- Strong Net Sales Growth in Q1 FY25 of 8% compared to Q1

FY24

- Significant increase of Average Order Value (AOV) by 9%

to a new record of €720 LTM in Q1 FY25

- Double-digit US Market Growth with +14% in Q1 FY25 vs.

Q1 FY24 and Net Sales share of the US further expanding to 20%

- Exceptional Customer Economics with strong increase in

average GMV per top customers by +16.7% in Q1 FY25

- Gross Margin Improvement of 150bps to 43.9% in Q1 FY25

as compared to Q1 FY24

- Improved Profitability by 200bps at adjusted EBITDA

margin level of 1.4% in Q1 FY25 as compared to -0.6% in the prior

year period

- Transformational opportunity with the announced

acquisition of YOOX NET-A-PORTER (“YNAP”) to create a leading,

global, multi-brand digital luxury group

MYT Netherlands Parent B.V. (NYSE: MYTE) (“Mytheresa” or the

“Company”) today announced financial results for its first quarter

fiscal year 2025 ended September 30, 2024. The luxury multi-brand

digital platform reported continued strong financial performance

for the first quarter, with strong revenue growth and significantly

improved profitability on adjusted EBITDA level as compared to last

year with increased AOV, improved gross margin, reduced return

rates and improved cost ratios.

Michael Kliger, Chief Executive Officer of Mytheresa,

said, “We are very pleased with our results despite many short-term

uncertainties. With strong revenue growth and positive adjusted

EBITDA in the first quarter we continued our very positive business

momentum that we have seen since the third quarter of fiscal year

2024.”

Kliger continued, “We have reaffirmed our leading position in a

clearly consolidating sector and displayed our unique

characteristic of profitable growth. We strongly believe that we

will benefit significantly from the improving market conditions

over the next quarters. Our strong growth with top customer, our

record high AOV, our improved gross margin and the excellent

customer satisfaction scores all highlight the fundamental health

of our business.”

FINANCIAL HIGHLIGHTS FOR THE FIRST QUARTER FY25 ENDED

SEPTEMBER 30, 2024

- Net Sales increase of 7.6% in Q1 FY25 to €201.7 million as

compared to 187.5 million in the prior year period

- GMV growth of 6.3% to €216.6 million in Q1 of FY25 compared

to Q1 FY24

- Gross Profit margin of 43.9%, a 150bps increase as compared

to 42.4% in the prior year period

- Improved Profitability by 200bps at adjusted EBITDA margin

level of 1.4% in Q1 FY25 as compared to -0.6% in the prior year

period

- Inventory decrease of -3.6% year-over-year to €365.0

million

Q1 FY25 KEY BUSINESS HIGHLIGHTS

- Launch of exclusive capsule collections and pre-launches in

collaboration with Chloé, Bottega Veneta, Saint Laurent, Loewe,

Gucci, The Row and others

- Highly impactful top customer events around the globe and

multi-day “money-can´t buy” experiences in partnership with luxury

brands, including an intimate dinner with Simone Rocha at the

illustrious Claridge’s in London, a supper club evening at the

iconic club Le Bristol After Dark in Paris, Mytheresa´s annual

cocktail soirée at the legendary Bar Basso in Milan and a two-day

experience with Tod´s in Milan

- Launch of own Chinese brand name 美遴世 (Mei Lin Shi) and of the

Mytheresa WeChat Mini Program, offering Chinese customers a

seamless and convenient shopping experience

- Release of Mytheresa’s third Environment, Social and Governance

(ESG) report highlighting Mytheresa´s progress towards ESG

commitments in fiscal year 2024

For the full fiscal year ending June 30, 2025, we expect:

- GMV and Net Sales growth in the range of 7% to 13%

- Adjusted EBITDA margin in the range of 3% and 5%

The foregoing forward-looking statements reflect Mytheresa’s

expectations as of today's date. Given the number of risk factors,

uncertainties and assumptions discussed below, actual results may

differ materially. Mytheresa does not intend to update its

forward-looking statements until its next quarterly results

announcement, other than in publicly available statements.

ACQUISITION OF YNAP

On October 7, 2024, the Company and Richemont Italia Holding

S.P.A signed an agreement for Mytheresa to acquire YOOX

Net-A-Porter Group S.p.A (“YNAP”):

- Richemont Italia Holding S.P.A will sell YNAP to Mytheresa with

a cash position of €555m and no financial debt, subject to

customary closing adjustments.

- Mytheresa to issue shares to Richemont Italia Holding S.P.A

representing 33% of Mytheresa’s fully diluted share capital.

