0001530950false00015309502024-02-052024-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2024

Post Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Missouri | 001-35305 | 45-3355106 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

| | | |

| |

2503 S. Hanley Road

St. Louis, Missouri 63144

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (314) 644-7600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | POST | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

Post Holdings, Inc. (the “Company”) is disclosing under Item 7.01 of this Current Report on Form 8-K the information contained in Exhibit 99.1, which information is incorporated by reference herein. The information contained in Exhibit 99.1 is excerpted from a preliminary offering memorandum that is being disseminated in connection with the Company’s private offering of senior secured notes described below.

The information contained in this Item 7.01 and in the accompanying Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On February 5, 2024, the Company announced that it intends to commence a private offering to eligible purchasers, subject to market and other conditions, of $875.0 million in aggregate principal amount of senior secured notes due 2032 (the “Notes”). The Company also announced it intends to use the net proceeds from the Notes offering, together with cash on hand, for purposes of repaying in full its outstanding $400.0 million incremental term loan under its credit agreement, which the Company borrowed in April 2023, redeeming its existing 5.75% senior notes due 2027, which is expected to occur on March 1, 2024, and paying the premiums, costs, fees and expenses associated with the offering, the term loan repayment and the notes redemption. To the extent there are any remaining net proceeds, the Company intends to use such proceeds for general corporate purposes, which could include, among other things, retirement or repayment of existing debt, acquisitions, share repurchases, capital expenditures and working capital.

A copy of the press release issued in connection with the commencement of the Notes offering is attached hereto as Exhibit 99.2 and incorporated herein by reference.

This Current Report on Form 8-K is not an offer to sell or a solicitation of an offer to buy any security, nor shall there be any sales of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This Current Report on Form 8-K does not constitute a notice of redemption with respect to any of the Company’s senior notes. Such notice, if any, will be given in accordance with the terms of the applicable indenture.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

Exhibit No. | Description |

| |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (the cover page iXBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: February 5, 2024 | Post Holdings, Inc. |

| (Registrant) |

| | |

| By: | /s/ Diedre J. Gray |

| Name: | Diedre J. Gray |

| Title: | EVP, General Counsel & Chief Administrative Officer, Secretary |

Exhibit 99.1

Excerpts from Preliminary Offering Memorandum dated February 5, 2024

Other financing transactions

Redemption of 5.75% senior notes due 2027

We intend to deliver a conditional notice of redemption providing for the redemption in full of the

$459.3 million aggregate outstanding principal amount of our 5.75% senior notes due 2027 (which we also refer to as the “5.75% notes”) with a redemption date of March 1, 2024. The redemption price for the 5.75% notes is specified in the indenture governing our 5.75% notes as 100.958% of the principal amount of the notes redeemed, plus accrued and unpaid interest, if any, to the redemption date. See “Description of Certain Indebtedness—5.75% Senior Notes Due 2027.” We estimate that the aggregate amount necessary to redeem the 5.75% notes, including the redemption premium, will be approximately $463.7 million, plus accrued and unpaid interest to the redemption date of approximately $13.2 million. We refer to the redemption of the 5.75% notes as the “pending redemption” and the redemption price to be paid to holders of the 5.75% notes as the “applicable redemption price.”

Our obligation to redeem the 5.75% notes is subject to the satisfaction or waiver, in our sole discretion, of the condition that we receive proceeds from this offering on terms satisfactory to us in our sole discretion, generating net proceeds in an amount that is sufficient to effect the redemption of the 5.75% notes at the applicable redemption price, the incremental term loan payoff (as defined below) and the payment of any costs, fees and expenses incurred in connection therewith. The redemption of the 5.75% notes is not being made by means of this offering memorandum, and nothing in this offering memorandum should be construed as an offer to purchase the 5.75% notes. This offering is not conditioned upon consummation of the redemption of the 5.75% notes.

This offering memorandum is not a notice of redemption of the 5.75% notes.

