Life-licensed sales force grew 7% driven by

solid recruiting and a 17% increase in new life

licenses

Term Life net premiums grew 5%; adjusted

direct premiums up 6%

Issued Term Life face amount of $31 billion,

up 5%; total in force coverage of $958 billion

Investment and Savings Products sales of

$2.9 billion, up 34%

Investment and Savings Products client asset

values up 26%, ending the quarter at $111 billion

Net earnings per diluted share from

continuing operations (EPS) of $5.72 increased 31% (including a

remeasurement gain of $0.52 per diluted share); return on

stockholders’ equity (ROE) of 38.3%

Diluted adjusted operating earnings per

share of $5.68 increased 28% (including a remeasurement gain of

$0.52 per diluted adjusted share); adjusted net operating income

return on adjusted stockholders’ equity (ROAE) of 36.5%

Declared dividend of $0.90 per share,

payable on December 12, 2024; repurchased $129 million of common

stock during the quarter

Primerica, Inc. (NYSE: PRI) today announced financial results

for the quarter ended September 30, 2024. Total revenues of $774.1

million, increased 11% compared to the third quarter of 2023. Net

income from continuing operations of $194.7 million increased 24%,

while net earnings per diluted share from continuing operations of

$5.72 increased 31% compared to the prior year period.

Comparisons to the prior year period were impacted by the

Company’s annual actuarial assumption review, as described below,

which resulted in a net remeasurement gain of $23.0 million, or

$0.52 after tax earnings per diluted share. The Company recorded a

remeasurement gain of $28.2 million in the Term Life segment and a

remeasurement loss of $5.2 million in the Corporate and Other

Distributed Products segment.

Net income and diluted earnings per share, including

discontinued operations, were $164.4 million and $4.83,

respectively during the third quarter of 2024 compared to $152.1

million and $4.23, respectively in the prior year period. On

September 30, 2024, the Company exited its senior health business

by permanently surrendering and relinquishing its rights to

e-TeleQuote Insurance, Inc. with no significant continuing

involvement. Consequently, the senior health business’ financial

results have been reported in discontinued operations for all

periods presented.

Adjusted operating revenues of $770.1 million increased 10%

compared to the third quarter of 2023. Adjusted net operating

income of $193.2 million increased 21%, while adjusted operating

earnings per diluted share of $5.68 grew 28% year-over-year.

Comparisons to the prior year period were impacted by the Company’s

annual actuarial assumption review, as described above. A

reconciliation of non-GAAP to GAAP financial measures is included

at the end of this release.

Distribution results during the third quarter were strong,

driven by sustained recruiting momentum and growth in new

life-licensed representatives. Financial results in the Term Life

segment, excluding the remeasurement gain, benefited from continued

strong sales and stable margins. Results in the Investment and

Savings Products segment were positively impacted by favorable

equity market conditions, which fueled sales growth and higher

client asset values.

“Our results continue to reflect the power of Primerica’s

distribution model as we meet the increasing financial needs of

middle-income families,” said Glenn Williams, Chief Executive

Officer of Primerica, Inc. “In the third quarter, we were able to

successfully leverage the momentum created by our convention in

July 2024 to accelerate growth.”

Third Quarter Distribution & Segment Results

Distribution Results

Q3 2024

Q3 2023

% Change

Life-Licensed Sales Force

148,890

139,053

7

%

Recruits

142,655

92,269

55

%

New Life-Licensed Representatives

14,349

12,311

17

%

Life Insurance Policies Issued

93,377

88,589

5

%

Life Productivity (1)

0.21

0.21

*

Issued Term Life Face Amount ($ billions)

(2)

$

30.8

$

29.5

5

%

ISP Product Sales ($ billions)

$

2.9

$

2.2

34

%

Average Client Asset Values ($

billions)

$

108.2

$

91.5

18

%

Closed U.S. Mortgage Volume ($ million

brokered)

$

105.4

$

82.7

27

%

__________________________

(1)

Life productivity equals the average

monthly policies issued divided by the average number of life

insurance licensed representatives.

