UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 11, 2024

Rigel Resource Acquisition Corp

(Exact Name of Registrant as Specified in Charter)

| Cayman Islands |

|

001-41022 |

|

98-1594226 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

7 Bryant Park

1045 Avenue of the Americas, Floor 25

New York, NY |

|

10018 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(646) 453-2672

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: |

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which

Registered:

|

| Units, each consisting of one Class A ordinary share and one-half of one redeemable

warrant |

|

RRAC.U |

|

The New York Stock Exchange |

| Class A ordinary shares, par value $0.0001 per share |

|

RRAC |

|

The New York Stock Exchange |

| Redeemable warrants, each whole warrant exercisable for Class A ordinary share at

an exercise price of $11.50 per share |

|

RRAC WS |

|

The New York Stock Exchange |

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected

not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry Into a Material Agreement |

On March 11, 2024, Rigel Resource Acquisition

Corp, a Cayman Islands exempted company (“Rigel”), entered into a Business

Combination Agreement (the “Business Combination Agreement”), by and among

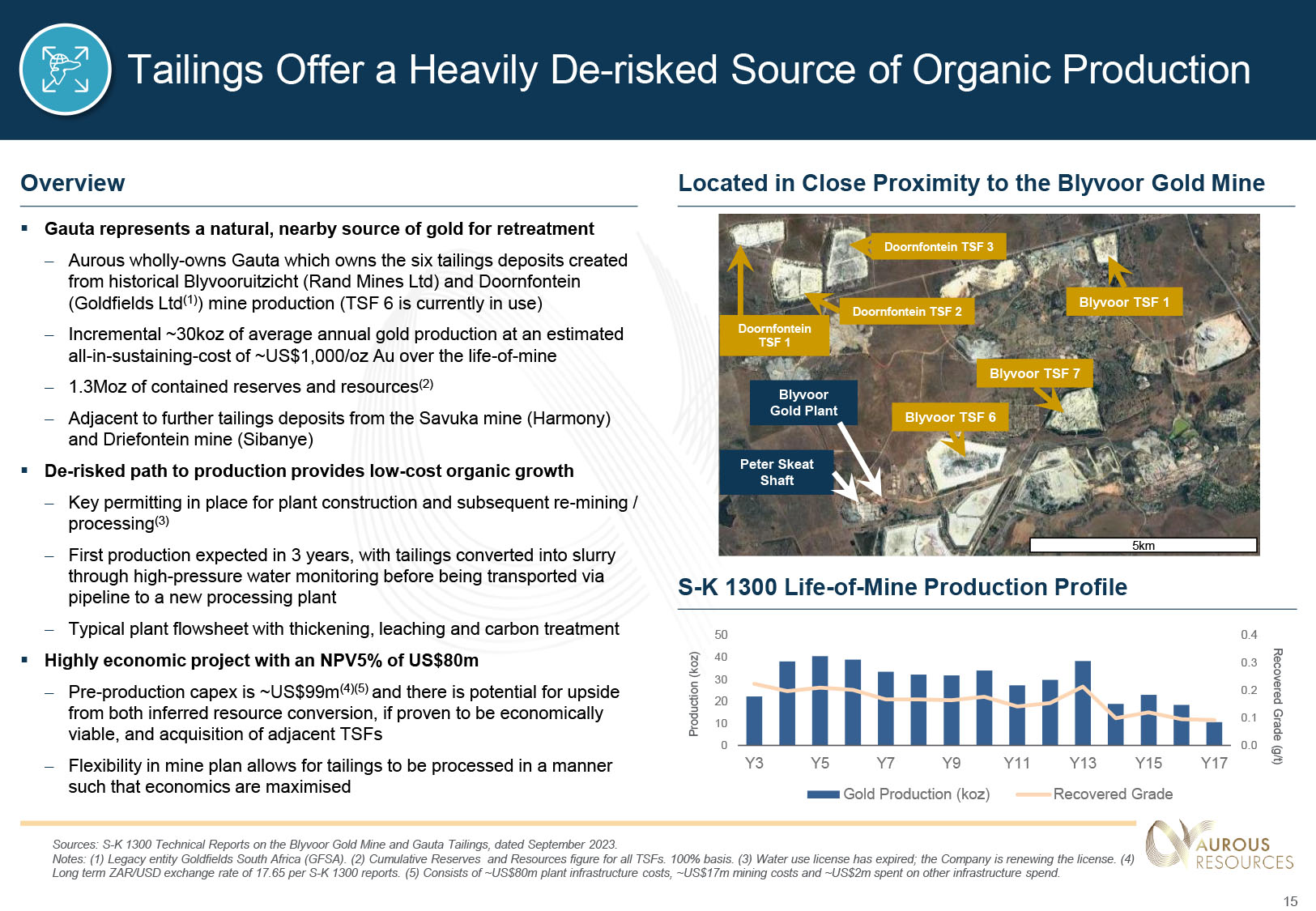

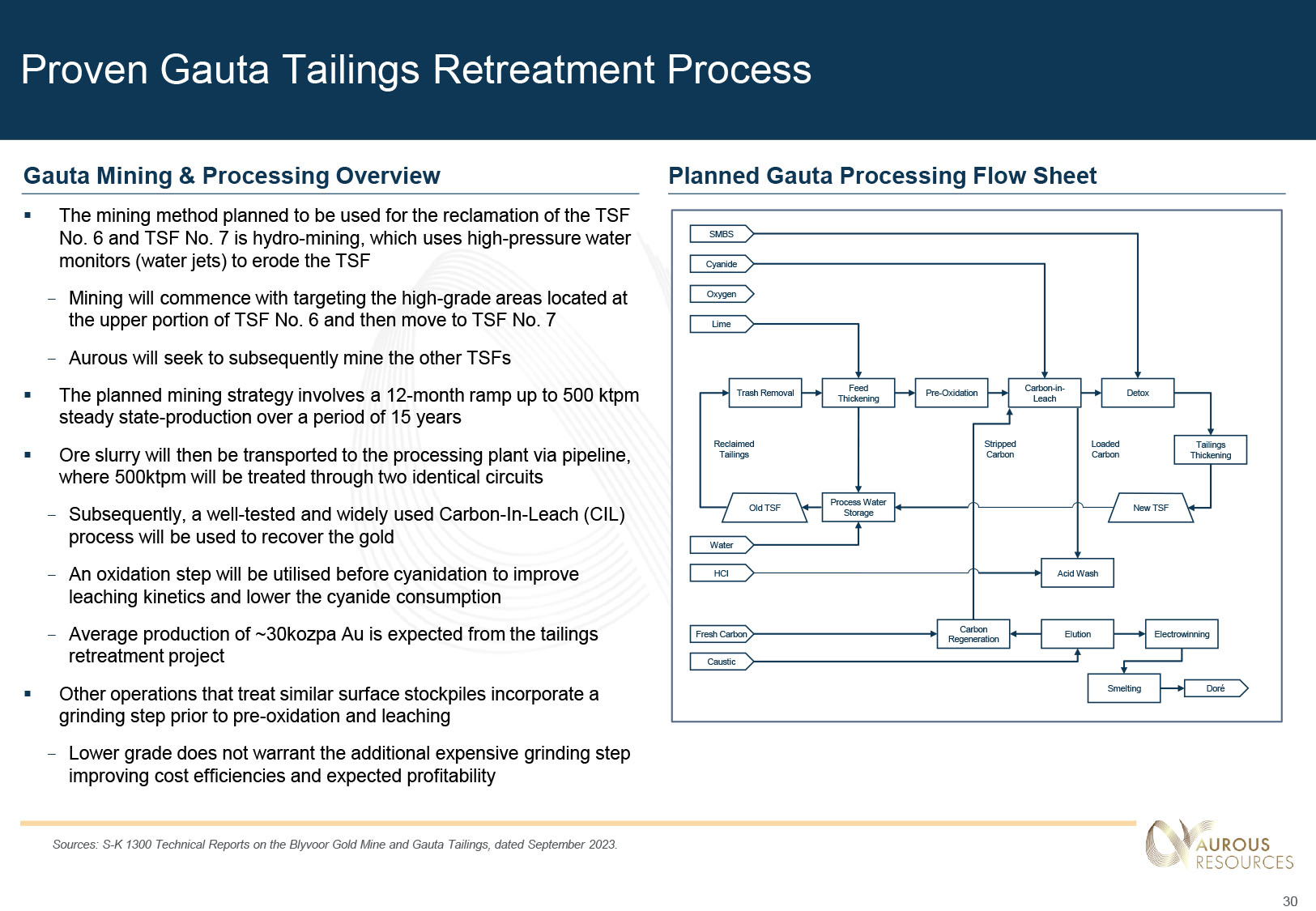

Rigel, Blyvoor Gold Resources Proprietary Limited, a South African private limited liability company (“Blyvoor

Resources”), Blyvoor Gold Operations Proprietary Limited, a South African private limited liability company (“Tailings”

and, together with Blyvoor Resources, the “Target Companies”, each a “Target

Company”), RRAC NewCo, a Cayman Islands exempted company and wholly-owned subsidiary of Rigel (“Newco”),

and RRAC Merger Sub, a Cayman Islands exempted company and wholly-owned subsidiary of Newco (“Merger

Sub”). Each of Newco and Merger Sub is a newly formed entity that was formed for the sole purpose of entering into and consummating

the transactions set forth in the Business Combination Agreement. Concurrently with the execution of the Business Combination Agreement,

Newco also entered into an Exchange Agreement (the “Exchange Agreement”),

by and among, Newco, Blyvoor Gold Proprietary Limited, a South African private limited liability company (“Blyvoor

Gold”), Orion Mine Finance Fund II L.P., a Bermuda limited partnership (“Orion”

and, together with Blyvoor Gold, the “Sellers”), and the Target Companies.