Credit agreement amendment

We intend to amend our second amended and restated credit agreement, dated as of March 18, 2020 (which, as amended (including pursuant to the credit agreement amendment described below), restated or amended and restated, we refer to as the “credit agreement”) with the institutions from time to time party thereto as lenders (which we refer to as the “lenders”) and Barclays Bank PLC, as administrative agent for the lenders (in such capacity, we refer to Barclays Bank PLC as the “agent”). (References in this offering memorandum to the “existing credit agreement” mean the credit agreement as currently in effect, without giving effect to the credit agreement amendment.) The proposed amendment to the existing credit agreement (which we refer to as the “credit agreement amendment”) would (i) replace our existing $750.0 million revolving credit facility (which we refer to as our “existing revolving credit facility”) with a new revolving credit facility in an amount not to exceed $1,000.0 million (which we refer to as our “new revolving credit facility”), (ii) extend the maturity of the new revolving credit facility to a date which is five years after the date of such amendment (subject to earlier maturity under certain circumstances) and (iii) modify certain other terms, conditions and provisions of our existing credit agreement, including (but not limited to) the transfer of the administrative agent role from Barclays Bank PLC to JPMorgan Chase Bank, N.A. This offering is not contingent upon the effectiveness of the credit agreement amendment. Concurrently with the credit agreement amendment and the closing of this offering, we intend to borrow approximately $300.0 million under the new revolving credit facility and use such funds, together with cash on hand, to repay in full the outstanding $300.0 million principal balance of the existing revolving credit facility and all accrued, unpaid interest thereon, and we intend to use a portion of the proceeds of this offering to repay in full such amount borrowed under the new revolving credit facility. On or about March 1, 2024, we intend to re-borrow approximately $300.0 million under the new revolving credit facility and use the proceeds, together with the remaining proceeds of this offering and cash on hand, to redeem the 5.75% notes and pay the applicable redemption price, the accrued and unpaid interest on the 5.75% notes and the costs, including payment of any fees and expenses, associated with the pending redemption. There can be no assurance that the credit agreement amendment will be entered into on the anticipated terms or timeframe or at all.

Repayment of incremental term loan

Concurrently with the credit agreement amendment and the closing of this offering, we intend to use a portion of the proceeds of this offering to repay in full our outstanding $400.0 million incremental term loan (which we refer to as the “incremental term loan”), and all accrued, unpaid interest thereon, which we borrowed in full on April 26, 2023 pursuant to that certain Joinder Agreement No. 4 dated April 26, 2023 (which we refer to as the “fourth joinder agreement”) by and among us, as borrower, certain of our subsidiaries, as guarantors, the institutions party to the fourth joinder agreement as lenders and Barclays Bank PLC, as the administrative agent (which we refer to as the "incremental term loan payoff").

In this offering memorandum, we may refer to the pending redemption, the credit agreement amendment and transactions under our revolving credit facility described above and the incremental term loan payoff as the “other financing transactions.”

Summary historical financial information

The following tables set forth certain of our summary historical condensed consolidated financial data for each of the fiscal years in the three-year period ended September 30, 2023 and for the three months ended December 31, 2023 and 2022. The summary historical financial data set forth below should be read in conjunction with: (i) the sections entitled “Use of Proceeds” and “Capitalization,” each of which are contained elsewhere in this offering memorandum, (ii) our audited consolidated financial statements and the notes thereto and our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for the fiscal year ended September 30, 2023 contained in our Annual Report on Form 10-K, as filed with the SEC on November 17, 2023 and incorporated by reference in this offering memorandum, and (iii) our unaudited condensed consolidated financial statements and the notes thereto and our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for the fiscal quarter ended December 31, 2023 contained in our Quarterly Report on Form 10-Q, as filed with the SEC on February 2, 2024 and incorporated by reference in this offering memorandum.

The summary historical condensed consolidated financial data for each of the fiscal years in the three-year period ended September 30, 2023 have been derived from our audited consolidated financial statements. The summary unaudited historical condensed consolidated financial data for the three months ended December 31, 2023 and 2022 have been derived from our unaudited condensed consolidated financial statements, and include, in the opinion of management, all adjustments, consisting of normal, recurring adjustments, necessary for a fair statement of such information. The financial data presented for the interim periods is not necessarily indicative of the results for the full fiscal year.