(2)

Includes face amount on issued term life

policies, additional riders added to existing policies, and face

increases under increasing benefit riders.

* Not calculated

Segment Results

Q3 2024

Q3 2023

% Change

($ in thousands)

Adjusted Operating Revenues:

Term Life Insurance

$

450,306

$

428,772

5

%

Investment and Savings Products

266,073

218,898

22

%

Corporate and Other Distributed Products

(1)

53,711

52,102

3

%

Total adjusted operating revenues

(1)

$

770,090

$

699,772

10

%

Adjusted Operating Income (Loss) before

income taxes:

Term Life Insurance

$

178,354

$

141,222

26

%

Investment and Savings Products

79,911

64,373

24

%

Corporate and Other Distributed Products

(1)

(5,713

)

3,065

NM

Total adjusted operating income before

income taxes (1)

$

252,552

$

208,660

21

%

__________________________

(1)

See the Non-GAAP Financial Measures

section and the Adjusted Operating Results reconciliation tables at

the end of this release for additional information.

Life Insurance Licensed Sales Force

The Company introduced new recruiting incentives for July and

the beginning of August to further the momentum created at the

convention. This led to a record number of new recruits and a 17%

increase in the number of new licenses. During the third quarter, a

total of 142,655 new recruits became part of Primerica and 14,349

individuals obtained a new life license. The size of the sales

force increased 7% year-over-year, for a total of 148,890

life-licensed representatives as of September 30, 2024.

Term Life Insurance

During the third quarter of 2024, the Company issued 93,377 new

life insurance policies, up 5% year-over-year. Productivity as

measured by the average monthly rate of new policies issued per

life-licensed independent sales representative remained unchanged

at 0.21.

Third quarter revenues of $450.3 million increased 5% compared

to the third quarter of 2023 driven by 6% growth in adjusted direct

premiums. Income before income taxes of $178.4 million in the

current year period included a $28.2 million remeasurement gain

primarily due to an assumption change stemming from the ongoing

decline in disability incidence rates under our waiver of premium

rider, resulting in a 26% increase year over year and a benefits

and claims ratio of 53.2%. Excluding the impact of the

remeasurement gain, the benefits and claims ratio would have been

57.6%. The DAC amortization and insurance commissions ratio at

11.9% and the insurance expense ratio at 7.4% remained stable

year-over-year. The Term Life Insurance operating margin at 27.5%

was favorably impacted by the remeasurement gain in the current

year period. Excluding the impact of the remeasurement gain, the

Term Life Insurance operating margin would have been 23.1%.

Investment and Savings Products

Ending client asset values continued to benefit from strong

equity market appreciation, ending the quarter at $111.2 billion,

up 26% compared to the prior year period. Total product sales

during the quarter were $2.9 billion, up 34% year-over-year, driven

by strong investor demand for mutual funds, annuities and managed

accounts, likely influenced by strong equity market performance.

Net client inflows during the quarter were $444 million.

Third quarter revenues of $266.1 million increased 22% compared

to the prior year period, while income before income taxes of $79.9

million increased 24%. Revenues from sales-based commissions and

fees increased 32%, while sales-based commission expenses increased

27%. Revenue growth slightly outpaced correlated product sales due

to continued strong client demand for variable annuities, on which

we earn higher up-front fees. Asset-based revenues increased 19%,

largely consistent with the growth in average client asset values.

The change in asset-based commission expenses was in line with

asset-based revenues.

Corporate and Other Distributed Products

During the third quarter of 2024, the segment recorded a pre-tax

adjusted operating loss of $5.7 million compared to pre-tax

adjusted operating income of $3.1 million in the prior year period.

The year-over-year decline was primarily due to a $5.2 million

remeasurement loss on a closed book of non-term life insurance

business, lower revenues from certain other distributed products

and growth in other operating expenses. This was partly offset by

higher net investment income ("NII") due to higher yields on

investments and growth in the size of the portfolio.

