false000070882100007088212024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 27, 2024

PAR Technology Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 1-09720 | 16-1434688 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

PAR Technology Park, 8383 Seneca Turnpike, New Hartford, New York 13413-4991

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (315) 738-0600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock | PAR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2024, PAR Technology Corporation (“Company”) issued a press release to report its financial results for the quarter and year ended December 31, 2023. A copy of the press release is attached to this current report on Form 8-K as Exhibit 99.1.*

Item 7.01 Regulation FD Disclosure.

There will be a conference call at 9:00 a.m. (Eastern) on February 27, 2024, during which management will discuss the Company’s financial results for the fourth quarter and year ended December 31, 2023. To participate on the conference call, please register in advance via the link provided at https://www.partech.com/investor-relations/. After registering, a confirmation email will be sent including dial-in details and unique conference call codes for entry. Registration is open through the live call, but to ensure you are connected for the full call we suggest registering at least 10 minutes before the start of the call. The conference call will also be webcast live. To access the webcast, please visit https://www.partech.com/investor-relations/; a recording of the webcast will be available on the site after the event.

The Company's quarterly earnings presentation containing additional information for the quarter and year ended December 31, 2023 is attached to this current report on Form 8-K as Exhibit 99.2.*

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | | | | |

| * | The information in Item 2.02, Item 7.01, Exhibit 99.1 and 99.2 of this current report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | PAR TECHNOLOGY CORPORATION |

| | (Registrant) |

| | |

| Date: | February 27, 2024 | /s/ Bryan A. Menar |

| | Bryan A. Menar |

| | Chief Financial Officer |

| | (Principal Financial Officer) |

Exhibit 99.1

| | | | | |

FOR RELEASE: CONTACT: | New Hartford, NY, February 27, 2024 Christopher R. Byrnes (315) 738-0600 ext. 6226 cbyrnes@partech.com, www.partech.com |

PAR TECHNOLOGY CORPORATION ANNOUNCES FOURTH QUARTER AND FULL YEAR 2023 RESULTS

•Total quarterly revenues increased 10.3% year-over-year from Q4 '22

•Total annual revenues increased 16.9% year-over-year from 2022

•Annual subscription service revenues increased 25.7% year-over-year from 2022

•Annual Recurring Revenue (ARR)(1) grew to $136.9 million - a 22.8% increase from $111.4 million reported in Q4 '22

New Hartford, NY- February 27, 2024 -- PAR Technology Corporation (NYSE: PAR) (“PAR Technology” or the “Company”) today announced its financial results for its fourth quarter and for the year ended December 31, 2023.

Summary of Fiscal 2023 Fourth Quarter

•Revenues were reported at $107.7 million for the fourth quarter of 2023, a 10.3% or $10.1 million increase compared to $97.7 million for the same period in 2022.

•Net loss for the fourth quarter of 2023 was $18.6 million, or $0.67 net loss per share, compared to a net loss of $13.5 million, or $0.50 net loss per share reported for the same period in 2022.

•EBITDA(1) for the fourth quarter of 2023 was a loss of $8.8 million compared to a loss of $4.6 million for the same period in 2022.

•Adjusted EBITDA(1) for the fourth quarter of 2023 was a loss of $4.5 million compared to Adjusted EBITDA loss of $2.8 million for the same period in 2022.

•Adjusted net loss(1) for the fourth quarter of 2023 was $9.3 million, or $0.33 adjusted diluted net loss per share(1), compared to an adjusted net loss of $7.0 million, or $0.26 adjusted diluted net loss per share, for the same period in 2022.

Summary of Full Year Financial Results

•Revenues were reported at $415.8 million for the year ended December 31, 2023, an increase of 16.9% or $60.0 million when compared to $355.8 million for the same period in 2022.

•Net loss for the year ended December 31, 2023 was $69.8 million, or $2.53 net loss per share, compared to a net loss of $69.3 million, or $2.55 net loss per share reported for the same period in 2022.

•EBITDA for the year ended December 31, 2023 was a loss of $33.4 million compared to an EBITDA loss of $33.2 million for the same period in 2022.

•Adjusted EBITDA for the year ended December 31, 2023 was a loss of $25.8 million compared to an Adjusted EBITDA loss of $18.8 million for the same period in 2022.

•Adjusted net loss for the year ended December 31, 2023 was $42.0 million, or $1.52 adjusted diluted net loss per share, compared to an adjusted net loss of $35.9 million, or $1.32 adjusted diluted net loss per share, for the same period in 2022.

Reconciliations and descriptions of non-GAAP financial measures to corresponding GAAP financial measures are included in the tables at the end of this press release.

_______

(1) See “Key Performance Indicators and Non-GAAP Financial Measures” below.

The Company's key performance indicators ARR, Activations, Bookings, and Active Sites(1) are grouped into three subscription service product lines: Guest Engagement (Punchh and MENU), Operator Solutions (Brink POS, PAR Pay, and PAR Payment Services), and Back Office (Data Central).

Highlights of Guest Engagement – Fourth Quarter 2023(1):

•ARR at end of Q4 '23 totaled $63.8 million

•New store Activations in Q4 '23 totaled approximately 3,200 sites

•Active Sites as of December 31, 2023 totaled approximately 70.8 thousand restaurants

Highlights of Operator Solutions – Fourth Quarter 2023(1):

•ARR at end of Q4 '23 totaled $60.2 million

•New store Activations in Q4 '23 totaled approximately 1,200 sites

•Bookings in Q4 '23 totaled approximately 3,400 sites

•Active Sites as of December 31, 2023 totaled approximately 23.3 thousand restaurants

Highlights of Back Office – Fourth Quarter 2023(1):

•ARR at end of Q4 '23 totaled $13.0 million

•New store Activations in Q4 '23 totaled approximately 400 sites

•Active Sites as of December 31, 2023 totaled approximately 7.7 thousand restaurants

Savneet Singh, PAR Technology CEO, commented on the results, "We are pleased to cap off the year with strong fourth quarter results as our subscription services revenue and ARR growth continues to drive our performance. Our strong results stem from the continued strength in our unified commerce platform, as the world’s most innovative enterprise restaurants turn to PAR to help them accelerate their digital initiatives. Evidenced by our notable new customer wins that include Burger King, Hooters of America and Bob Evans to name a select few. Our Q4 performance marked the end of an exciting year for PAR as we delivered on our vision for the digital restaurant. In the quarter we began to build out our capabilities in order to hit the ground running with the Burger King rollout and also to prepare for the significant number of deals coming to market in early ’24. We have begun the new year with improved visibility, clear new business opportunities and a resilient end market. I’m confident in the team we have on board and the opportunity ahead for our Company."

