Form 8-K - Current report

07 Oktober 2024 - 12:04PM

Edgar (US Regulatory)

0001443669FALSE00014436692024-10-012024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 1, 2024

Proto Labs, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Minnesota | | 001-35435 | | 41-1939628 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification Number) |

| | | | | | | | |

5540 Pioneer Creek Drive Maple Plain, Minnesota | | 55359 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

| Registrant’s telephone number, including area code: | | (763) 479-3680 |

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, Par Value $0.001 Per Share | PRLB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

As previously disclosed on a Form 8-K filed by Proto Labs, Inc. (the “Company”) on July 24, 2024, on July 22, 2024, Bjoern Klaas, former Vice President and General Manager of the EMEA region, exited his position as vice president and was no longer an executive officer of the Company. On October 1, 2024, Mr. Klaas, the Company and Proto Labs Germany GmbH entered into a Settlement Agreement (the “Settlement Agreement”) that sets forth the mutually agreed upon terms of Mr. Klaas’ separation of service from the Company and Proto Labs Germany GmbH.

Pursuant to the Settlement Agreement, Mr. Klaas’ termination date will be November 30, 2024 (the “Termination Date”). The Settlement Agreement provides that Mr. Klaas will receive the following, pursuant to the terms of the Severance Agreement previously entered into by Mr. Klaas:

•base salary cash severance in the amount of EUR 299,792 (an amount equal to one times Mr. Klaas’ annualized base salary as of the Termination Date), payable following the Termination Date with his salary for his last month of employment;

•a pro rata cash incentive bonus amount under the Company’s short-term incentive plan for the 2024 fiscal year, to be calculated based on performance in accordance with the terms of that plan and prorated based on the time in 2024 that Mr. Klaas was employed, payable no later than March 15, 2025;

•the accelerated vesting of 3,651 stock options and 3,881 restricted stock units (“RSUs”) held by Mr. Klaas,which were calculated pro rata based on time of service and the awards scheduled to vest on the next anniversary of the grant date, with all other stock options and RSUs held by Mr. Klaas to be forfeited; and

•the settlement of shares under the three performance stock unit awards (“PSUs”) held by Mr. Klaas, which will be determined by multiplying the total number of additional PSUs that would otherwise have been determined to have been earned had Mr. Klaas remained employed through the end of the applicable performance period by a fraction, the numerator of which is the number of days he was employed during the performance period and the denominator is the number of days in the performance period, with settlement occurring no later than March 15 following each applicable performance year.

In order to resolve and release the Company from certain post-employment obligations, the Company agreed to waive Mr. Klaas' post-employment non-compete and non-solicitation obligations and pay Mr. Klaas half of his base salary for one year.

The foregoing description of the Settlement Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Settlement Agreement as set forth in Exhibit 10.1 to this Form 8-K and is incorporated herein by reference.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d)Exhibits

| | | | | | | | |

| Exhibit No. | Description | |

| 10.1 | | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | Proto Labs, Inc. | |

| | | | |

| | | | |

| Date: | October 7, 2024 | By: | /s/ Robert Bodor | |

| | | Robert Bodor | |

| | | President and Chief Executive Officer | |

| | | | | |

| Zwischen | Between |

Proto Labs, Inc. 5540 Pioneer Creek Drive Maple Plain, MN 55359 USA

- im Folgenden „die US Gesellschaft“ genannt - | Proto Labs, Inc. 5540 Pioneer Creek Drive Maple Plain, MN 55359 USA

- hereinafter referred to as “US Company” - |

und | and |

Proto Labs Germany GmbH Hermann-Oberth-Straße 21 85640 Putzbrunn Deutschland

- im Folgenden „Proto Labs Germany GmbH“ genannt – | Proto Labs Germany GmbH Hermann-Oberth-Straße 21 85640 Putzbrunn Germany

- hereinafter referred to as “Proto Labs Germany GmbH” - |

und | and |

Herrn Björn Klaas Eckloßberg 24, 22391 Hamburg Deutschland

- im Folgenden “Geschäftsführer“ genannt – | Mr. Björn Klaas Eckloßberg 24, 22391 Hamburg Germany

