction with American Express

As announced on June 21, 2024, Squarespace entered into an agreement to sell Tock, the reservation, table, and event management technology provider, to American Express (NYSE: AXP) for $400.0 million. The transaction is subject to customary closing conditions, including regulatory approval. Squarespace classified the assets and liabilities of the Tock business as held for sale, including certain cash, cash equivalents and restricted cash as of June 30, 2024.

Non-GAAP Financial Measures

Revenue growth in constant currency is being provided to increase transparency and align our disclosures with companies in our industry that receive material revenues from international sources. Revenue constant currency has been adjusted to exclude the effect of year-over-year changes in foreign currency exchange rate fluctuations. We believe providing this information better enables investors to understand our operating performance irrespective of currency fluctuations.

We calculate constant currency information by translating current period results from entities with foreign functional currencies using the comparable foreign currency exchange rates from the prior fiscal year. To calculate the effect of foreign currency translation, we apply the same weighted monthly average exchange rate as the comparative period. Our definition of constant currency may differ from other companies reporting similarly named measures, and these constant currency performance measures should be viewed in addition to, and not as a substitute for, our operating performance measures calculated in accordance with GAAP.

Adjusted EBITDA is a supplemental performance measure that our management uses to assess our operating performance. We calculate adjusted EBITDA as net income/(loss) excluding interest expense, other income/(loss), net (provision for)/benefit from income taxes, depreciation and amortization, stock-based compensation expense and other items that we do not consider indicative of our ongoing operating performance.

Unlevered free cash flow is a supplemental liquidity measure that Squarespace's management uses to evaluate its core operating business and its ability to meet its current and future financing and investing needs. Unlevered free cash flow is defined as cash flow from operating activities, including one-time expenses related to Squarespace's direct listing, less cash paid for capital expenditures increased by cash paid for interest expense net of the associated tax benefit.

Adjusted EBITDA, unlevered free cash flow and revenue constant currency are not prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) and have important limitations as an analytical tool. Non-GAAP financial measures are supplemental, should only be used in conjunction with results presented in accordance with GAAP and should not be considered in isolation or as a substitute for such GAAP results.

Further information on these non-GAAP items and reconciliation to their closest GAAP measure is provided below under, “Reconciliation of Non-GAAP Financial Measures.”

Definitions of Key Operating Metrics

On September 7, 2023, we closed an asset purchase agreement between us and Google LLC (“Google”) to acquire, among other things, Google’s domain assets (the “Google Domains Asset Acquisition”). Unique subscriptions and average revenue per unique subscription do not account for single domain subscriptions originally sold by Google as a part of the Google Domains Asset Acquisition (the “Acquired Domain Assets”).

Annual run rate revenue (“ARRR”). We calculate ARRR as the quarterly revenue from subscription fees and revenue generated in conjunction with associated fees (fees taken or assessed in conjunction with commerce

transactions) in the last quarter of the period multiplied by 4. We believe that ARRR is a key indicator of our future revenue potential. However, ARRR should be viewed independently of revenue, and does not represent our GAAP revenue on an annualized basis, as it is an operating metric that can be impacted by subscription start and end dates and renewal rates. ARRR is not intended to be a replacement or forecast of revenue. ARRR for the three months ended June 30, 2023 has been recast to conform to the current period definition. Previously, ARRR was calculated using monthly revenue from subscription fees and revenue generated in conjunction with associated fees in the last month of the period multiplied by 12. We have since revised our calculation to use quarterly revenue from subscription fees and revenue generated in conjunction with associated fees in the last quarter of the period multiplied by 4 to normalize results for the run rate each quarter.

