0001720635False00017206352024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 6, 2024

Commission file number 001-38265

nVent Electric plc

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| | | |

| Ireland | | 98-1391970 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification number) |

The Mille, 1000 Great West Road, 8th Floor (East), London, TW8 9DW, United Kingdom

(Address of principal executive offices)

Registrant's telephone number, including area code: 44-20-3966-0279

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Ordinary Shares, nominal value $0.01 per share | NVT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 2.02 Results of Operations and Financial Condition

On February 6, 2024, nVent Electric plc (the "Company") issued a press release announcing earnings results for the fourth quarter and full year of 2023 and a conference call in connection therewith. A copy of the release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

This press release refers to certain non-GAAP financial measures (organic sales, segment income, return on sales, adjusted net income, adjusted diluted earnings per share and free cash flow) and a reconciliation of those non-GAAP financial measures to the corresponding financial measures contained in the Company's financial statements prepared in accordance with generally accepted accounting principles.

The 2023 and 2022 segment income, return on sales, adjusted net income and adjusted diluted earnings per share eliminate, where applicable:

•Expense related to certain targeted restructuring activities.

•Expense related to certain acquisition and integration activities associated with our business acquisitions.

•Amortization of all intangible assets associated with our business acquisitions, including inventory step-up amortization, associated with those acquisitions. The Company excludes these non-cash expenses because the Company believes it (i) enhances management’s and investors’ ability to analyze underlying business performance, (ii) facilitates comparisons of our financial results over multiple periods, and (iii) provides more relevant comparisons of the Company's results with the results of other companies as the amortization expense, inventory step-up amortization, and acquisition related expenses may fluctuate significantly from period to period based on the timing, size, nature, and number of acquisitions. Although the Company excludes amortization of these acquired intangible assets and inventory step-up from its non-GAAP results, the Company believes that it is important for investors to understand that revenue generated, in part, from such intangibles is included within revenue in determining adjusted results.

•Gain on sale of investments.

•Pension and other postretirement mark-to-market loss (gain). The Company recognizes changes in the fair value of plan assets and net actuarial gains or losses for pension and other post-retirement benefits as a mark-to-market adjustment. Net actuarial gains and losses occur when the actual experience differs from any of the various assumptions used to value the Company's pension and other post-retirement plans or when assumptions change. This accounting method also results in the potential for volatile and difficult to forecast mark-to-market adjustments. The Company believes that the exclusion of pension and other postretirement mark-to-market loss (gain) better reflects the ongoing costs of providing pension and postretirement benefits to its employees.

•Amortization of bridge financing debt issuance costs.

•Income tax effects of the above adjustments, which are calculated using the Company's estimated non-GAAP tax rate. This non-GAAP tax approach eliminates the effects of period specific items, which can vary in size and frequency and do not necessarily reflect our long-term operations. The non-GAAP tax rate could be subject to change for a variety of reasons, including the rapidly evolving global tax environment, significant changes in the Company's geographic earnings mix including due to acquisition activity or other changes in our strategy or business operations.

The Company uses the term "organic sales" to refer to GAAP net sales excluding 1) the impact of currency translation and 2) the impact of revenue from acquired businesses recorded prior to the first anniversary of the acquisition less the amount of sales attributable to divested product lines not considered discontinued operations ("acquisition sales"). The portion of GAAP net sales attributable to currency translation is calculated as the difference between (a) the period-to-period change in net sales (excluding acquisition sales) and (b) the period-to-period change in net sales (excluding acquisition sales) after applying prior period foreign exchange rates to the current year period. The Company uses the term "organic sales growth" to refer to the measure of comparing current period organic net sales with the corresponding period of the prior year.

Management utilizes these adjusted financial measures to assess the run-rate of its continuing operations against those of prior periods without the distortion of these factors that the Company does not consider components of our core operating performance. The Company believes that these non-GAAP financial measures will be useful to investors as well to assess the continuing strength of the Company's underlying operations. In addition, adjusted diluted earnings per share is used as a criterion to measure and pay long-term incentive compensation and segment income is used as a criterion to measure and pay annual incentive compensation. These non-GAAP measures may not be comparable to similarly titled measures reported by other companies.

The Company uses free cash flow to assess its cash flow performance. The Company believes free cash flow is an important measure of liquidity because it provides the Company and its investors a measurement of cash generated from operations that is available to pay dividends, make acquisitions, repay debt and repurchase shares. In addition, free cash flow is used as criterion to measure and pay annual incentive compensation. The Company's measure of free cash flow may not be comparable to similarly titled measures reported by other companies.

