0001860879

false

0001860879

2023-10-05

2023-10-05

0001860879

rrac:UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember

2023-10-05

2023-10-05

0001860879

rrac:ClassOrdinarySharesParValue0.0001PerShareMember

2023-10-05

2023-10-05

0001860879

rrac:RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2023-10-05

2023-10-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): October 5, 2023

Rigel Resource Acquisition Corp

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-41022 |

|

98-1594226 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

7 Bryant Park

1045 Avenue of the Americas, Floor 25

New York, NY |

|

10018 |

| (Address of principal executive offices) |

|

(Zip Code) |

| |

|

|

(646) 453-2672

(Registrant’s telephone number, including area code) |

| |

|

|

Not Applicable

(Former name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units, each consisting

of one Class A ordinary share and one-half of one redeemable warrant |

|

RRAC.U |

|

The New York Stock Exchange |

| Class A ordinary shares,

par value $0.0001 per share |

|

RRAC |

|

The New York Stock Exchange |

| Redeemable warrants, each

whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

RRAC.WS |

|

The New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01

Entry into a Material Definitive Agreement.

On

October 5, 2023, Rigel Resource Acquisition Corp (the “Company”) and Continental Stock Transfer & Trust Company

(“CST”) entered into an amendment (the “Trust Agreement Amendment”) to the Investment Management Trust Agreement,

dated as of November 4, 2021, relating to the Company’s trust account (the “Trust Account”) to permit CST, as

trustee, to effectuate the Company’s instructions to liquidate the U.S. government securities or money market funds previously

held in the Trust Account and to subsequently hold such funds in an interest-bearing demand deposit bank account.

The

foregoing summary of the Trust Agreement Amendment does not purport to be complete and is subject to, and qualified in its entirety by,

the full text of the Trust Agreement Amendment filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 9.01

Financial Statements and Exhibits.

| (d) | Exhibits.

The following exhibits are filed with this Form 8-K: |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

October 11, 2023

| Rigel

Resource Acquisition Corp |

| | |

| | By: |

/s/

Jonathan Lamb |

| | |

Name: |

Jonathan Lamb |

| | |

Title: |

Chief Executive Officer |

Exhibit 10.1

AMENDMENT

NO. 1 TO INVESTMENT MANAGEMENT TRUST AGREEMENT

THIS

AMENDMENT NO. 1 TO THE INVESTMENT MANAGEMENT TRUST AGREEMENT (this “Amendment”) is made as of October 5, 2023,

by and between Rigel Resource Acquisition Corp, a Cayman Islands exempted company (the “Company”), and Continental

Stock Transfer & Trust Company, a New York corporation (the “Trustee”). Capitalized terms contained in

this Amendment, but not specifically defined in this Amendment, shall have the meanings ascribed to such terms in the Original Agreement

(as defined below).

WHEREAS,

on November 9, 2021, the Company consummated its initial public offering of units of the Company (the “Units”),

each of which is composed of one Class A ordinary share of the Company, par value $0.0001 per share (the “Class A Ordinary

Shares”), and one-half of one redeemable warrant, each whole warrant entitling the holder thereof to purchase one Class

A Ordinary Share of the Company (such initial public offering hereinafter referred to as the “Offering”);

WHEREAS,

$306,000,000 from the net proceeds of the Offering and the sale of private placement warrants were delivered to the Trustee to be deposited

and held in the segregated Trust Account located in the United States for the benefit of the Company and the holders of Class A Ordinary

Shares included in the Units issued in the Offering pursuant to the Investment Management Trust Agreement made effective as of November

4, 2021, by and between the Company and the Trustee (the “Original Agreement”);

WHEREAS,

pursuant to Section 6(c) of the Original Agreement, the Original Agreement may be changed, amended or modified by a writing signed by

each of the Company and the Trustee;

WHEREAS,

the Company previously instructed the Trustee to transfer the funds in the Trust Account to an interest-bearing bank deposit account;

and

WHEREAS,

the Company and the Trustee desire to amend the Original Agreement in order to facilitate the transfer of funds in the Trust Account

to an interest-bearing bank deposit account.

NOW,

THEREFORE, in consideration of the mutual agreements contained herein and other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the Company and the Trustee agree as follows:

1. Amendments

to Trust Agreement

(a) Section

1(c) of the Original Agreement is hereby amended and restated to read in its entirety as follows:

1. Agreements

and Covenants of Trustee. The Trustee hereby agrees and covenants to:

(c)

In a timely manner, upon the written instruction of the Company, (i) hold funds uninvested, (ii) hold funds in an interest-bearing bank

demand deposit account or (iii) invest and reinvest the Property in United States government securities within the meaning of Section

2(a)(16) of the Investment Company Act of 1940, as amended, having a maturity of 185 days or less, or in money market funds meeting the

conditions of paragraphs (d)(1), (d)(2), (d)(3) and (d)(4) of Rule 2a-7 promulgated under the Investment Company Act of 1940, as amended,

which invest only in direct U.S. government treasury obligations, as determined by the Company; it being understood that the Trust Account

will earn no interest while account funds are uninvested awaiting the Company’s instructions hereunder; while the trustee funds

are invested or uninvested, the Trustee may earn bank credits or other consideration;

2. Miscellaneous

Provisions.

(a) Entire

Agreement. The Original Agreement, as modified by this Amendment, constitutes the entire understanding of the parties and

supersedes all prior agreements, understandings, arrangements, promises and commitments, whether written or oral, express or

implied, relating to the subject matter hereof, and all such prior agreements, understandings, arrangements, promises and

commitments are hereby canceled and terminated.

[Signature

pages follow]

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the date first above written.

| |

CONTINENTAL STOCK TRANSFER AND TRUST COMPANY,

as Trustee |

| |

|

| |

By: |

/s/ Francis Wolf |

| |

Name: |

Francis Wolf |

| |

Title: |

Vice President |

| |

|

| |

RIGEL RESOURCE ACQUISITION CORP |

| |

|

| |

By: |

/s/ Jonathan Lamb |

| |

Name: |

Jonathan Lamb |

| |

Title: |

Chief Executive Officer |

[Signature Page to IMTA

Amendment No. 1]

v3.23.3

Cover

|

Oct. 05, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 05, 2023

|

| Entity File Number |

001-41022

|

| Entity Registrant Name |

Rigel Resource Acquisition Corp

|

| Entity Central Index Key |

0001860879

|

| Entity Tax Identification Number |

98-1594226

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

7 Bryant Park

|

| Entity Address, Address Line Two |

1045 Avenue of the Americas

|

| Entity Address, Address Line Three |

Floor 25

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10018

|

| City Area Code |

(646)

|

| Local Phone Number |

453-2672

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting

of one Class A ordinary share and one-half of one redeemable warrant

|

| Trading Symbol |

RRAC.U

|

| Security Exchange Name |

NYSE

|

| Class A ordinary shares, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A ordinary shares,

par value $0.0001 per share

|

| Trading Symbol |

RRAC

|

| Security Exchange Name |

NYSE

|

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable warrants, each

whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50

|

| Trading Symbol |

RRAC.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=rrac_UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=rrac_ClassOrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=rrac_RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

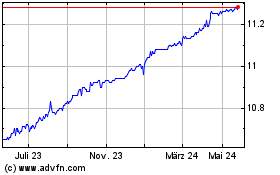

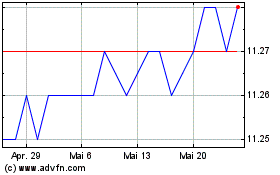

Rigel Resource Acquisition (NYSE:RRAC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Rigel Resource Acquisition (NYSE:RRAC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024