Earnings Conference Call.

There will be a conference call at 9:00 a.m. (Eastern) on February 27, 2024, during which management will discuss the Company's financial results for the fourth quarter and year ended December 31, 2023. To participate on the conference call, please register in advance via the link provided at https://www.partech.com/investor-relations/. After registering, a confirmation email will be sent including dial-in details and unique conference call codes for entry. Registration is open through the live call, but to ensure you are connected for the entire call we suggest registering at least 10 minutes before the start of the call. The conference call will also be webcast live. To access the webcast, please visit https://www.partech.com/investor-relations/; a recording of the webcast will be available on the site after the event.

About PAR Technology Corporation.

For more than 40 years, PAR Technology Corporation’s (NYSE Symbol: PAR) cutting-edge products and services have helped bold and passionate restaurant brands build lasting guest relationships. We are the partner enterprise restaurants rely on when they need to serve amazing moments from open to close, during the most hectic rush hours, and when the world forces them to adapt and overcome. More than 70,000 restaurants in more than 110 countries use PAR’s restaurant point-of-sale, customer loyalty and engagement, payments, omnichannel digital ordering and delivery, and back-office software solutions as well as industry leading hardware and drive-thru offerings. To learn more, visit partech.com or connect with us on LinkedIn, Twitter, Facebook, and Instagram. The Company's Environmental, Social, and Governance report can be found at https://www.partech.com/company/ESG.

_______

(1) See “Key Performance Indicators and Non-GAAP Financial Measures” below.

Key Performance Indicators and Non-GAAP Financial Measures.

We monitor certain key performance indicators and non-GAAP financial measures in the evaluation and management of our business; certain key performance indicators and non-GAAP financial measures are provided in this press release as we believe they are useful in facilitating period-to-period comparisons of our business performance. Key performance indicators and non-GAAP financial measures do not reflect and should be viewed independently of our financial performance determined in accordance with GAAP. Key performance indicators and non-GAAP financial measures are not forecasts or indicators of future or expected results and should not have undue reliance placed upon them by investors.

Where non-GAAP financial measures are included in this press release, the most directly comparable GAAP financial measures and a detailed reconciliation between GAAP and non-GAAP financial measures is included in this press release under “Non-GAAP Financial Measures”.

Unless otherwise indicated, financial and operating data included in this presentation is as of December 31, 2023.

As used in this press release,

“Annual Recurring Revenue” or “ARR” is the annualized revenue from subscription services, including subscription fees for our SaaS solutions, related software support, and transaction-based payment processing services. We calculate ARR by annualizing the monthly subscription service revenue for all Active Sites as of the last day of each month for the respective reporting period.

“Active Sites” represent locations active on PAR’s subscription services as of the last day of the respective fiscal period.

“Activations” are calculated as of the end of each month based on the number of customers that have initiated use of our subscription services. Once “activated”, PAR begins to invoice/bill the customer. In specific cases with Punchh, invoicing takes place before activation take place.

“Bookings” are a customer purchase order for subscription services; upon PAR's acceptance, the customer is obligated to purchase the subscription service and pay PAR for the subscription services. In specific cases with Punchh, bookings are added at the time of execution of the relevant master services agreement.

Trademarks.

“PAR®,” “Brink POS®,” “Punchh®,” “MENUTM,” “Data Central®,” "PAR® Pay”, “PAR® Payment Services” and other trademarks appearing in this press release belong to us.

Forward-Looking Statements.

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, Section 27A of the Securities Act of 1933, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical in nature, but rather are predictive of our future operations, financial condition, financial results, business strategies and prospects. Forward-looking statements are generally identified by words such as “anticipate,” “believe,” “belief,” “continue,” “could,” “expect,” “estimate,” “intend,” “may,” “opportunity,” “plan,” “should,” “will,” “would,” “will likely result,” and similar expressions. Forward-looking statements are based on management's current expectations and assumptions that are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause our actual results to differ materially from those expressed in or implied by forward-looking statements contained in this press release on our business, financial condition, and results of operations. Factors, risks, trends and uncertainties that could cause our actual results to differ materially from those expressed in or implied by forward-looking statements contained in this press release include, among others, unfavorable macroeconomic conditions, such as recession or slowed economic growth, fluctuating interest rates, inflation, and changes in consumer confidence and discretionary spending; geopolitical events, including the effects of the Russia-Ukraine war, tensions with China and between China and Taiwan, the Israel-Hamas conflict and other hostilities in the Middle East; the competitive marketplace for talent and its impact on employee recruitment and retention; component shortages, inventory management, and/or manufacturing disruptions and logistics challenges; risks associated with our international operations; the effects of global pandemics, such as COVID-19, or other public health crises; our ability to maintain proper and effective internal control over financial reporting; changes in estimates and assumptions we make in connection with the preparation of our financial statements, in building our business and operational plans, and in executing our strategies; and the other factors, risks, trends and uncertainties discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on the information available to us on the date hereof. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

###

PAR TECHNOLOGY CORPORATION

CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands, except share amounts)