ITEM 9.01 Financial Statements and Exhibits

| | | | | | | | |

| (a) | Financial Statements of Businesses Acquired | |

| Not applicable. | |

| (b) | Pro Forma Financial Information | |

| Not applicable. | |

| (c) | Shell Company Transactions | |

| Not applicable. | |

| (d) | Exhibits | |

EXHIBIT INDEX | | | | | | | | |

| Exhibit | | Description |

| | nVent Electric plc press release dated February 6, 2024 announcing earnings results for the fourth quarter and full year of 2023 |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on February 6, 2024.

| | | | | | | | |

|

| | |

| | nVent Electric plc |

| | Registrant |

| | | |

| | By | /s/ Sara E. Zawoyski |

| | | Sara E. Zawoyski |

| | | Executive Vice President and Chief Financial Officer |

News Release

nVent Announces Fourth Quarter and Full-Year 2023 Financial Results

Record sales, earnings and cash flow performance

•Fourth quarter reported sales of $861 million, up 16%; Organically up 2%

•Fourth quarter reported EPS of $1.51, up 61%; Adjusted EPS of $0.78, up 18%

•Full-year reported sales of $3.3 billion, up 12%; Organically up 3%

•Full-year reported EPS of $3.37, up 42%; Adjusted EPS of $3.06, up 28%

•Full-year Cash Flows from Operations of $528 million; Free Cash Flow of $465 million

•Company issues full-year 2024 guidance:

◦Reported sales growth of 8% to 10%; Organic sales growth of 3% to 5%

◦Reported EPS of $2.73 to $2.83 and Adjusted EPS of $3.17 to $3.27

Reconciliations of GAAP (reported) to Non-GAAP measures are in the attached financial tables.

LONDON, UNITED KINGDOM – February 6, 2024 – nVent Electric plc (NYSE:NVT) (“nVent”), a global leader in electrical connection and protection solutions, today announced financial results for the fourth quarter and full-year 2023 and provided guidance for the first quarter and full-year 2024.

"2023 was another year of strong performance for nVent, and I’m proud of all that our team accomplished. Fourth quarter sales grew double-digits and all segments expanded margins. For the full year, we had strong growth and execution resulting in record sales, margins and cash flow. We launched 95 new products, our Data Solutions business grew over 20 percent and we completed two acquisitions, adding over $400 million in annualized sales. I'm very pleased with all the awards and recognition we've received, including a gold sustainability rating from EcoVadis for our ESG efforts, placing us in the top 3 percent of companies assessed in our industry," said Beth Wozniak, nVent's chair and chief executive officer.

“The electrification of everything, sustainability and digitalization are driving demand for our products and solutions. We are well positioned for another year of strong sales and profit growth. We are particularly excited about the acceleration of AI and scaling our liquid cooling solutions, our momentum in innovation and new products, and our combined strength with the new acquisitions. Our future is bright at nVent."

Fourth quarter 2023 sales of $861 million were up 16 percent relative to the fourth quarter 2022 and increased 2 percent organically, which excludes the impact from acquisitions and currency fluctuations. Fourth quarter 2023 earnings per diluted share (“EPS”) were $1.51, up 61 percent from $0.94 in the prior year quarter, while on an adjusted basis, the company had EPS of $0.78, up 18 percent from $0.66. Full-year 2023 sales of $3.3 billion were up 12 percent relative to full-year 2022 and increased 3 percent organically. Full-year 2023 EPS were $3.37, up 42 percent from $2.38 in the prior year, while on an adjusted basis, the company had EPS of $3.06, up 28 percent from $2.40 in the prior year. Segment income, adjusted net income, free cash flow and adjusted EPS are described in the attached schedules.

Fourth quarter 2023 operating income was $160 million, up 28 percent, compared to $125 million in the fourth quarter of 2022. On an adjusted basis, segment income was $189 million, up 31 percent, compared to $144 million in the fourth quarter of 2022. Full-year 2023 operating income was $587 million, up 33 percent, compared to $440 million in 2022. On an adjusted basis, segment income was $721 million, up 38 percent, compared to $524 million in full-year 2022.

nVent had net cash provided by operating activities of $237 million in the fourth quarter of 2023 and free cash flow of $215 million. Full-year net cash provided by operating activities was $528 million and free cash flow was $465 million.

FOURTH QUARTER PERFORMANCE ($ in millions)

| | | | | | | | | | | |

| nVent Electric plc | | | |

| Three months ended |

| December 31, 2023 | December 31, 2022 | % / point

change |

| Net Sales | $861 | $742 | 16% |

| Organic | | | 2% |

| Operating Income | $160 | $125 | 28% |

| Reported ROS | 18.6% | 16.9% | 170 bps |

| Segment Income | $189 | $144 | 31% |

| Adjusted ROS | 22.0% | 19.4% | 260 bps |

| | | | | | | | | | | |

| Enclosures | | | |

| Three months ended |

| December 31, 2023 | December 31, 2022 | % / point

change |

| Net Sales | $402 | $376 | 7% |

| Organic | | | 4% |

| ROS | 21.1% | 19.2% | 190 bps |

| | | | | | | | | | | |

| Electrical & Fastening Solutions | | | |

| Three months ended |

| December 31, 2023 | December 31, 2022 | % / point

change |

| Net Sales | $288 | $194 | 49% |

| Organic | | | 0% |

| ROS | 29.6% | 27.5% | 210 bps |

| | | | | | | | | | | |

| Thermal Management | | | |

| Three months ended |

| December 31, 2023 | December 31, 2022 | % / point

change |

| Net Sales | $171 | $172 | -1% |

| Organic | | | -2% |

| ROS | 25.9% | 25.7% | 20 bps |

FULL-YEAR PERFORMANCE ($ in millions)