- Richemont International Holding S.A. to provide a €100m

revolving credit facility to YNAP.

- Closing of transaction expected in the first half of 2025,

subject to customary conditions, including regulatory

approvals.

CONFERENCE CALL AND WEBCAST INFORMATION

Mytheresa will host a conference call to discuss its first

quarter of fiscal year 2025 financial results on November 19, 2024

at 8:00am Eastern Time. Those wishing to participate via webcast

should access the call through Mytheresa’s Investor Relations

website at https://investors.mytheresa.com. Those wishing to

participate via the telephone may dial in at +1 (800) 715-9871

(USA). The participant access code will be 7531135. The conference

call replay will be available via webcast through Mytheresa’s

Investor Relations website. The telephone replay will be available

from 11:00am Eastern Time on November 19, 2024, through November

26, 2024, by dialing +1 (800) 770-2030 (USA). The replay passcode

will be 7531135. For specific international dial-ins please see

here.

FORWARD LOOKING STATEMENTS

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, including statements relating to financing activities;

future sales, expenses, and profitability; future development and

expected growth of our business and industry; our ability to

execute our business model and our business strategy; having

available sufficient cash and borrowing capacity to meet working

capital, debt service and capital expenditure requirements for the

next twelve months; and projected capital spending. In some cases,

you can identify forward-looking statements by the following words:

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “ongoing,” “plan,” “potential,” “predict,”

“project,” “should,” “will,” “would” or the negative of these terms

or other comparable terminology, although not all forward-looking

statements contain these words. These statements are only

predictions. Actual events or results may differ materially from

those stated or implied by these forward-looking statements. In

evaluating these statements and our prospects, you should carefully

consider the factors set forth below.

We undertake no obligation to update any forward-looking

statements made in this press release to reflect events or

circumstances after the date of this press release or to reflect

new information or the occurrence of unanticipated events, except

as required by law.

The achievement or success of the matters covered by such

forward-looking statements involves known and unknown risks,

uncertainties and assumptions. If any such risks or uncertainties

materialize or if any of the assumptions prove incorrect, our

results could differ materially from the results expressed or

implied by the forward-looking statements we make.

You should not rely upon forward-looking statements as

predictions of future events. Forward-looking statements represent

our management’s beliefs and assumptions only as of the date such

statements are made.

Further information on these and other factors that could affect

our financial results is included in filings we make with the U.S.

Securities and Exchange Commission (“SEC”) from time to time,

including the section titled “Risk Factors” included in the Form

20-F filed on September 12, 2024. These documents are available on

the SEC’s website at www.sec.gov and on the SEC Filings section of

the Investor Relations section of our website at:

https://investors.mytheresa.com.

ABOUT NON-IFRS FINANCIAL MEASURES AND OPERATING

METRICS

Our non-IFRS financial measures include:

- Adjusted EBITDA is a non-IFRS financial measure that we

calculate as net income before finance expense (net), taxes, and

depreciation and amortization, adjusted to exclude Other

transaction-related, certain legal and other expenses and

Share-based compensation expense. Adjusted EBITDA Margin is a

non-IFRS financial measure which is calculated in relation to net

sales.

- Adjusted Operating Income is a non-IFRS financial

measure that we calculate as operating income, adjusted to exclude

Other transaction-related, certain legal and other expenses and

Share-based compensation expense. Adjusted Operating Income Margin

is a non-IFRS financial measure which is calculated in relation to

net sales.

- Adjusted Net Income is a non-IFRS financial measure that

we calculate as net income, adjusted to exclude Other

transaction-related, certain legal and other expenses and

Share-based compensation expense. Adjusted Net Income Margin is a

non-IFRS financial measure which is calculated in relation to net

sales.

We are not able to forecast net income (loss) on a

forward-looking basis without unreasonable efforts due to the high

variability and difficulty in predicting certain items that affect

net income (loss), including, but not limited to, Income taxes and

Interest expense and, as a result, are unable to provide a

reconciliation to forecasted Adjusted EBITDA.

Gross Merchandise Value (GMV) is an operative measure and means

the total Euro value of orders processed. GMV is inclusive of

merchandise value, shipping and duty. It is net of returns, value

added taxes and cancellations. GMV does not represent revenue

earned by us. We use GMV as an indicator for the usage of our

platform that is not influenced by the mix of direct sales and

commission sales. The indicators we use to monitor usage of our

platform include, among others, active customers, total orders

shipped and GMV.