- hereinafter referred to as “Managing Director” – |

-gemeinsam im Folgenden “die Parteien“ - | -jointly hereinafter referred to as “the parties” – |

wird folgende

ABWICKLUNGSVEREINBARUNG

getroffen: | the following

SETTLEMENT AGREEMENT

is concluded: |

Präambel | Preamble |

Zwischen der zwischen der Proto Labs Germany GmbH und dem Geschäftsführer besteht auf Grundlage des Dienstvertrages vom 28./29.11.2017 ein Dienstverhältnis, welches von der Proto Labs Germany GmbH mit Schreiben vom 16.07.2024 zum 31.10.2024 ordentlich gekündigt wurde. Zwischen der US Gesellschaft und dem Geschäftsführer besteht darüber hinaus ein „Severance Agreement“, welches am 28./29.09.2017 abgeschlossen wurde. Zur ordnungsgemäßen Erfüllung und Abwicklung aller vertraglichen Beziehung zwischen den Parteien wird folgende Vereinbarung getroffen: | On basis of the service agreement dated 28./29.09.2017 a service relationship exists between Proto Labs Germany GmbH and the Managing Director, which was terminated with ordinary notice by letter dated 16.07.2024 with effect as of 31.10.2024. Between the US Company and the Managing Director furthermore exists a "Severance Agreement" which was entered into on 28./29.09.2017. To ensure proper fulfilment and settlement of any contractual relationship between them the parties agree on the following: |

| | | | | |

1.Die Proto Labs Germany GmbH und der Geschäftsführer sind sich darüber einig, dass das zwischen ihnen bestehende Dienstverhältnis erst zum 30.11.2024 („Beendigungsdatum“) endet.

Der Geschäftsführer verpflichtet sich, zum Beendigungsdatum sämtliches Eigentum der Proto Labs Germany GmbH, insbesondere alle in seinem Besitz befindlichen Unterlagen, die er im Zusammenhang mit dem Dienstverhältnis erlangt oder angefertigt hat, an die Proto Labs Germany GmbH an deren Standort in Putzbrunn vollständig herauszugeben. Ein Zurückbehaltungsrecht besteht nicht. Diese Verpflichtung gilt sinngemäß auch für sämtliche Daten oder andere unkörperliche Informationen und erfasst auch etwa angefertigte Kopien oder Mehrstücke. |

1.Proto Labs Germany GmbH and the Managing Director mutually agree that their service relationship will only end on 30.11.2024 (“Termination Date”).

The Manging Director shall promptly return to Proto Labs Germany GmbH at its premises in Putzbrunn all property of the Proto Labs Germany GmbH, especially all documents in his possession which he has received or prepared in the context of the service relationship. A right of retention does not exist. He shall also return all records and documents, including data and other incorporeal information and all copies or duplications thereof. |

2.Der Geschäftsführer wird ab dem 01.10.2024 unter Anrechnung auf offene Urlaubsansprüche sowie etwaige Ansprüche aus Zeitguthaben von der Verpflichtung zur Arbeitsleistung unwiderruflich freigestellt. Es besteht Einigkeit darüber, dass mit der Freistellung sämtliche Urlaubsansprüche bzw. Ansprüche aus Zeitguthaben ordnungsgemäß erfüllt sind. Anderweitiger Verdienst aus der Verwertung der Arbeitskraft während der Freistellungsphase wird auf die fortzuzahlende Vergütung angerechnet. Das vertragliche Wettbewerbsverbot bleibt allerdings aufrechterhalten. Der Geschäftsführer verpflichtet sich, der Proto Labs Germany GmbH unverzüglich über anzurechnende Beträge im Sinne des § 615 S. 2 BGB zu informieren. Dies beinhaltet insbesondere eine Mitteilung darüber, was er durch anderweitige Verwendung seiner Dienste erwirbt. |