| | | | | | | | | | | |

| nVent Electric plc | | | |

| Full-Year |

| December 31, 2023 | December 31, 2022 | % / point

change |

| Net Sales | $3,264 | $2,909 | 12% |

| Organic | | | 3% |

| Operating Income | $587 | $440 | 33% |

| Reported ROS | 18.0% | 15.1% | 290 bps |

| Segment Income | $721 | $524 | 38% |

| Adjusted ROS | 22.1% | 18.0% | 410 bps |

| | | | | | | | | | | |

| Enclosures | | | |

| Full-Year |

| December 31, 2023 | December 31, 2022 | % / point

change |

| Net Sales | $1,606 | $1,504 | 7% |

| Organic | | | 6% |

| ROS | 21.6% | 17.0% | 460 bps |

| | | | | | | | | | | |

| Electrical & Fastening Solutions | | | |

| Full-Year |

| December 31, 2023 | December 31, 2022 | % / point

change |

| Net Sales | $1,063 | $791 | 34% |

| Organic | | | 4% |

| ROS | 31.1% | 27.8% | 330 bps |

| | | | | | | | | | | |

| Thermal Management | | | |

| Full-Year |

| December 31, 2023 | December 31, 2022 | % / point

change |

| Net Sales | $595 | $614 | -3% |

| Organic | | | -3% |

| ROS | 23.3% | 22.9% | 40 bps |

GUIDANCE FOR FULL-YEAR AND FIRST QUARTER 2024

The company introduces 2024 sales guidance of up 8 to 10 percent, which represents a range of a 3 to 5 percent increase in organic sales versus the prior year. The company expects full-year 2024 EPS on a GAAP basis of $2.73 to $2.83 and $3.17 to $3.27 on an adjusted basis, which both include an approximate $0.11 negative impact due to changes in global tax standards.

In addition, the company estimates reported sales for the first quarter of 2024 to be in the range of up 16 to 18 percent, which represents a 2 to 4 percent increase on an organic basis. The company estimates first quarter 2024 EPS on a GAAP basis of $0.61 to $0.63 and adjusted EPS of $0.72 to $0.74, which both include an approximate $0.03 negative impact due to changes in global tax standards.

DIVIDENDS

nVent previously announced on September 26, 2023 that its Board of Directors approved a regular cash dividend of $0.175 per ordinary share, which was paid during the fourth quarter on November 3, 2023. The company also announced on December 12, 2023 that its Board of Directors approved a regular cash dividend of $0.19 per ordinary share, paid during the first quarter on February 2, 2024.

EARNINGS CONFERENCE CALL

nVent’s management team will discuss the company’s fourth quarter and full-year performance on a conference call with analysts and investors at 10:00 a.m. Eastern today. A live audio webcast of the conference call and materials will be available through the “Investor Relations” section of the company’s website (https://investors.nvent.com). To participate, please dial 1-833-630-1071 or 1-412-317-1832 approximately ten minutes before the 10:00 a.m. ET start. A replay of the conference call will be made accessible once it becomes available and will remain accessible through February 20, 2024 by dialing 1-877-344-7529 or 1-412-317-0088, along with the access code 1084589.

About nVent

nVent is a leading global provider of electrical connection and protection solutions. We believe our inventive electrical solutions enable safer systems and ensure a more secure world. We design, manufacture, market, install and service high performance products and solutions that connect and protect some of the world's most sensitive equipment, buildings and critical processes. We offer a comprehensive range of enclosures, electrical connections and fastening and thermal management solutions across industry-leading brands that are recognized globally for quality, reliability and innovation. Our principal office is in London and our management office is in Minneapolis. Our robust portfolio of leading electrical product brands dates back more than 100 years and includes nVent CADDY, ERICO, HOFFMAN, ILSCO, GARDNER BENDER, RAYCHEM, SCHROFF and TRACER.

