REGAL-BELOIT Reports 22% Increase in Full Year 2004 Earnings Per

Share BELOIT, Wis., Feb. 10 /PRNewswire-FirstCall/ -- James L.

Packard, Chairman and Chief Executive Officer of REGAL-BELOIT

CORPORATION (NYSE:RBC), today announced fourth quarter and full

year 2004 financial results. Net income in the fourth quarter of

2004 was $7.0 million, a 14.2% increase from $6.1 million reported

in the fourth quarter of 2003. For the full year, net income rose

20.7% to $30.4 million as compared to the $25.2 million reported

for the full year of 2003. Diluted earnings per share were $.28 and

$1.22 for the fourth quarter and full year, respectively, increases

of 16.7% and 22.0% from $.24 and $1.00 per share in the comparable

periods of 2003. The fourth quarter results also included the

impact of the favorable resolution of certain tax matters which

offset, on an after tax basis, the non-cash adjustment of certain

pension plans. The pension plan adjustment reduced income from

operations by $2.1 million, or $1.3 million after-tax. The

resolution of the tax matters resulted in a favorable income tax

adjustment of $1.4 million. Fourth quarter net sales of the Company

increased 45.9% to $221.9 million from $152.1 million in the fourth

quarter of 2003, establishing another quarterly sales record for

the Company. Excluding the impact of the Commercial AC motor

acquisition in August 2004, sales were $181.9 million, an increase

of 19.6%. The record sales performance was driven by strong demand

throughout the Company's various markets. Sales for the quarter

were strong in both operating segments with Mechanical Group sales

increasing 15.0% and Electrical Group sales increasing 21.5%

excluding the impact of the acquisition. For the full year, sales

increased 22.2% to $756.6 million as compared to $619.1 million in

2003. Excluding the impact of the acquisition of the Commercial AC

motor business, sales increased 13.5%. Income from operations

increased 13.8% to $13.0 million from $11.4 million reported for

the fourth quarter of 2003. The gross profit for the quarter was

20.3% of sales as compared to 24.1% in the same period last year.

Material inflation continued to reduce the margin performance of

the Company as previous price increases by the Company did not

offset the added levels of inflation that occurred in the quarter.

Additionally, the Company experienced a significant increase in

health benefit costs during the quarter. For the full year, income

from operations increased 16.8% to $55.2 million from $47.2

million. Gross margins finished the year at 22.1% versus the 23.7%

reported in 2003. The Company's debt increased to $547.6 million at

the end of the year from $275.3 million at the end of the third

quarter. The increase was primarily due to the purchase of General

Electric's HVAC motor business which was completed on December 31,

2004 at a price of approximately $400 million, of which $270

million was paid in cash and the balance in common stock of the

Company. A balance sheet will not be published until a valuation

for the recent acquisition is complete. "While 2004 certainly

presented challenges related to raw material costs, we are

extremely pleased with our overall results and are excited about

the future for REGAL-BELOIT," said Packard, Chairman and CEO. "We

have continued to execute our strategy and are continuing to see

the benefits. The recent acquisitions, including the acquisition of

CMT announced this week, have doubled the size of our Company on an

annualized basis and firmly positioned REGAL-BELOIT as a market

leader in both the electric motor and the mechanical power

transmission businesses." "Earnings for the first quarter are

projected to be in a range of $.37 - $.41 per share," Packard

added. "This guidance is inclusive of the guidance previously

provided for the businesses acquired from GE and reflects the

seasonality of the HVAC business." REGAL-BELOIT will be holding a

telephone conference call pertaining to this news release at 10:00

AM CST (11:00 AM EST) on Thursday, February 10, 2005. Interested

parties should call 866-297-6315, referencing the REGAL-BELOIT

conference call. A replay of the call will be available through

February 18, 2005 at 877-213-9653, access code 10870377.