Pursuant to the terms, and subject to the conditions, set forth in the Business Combination Agreement, the parties thereto will enter into a business combination transaction

(together with the other transactions contemplated by the Business Combination Agreement, the “Transactions”), pursuant to which, among other things, (i) Rigel will merge with and into Merger Sub (the “Merger”), with Merger Sub being the surviving company, and (ii) Newco will acquire all of the outstanding equity interests of the Target Companies

(the “Share Exchange”). Following the Merger and the Share Exchange, each of the Target Companies and Merger Sub will be a wholly owned subsidiary of Newco, and Newco will become a publicly traded company. At the closing of the Transactions (the “Closing”), Newco is expected to change its name to Aurous Resources, and its ordinary shares, par value $0.0001 (the “Newco Ordinary Shares”), are expected to be listed on the NASDAQ.

The Transactions are expected to be consummated after the required approval by the

holders of Rigel ordinary shares and the satisfaction of certain other conditions summarized below.

Business Combination Agreement

Share Exchange

The consideration to the holders of the Target Companies’ outstanding equity interests at the Closing will consist of (a) 600,000 Newco Ordinary Shares to Blyvoor Gold in exchange for its shares of Tailings (the “Gold Tailings Consideration”), (b) 28,017,500 Newco Ordinary Shares to Blyvoor Gold in exchange for its shares of Blyvoor Resources (the “Gold Resources Consideration”), and (c) 6,982,500 Newco Ordinary Shares to Orion in exchange for its shares of Blyvoor Resources (the “Orion Resources Consideration” and, together with the Gold Tailings Consideration and the Gold Resources Consideration,

the “Exchange Consideration”). Pursuant to the Exchange Agreement, the Sellers have agreed, subject to customary

exceptions, not to transfer any Newco Ordinary Shares received as Exchange Consideration

until the 6-month anniversary of the Closing.

As additional consideration for its shares of Tailings, Blyvoor Gold will be entitled

to receive, as promptly as practicable after the date that is 90 days following the Closing, a number of Newco Ordinary Shares equal to the product of (A) the quotient of (i) the aggregate amount of proceeds from the PIPE Investment (as defined in the Business Combination Agreement), divided by (ii) 100,000, multiplied by (B) 346.6666667.

In addition to the foregoing, the Sellers shall have the contingent right to receive

additional Newco Ordinary Shares, as described below, (the “Earnout Shares”), subject to the following milestone conditions (the “Milestone Conditions”):

|

(i) |

If Net Cash Proceeds (as defined in the Business Combination Agreement) are equal

to or greater than $33,000,000 as of immediately prior to Closing: |

|

a. |

The Sellers will be

entitled to receive, upon the cumulative payable gold production of the Mine (as defined in the Business Combination Agreement)

exceeding 55,000 ounces (the “First Base Case Milestone”) for the

12-month period ending on the date that is the 18-month anniversary of the last day of the calendar month in which the Closing

occurs (the “First Earnout Period”), 1,050,000 Newco Ordinary Shares;

and |

|

b. |

the Sellers will be

entitled to receive, upon the cumulative payable gold production of the Mine exceeding 95,000 ounces (the “Second

Base Case Milestone”) for the 12-month period ending on the date that is the 30-month anniversary of the last day of

the calendar month in which the Closing occurs (the “Second Earnout

Period” and together with the First Earnout Period, the “Earnout

Periods”), 1,575,000 Newco Ordinary Shares; |

|

(ii) |

If Net Cash Proceeds are less than $33,000,000 as of immediately prior to Closing: |

|

a. |

the Sellers will be entitled to receive (such amount not to exceed 1,050,000

Newco Ordinary Shares), upon the cumulative payable gold production of the Mine for the First Earnout Period exceeding an amount, in ounces,

equal to (but in no event to be less than 32,650 ounces) the product of (1) the First Base Case Milestone multiplied by (2) the

sum of (x) one minus (y) the Adjustment Multiplier (as defined in the Business Combination Agreement), a number of Newco Ordinary

Shares equal to (but in no event to exceed 1,050,000 Newco Ordinary Shares) the product of (I) 1,050,000 Newco Ordinary Shares multiplied

by (II) the sum of (A) one minus (B) the product of (x) the Adjustment Multiplier multiplied by (y) 0.25 plus (C)

the Share Consideration Multiplier (as defined in the Business Combination Agreement); and |

|

b. |

the Sellers will be entitled to receive (such amount not to exceed 2,625,000

Newco Ordinary Shares, upon the cumulative payable gold production of the Mine for the Second Earnout Period exceeding an amount, in ounces,

equal to (but in no event to be less than 56,240 ounces) the product of (1) the Second Base Case Milestone multiplied by (2) the

sum of (x) one minus (y) the Adjustment Multiplier, a number of Newco Ordinary Shares equal to (but in no event to exceed, in the

aggregate with the First Earnout Share Consideration (as defined in the Business Combination Agreement), 2,625,000 Newco Ordinary Shares)

the product of (I) 1,575,000 Newco Ordinary Shares multiplied by (II) the sum of (A) one minus (B) the product of (x) the

Adjustment Multiplier multiplied by (y) 0.25 plus (C) the Share Consideration Multiplier; |

The respective Milestone Conditions described above will be deemed to be achieved, and the respective Earnout

Shares for the applicable Earnout Period(s) will be issued to the Sellers if, at any

point prior to the end of the applicable Earnout Period(s), there is a sale, exchange or other transfer, directly or indirectly, in one transaction or a series of related transactions, of

all or substantially all of the assets of the Target Companies or a merger, consolidation, recapitalization or other transaction in which any person other than Newco or any affiliate of Newco becomes the beneficial owner, directly or indirectly, of 50% or

more of the combined voting power of all interests in the Target Companies, taken as a

whole. Any Earnout Shares not properly earned by the end of the Earnout Periods shall no

longer be issuable to Sellers and the obligations of Newco to issue such Earnout Shares

shall be terminated.

Effect of the Merger

On the terms, and subject to the conditions, set forth in the Business Combination Agreement, at the effective time of the Merger (the “Merger Effective Time”), by virtue of the Merger:

| (i) | each Class A ordinary share of Rigel (a “Rigel Class

A Ordinary Share”) issued and outstanding immediately prior to the Merger Effective Time (other than shares to be cancelled

in accordance with the Business Combination Agreement and any Redemption Shares (as defined below)) will be automatically cancelled and

converted into the right to receive (A) cash consideration in an amount per share equal to the cash value per share as of the Closing

date to be received in respect of a Rigel Class A Ordinary Share redeemed in the Rigel Stockholder Redemption (as defined below) minus

$10.00 (the “Cash Consideration”) and (B) one Newco Ordinary Share (the “Equity Consideration”

and together with the Cash Consideration, the “Ordinary Shareholder Consideration”); |

| (ii) | each Rigel Class A Ordinary Share issued and outstanding immediately

prior to the Merger Effective Time with respect to which a Rigel stockholder has validly exercised its redemption rights (collectively,

the “Redemption Shares”) will not be converted into and become the Ordinary Shareholder Consideration, and instead

will at the Merger Effective Time be converted into the right to receive from Rigel, in cash, an amount per share calculated in accordance

with such stockholder’s redemption rights; |

| (iii) | each Class B ordinary share of Rigel (a “Rigel Class

B Ordinary Share”) issued and outstanding immediately prior to the Merger Effective Time will be automatically cancelled and

converted into the right to receive one Newco Ordinary Share; and |

| (iv) | each issued and outstanding public warrant of Rigel (the “Rigel

Public Warrants”) shall be converted automatically into the right of the holder thereof to receive one public warrant of Newco

(the “Newco Public Warrants”), and each issued and outstanding private warrant of Rigel (the “Rigel Private

Warrants”) shall be converted automatically into the right of the holder thereof to receive one private warrant of Newco (the

“Newco Private Warrants” and, together with the Newco Public Warrants, the “Newco Warrants”). Each

Newco Public Warrant shall have, and be subject to, substantially the same terms and conditions as are in effect with respect to the

Rigel Public Warrants, and each Newco Private Warrant shall have, and be subject to, substantially the same terms and conditions as are

in effect with respect to the Rigel Private Warrants, except that in each case they shall represent the right to acquire Newco Ordinary

Shares. |

Representations and Warranties

The Business Combination Agreement contains customary representations and warranties of the parties thereto with respect

to, among other things, (i) entity organization, standing, formation and authority,

(ii) authorization to enter into the Business Combination Agreement, (iii) capital structure, (iv) consents and approvals, (v) financial statements,

(vi) absence of changes, (vii) license and permits, (viii) litigation, (ix) material

contracts, (x) intellectual property, (xi) taxes, (xii) real and personal properties,

(xiii) employee matters, (xiv) benefit plans, (xv) compliance with laws, (xvi) environmental

matters, (xvii) benefit plans, (xviii) affiliate transactions, (xix) insurance, (xx)

business practices and (xx) finders and brokers. Except in the case of fraud or intentional

and willful breach, the representations and warranties of the parties contained in

the Business Combination Agreement will terminate and be of no further force and effect as of the Closing.

Covenants

The Business Combination Agreement contains customary covenants of the parties, including, among others, covenants providing

for (i) the operation of the Target Companies’ businesses in the ordinary course of business prior to consummation of the Transactions,

(ii) the parties’ efforts to satisfy conditions to obligations of the Transactions, (iii) the preparation and filing of a registration statement

on Form F-4 (the “Registration Statement”) in connection with the registration under the Securities Act of 1933, as amended

(the “Securities Act”), of the Newco Ordinary Shares and Newco Warrants to be issued pursuant to the Business Combination Agreement, which will also contain a prospectus and proxy statement for the purpose of soliciting

proxies from Rigel’s stockholders to vote in favor of certain matters (the “Rigel Stockholder Approval Matters”), (iv) Newco’s adoption of an equity incentive plan that provides for grants and awards to eligible

service providers, (v) the protection of, and access to, confidential information

of the parties, and (vi) the parties’ efforts to obtain necessary approvals from Governmental Authorities (as defined in

the Business Combination Agreement).