| | | | | | | | | | | |

| Assets | December 31, 2023 | | December 31, 2022 |

| Current assets: | | | |

| Cash and cash equivalents | $ | 37,369 | | | $ | 70,328 | |

| Cash held on behalf of customers | 10,170 | | | 7,205 | |

| Short-term investments | 37,194 | | | 40,290 | |

| Accounts receivable – net | 63,382 | | | 59,960 | |

| Inventories | 23,594 | | | 37,594 | |

| Other current assets | 8,890 | | | 8,572 | |

| Total current assets | 180,599 | | | 223,949 | |

| Property, plant and equipment – net | 15,755 | | | 12,961 | |

| Goodwill | 489,654 | | | 486,762 | |

| Intangible assets – net | 94,852 | | | 111,097 | |

| Lease right-of-use assets | 4,083 | | | 4,061 | |

| Other assets | 17,663 | | | 16,028 | |

| Total Assets | $ | 802,606 | | | $ | 854,858 | |

| | | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities: | | | |

| | | |

| Accounts payable | $ | 29,808 | | | $ | 23,283 | |

| Accrued salaries and benefits | 19,141 | | | 18,936 | |

| Accrued expenses | 10,443 | | | 6,531 | |

| Customers payable | 10,170 | | | 7,205 | |

| Lease liabilities – current portion | 1,366 | | | 1,307 | |

| Customer deposits and deferred service revenue | 9,304 | | | 10,562 | |

| Total current liabilities | 80,232 | | | 67,824 | |

| Lease liabilities – net of current portion | 2,819 | | | 2,868 | |

| Long-term debt | 377,647 | | | 389,192 | |

| Deferred service revenue – noncurrent | 4,204 | | | 5,125 | |

| Other long-term liabilities | 4,639 | | | 14,655 | |

| Total liabilities | 469,541 | | | 479,664 | |

| | | |

| Shareholders’ equity: | | | |

| Preferred stock, $.02 par value, 1,000,000 shares authorized | — | | | — | |

| Common stock, $.02 par value, 58,000,000 shares authorized; 29,386,234 and 28,589,567 shares issued, 28,029,915 and 27,319,045 outstanding at December 31, 2023 and December 31, 2022, respectively | 584 | | | 570 | |

| Additional paid in capital | 625,154 | | | 595,286 | |

| Accumulated deficit | (274,956) | | | (205,204) | |

| Accumulated other comprehensive loss | (939) | | | (1,365) | |

Treasury stock, at cost, 1,356,319 and 1,270,522 shares at December 31, 2023 and December 31, 2022, respectively | (16,778) | | | (14,093) | |

| Total shareholders’ equity | 333,065 | | | 375,194 | |

| Total Liabilities and Shareholders’ Equity | $ | 802,606 | | | $ | 854,858 | |

PAR TECHNOLOGY CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues, net: | | | | | | | |

| Hardware | $ | 24,400 | | | $ | 29,590 | | | $ | 103,391 | | | $ | 114,410 | |

| Subscription service | 32,897 | | | 27,908 | | | 122,597 | | | 97,499 | |

| Professional service | 12,603 | | | 13,479 | | | 50,726 | | | 50,438 | |

| Contract | 37,808 | | | 26,673 | | | 139,109 | | | 93,448 | |

| Total revenues, net | 107,708 | | | 97,650 | | | 415,823 | | | 355,795 | |

| Costs of sales: | | | | | | | |

| Hardware | 17,317 | | | 22,558 | | | 80,319 | | | 92,224 | |

| Subscription service | 17,080 | | | 13,092 | | | 63,735 | | | 47,424 | |

| Professional service | 11,289 | | | 10,333 | | | 43,214 | | | 40,982 | |

| Contract | 35,621 | | | 25,516 | | | 130,245 | | | 85,872 | |

| Total cost of sales | 81,307 | | | 71,499 | | | 317,513 | | | 266,502 | |

| Gross margin | 26,401 | | | 26,151 | | | 98,310 | | | 89,293 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 9,508 | | | 9,210 | | | 38,513 | | | 34,900 | |

| General and administrative | 18,640 | | | 16,700 | | | 68,992 | | | 66,319 | |

| Research and development | 14,493 | | | 14,858 | | | 58,356 | | | 48,643 | |

| Amortization of identifiable intangible assets | 465 | | | 464 | | | 1,858 | | | 1,863 | |

| Adjustment to contingent consideration liability | (1,700) | | | (4,400) | | | (9,200) | | | (4,400) | |

| Gain on insurance proceeds | — | | | — | | | (500) | | | — | |

| Total operating expenses | 41,406 | | | 36,832 | | | 158,019 | | | 147,325 | |

| Operating loss | (15,005) | | | (10,681) | | | (59,709) | | | (58,032) | |

| Other expense, net | (152) | | | (420) | | | (489) | | | (1,224) | |

| Loss on extinguishment of debt | (635) | | | — | | | (635) | | | — | |

| Interest expense, net | (1,779) | | | (1,757) | | | (6,931) | | | (8,811) | |

| Loss before provision for income taxes | (17,571) | | | (12,858) | | | (67,764) | | | (68,067) | |

| Provision for income taxes | (1,058) | | | (623) | | | (1,988) | | | (1,252) | |

| Net loss | $ | (18,629) | | | $ | (13,481) | | | $ | (69,752) | | | $ | (69,319) | |

| Net loss per share (basic and diluted) | $ | (0.67) | | | $ | (0.50) | | | $ | (2.53) | | | $ | (2.55) | |

| Weighted average shares outstanding (basic and diluted) | 27,968 | | | 27,118 | | | 27,552 | | | 27,152 | |

PAR TECHNOLOGY CORPORATION

SUPPLEMENTAL INFORMATION

(Unaudited)

The following table sets forth certain unaudited supplemental financial data for the eight trailing quarters indicated:

Segment Revenue by Product Line:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 |

in thousands | Q4 | | Q3 | | Q2 | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 |

| Restaurant/Retail | | | | | | | | | | | | | | | |

| Hardware | $ | 24,400 | | | $ | 25,824 | | | $ | 26,390 | | | $ | 26,777 | | | $ | 29,590 | | | $ | 31,343 | | | $ | 28,390 | | | $ | 25,073 | |

| Subscription service | 32,897 | | | 31,363 | | | 30,372 | | | 27,965 | | | 27,908 | | | 25,170 | | | 23,150 | | | 21,285 | |

| Professional service | 12,603 | | | 11,514 | | | 12,767 | | | 13,842 | | | 13,479 | | | 11,840 | | | 12,631 | | | 12,488 | |

| Total Restaurant/Retail | $ | 69,900 | | | $ | 68,701 | | | $ | 69,529 | | | $ | 68,584 | | | $ | 70,977 | | | $ | 68,353 | | | $ | 64,171 | | | $ | 58,846 | |

| | | | | | | | | | | | | | | |

| Government | | | | | | | | | | | | | | | |

| Mission systems | $ | 8,174 | | | $ | 8,808 | | | $ | 9,218 | | | $ | 9,383 | | | $ | 8,678 | | | $ | 8,982 | | | $ | 8,883 | | | $ | 8,915 | |

| Intelligence, surveillance, and reconnaissance solutions | 29,152 | | | 29,275 | | | 21,510 | | | 22,216 | | | 17,394 | | | 14,710 | | | 11,747 | | | 12,290 | |

| Commercial software | 482 | | | 350 | | | 287 | | | 254 | | | 601 | | | 722 | | | 292 | | | 234 | |

| Total Government | $ | 37,808 | | | $ | 38,433 | | | $ | 31,015 | | | $ | 31,853 | | | $ | 26,673 | | | $ | 24,414 | | | $ | 20,922 | | | $ | 21,439 | |

| | | | | | | | | | | | | | | |

| Total Revenue | $ | 107,708 | | | $ | 107,134 | | | $ | 100,544 | | | $ | 100,437 | | | $ | 97,650 | | | $ | 92,767 | | | $ | 85,093 | | | $ | 80,285 | |