The summary unaudited historical consolidated financial data for the twelve months ended December 31, 2023 were calculated by subtracting our summary historical consolidated financial information for the three months ended December 31, 2022 from our summary historical consolidated financial information for the fiscal year ended September 30, 2023, and then adding our summary historical consolidated financial information for the three months ended December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended September 30, | | Three months

ended

December 31, | | Twelve months

ended

December 31, |

|

|

|

| | 2022 | 2023 | | 2023 |

| 2021 | 2022 | 2023 | | (unaudited) | (unaudited) | | (unaudited) |

| (In millions) |

| | | | | | | | |

Statements of Operations Data: | | | | | | | | |

Net sales | $ | 4,980.7 | | $ | 5,851.2 | | $ | 6,991.0 | | | $ | 1,566.3 | | $ | 1,965.9 | | | $ | 7,390.6 | |

Cost of goods sold | 3,552.6 | | 4,383.7 | | 5,109.3 | | | 1,151.4 | | 1,393.3 | | | 5,351.2 | |

Gross profit | 1,428.1 | | 1,467.5 | | 1,881.7 | | | 414.9 | | 572.6 | | | 2,039.4 | |

Selling, general and administrative

expenses | 807.0 | | 904.7 | | 1,078.4 | | | 228.7 | | 322.9 | | | 1,172.6 | |

Amortization of intangible assets | 143.2 | | 146.0 | | 160.7 | | | 36.4 | | 45.7 | | | 170.0 | |

Impairment of goodwill(1) | — | | — | | 42.2 | | | — | | — | | | 42.2 | |

Other operating (income) expense, net | (9.8) | | 1.2 | | 1.5 | | | (0.1) | | (5.3) | | | (3.7) | |

Operating profit | 487.7 | | 415.6 | | 598.9 | | | 149.9 | | 209.3 | | | 658.3 | |

Interest expense, net | 332.6 | | 317.8 | | 279.1 | | | 65.9 | | 78.1 | | | 291.3 | |

Loss (gain) on extinguishment of debt,

net | 93.2 | | (72.6) | | (40.5) | | | (8.7) | | (3.1) | | | (34.9) | |

(Income) expense on swaps, net | (122.8) | | (268.0) | | (39.9) | | | (12.3) | | 21.1 | | | (6.5) | |

Gain on investment in BellRing | — | | (437.1) | | (5.1) | | | (5.1) | | — | | | — | |

Other income, net | (29.3) | | (19.8) | | (7.6) | | | (8.3) | | (3.5) | | | (2.8) | |

Earnings before income taxes and equity

method loss | 214.0 | | 895.3 | | 412.9 | | | 118.4 | | 116.7 | | | 411.2 | |

Income tax expense | 58.2 | | 85.7 | | 99.7 | | | 24.7 | | 28.5 | | | 103.5 | |

Equity method loss, net of tax | 43.9 | | 67.1 | | 0.3 | | | — | | 0.1 | | | 0.4 | |

Net earnings from continuing operations,

including noncontrolling interests | 111.9 | | 742.5 | | 312.9 | | | 93.7 | | 88.1 | | | 307.3 | |

Less: Net earnings attributable to

noncontrolling interests from continuing operations | 7.0 | | 7.5 | | 11.6 | | | 1.8 | | — | | | 9.8 | |

Net earnings from continuing

operations | 104.9 | | 735.0 | | 301.3 | | | 91.9 | | 88.1 | | | 297.5 | |

Net earnings from discontinued

operations, net of tax and

noncontrolling interest | 61.8 | | 21.6 | | — | | | — | | — | | | — | |

Net earnings | $ | 166.7 | | $ | 756.6 | | $ | 301.3 | | | $ | 91.9 | | $ | 88.1 | | | 297.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended September 30, | | Three months

ended

December 31 | | Twelve months

ended

December 31, |

| | | | | 2022 | 2023 | | 2023 |

| 2021 | 2022 | 2023 | | (unaudited) | (unaudited) | | (unaudited) |

| (In millions) |

Statements of Cash Flow Data: | | | | | | | | |

Depreciation and amortization | $ | 366.5 | $ | 380.2 | $ | 407.1 | | $ | 92.6 | $ | 112.4 | | $ | 426.9 |

Cash provided by (used in): | | | | | | | | |

Operating activities—continuing

operations | 362.1 | 384.2 | 750.3 | | 98.3 | 174.4 | | 826.4 |

Investing activities – continuing

operations | (792.0) | (220.2) | (669.3) | | (53.0) | (333.8) | | (950.1) |

Financing activities – continuing

operations | (46.6) | (237.2) | (555.7) | | (28.3) | 206.3 | | (321.1) |

Net cash provided by (used in)

discontinued operations | 103.6 | (151.9) | — | | — | — | | — |

| Other Financial Data: | | | | | | | | |

Cash paid for business acquisitions, net of

cash acquired(2) | $ | 290.3 | $ | 24.8 | $ | 715.2 | | $ | — | $ | 252.7 | | $ | 967.9 |