Unique subscriptions represent the number of unique sites, standalone scheduling subscriptions, Unfold (social) and hospitality subscriptions, as of the end of a period. A unique site represents a single subscription and/or group of related subscriptions, including a website subscription and/or a domain subscription, and other subscriptions related to a single website or domain. Every unique site contains at least one domain subscription or one website subscription. For instance, an active website subscription, a custom domain subscription and a Google Workspace subscription that represent services for a single website would count as one unique site, as all of these subscriptions work together and are in service of a single entity’s online presence. Unique subscriptions do not account for one-time purchases in Unfold or for hospitality services nor do they account for our Acquired Domain Assets. The total number of unique subscriptions is a key indicator of the scale of our business and is a critical factor in our ability to increase our revenue base.

Average revenue per unique subscription (“ARPUS”). We calculate ARPUS as the total revenue during the preceding 12-month period divided by the average of the number of total unique subscriptions at the beginning and end of the period. ARPUS does not account for Acquired Domain Assets or the revenue from Acquired Domain Assets. We believe ARPUS is a useful metric in evaluating our ability to sell higher-value plans and add-on subscriptions.

Total bookings represents cash receipts for all subscriptions purchased, as well as payments due under the terms of contractual agreements for obligations to be fulfilled. In the case of multi-year contracts, total bookings only includes one year of committed revenue.

Gross payment volume (“GPV”) represents the value of physical goods and services, including content, time sold, hospitality and events, net of refunds, on our platform over a given period of time. “Gross payment volume” or “GPV” was previously presented as “Gross merchandise value” or “GMV” in prior period disclosures. There were no revisions to the calculation of GPV as a result of this nomenclature change.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on management's expectations, assumptions, and projections based on information available at the time the statements were made. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including risks and uncertainties related to: Squarespace's ability to consummate the take private transaction; Squarespace's ability to attract and retain customers and expand their use of its platform; Squarespace’s ability to anticipate market needs and develop new solutions to meet those needs; Squarespace's ability to improve and enhance the functionality, performance, reliability, design, security and scalability of its existing solutions; Squarespace's ability to compete successfully in its industry against current and future competitors; Squarespace’s ability to manage growth and maintain demand for its solutions; Squarespace's ability to protect and promote its brand; Squarespace's ability to generate new customers through its marketing and selling activities; Squarespace’s ability to successfully identify, manage and integrate any existing and potential acquisitions or achieve the expected benefits of such acquisitions; Squarespace's ability to hire, integrate and retain highly skilled personnel; Squarespace’s ability to adapt to and comply with existing and emerging regulatory developments, technological changes and cybersecurity needs; Squarespace's compliance with privacy and data protection laws and regulations as well as contractual privacy and data protection obligations; Squarespace’s ability

to establish and maintain intellectual property rights; Squarespace’s ability to manage expansion into international markets; and the expected timing, amount, and effect of Squarespace’s share repurchases. It is not possible for Squarespace's management to predict all risks, nor can it assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements Squarespace may make. In light of these risks, uncertainties, and assumptions, Squarespace's actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Further information on risks that could cause actual results to differ materially from forecasted results are included in Squarespace's filings with the Securities and Exchange Commission. Except as required by law, Squarespace assumes no obligation to update these forward-looking statements, or to update the reasons if actual results differ materially from those anticipated in the forward-looking statements.

About Squarespace

Squarespace (NYSE: SQSP) is a design-driven platform helping entrepreneurs build brands and businesses online. We empower millions in more than 200 countries and territories with all the tools they need to create an online presence, build an audience, monetize, and scale their business. Our suite of products range from websites, domains, ecommerce, and marketing tools, as well as tools for scheduling with Acuity, creating and managing social media presence with Bio Sites and Unfold, and hospitality business management via Tock. For more information, visit www.squarespace.com.