REGAL-BELOIT CORPORATION is a leading manufacturer of mechanical

and electrical motion control and power generation products serving

markets throughout the world. REGAL-BELOIT is headquartered in

Beloit, Wisconsin, and has manufacturing, sales, and service

facilities throughout United States, and in Canada, Mexico, Europe

and Asia. CAUTIONARY STATEMENT The following is a cautionary

statement made under the Private Securities Litigation Reform Act

of 1995: With the exception of historical facts, the statements

contained in this news release may be forward looking statements.

Actual results may differ from those contemplated. Forward looking

statements involve risks and uncertainties, including but not

limited to, the following risks: 1) cyclical downturns affecting

the markets for capital goods, 2) substantial increases in interest

rates that impact the cost of the Company's outstanding debt, 3)

our success in increasing sales and maintaining or improving the

operating margins of our existing businesses and in integrating

acquisitions, 4) the availability of or material increases in the

costs of select raw materials or parts, 5) actions taken by our

competitors, and 6) our ability to satisfy various covenant

requirements under our credit facility. Investors are directed to

the Company's documents, such as its Annual Report on Form 10-K and

Form 10-Q's filed with the Securities and Exchange Commission.

STATEMENT OF INCOME (Unaudited) In Thousands of Dollars Three

Months Ended Twelve Months Ended December 31, December 31, 2004

2003 2004 2003 Net Sales $221,933 $152,098 $756,557 $619,098 Cost

of Sales 176,845 115,392 589,497 472,343 Gross Profit 45,088 36,706

167,060 146,755 Operating Expenses 32,135 25,324 111,898 99,529

Income From Operations 12,953 11,382 55,162 47,226 Interest Expense

2,229 1,555 6,787 6,462 Interest Income 95 29 182 79 Income Before

Income Taxes and Minority Interest 10,819 9,856 48,557 40,843

Provision For Income Taxes 2,732 3,401 15,728 14,791 Income Before

Minority Interest 8,087 6,455 32,829 26,052 Minority Interest in

Income, Net of Tax 1,069 310 2,395 846 Net Income $7,018 $6,145

$30,434 $25,206 Per Share of Common Stock: Earnings Per Share $.29

$25 $1.24 $1.01 Earnings Per Share- Assuming Dilution $.28 $.24

$1.22 $1.00 Cash Dividends Declared $.12 $.12 $.48 $.48 Average

Number of Shares Outstanding 24,463,251 25,031,656 24,602,868

25,029,942 Average Number of Shares- Assuming Dilution 24,936,956

25,268,363 24,904,287 25,246,088 SEGMENT INFORMATION In Thousands

of Dollars (Unaudited) Mechanical Group Three Months Ended Twelve

Months Ended December 31, December 31, 2004 2003 2004 2003 Net

Sales $51,431 $44,744 $199,590 $180,741 Income From Operations

$4,065 $3,158 $15,720 $13,349 (Unaudited) Electrical Group Three

Months Ended Twelve Months Ended December 31, December 31, 2004

2003 2004 2003 Net Sales $170,502 $107,354 $556,967 $438,357 Income

From Operations $8,888 $8,224 $39,442 $33,877 NOTES TO FINANCIAL

STATEMENTS 1. Certain footnotes and other information normally

included in financial statements prepared in accordance with

accounting principles generally accepted in the United States have

been condensed or omitted from these statements and, therefore,

these statements should be read in conjunction with the Company's

2003 Annual Report and Securities and Exchange Commission filings

DATASOURCE: REGAL-BELOIT CORPORATION CONTACT: Dave Barta, VP, Chief

Financial Officer, +1-608-364-8808, ext. 106, or Ken Kaplan, VP,

Treasurer & Secretary, +1-608-364-8808, ext. 104, both of

REGAL-BELOIT CORPORATION Web site: http://www.regal-beloit.com/

Copyright

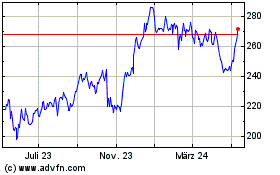

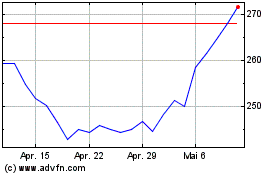

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024