Taxes

The effective tax rate from continuing operations remained

largely unchanged at 23.5% in the third quarter of 2024 compared to

23.7% in the prior year period.

Capital

The Company repurchased 510,911 shares of common stock for

$128.8 million during the third quarter of 2024 and the Board of

Directors has approved a dividend of $0.90 per share, payable on

December 12, 2024 to stockholders of record on November 21, 2024.

Primerica Life Insurance Company’s statutory risk-based capital

(RBC) ratio was estimated to be about 440% as of September 30,

2024.

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with

U.S. generally accepted accounting principles (“GAAP”), the Company

presents certain non-GAAP financial measures. Specifically, the

Company presents adjusted direct premiums, other ceded premiums,

adjusted operating revenues, adjusted operating income before

income taxes, adjusted net operating income, diluted adjusted

operating earnings per share and adjusted stockholders' equity.

Adjusted direct premiums and other ceded premiums are net of

amounts ceded under coinsurance transactions that were executed

concurrent with our initial public offering (the “IPO coinsurance

transactions”) for all periods presented. We exclude amounts ceded

under the IPO coinsurance transactions in measuring adjusted direct

premiums and other ceded premiums to present meaningful comparisons

of the actual premiums economically maintained by the Company.

Amounts ceded under the IPO coinsurance transactions will continue

to decline over time as policies terminate within this block of

business.

Adjusted operating revenues, adjusted operating income before

income taxes, adjusted net operating income and diluted adjusted

operating earnings per share exclude the impact of investment gains

(losses), including credit impairments, and fair value

mark-to-market (“MTM”) investment adjustments for all periods

presented. We exclude investment gains (losses), including credit

impairments, and MTM investment adjustments in measuring these

non-GAAP financial measures to eliminate period-over-period

fluctuations that may obscure comparisons of operating results due

to items such as the timing of recognizing gains (losses) and

market pricing variations prior to an invested asset’s maturity or

sale that are not directly associated with the Company’s insurance

operations.

Adjusted operating income before taxes, adjusted net operating

income, and diluted adjusted operating earnings per share exclude

corporate restructuring and related charges associated with the

decision to exit the senior health business. We exclude these items

from our non-GAAP financial measures as they are not useful in

evaluating the Company’s ongoing operations. Adjusted net operating

income and diluted adjusted operating earnings per share also

exclude the tax effect of pre-tax operating adjustments. We exclude

these items from our non-GAAP financial measures as they represent

the tax effect of pre-tax operating adjustments and/or

non-recurring items that will cause incomparability between

period-over-period results.

Adjusted stockholders’ equity excludes the impact of net

unrealized investment gains (losses) recorded in accumulated other

comprehensive income (loss) for all periods presented. We exclude

unrealized investment gains (losses) in measuring adjusted

stockholders’ equity as unrealized gains (losses) from the

Company’s available-for-sale securities are largely caused by

market movements in interest rates and credit spreads that do not

necessarily correlate with the cash flows we will ultimately

realize when an available-for-sale security matures or is sold.

Adjusted stockholders’ equity also excludes the difference in

future policy benefits calculated using the current discount rate

and future policy benefits calculated using the locked-in discount

rate at contract issuance recognized in accumulated other

comprehensive income (loss). We exclude the impact from the

difference in the discount rate in measuring adjusted stockholders'

equity as such difference is caused by market movements in interest

rates that are not permanent and may not align with the cash flows

we will ultimately incur when policy benefits are settled.

Our definitions of these non-GAAP financial measures may differ

from the definitions of similar measures used by other companies.

Management uses these non-GAAP financial measures in making

financial, operating and planning decisions and in evaluating the

Company’s performance. Furthermore, management believes that these

non-GAAP financial measures may provide users with additional

meaningful comparisons between current results and results of prior

periods as they are expected to be reflective of the core ongoing

business. These measures have limitations and users should not

consider them in isolation or as a substitute for analysis of the

Company’s results as reported under GAAP. Reconciliations of GAAP

to non-GAAP financial measures are attached to this release.