Pursuant to the Business Combination Agreement, Rigel’s public stockholders will be given an opportunity, in accordance with Rigel’s amended and restated articles and memorandum of association and the final prospectus

from Rigel’s initial public offering, which was filed with the SEC on November 8, 2021, to have their Rigel Class A Ordinary Shares redeemed (the “Rigel Stockholder Redemption”), in conjunction with the Rigel Stockholder Approval (as defined below).

During the Interim Period (as defined in the Business Combination Agreement), each of the parties to the Business Combination Agreement shall not, and shall cause

its representatives not to, solicit, initiate, continue or engage in discussions or negotiations with, or enter

into any agreement with, or knowingly encourage, respond to, or provide information

to, any person concerning an “Acquisition Transaction” or a “Business Combination Proposal”, as applicable.

Conditions to Closing

The consummation of the Transactions is subject to customary closing conditions for

transactions involving special purpose acquisition companies, including, among others:

(i) approval of the Rigel Stockholder Approval Matters by Rigel’s stockholders (the “Rigel Stockholder Approval”), (ii) no order, statute, rule or regulation enjoining or prohibiting the consummation

of the Transactions being in force, (iii) the Registration Statement having become effective, (iv) the shares of Newco Ordinary Shares to be issued pursuant to the Business Combination Agreement having been approved for listing on the NASDAQ and (v) certain other customary bring-down conditions. In addition, the obligation of the Sellers to consummate the Transactions is subject

to the availability of Aggregate Cash Proceeds (as defined in the Business Combination

Agreement) of not less than $50,000,000 at the Closing.

Termination

The Business Combination Agreement may be terminated as follows:

|

(i) |

by mutual written consent of the Target Companies and Rigel; |

|

(ii) |

prior to the Closing, by written notice to the Target Companies from Rigel if: |

|

a. |

there is any breach of any representation, warranty, covenant or agreement on the

part of the Target Companies set forth in the Business Combination Agreement, such

that certain closing conditions therein would not be satisfied; provided that the

Target Companies are provided the option to cure such breach as specified in the Business

Combination Agreement; |

|

b. |

if the Closing has not occurred on or before August 9, 2024 (the “Termination Date”); |

|

c. |

if the consummation of the Transactions is permanently enjoined, prohibited or prevented by the terms of a final,

non-appealable governmental order; |

|

(iii) |

prior to the Closing, by written notice to Rigel from the Target Companies if: |

|

a. |

there is any breach of any representation, warranty, covenant or agreement on the

part of Rigel, Newco or Merger Sub set forth in the Business Combination Agreement,

such that certain closing conditions therein would not be satisfied; provided that

Rigel, Newco, or Merger Sub, as applicable, are provided the option to cure such breach

as specified in the Business Combination Agreement; |

|

b. |

the Closing has not occurred on or before the Termination Date, |

|

c. |

the consummation of the Transactions is permanently enjoined, prohibited or prevented

by the terms of a final, non-appealable Governmental Order; or |

|

d. |

if there has been a Change in Recommendation (as defined in the Business Combination

Agreement). |

The foregoing description of the Business Combination Agreement and the Transactions does not purport to be complete and is qualified in its entirety

by the terms and conditions of the Business Combination Agreement and any related agreements. The Business Combination Agreement has been included as an exhibit to this Current Report on Form 8-K (this “Current Report”) to provide investors with information regarding its terms. It is not intended to

provide any other factual information about Rigel, the Target Companies or any other

party to the Business Combination Agreement or any related agreement. In particular, the representations, warranties, covenants

and agreements contained in the Business Combination Agreement, which were made only for purposes of such agreement and as of specific dates, are

solely for the benefit of the parties to the Business Combination Agreement, are subject to limitations agreed upon by the contracting parties (including being

qualified by confidential disclosures made for the purposes of allocating contractual

risk between the parties to the Business Combination Agreement instead of establishing these matters as facts) and are subject to standards of materiality

applicable to the contracting parties that may differ from those applicable to investors

and security holders. Investors and security holders are not third-party beneficiaries

under the Business Combination Agreement and should not rely on the representations, warranties, covenants and agreements,

or any descriptions thereof, as characterizations of the actual state of facts or

condition of any party to the Business Combination Agreement. Moreover, information concerning the subject matter of the representations and warranties

may change after the date of the Business Combination Agreement, which subsequent information may or may not be fully reflected in Rigel’s public disclosures.

The foregoing description of the Business Combination Agreement and the Exchange Agreement is not complete and is qualified in its entirety by reference to the Business Combination Agreement and the Exchange Agreement which are filed with this Current Report as Exhibit 2.1 and Exhibit 2.2, respectively,

and are incorporated herein by reference.

Related Agreements

Sponsor Support Agreement

In connection with the execution of the Business Combination Agreement, Rigel, the Target Companies, Rigel Resource Acquisition Holding LLC (the “Sponsor”) and the persons set forth on Schedule I thereto (collectively with the Sponsor, the “Sponsors”) have entered into a Sponsor Support Agreement (the “Sponsor Support Agreement”). The Sponsor Support Agreement provides that, among other things, the Sponsors

agree (i) to vote in favor of the Transactions, (ii) to appear at certain Rigel stockholder meetings for purposes of constituting a quorum, (iii) to vote against any

proposals that could reasonably be expected to prevent or materially impede the Transactions

and (iv) to waive any anti-dilution adjustment to the conversion ratio with respect

to their existing shares that would result from the issuance of Newco Ordinary Shares,

in each case, on the terms and subject to the conditions set forth in the Sponsor

Support Agreement.

In addition, pursuant to the Sponsor Support

Agreement, the Sponsors have agreed, subject to certain customary exceptions, not to transfer (i) any Newco Ordinary Shares owned by

such Sponsor until the 12-month anniversary of the Closing, (ii) a number of Newco Private Warrants equal to 40% of all Newco Private

Warrants owned by such Sponsor (including any Newco Ordinary Shares issuable upon the exercise of such warrants) until the 12-month anniversary

of the Closing and (iii) a number of Newco Private Warrants equal to 60% of all Newco Private Warrants owned by such Sponsor (including

any Newco Ordinary Shares issuable upon the exercise of such warrants) until the 24-month anniversary of the Closing. The foregoing restrictions

on transfer with respect to Newco Ordinary Shares shall be released if the last reported sale price of the Newco Ordinary Shares equals

or exceeds $12.00 per share for any 20 trading days within any 30-trading day period commencing at least 180 days after closing.

The foregoing description of the Sponsor Support Agreement is not complete and is qualified by reference to the Sponsor Support Agreement, which is filed with this Current Report as Exhibit 10.1 and is incorporated herein by reference.

Amended and Restated Registration Rights Agreement

Pursuant to the terms of the Business Combination Agreement, at the Closing, Newco,

the Sponsor and certain other holders of the Newco Ordinary Shares will enter into

an Amended and Restated Registration Rights Agreement (the “Registration Rights Agreement”). The Registration Rights Agreement will provide these holders (and their permitted

transferees) with the right to require Newco, at Newco’s expense, to register the Newco Ordinary Shares that they hold, on customary terms,

including customary demand and piggyback registration rights. The Registration Rights

Agreement will also provide that Newco pay certain expenses of the electing holders

relating to such registration and indemnify them against liabilities that may arise

under the Securities Act.

The foregoing description of the Registration Rights Agreement is not complete and

is qualified in its entirety by reference to the form of Registration Rights Agreement,

which is attached as Exhibit A to the Business Combination Agreement which is included as Exhibit 2.1 to this Current Report and is incorporated herein

by reference.

Subscription Agreements

Concurrently with the execution of the Business Combination Agreement, Rigel, Newco, Blyvoor Gold and the Sponsor entered into subscription agreements with certain institutional and accredited investors

(the “PIPE Investors”, and each a “PIPE Investor”, and the subscription agreements, the “Subscription Agreements”) pursuant to which the PIPE Investors have agreed, subject to the terms and conditions

set forth therein, to subscribe for and purchase from Newco at the Closing, an aggregate of 750,000 Newco Ordinary Shares (the “PIPE Shares”), at a purchase price of $10 per share, for an aggregate cash amount of $7,500,000.

Pursuant to the Subscription Agreements, a PIPE Investor may elect to reduce the number of PIPE Shares it is obligated to purchase

under its Subscription Agreement, on a one-for-one basis, up to the total amount of

PIPE Shares subscribed thereunder, to the extent PIPE Investor (i) purchases Rigel Class A Ordinary Shares (the “Open-Market Purchase Shares”) in open market transactions at a price of less than the Closing redemption price per-share prior to the record date established for voting at the Rigel stockholder meeting held to approve the Transactions (the “Rigel Stockholder Meeting”), but only if the PIPE Investor agrees, with respect to such Open-Market Purchase

Shares, to (A) not sell or transfer any such Open-Market Purchase Shares prior to

the Closing (B) not vote any such Open-Market Purchase Shares in favor of approving

the Transactions and instead submits a proxy abstaining from voting thereon and (C)

to the extent such investor has the right to have all or some of its Open-Market Purchase

Shares redeemed for cash in connection with the Closing, not exercise any such redemption

rights; and (ii) beneficially owned any Rigel Class A Ordinary Shares as of the date of its Subscription Agreement (the “Currently Owned Shares” and together with the Open-Market Purchase Shares and the PIPE Shares, the “Total PIPE Shares”), but only if the PIPE Investor agrees, with respect to such Currently Owned Shares,

to (A) not to sell or transfer and such Currently Owned Shares prior to the Closing,

(B) vote all of its Currently Owned Shares in favor of approving the Transactions

at the Rigel Stockholder Meeting, and (C) to the extent such investor has the right to have all or some

of its Currently Owned Shares redeemed for cash in connection with the Closing, not

exercise any such redemption rights.

