UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-39880

MYT NETHERLANDS PARENT B.V.

(Exact Name

of Registrant as Specified in its Charter)

Einsteinring 9

85609 Aschheim/Munich

Germany

+49 89 127695-614

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

On September 14, 2023, MYT Netherlands Parent B.V. will hold a

conference call regarding its audited financial results for the fourth fiscal quarter and year-end June 30, 2023.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

MYT Netherlands Parent B.V. |

| |

|

| |

By: |

/s/ Martin Beer |

| |

Name: |

Dr. Martin Beer |

| |

Title: |

Chief Financial Officer |

Date: September 14, 2023

Exhibit 99.1

Q4 and Full FY23 Results:

Mytheresa reports excellent results with 15%

GMV growth and strong profitability for full fiscal year 2023

| · | Excellent

Financial Performance resulting in a record €855.8 million GMV in FY23 and continued

strong profitability in a very difficult market environment |

| · | US

Market Outperformance with extraordinary GMV growth of 40.8% far above slowing market

trend in Q4 FY23 |

| · | Strong

Customer Growth with +10% active customers in the last twelve months and over 126,000

first-time buyers in Q4 FY23 |

| · | Exceptional

Top Customers Growth with +30.1% in terms of GMV by top customers in FY23 |

| · | Experiential

Innovation with the first ever physical pop-up store in East Hampton, USA, welcoming

3,200 highly selected guests over five weeks |

| · | Extensive

Operational Scaling with the upcoming start of operations in our new state-of-the-art

distribution center at Leipzig airport |

MUNICH,

Germany (September 14, 2023) – MYT Netherlands Parent B.V. (NYSE: MYTE) (“Mytheresa” or the

“Company”), the parent company of Mytheresa Group GmbH, today announced financial results for its fourth quarter and full

fiscal year 2023 ended June 30, 2023. The luxury multi-brand digital platform reported excellent financial performance both for

the fourth quarter and the full fiscal year, delivering double-digit growth and continued strong profitability amidst very difficult

market conditions.

Mytheresa fourth quarter highlights include double-digit

GMV growth globally, exceptional GMV growth in the US in contrast to slowing market trend, excellent Top Customer GMV growth, successful

transition to completely new tech platform and continued strong profitability.

Michael

Kliger, Chief Executive Officer of Mytheresa, said, “We are extremely pleased with our excellent full fiscal year 2023

results. Double-digit growth across all geographies as well as continued profitability sets us apart especially in the current very difficult

market environment.”

Kliger continued, “The driver for our excellent

results is our continued focus on the big spending, wardrobe building top customers and not the aspirational, occasional luxury shoppers.

Our business with Top Customers grew by +30% in terms of GMV in fiscal year 2023. The share of Top Customers in our business in terms

of GMV has increased to now 39%.”

FINANCIAL HIGHLIGHTS FOR THE FOURTH QUARTER

ENDED JUNE 30, 2023

| · | GMV

growth of 13.0% to €222.2 million in Q4 FY23 as compared to €196.7 million in the

prior year period |

| · | Net

sales increase of 16.5% year-over-year to €203.8 million |

| · | Gross

Profit margin of 49.0% |

| · | Consistent

profitability with Adjusted EBITDA of €7.4 million in Q4 FY23, representing an Adjusted

EBITDA margin of 3.6% |

| · | Positive

Adjusted operating income of €4.2 million and Adjusted net income of €0.8 million |

FINANCIAL HIGHLIGHTS FOR THE TWELVE MONTHS

ENDED JUNE 30, 2023

| · | GMV

growth of 14.5% to €855.8 million, compared to €747.3 million in fiscal year 2022 |

| · | Net

sales increase to €768.6 million, a 11.4% growth from €689.8 in fiscal year 2022 |

| · | Gross

Profit margin of 49.8% compared to 51.5% in the prior year |

| · | Adjusted

EBITDA of €41.1 million with an adjusted EBITDA margin of 5.3% |

| · | Consistent

profitability levels also on Adjusted operating income margin level and Adjusted net income

margin level of 3.8% and 2.6% respectively |

Q4 FY23 KEY BUSINESS HIGHLIGHTS

| · | ‘Money

can’t buy’ experiences for top customers across the world, such as a unique three-day

experience in Portofino in partnership with Dolce&Gabbana to celebrate the launch of

the 84 piece exclusive capsule collection only available at Mytheresa, including a private

cocktail reception by Domenico Dolce and Stefano Gabbana at their home in Portofino |

| · | Launch

of exclusive capsule collections and pre-launches in collaboration with Valentino, Givenchy,