Non-GAAP Financial Measures

The Company reports its financial results in accordance with GAAP. However, the non-GAAP financial measures set forth in the reconciliation tables below are provided because management uses these non-GAAP financial measures in evaluating the results of the Company's continuing operations and believes this information provides investors supplemental insight into underlying business trends and operating results. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP. While we believe that these non-GAAP financial measures provide useful supplemental information to investors, there are limitations associated with the use of these non-GAAP financial measures. In addition, these non-GAAP financial measures should be read in conjunction with the Company’s unaudited interim condensed consolidated financial statements prepared in accordance with GAAP.

Within this press release, the Company makes reference to EBITDA, adjusted EBITDA, adjusted net loss, and adjusted diluted net loss per share which are non-GAAP financial measures. EBITDA represents net loss before income taxes, interest expense, and depreciation and amortization. Adjusted EBITDA represents EBITDA as adjusted to exclude certain non-cash and non-recurring charges including stock-based compensation, acquisition expenses, certain pending litigation expenses, and other non-recurring charges that may not be indicative of our financial performance; and adjusted net loss and adjusted diluted net loss per share represents the exclusion of amortization of acquired intangible assets, certain non-cash and non-recurring charges, including stock-based compensation, acquisition expense, certain pending litigation expenses, and other non-recurring charges that may not be indicative of our financial performance.

The Company is presenting adjusted EBITDA and adjusted net loss because we believe that these financial measures provide supplemental information that may be useful to investors in evaluating the Company's core business operating results and comparing such results to other similar companies. Management believes that adjusted EBITDA and adjusted net loss, when viewed with the Company's results of operations in accordance with GAAP and the reconciliations to the most directly comparable GAAP measures provided in the tables below, provide useful information about operating performance and period-over-period growth, and provide additional information that is useful for evaluating the operating performance of the Company's core business without regard to potential distortions. Management also believes that adjusted EBITDA provides investors with insight into factors and trends that could affect the Company's ongoing cash earnings, from which capital investments are made and debt is serviced.

The Company's results of operations are impacted by certain non-cash and non-recurring charges, including stock-based compensation, acquisition related expenditures, and other non-recurring charges that may not be indicative of the Company’s financial performance. Management believes that adjusting its net loss and diluted loss per share to remove non-recurring charges provides a useful perspective with respect to the Company's operating results and provides supplemental information to both management and investors by removing items that are difficult to predict and are often unanticipated.

EBITDA, adjusted EBITDA, adjusted net loss, and adjusted diluted net loss per share are not measures of financial performance or liquidity under GAAP and, accordingly, should not be considered as alternatives to net income (loss) or cash flow from operating activities as indicators of operating performance or liquidity. Also, these measures may not be comparable to similarly titled captions of other companies. The tables below provide reconciliations between net loss and EBITDA, adjusted EBITDA and adjusted net loss, as well as diluted loss per share and adjusted diluted loss per share.

The following tables set forth certain unaudited supplemental financial and other data for the periods indicated:

| | | | | | | | | | | |

| Three Months Ended December 31, |

| in thousands | 2023 | | 2022 |

| Reconciliation of Net Loss to EBITDA and Adjusted EBITDA | | | |

| Net loss | $ | (18,629) | | | $ | (13,481) | |

| Provision for income taxes | 1,058 | | | 623 | |

| Interest expense | 1,779 | | | 1,757 | |

| Depreciation and amortization | 7,001 | | | 6,502 | |

| EBITDA | $ | (8,791) | | | $ | (4,599) | |

| Stock-based compensation expense (1) | 3,785 | | | 3,169 | |

| | | |

| Contingent consideration (2) | (1,700) | | | (4,400) | |

| Litigation expense (3) | (808) | | | 525 | |

| Transaction costs (4) | 2,273 | | | 215 | |

| | | |

| Severance (5) | — | | | 525 | |

| Loss on extinguishment of debt (6) | 635 | | | — | |

| Impairment loss (7) | — | | | 1,301 | |

| Other expense – net (8) | 152 | | | 420 | |

| Adjusted EBITDA | $ | (4,454) | | | $ | (2,844) | |

| | | | | |

| 1 | Adjustments reflect total stock-based compensation expense of $3.8 million and $3.2 million for the three months ended December 31, 2023 and 2022, respectively. |

| 2 | Adjustments reflect non-cash reductions to the fair market value of the contingent consideration liability of $1.7 million and $4.4 million related to the acquisition of MENU Technologies AG ("MENU Acquisition") for the three months ended December 31, 2023 and 2022, respectively. |

| 3 | Adjustment reflects the release of a loss contingency for a legal matter of $0.8 million for the three months ended December 31, 2023 and settlement expenses for legal matters of $0.5 million for the three months ended December 31, 2022. |

| 4 | Adjustment reflects non-recurring professional fees incurred in transaction due diligence of $2.3 million for the three months ended December 31, 2023 and acquisition expenses incurred in the MENU Acquisition of $0.2 million for the three months ended December 31, 2022. |

| 5 | Adjustment reflects severance included in General and Administrative ("G&A") and Research and Development ("R&D") expense. |

| 6 | Adjustment reflects loss on extinguishment of debt related to the induced conversion of the 4.500% Convertible Senior Notes due 2024 (the "2024 Notes"). |

| 7 | Adjustment reflects impairment loss included in research and development expense related to the impairment of internally developed software costs not meeting the general release threshold as a result of acquiring go-to-market software in the MENU Acquisition. |

| 8 | Adjustment reflects foreign currency transaction gains and losses, rental income and losses, and other non-recurring expenses recorded in other expense, net, in the accompanying statements of operations. |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| Reconciliation of Net Loss/Diluted Net Loss per Share to Adjusted Net Loss/Adjusted Diluted Net Loss per Share: | | | | | | | |