Capital expenditures | 190.9 | 255.3 | 303.0 | | 52.3 | 80.8 | | 331.5 |

EBITDA(3) | 862.2 | 1,518.7 | 1,087.2 | | 275.1 | 307.1 | | 1,119.2 |

Adjusted EBITDA(4) | 889.4 | 963.5 | 1,233.4 | | 269.9 | 359.5 | | 1,323.0 |

Acquisition EBITDA(5) | | | | | | | | 1,386.6 |

Net debt (as adjusted, as of the last day

of the period(6) | | | | | | | | 6,206.8 |

Ratio of net debt (as adjusted) to

acquisition adjusted EBITDA(7) | | | | | | | | 4.5 |

| | | | | | | | | | | | | | |

| | | December 31, |

| September 30, | | 2023 |

| 2022 | 2023 | | (unaudited) |

| (In millions) |

| Balance Sheet Data: | | | | |

| Cash and cash equivalents | $ | 586.5 | | $ | 93.3 | | | $ | 150.6 | |

Working capital, excluding cash and cash equivalents, current

investments held in trust, restricted cash and current portion of

long-term debt | 463.8 | | 557.1 | | | 660.5 | |

Total assets | 11,308.0 | | 11,646.7 | | | 12,072.4 | |

Debt, including current portion(8) | 5,957.7 | | 6,040.1 | | | 6,315.1 | |

Other liabilities | 266.9 | | 276.7 | | | 285.7 | |

Total shareholders’ equity | $ | 3,265.7 | | $ | 3,851.3 | | | $ | 3,952.8 | |

(1) For information about the impairment of goodwill, see “Critical Accounting Estimates” and Notes 2 and 8 of “Notes to Consolidated Financial Statements” in our audited consolidated financial statements for the fiscal year ended September 30, 2023 contained in our Annual Report on Form 10-K filed with the SEC on November 17, 2023 and incorporated by reference in this offering memorandum.

(2) We completed the Pet Food acquisition in April 2023 and the Perfection acquisition in December 2023. The amounts included in cash paid for business acquisitions, net of cash acquired, reflect the cash consideration paid less any cash acquired in the transactions and include $715.2 million for the year ended September 30, 2023 related to the Pet Food acquisition and $238.5 million for the three months ended December 31, 2023 related to the Perfection acquisition.

(3) As used herein, EBITDA represents net earnings from continuing operations plus interest expense, net, income tax expense/benefit, depreciation and amortization. We present EBITDA because we consider it an important supplemental measure of our operating performance and believe it is commonly reported and frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. In addition, management understands that investors, analysts and rating agencies consider EBITDA useful in measuring the ability of issuers of “high yield” securities to meet debt service obligations. Our management believes EBITDA is an appropriate supplemental measure of debt service capacity because cash expenditures on interest are, by definition, available to pay interest, and income taxes are inversely correlated to interest expense. Depreciation and amortization are non-cash charges.

The indenture that will govern the notes and the indentures governing our other senior notes and the credit agreement use EBITDA (with additional adjustments similar to those discussed below regarding our calculation of “Adjusted EBITDA”) to measure our compliance with covenants such as interest coverage and debt incurrence. Our management also believes EBITDA is an accepted indicator of our ability to incur and service debt and make capital expenditures. We believe that EBITDA is a useful financial metric to assess our operating performance from period to period by excluding certain items that we believe are not representative of our core business.

EBITDA has limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

• it does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

• it does not reflect changes in, or cash requirements for, our working capital needs;

• it does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt;

• although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and such measures do not reflect any cash requirements for such replacements;

• it does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations, as discussed under “Adjusted EBITDA” below; and

• other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative benchmark measure.

Because of these limitations, EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. You should compensate for these limitations by relying primarily on our GAAP results and using EBITDA only supplementally.