Dolce&Gabbana, Bottega Veneta, Loewe, Zimmermann, Gucci, Etro and many more |

| · | First

ever physical Mytheresa Pop-Up Store in East Hampton in the United States attracting 3,200

selected guests over five weeks and creating brand awareness in the US |

| · | Launch

of certified pre-owned watches from over 25 luxury brands in collaboration with world’s

largest luxury watches and jewelry retailer Bucherer with a €86,000 watch being so far

the most expensive item sold on Mytheresa |

| · | Record

Average Order Value increasing to €654 in full FY23 |

| · | Strong

customer growth of +9.6% and even stronger growth of number of top customers with +24.2%

in Q4 FY23 vs. Q4 FY22 |

| · | Upcoming

start of operations in new state-of-the-art distribution center at Leipzig airport with dramatically

improved customer service |

For the full fiscal year ending June 30,

2024, we expect:

| · | GMV

and Net Sales growth in the range of 8% to 13% |

| · | Gross

Profit growth in the range of 8% to 13% |

| · | Adjusted

EBITDA margin in the range of 3% and 5% |

We expect a much stronger H2 vs. H1 in FY24 as

the market environment improves and the full leverage of major infrastructure investments boost the business.

The foregoing forward-looking statements reflect

Mytheresa’s expectations as of today's date. Given the number of risk factors, uncertainties and assumptions discussed below, actual

results may differ materially. Mytheresa does not intend to update its forward-looking statements until its next quarterly results announcement,

other than in publicly available statements.

CONFERENCE CALL AND WEBCAST INFORMATION

Mytheresa

will host a conference call to discuss its fourth quarter and full fiscal year 2023 financial results on September 14, 2023 at 8:00am

Eastern Time. Those wishing to participate via webcast should access the call through Mytheresa’s Investor Relations website at

https://investors.mytheresa.com. Those wishing to participate via the telephone may dial in at +1 (888) 550-5658 (USA).

The participant access code will be 4922601. The conference call replay will be available via webcast through Mytheresa’s Investor

Relations website. The telephone replay will be available from 11:00am Eastern Time on September 14, 2023, through September 21,

2023, by dialing +1 (800) 770-2030 (USA). The replay passcode will be 4922601. For specific international dial-ins please see here.

FORWARD LOOKING STATEMENTS

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, including statements relating to the impact of the COVID-19 global pandemic; the impact of restrictions

on use of identifiers for advertisers (IDFA); future sales, expenses, and profitability; future development and expected growth of our

business and industry; our ability to execute our business model and our business strategy; having available sufficient cash and borrowing

capacity to meet working capital, debt service and capital expenditure requirements for the next twelve months; and projected capital

spending. In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,”

“plan,” “potential,” “predict,” “project,” “should,” “will,”

“would” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain

these words. These statements are only predictions. Actual events or results may differ materially from those stated or implied by these

forward-looking statements. In evaluating these statements and our prospects, you should carefully consider the factors set forth below.

We undertake no obligation to update any forward-looking

statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information

or the occurrence of unanticipated events, except as required by law.

The achievement or success of the matters covered

by such forward-looking statements involves known and unknown risks, uncertainties and assumptions. If any such risks or uncertainties

materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by

the forward-looking statements we make.

You should not rely upon forward-looking statements

as predictions of future events. Forward-looking statements represent our management’s beliefs and assumptions only as of the date

such statements are made.

Further

information on these and other factors that could affect our financial results is included in filings we make with the U.S. Securities

and Exchange Commission (“SEC”) from time to time, including the section titled “Risk Factors” included in the

form 20-F filed on September 14, 2022 under Rule 424(b)(4) of the Securities Act. These documents are available on the

SEC’s website at www.sec.gov and on the SEC Filings section of the Investor Relations section of our website at:

https://investors.mytheresa.com.