| Net loss/diluted net loss per share (1) | $ | (18,629) | | | $ | (0.67) | | | $ | (13,481) | | | $ | (0.50) | |

| | | | | | | |

| Non-cash interest expense (2) | 499 | | | 0.02 | | | 513 | | | 0.02 | |

| Acquired intangible assets amortization (3) | 4,519 | | | 0.16 | | | 4,170 | | | 0.15 | |

| Stock-based compensation expense (4) | 3,785 | | | 0.14 | | | 3,169 | | | 0.12 | |

| Contingent consideration (5) | (1,700) | | | (0.06) | | | (4,400) | | | (0.16) | |

| Litigation expense (6) | (808) | | | (0.03) | | | 525 | | | 0.02 | |

| Transaction costs (7) | 2,273 | | | 0.08 | | | 215 | | | 0.01 | |

| Severance (8) | — | | | — | | | 525 | | | 0.02 | |

| Loss on extinguishment of debt (9) | 635 | | | 0.02 | | | — | | | — | |

| Impairment loss (10) | — | | | — | | | 1,301 | | | 0.05 | |

| Other expense – net (11) | 152 | | | 0.01 | | | 420 | | | 0.02 | |

| Adjusted net loss/adjusted diluted net loss per share | $ | (9,274) | | | $ | (0.33) | | | $ | (7,043) | | | $ | (0.26) | |

| | | | | | | |

| Weighted average common shares outstanding | 27,968 | | | | | 27,118 | | | |

| | | | | |

| 1 | The income tax effect of the below adjustments were not tax-effected due to the valuation allowance on all of our net deferred tax assets. |

| 2 | Adjustment reflects non-cash amortization of issuance costs related to the 2024 Notes, 2.875% Convertible Senior Notes due 2026 (the "2026 Notes"), and the 1.500% Convertible Senior Notes due 2027 (the “2027 Notes”, and together with the 2026 Notes, the “Senior Notes”) of $0.5 million and $0.5 million for the three months ended December 31, 2023 and 2022, respectively. |

| 3 | Adjustment amortization expense of acquired developed technology within cost of sales of $4.0 million and $3.7 million for the three months ended December 31, 2023 and 2022, respectively; and amortization expense of acquired intangible assets of $0.5 million and $0.5 million for the three months ended December 31, 2023 and 2022, respectively. |

| 4 | Adjustments reflect total stock-based compensation expense of $3.8 million and $3.2 million for the three months ended December 31, 2023 and 2022, respectively. |

| 5 | Adjustments reflect non-cash reductions to the fair market value of the contingent consideration liability of $1.7 million and $4.4 million related to the MENU Acquisition for the three months ended December 31, 2023 and 2022, respectively. |

| 6 | Adjustment reflects the release of a loss contingency for a legal matter of $0.8 million for the three months ended December 31, 2023 and settlement expenses for legal matters of $0.5 million for the three months ended December 31, 2022. |

| 7 | Adjustment reflects non-recurring professional fees incurred in transaction due diligence of $2.3 million for the three months ended December 31, 2023 and acquisition expenses incurred in the MENU Acquisition of $0.2 million for the three months ended December 31, 2022. |

| 8 | Adjustment reflects severance included in G&A and R&D expense. |

| 9 | Adjustment reflects loss on extinguishment of debt related to the induced conversion of the 2024 Notes. |

| 10 | Adjustment reflects impairment loss included in research and development expense related to the impairment of internally developed software costs not meeting the general release threshold as a result of acquiring go-to-market software in the MENU Acquisition. |

| 11 | Adjustment reflects foreign currency transaction gains and losses, rental income and losses, and other non-recurring expenses recorded in other expense, net, in the accompanying statements of operations. |

| |

| | | | | | | | | | | | | | | | | |

| Year Ended

December 31, |

| 2023 | | 2022 | | 2021 |

| Reconciliation of Net Loss to EBITDA and Adjusted EBITDA | | | | | |

| Net loss | $ | (69,752) | | | $ | (69,319) | | | $ | (75,799) | |

| Provision for (benefit from) income taxes | 1,988 | | | 1,252 | | | (9,424) | |

| Interest expense | 6,931 | | | 8,811 | | | 18,147 | |

| Depreciation and amortization | 27,481 | | | 26,095 | | | 21,421 | |

| EBITDA | $ | (33,352) | | | $ | (33,161) | | | $ | (45,655) | |

| Stock-based compensation expense (1) | 14,427 | | | 13,426 | | | 14,615 | |

| Regulatory matters (2) | — | | | 415 | | | 50 | |

| Contingent consideration (3) | (9,200) | | | (4,400) | | | — | |

| Litigation expense (4) | (808) | | | 525 | | | 790 | |

| Transaction costs (5) | 2,273 | | | 1,300 | | | 3,612 | |

| Gain on insurance proceeds (6) | (500) | | | — | | | (4,400) | |

| Severance (7) | 253 | | 525 | | | — | |

| Loss on extinguishment of debt (8) | 635 | | | — | | | 11,916 |

| Impairment loss (9) | — | | | 1,301 | | | — | |

| Other expense – net (10) | 489 | | | 1,224 | | | 1,279 | |

| Adjusted EBITDA | $ | (25,783) | | | $ | (18,845) | | | $ | (17,793) | |

| | | | | |

| 1 | Adjustments reflect total stock-based compensation expense for the years ended December 31, 2023, 2022 and 2021 of $14.4 million, $13.4 million and $14.6 million, respectively. |

| 2 | Adjustment reflects non-recurring expenses related to our efforts to resolve regulatory matters of $0.4 million and $0.1 million for the years ended December 31, 2022 and 2021, respectively. |

| 3 | Adjustments reflect non-cash reductions to the fair market value of the contingent consideration liability of $9.2 million and $4.4 million related to the MENU Acquisition for the years ended December 31, 2023 and 2022, respectively. |

| 4 | Adjustment reflects the release of a loss contingency for a legal matter of $0.8 million for the year ended December 31, 2023 and settlement expenses for legal matters of $0.5 million and $0.8 million for the years ended December 31, 2022 and 2021, respectively. |

| 5 | Adjustment reflects non-recurring professional fees incurred in transaction due diligence of $2.3 million for the year ended December 31, 2023 and acquisition expenses incurred in the MENU Acquisition of $1.3 million and the acquisition of Punchh Inc. ("Punchh Acquisition") of $3.6 million for the years ended December 31, 2022 and 2021, respectively. |

