UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 16, 2024

Pyrophyte Acquisition Corp.

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

001-40957 |

|

N/A |

(State or incorporation

or organization) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

3262 Westheimer Road

Suite 706

Houston, Texas |

|

77098 |

| (Address of principal executive offices) |

|

(Zip Code) |

(281) 701-4234

Registrant’s telephone number, including

area code

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class registered |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

PHYT.U |

|

The New York Stock Exchange |

| Class A ordinary shares, par value $0.0001 per share |

|

PHYT |

|

The New York Stock Exchange |

| Redeemable warrants, each warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

PHYT WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

As previously announced, on November 13, 2023, Pyrophyte

Acquisition Corp., a Cayman Islands exempted company (“Pyrophyte”), entered into a business combination agreement

with Sio Silica Corporation, an Alberta corporation (“Sio”), and the other parties thereto (the

transactions contemplated by the business combination agreement, the “Business Combination”).

On February 16, 2024, Sio released a

statement regarding the Manitoba government’s denial of its sand extraction permit.

The information in this Item 7.01, including Exhibit

99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to

liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of Pyrophyte under the Securities

Act or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be

deemed an admission as to the materiality of any information of the information in this Item 7.01, including Exhibit 99.1.

Additional Information

about the Business Combination and Where to Find It

In connection with the

Business Combination, Sio Silica Incorporated, a newly-formed Alberta corporation (“Sio Newco” and after the

transactions in connection with the Business Combination, “Pubco”) intends to publicly file a registration statement

on Form F-4 with the U.S. Securities and Exchange Commission (the “SEC”), which will include a preliminary proxy

statement of Pyrophyte and a preliminary prospectus of Pubco. After such registration statement on Form F-4 is declared effective, Pyrophyte

will mail the definitive proxy statement/prospectus relating to the Business Combination to Pyrophyte’s shareholders as of a record

date to be established for voting on the Business Combination. The registration statement on Form F-4, including the proxy statement/prospectus

contained therein, will contain important information about the Business Combination and the other matters to be voted upon at Pyrophyte’s

extraordinary general meeting of its shareholders to be held to consider, among other things, approval of the Business Combination (the

“Pyrophyte Shareholders Meeting”). This communication does not contain all the information that should be considered

concerning the Business Combination and other matters and is not intended to provide the basis for any investment decision or any other

decision in respect of such matters. Pyrophyte and Pubco may also file other documents with the SEC regarding the Business Combination.

Pyrophyte’s shareholders and other interested persons are advised to read, when available, the registration statement on Form F-4,

including the preliminary proxy statement/prospectus contained therein, and the amendments thereto and the definitive proxy statement/prospectus

and other documents filed in connection with the Business Combination, as these materials will contain important information about Pyrophyte,

Sio, Pubco and the Business Combination.

Pyrophyte’s shareholders

and other interested persons will be able to obtain, when available, copies of the registration statement on Form F-4, including the preliminary

proxy statement/prospectus contained therein, the definitive proxy statement/prospectus and other documents filed or that will be filed

with the SEC, free of charge, by Pyrophyte and Pubco through the website maintained by the SEC at www.sec.gov.

Participants in

Solicitation

Pyrophyte, Sio, Pubco

and their respective directors and officers may be deemed participants in the solicitation of proxies of Pyrophyte’s shareholders

in connection with the Business Combination. More detailed information regarding the directors and officers of Pyrophyte, and a description

of their interests in Pyrophyte, is contained in Pyrophyte’s filings with the SEC, including its Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, which was filed with the SEC on April 12, 2023, and is available free of charge at the SEC’s

website at www.sec.gov. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies

of Pyrophyte’s shareholders in connection with the Business Combination and other matters to be voted upon at the Pyrophyte Shareholders

Meeting will be set forth in the registration statement on Form F-4 for the Business Combination when available.