In addition, in connection with the Closing and pursuant to the Subscription Agreements:

| (i) | the Sponsor shall surrender an aggregate number of Rigel Class

B Ordinary Shares it holds in an amount equal to (a) (I) 4, multiplied by (II) the aggregate number of Total PIPE Shares, divided

by (b) 10 (the “Sponsor Forfeit Shares”); and |

| (ii) | Blyvoor Gold shall surrender an aggregate number of Newco Ordinary

Shares it receives as Exchange Consideration in an amount equal to (a) (I) 1, multiplied by (II) the aggregate number of Total

PIPE Shares, divided by (b) 10 (the “Blyvoor Forfeit Shares”); and |

| (iii) | each PIPE Investors shall receive following the Closing, a number

of Newco Ordinary Shares equal to the sum of the Sponsor Forfeit Shares and the Blyvoor Forfeit Shares for no additional cash consideration. |

The foregoing description of the Subscription Agreements does not purport to be complete and is qualified in its entirety by the terms and

conditions of the form of the Subscription Agreement, a copy of which is filed as

Exhibit 10.2 hereto and are incorporated by reference herein.

| Item 3.02. |

Unregistered Sales of Equity Securities. |

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K is

incorporated by reference herein. The Newco Ordinary Shares issuable in connection with the Subscription Agreements will not

be registered under the Securities Act, in reliance on the exemption from registration

provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

| Item 7.01. |

Regulation FD Disclosure. |

On March 11, 2024, Rigel and the Target Companies issued a joint press release (the “Press Release”) announcing the Transactions. The Press Release is attached hereto as Exhibit 99.1

and incorporated by reference herein.

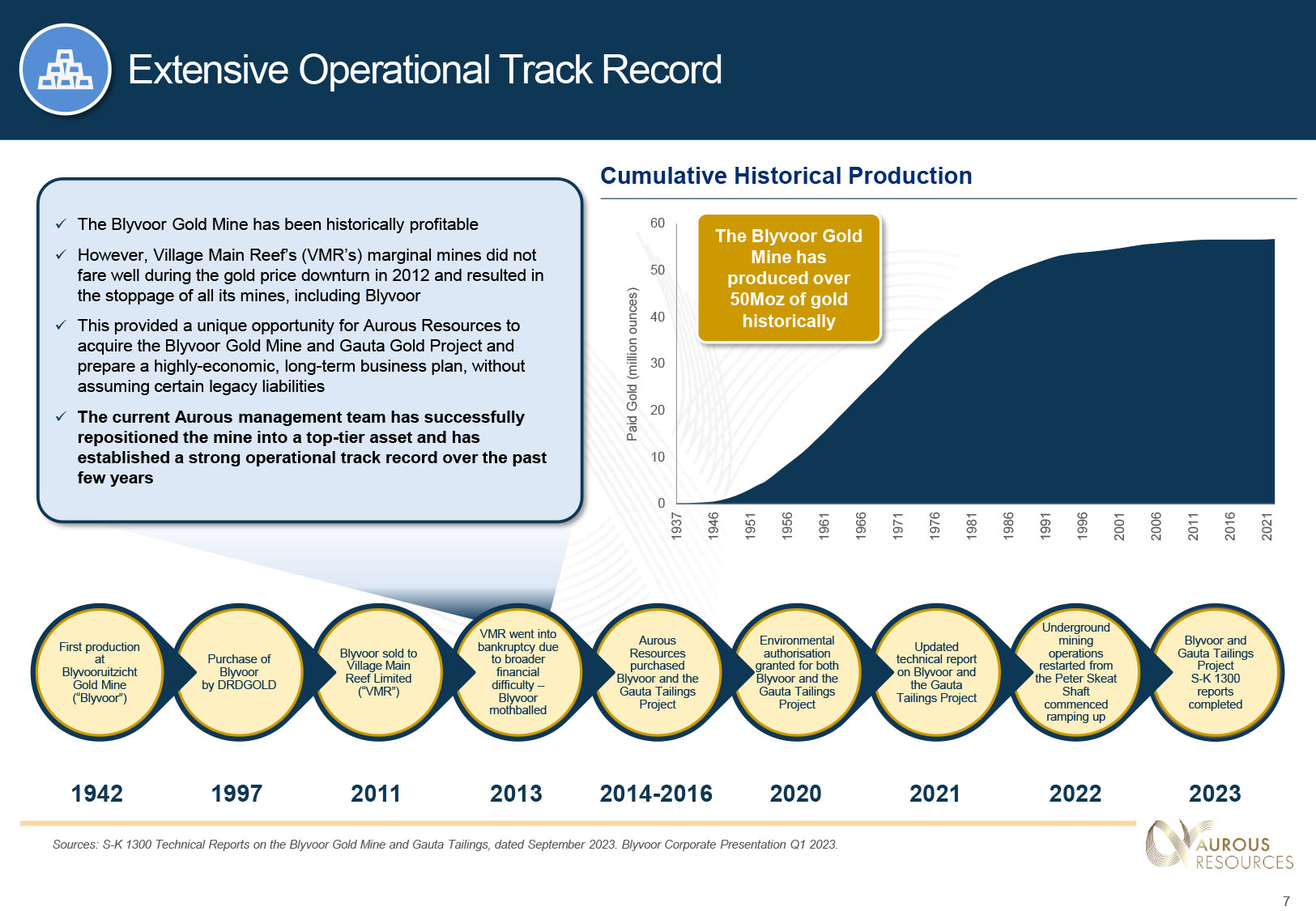

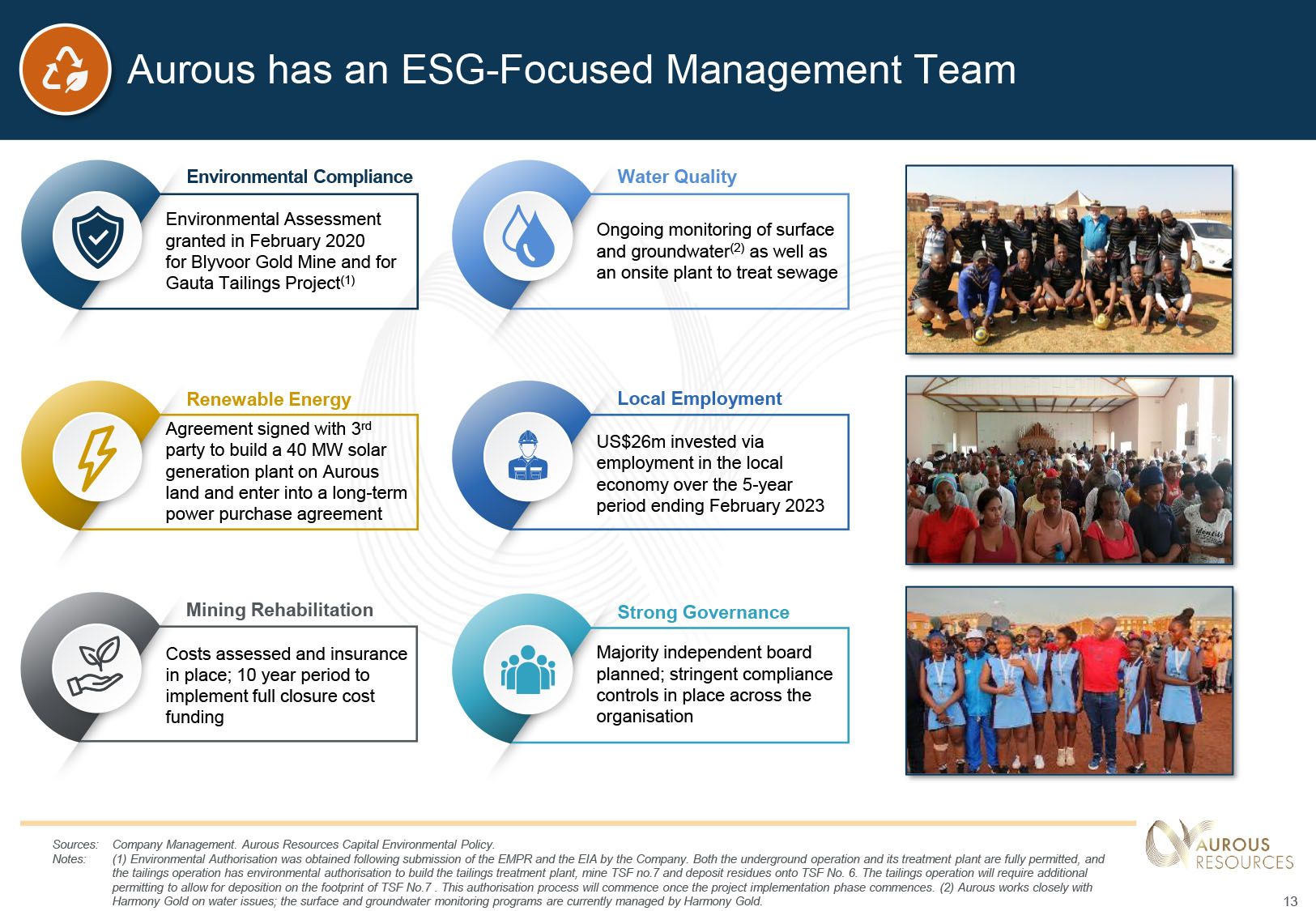

In addition, furnished as Exhibit 99.2 hereto is the investor presentation dated December 2023, that will be used by Rigel and the Target Companies with respect to the Transactions.