ABOUT NON-IFRS FINANCIAL MEASURES AND OPERATING

METRICS

Our non-IFRS financial measures include:

| · | Adjusted

EBITDA is a non-IFRS financial measure that we calculate as net income before finance

expense (net), taxes, and depreciation and amortization, adjusted to exclude Other transaction-related,

certain legal and other expenses and Share-based compensation expense. Adjusted EBITDA Margin

is a non-IFRS financial measure which is calculated in relation to net sales. |

| · | Adjusted

Operating Income is a non-IFRS financial measure that we calculate as operating income,

adjusted to exclude Other transaction-related, certain legal and other expenses and Share-based

compensation expense. Adjusted Operating Income Margin is a non-IFRS financial measure which

is calculated in relation to net sales. |

| · | Adjusted

Net Income is a non-IFRS financial measure that we calculate as net income, adjusted

to exclude Other transaction-related, certain legal and other expenses and Share-based compensation

expense. Adjusted Net Income Margin is a non-IFRS financial measure which is calculated in

relation to net sales. |

We are not able to forecast net income (loss)

on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect

net income (loss), including, but not limited to, Income taxes and Interest expense and, as a result, are unable to provide a reconciliation

to forecasted Adjusted EBITDA.

Gross Merchandise Value (GMV) is an operative

measure and means the total Euro value of orders processed. GMV is inclusive of merchandise value, shipping and duty. It is net of returns,

value added taxes and cancellations. GMV does not represent revenue earned by us. We use GMV as an indicator for the usage of our platform

that is not influenced by the mix of direct sales and commission sales. The indicators we use to monitor usage of our platform include,

among others, active customers, total orders shipped and GMV.

ABOUT MYTHERESA

Mytheresa is one of the leading global luxury

e-commerce platforms shipping to over 130 countries. Founded as a boutique in 1987, Mytheresa launched online in 2006 and offers ready-to-wear,

shoes, bags and accessories for womenswear, menswear and kidswear. In 2022, Mytheresa expanded its luxury offering to home décor

and lifestyle products with the launch of the category “LIFE”. The highly curated edit of over 200 brands focuses on true

luxury brands such as Bottega Veneta, Burberry, Dolce&Gabbana, Gucci, Loewe, Loro Piana, Moncler, Prada, Saint Laurent, Valentino,

and many more. Mytheresa’s unique digital experience is based on a sharp focus on high-end luxury shoppers, exclusive product and

content offerings, leading technology and analytical platforms as well as high quality service operations. The NYSE listed company reported

€747.3 million GMV in fiscal year 2022 (+21.3% vs. FY21).

For more information

and updated Mytheresa campaign imagery, please visit https://investors.mytheresa.com.

Investor

Relations Contacts

Mytheresa.com GmbH

Stefanie Muenz

phone: +49 89 127695-1919

email:

investors@mytheresa.com

|

Solebury Strategic Communications

Maria Lycouris / Carly Grant

phone: +1 800 929 7167

email:

investors@mytheresa.com

|

Media Contacts for public relations

Mytheresa.com GmbH

Sandra Romano

mobile: +49 152 54725178

phone: +49 89 127695-236

email:

sandra.romano@mytheresa.com

|

Media Contacts for business press

Mytheresa.com GmbH

Alberto Fragoso

mobile: +49 152 38297355

phone: +49 89 127695-1358

email:

alberto.fragoso@mytheresa.com

|

Source: MYT Netherlands Parent B.V.

MYT Netherlands Parent B.V.

Financial Results and Key Operating Metrics

(Amounts in € millions)