2.The Managing Director shall be irrevocably released from his duty to work with effect as of 01.10.2024. Any claims for holidays and compensation for free time - if any - shall be compensated by the release from work and shall thus be settled. Any earnings from the use of work during the release period will be offset against the remuneration. The contractual non-competition clause remains in effect. The Managing Director undertakes to promptly inform Proto Labs Germany GmbH about any amounts to be credited under Art. 615 sentence 2 BGB (German Civil Code). This includes, in particular, providing information about Managing Director’s earnings through the alternative use of his services. |

| | | | | |

3.Das Dienstverhältnis zwischen der Proto Labs Germany GmbH und dem Geschäftsführer wird bis zum Beendigungsdatum auf der Grundlage des bisherigen Bruttomonatsgehaltes in Höhe von € 24.982,67 abgerechnet und die entsprechenden Nettobeträge werden von der Proto Labs Germany GmbH an den Geschäftsführer ausbezahlt.

Weitere Vergütungsansprüche des Geschäftsführers gegenüber der Proto Labs Germany GmbH bestehen nicht. |

3.Until the Termination Date, the service relationship between Proto Labs Germany GmbH and the Managing Director shall be processed with the current monthly gross salary of € 24.982,67 and the respective net amounts shall be paid out to the Managing Director by Proto Labs Germany GmbH.

Further entitlements to remuneration against Proto Labs Germany GmbH, in particular to a bonus for the financial year 2024, shall not exists. |

4.Der Geschäftsführer erhält gemäß Abschnitt 5.A.(i) des „Severance Agreements“ weiter von der US Gesellschaft eine Abfindung („Base Salary Cash Severance“) in Höhe von EUR 299.792,00 brutto. Der Anspruch auf die Abfindung entsteht sofort und ist vererblich und wird mit den Gehalt für den letzten Tätigkeitsmonat abgerechnet und ausbezahlt. |

4.Further the Managing Director shall receive compensation ("Base Salary Cash Severance") from the US Company in the amount of EUR 299,792.00 gross in accordance with Section 5.A.(i) of the “Severance Agreement”. The entitlement to the compensation arises immediately and is inheritable; the compensation shall be due and payable together with the salary for the last month of employment. |

5.Der Geschäftsführer erhält außerdem aus der Teilnahme am Short Term Incentive Plan der Proto Labs, Inc. gemäß Abschnitt 5.A.(ii) des „Severance Agreements“ von der US Gesellschaft einen Bonus („Pro Rata Bonus Payment“). Der Bonus wird gemäß dem Short Term Incentive Plan der US Gesellschaft berechnet und spätestens zum 15.03.2025 abgerechnet und ausbezahlt. |

5.The Managing Director shall also receive a bonus ("Pro Rata Bonus Payment") from the US Company from participation in the Short Term Incentive Plan of Proto Labs, Inc., pursuant to Section 5.A.(ii) of the “Severance Agreement”. The bonus shall be calculated in accordance with the US Company’s Short Term Incentive Plan and due and payable no later than 15.03.2025. |

| | | | | |

6.Die Parteien sind sich darüber einig, dass zum Beendigungsdatum 3.651 Stock Options im Wert und 3.881 Restricted Stock Units vesten (zugeteilt werden) im Sinne des 5.A.(iv) des „Severance Agreements“ („accelerated vesting“). Die Abwicklung richtet sich nach dem zugrundeliegenden Long Term Incentive Plans.

Der Geschäftsführer und die US Gesellschaft sind darüber hinaus auch Parteien von drei Performance-Stock-Unit-Vereinbarungen („PSU-Vereinbarungen“). Der Geschäftsführer erhält von der US Gesellschaft auch eine anteilige Performance-Stock-Unit-Zahlung, deren Höhe gemäß den Bedingungen der PSU-Vereinbarungen berechnet wird. Die Zahlung aus den PSU-Vereinbarungen ist spätestens am 15.03. des jeweiligen Zahlungsjahres fällig und zahlbar.

Im Übrigen sind sich die Parteien darüber einig, dass sämtliche, verfallbare (unvested) und nicht ausübbaren Stock Options, Restricted Stock Units, Performance Stock Units und NQ‘s mit Wirksamwerden dieser Vereinbarung verfallen.