Earnings Webcast Information

Primerica will hold a webcast on Thursday, November 7, 2024, at

10:00 a.m. Eastern, to discuss the quarter’s results. To access the

webcast, go to https://investors.primerica.com at least 15 minutes

prior to the event to register, download and install any necessary

software. A replay of the call will be available for approximately

30 days. This release and a detailed financial supplement will be

posted on Primerica’s website.

Forward-Looking Statements

Except for historical information contained in this press

release, the statements in this release are forward-looking and

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements contain known and unknown risks and uncertainties that

may cause our actual results in future periods to differ materially

from anticipated or projected results. Those risks and

uncertainties include, among others, our failure to continue to

attract and license new recruits, retain sales representatives or

license or maintain the licensing of sales representatives; new

laws or regulations that could apply to our distribution model,

which could require us to modify our distribution structure;

changes to the independent contractor status of sales

representatives; our or sales representatives’ violation of or

non-compliance with laws and regulations; litigation and regulatory

investigations and actions concerning us or sales representatives;

differences between our actual experience and our expectations

regarding mortality, persistency, disability or insurance as

reflected in the pricing for our insurance policies; changes in

federal, state and provincial legislation or regulation that

affects our insurance, investment product and mortgage businesses;

our failure to meet regulatory capital ratios or other minimum

capital and surplus requirements; a significant downgrade by a

ratings organization; the failure of our reinsurers or reserve

financing counterparties to perform their obligations; the failure

of our investment products to remain competitive with other

investment options or the loss of our relationship with one or more

of the companies whose investment products we provide; heightened

standards of conduct or more stringent licensing requirements for

sales representatives; inadequate policies and procedures regarding

suitability review of client transactions; revocation of our

subsidiary’s status as a non-bank custodian; a significant change

to or disruption in the mortgage lenders’ mortgage businesses or an

inability of the mortgage lenders to satisfy their contractual

obligations to us; economic downcycles that impact our business,

financial condition and results of operations; major public health

pandemics, epidemics or outbreaks or other catastrophic events; the

failure of our or a third-party partner’s information technology

systems, breach of our information security, failure of our

business continuity plan or the loss of the Internet; any failure

to protect the confidentiality of client information; the current

legislative and regulatory climate with regard to privacy and

cybersecurity; cyber-attack(s), security breaches; the effects of

credit deterioration and interest rate fluctuations on our invested

asset portfolio and other assets; incorrectly valuing our

investments; changes in accounting standards may impact how we

record and report our financial condition and results of

operations; the inability of our subsidiaries to pay dividends or

make distributions; litigation and regulatory investigations and

actions; a significant change in the competitive environment in

which we operate; the loss of key personnel or sales force leaders;

the efficiency and success of business initiatives to enhance our

technology, products and services; any acquisition or investment in

businesses that do not perform as we expect or are difficult to

integrate; and fluctuations in the market price of our common stock

or Canadian currency exchange rates. These and other risks and

uncertainties affecting us are more fully described in our filings

with the Securities and Exchange Commission, which are available in

the "Investor Relations" section of our website at

https://investors.primerica.com. Primerica assumes no duty to

update its forward-looking statements as of any future date.

About Primerica, Inc.

Primerica, Inc., headquartered in Duluth, GA, is a leading

provider of financial products and services to middle-income

households in North America. Independent licensed representatives

educate Primerica clients about how to better prepare for a more

secure financial future by assessing their needs and providing

appropriate solutions through term life insurance, which we

underwrite, and mutual funds, annuities and other financial

products, which we distribute primarily on behalf of third parties.

We insured approximately 5.7 million lives and had approximately

2.9 million client investment accounts on December 31, 2023.

Primerica, through its insurance company subsidiaries, was the #2

issuer of Term Life insurance coverage in the United States and

Canada in 2023. Primerica stock is included in the S&P MidCap

400 and the Russell 1000 stock indices and is traded on The New

York Stock Exchange under the symbol “PRI”.