The following table reconciles net earnings from continuing operations to EBITDA for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended September 30, | | Three months

ended

December 31, | | Twelve months

ended

December 31, |

| 2021 | 2022 | 2023 | | 2022 | 2023 | | 2023 |

| (In millions) | |

| |

Net earnings from continuing operations | $ | 104.9 | | $ | 735.0 | | $ | 301.3 | | | $ | 91.9 | | $ | 88.1 | | | $ | 297.5 | |

Income tax expense | 58.2 | | 85.7 | | 99.7 | | | 24.7 | | 28.5 | | | 103.5 | |

Interest expense, net | 332.6 | | 317.8 | | 279.1 | | | 65.9 | | 78.1 | | | 291.3 | |

Depreciation and amortization | 366.5 | | 380.2 | | 407.1 | | | 92.6 | | 112.4 | | | 426.9 | |

EBITDA | $ | 862.2 | | $ | 1,518.7 | | $ | 1,087.2 | | | $ | 275.1 | | $ | 307.1 | | | $ | 1,119.2 | |

(4) We present Adjusted EBITDA as a further supplemental measure of our operating performance and ability to service debt. We prepare Adjusted EBITDA by adjusting EBITDA to eliminate the impact of a number of items that are non-cash items, unusual items which we do not expect to recur or continue at the same level or other items which we do not believe to be reflective of our ongoing operating performance. You are encouraged to evaluate each adjustment and the reasons we consider them appropriate for supplemental analysis. As an analytical tool, Adjusted EBITDA is subject to all of the limitations applicable to EBITDA, including the fact that we may calculate Adjusted EBITDA differently than other companies in our industry. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally. In addition, in evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

The following table reconciles EBITDA to Adjusted EBITDA for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended September 30, | | Three months

ended

December 31, | | Twelve months

ended

December 31, |

| 2021 | 2022 | 2023 | | 2022 | 2023 | | 2023 |

| (In millions) |

| | | | | | | | |

| EBITDA | $ | 862.2 | | $ | 1,518.7 | | $ | 1,087.2 | | | $ | 275.1 | | $ | 307.1 | | | $ | 1,119.2 | |

Gain on investment in BellRing | — | | (437.1) | | (5.1) | | | (5.1) | | — | | | — | |

(Income) expense on swaps, net(a) | (122.8) | | (268.0) | | (39.9) | | | (12.3) | | 21.1 | | | (6.5) | |

Loss (gain) on extinguishment of debt, net(b) | 93.2 | | (72.6) | | (40.5) | | | (8.7) | | (3.1) | | | (34.9) | |

Impairment of goodwill(c) | — | | — | | 42.2 | | | — | | — | | | 42.2 | |

Non-cash stock-based compensation(d) | 48.7 | | 65.8 | | 77.2 | | | 17.0 | | 19.1 | | | 79.3 | |

Equity method investment adjustments(e) | 44.1 | | 67.1 | | 0.4 | | | — | | 0.1 | | | 0.5 | |

Mark-to-market adjustments on commodity and foreign

exchange hedges and warrant liabilities(f) | (54.2) | | 14.0 | | 31.6 | | | 5.2 | | 5.0 | | | 31.4 | |

Mark-to-market adjustments and impairments on equity securities and investments(g) | (9.6) | | 1.4 | | 15.9 | | | (5.2) | | (1.0) | | | 20.1 | |

Integration costs(h) | 4.1 | | 11.1 | | 30.4 | | | 1.3 | | 6.5 | | | 35.6 | |

Transaction costs(i) | 5.8 | | 32.1 | | 15.6 | | | 0.1 | | 2.2 | | | 17.7 | |

Provision for legal settlements(j) | 15.0 | | 13.8 | | 2.0 | | | — | | 0.1 | | | 2.1 | |

Restructuring and facility closure costs, excluding accelerated depreciation(k) | 0.4 | | 11.1 | | 6.9 | | | — | | 7.7 | | | 14.6 | |

Inventory revaluation adjustment on acquired businesses(l) | 3.4 | | 0.6 | | 12.7 | | | — | | 1.0 | | | 13.7 | |

Gain on dissolution of PHPC(m) | — | | — | | (10.5) | | | — | | — | | | (10.5) | |

Gain on bargain purchase(n) | (11.4) | | — | | — | | | — | | (6.2) | | | (6.2) | |

Gain on assets held for sale(o) | (0.5) | | (9.4) | | — | | | — | | — | | | — | |

Loss on sale of business(p) | — | | 6.3 | | — | | | — | | — | | | — | |

Asset disposal costs(q) | 6.0 | | 6.1 | | — | | | — | | — | | | — | |

Costs expected to be indemnified, net(r) | — | | (1.6) | | (4.2) | | | 1.2 | | — | | | (5.4) | |

Purchase price adjustment on acquisition(s) | — | | (1.2) | | — | | — | — | | — |