Forward-Looking

Statements

This Current Report on

Form 8-K includes certain statements that may constitute “forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements include, but are not limited to, statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,”

“plan,” “possible,” “potential,” “predict,” “project,” “seek,”

“should,” “target,” “would” and similar expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not forward-looking. Forward-looking statements may include, for example, statements

about the Pyrophyte or Sio’s ability to effectuate the Business Combination discussed in this document; the benefits of the Business

Combination; the future financial performance of Pubco (which will be the go-forward public company following the completion of the business

combination) following the transactions; changes in Sio’s strategy, future operations, financial position, estimated revenues and

losses, projected costs, prospects, plans and objectives of management. These forward-looking statements are based on information available

as of the date of this document, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties.

Accordingly, forward-looking statements should not be relied upon as representing Pyrophyte, Sio or Pubco’s views as of any subsequent

date, and none of Pyrophyte, Sio or Pubco undertakes any obligation to update forward-looking statements to reflect events or circumstances

after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable

securities laws. Neither Pubco nor Pyrophyte gives any assurance that either Pubco or Pyrophyte will achieve its expectations. You should

not place undue reliance on these forward-looking statements. As a result of a number of known and unknown risks and uncertainties, Pubco’s

actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors

that could cause actual results to differ include: (i) the timing to complete the Business Combination by Pyrophyte’s business combination

deadline and the potential failure to obtain an extension of the business combination deadline if sought by Pyrophyte; (ii) the occurrence

of any event, change or other circumstances that could give rise to the termination of the definitive agreements relating to the Business

Combination; (iii) the outcome of any legal, regulatory or governmental proceedings that may be instituted against Pubco, Pyrophyte, Sio

or any investigation or inquiry following announcement of the Business Combination, including in connection with the Business Combination;

(iv) the inability to complete the Business Combination due to the failure to obtain approval of Pyrophyte’s or Sio’s shareholders;

(v) Sio’s and Pubco’s success in retaining or recruiting, or changes required in, its officers, key employees or directors

following the Business Combination; (vi) the ability of the parties to obtain the listing of Pubco’s common shares and warrants

on the New York Stock Exchange or another national securities exchange upon the closing of the Business Combination; (vii) the risk that

the Business Combination disrupts current plans and operations of Sio; (viii) the ability to recognize the anticipated benefits of the

Business Combination; (ix) unexpected costs related to the Business Combination; (x) the amount of redemptions by Pyrophyte’s public

shareholders being greater than expected; (xi) the management and board composition of Pubco following completion of the Business Combination;

(xii) limited liquidity and trading of Pubco’s securities; (xiii) geopolitical risk and changes in applicable laws or regulations;

(xiv) the possibility that Sio or Pyrophyte may be adversely affected by other economic, business, and/or competitive factors; (xv) operational

risks; (xvi) litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional

costs and demands on Sio’s resources; (xvii) the risk that the consummation of the Business Combination is substantially delayed

or does not occur; and (xix) other risks and uncertainties indicated from time to time in the registration statement on Form F-4, when

available, including those under “Risk Factors” therein, and in Pyrophyte’s other filings with the SEC.

No Offer or Solicitation

This communication relates

to a Business Combination between Sio and Pyrophyte. This document does not constitute a solicitation of a proxy, consent or authorization

with respect to any securities or in respect of the Business Combination. This document does not constitute an offer to sell or exchange,

or the solicitation of an offer to buy or exchange, any securities, nor shall there be any offer, sale or exchange of securities in any

state or jurisdiction in which such offer, solicitation, sale or exchange would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act or an exemption therefrom.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits. The following exhibits are

filed with this Current Report on Form 8-K:

| * | Certain

schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule or exhibit will

be furnished supplementally to the SEC upon request. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PYROPHYTE ACQUISITION CORP. |

| |

|

| Date: February 20, 2024 |

By: |

/s/ Sten Gustafson |

| |

|

Name: |

Sten Gustafson |

| |

|

Title: |

Chief Financial Officer |

4

Exhibit 99.1

| FOR IMMEDIATE RELEASE |

MEDIA CONTACT: info@siosilica.com |

February 16, 2024

Sio’s Statement on Minister Schmidt’s Decision Today

This is a huge loss for Manitoba and Canada as a whole. Of course,

we are disappointed with the decision of the NDP Government today on our licence, especially in light of the fact that Sio was advised