PRIMERICA, INC. AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(Unaudited)

September 30,

2024

December 31,

2023

(In thousands)

Assets

Investments:

Fixed-maturity securities

available-for-sale, at fair value

$

2,994,955

$

2,719,467

Fixed-maturity security held-to-maturity,

at amortized cost

1,330,430

1,386,980

Short-term investments available-for-sale,

at fair value

-

276

Equity securities, at fair value

28,411

29,680

Trading securities, at fair value

3,235

18,383

Policy loans and other invested assets

52,842

51,175

Total investments

4,409,873

4,205,961

Cash and cash equivalents

550,142

594,148

Accrued investment income

26,389

23,958

Reinsurance recoverables

2,873,528

3,015,777

Deferred policy acquisition costs, net

3,636,964

3,447,234

Agent balances, due premiums and other

receivables

300,697

269,216

Intangible assets, net

45,275

45,275

Income taxes

128,479

120,035

Operating lease right-of-use assets

48,190

51,506

Other assets

394,494

439,940

Separate account assets

2,401,137

2,395,842

Assets from discontinued operations

entities

-

418,840

Total assets

$

14,815,168

$

15,027,732

Liabilities and Stockholders'

Equity

Liabilities:

Future policy benefits

$

6,919,418

$

6,742,025

Unearned and advance premiums

16,186

14,876

Policy claims and other benefits

payable

496,835

513,803

Other policyholders' funds

398,464

435,094

Note payable

594,311

593,709

Surplus note

1,330,090

1,386,592

Income taxes

20,524

76,257

Operating lease liabilities

56,930

58,893

Other liabilities

549,209

579,045

Payable under securities lending

85,236

99,785

Separate account liabilities

2,401,137

2,395,842

Liabilities from discontinued operations

entities

-

65,844

Total liabilities

12,868,340

12,961,765

Stockholders' equity

Common stock

335

350

Paid-in capital

-

-

Retained earnings

2,132,015

2,276,946

Accumulated other comprehensive income

(loss), net of income tax:

Effect of change in discount rate

assumptions on the liability for future policy benefits

(71,241

)

(39,086

)

Unrealized foreign currency translation

gains (losses)

(10,771

)

(2,235

)

Net unrealized gains (losses) on

available-for-sale securities

(103,510

)

(170,008

)

Total stockholders' equity

1,946,828

2,065,967

Total liabilities and stockholders'

equity

$

14,815,168

$

15,027,732

PRIMERICA, INC. AND

SUBSIDIARIES

Condensed Consolidated

Statements of Income

(Unaudited)

Three months ended September

30,

2024

2023

(In thousands, except

per-share amounts)

Revenues:

Direct premiums

$

852,452

$

831,681

Ceded premiums

(412,645

)

(411,015

)

Net premiums

439,807

420,666

Commissions and fees

271,901

227,514

Net investment income

41,109

34,730

Investment gains (losses)

2,209

(1,795

)

Other, net

19,103

16,381

Total revenues

774,129

697,496

Benefits and expenses:

Benefits and claims

164,363

162,062

Future policy benefits remeasurement

(gain) loss

(23,019

)

179

Amortization of deferred policy

acquisition costs

75,539

69,405

Sales commissions

142,254

116,200

Insurance expenses

63,529

57,821

Insurance commissions

7,180

7,911

Interest expense

6,093

6,632

Other operating expenses

83,612

70,902

Total benefits and expenses

519,551

491,112

Income from continuing operations before

income taxes

254,578

206,384

Income taxes from continuing

operations

59,841

48,930

Income from continuing operations

194,737

157,454

Loss from discontinued operations, net of

income tax

(30,364

)

(5,391

)

Net income

$

164,373

$

152,063

Basic earnings per share:

Continuing operations

$

5.73

$

4.38

Discontinued operations

(0.89

)

(0.15

)

Basic earnings per share

$

4.84

$

4.23

Diluted earnings per share:

Continuing operations

$

5.72

$

4.38

Discontinued operations

(0.89

)

(0.15

)

Diluted earnings per share

$

4.83

$

4.23

Weighted-average shares used in

computing earnings per share:

Basic

33,834

35,760

Diluted

33,891

35,822

PRIMERICA, INC. AND

SUBSIDIARIES

Consolidated Adjusted

Operating Results Reconciliation

(Unaudited)

Three months ended September

30,

2024

2023

%

Change

(In thousands, except

per-share amounts)

Total revenues

$

774,129

$

697,496

11

%

Less: Investment (losses) gains

2,209

(1,795

)

Less: 10% deposit asset MTM included in

NII

1,830

(481

)

Adjusted operating revenues

$

770,090

$

699,772

10

%

Income from continuing operations before

income taxes

$

254,578

$

206,384

23

%

Less: Investment (losses) gains

2,209

(1,795

)

Less: 10% deposit asset MTM included in

NII

1,830

(481

)

Less: Restructuring costs

(2,013

)

-

Adjusted operating income before income

taxes

$

252,552

$

208,660

21

%

Income from continuing operations

$

194,737

$

157,454

24

%

Less: Investment (losses) gains

2,209

(1,795

)

Less: 10% deposit asset MTM included in

NII

1,830

(481

)

Less: Restructuring costs

(2,013

)

-

Less: Tax impact of preceding items

(476

)

535

Adjusted net operating income

$

193,187

$

159,195

21

%

Diluted earnings per share from continuing

operations

$

5.72

$

4.38

31

%

Less: Net after-tax impact of operating

adjustments

0.04

(0.05

)

Diluted adjusted operating earnings per

share

$

5.68

$

4.43

28

%

TERM LIFE INSURANCE

SEGMENT

Adjusted Premiums

Reconciliation

(Unaudited)

Three months ended September

30,

2024

2023

% Change

(In thousands)

Direct premiums

$

847,626

$

826,665

3

%

Less: Premiums ceded to IPO coinsurers

198,726

212,951

Adjusted direct premiums

648,900

613,714

6

%

Ceded premiums

(411,526

)

(409,801

)

Less: Premiums ceded to IPO coinsurers

(198,726

)

(212,951

)

Other ceded premiums

(212,800

)

(196,850

)

Net premiums

$

436,100

$

416,864

5

%

CORPORATE AND OTHER

DISTRIBUTED PRODUCTS SEGMENT

Adjusted Operating Results

Reconciliation

(Unaudited)

Three months ended September

30,

2024

2023

% Change

(In thousands)

Total revenues

$

57,750

$

49,826

16

%

Less: Investment gains (losses)

2,209

(1,795

)

Less: 10% deposit asset MTM included in

NII

1,830

(481

)

Adjusted operating revenues

$

53,711

$

52,102

3

%

Income (loss) before income taxes

$

(3,687

)

$

789

NM

Less: Investment gains (losses)

2,209

(1,795

)

Less: 10% deposit asset MTM included in

NII

1,830

(481

)

Less: Restructuring costs

(2,013

)

-

Adjusted operating income (loss) before

income taxes

$

(5,713

)

$

3,065

NM

PRIMERICA, INC. AND

SUBSIDIARIES

Adjusted Stockholders' Equity

Reconciliation

(Unaudited)

September 30, 2024

December 31, 2023

%

Change

(In thousands)

Stockholders' equity

$

1,946,828

$

2,065,967

(6

)%

Less: Net unrealized gains (losses)

(103,510

)

(170,008

)

Less: Effect of change in discount rate

assumptions on the liability for future policy benefits

(71,241

)

(39,086

)

Adjusted stockholders' equity

$

2,121,579

$

2,275,061

(7

)%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106746785/en/

Investor Contact: Nicole Russell 470-564-6663 Email:

Nicole.Russell@primerica.com

Media Contact: Susan Chana 404-229-8302 Email:

Susan.Chana@Primerica.com

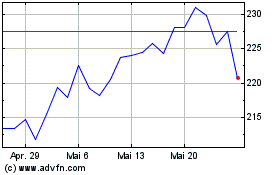

Primerica (NYSE:PRI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Primerica (NYSE:PRI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024