| 6 | Adjustment represents the gain on insurance stemming from a legacy claim of $0.5 million and $4.4 million for the years ended December 31, 2023 and 2021, respectively. |

| 7 | Adjustment reflects the severance included in general and administrative expense and research and development expense of $0.3 million and $0.5 million for the years ended December 31, 2023 and 2022, respectively. |

| 8 | Adjustment reflects loss on extinguishment of debt of $0.6 million related to the induced conversion of the 2024 Notes during the year ended December 31, 2023, and $11.9 million related to the repayment of the term loan in an initial aggregate principal amount of $180.0 million (“Owl Rock Term Loan”) during the year ended December 31, 2021. |

| 9 | Adjustment reflects impairment loss included in research and development expense related to the impairment of internally developed software costs not meeting the general release threshold as a result of acquiring go-to-market software in the MENU Acquisition. |

| 10 | Adjustment reflects foreign currency transaction gains and losses, rental income and losses, and other non-recurring expenses recorded in other expense, net in the accompanying statements of operations. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 | | 2021 |

| Reconciliation of adjusted net loss/diluted net loss per share: | | | | | | | | | | | |

| Net loss / diluted earnings per share | $ | (69,752) | | | $ | (2.53) | | | $ | (69,319) | | | $ | (2.55) | | | $ | (75,799) | | | $ | (3.02) | |

| Provision for (benefit from) income taxes (1) | — | | | — | | | — | | | — | | | (10,417) | | | (0.42) | |

| Non-cash interest expense (2) | 2,093 | | | 0.08 | | | 1,997 | | | 0.07 | | | 8,727 | | | 0.35 | |

| Acquired intangible assets amortization (3) | 18,074 | | | 0.66 | | | 17,111 | | | 0.63 | | | 13,802 | | | 0.55 | |

| Stock-based compensation expense (4) | 14,427 | | | 0.52 | | | 13,426 | | | 0.49 | | | 14,615 | | | 0.58 | |

| Regulatory matters (5) | — | | | — | | | 415 | | | 0.02 | | | 50 | | | — | |

| Contingent consideration (6) | (9,200) | | | (0.33) | | | (4,400) | | | (0.16) | | | — | | | — | |

| Litigation expense (7) | (808) | | | (0.03) | | | 525 | | | 0.02 | | | 790 | | | 0.03 | |

| Transaction costs (8) | 2,273 | | | 0.08 | | | 1,300 | | | 0.05 | | | 3,612 | | | 0.14 | |

| Gain on insurance proceeds (9) | (500) | | | (0.02) | | | — | | | — | | | (4,400) | | | (0.18) | |

| Severance (10) | 253 | | | 0.01 | | | 525 | | | 0.02 | | | — | | | — | |

| Loss on extinguishment of debt (11) | 635 | | | 0.02 | | | — | | | — | | | 11,916 | | | 0.47 | |

| Impairment loss (12) | — | | | — | | | 1,301 | | | 0.05 | | | — | | | — | |

| Other expense – net (13) | 489 | | | 0.02 | | | 1,224 | | | 0.05 | | | 1,279 | | | 0.05 | |

| Adjusted net loss/diluted net loss per share | $ | (42,016) | | | $ | (1.52) | | | $ | (35,895) | | | $ | (1.32) | | | $ | (35,825) | | | $ | (1.43) | |

| | | | | | | | | | | |

| Weighted average common shares outstanding | 27,552 | | | | | 27,152 | | | | | 25,088 | | | |

| | | | | |

| 1 | Adjustment reflects a partial release of our deferred tax asset valuation allowance of $10.4 million related to the Punchh Acquisition for the year ended December 31, 2021. The income tax effect of the below adjustments were not tax-effected due to the valuation allowance on all of our net deferred tax assets. |

| 2 | Adjustment reflects non-cash accretion of interest expense and amortization of issuance costs related to the 2024 Notes, Senior Notes, and the Owl Rock Term Loan of $2.1 million, $2.0 million, and $8.7 million for the years ended December 31, 2023, 2022, and 2021, respectively. |

| 3 | Adjustment reflects amortization expense of acquired developed technology within cost of sales of $16.2 million, $15.2 million, and $12.0 million for the years ended December 31, 2023, 2022, and 2021, respectively; and amortization expense of acquired intangible assets of $1.9 million, $1.9 million, and $1.8 million for the years ended December 31, 2023, 2022, and 2021, respectively. |

| 4 | Adjustments reflect total stock-based compensation expense for the years ended December 31, 2023, 2022 and 2021 of $14.4 million, $13.4 million and $14.6 million respectively. |

| 5 | Adjustment reflects non-recurring expenses related to our efforts to resolve regulatory matters of $0.4 million and $0.1 million for the years ended December 31, 2022 and 2021, respectively. |

| 6 | Adjustments reflect non-cash reductions to the fair market value of the contingent consideration liability of $9.2 million and $4.4 million related to the MENU Acquisition for the years ended December 31, 2023 and 2022, respectively. |

| 7 | Adjustment reflects the release of a loss contingency for a legal matter of $0.8 million for the year ended December 31, 2023 and settlement expenses for legal matters of $0.5 million and $0.8 million for the years ended December 31, 2022 and 2021, respectively. |

| 8 | Adjustment reflects non-recurring professional fees incurred in transaction due diligence of $2.3 million for the year ended December 31, 2023 and acquisition expenses incurred in the MENU Acquisition of $1.3 million and Punchh Acquisition of $3.6 million for the years ended December 31, 2022 and 2021, respectively. |

| 9 | Adjustment represents the gain on insurance stemming from a legacy claim of $0.5 million and $4.4 million for the years ended December 31, 2023 and 2021, respectively. |

| 10 | Adjustment reflects the severance included in general and administrative expense and research and development expense of $0.3 million and $0.5 million for the years ended December 31, 2023 and 2022, respectively. |

| 11 | Adjustment reflects loss on extinguishment of debt of $0.6 million related to the induced conversion of the 2024 Notes during the year ended December 31, 2023, and $11.9 million related to the repayment of the Owl Rock Term Loan during the year ended December 31, 2021. |

| 12 | Adjustment reflects impairment loss included in research and development expense related to the impairment of internally developed software costs not meeting the general release threshold as a result of acquiring go-to-market software in the MENU Acquisition. |