The information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2 hereto,

is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to liabilities under that section, and shall not be deemed

to be incorporated by reference into the filings of Rigel under the Securities Act

or the Exchange Act, regardless of any general incorporation language in such filings.

This Current Report will not be deemed an admission as to the materiality of any information

of the information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2.

*******

No Offer or Solicitation

This Current Report shall not constitute an offer to sell or the solicitation of an offer to buy any securities,

or a solicitation of any vote or approval, nor shall there be any sale of any such

securities in any state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws

of any such state or jurisdiction. This Current Report does not constitute either advice or a recommendation regarding

any securities. No offering of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act of 1933, as amended, or an exemption

therefrom.

Forward Looking Statements

This Current Report contains forward-looking statements within the meaning of the “safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally relate to future

events or Rigel’s or the Target Companies’ future financial or operating performance. In some cases, you can identify forward-looking

statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,”

“anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of

these terms or variations of them or similar terminology. Such forward-looking statements

are subject to risks, uncertainties, and other factors, which could cause actual results

to differ materially from those expressed or implied by such forward looking statements.

These statements are based on various assumptions and on the current expectations

of Rigel or the Target Companies, as applicable, and are not predictions of actual

performance. These forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on by any investor or

other person as, a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Actual events and circumstances are difficult or impossible

to predict and will differ from assumptions.

These forward-looking statements are based upon estimates and assumptions that, while

considered reasonable by Rigel and its management, the Target Companies and their

management, and Newco and its management, as the case may be, are inherently uncertain. Factors that may cause actual results

to differ materially from current expectations include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to

the termination of the proposed business combination; (2) the outcome of any legal proceedings that may be instituted against Rigel, the Target Companies, Newco or others following the announcement of the proposed business combination and any

definitive agreements with respect thereto; (3) the inability to complete the proposed business combination due to the failure to

obtain approval of the shareholders of Rigel, the Target Companies or Newco, to obtain financing to complete the proposed business combination or to satisfy

other conditions to closing; (4) changes to the proposed structure of the proposed business combination that may be

required or appropriate as a result of applicable laws or regulations or as a condition

to obtaining regulatory approval of the proposed business combination; (5) the ability to meet the listing standards of NASDAQ or any other stock exchange following

the consummation of the proposed business combination; (6) the risk that the proposed business combination disrupts current plans and operations

of the Target Companies as a result of the announcement and consummation of the proposed

business combination; (7) the ability to recognize the anticipated benefits of the proposed business combination,

which may be affected by, among other things, competition, the ability of the Target

Companies to grow and manage growth profitably, maintain relationships with customers

and suppliers and retain their management and key employees; (8) costs related to the proposed business combination; (9) changes in applicable laws or regulations; (10) the possibility that the Target Companies may be adversely affected by other economic,

business and/or competitive factors; (11) the Target Companies’ estimates of their financial performance; (12) the possibility that the assumptions and estimates used in the S-K 1300 Technical

Reports may be different than the actual results; and (13) other risks and uncertainties set forth in the sections entitled “Risk Factors” and

“Cautionary Note Regarding Forward-Looking Statements and Risk Factor Summary” in

Rigel’s Prospectus dated November 4, 2021 filed with the Securities and Exchange Commission on November 8, 2021, the section entitled “Risk Factors” in Rigel’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, for the fiscal year ended December 31, 2022, and in Rigel’s Quarterly Report on Form 10-Q for the quarterly period ended November 30, 2023 as well as any further risks and uncertainties to be contained in the Registration

Statement filed after the date hereof. In addition, forward-looking statements reflect

the Target Companies’, Rigel’s or Newco’s expectations, plans or forecasts of future events and views as of the date of this

Current Report. The Target Companies, Newco, and Rigel anticipate that subsequent events and developments will cause these assessments

to change. However, while the Target Companies and/or Rigel and/or Newco may elect to update these forward-looking statements at some point in the future,

each of the Target Companies, Newco, and Rigel specifically disclaim any obligation to do so. These forward-looking statements

should not be relied upon as representing the Target Companies’, Newco’s, nor Rigel’s assessments as of any date subsequent to the date of this Current Report.

Important Information for Investors and Stockholders

The Transactions will be submitted to stockholders of Rigel for their consideration and approval at a special meeting of stockholders. Rigel and the Target Companies will prepare the Registration Statement to be filed

with the SEC by Newco, which will include preliminary and definitive proxy statements

to be distributed to Rigel’s stockholders in connection with Rigel’s solicitation for proxies for the vote by Rigel’s stockholders in connection with the Transactions and other matters as described in the Registration Statement, as well as the prospectus

relating to the offer of the securities to be issued to Rigel’s stockholders in connection with the completion of the Transactions. After the Registration Statement has been filed and declared effective, Rigel will

mail a definitive proxy statement and other relevant documents to its stockholders as of the record date established for voting on the Transactions. Rigel’s stockholders and other interested persons are advised to read, once available, the preliminary

proxy statement/prospectus and any amendments thereto and, once available, the definitive

proxy statement/prospectus, in connection with Rigel’s solicitation of proxies for its special meeting of stockholders to be held to approve, among other things, the Transactions, because these documents will contain important information about Rigel, the Target

Companies, Newco and the Transactions. Stockholders may also obtain a copy of the preliminary or definitive proxy statement, once available,

as well as other documents filed with the SEC regarding the Transactions and other documents filed with the SEC by Rigel, without charge, at the SEC’s website located at www.sec.gov.

Participants in the Solicitation

Rigel, Newco, and the Target Companies and their respective directors, executive officers, other

members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of Rigel’s stockholders in connection with the Transactions. Information regarding the persons who may, under SEC rules, be deemed participants

in the solicitation of Rigel’s stockholders in connection with the Transactions will be set forth in the Registration Statement, including a proxy statement/prospectus, when it is filed with the SEC. Investors

and security holders may obtain more detailed information regarding the names and

interests in the Transactions of Rigel’s directors and officers in Rigel’s filings with the SEC and such information will also be in the registration statement

to be filed with the SEC by Rigel, which will include the proxy statement/prospectus of Rigel for the Transactions.

This Current Report is not a substitute for the Registration Statement or for any

other document that Rigel, the Target Companies, or Newco may file with the SEC in

connection with the potential Transactions. INVESTORS AND SECURITY HOLDERS ARE URGED

TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security

holders may obtain free copies of other documents filed with the SEC by Rigel, the

Target Companies, and Newco through the website maintained by the SEC at http://www.sec.gov.

| Item 9.01. |

Financial Statement and Exhibits. |

EXHIBIT INDEX

| Exhibit No. |

|

Description of Exhibits |

| 2.1* |

|

Business Combination Agreement, dated March 11, 2024, by and among Blyvoor Gold Resources Proprietary Limited, Blyvoor Gold Operations Proprietary Limited,

Rigel Resource Acquisition Corp, RRAC NewCo, and RRAC Merger Sub |

| 2.2 |

|

Exchange Agreement, dated March 11, 2024, by and among RRAC NewCo, Blyvoor Gold Proprietary Limited, Orion Mine Finance Fund II L.P., Blyvoor Gold Operations Proprietary Limited and Blyvoor Gold Resources Proprietary Limited |

| 10.1* |

|

Sponsor Support Agreement, dated March 11, 2024, by and among Rigel Resource Acquisition Holding LLC, Rigel Resource Acquisition Corp, Blyvoor Gold Resources Proprietary Limited, Blyvoor Gold Operations Proprietary Limited and the persons set forth on Schedule I thereto |

| 10.2 |

|

Form of Subscription Agreement |

| 99.1 |

|

Joint Press Release of Rigel

Resources Acquisition Corp., Blyvoor Gold Resources Proprietary Limited, and Blyvoor Gold Operations Proprietary Limited issued

March 11, 2024 |

| 99.2 |

|

Investor Presentation dated March, 2024 |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| * |

Schedules omitted pursuant to Item 601(b)(2) of Regulation S-K. Rigel Resources Acquisition Corp. agrees to furnish supplementally a copy of any omitted schedule to the Securities

and Exchange Commission upon request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the

registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

RIGEL RESOURCE ACQUISITION CORP |

| |

|

|

| Date: March 11, 2024 |

By: |

/s/ Jonathan Lamb |

| |

Name: |

Jonathan Lamb |

| |

Title: |

Chief Executive Officer |

Exhibit 2.1

PRIVILEGED & CONFIDENTIAL

EXECUTION VERSION

BUSINESS COMBINATION AGREEMENT

by and among

Blyvoor Gold Resources Proprietary Limited,

Blyvoor Gold Operations Proprietary Limited

Rigel Resource Acquisition Corp,

RRAC NEWCO,

AND

RRAC MERGER SUB

dated as of

March 11, 2024

This document is intended solely to facilitate discussions among the parties identified

herein. It is not intended to create, and it will not be deemed to create, a legally

binding or enforceable offer or agreement of any type or nature prior to the actual

execution of this document by all such parties and the delivery of an executed copy

of this document by all such parties to all other parties.

