Putnam Announces Dividend Rates for Class A Open-End Funds

09 Oktober 2009 - 1:24AM

Business Wire

The Trustees of The Putnam Funds declared the following

distributions at a meeting held today.

RECORD

PAYMENT

FUND NAME AND DISTRIBUTIONS

DATE

DATE

Putnam American Government Income Trust – Class

A Shares (PAGVX)

$0.0330 per share investment income 10/16/09 10/20/09

Putnam Asset Allocation Conservative Fund– Class

A Shares (PACAX)

$0.0240 per share investment income 10/16/09 10/20/09

Putnam Diversified Income Trust – Class A Shares

(PDINX)

$0.0670 per share investment income 10/14/09 10/20/09

Putnam Global Income Trust – Class A Shares

(PGGIX)

$0.0870 per share investment income 10/26/09 10/30/09

Putnam High Yield Advantage Fund – Class A

Shares (PHYIX)

$0.0350 per share investment income 10/20/09 10/26/09

Putnam High Yield Trust – Class A Shares

(PHIGX)

$0.0450 per share investment income 10/22/09 10/26/09

Putnam Income Fund – Class A Shares

(PINCX)

$0.0390 per share investment income 10/20/09 10/26/09

Putnam Income Strategies Fund – Class A Shares

(PISFX)

$0.0360 per share investment income 10/22/09 10/26/09

Putnam U.S. Government Income Trust – Class A

Shares (PGSIX)

$0.0550 per share investment income 10/14/09 10/20/09

Section 19

Disclosure

Global Income Trust

.015 per share of this fund’s dividend represents a foreign

currency gain. This is only an estimate for the current fund fiscal

year based on information we have at this time. In January 2010, we

will provide final information about all 2009 distributions for

your tax filing. See the additional disclosure below for more

details.

High Yield Advantage

.004 per share of this fund’s dividend represents a return of

capital. This is only an estimate for the current fund fiscal year

based on information we have at this time. In January 2010, we will

provide final information about all 2009 distributions for your tax

filing. See the additional disclosure below for more details.

High Yield Trust

.004 per share of this fund’s dividend represents a return of

capital. This is only an estimate for the current fund fiscal year

based on information we have at this time. In January 2010, we will

provide final information about all 2009 distributions for your tax

filing. See the additional disclosure below for more details.

Income Fund

.014 per share of this fund’s dividend represents a return of

capital. This is only an estimate for the current fund fiscal year

based on information we have at this time. In January 2010, we will

provide final information about all 2009 distributions for your tax

filing. See the additional disclosure below for more details.

Income Strategies

.005 per share of this fund’s dividend represents a return of

capital. This is only an estimate for the current fund fiscal year

based on information we have at this time. In January 2010, we will

provide final information about all 2009 distributions for your tax

filing. See the additional disclosure below for more details.

Additional

disclosure:

If a fund’s dividend included an estimated distribution such as

a return of capital or capital gain: For the purposes of this

disclosure, a fund’s dividend sources are determined in accordance

with accounting principles, which may vary from federal tax

treatment. The sources of dividends are estimated at the time of

declaration. Actual results may vary. Any non-taxable return of

capital cannot be determined until after the end of the fund’s

fiscal year. In January 2010, you will receive information as to

the federal tax status of this and other distributions from the

fund in the preceding calendar year.

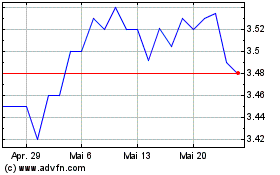

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024