ABOUT MYTHERESA

Mytheresa is one of the leading luxury multi-brand digital

platforms shipping to over 130 countries. Founded as a boutique in

1987, Mytheresa launched online in 2006 and offers ready-to-wear,

shoes, bags and accessories for womenswear, menswear, kidswear as

well as lifestyle products and fine jewelry. The highly curated

edit of up to 250 brands focuses on true luxury brands such as

Bottega Veneta, Brunello Cucinelli, Dolce&Gabbana, Gucci,

Loewe, Loro Piana, Moncler, Prada, Saint Laurent, The Row,

Valentino, and many more. Mytheresa’s unique digital experience is

based on a sharp focus on high-end luxury shoppers, exclusive

product and content offerings, leading technology and analytical

platforms as well as high quality service operations. The NYSE

listed company reported €913.6 million GMV in fiscal year 2024 (+7%

vs. FY23).

For more information and updated Mytheresa campaign imagery,

please visit https://investors.mytheresa.com.

MYT Netherlands Parent

B.V.

Financial Results and Key

Operating Metrics

(Amounts in €

millions)

Three Months Ended

September 30, 2023

September 30, 2024

Change in % / BPs

(in millions) (unaudited)

Gross Merchandise Value (GMV) (1)

€ 203.8

€ 216.6

6.3%

Active customer (LTM in thousands) (1),

(2)

865

842

(2.7%)

Total orders shipped (LTM in thousands)

(1), (2)

2,027

2,095

3.3%

Net sales

€ 187.5

€ 201.7

7.6%

Gross profit

€ 79.5

€ 88.6

11.5%

Gross profit margin (3)

42.4%

43.9%

150 BPs

Operating Loss

€ (13.5)

€ (30.0)

(122.9%)

Operating Loss margin (3)

(7.2%)

(14.9%)

(770 BPs)

Net Loss

€ (12.2)

€ (23.5)

(93.2%)

Net Loss margin (3)

(6.5%)

(11.7%)

(520 BPs)

Adjusted EBITDA (4)

€ (1.2)

€ 2.9

353.0%

Adjusted EBITDA margin (3)

(0.6%)

1.4%

200 BPs

Adjusted Operating Income (Loss) (4)

€ (4.6)

€ (1.1)

75.1%

Adjusted Operating Income (Loss) margin

(3)

(2.4%)

(0.6%)

180 BPs

Adjusted Net Income (Loss) (4)

€ (3.3)

€ 5.4

265.4%

Adjusted Net Income (Loss) margin (3)

(1.7%)

2.7%

440 BPs

(1)

Definition of GMV, Active customer and

Total orders shipped can be found on page 28 in our quarterly

report.

(2)

Active customers and total orders shipped

are calculated based on orders shipped from our sites during the

last twelve months (LTM) ended on the last day of the period

presented.

(3)

As a percentage of net sales.

(4)

EBITDA, adjusted EBITDA, adjusted

operating income and adjusted net income are measures not defined

under IFRS. For further information about how we calculate these

measures and limitations of its use, see page 28 in our quarterly

report.

MYT Netherlands Parent B.V.

Financial Results and Key Operating

Metrics (Amounts in € millions)

The following tables set forth the reconciliations of net income

(loss) to EBITDA and adjusted EBITDA, operating income (loss) to

adjusted operating income and net income (loss) to adjusted net

income and their corresponding margins as a percentage of net

sales:

Three Months Ended

September 30, 2023

September 30, 2024

Change in %

(in millions) (unaudited)

Net loss

€ (12.2)

€ (23.5)

(93.2%)

Finance expenses, net

€ 1.0

€ 1.2

21.1%

Income tax expense (benefit)

€ (2.3)

€ (7.7)

235.2%

Depreciation and amortization

€ 3.4

€ 7.1

109.9%

thereof depreciation of right-of use

assets

€ 2.4

€ 2.4

1.5%

thereof impairment loss on property and

equipment (3)

-

€ 3.1

N/A

EBITDA

€ (10.1)

€ (22.9)

(127.3%)

Other transaction-related, certain legal

and other expenses (1)

€ 2.4

€ 21.3

773.7%

Share-based compensation (2)

€ 6.5

€ 4.5

(30.6%)

Adjusted EBITDA

€ (1.2)

€ 2.9

(353.0%)

Reconciliation to Adjusted EBITDA

Margin

Net Sales

€ 187.5

€ 201.7

7.6%

Adjusted EBITDA margin

(0.6%)

1.4%

200 BPs

Three Months Ended

September 30, 2023

September 30, 2024

Change in %

(in millions) (unaudited)

Operating loss

€ (13.5)

€ (30.0)

(122.9%)

Other transaction-related, certain legal

and other expenses (1)