Contacts

Investors

investors@squarespace.com

Media

press@squarespace.com

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 296,769 | | | $ | 247,529 | | | $ | 577,917 | | | $ | 484,557 | |

| Cost of revenue (1) | 82,939 | | | 43,167 | | | 163,713 | | | 86,117 | |

| Gross profit | 213,830 | | | 204,362 | | | 414,204 | | | 398,440 | |

| Operating expenses: | | | | | | | |

| Research and product development (1) | 69,805 | | | 61,412 | | | 136,651 | | | 119,982 | |

| Marketing and sales (1) | 88,282 | | | 75,373 | | | 205,815 | | | 177,045 | |

| General and administrative (1) | 38,873 | | | 30,909 | | | 69,696 | | | 63,249 | |

| Total operating expenses | 196,960 | | | 167,694 | | | 412,162 | | | 360,276 | |

| Operating income | 16,870 | | | 36,668 | | | 2,042 | | | 38,164 | |

| Interest expense | (10,157) | | | (8,635) | | | (20,538) | | | (16,729) | |

| Other income, net | 4,454 | | | 2,038 | | | 9,031 | | | 1,198 | |

| Income/(loss) before (provision for)/benefit from income taxes | 11,167 | | | 30,071 | | | (9,465) | | | 22,633 | |

| (Provision for)/benefit from income taxes | (5,034) | | | (26,411) | | | 15,742 | | | (18,471) | |

| Net income | $ | 6,133 | | | $ | 3,660 | | | $ | 6,277 | | | $ | 4,162 | |

| | | | | | | |

| Net income per share, basic | $ | 0.04 | | | $ | 0.03 | | | $ | 0.05 | | | $ | 0.03 | |

| Net income per share, diluted | $ | 0.04 | | | $ | 0.03 | | | $ | 0.04 | | | $ | 0.03 | |

| Weighted-average shares used in computing net income per share, basic | 137,760,693 | | | 135,302,409 | | | 137,348,777 | | | 135,111,072 | |

| Weighted-average shares used in computing net income per share, diluted | 142,143,018 | | | 138,771,613 | | | 141,419,521 | | | 138,013,454 | |

(1) Includes stock-based compensation as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenue | $ | 2,026 | | | $ | 1,549 | | | $ | 3,795 | | | $ | 2,601 | |

| Research and product development | 19,025 | | | 15,650 | | | 34,675 | | | 26,337 | |

| Marketing and sales | 3,590 | | | 3,045 | | | 6,801 | | | 4,916 | |

| General and administrative | 8,157 | | | 9,235 | | | 15,694 | | | 17,751 | |

| Total stock-based compensation | $ | 32,798 | | | $ | 29,479 | | | $ | 60,965 | | | $ | 51,605 | |

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 270,363 | | | $ | 257,702 | |

| Restricted cash | — | | | 36,583 | |

| Investment in marketable securities | 52,041 | | | — | |

| Accounts receivable | 41,384 | | | 24,894 | |

| Due from vendors | — | | | 6,089 | |

| Prepaid expenses and other current assets | 83,016 | | | 48,947 | |

| Total current assets | 446,804 | | | 374,215 | |

| Property and equipment, net | 49,609 | | | 58,211 | |

| Operating lease right-of-use assets | 61,016 | | | 77,764 | |

| Goodwill | 196,522 | | | 210,438 | |

| Intangible assets, net | 140,839 | | | 190,103 | |

| Other assets | 11,560 | | | 11,028 | |

| Assets of business held for sale | 94,529 | | | — | |

| Total assets | $ | 1,000,879 | | | $ | 921,759 | |

| Liabilities and Stockholders’ Deficit | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 21,933 | | | $ | 12,863 | |

| Accrued liabilities | 98,933 | | | 99,435 | |

| Deferred revenue | 397,923 | | | 333,191 | |

| Funds payable to customers | — | | | 42,672 | |

| Debt, current portion | 57,140 | | | 48,977 | |

| Operating lease liabilities, current portion | 11,281 | | | 12,640 | |

| Total current liabilities | 587,210 | | | 549,778 | |

| Deferred income taxes, non-current portion | 1,164 | | | 1,039 | |

| Debt, non-current portion | 487,846 | | | 519,816 | |

| Operating lease liabilities, non-current portion | 71,843 | | | 97,714 | |

| Other liabilities | 18,940 | | | 13,764 | |

| Liabilities of business held for sale | 76,745 | | | — | |

| Total liabilities | 1,243,748 | | | 1,182,111 | |

| Commitments and contingencies | | | |

| Stockholders’ deficit: | | | |

| Class A common stock, par value of $0.0001; 1,000,000,000 shares authorized as of June 30, 2024 and December 31, 2023, respectively; 90,630,649 and 88,545,012 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 9 | | | 9 | |