TABLE OF CONTENTS

| Article I CERTAIN DEFINITIONS |

|

3 |

| |

|

|

| |

Section 1.01 |

|

Definitions |

|

3 |

| |

Section 1.02 |

|

Construction |

|

19 |

| |

Section 1.03 |

|

Equitable Adjustments |

|

20 |

| |

|

|

| Article II THE MERGER |

|

21 |

| |

|

|

| |

Section 2.01 |

|

The Merger |

|

21 |

| |

Section 2.02 |

|

Effective Time |

|

21 |

| |

Section 2.03 |

|

Effect of the Merger |

|

21 |

| |

Section 2.04 |

|

Governing Documents of the Surviving Company |

|

21 |

| |

Section 2.05 |

|

Directors and Officers |

|

21 |

| |

Section 2.06 |

|

Taking Necessary Action; Further Action |

|

22 |

| |

Section 2.07 |

|

Release of Funds from Trust Account |

|

22 |

| |

|

|

| Article III EFFECT OF

THE MERGER ON SHARE CAPITAL AND CAPITAL STOCK |

|

22 |

| |

|

|

| |

Section 3.01 |

|

Effect of Merger on Rigel Securities |

|

22 |

| |

Section 3.02 |

|

Treatment of Securities of Merger Sub |

|

23 |

| |

Section 3.03 |

|

Exchange of Book-Entry Shares |

|

23 |

| |

Section 3.04 |

|

Satisfaction of Rights |

|

25 |

| |

Section 3.05 |

|

Payment of Settlement Obligations |

|

25 |

| |

|

|

| Article IV SHARE EXCHANGE

TRANSACTIONS |

|

25 |

| |

|

|

| |

Section 4.01 |

|

Share Exchange |

|

25 |

| |

Section 4.02 |

|

Exchange Consideration |

|

25 |

| |

Section 4.03 |

|

Governing Documents |

|

28 |

| |

Section 4.04 |

|

Closing Payments |

|

28 |

| |

Section 4.05 |

|

Withholding Rights |

|

29 |

| |

|

|

| Article V CLOSING TRANSACTIONS |

|

29 |

| |

|

|

| |

Section 5.01 |

|

Closing |

|

29 |

| |

Section 5.02 |

|

Pre-Closing Deliverables |

|

29 |

| |

Section 5.03 |

|

Closing Deliverables |

|

30 |

| |

|

|

| Article VI REPRESENTATIONS

AND WARRANTIES OF THE TARGET COMPANIES |

|

32 |

| |

|

|

| |

Section 6.01 |

|

Corporate Organization of the Target Companies |

|

32 |

| |

Section 6.02 |

|

Target Company Subsidiaries |

|

32 |

| |

Section 6.03 |

|

Due Authorization |

|

32 |

| |

Section 6.04 |

|

No Conflict |

|

33 |

| |

Section 6.05 |

|

Governmental Authorities; Consents |

|

33 |

| |

Section 6.06 |

|

Current Capitalization |

|

33 |

| |

Section 6.07 |

|

Capitalization of Subsidiaries of the Target Companies |

|

34 |

| |

Section 6.08 |

|

Financial Statements |

|

35 |

| |

Section 6.09 |

|

Undisclosed Liabilities |

|

35 |

| |

Section 6.10 |

|

Litigation and Proceedings |

|

36 |

| |

Section 6.11 |

|

Compliance with Laws |

|

36 |

| |

Section 6.12 |

|

Contracts; No Defaults |

|

36 |

| |

Section 6.13 |

|

Company Benefit Plans |

|

38 |

| |

Section 6.14 |

|

Labor and Employment Matters |

|

39 |

| |

Section 6.15 |

|

Taxes |

|

40 |

| |

Section 6.16 |

|

Insurance |

|

42 |

| |

Section 6.17 |

|

Permits |

|

42 |

| |

Section 6.18 |

|

Real Property and Mineral Rights |

|

42 |

| |

Section 6.19 |

|

Intellectual Property and IT Security |

|

43 |

| |

Section 6.20 |

|

Environmental Matters |

|

44 |

| |

Section 6.21 |

|

Absence of Changes |

|

45 |

| |

Section 6.22 |

|

Brokers’ Fees |

|

45 |

| |

Section 6.23 |

|

Business Relationships |

|

45 |

| |

Section 6.24 |

|

Related Party Transactions |

|

46 |

| |

Section 6.25 |

|

Mining |

|

46 |

| |

Section 6.26 |

|

Information Supplied |

|

47 |

| |

Section 6.27 |

|

Regulatory Compliance |

|

47 |

| |

Section 6.28 |

|

No Additional Representations or Warranties |

|

48 |

| |

|

|

| Article VII REPRESENTATIONS

AND WARRANTIES OF RIGEL, NEWCO AND MERGER SUB |

|

48 |

| |

|

|

| |

Section 7.01 |

|

Corporate Organization |

|

48 |

| |

Section 7.02 |

|

Due Authorization |

|

49 |

| |

Section 7.03 |

|

No Conflict |

|

50 |

| |

Section 7.04 |

|

Litigation and Proceedings |

|

50 |

| |

Section 7.05 |

|

Governmental Authorities; Consents |

|

50 |

| |

Section 7.06 |

|

Financial Ability; Trust Account |

|

51 |

| |

Section 7.07 |

|

Brokers’ Fees |

|

51 |

| |

Section 7.08 |

|

SEC Reports; Financial Statements; Sarbanes-Oxley Act; Undisclosed Liabilities |

|

52 |

| |

Section 7.09 |

|

Business Activities |

|

53 |

| |

Section 7.10 |

|

Tax Matters |

|

54 |

| |

Section 7.11 |

|

Capitalization |

|

55 |

| |

Section 7.12 |

|

Listing |

|

57 |

| |

Section 7.13 |

|

PIPE Investment |

|

57 |

| |

Section 7.14 |

|

Related Party Transactions |

|

58 |

| |

Section 7.15 |

|

Investment Company Act |

|

58 |

| |

Section 7.16 |

|

Interest in Competitors |

|

58 |

| |

Section 7.17 |

|

Rigel Stockholders |

|

58 |

| |

Section 7.18 |

|

Registration Statement; Proxy Statement |

|

59 |

| |

|

|

| Article VIII COVENANTS

OF THE TARGET COMPANIES |

|

59 |

| |

|

|

| |

Section 8.01 |

|

Conduct of Business |

|

59 |

| |

Section 8.02 |

|

Inspection |

|

62 |

| |

Section 8.03 |

|

Regulatory Approvals |

|

63 |

| |

Section 8.04 |

|

No Claim Against the Trust Account |

|

63 |

| Article IX COVENANTS

OF RIGEL, NEWCO AND MERGER SUB |

|

63 |

| |

|

|

| |

Section 9.01 |

|

Regulatory Approvals |

|

63 |

| |

Section 9.02 |

|

Indemnification and Insurance |

|

64 |

| |

Section 9.03 |

|

Conduct of Rigel During the Interim Period |

|

66 |

| |

Section 9.04 |

|

PIPE and the Orion Forward Purchase Agreement |

|

67 |

| |

Section 9.05 |

|

Inspection |

|

68 |

| |

Section 9.06 |

|

Rigel Listing |

|

68 |

| |

Section 9.07 |

|

Rigel Public Filings |

|

68 |

| |

Section 9.08 |

|

Section 16 Matters |

|

68 |

| |

Section 9.09 |

|

Newco Board of Directors, Committees and Officers |

|

68 |

| |

Section 9.10 |

|

Incentive Equity Plan |

|

69 |

| |

Section 9.11 |

|

Qualification as an Emerging Growth Company |

|

69 |

| |

Section 9.12 |

|

Stockholder Litigation |

|

69 |

| |

|

|

| Article X JOINT COVENANTS |

|

69 |

| |

|

|

| |

Section 10.01 |

|

Support of Transaction; Further Assurances |

|

69 |

| |

Section 10.02 |

|

Registration Statement; Rigel Extraordinary General Meeting |

|

70 |

| |

Section 10.03 |

|

Exclusivity |

|

73 |

| |

Section 10.04 |

|

Tax Matters |

|

74 |

| |

Section 10.05 |

|

Confidentiality; Publicity |

|

75 |

| |

Section 10.06 |

|

Post-Closing Cooperation; Further Assurances |

|

76 |

| |

Section 10.07 |

|

Employee Matters |

|

76 |

| |

Section 10.08 |

|

PIPE Financing |

|

77 |

| |

Section 10.09 |

|

Nasdaq Listing |

|

77 |

| |

Section 10.10 |

|

Additional Financial Information |

|

78 |

| |

|

|

| Article XI CONDITIONS

TO OBLIGATIONS |

|

78 |

| |

|

|

| |

Section 11.01 |

|

Conditions to Obligations of All Parties |

|

78 |

| |

Section 11.02 |

|

Additional Conditions to Obligations of Rigel, Newco and Merger Sub |

|

78 |

| |

Section 11.03 |

|

Additional Conditions to Obligations of the Target Companies |

|

79 |

| |

Section 11.04 |

|

Conditions to Obligations of Target Companies With Respect to the Tailings Acquisition and the Blyvoor Resources Acquisition |