€ 2.4

€ 21.3

773.7%

Share-based compensation (2)

€ 6.5

€ 4.5

(30.6%)

Impairment loss on property and equipment

(3)

-

€ 3.1

N/A

Adjusted Operating loss

€ (4.6)

€ (1.1)

75.1%

Reconciliation to Adjusted Operating

Income Margin

Net Sales

€ 187.5

€ 201.7

7.6%

Adjusted Operating Income (Loss)

margin

(2.4%)

(0.6%)

180 BPs

Three Months Ended

September 30, 2023

September 30, 2024

Change in %

(in millions) (unaudited)

Net loss

€ (12.2)

€ (23.5)

(93.2%)

Other transaction-related, certain legal

and other expenses (1)

€ 2.4

€ 21.3

773.7%

Share-based compensation (2)

€ 6.5

€ 4.5

(30.6%)

Impairment loss on property and equipment

(3)

-

€ 3.1

N/A

Adjusted Net Income (loss)

€ (3.3)

€ 5.4

265.4%

Reconciliation to Adjusted Net Income

Margin

Net Sales

€ 187.5

€ 201.7

7.6%

Adjusted Net Income (Loss) margin

(1.7%)

2.7%

440 BPs

(1)

Other transaction-related, certain legal

and other expenses represent (i) professional fees, including

advisory and accounting fees, related to potential transactions,

(ii) certain legal and other expenses incurred outside the ordinary

course of our business and (iii) other non-recurring expenses

incurred in connection with the costs of closing distribution

center in Heimstetten, Germany.

(2)

Certain members of management and

supervisory board members have been granted share-based

compensation for which the share-based compensation expense will be

recognized upon defined vesting schedules in the future periods.

Our methodology to adjust for share-based compensation and

subsequently calculate adjusted EBITDA, adjusted operating income

and adjusted net income includes both share-based compensation

expense connected to the IPO and share-based compensation expense

recognized in connection with grants under the Long-Term Incentive

Plan (LTI) for the Mytheresa Group key management members and

share-based compensation expense due to Supervisory Board Members

Plans. We do not consider share-based compensation expense to be

indicative of our core operating performance. For further

information about how we calculate these measures and limitations

of its use, see our annual report on Form 20-F filed on September

12, 2024.

(3)

Included in depreciation and amortization

is an impairment loss recognized, in accordance with IAS 36, on

property plant and equipment utilized in the Heimstetten

distribution center, which was closed in August 2024.

MYT Netherlands Parent

B.V.

Consolidated Statements of

Profit or Loss and Comprehensive Loss

(Amounts in € thousands,

except share and per share data)

Three Months Ended

(in € thousands)

September 30, 2023

September 30, 2024

Net sales

187,467

201,701

Cost of sales, exclusive of depreciation

and amortization

(107,978)

(113,067)

Gross profit

79,488

88,633

Shipping and payment cost

(28,312)

(29,360)

Marketing expenses

(23,699)

(24,992)

Selling, general and administrative

expenses

(38,428)

(56,013)

Depreciation and amortization

(3,396)

(7,128)

Other income, net

874

(1,177)

Operating loss

(13,473)

(30,036)

Finance income

1

-

Finance costs

(1,009)

(1,221)

Finance costs, net

(1,008)

(1,221)

Loss before income taxes

(14,481)

(31,257)

Income tax (expense) benefit

2,307

7,736

Net loss

(12,174)

(23,522)

Cash Flow Hedge

(1,744)

1,035

Income Taxes related to Cash Flow

Hedge

487

(289)

Foreign currency translation

(13)

(29)

Other comprehensive loss

(1,270)

717

Comprehensive loss

(13,444)

(22,805)

Basic & diluted earnings per share

€

(0.14)

(0.27)

Weighted average ordinary shares

outstanding

(basic and diluted) – in millions (1)

86.8

87.2

(1)

In accordance with IAS 33, includes

contingently issuable shares that are fully vested and can be

converted at any time for no consideration. For further details,

refer to note 13 in our quarterly report.

MYT Netherlands Parent

B.V.