nVent, CADDY, ERICO, HOFFMAN, ILSCO, GARDNER BENDER, RAYCHEM, SCHROFF and TRACER are trademarks owned or licensed by nVent Services GmbH or its affiliates.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This press release contains statements that we believe to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact are forward looking statements. Without limitation, any statements preceded or followed by or that include the words “targets,” “plans,” “believes,” “expects,” “intends,” “will,” “likely,” “may,” “anticipates,” “estimates,” “projects,” “forecasts,” “should,” “would,” "could," “positioned,” “strategy,” “future,” “are confident,” or words, phrases or terms of similar substance or the negative thereof, are forward-looking statements. All projections in this press release are also forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, assumptions and other factors, some of which are beyond our control, which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include adverse effects on our business operations or financial results, including due to the overall global economic and business conditions impacting our business; the ability to achieve the benefits of our restructuring plans; the ability to successfully identify, finance, complete and integrate acquisitions, including the ECM Industries and other recent acquisitions; competition and pricing pressures in the markets we serve, including the impacts of tariffs; volatility in currency exchange rates, interest rates and commodity prices; inability to generate savings from excellence in operations initiatives consisting of lean enterprise, supply management and cash flow practices; inability to mitigate material and other cost inflation; risks related to the availability of, and cost inflation in, supply chain inputs, including labor, raw materials, commodities, packaging and transportation; increased risks associated with operating foreign businesses, including risks associated with military conflicts, such as that between Russia and Ukraine, and related sanctions; the ability to deliver backlog and win future project work; failure of markets to accept new product introductions and enhancements; the impact of changes in laws and regulations, including those that limit U.S. tax benefits; the outcome of litigation and governmental proceedings; and the ability to achieve our long-term strategic operating goals. Additional information concerning these and other factors is contained in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. All forward-looking statements speak only as of the date of this press release. nVent assumes no obligation, and disclaims any obligation, to update the information contained in this press release.

Investor Contact

Tony Riter

Vice President, Investor Relations

nVent

763.204.7750

Tony.Riter@nVent.com

Media Contact

Stacey Wempen

Director, External Communications

nVent

763.204.7857

Stacey.Wempen@nVent.com

| | | | | | | | | | | | | | | | | |

| nVent Electric plc |

| Condensed Consolidated Statements of Income (Unaudited) |

| | | | | |

| Three months ended | | Twelve months ended |

| In millions, except per-share data | December 31,

2023 | December 31,

2022 | | December 31,

2023 | December 31,

2022 |

| Net sales | $ | 861.2 | | $ | 741.6 | | | $ | 3,263.6 | | $ | 2,909.0 | |

| Cost of goods sold | 507.4 | | 450.0 | | | 1,921.5 | | 1,812.3 | |

| Gross profit | 353.8 | | 291.6 | | | 1,342.1 | | 1,096.7 | |

| % of net sales | 41.1 | % | 39.3 | % | | 41.1 | % | 37.7 | % |

| Selling, general and administrative | 174.4 | | 150.7 | | | 683.2 | | 595.9 | |

| % of net sales | 20.3 | % | 20.3 | % | | 20.9 | % | 20.5 | % |

| Research and development | 19.0 | | 15.8 | | | 71.5 | | 60.4 | |

| % of net sales | 2.2 | % | 2.1 | % | | 2.2 | % | 2.1 | % |

| | | | | |

| | | | | |

| | | | | |

| Operating income | 160.4 | | 125.1 | | | 587.4 | | 440.4 | |

| % of net sales | 18.6 | % | 16.9 | % | | 18.0 | % | 15.1 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net interest expense | 24.4 | | 8.4 | | | 79.4 | | 31.2 | |

| | | | | |

| Gain on sale of investment | (0.1) | | — | | | (10.3) | | — | |

| Other (income) expense | 15.1 | | (65.7) | | | 18.8 | | (63.4) | |

| | | | | |

| Income before income taxes | 121.0 | | 182.4 | | | 499.5 | | 472.6 | |

| Provision (benefit) for income taxes | (133.9) | | 23.7 | | | (67.6) | | 72.8 | |

| Effective tax rate | (110.7 | %) | 13.0 | % | | (13.5 | %) | 15.4 | % |

| | | | | |

| | | | | |

| | | | | |

| Net income | $ | 254.9 | | $ | 158.7 | | | $ | 567.1 | | $ | 399.8 | |

| Earnings per ordinary share | | | | | |

| Basic | 1.54 | | $ | 0.95 | | | 3.42 | | $ | 2.40 | |

| | | | | |

| | | | | |

| | | | | |

| Diluted | $ | 1.51 | | $ | 0.94 | | | $ | 3.37 | | $ | 2.38 | |

| | | | | |

| | | | | |

| | | | | |

| Weighted average ordinary shares outstanding | | | | | |

| Basic | 165.5 | | 166.2 | | | 165.6 | | 166.3 | |

| Diluted | 168.3 | | 168.4 | | | 168.2 | | 168.3 | |

| Cash dividends paid per ordinary share | $ | 0.175 | | $ | 0.175 | | | $ | 0.70 | | $ | 0.70 | |