that the province had no more questions. In fact, Minister Schmidt declined meeting requests and has never shared with Sio any concerns

her office or the department may have had. The Sio Silica project is not dangerous or unproven. The safety and feasibility to proceed

has been confirmed by some of the largest global engineering firms and respected independent experts. The analysis from these experts

has been reviewed independently by all interested provincial government departments, through the lens of the Technical Advisory Committee

(“TAC”), and finally by the Clean Environment Commission (“CEC”). All required technical reviews have been completed

and the final CEC report recommendations have been incorporated into the draft license, which has been thoroughly reviewed and finalized

by the Environmental Approvals Branch. As the Minister pointed out, the decision was unilaterally hers based on Minister Schmidt’s

opinion of the environmental concerns, and not based on feedback from the Environmental Approvals Branch who had oversight and review

of this application.

It is also unfortunate that this decision was political and not based

on science or facts. This is supported by the fact that Sio was not given prior notice of the decision nor provided with an opportunity

to provide a response in advance of the public announcement. Sio and the general public as a whole were not notified that an announcement

would be occurring today, yet there were many participants in the gallery that were gathered for no other reason but to applaud this decision.

It is interesting that some select members of the public were provided the privilege to be in attendance while the company and the majority

of Manitobans were left in the dark.

A draft licence was circulated to Sio in September of 2023 from the

Approvals Branch with a phased approach requiring Sio to conduct initial multi-well testing, rigorous data collection and a final report

on findings as well as a Cumulative Effects Assessment all before proceeding with commercial-scale extraction. All recommendations from

the CEC were included in the draft licence and Sio accepted these recommendations from the findings of the CEC and conveyed that acceptance

to the Provincial Government. This draft licence was known to the current NDP government. This staged approach would have required Sio

to address any remaining environmental and technical concerns the Government may have had with the commercial extraction process, before

any commercial extraction actually occurred.

This is also unfortunate news for Indigenous groups in Manitoba. The

company was working with Peguis Special Projects and Consultation to conduct environmental monitoring for the project. This independent

organization is going to have their hand on the stop button if they see any changes in the groundwater. Sio has also entered into discussions

with Broken Head Ojibway Nation for the location of advanced manufacturing facilities on their lands. Peguis Special Projects and Consultation

and Broken Head Ojibway Nation are going to meaningfully participate in the development of our project through education, jobs, benefits,

and revenues. These benefits will disappear if the project is cancelled.

Although the decision today was not based on economic contribution

to the Province, Sio and RCT have had active dialogue with the NDP for over 12 months and it is a known fact that RCT and Sio are contingent

upon each other. Unfortunately, Manitoba will now lose RCT as the Province has not licenced the resource pure enough for RCT’s stringent

requirements. Sio has continuously advised this government that Manitoba was one of three sites being considered in North America for

RCT. All sites are known to the NDP, and with this decision RCT will not be in Manitoba.

Sio remains hopeful that the government will be open to discussing

solutions that are grounded in science and do not squander this multi-generational opportunity for the people of Manitoba. In the meantime,

Sio will take the coming weeks to evaluate its legal options in the face of the Minister’s decision today.

Sio Silica Corporation P.O. Box 42 Suite 1930,

440 - 2nd Ave. SW Calgary, Alberta T2P 5E9

Phone: 403.265.1425 Email: info@siosilica.com www.siosilica.com |

|

|

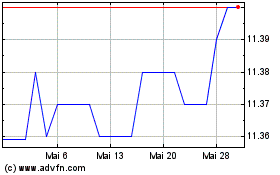

Pyrophyte Acquisition (NYSE:PHYT)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Pyrophyte Acquisition (NYSE:PHYT)

Historical Stock Chart

Von Mai 2023 bis Mai 2024