| Class B common stock, par value of $0.0001; 100,000,000 shares authorized as of June 30, 2024 and December 31, 2023, respectively; 47,844,755 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 5 | | | 5 | |

| Class C common stock (authorized May 10, 2021), par value of $0.0001; 1,000,000,000 shares authorized as of June 30, 2024 and December 31, 2023, respectively; zero shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | — | | | — | |

| Additional paid in capital | 936,277 | | | 924,634 | |

| Accumulated other comprehensive loss | (1,280) | | | (843) | |

| Accumulated deficit | (1,177,880) | | | (1,184,157) | |

| Total stockholders’ deficit | (242,869) | | | (260,352) | |

| Total liabilities and stockholders’ deficit | $ | 1,000,879 | | | $ | 921,759 | |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| OPERATING ACTIVITIES: | | | |

| Net income | $ | 6,277 | | | $ | 4,162 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 36,885 | | | 14,477 | |

| Stock-based compensation | 60,965 | | | 51,605 | |

| Deferred income taxes | 125 | | | 124 | |

| Non-cash lease income | (1,757) | | | (989) | |

| Other | 625 | | | 310 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable and due from vendors | (15,697) | | | 2,364 | |

| Prepaid expenses and other current assets | (35,545) | | | (1,480) | |

| Accounts payable and accrued liabilities | 29,784 | | | 9,822 | |

| Deferred revenue | 69,012 | | | 38,030 | |

| Funds payable to customers | (4,943) | | | (2,131) | |

| Other operating assets and liabilities | 117 | | | 408 | |

| Net cash provided by operating activities | 145,848 | | | 116,702 | |

| INVESTING ACTIVITIES: | | | |

| Proceeds from the sale and maturities of marketable securities | 1,000 | | | 39,664 | |

| Purchases of marketable securities | (52,856) | | | (7,824) | |

| Purchase of property and equipment | (6,074) | | | (7,167) | |

| Net cash (used in)/provided by investing activities | (57,930) | | | 24,673 | |

| FINANCING ACTIVITIES: | | | |

| Principal payments on debt | (24,488) | | | (20,379) | |

| Payments for repurchase and retirement of Class A common stock | (16,311) | | | (25,321) | |

| Taxes paid related to net share settlement of equity awards | (37,640) | | | (20,318) | |

| Proceeds from exercise of stock options | 2,585 | | | 134 | |

| Net cash used in financing activities | (75,854) | | | (65,884) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (513) | | | 165 | |

| Increase in cash, cash equivalents and restricted cash, including cash classified as assets of business held for sale | 11,551 | | | 75,656 | |

| Less: Increase in cash, cash equivalents and restricted cash classified as assets of business held for sale | (35,473) | | | — | |

| Net (decrease)/increase in cash, cash equivalents and restricted cash | (23,922) | | | 75,656 | |

| Cash, cash equivalents and restricted cash at the beginning of the period | 294,285 | | | 232,620 | |

| Cash, cash equivalents and restricted cash at the end of the period | $ | 270,363 | | | $ | 308,276 | |

| | | |

| Reconciliation of cash, cash equivalents, and restricted cash: | | | |

| Cash and cash equivalents | $ | 270,363 | | | $ | 274,004 | |

| Restricted cash | — | | | 34,272 | |

| Cash, cash equivalents, and restricted cash at the end of the period | $ | 270,363 | | | $ | 308,276 | |

| | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW | | | |

| Cash paid during the year for interest | $ | 19,883 | | | $ | 16,360 | |

| Cash paid during the year for income taxes, net of refunds | $ | 31,231 | | | $ | 22,902 | |

| Cash paid for amounts included in the measurement of operating lease liabilities | $ | 8,124 | | | $ | 7,861 | |

| | | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCE ACTIVITIES | | | |

| Purchases of property and equipment included in accounts payable and accrued liabilities | $ | 295 | | | $ | 196 | |

| Capitalized stock-based compensation | $ | 1,404 | | | $ | 1,638 | |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