| | | | | |

| | | | | | | | | |

| nVent Electric plc | |

| Condensed Consolidated Balance Sheets (Unaudited) | |

| | | |

| | December 31,

2023 | December 31,

2022 | |

| In millions |

| Assets | |

| Current assets | | | |

| Cash and cash equivalents | $ | 185.1 | | $ | 297.5 | | |

| Accounts and notes receivable, net | 589.5 | | 472.5 | | |

| Inventories | 441.3 | | 346.7 | | |

| Other current assets | 120.2 | | 112.5 | | |

| | | |

| Total current assets | 1,336.1 | | 1,229.2 | | |

| Property, plant and equipment, net | 390.0 | | 289.2 | | |

| Other assets | | | |

| Goodwill | 2,571.1 | | 2,178.1 | | |

| Intangibles, net | 1,517.0 | | 1,066.1 | | |

| Other non-current assets | 347.5 | | 139.6 | | |

| | | |

| Total other assets | 4,435.6 | | 3,383.8 | | |

| Total assets | $ | 6,161.7 | | $ | 4,902.2 | | |

| Liabilities and Equity | |

| Current liabilities | | | |

| Current maturities of long-term debt and short-term borrowings | $ | 31.9 | | $ | 15.0 | | |

| Accounts payable | 275.7 | | 252.1 | | |

| Employee compensation and benefits | 122.2 | | 109.3 | | |

| Other current liabilities | 303.8 | | 273.1 | | |

| | | |

| Total current liabilities | 733.6 | | 649.5 | | |

| Other liabilities | | | |

| Long-term debt | 1,748.8 | | 1,068.2 | | |

| Pension and post-retirement compensation and benefits | 153.0 | | 128.5 | | |

| Deferred tax liabilities | 204.4 | | 199.6 | | |

| Other non-current liabilities | 179.8 | | 124.7 | | |

| | | |

| Total liabilities | 3,019.6 | | 2,170.5 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Equity | 3,142.1 | | 2,731.7 | | |

| Total liabilities and equity | $ | 6,161.7 | | $ | 4,902.2 | | |

| | | |

| | | | | | | | |

| nVent Electric plc |

Condensed Consolidated Statements of Cash Flows (Unaudited) |

|

| | Twelve months ended |

| In millions | December 31,

2023 | December 31,

2022 |

| Operating activities | | |

| Net income | $ | 567.1 | | $ | 399.8 | |

| | |

| | |

| Adjustments to reconcile net income to net cash provided by (used for) operating activities | | |

| | |

| Depreciation | 51.7 | | 43.5 | |

| Amortization | 89.7 | | 70.7 | |

| Deferred income taxes | (178.6) | | (13.6) | |

| | |

| Share-based compensation | 23.5 | | 25.0 | |

| | |

| | |

| Gain on sale of property and equipment | (1.1) | | — | |

| Gain on sale of investment | (10.3) | | — | |

| | |

| Amortization of bridge financing debt issuance costs | 3.6 | | — | |

| Pension and post-retirement expense (income) | 21.6 | | (61.4) | |

| Pension and post-retirement contributions | (6.5) | | (5.5) | |

| | |

| Changes in assets and liabilities, net of effects of business acquisitions | | |

| Accounts and notes receivable | (21.3) | | (45.9) | |

| Inventories | 20.1 | | (34.7) | |

| Other current assets | (12.9) | | 13.4 | |

| Accounts payable | (2.1) | | (4.7) | |

| Employee compensation and benefits | — | | (2.1) | |

| Other current liabilities | (1.0) | | 18.1 | |

| Other non-current assets and liabilities | (15.4) | | (8.0) | |

| | |

| | |

| Net cash provided by (used for) operating activities | 528.1 | | 394.6 | |

| Investing activities | | |

| Capital expenditures | (71.0) | | (45.9) | |

| Proceeds from sale of property and equipment | 7.5 | | 2.0 | |

| Proceeds from sale of investment | 14.1 | | — | |

| | |

| Settlement of net investment hedge | 4.8 | | — | |

| Acquisitions, net of cash acquired | (1,120.1) | | (8.6) | |

| | |

| | |

| | |

| Net cash provided by (used for) investing activities | (1,164.7) | | (52.5) | |

| Financing activities | | |

| | |

| | |

| | |

| Net repayments of revolving credit facility | — | | (106.7) | |

| Proceeds from long-term debt | 800.0 | | 200.0 | |

| Repayments of long-term debt | (101.1) | | (10.0) | |

| Settlement of cash flow hedge | 4.5 | | 10.0 | |

| | |

| Debt issuance costs | (11.2) | | — | |

| | |

| Dividends paid | (116.8) | | (117.0) | |

| Shares issued to employees, net of shares withheld | 2.1 | | 7.5 | |

| Repurchases of ordinary shares | (60.8) | | (65.9) | |

| Net cash provided by (used for) financing activities | 516.7 | | (82.1) | |

| Effect of exchange rate changes on cash and cash equivalents | 7.5 | | (12.0) | |