| 13 | Adjustment reflects foreign currency transaction gains and losses, rental income and losses, and other non-recurring expenses recorded in other expense, net in the accompanying statements of operations. |

partech.com Q4 ‘23 Earnings Presentation February 27, 2024 NYSE: PAR

partech.com Forward-Looking Statements. This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, Section 27A of the Securities Act of 1933, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical in nature, but rather are predictive of our future operations, financial condition, financial results, business strategies and prospects. Forward-looking statements are generally identified by words such as “anticipate,” “believe,” “belief,” “continue,” “could,” “expect,” “estimate,” “intend,” “may,” “opportunity,” “plan,” “should,” “will,” “would,” “will likely result,” and similar expressions. Forward-looking statements are based on management's current expectations and assumptions that are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause our actual results to differ materially from those expressed in or implied by forward-looking statements contained in this presentation about our business, financial condition, and results of operations. Factors, risks, trends and uncertainties that could cause our actual results to differ materially from those expressed in or implied by forward-looking statements contained in this presentation include, among others, unfavorable macroeconomic conditions, such as recession or slowed economic growth, fluctuating interest rates, inflation, and changes in consumer confidence and discretionary spending; geopolitical events, including the effects of the Russia-Ukraine war, tensions with China and between China and Taiwan, the Israel-Hamas conflict and other hostilities in the Middle East; the competitive marketplace for talent and its impact on employee recruitment and retention; component shortages, inventory management, and/or manufacturing disruptions and logistics challenges; risks associated with our international operations; the effects of global pandemics, such as COVID-19, or other public health crises; our ability to maintain proper and effective internal control over financial reporting; changes in estimates and assumptions we make in connection with the preparation of our financial statements, in building our business and operational plans, and in executing our strategies; and the other factors, risks, trends and uncertainties discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law. Industry and Market Data. Market, industry, and other data included in this presentation are from or based on our own internal good faith estimates and research, and on publicly available publications, research, surveys and studies conducted by third parties, which we believe are reliable, but have not independently verified. Similarly, while we believe our internal estimates and research are reliable, we have not independently verified our internal estimates or research. While we are not aware of any misstatements regarding any market, industry, or other data used by us or expressed in this presentation, such information, because it has not been verified or, by its nature - market surveys, estimates, projections or similar data, are inherently subject to uncertainties, and actual results may differ materially from the assumptions and circumstances reflected in this information. Key Performance Indicators and Non-GAAP Financial Measures.(1) We monitor certain key performance indicators and non-GAAP financial measures in the evaluation and management of our business; certain key performance indicators and non-GAAP financial measures are provided in this presentation as we believe they are useful in facilitating period-to-period comparisons of our business performance. Key performance indicators and non-GAAP financial measures do not reflect and should be viewed independently of our financial performance determined in accordance with GAAP. Key performance indicators and non-GAAP financial measures are not forecasts or indicators of future or expected results and should not have undue reliance placed upon them by investors. Where non-GAAP financial measures are included in this presentation, the most directly comparable GAAP financial measures and a detailed reconciliation between GAAP and non- GAAP financial measures is included in the Appendix to this presentation. Unless otherwise indicated, financial and operating data included in this presentation is as of December 31, 2023. Trademarks. “PAR®,” “Brink POS®,” “Punchh®,” “MENUTM,” “Data Central®,” "PAR® Pay”, “PAR® Payment Services” and other trademarks identifying our products and services appearing in this presentation belong to us. This presentation may also contain trade names and trademarks of other companies. Our use of such other companies’ trade names or trademarks is not intended to imply any endorsement or sponsorship by these companies of us or our products or services. (1) See Appendix A for non-GAAP reconciliation and Key Performance Indicators

partech.com A little about us...

partech.com Our Journey … Thus Far ... $136.9M Q4 2023

partech.com • Unified technology platform offering integrated solutions and sophisticated data insights • Pairs with our state of the art hardware offerings for a complete tech stack • Supported by our comprehensive professional service offerings to drive a positive customer experience Building a Unified Experience

partech.com Financial Review Fourth Quarter 2023 Highlights

partech.com Q4 ‘23 Financials Consolidated Highlights • 10% increase in revenue from Q4 2022 Subscription Service Highlights • 23% increase in ARR from Q4 2022 • 18% increase in revenue from Q4 2022 Three Months Ended December 31 in thousands 2023 2022 Revenues, net: Hardware $ 24,400 $ 29,590 Subscription service 32,897 27,908 Professional service 12,603 13,479 Contract 37,808 26,673 Total revenues, net 107,708 97,650 Total gross margin 26,401 26,151 Operating expenses Sales and marketing 9,508 9,210 General and administrative 18,640 16,700 Research and development 14,493 14,858 Amort of identifiable intangible assets 465 464 Adjustment to contingent consideration liability (1,700) (4,400) Total operating expenses 41,406 36,832 Other expense, net (152) (420) Loss on extinguishment of debt (635) — Interest expense, net (1,779) (1,757) Loss before provision for income taxes (17,571) (12,858) Provision for income taxes (1,058) (623) Net loss (18,629) (13,481) Non-GAAP adjustments 9,355 6,438 Adjusted net loss (9,274) (7,043) Adjusted diluted net loss per share (0.33) (0.26) Adjusted weighted average shares 27,968 27,118 All amounts in thousands, except for Adjusted diluted net loss per share

partech.com Quarterly KPI Trends ARR ($‘000,000) 58.9 59.4 60.9 62.2 63.8 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 8% Y/Y Growth Active Sites (‘000) 69.9 68.1 70.5 68.1 70.8 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 1% Y/Y Growth Guest Engagement (Punchh + MENU) Year-over-year metrics are for the quarter ended 12/31/2023 compared to the quarter ended 12/31/2022. Please see Appendix A — Key Performance Indicators for more information on ARR and Active Sites.