(in thousands)

(unaudited)

The following tables reconcile each non-GAAP financial measure to its most directly comparable GAAP financial measure:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 6,133 | | | $ | 3,660 | | | $ | 6,277 | | | $ | 4,162 | |

| Interest expense | 10,157 | | | 8,635 | | | 20,538 | | | 16,729 | |

| Provision for/(benefit from) income taxes | 5,034 | | | 26,411 | | | (15,742) | | | 18,471 | |

| Depreciation and amortization | 18,213 | | | 7,236 | | | 36,885 | | | 14,477 | |

| Stock-based compensation expense | 32,798 | | | 29,479 | | | 60,965 | | | 51,605 | |

| Other income, net | (4,454) | | | (2,038) | | | (9,031) | | | (1,198) | |

| Proposed merger costs | 4,198 | | | — | | | 4,198 | | | — | |

| Adjusted EBITDA | $ | 72,079 | | | $ | 73,383 | | | $ | 104,090 | | | $ | 104,246 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities | $ | 60,629 | | | $ | 52,547 | | | $ | 145,848 | | | $ | 116,702 | |

| Cash paid for capital expenditures | (2,689) | | | (4,092) | | | (6,074) | | | (7,167) | |

| Free cash flow | $ | 57,940 | | | $ | 48,455 | | | $ | 139,774 | | | $ | 109,535 | |

| Cash paid for interest, net of the associated tax benefit | 7,480 | | | 6,310 | | | 14,968 | | | 12,326 | |

| Unlevered free cash flow | $ | 65,420 | | | $ | 54,765 | | | $ | 154,742 | | | $ | 121,861 | |

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Total debt outstanding | $ | 544,986 | | | $ | 568,793 | |

| Less: total cash and cash equivalents and marketable securities | 322,404 | | | 257,702 | |

| Total net debt | $ | 222,582 | | | $ | 311,091 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue, as reported | $ | 296,769 | | | $ | 247,529 | | | $ | 577,917 | | | $ | 484,557 | |

| Revenue year-over-year growth rate, as reported | 19.9 | % | | 16.4 | % | | 19.3 | % | | 15.2 | % |

| Effect of foreign currency translation ($)(1) | $ | (686) | | | $ | 685 | | | $ | (218) | | | $ | (2,118) | |

| Effect of foreign currency translation (%)(1) | (0.3) | % | | 0.3 | % | | — | % | | (0.5) | % |

| Revenue constant currency growth rate | 20.2 | % | | 16.1 | % | | 19.3 | % | | 15.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Commerce revenue, as reported | $ | 81,396 | | | $ | 75,455 | | | $ | 161,660 | | | $ | 148,092 | |

| Revenue year-over-year growth rate, as reported | 7.9 | % | | 14.0 | % | | 9.2 | % | | 13.9 | % |

| Effect of foreign currency translation ($)(1) | $ | (107) | | | $ | 119 | | | $ | (29) | | | $ | (369) | |

| Effect of foreign currency translation (%)(1) | (0.1) | % | | 0.2 | % | | — | % | | (0.3) | % |

| Commerce revenue constant currency growth rate | 8.0 | % | | 13.8 | % | | 9.2 | % | | 14.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Presence revenue, as reported | $ | 215,373 | | | $ | 172,074 | | | $ | 416,257 | | | $ | 336,465 | |

| Revenue year-over-year growth rate, as reported | 25.2 | % | | 17.4 | % | | 23.7 | % | | 15.8 | % |

| Effect of foreign currency translation ($)(1) | $ | (579) | | | $ | 565 | | | $ | (188) | | | $ | (1,749) | |

| Effect of foreign currency translation (%)(1) | (0.3) | % | | 0.4 | % | | (0.1) | % | | (0.6) | % |

| Presence revenue constant currency growth rate | 25.5 | % | | 17.0 | % | | 23.8 | % | | 16.4 | % |