| Change in cash and cash equivalents | (112.4) | | 248.0 | |

| Cash and cash equivalents, beginning of period | 297.5 | | 49.5 | |

| Cash and cash equivalents, end of period | $ | 185.1 | | $ | 297.5 | |

| | | | | | | | | | | | | | | | | |

| nVent Electric plc |

| Supplemental Financial Information by Reportable Segment (Unaudited) |

| | | | | |

| 2023 |

| In millions | First

Quarter | Second

Quarter | Third

Quarter | Fourth

Quarter | Full

Year |

| Net sales | | | | | |

| Enclosures | $ | 391.0 | | $ | 400.0 | | $ | 412.7 | | $ | 402.2 | | $ | 1,605.9 | |

| Electrical & Fastening Solutions | 205.7 | | 266.7 | | 302.3 | | 288.3 | | 1,063.0 | |

| Thermal Management | 143.9 | | 136.3 | | 143.8 | | 170.7 | | 594.7 | |

| Total | $ | 740.6 | | $ | 803.0 | | $ | 858.8 | | $ | 861.2 | | $ | 3,263.6 | |

| Segment income (loss) | | | | | |

| Enclosures | $ | 82.5 | | $ | 90.0 | | $ | 89.4 | | $ | 84.7 | | $ | 346.6 | |

| Electrical & Fastening Solutions | 61.3 | | 86.5 | | 97.6 | | 85.2 | | 330.6 | |

| Thermal Management | 30.9 | | 28.6 | | 34.8 | | 44.2 | | 138.5 | |

| Other | (26.7) | | (23.8) | | (19.8) | | (24.8) | | (95.1) | |

| Total | $ | 148.0 | | $ | 181.3 | | $ | 202.0 | | $ | 189.3 | | $ | 720.6 | |

| Return on sales | | | | | |

| Enclosures | 21.1 | % | 22.5 | % | 21.7 | % | 21.1 | % | 21.6 | % |

| Electrical & Fastening Solutions | 29.8 | % | 32.4 | % | 32.3 | % | 29.6 | % | 31.1 | % |

| Thermal Management | 21.5 | % | 21.0 | % | 24.2 | % | 25.9 | % | 23.3 | % |

| | | | | |

| Total | 20.0 | % | 22.6 | % | 23.5 | % | 22.0 | % | 22.1 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| 2022 | | | |

| In millions | First

Quarter | Second

Quarter | Third

Quarter | Fourth

Quarter | Full

Year | | | |

| Net sales | | | | | | | | |

| Enclosures | $ | 359.4 | | $ | 380.8 | | $ | 387.7 | | $ | 375.8 | | $ | 1,503.7 | | | | |

| Electrical & Fastening Solutions | 187.6 | | 200.9 | | 209.2 | | 193.7 | | 791.4 | | | | |

| Thermal Management | 147.7 | | 145.8 | | 148.3 | | 172.1 | | 613.9 | | | | |

| Total | $ | 694.7 | | $ | 727.5 | | $ | 745.2 | | $ | 741.6 | | $ | 2,909.0 | | | | |

| Segment income (loss) | | | | | | | | |

| Enclosures | $ | 50.3 | | $ | 61.5 | | $ | 71.9 | | $ | 72.3 | | $ | 256.0 | | | | |

| Electrical & Fastening Solutions | 47.1 | | 58.8 | | 60.8 | | 53.2 | | 219.9 | | | | |

| Thermal Management | 32.4 | | 28.3 | | 35.9 | | 44.2 | | 140.8 | | | | |

| Other | (19.6) | | (23.4) | | (24.6) | | (25.5) | | (93.1) | | | | |

| Total | $ | 110.2 | | $ | 125.2 | | $ | 144.0 | | $ | 144.2 | | $ | 523.6 | | | | |

| Return on sales | | | | | | | | |

| Enclosures | 14.0 | % | 16.2 | % | 18.5 | % | 19.2 | % | 17.0 | % | | | |

| Electrical & Fastening Solutions | 25.1 | % | 29.3 | % | 29.1 | % | 27.5 | % | 27.8 | % | | | |

| Thermal Management | 21.9 | % | 19.4 | % | 24.2 | % | 25.7 | % | 22.9 | % | | | |

| | | | | | | | |

| Total | 15.9 | % | 17.2 | % | 19.3 | % | 19.4 | % | 18.0 | % | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | |

| nVent Electric plc |

Reconciliation of GAAP to non-GAAP financial measures for the year ended December 31, 2023 |

| excluding the effect of adjustments (Unaudited) |

| | | | | |

| In millions, except per-share data | First

Quarter | Second

Quarter | Third

Quarter | Fourth

Quarter | Full

Year |

| Net sales | $ | 740.6 | | $ | 803.0 | | $ | 858.8 | | $ | 861.2 | | $ | 3,263.6 | |

