Current Report Filing (8-k)

31 Mai 2023 - 10:06PM

Edgar (US Regulatory)

0000894315false0000894315us-gaap:CommonStockMember2023-05-312023-05-310000894315sitc:ClassACumulativeRedeemablePreferredSharesMember2023-05-312023-05-3100008943152023-05-312023-05-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 31, 2023 |

SITE Centers Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Ohio |

1-11690 |

34-1723097 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3300 Enterprise Parkway |

|

Beachwood, Ohio |

|

44122 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (216) 755-5500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, Par Value $0.10 Per Share |

|

SITC |

|

New York Stock Exchange |

Depositary Shares, each representing 1/20 of a share of 6.375% Class A Cumulative Redeemable Preferred Shares without Par Value |

|

SITC PRA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

During the second quarter, SITE Centers Corp. (the “Company” or “SITE Centers”) initiated a restructuring plan, which includes a voluntary retirement offer (the “VRO”), to align the Company’s cost structure and technology platform with current and future expected operations. The VRO was offered to certain eligible employees aged 59.5 or above with 10 years or more of service.

As a result of these activities, SITE Centers anticipates it will incur total severance and other charges, including accelerated non-real estate depreciation and amortization, of approximately $5.3 million, of which approximately $3.1 million is expected to be recognized in the second quarter and the balance in the third and the fourth quarters of 2023. The charges and accelerated depreciation and amortization will impact Net Income Applicable to Common Shareholders and Funds from Operations (FFO) in 2023 but will be excluded from Operating Funds from Operations (OFFO). The restructuring plan is expected to lead to an annualized reduction in General and administrative and Operating and maintenance expenses and non-real estate depreciation and amortization of approximately $3.7 million. The Company expects to realize the full benefit of these savings beginning in the second quarter of 2024.

This information shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except as shall be set forth by specific reference in such filing.

Safe Harbor

SITE Centers considers portions of the information in this Current Report on Form 8-K to be forward‑looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act with respect to the Company’s expectation for future periods. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. For this purpose, any statements contained herein that are not historical fact may be deemed to be forward-looking statements. There are a number of important factors that could cause the Company’s results to differ materially from those indicated by such forward-looking statements, including, among other factors, general economic conditions, including inflation and interest rate volatility; local conditions such as the supply of, and demand for, retail real estate space in our geographic markets; the impact of e-commerce; dependence on rental income from real property; the loss of, significant downsizing of or bankruptcy of a major tenant and the impact of any such event on rental income from other tenants and our properties; redevelopment and construction activities may not achieve a desired return on investment; our ability to buy or sell assets on commercially reasonable terms; our ability to secure equity or debt financing on commercially acceptable terms or at all; impairment charges; valuation and risks relating to our joint venture investments; the termination of any joint venture arrangements or arrangements to manage real property; property damage, expenses related thereto and other business and economic consequences (including the potential loss of rental revenues) resulting from extreme weather conditions or natural disasters in locations where we own properties, and the ability to estimate accurately the amounts thereof; sufficiency and timing of any insurance recovery payments related to damages from extreme weather conditions or natural disasters; any change in strategy; the impact of pandemics (including the COVID-19 pandemic) and other public health crises; unauthorized access, use, theft or destruction of financial, operations or third party data maintained in our information systems or by third parties on our behalf; and our ability to maintain REIT status. For additional factors that could cause the results of the Company to differ materially from those indicated in the forward-looking statements, please refer to the Company's most recent reports on Forms 10-K and 10-Q. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

SITE Centers Corp. |

|

|

|

|

Date: |

May 31, 2023 |

By: |

/s/ Christa A. Vesy |

|

|

Name: Title: |

Christa A. Vesy

Executive Vice President and Chief Accounting Officer |

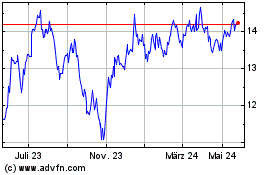

SITE Centers (NYSE:SITC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

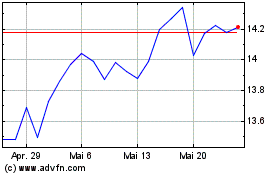

SITE Centers (NYSE:SITC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025