Advisory income(t) | (0.6) | | (0.6) | | (0.6) | | | (0.2) | | (0.1) | | | (0.5) | |

Adjustment to TRA liability(u) | 0.4 | | — | | — | | | — | | — | | | — | |

Noncontrolling interest adjustment(v) | 5.2 | | 5.9 | | 12.1 | | | 1.5 | | — | | | 10.6 | |

Adjusted EBITDA | $ | 889.4 | | $ | 963.5 | | $ | 1,233.4 | | | $ | 269.9 | | $ | 359.5 | | | $ | 1,323.0 | |

(a) Represents mark-to-market adjustments and cash settlements on our interest rate swaps.

(b) Represents gains and losses recorded on extinguishment of debt, inclusive of payments for premiums and tender fees, the write-off of debt issuance and deferred financing costs and the write-off of net unamortized debt premiums, net of gains realized on debt repurchased at a discount.

(c) For information about the impairment of goodwill, see “Critical Accounting Estimates” and Notes 2 and 8 of “Notes to Consolidated Financial Statements” in our audited consolidated financial statements for the fiscal year ended September 30, 2023 contained in our Annual Report on Form 10-K filed with the SEC on November 17, 2023 and incorporated by reference in this offering memorandum.

(d) Represents non-cash expenses related to stock-based compensation.

(e) Represents adjustments for the 8th Avenue equity method investment loss and our portion of interest expense, net, income tax expense/ benefit and depreciation and amortization for our unconsolidated Weetabix investment accounted for using the equity method.

(f) Represents non-cash expenses for mark-to-market adjustments on economic hedges for commodities and foreign exchange contracts and warrant liabilities.

(g) Represents non-cash expenses for mark-to-market adjustments and impairments on equity securities and investments.

(h) Represents costs incurred to integrate acquired or to-be-acquired businesses.

(i) Represents expenses related to professional service fees and other related costs associated with signed and closed business combinations and business divestitures.

(j) Represents gains and losses recorded to recognize a receivable or liability associated with an anticipated resolution of certain ongoing litigation of the Company.

(k) Represents certain facility closure-related expenses, excluding accelerated depreciation.

(l) Represents the profit impact of inventory basis step-up related to business combinations.

(m) Represents the gains recorded upon the dissolution of PHPC primarily related to the write-off of costs recorded in connection with its initial public offering.

(n) Represents gains recorded related to acquisitions in which the fair value of the identifiable net assets acquired exceeded the purchase price.

(o) Represents non-cash adjustments of the carrying value of fixed assets and businesses classified as held for sale to fair value.

(p) Represents losses recorded on the Company’s divestiture of the Willamette Egg Farms business.

(q) Represents costs recorded in connection with the disposal of certain assets that were never put into use.

(r) Represents costs incurred and expected to be indemnified in connection with damaged assets and gains related to indemnification proceeds received above the carrying value of damaged assets.

(s) Represents adjustments to the purchase price of an acquisition occurring beyond one year of the acquisition date.

(t) Represents advisory income from 8th Avenue.

(u) Represents adjustments to BellRing’s tax receivable agreement (which we refer to as the “TRA”) liability with Post.

(v) Represents adjustments for net earnings, interest expense, net, income tax expense and depreciation and amortization for consolidated investments which are attributable to the noncontrolling owners of the consolidated investments.

(5) “Acquisition Adjusted EBITDA” represents a further supplemental measure of our operating performance and ability to service debt. We prepare Acquisition Adjusted EBITDA by further adjusting Adjusted EBITDA to give effect to recent acquisitions, as if those acquisitions had occurred on January 1, 2023, as follows:

• Our acquisition of Pet Food was completed effective April 28, 2023. Our results for the twelve month period ended December 31, 2023 include eight months of financial results attributable to Pet Food. Acquisition Adjusted EBITDA for the twelve month period ended December 31, 2023 includes management’s estimate of the pre-acquisition Pet Food Adjusted EBITDA for the period January 1, 2023 through April 27, 2023.

• Our acquisition of Perfection was completed effective December 1, 2023. Our results for the twelve month period ended December 31, 2023 include one month of financial results attributable to Perfection. Acquisition Adjusted EBITDA for the twelve month period ended

December 31, 2023 includes management’s estimate of the pre-acquisition Perfection Adjusted EBITDA for the period January 1, 2023 through November 30, 2023.