Sämtliche Ansprüche des Geschäftsführers aus der Teilnahme am Long Term Incentive Plan der Proto Labs, Inc. bzw. der PSU-Vereinbarung richten sich ausschließlich gegen die US Gesellschaft gemäß den zwischen dem Geschäftsführer und der US Gesellschaft getroffenen Vereinbarungen. Ansprüche gegen die Proto Labs Germany GmbH besteht nicht. |

6.The Parties agree that as of the Termination Date, 3,651 Stock Options und 3,881 Restricted Stock Units will vest pursuant to Section 5.A.(iv) of the “Severance Agreement” („accelerated vesting“). The settlement will be governed by the underlying Long Term Incentive Plans.

The Managing Director and the US Company are also parties to three Performance Stock Unit Agreements (“PSU Agreements”). The Managing Director shall also receive a pro rata Performance Stock Unit payment from the US Company in the amount calculated in accordance with the terms of the PSU Agreements. The PSU Agreement payment shall be due and payable no later than 15 March each payment year.

Furthermore, the parties agree that all unvested and non-exercisable Stock Options, Performance Stock Units, Restricted Stock Units, and NQs shall be forfeited effective upon the effectiveness of this Agreement.

All claims of the Managing Director arising from participation in the Long Term Incentive Plan of Proto Labs, Inc. or the PSU Agreement are directed exclusively against the US Company in accordance with the agreements made between the Managing Director and the US Company. There are no claims against Proto Labs Germany GmbH. |

7.Weitere Zahlungsansprüche bestehen nicht. Etwaige Ansprüche aus betrieblicher Altersversorgung bleiben von dieser Vereinbarung unberührt. |

7.Further entitlements to payments shall not exists. Possible claims resulting from a company pension plan shall remain unaffected by this Agreement. |

| | | | | |

8.Proto Labs Germany GmbH verzichtet auf das in § 14 im Dienstvertrag vom 28./29.09.2017 mit dem Geschäftsführer geregelte nachvertragliche Wettbewerbs- und Abwerbeverbot. Mit Zugang dieser Verzichtserklärung wird der Geschäftsführer von dieser Verpflichtung befreit und ist – unter Beachtung des vertraglichen Wettbewerbsverbots bis zum Beendigungsdatum - frei in der Verwertung seiner Arbeitskraft. Proto Labs Germany GmbH wird mit Ablauf eines Jahres ab Zugang der Verzichtserklärung frühestens aber zum Ablauf eines Jahres nach dem Beendigungsdatum von der Verpflichtung zur Zahlung der Karenzentschädigung frei. |

8.Proto Labs Germany GmbH hereby waives the post-contractual non-compete and non-solicitation clause regulated in Sec. 14 of the service contract dated 28/29.09.2017 with the Managing Director. Upon receipt of this waiver declaration, the Managing Director is released from this obligation and is free to utilize his labor – subject to the contractual non-compete clause until the termination date. Proto Labs Germany GmbH will be released from the obligation to pay the non-compete compensation one year after receipt of the waiver declaration, but earliest one year after the Termination Date. |

9.Zwischen den Parteien besteht Einigkeit, dass der Geschäftsführer mit sofortiger Wirkung als Geschäftsführer der Proto Labs Germany GmbH sowie als Geschäftsführ der Verbundenen Unternehmen abberufen wird. Die notwendigen Löschungen der Bestellung im Handelsregister werden unverzüglich nach Abberufung vorgenommen. Der Geschäftsführer wird auf Verlangen sämtliche Erklärungen abgeben, die erforderlich sind, um seine gesellschaftsrechtlichen Ämter zu beenden. Ferner plant Proto Labs Germany GmbH, dem Geschäftsführer Entlastung zu erteilen. Zum Zeitpunkt des Zustandekommens dieser Abwicklungsvereinbarung sind keine Umstände bekannt, die einer solchen Entlastung entgegenstehen. |

9.The Parties agree that the Managing Director will be removed from the office of managing director of Proto Labs Germany GmbH and of any Affiliated Companies with immediate effect. The necessary deletions of the appointment in the commercial register will be made without delay after the removal. At request the Managing Director will make all declarations required to remove him from his corporate offices. Furthermore, Proto Labs Germany GmbH plans to discharge the Managing Director. At the time of the conclusion of this settlement agreement, no circumstances are known that would oppose such a discharge. |

| | | | | |

10.Der Geschäftsführer unterzeichnet diese Vereinbarung nach reiflicher Überlegung. Er wird darauf hingewiesen, dass verbindliche Auskünfte zu den Rechtsfolgen dieser Vereinbarung, insbesondere in steuer- und sozialrechtlicher Hinsicht nur die zuständigen Stellen wie beispielsweise die Arbeits- und Finanzämter erteilen.

