0001019849FALSE00010198492024-01-172024-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| |

| Date of Report (Date of Earliest Event Reported): | January 17, 2024 |

Penske Automotive Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 1-12297 | | 22-3086739 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | |

2555 Telegraph Road, | | | | |

Bloomfield Hills, Michigan | | | | 48302 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | |

| Registrant’s telephone number, including area code: | | 248-648-2500 |

| | |

| | Not Applicable | | |

Former name or former address, if changed since last report |

| | | | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Voting Common Stock, par value $0.0001 per share | PAG | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On January 17, 2024, Penske Automotive Group, Inc. announced that its Board of Directors declared a quarterly dividend in the amount of $0.87 per share, payable on March 1, 2024 to shareholders of record as of February 15, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Index

| | | | | | | | | | | |

| | |

| Exhibit No. | | Description |

99.1 | | | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | Penske Automotive Group, Inc. |

| | |

| January 17, 2024 | | By: | /s/ Shane M. Spradlin |

| | | Name: Shane M. Spradlin |

| | | Title: Executive Vice President |

FOR IMMEDIATE RELEASE

PENSKE AUTOMOTIVE GROUP INCREASES DIVIDEND BY 10%

BLOOMFIELD HILLS, MI, January 17, 2024 -- Penske Automotive Group, Inc. (NYSE: PAG), a diversified international transportation services company and one of the world's premier automotive and commercial truck retailers, today announced that its Board of Directors has approved a quarterly dividend of $0.87 per share, representing an increase of 10%. “We are pleased to provide an increase in the cash dividend. The strength of our balance sheet and our continued strong cash flow enables us to reward our shareholders,” said Penske Automotive Group President, Robert Kurnick, Jr. The dividend is payable March 1, 2024, to shareholders of record as of February 15, 2024.

About Penske Automotive

Penske Automotive Group, Inc., (NYSE: PAG) headquartered in Bloomfield Hills, Michigan, is a diversified international transportation services company and one of the world's premier automotive and commercial truck retailers. PAG operates dealerships in the United States, the United Kingdom, Canada, Germany, Italy, and Japan and is one of the largest retailers of commercial trucks in North America for Freightliner. PAG also distributes and retails commercial vehicles, diesel and gas engines, power systems, and related parts and services principally in Australia and New Zealand. PAG employs over 28,000 people worldwide. Additionally, PAG owns 28.9% of Penske Transportation Solutions ("PTS"), a business that employs over 44,000 people worldwide, manages one of the largest, most comprehensive and modern trucking fleets in North America with over 442,000 trucks, tractors, and trailers under lease, rental, and/or maintenance contracts and provides innovative transportation, supply chain, and technology solutions to its customers. PAG is a member of the Fortune 500, Russell 1000, Russell 3000 index and S&P 400 Mid Cap Indexes. For additional information, including the Company's 2023 Corporate Responsibility Report highlighting its strategies, activities, and certain metrics, visit the Company's website at www.penskeautomotive.com.

Caution Concerning Forward Looking Statements

Statements in this press release may involve forward-looking statements, including forward-looking statements regarding Penske Automotive Group, Inc.'s profitability and cash flow. Actual results may vary materially because of risks and uncertainties that are difficult to predict. These risks and uncertainties include, among others, those risks and uncertainties related to macro-economic, geo-political and industry conditions and events, including their impact on new and used vehicle sales, the

availability of consumer credit, changes in consumer demand, consumer confidence levels, fuel prices, personal discretionary spending levels, interest rates, and unemployment rates; our ability to obtain vehicles and parts from our manufacturers, especially in light of supply chain disruptions due to natural disasters, the shortage of vehicle components, the war in Ukraine, challenges in sourcing labor, or labor strikes or work stoppages, or other disruptions; changes in the retail model either from direct sales by manufacturers, a transition to an agency model of sales, sales by online competitors, or from the expansion of electric vehicles; the effects of a pandemic on the global economy, including our ability to react effectively to changing business conditions in light of any pandemic; the rate of inflation, including its impact on vehicle affordability; changes in interest rates and foreign currency exchange rates; with respect to PTS, changes in the financial health of its customers, labor strikes or work stoppages by its employees, a reduction in PTS' asset utilization rates, continued availability from truck manufacturers and suppliers of vehicles and parts for its fleet, potential decreases in the resale value of used vehicles which may affect PTS' ability to sell its used vehicles after the expiration of its customers' leases or at the end of its holding period for rental vehicles, which may affect PTS' profitability and regulatory risks and related compliance costs; our ability to realize returns on our significant capital investment in new and upgraded dealership facilities; our ability to navigate a rapidly changing automotive and truck landscape; our ability to respond to new or enhanced regulations in both our domestic and international markets relating to automotive and commercial truck dealerships and vehicles sales, including those related to the sales process or emissions standards, as well as changes in consumer sentiment relating to commercial truck sales that may hinder our or PTS' ability to maintain, acquire, sell, or operate trucks; the success of our distribution of commercial vehicles, engines, and power systems; natural disasters; recall initiatives or other disruptions that interrupt the supply of vehicles or parts to us; the outcome of legal and administrative matters, and other factors over which management has limited control. These forward-looking statements should be evaluated together with additional information about Penske Automotive Group's business, markets, conditions, risks, and other uncertainties, which could affect Penske Automotive Group's future performance. The risks and uncertainties discussed above are not exhaustive and additional risk and uncertainties are addressed in Penske Automotive Group's Form 10-K for the year ended December 31, 2022, its Form 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023, September 30, 2023, and its other filings with the Securities and Exchange Commission. This press release speaks only as of its date, and Penske Automotive Group disclaims any duty to update the information herein.

Inquiries should contact:

| | | | | |

| |

| Shelley Hulgrave | Anthony Pordon |

| Executive Vice President and | Executive Vice President Investor Relations |

| Chief Financial Officer | and Corporate Development |

| Penske Automotive Group, Inc. | Penske Automotive Group, Inc. |

| 248-648-2812 | 248-648-2540 |

| shulgrave@penskeautomotive.com | tpordon@penskeautomotive.com |

# # # # #

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

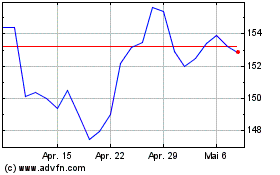

Penske Automotive (NYSE:PAG)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

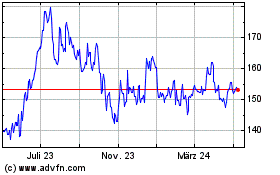

Penske Automotive (NYSE:PAG)

Historical Stock Chart

Von Mai 2023 bis Mai 2024