(1) To calculate the effect of foreign currency translation, we apply the same weighted monthly average exchange rate as the comparative period.

Amounts may not sum due to rounding.

SUMMARY OF SHARES OUTSTANDING

(unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Shares outstanding: | | | |

| Class A common stock | 90,630,649 | | 87,723,667 |

| Class B common stock | 47,844,755 | | 47,844,755 |

| Class C common stock | 0 | | 0 |

| Total shares outstanding | 138,475,404 | | 135,568,422 |

KEY PERFORMANCE INDICATORS AND NON-GAAP FINANCIAL MEASURES

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Unique subscriptions (in thousands) (1) | 5,195 | | | 4,305 | | | 5,195 | | | 4,305 | |

| Total bookings (in thousands) | $ | 319,774 | | | $ | 256,137 | | | $ | 645,720 | | | $ | 521,926 | |

| ARRR (in thousands) (2) | $ | 1,179,456 | | | $ | 983,265 | | | $ | 1,179,456 | | | $ | 983,265 | |

| ARPUS (1) | $ | 225.45 | | | $ | 219.42 | | | $ | 225.45 | | | $ | 219.42 | |

| Adjusted EBITDA (in thousands) | $ | 72,079 | | | $ | 73,383 | | | $ | 104,090 | | | $ | 104,246 | |

| Unlevered free cash flow (in thousands) | $ | 65,420 | | | $ | 54,765 | | | $ | 154,742 | | | $ | 121,861 | |

| GPV (in thousands) (3) | $ | 1,589,076 | | | $ | 1,525,476 | | | $ | 3,238,533 | | | $ | 3,059,534 | |

______________

(1)Unique subscriptions and average revenue per unique subscription (“ARPUS”) do not account for single domain subscriptions originally sold by Google as a part of the Google Domains Asset Acquisition.

(2)Annual run rate revenue (“ARRR”) for the three and six months ended June 30, 2023 has been recast to conform to the current period definition. Previously, ARRR was calculated using monthly revenue from subscription fees and revenue generated in conjunction with associated fees in the last month of the period multiplied by 12. We have since revised our calculation to use quarterly revenue from subscription fees and revenue generated in conjunction with associated fees in the last quarter of the period multiplied by 4 to normalize results for the run rate each quarter.

(3)“Gross payment volume” or “GPV” was previously presented as “Gross merchandise value” or “GMV” in prior period disclosures. There were no revisions to the calculation of GPV as a result of this nomenclature change.

v3.24.2.u1

Cover

|

Aug. 02, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 02, 2024

|

| Entity Registrant Name |

Squarespace, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40393

|

| Entity Tax Identification Number |

20-0375811

|

| Entity Address, Address Line One |

225 Varick Street

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10014

|

| City Area Code |

646

|

| Local Phone Number |

580-3456

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value

|

| Trading Symbol |

SQSP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001496963

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

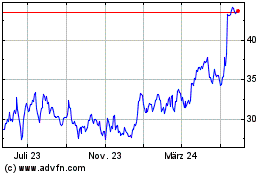

Squarespace (NYSE:SQSP)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

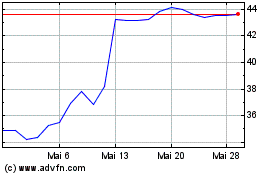

Squarespace (NYSE:SQSP)

Historical Stock Chart

Von Dez 2023 bis Dez 2024