|

80 |

| |

Section 11.05 |

|

Frustration of Conditions |

|

81 |

| |

|

|

| Article XII TERMINATION/EFFECTIVENESS |

|

81 |

| |

|

|

| |

Section 12.01 |

|

Termination |

|

81 |

| |

Section 12.02 |

|

Effect of Termination |

|

82 |

| |

|

|

| Article XIII MISCELLANEOUS |

|

82 |

| |

|

|

| |

Section 13.01 |

|

Waiver |

|

82 |

| |

Section 13.02 |

|

Notices |

|

82 |

| |

Section 13.03 |

|

Assignment |

|

84 |

| |

Section 13.04 |

|

Rights of Third Parties |

|

84 |

| |

Section 13.05 |

|

Expenses |

|

84 |

| |

Section 13.06 |

|

Governing Law |

|

84 |

| |

Section 13.07 |

|

Captions; Counterparts |

|

84 |

| |

Section 13.08 |

|

Schedules and Exhibits |

|

84 |

| |

Section 13.09 |

|

Entire Agreement |

|

85 |

| |

Section 13.10 |

|

Amendments |

|

85 |

| |

Section 13.11 |

|

Severability |

|

85 |

| |

Section 13.12 |

|

Jurisdiction; WAIVER OF TRIAL BY JURY |

|

85 |

| |

Section 13.13 |

|

Enforcement |

|

85 |

| |

Section 13.14 |

|

Non-Recourse |

|

86 |

| |

Section 13.15 |

|

Nonsurvival of Representations, Warranties and Covenants |

|

86 |

| |

Section 13.16 |

|

Acknowledgements |

|

86 |

| |

Section 13.17 |

|

Provisions Respecting Representation of the Target Companies |

|

87 |

| |

Section 13.18 |

|

Obligations of Rigel, Newco and Merger Sub |

|

88 |

| EXHIBITS |

|

|

|

|

| |

|

|

|

|

|

| |

Exhibit A |

– |

Form of Registration Rights Agreement |

|

A-1 |

| |

Exhibit B |

– |

Sponsor Support Agreement |

|

B-1 |

| |

Exhibit C |

– |

Form of Restrictive Legend |

|

C-1 |

BUSINESS COMBINATION AGREEMENT

THIS BUSINESS COMBINATION AGREEMENT (this “Agreement”) is made and entered into as of March 11, 2024, by and among Blyvoor Gold Resources Proprietary Limited, a South African private limited liability company (“Blyvoor Resources”), Blyvoor Gold Operations Proprietary Limited, a South African private limited liability company (“Tailings”), Rigel Resource Acquisition Corp, a Cayman Islands exempted company (“Rigel”), RRAC NewCo, a Cayman Islands exempted company (“Newco”), and RRAC Merger Sub, a Cayman Islands exempted company (“Merger Sub”). Blyvoor Resources, Tailings, Rigel, Newco and Merger Sub are collectively referred to herein as the “Parties” and individually as a “Party.” Capitalized terms used and not otherwise defined herein have the meanings set forth

in Section 1.01.

RECITALS

WHEREAS, Rigel is a blank check company incorporated as a Cayman Islands exempted

company and formed for the purpose of effecting a merger, share exchange, asset acquisition,

share purchase, reorganization or similar business combination with one or more businesses

through a Business Combination;

WHEREAS, each of Newco and Merger Sub is a newly formed, wholly owned, direct or indirect, Subsidiary of Rigel that was formed for purposes of consummating

the Transactions;

WHEREAS, at the Merger Effective Time, Newco will be treated as a corporation and Merger Sub will be treated as an entity

disregarded as separate from Newco, in each case, for U.S. federal income tax purposes;

WHEREAS, upon the terms and subject to the conditions set forth herein and in accordance with the Cayman Act, at least one (1) day prior to the Closing Date, Rigel will merge with and into Merger Sub (the “Merger”), as a result of which (a) the separate corporate existence of Rigel will cease and Merger Sub will continue

as the surviving company and a wholly owned, direct Subsidiary of Newco, and (b) each security of Rigel issued and outstanding immediately prior to the Merger Effective

Time shall no longer be outstanding and shall automatically be cancelled in exchange

for the right of the holder thereof to receive a substantially equivalent security

of Newco in accordance with the terms of this Agreement;

WHEREAS, in connection with the Merger, the Parties desire for Newco to (a) register the issuance of Newco Ordinary Shares to Legacy Rigel Holders with the

SEC and (b) cause the Newco Ordinary Shares to become listed on NASDAQ or another mutually agreeable national stock exchange;

WHEREAS, (a) Sellers collectively own, directly or indirectly, all of the issued and

outstanding ordinary no par value shares of Blyvoor Resources (the “Blyvoor Resources Shares”) as follows: (i) Blyvoor Gold owns 590 issued and outstanding Blyvoor Resources Shares (the “Gold Resources Shares”); and (ii) Orion owns 147 issued and outstanding Blyvoor Resources Shares (the “Orion Resources Shares”), which collectively represent all of the issued and outstanding Blyvoor Resources

Shares as of the date hereof; and (b) Blyvoor Gold owns all of the ordinary no par

value shares of Tailings (the “Tailings Shares”) issued and outstanding as of the date hereof (the “Gold Tailings Shares”);

WHEREAS, upon the terms

and subject to the conditions set forth herein and in the Share Exchange Agreement (a) Blyvoor Gold desires to transfer to Newco, and

Newco desires to receive from Blyvoor Gold, all of the Gold Resources Shares and the Gold Tailings Shares, in exchange for the Gold Resources

Share Consideration and the Gold Tailings Share Consideration, respectively; and (b) Orion desires to transfer to Newco, and Newco desires

to receive from Orion, all of the Orion Resources Shares, in exchange for the Orion Share Consideration;

WHEREAS, as a condition and inducement to Rigel’s willingness to enter into this Agreement, simultaneously with the execution and

delivery of this Agreement, Sellers have delivered to Rigel the Company Stockholder Approvals;

WHEREAS, the board of directors of Blyvoor Resources has (a) determined that it is

in the best interests of Blyvoor Resources and the stockholders of Blyvoor Resources,

and declared it advisable, to enter into this Agreement providing for the Transactions,

(b) approved this Agreement and the Transactions, on the terms and subject to the

conditions of this Agreement, and (c) adopted a resolution recommending that this

Agreement and the Transactions be adopted by the stockholders of Blyvoor Resources;

WHEREAS, the board of directors of Tailings has (a) determined that it is in the best

interests of Tailings and the stockholders of Tailings, and declared it advisable,

to enter into this Agreement providing for the Transactions, (b) approved this Agreement

and the Transactions, on the terms and subject to the conditions of this Agreement,

and (c) adopted a resolution recommending that this Agreement and the Transactions

be adopted by the stockholders of Tailings;

WHEREAS, the board of directors of Rigel has (a) determined that it is in the best interests of Rigel and the Rigel Stockholders, and declared it advisable, to enter into this Agreement providing for the Transactions,

(b) approved this Agreement and the Transactions, on the terms and subject to the conditions of this Agreement, and (c) passed resolutions recommending that this Agreement and the Transactions, be approved by the Rigel Stockholders (the “Rigel Board Recommendation”);

WHEREAS, the board of directors of Newco has (a) determined that it is in the best

interests of Newco and the stockholder of Newco, and declared it advisable, to enter into this Agreement

providing for the Transactions, (b) approved this Agreement and the Transactions,

on the terms and subject to the conditions of this Agreement, and (c) adopted a resolution

recommending that this Agreement and the Transactions be adopted by the stockholder

of Newco;

WHEREAS, the board of directors of Merger Sub has (a) determined that it is in the

best interests of Merger Sub and the stockholder of Merger Sub, and declared it advisable, to enter into this Agreement

providing for the Transactions, (b) approved this Agreement and the Transactions,

on the terms and subject to the conditions of this Agreement, and (c) adopted a resolution

recommending that this Agreement and the Transactions be adopted by the stockholder

of Merger Sub;

WHEREAS, Newco, as the sole shareholder of Merger Sub, has approved the execution,

delivery and performance of this Agreement and the consummation of the Transactions

and has adopted this Agreement;

WHEREAS, in furtherance of the Transactions and in accordance with the terms hereof,

Rigel shall provide an opportunity to the Rigel Stockholders to have their outstanding Rigel Class A Shares redeemed on the

terms and subject to the conditions set forth in this Agreement and Rigel’s Organizational Documents in connection with obtaining the Rigel Stockholder Approval;

WHEREAS, at the Closing, the Sponsor, Newco, Sellers and certain other parties will enter into a Registration Rights Agreement,

substantially in the form of Exhibit A attached hereto (as amended, restated, modified, supplemented or waived from time

to time, the “Registration Rights Agreement”);

WHEREAS, as a condition and inducement to the other Parties’ willingness to enter into this Agreement, concurrently with the execution and delivery of this Agreement, the Sponsor, the Target Companies, Newco, Rigel, and the other parties thereto have entered into the Sponsor Support Agreement, a copy of which is attached as Exhibit B;

WHEREAS, on or prior to the date hereof, Rigel has obtained commitments from certain investors for a private placement of Newco Ordinary Shares (the “PIPE Investment”) pursuant to the terms of one or more subscription agreements (each, a “Subscription Agreement”), pursuant to which, among other things, such investors have agreed to subscribe

for and purchase, and Newco has agreed to issue and sell to such investors, an aggregate number of Newco Ordinary Shares set forth in the Subscription Agreements in exchange for an aggregate purchase price

of at least $7,500,000.00 on the Closing Date, on the terms and subject to the conditions set forth therein; and

WHEREAS, for U.S. federal income tax purposes, it is intended that (a) (i) the Merger qualify as a “reorganization” within the meaning of Section 368(a)(1)(F) of the Code, (ii) this Agreement constitutes, and is adopted as, a “plan

of reorganization” for purposes of Sections 354 and 361 of the Code and (iii) Rigel, Newco and Merger Sub will be parties to such

“reorganization” with the meaning of Section 368(b) of the Code and (b) (i) the Blyvoor Resources Acquisition qualifies as a “reorganization” within the meaning of Section 368(a)(1)(B) of the Code, (ii) this Agreement constitutes, and is adopted as, a “plan

of reorganization” for purposes of Sections 354 and 361 of the Code, (iii) Newco and Blyvoor Resources will be parties to such “reorganization” within the meaning of Section 368(b) of the Code (collectively, the “Intended Tax Treatment”) and (iv) the Cash Consideration will be treated as a distribution under Section 301 of the Code.

NOW, THEREFORE, in consideration of the foregoing and the respective representations,

warranties, covenants and agreements set forth in this Agreement, and intending to be legally bound, the Parties hereby agree as follows:

Article I

CERTAIN DEFINITIONS

Section 1.01 Definitions. For purposes of this Agreement, the following capitalized terms have the following

meanings:

“Acquisition Transaction” has the meaning specified in Section 10.03(a).

“Action” means any claim, enforcement, action, suit, assessment, inquiry, audit, investigation, arbitration, mediation, or other legal, regulatory, governmental, judicial or administrative proceeding (whether at law or in equity) or other alternative dispute resolution process.