Management’s estimate of the pre-acquisition Adjusted EBITDA of Pet Food and Perfection, and the other financial data presented in this offering memorandum for each such acquisition, are based on the financial statements that were prepared by their respective prior management teams and do not include any contributions from synergies or cost savings that our management expects to achieve in the future. Acquisition Adjusted EBITDA of Pet Food and Perfection is based on reasonable assumptions and information management believes to be reliable and accurate and represents management’s good faith estimates that are made on the basis of such assumptions and information. These financial statements and the reconciliations below have not been audited, reviewed, examined, compiled or subject to agreed-upon procedures by our independent registered public accounting firm. Investors should be aware that Adjusted EBITDA for Pet Food and Perfection may not be entirely comparable to our measure of Adjusted EBITDA. Acquisition Adjusted EBITDA has not been prepared in accordance with the requirements of Article 11 of Regulation S-X or any other securities laws relating to the presentation of pro forma financial information. Acquisition Adjusted EBITDA and the related ratios are presented for information purposes only and do not purport to represent what our actual financial position or results of operations would have been if the acquisitions had been completed as of an earlier date or that may be achieved in the future.

The following table reconciles Adjusted EBITDA to Acquisition Adjusted EBITDA for the periods indicated:

| | | | | |

| Twelve months

ended

December 31, 2023 |

| (In millions) |

| Adjusted EBITDA | $ | 1,323.0 | |

| Pet Food Adjusted EBITDA(a) | 40.2 | |

| Perfection Adjusted EBITDA(b) | 23.4 | |

| Acquisition Adjusted EBITDA | $ | 1,386.6 | |

(a) Adjustment gives effect to the Pet Food acquisition, which was completed effective April 28, 2023, as if the Pet Food acquisition had occurred on January 1, 2023, by including management’s estimate of the pre-acquisition Adjusted EBITDA of Pet Food for the period January 1, 2023 through April 27, 2023, including estimated unallocated Smucker selling, general and administrative expenses that were not included in Pet Food’s pre-acquisition earnings before income taxes. This estimate does not include any contributions from synergies or cost savings management expects to achieve in the future. The following is a reconciliation of earnings before income taxes to Adjusted EBITDA for Pet Food:

| | | | | |

| January 1, 2023

through

April 27, 2023 |

| (In millions) |

| Earnings before income taxes | $ | 52.7 | |

| Depreciation and amortization | 4.2 | |

| Unallocated selling, general and administrative expenses | (16.7) | |

| Pet Food Adjusted EBITDA | $ | 40.2 | |

(b) Adjustment gives effect to the Perfection acquisition, which was completed effective December 1, 2023, as if the Perfection acquisition had occurred on January 1, 2023, by including management’s estimate of the pre-acquisition Adjusted EBITDA of Perfection for the period January 1, 2023 through November 30, 2023. This estimate does not include any contributions from synergies or cost savings management expects to achieve in the future. The following is a reconciliation of earnings before income taxes to Adjusted EBITDA for Perfection:

| | | | | |

| January 1, 2023

through

November 30, 2023 |

| (In millions) |

| Earnings before income taxes | $ | 14.4 | |

| Depreciation and amortization | 5.9 | |

| Interest expense, net | 3.1 | |

| Perfection Adjusted EBITDA | $ | 23.4 | |

(6) We present Net Debt (as adjusted) as a further supplemental measure of financial position. Net Debt (as adjusted) is defined as (a) the aggregate principal amount of our long term debt of $6,339.4 million less (b) cash and cash equivalents of $132.6 million, in each case after giving effect to the issuance of the notes offered hereby and the other financing transactions, as if each of the foregoing transactions had occurred on December 31, 2023 and, in the case of cash and cash equivalents, after giving effect to the payment of accrued and unpaid interest, the termination of certain interest rate swaps in connection with the other financing transactions and estimated costs, fees and expenses with respect to such transactions.

(7) We present Ratio of Net Debt (as adjusted) to Acquisition Adjusted EBITDA as a further supplemental measure of financial position. Ratio of Net Debt (as adjusted) to Acquisition Adjusted EBITDA represents the ratio of our Net Debt (as adjusted) as of December 31, 2023 (calculated as described above in note (6)) to our Acquisition Adjusted EBITDA for the twelve month period ended December 31, 2023 (calculated as described above in note (5)).