| Operating income | 124.1 | | 146.7 | | 156.2 | | 160.4 | | 587.4 | |

| % of net sales | 16.8 | % | 18.3 | % | 18.2 | % | 18.6 | % | 18.0 | % |

| Adjustments: | | | | | |

| Restructuring and other | 4.0 | | 2.5 | | 5.4 | | 0.9 | | 12.8 | |

| Acquisition transaction and integration costs | 2.3 | | 4.9 | | 3.0 | | 2.8 | | 13.0 | |

| Intangible amortization | 17.6 | | 21.3 | | 25.6 | | 25.2 | | 89.7 | |

| Inventory step-up amortization | — | | 5.9 | | 11.8 | | — | | 17.7 | |

| | | | | |

| | | | | |

| | | | | |

| Segment income | $ | 148.0 | | $ | 181.3 | | $ | 202.0 | | $ | 189.3 | | $ | 720.6 | |

| Return on sales | 20.0 | % | 22.6 | % | 23.5 | % | 22.0 | % | 22.1 | % |

| | | | | |

| Net income - as reported | $ | 93.8 | | $ | 112.9 | | $ | 105.5 | | $ | 254.9 | | $ | 567.1 | |

| Adjustments to operating income | 23.9 | | 34.6 | | 45.8 | | 28.9 | | 133.2 | |

| Pension and post-retirement mark-to-market loss | — | | — | | — | | 13.9 | | 13.9 | |

| Gain on sale of investment | — | | (10.2) | | — | | (0.1) | | (10.3) | |

| Amortization of bridge financing debt issuance costs | — | | 3.6 | | — | | — | | 3.6 | |

| | | | | |

Income tax adjustments (1) | (4.4) | | (12.0) | | (10.3) | | (165.8) | | (192.6) | |

| Net income - as adjusted | $ | 113.3 | | $ | 128.9 | | $ | 141.0 | | $ | 131.8 | | $ | 514.9 | |

| Diluted earnings per ordinary share | | | | | |

| Diluted earnings per ordinary share - as reported | $ | 0.56 | | $ | 0.67 | | $ | 0.63 | | $ | 1.51 | | $ | 3.37 | |

| Adjustments | 0.11 | | 0.10 | | 0.21 | | (0.73) | | (0.31) | |

| Diluted earnings per ordinary share - as adjusted | $ | 0.67 | | $ | 0.77 | | $ | 0.84 | | $ | 0.78 | | $ | 3.06 | |

(1) Income tax adjustments in the fourth quarter include $157.5 million resulting from favorable discrete items, primarily related to the initial recognition of tax basis in intangible assets in foreign jurisdictions and the related valuation allowance, and the tax benefit of statutory losses at a foreign holding company.

| | | | | | | | | | | | | | | | | |

| nVent Electric plc |

Reconciliation of GAAP to non-GAAP financial measures for the year ended December 31, 2022 |

excluding the effect of 2022 adjustments (Unaudited) |

| | | | | |

| In millions, except per-share data | First

Quarter | Second

Quarter | Third

Quarter | Fourth

Quarter | Full Year |

| Net sales | $ | 694.7 | | $ | 727.5 | | $ | 745.2 | | $ | 741.6 | | $ | 2,909.0 | |

| Operating income | 90.1 | | 104.7 | | 120.5 | | 125.1 | | 440.4 | |

| % of net sales | 13.0 | % | 14.4 | % | 16.2 | % | 16.9 | % | 15.1 | % |

| Adjustments: | | | | | |

| Restructuring and other | 2.0 | | 2.3 | | 5.9 | | 1.5 | | 11.7 | |

| Acquisition transaction and integration costs | 0.3 | | 0.5 | | — | | — | | 0.8 | |

| Intangible amortization | 17.8 | | 17.7 | | 17.6 | | 17.6 | | 70.7 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Segment income | $ | 110.2 | | $ | 125.2 | | $ | 144.0 | | $ | 144.2 | | $ | 523.6 | |

| Return on sales | 15.9 | % | 17.2 | % | 19.3 | % | 19.4 | % | 18.0 | % |

| | | | | |

| Net income - as reported | $ | 67.8 | | $ | 79.9 | | $ | 93.4 | | $ | 158.7 | | $ | 399.8 | |

| Adjustments to operating income | 20.1 | | 20.5 | | 23.5 | | 19.1 | | 83.2 | |

| Pension and post-retirement mark-to-market gain | — | | — | | — | | (66.3) | | (66.3) | |

| | | | | |

| | | | | |

| | | | | |

| Income tax adjustments | (3.4) | | (4.3) | | (5.2) | | 0.1 | | (12.8) | |

| Net income - as adjusted | $ | 84.5 | | $ | 96.1 | | $ | 111.7 | | $ | 111.6 | | $ | 403.9 | |

| Diluted earnings per ordinary share | | | | | |

| Diluted earnings per ordinary share - as reported | $ | 0.40 | | $ | 0.48 | | $ | 0.55 | | $ | 0.94 | | $ | 2.38 | |