Consolidated Statements of

Financial Position

(Amounts in €

thousands)

(in € thousands)

June 30, 2024

September 30, 2024

Assets

Non-current assets

Intangible assets and goodwill

154,951

155,317

Property and equipment

43,653

39,856

Right-of-use assets

45,468

44,736

Deferred tax assets

1,999

8,856

Other non-current assets

7,572

7,499

Total non-current assets

253,643

256,265

Current assets

Inventories

370,635

364,977

Trade and other receivables

11,819

8,977

Other assets

45,306

37,056

Cash and cash equivalents

15,107

8,960

Total current assets

442,867

419,969

Total assets

696,511

676,234

Shareholders’ equity and

liabilities

Subscribed capital

1

1

Capital reserve

546,913

551,407

Accumulated Deficit

(112,767)

(136,289)

Accumulated other comprehensive income

1,496

2,213

Total shareholders’ equity

435,643

417,333

Non-current liabilities

Provisions

2,789

2,829

Lease liabilities

40,483

40,152

Deferred tax liabilities

11

525

Total non-current liabilities

43,282

43,505

Current liabilities

Borrowings

-

25,316

Tax liabilities

10,643

8,994

Lease liabilities

9,282

8,985

Contract liabilities

17,104

16,305

Trade and other payables

85,322

45,619

Other liabilities

95,235

110,177

Total current liabilities

217,585

215,396

Total liabilities

260,867

258,901

Total shareholders’ equity and

liabilities

696,511

676,234

MYT Netherlands Parent

B.V.

Consolidated Statements of

Changes in Equity

(Amounts in €

thousands)

(in € thousands)

Subscribed capital

Capital reserve

Accumulated deficit

Hedging reserve

Foreign currency translation

reserve

Total shareholders’

equity

Balance as of July 1, 2023

1

529,775

(87,856)

-

1,509

443,429

Net loss

-

-

(12,174)

-

-

(12,174)

Other comprehensive loss

-

-

-

(1,257)

(13)

(1,270)

Comprehensive loss

-

-

(12,174)

(1,257)

(13)

(13,444)

Share options exercised

-

-

-

-

-

Share-based compensation

-

6,478

-

-

-

6,478

Balance as of September 30,

2023

1

536,253

(100,030)

(1,257)

1,496

436,464

Balance as of July 1, 2024

1

546,913

(112,767)

-

1,496

435,643

Net loss

-

-

(23,522)

-

-

(23,522)

Other comprehensive loss

-

-

-

746

(29)

717

Comprehensive loss

-

-

(23,522)

746

(29)

(22,805)

Share-based compensation

-

4,495

-

-

-

4,495

Balance as of September 30,

2024

1

551,407

(136,289)

746

1,467

417,333

MYT Netherlands Parent

B.V.

Consolidated Statements of

Cash Flows

(Amounts in €

thousands)

Three months ended September

30,

(in € thousands)

2023

2024

Net Loss

(12,174)

(23,522)

Adjustments for

Depreciation and amortization

3,396

7,128

Finance (income) costs, net

1,008

1,221

Share-based compensation

6,341

4,495

Income tax benefit

(2,307)

(7,736)

Change in operating assets and

liabilities

(Increase) decrease in inventories

(18,364)

5,658

Decrease in trade and other

receivables

618

2,842

Decrease in other assets

6,003

10,096

(Increase) decrease in other

liabilities

(11,309)

14,205

Decrease in contract liabilities

(6,652)

(799)

(Decrease) increase in trade and other

payables

2,729

(39,700)

Income taxes paid

(2,607)

(544)

Net cash used in operating

activities

(33,317)

(26,655)

Expenditure for property and equipment and

intangible assets

(3,107)

(1,296)

Net cash used in investing

activities

(3,107)

(1,296)

Interest paid

(1,008)

(1,156)

Proceeds from borrowings

16,393

25,316

Lease payments

(1,645)

(2,258)

Net cash inflow from financing

activities

13,740

21,902

Net decrease in cash and cash

equivalents

(22,684)

(6,049)

Cash and cash equivalents at the

beginning of the period

30,136

15,107

Effects of exchange rate changes on

cash and cash equivalents

46

(98)

Cash and cash equivalents at end of the

period

7,497

8,960

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119106659/en/

Investor Relations Contacts Mytheresa.com GmbH Stefanie

Muenz phone: +49 89 127695-1919 email: investors@mytheresa.com

Media Contacts for public relations Mytheresa.com GmbH

Sandra Romano mobile: +49 152 54725178 email:

sandra.romano@mytheresa.com Media Contacts for business

press Mytheresa.com GmbH Lisa Schulz mobile: +49 151 11216490

email: lisa.schulz@mytheresa.com

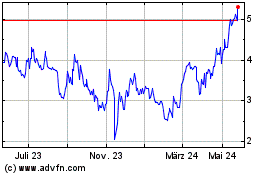

MYT Netherlands Parent BV (NYSE:MYTE)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

MYT Netherlands Parent BV (NYSE:MYTE)

Historical Stock Chart

Von Jan 2024 bis Jan 2025