(8) Includes unamortized debt issuance costs and unamortized debt premiums, net of unamortized debt discounts of $11.6 million at September 30, 2022, $9.5 million at September 30, 2023 and $8.6 million at December 31, 2023.

Exhibit 99.2

Post Holdings Announces Commencement of Senior Secured Notes Offering

ST. LOUIS, February 5, 2024 - Post Holdings, Inc. (NYSE:POST) (the “Company” or “Post”) today announced it intends to commence a private offering to eligible purchasers, subject to market and other conditions, of $875.0 million in aggregate principal amount of senior secured notes due 2032 (the “Notes”). The Notes will be secured obligations of the Company and will be guaranteed on a senior secured basis by each of the Company’s existing and subsequently acquired or organized wholly-owned domestic subsidiaries that guarantee the Company’s credit agreement or certain of its other indebtedness; however, immaterial subsidiaries, receivables finance subsidiaries and subsidiaries the Company designates as unrestricted subsidiaries will not be required to guarantee the Notes.

The Company intends to use the net proceeds from the Notes offering, together with cash on hand, for purposes of repaying in full its outstanding $400.0 million incremental term loan under its credit agreement, which the Company borrowed in April 2023, redeeming its existing 5.75% senior notes due 2027 and paying the premiums, costs, fees and expenses associated with the offering, the term loan repayment and the notes redemption. To the extent there are any remaining net proceeds, the Company intends to use such proceeds for general corporate purposes, which could include, among other things, retirement or repayment of existing debt, acquisitions, share repurchases, capital expenditures and working capital. The final terms and amounts of the Notes are subject to market and other conditions and may be materially different than expectations. The offering is not conditioned upon the consummation of the redemption of the Company’s 5.75% senior notes due 2027, which is expected to occur on March 1, 2024.

The Notes and the related subsidiary guarantees are being offered to persons reasonably believed to be qualified institutional buyers in an offering exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and to non-U.S. persons outside of the United States in compliance with Regulation S under the Securities Act. The Notes and the related subsidiary guarantees have not been registered under the Securities Act, or any state securities laws, and unless so registered, may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws.

This press release is not an offer to sell or a solicitation of an offer to buy any security, nor shall there be any sales of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any jurisdiction. This press release is being issued pursuant to and in accordance with Rule 135c under the Securities Act. This press release is not a notice of redemption with respect to the 5.75% senior notes due 2027.

Cautionary Statement on Forward-Looking Language

Forward-looking statements, within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, are made throughout this press release, including statements regarding the anticipated terms of the Notes being offered, the completion, timing and size of the offering and the intended use of the net proceeds of the offering. These forward-looking statements are sometimes identified from the use of forward-looking words such as “believe,” “should,” “could,” “potential,” “continue,” “expect,” “project,” “estimate,” “predict,” “anticipate,” “aim,” “intend,” “plan,” “forecast,” “target,” “is likely,” “will,” “can,” “may” “would” or the negative of these terms or similar expressions elsewhere in this press release. All forward-looking statements are subject to a number of important factors, risks, uncertainties and assumptions that could cause actual results to differ materially from those described in any forward-looking statements. These factors and risks include, but are not limited to, unanticipated developments that prevent, delay or negatively impact the offering and other financial, operational and legal risks and uncertainties detailed from time to time in the Company’s cautionary statements contained in its filings with the Securities and Exchange Commission. The Company may not

consummate the offering as described in this press release and, if the offering is consummated, cannot provide any assurance regarding the final terms of the offering or the Notes or its ability to effectively apply the net proceeds as described above. These forward-looking statements represent the Company’s judgment as of the date of this press release. The Company disclaims, however, any intent or obligation to update these forward-looking statements. There can be no assurance that the proposed offering will be completed as anticipated or at all.

About Post Holdings, Inc.

Post Holdings, Inc., headquartered in St. Louis, Missouri, is a consumer packaged goods holding company with businesses operating in the center-of-the-store, refrigerated, foodservice and food ingredient categories.

Contact:

Investor Relations

Daniel O’Rourke

daniel.orourke@postholdings.com

(314) 806-3959

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

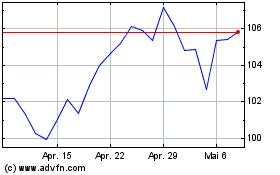

Post (NYSE:POST)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Post (NYSE:POST)

Historical Stock Chart

Von Mai 2023 bis Mai 2024