partech.com Quarterly KPI Trends Operator Solutions (Brink POS + PAR Payment Services + PAR Pay) ARR ($‘000,000) Year-over-year metrics are for the quarter ended 12/31/2023 compared to the quarter ended 12/31/2022. Please see Appendix A — Key Performance Indicators for more information on ARR and Active Sites. 41.6 45.2 50.0 53.8 60.2 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 45% Y/Y Growth Active Sites (‘000) 19.5 20.5 21.5 22.5 23.3 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 19% Y/Y Growth

partech.com Quarterly KPI Trends Back Office (Data Central) ARR ($‘000,000) Year-over-year metrics are for the quarter ended 12/31/2023 compared to the quarter ended 12/31/2022. Please see Appendix A — Key Performance Indicators for more information on ARR and Active Sites. 10.9 11.3 11.6 12.4 13.0 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 19% Y/Y Growth Active Sites (‘000) 7.0 7.1 7.2 7.5 7.7 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 10% Y/Y Growth

partech.com Annual KPI Trends ARR ($‘000,000) (1) Adjusted Subscription Service Gross Margin is a non-GAAP financial measure. Please see Appendix A for a detailed reconciliation to Subscription Service Gross Margin (GAAP). (2) The leveling off of Adjusted Subscription Service Gross Margin is primarily due to absorbing the initial growth of MENU and PAR Payment Services which are early stage products. CAGR stands for Compounded Annual Growth Rate. Please see Appendix A — Key Performance Indicators for more information on ARR and Active Sites. 88.2 111.4 136.9 2021 2022 2023 Subscription Service 25% CAGR Adjusted Subscription Service Gross Margin(1) 66% 73% 66% 2021 2022 2023 (2)

partech.com Annual KPI Trends Subscription Service S&M and R&D Expense as a % of ARR (1) Subscription Service S&M and R&D expense is a non-GAAP financial measure. Please see Appendix A for a detailed reconciliation to S&M and R&D expense, respectively. Please see Appendix A — Key Performance Indicators for more information on ARR. May not sum/recalculate due to rounding. 55% 64% 63% 20% 24% 24% 35% 40% 39% Sales and Marketing % of ARR Research and Development % of ARR 2021 2022 2023 Effectively managing spend while absorbing strategic acquisitions (1) • Of the 9% growth from 2021 to 2022, 6% is inorganic growth due to the Punchh acquisition (3% S&M and 3% R&D) • Included in the 63% for 2023, 8% is inorganic due to the MENU acquisition (2% S&M and 6% R&D)

partech.com Appendix A

partech.com ($'000,000), except % 12 Months Ended Dec 2021 Dec 2022 Dec 2023 Subscription Service Revenue $63 $97 $123 Subscription Service Gross Margin 24 50 59 Add back Amortization from Acquired and Internally Developed Technology included in Subscription Service Gross Margin 17 21 22 Adjusted Subscription Service Gross Margin $41 $71 $81 Adjusted Subscription Service Gross Margin % 66% 73% 66% May not sum/recalculate due to rounding. The presentation of this non-GAAP reconciliation reflects the bifurcation of service revenue between subscription service revenue and professional service revenue that was implemented in Q4 2022. Adjusted Subscription Gross Margin Non-GAAP Reconciliation

partech.com ($'000,000), except % 3 Months Ended Dec 2022 Dec 2023 Subscription Service Revenue $28 $33 Subscription Service Gross Margin 15 16 Add back Amortization from Acquired and Internally Developed Technology included in Subscription Service Gross Margin 5 6 Adjusted Subscription Service Gross Margin $20 $21 Adjusted Subscription Service Gross Margin % 72% 65% May not sum/recalculate due to rounding. The presentation of this non-GAAP reconciliation reflects the bifurcation of service revenue between subscription service revenue and professional service revenue that was implemented in Q4 2022. Adjusted Subscription Gross Margin Non-GAAP Reconciliation

partech.com ($'000,000), except % 12 Months Ended Dec 2021 Dec 2022 Dec 2023 ARR $88 $111 $137 Total S&M Expense 24 35 39 Less: Hardware S&M Expense (7) (8) (5) Subscription Service S&M Expense $18 $27 $33 Subscription Service S&M Expense as a % of ARR 20% 24% 24% May not sum/recalculate due to rounding. The presentation of this non-GAAP reconciliation reflects the bifurcation of selling, general and administrative expense between sales and marketing expense and general and administrative expense that was implemented in Q4 2023. Subscription Service S&M Non-GAAP Reconciliation

partech.com ($'000,000), except % 12 Months Ended Dec 2021 Dec 2022 Dec 2023 ARR $88 $111 $137 Total R&D Expense 35 49 58 Less: Hardware R&D Expense (4) (5) (5) Subscription Service R&D Expense $31 $44 $53 Subscription Service R&D Expense as a % of ARR 35% 40% 39% May not sum/recalculate due to rounding. Subscription Service R&D Non-GAAP Reconciliation

partech.com 1. Foodservice market ready for disruption • Large TAM in restaurants with ~1m locations in the US spending 2-3% of total revenue on technology1 • The industry shift to cloud technology has led to an explosion in new technology from Voice AI to marketing technology 2. Meeting market need with a Unified Experience • Today technology is driving a wedge between restaurants and their guests • Brands are shifting to well integrated vendors and more targeted guest interactions • There is an opportunity to create an integrated solution with unified data that enables restaurants to have 1:1 relationship with their guests 3. ARR at scale with strong SaaS metrics • Through both organic and inorganic strategies, ARR has reached $136.9M with significant opportunity to expand within existing customers and win new business. 1) Source: Technomic Investment Thesis

partech.com • Annual Recurring Revenue or "ARR” is the annualized revenue from subscription services, including subscription fees for our SaaS solutions, related software support, and transaction-based payment processing services. We calculate ARR by annualizing the monthly subscription service revenue for all Active Sites as of the last day of each month for the respective reporting period. • “Activations” are calculated as of the end of each month based on the number of customers that have initiated use of our subscription services. Once “activated”, PAR begins to invoice/bill the customer. In specific cases with Punchh, invoicing takes place before activation take place. • “Active Sites” represent locations active on PAR’s subscription services as of the last day of the respective fiscal period. • “Adjusted Subscription Gross Margin” is a non-GAAP financial measure for PAR’s gross margin of subscription service revenue excluding amortization of acquired and internally developed technology. • “Bookings” are customer purchase orders for subscription services; upon PAR's acceptance, the customer is obligated to purchase the subscription service and pay PAR for the subscription services. In specific cases with Punchh, bookings are added at the time of execution of the relevant master services agreement. • “Churn” reflects the negative change in Active Site count of PAR customers, for a specific period. Key Performance Indicators

partech.com Thank You!

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

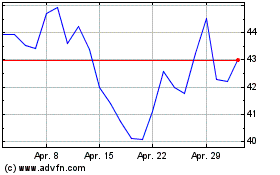

PAR Technology (NYSE:PAR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

PAR Technology (NYSE:PAR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024