| Adjustments | 0.10 | | 0.09 | | 0.11 | | (0.28) | | 0.02 | |

| Diluted earnings per ordinary share - as adjusted | $ | 0.50 | | $ | 0.57 | | $ | 0.66 | | $ | 0.66 | | $ | 2.40 | |

| | | | | |

| | | | | | | | | | | | | | |

| nVent Electric plc |

Reconciliation of GAAP to non-GAAP financial measures for the year ending December 31, 2024 |

excluding the effect of 2024 adjustments (Unaudited) |

| | | | |

| In millions, except per-share data | | Forecast (1) |

| First Quarter | | Full Year |

| Net income - as reported | | $ | 104 | | | $ | 468 | |

| Intangible amortization | | 25 | | | 97 | |

| Income tax adjustments | | (6) | | | (22) | |

| Net income - as adjusted | | $ | 123 | | | $ | 543 | |

| Diluted earnings per ordinary share | | | | |

| Diluted earnings per ordinary share - as reported | | $0.61 - $0.63 | | $2.73 - $2.83 |

| Adjustments | | 0.11 | | | 0.44 | |

| Diluted earnings per ordinary share - as adjusted | | $0.72 - $0.74 | | $3.17 - $3.27 |

(1) Forecast information represents an approximation |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| nVent Electric plc | | | | | |

| Reconciliation of Net Sales Growth to Organic Net Sales Growth by Segment | | | | | |

for the quarter and year ended December 31, 2023 (Unaudited) | | | | | |

| | | | | |

| Q4 Net Sales Growth | | Full Year Net Sales Growth | | |

| Organic | Currency | Acq./Div. | Total | | Organic | Currency | Acq./Div. | Total | | | | | |

| nVent | 1.8 | % | 1.0 | % | 13.3 | % | 16.1 | % | | 3.5 | % | — | % | 8.7 | % | 12.2 | % | | | | | |

| Enclosures | 4.4 | % | 1.0 | % | 1.6 | % | 7.0 | % | | 5.9 | % | 0.1 | % | 0.8 | % | 6.8 | % | | | | | |

| Electrical & Fastening Solutions | — | % | 1.1 | % | 47.8 | % | 48.9 | % | | 3.6 | % | 0.3 | % | 30.4 | % | 34.3 | % | | | | | |

| Thermal Management | (1.9) | % | 1.1 | % | — | % | (0.8) | % | | (2.6) | % | (0.5) | % | — | % | (3.1) | % | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| nVent Electric plc | | | | |

| Reconciliation of Net Sales Growth to Organic Net Sales Growth | | | | |

for the quarter ending March 31, 2024 and the year ending December 31, 2024 (Unaudited) | | | | |

| | | | |

| Forecast (1) | | | | |

| Q1 Net Sales Growth | | Full Year Net Sales Growth | |

| Organic | Currency | Acq./Div. | Total | | Organic | Currency | Acq./Div. | Total | | | | |

| nVent | 2 - 4 % | 1 | % | 13 | % | 16 - 18 % | | 3 - 5 % | — | % | 5 | % | 8 - 10 % | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1) Forecast information represents an approximation | | | | |

| | | | | | | | | | | | | | | | | | |

|

Reconciliation of cash from operating activities to free cash flow (Unaudited) |

|

| | Three months ended | | Twelve months ended | |

| In millions | December 31,

2023 | December 31,

2022 | | December 31,

2023 | December 31,

2022 | |

| | | | | | |

| Net cash provided by (used for) operating activities | $ | 236.5 | | $ | 194.8 | | | $ | 528.1 | | $ | 394.6 | | |

| Capital expenditures | (22.1) | | (15.1) | | | (71.0) | | (45.9) | | |

| Proceeds from sale of property and equipment | 0.2 | | — | | | 7.5 | | 2.0 | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Free cash flow | $ | 214.6 | | $ | 179.7 | | | $ | 464.6 | | $ | 350.7 | | |

Cover Page

|

Feb. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| 8-K |

Feb. 06, 2024

|

| Entity File Number |

001-38265

|

| Entity Registrant Name |

nVent Electric plc

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity Tax Identification Number |

98-1391970

|

| Entity Address, Address Line One |

The Mille, 1000 Great West Road, 8th Floor (East)

|

| Entity Address, City or Town |

London

|

| Entity Address, Postal Zip Code |

TW8 9DW

|

| Entity Address, Country |

GB

|

| Country Region |

44

|

| City Area Code |

20

|

| Local Phone Number |

3966-0279

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary Shares, nominal value $0.01 per share

|

| Trading Symbol |

NVT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001720635

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

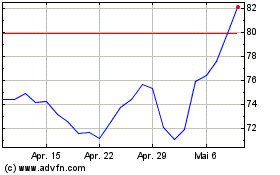

nVent Electric (NYSE:NVT)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

nVent Electric (NYSE:NVT)

Historical Stock Chart

Von Mai 2023 bis Mai 2024