Der Geschäftsführer wird hiermit darüber informiert, dass er gesetzlich dazu verpflichtet ist, sich innerhalb von drei Tagen nach Kenntnis des Beendigungsdatums persönlich bei der Agentur für Arbeit als arbeitssuchend zu melden. Weiter wird der Geschäftsführer darauf hingewiesen, dass bei einem Verstoß gegen diese Meldepflicht eine Minderung des Arbeitslosengeldes eintreten kann. |

10.The Managing Director agrees to this Agreement after due consideration. The Managing Director shall herewith be informed that binding information about the legal consequences of this Agreement, in particular in tax and social security matters, may only be given by the competent authorities, for example by the labour and tax offices.

The Managing Director has been informed that he is legally obliged to announce the end of his service relationship to the labour office in person within three days of knowledge of the Termination Date of the service relationship. Furthermore, the Managing Director has been informed that any breach of this obligation may result in a reduction of unemployment benefits. |

11.Die Parteien sind sich darüber einig, dass - mit Ausnahme der in dieser Vereinbarung ausdrücklich genannten Ansprüche - keine weiteren finanziellen Ansprüche des Geschäftsführers mehr bestehen. Mit Erfüllung der Verpflichtungen aus dieser Vereinbarung sind sämtliche wechselseitigen Ansprüche der Parteien aus dem Dienstvertrag, dem Severance Agreement sowie alle sonstigen Ansprüche, die im Zusammenhang mit dem Dienstverhältnis und seiner Beendigung bestehen, bekannt oder unbekannt, abgegolten und erledigt. Dies gilt auch im Verhältnis zwischen dem Geschäftsführer und mit der US Gesellschaft oder Proto Labs Germany GmbH verbundenen Unternehmen. |

11.The parties agree that the Managing Director shall have no further financial claims with the exception of those claims expressly mentioned herein. With the fulfilment of the obligations resulting from this Agreement all mutual claims arising from or in connection with the service contract, the Severance Agreement, as well as any other claims related to the service relationship and/or its termination, irrespective of whether known or unknown, shall be deemed settled and fulfilled. This also applies to the relationship between the Managing Director and companies affiliated with the US Company or Proto Labs Germany GmbH. |

12.Bei etwaigen unterschiedlichen Auslegungsmöglichkeiten der deutschen und englischen Fassung dieses Aufhebungsvertrages hat stets die deutsche Fassung Vorrang. Es gilt deutsches Recht. |

12.In case of possible different interpretation possibilities of the German and the English version of this Agreement, the German version shall always prevail. German law shall apply. |

| | | | | | | | |

| Maple Plain, MN October 1, 2024 | |

| Ort/Datum / place/date | |

| | |

| /s/ Daniel Schumacher | |

| Daniel Schumacher, Chief Financial Officer | |

| US Gesellschaft / US Company | |

| | |

| Maple Plain, MN October 1, 2024 | |

| Ort/Datum / place/date | |

| | |

| /s/ Daniel Schumacher | |

| Daniel Schumacher, Director PL Euro Services Limited | |

| Proto Labs Germany GmbH | |

| | |

| Hamburg September 27, 2024 | |

| Ort/Datum / place/date | |

| | |

| /s/ Bjoern Klaas | |

| Bjoern Klaas | |

| Geschäftsführer / Managing Director | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

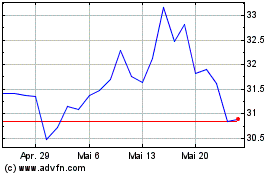

Proto Labs (NYSE:PRLB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Proto Labs (NYSE:PRLB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024