UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ | Preliminary

Proxy Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive

Proxy Statement |

| ☒ | Definitive

Additional Materials |

| ☐ | Soliciting

Material under § 240.14a-12 |

Rigel

Resource Acquisition Corp.

(Name of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☐ | Fee

paid previously with preliminary materials |

| ☐ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): July 26, 2023

Rigel

Resource Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Cayman

Islands |

|

001-41022 |

|

98-1594226 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

7

Bryant Park

1045 Avenue of the Americas, Floor 25

New York, NY |

|

10018 |

| (Address of principal

executive offices) |

|

(Zip Code) |

(646)

453-2672

(Registrant’s telephone number, including area code)

Not

Applicable

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units, each consisting

of one Class A ordinary share and one-half of one redeemable warrant |

|

RRAC.U |

|

The New York Stock Exchange |

| Class A ordinary shares,

par value $0.0001 per share |

|

RRAC |

|

The New York Stock Exchange |

| Redeemable warrants,

each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

RRAC.WS |

|

The New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).+

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On

March 23, 2023, Rigel Resource Acquisition Corp. (the “Company”) signed a non-binding letter of intent for a

business combination with a company in the global metals sector (“Target”). However, no assurances can be made that

the Company and Target will successfully negotiate and enter into a definitive agreement regarding a business combination. Any transaction

would be subject to board and equity holder approval of both the Company and Target, regulatory approvals and other customary closing

conditions.

Cautionary

Note Regarding Forward-Looking Statements

This

Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements that are not historical

facts. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking

statements. These forward-looking statements and factors that may cause such differences include, without limitation, uncertainties relating

to our ability to obtain approval for the Extension (as defined below), our ability to complete an initial business combination, and

other risks and uncertainties indicated from time to time in filings with the U.S. Securities and Exchange Commission (the “SEC”),

including “Risk Factors” in the Definitive Proxy Statement (as defined below) and in other reports we file with the SEC.

The Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or

circumstances on which any statement is based.

Additional

Information and Where to Find It

The

Company urges investors, shareholders and other interested persons to read the definitive proxy statement (the “Definitive Proxy

Statement”) in connection with an extraordinary general meeting of shareholders of the Company to be held at 11:00 a.m., Eastern

Time, on August 7, 2023 for the purpose of, among other things, extending the time by which it has to consummate an initial business

combination from August 9, 2023 to August 9, 2024 (the “Extension”), as well as other documents filed by the Company

with the SEC, because these documents contain important information about the Company and the Extension. The Definitive Proxy Statement

was mailed to shareholders of the Company as of a record date of July 10, 2023, on or about July 19, 2023. Shareholders may obtain copies

of the Definitive Proxy Statement, without charge, at the SEC’s website at www.sec.gov or by directing a request

to: Rigel Resource Acquisition Corp, 7 Bryant Park, 1045 Avenue of the Americas, Floor 25, New York, NY 10018.

Participants

in the Solicitation

The

Company and its directors and officers may be deemed to be participants in the solicitation of proxies of the Company’s shareholders

in connection with the proposals described in the Definitive Proxy Statement. Investors and security holders may obtain more detailed

information regarding the names, affiliations and interests of the Company’s directors and officers in the Definitive Proxy Statement,

which may be obtained free of charge from the sources indicated above.

Item 9.01 Financial Statements and

Exhibits.

(d)

Exhibits

EXHIBIT

INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

July 26, 2023

| Rigel

Resource Acquisition Corp. |

| | |

| |

| | By: |

/s/

Jonathan Lamb |

| | |

Name: | Jonathan

Lamb |

| | |

Title: | Chief

Executive Officer |

Exhibit 99.1

Rigel

Resource Acquisition Corp. Announces Non-Binding Letter of Intent

to Acquire Metals Company

NEW

YORK, July 26, 2023 4:05 PM Eastern Daylight Time--(BUSINESS WIRE)--Rigel Resource Acquisition Corp. (NYSE: RRAC) (the

“Company”) today announced that it signed a non-binding letter of intent for a business combination with a company in

the global metals sector (“Target”) on March 23, 2023. However, no assurances can be made that the Company and Target

will successfully negotiate and enter into a definitive agreement regarding a business combination. Any transaction would be subject

to board and equity holder approval of both the Company and Target, regulatory approvals and other customary closing

conditions.

About

Rigel Resource Acquisition Corp.

Rigel

Resource Acquisition Corp is a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition, share

purchase, reorganization or similar business combination with one or more businesses. Rigel Resource Acquisition Corp aims to identify

and transact with a prospective target business in the global metals sector.

Additional

Information and Where to Find It

The

Company urges investors, shareholders and other interested persons to read the definitive proxy statement (the “Definitive Proxy

Statement”) in connection with an extraordinary general meeting of shareholders of the Company to be held at 11:00 a.m., Eastern

Time, on August 7, 2023 for the purpose of, among other things, extending the time by which it has to consummate an initial business

combination from August 9, 2023 to August 9, 2024 (the “Extension”), as well as other documents filed by the Company with

the U.S. Securities and Exchange Commission (the “SEC”), because these documents contain important information about the

Company and the Extension. The Definitive Proxy Statement was mailed to shareholders of the Company as of a record date of July 10, 2023,

on or about July 19, 2023. Shareholders may obtain copies of the Definitive Proxy Statement, without charge, at the SEC’s website

at www.sec.gov or by directing a request to: Rigel Resource Acquisition Corp, 7 Bryant Park, 1045 Avenue of the Americas, Floor 25, New

York, NY 10018.

Participants

in the Solicitation

The

Company and its directors and officers may be deemed to be participants in the solicitation of proxies of the Company’s shareholders

in connection with the proposals described in the Definitive Proxy Statement. Investors and security holders may obtain more detailed

information regarding the names, affiliations and interests of the Company’s directors and officers in the Definitive Proxy Statement,

which may be obtained free of charge from the sources indicated above.

Forward

Looking Statements

This

press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements that are not historical facts. Such

forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking

statements. These forward-looking statements and factors that may cause such differences include, without limitation, uncertainties relating

to our ability to obtain approval for the Extension, our ability to complete an initial business combination, and other risks and uncertainties

indicated from time to time in filings with the SEC, including “Risk Factors” in the Definitive Proxy Statement and in other

reports we file with the SEC. The Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions

to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or

any change in events, conditions or circumstances on which any statement is based.

Contact

Jon Lamb

jlamb@orionrp.com

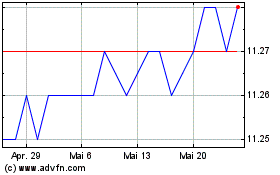

Rigel Resource Acquisition (NYSE:RRAC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

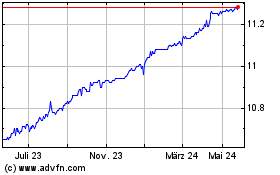

Rigel Resource Acquisition (NYSE:RRAC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024