“Additional PIPE Investors” has the meaning specified in Section 10.08.

“Adjustment Factor” means a number equal to one (1); provided, that (a) if the Net Cash Proceeds are greater than $20,000,000, the Adjustment Factor

shall be increased by 0.04 on a sliding scale basis for every rounded $1,000,000 by

which the Net Cash Proceeds exceed $20,000,000 and (b) if the Net Cash Proceeds are

less than $20,000,000, the Adjustment Factor shall be decreased by 0.04 on a sliding

scale basis for every rounded $1,000,000 by which the Net Cash Proceeds are less than

$20,000,000.

“Adjustment Multiplier” means the percentage equal to the product of (a) the sum of (i) one (1) minus (ii) the quotient of (x) Net Cash Proceeds divided by (y) $33,000,000 multiplied by (b) the Adjustment Factor.

“Affiliate” means, with respect to any specified Person, any Person that, directly or indirectly, controls, is controlled by, or is under common control

with, such specified Person, through one or more intermediaries or otherwise. The term “control” means the ownership of a majority of the voting securities of the applicable Person

or the possession, direct or indirect, of the power to direct or cause the direction

of the management and policies of the applicable Person, whether through ownership

of voting securities, by Contract or otherwise, and the terms “controlled” and “controlling” have meanings correlative thereto; provided, that for the avoidance of doubt, Orion shall not be considered an Affiliate of Blyvoor Gold or, prior to the Closing, any Target Group Company. For the avoidance of doubt, Sponsor shall be deemed to be an Affiliate of Rigel prior to the Closing.

“Aggregate Cash Proceeds” means an amount equal to (a) all amounts in the Trust Account (after reduction for

the aggregate amount of payments required to be made in connection with the Rigel

Stockholder Redemption), plus (b) the aggregate amount of cash that has been funded to Rigel pursuant to the Subscription

Agreements with respect to the PIPE Investment and the PIPE Financing, in each case, as of immediately prior to the Closing, plus (c) the aggregate amount of cash that has been funded to Newco pursuant to the Orion Forward Purchase Agreement, minus (d) the aggregate Cash Consideration.

“Agreement” has the meaning specified in the preamble hereto.

“Anti-Corruption Laws” means, collectively: (a) the U.S. Foreign Corrupt Practices Act, as amended (FCPA); (b) the UK Bribery Act 2010; (c) the Prevention and Combating of Corrupt Activities Act, No. 12 of 2004 of South

Africa; (d) the Prevention of Organised Crime Act, No. 121 of 1998 of South Africa

and (e) any other applicable anti-bribery or anti-corruption Laws related to combating bribery, corruption and

money laundering.

“Antitrust Fees” has the meaning specified in the definition of “Rigel Transaction Expenses”.

“Arrangement Costs” has the meaning specified in the definition of “Rigel Transaction Expenses.”

“Blyvoor Capital” means Blyvoor Gold Capital Proprietary Limited, a South African private limited

liability company.

“Blyvoor Gold” means Blyvoor Gold Proprietary Limited, a South African private limited liability company.

“Blyvoor Gold Stockholder Approval” means the adoption of a special resolution of the shareholders of Blyvoor Gold approving

this Agreement and the Transactions.

“Blyvoor Empowerment Partners” means Blyvoor Empowerment Partners (RF) Proprietary Limited, a South Africa private limited liability company.

“Blyvoor Resources” has the meaning specified in the preamble hereto.

“Blyvoor Resources Acquisition” has the meaning specified in Section 4.01(a).

“Blyvoor Resources Shares” has the meaning specified in the Recitals hereto.

“Business Combination” has the meaning ascribed to such term in the Memorandum and Articles of Association.

“Business Combination Proposal” has the meaning specified in Section 10.03(b).

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks

in New York, New York or Johannesburg, South Africa are authorized or required by Law to close.

“Cash Consideration” has the meaning specified in Section 3.01(a)(i).

“Cayman Act” means the Companies Act (as revised) of the Cayman Islands.

“Change in Recommendation” has the meaning specified in Section 10.02(b).

“Class A Merger Consideration” has the meaning specified in Section 3.01(a)(i).

“Closing” has the meaning specified in Section 5.01.

“Closing Date” has the meaning specified in Section 5.01.

“Code” means the Internal Revenue Code of 1986, as amended.

“Companies Act” means the Companies Act, No. 71 of 2008 of the Republic of South Africa, together

with the Companies Regulations 2011, promulgated thereunder.

“Company Benefit Plan” has the meaning specified in Section 6.13(a).

“Company Closing Statement” has the meaning specified in Section 5.02(b).

“Company Cure Period” has the meaning specified in Section 12.01(b).

“Company Data” means all confidential data, information, and data compilations contained in the IT

Systems or any databases of the Target Companies, including Personal Information,

that are used or held for use in the conduct of the business of, the Target Companies.

“Company Software” means all Software owned or purported to be owned by any of the Target Group Companies.

“Company Stockholder Approvals” means the Resources Stockholder Approval and the Tailings Stockholder Approval and, to the extent required in terms of section 112 and 115 of the Companies Act, the Blyvoor Gold Stockholder Approval.

“Confidentiality Agreement” has the meaning specified in Section 13.09.

“Continuing Employee” has the meaning specified in Section 10.07(a).

“Contracts” means any legally binding contracts, agreements, subcontracts and leases and all material amendments, written modifications and written supplements thereto.

“Counsel” has the meaning specified in Section 13.17.

“COVID-19” means SARS-CoV-2 or COVID-19, and any evolutions thereof or any other epidemics, pandemics or disease outbreaks.

“COVID-19 Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down, closure, sequester or any other

Law, Governmental Order, Action, directive, pronouncement, guidelines or recommendations by any Governmental Authority (including the

Centers for Disease Control and Prevention and the World Health Organization) in connection with, related to or in response to COVID-19, including, but not limited to, the Coronavirus Aid, Relief, and Economic Security Act and the Families First Coronavirus Response Act, or any changes thereto.

“Cumulative Issue Price” has the meaning specified in Section 3.01(b).

“Data Room” means the Project BLAZE virtual data room hosted by Firmex Inc.

“D&O Cost” has the meaning specified in the definition of “Rigel Transaction Expenses”.

“D&O Tail” has the meaning specified in Section 9.02(b).

“Data Protection Requirements” means with respect to the protection or Processing of Personal Information: (a) Laws

and binding regulations applicable to the Target Group Companies relating to data

protection, information security, cybercrime, Security Incident notification, social

security number protection, outbound communications and/or electronic marketing, use

of electronic data and privacy matters (including online privacy) in any applicable

jurisdictions; (b) each Contract relating to the Processing of Personal Information

binding on a Target Group Company; and (c) any other rule, code of conduct, or other

requirement of self-regulatory bodies and industry standards binding on the conduct

of a Target Group Company, including, to the extent applicable, the Payment Card Industry

Data Security Standard (“PCI-DSS”).

“Deeds Registry Office” means the deeds registry offices contemplated in section 1 of the Deeds Registries Act, No. 47 of 1937 of South Africa.

“Debt Payoff” has the meaning specified in Section 4.04(b).

“Deferred Share Consideration” means such number of Newco Ordinary Shares that is equal to the product of (A) the quotient of (i) the aggregate amount of PIPE Investment proceeds divided by (ii) 100,000 multiplied by (B) 346.6666667.

“Disclosure Letter” means, as applicable, the Target Company Disclosure Letter or the Rigel Disclosure Letter.

“DTC” has the meaning specified in Section 3.03(b).

“Earnout Period” means, as applicable, the First Earnout Period or the Second Earnout Period.

“Earnout Share Consideration” means, as applicable, the First Earnout Share Consideration and the Second Earnout Share Consideration.

“Enforceability Exceptions” has the meaning specified in Section 6.03.

“Environmental Laws” means any Laws relating to pollution or protection of the environment, natural resources or health and safety, or relating to the use, generation, management, manufacture, processing, treatment,

storage, transportation, remediation, cleanup, handling, disposal or Release of or threatened Release of, or exposure to, Hazardous Materials, including but not limited to the National Water Act, 1998, the National Environmental

Management Act, 1998, the Environment Conservation Act, 1989, the National Environmental

Management: Air Quality Act, 2004, the National Environmental Management: Biodiversity

Act, 2004, and the National Environmental Management: Waste Act, 2008.

“Environmental Permit” means any permit, license, approval, registration, notification, exemption, waiver, consent, directive, entitlement, or other authorization required by or from a Governmental Authority under Environmental

Law.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Exchange Agent” has the meaning specified in Section 3.03(a).

“Exchange Fund” has the meaning specified in Section 3.03(a).

“Export Control Laws” means (a) the U.S. Export Administration Regulations and all import and export control

Laws adopted by Governmental Authorities of other countries relating to the same matter

and (b) the anti-boycott regulations administered by the U.S. Department of Commerce

and the U.S. Department of the Treasury and all anti-boycott Laws adopted by Governmental

Authorities of other countries relating to the same matter.

“Extraordinary General Meeting” has the meaning specified in Section 10.02(b).

“Final Prospectus” has the meaning specified in Section 7.06(a).

“Financial Statements” has the meaning specified in Section 6.08(a).

“First Base Case Milestone” has the meaning specified in Section 4.02(b)(i)(A).

“First Downside Milestone” means the amount of cumulative payable gold production of the Mine, in ounces, equal to

(a) the First Base Case Milestone multiplied by (b) the sum of (i) one (1) minus (ii) the Adjustment Multiplier; provided, that in no event shall the First Downside Milestone be less than 32,650 ounces. An illustrative calculation of the First Downside Milestone is included on Section 1.01(a) of the Target Company Disclosure Letter.

“First Earnout Period” means the 12-month period ending on the date that is the 18-month anniversary of

the last day of the calendar month in which the Closing Date falls.