| |

|

Three Months Ended |

|

Twelve months Ended |

| (in millions) |

|

June 30,

2022 |

|

June 30,

2023 |

|

Change

in % / BPs |

|

June 30,

2022 |

|

June 30,

2023 |

|

Change

in % / BPs |

| Gross Merchandise Value (GMV) (1) |

|

€ 196.7 |

|

€ 222.2 |

|

13.0% |

|

€ 747.3 |

|

€ 855.8 |

|

14.5% |

| Active customer (LTM in thousands) (2) |

|

781 |

|

856 |

|

9.6% |

|

781 |

|

856 |

|

9.6% |

| Total orders shipped (LTM in thousands) (2) |

|

1,765 |

|

2,012 |

|

14.0% |

|

1,765 |

|

2,012 |

|

14.0% |

| Average order value (LTM) (2) |

|

626 |

|

654 |

|

4.5% |

|

626 |

|

654 |

|

4.5% |

| Net sales |

|

€ 174.8 |

|

€ 203.8 |

|

16.5% |

|

€ 689.8 |

|

€ 768.6 |

|

11.4% |

| Gross profit |

|

€ 94.8 |

|

€ 99.9 |

|

5.4% |

|

€ 355.0 |

|

€ 382.6 |

|

7.8% |

| Gross profit margin |

|

54.2% |

|

49.0% |

|

(520 BPs) |

|

51.5% |

|

49.8% |

|

(170 BPs) |

| Operating Income (loss) |

|

€ 1.3 |

|

€ (2.3) |

|

(281.2%) |

|

€ 4.8 |

|

€ (6.1) |

|

(225.4%) |

| Operating Income (loss) margin |

|

0.7% |

|

(1.1%) |

|

(180 BPs) |

|

0.7% |

|

(0.8%) |

|

(150 BPs) |

| Net loss |

|

€ 1.6 |

|

€ (5.7) |

|

(447.0%) |

|

€ (7.9) |

|

€ (15.1) |

|

91.4% |

| Net loss margin |

|

0.9% |

|

(2.8%) |

|

(380 BPs) |

|

(1.1%) |

|

(2.0%) |

|

(90 BPs) |

| Adjusted EBITDA(3) |

|

€ 14.4 |

|

€ 7.4 |

|

(48.7%) |

|

€ 68.7 |

|

€ 41.1 |

|

(40.3%) |

| Adjusted EBITDA margin(3) |

|

8.2% |

|

3.6% |

|

(460 BPs) |

|

10.0% |

|

5.3% |

|

(470 BPs) |

| Adjusted Operating Income(3) |

|

€ 12.0 |

|

€ 4.2 |

|

(65.0%) |

|

€ 59.6 |

|

€ 29.4 |

|

(50.7%) |

| Adjusted Operating Income margin(3) |

|

6.9% |

|

2.1% |

|

(480 BPs) |

|

8.6% |

|

3.8% |

|

(480 BPs) |

| Adjusted Net Income(3) |

|

€ 12.4 |

|

€ 0.8 |

|

(93.8%) |

|

€ 46.9 |

|

€ 20.3 |

|

(56.0%) |

| Adjusted Net Income margin(3) |

|

7.1% |

|

0.4% |

|

(670 BPs) |

|

6.8% |

|

2.6% |

|

(420 BPs) |

| (1) | Gross

Merchandise Value (“GMV”) is an operative measure and means the total Euro value

of orders processed, either as principal or as agent. GMV is inclusive of product value,

shipping and duty. It is net of returns, value added taxes, applicable sales taxes and cancellations.

GMV does not represent revenue earned by us. |

| (2) | Active

customers, total orders shipped and average order value are calculated based on the GMV of

orders shipped from our sites during the last twelve months (LTM) ended on the last day of

the period presented. |

| (3) | Adjusted

EBITDA, Adjusted Operating Income and Adjusted Net Income, and their corresponding margins

as a percentage of net sales, are measures that are not defined under IFRS. We use these

financial measures to evaluate the performance of our business. We present Adjusted EBITDA,

Adjusted Operating Income and Adjusted Net Income, and their corresponding margins, because

they are used by our management and frequently used by analysts, investors and other interested

parties to evaluate companies in our industry. Further, we believe these measures are helpful

in highlighting trends in our operating results, because they exclude the impact of items,

that are outside the control of management or not reflective of our ongoing core operations

and performance. Adjusted EBITDA, Adjusted Operating Income and Adjusted Net Income have

limitations, because they exclude certain types of expenses. Furthermore, other companies

in our industry may calculate similarly titled measures differently than we do, limiting

their usefulness as comparative measures. We use Adjusted EBITDA, Adjusted Operating Income

and Adjusted Net Income, and their corresponding margins, as supplemental information only.

You are encouraged to evaluate each adjustment and the reasons we consider it appropriate

for supplemental analysis. Adjusted EBITDA, Adjusted Operating Income and Adjusted Net Income

in the current and prior periods presented have been changed to reflect our updated methodology

in adjusting for share-based compensation. |

MYT Netherlands Parent B.V.

Financial Results and Key Operating Metrics

(Amounts in € millions)

The following tables set forth the reconciliations

of net income (loss) to EBITDA and adjusted EBITDA, operating income (loss) to adjusted operating income and net income (loss) to adjusted

net income and their corresponding margins as a percentage of net sales:

| |

|

Three

Months Ended |

|

Twelve

months Ended |

| (in

millions) |

|

June

30,

2022 |

|

June

30,

2023 |

|

Change

in % |

|

June

30,

2022 |

|

June

30,

2023 |

|

Change

in % |

| Net loss |

|

€ 1.6 |

|

€ (5.7) |

|

(447.0%) |

|

€ (7.9) |

|

€ (15.1) |

|

91.4% |

| Finance (income) expenses, net |

|

€ 0.3 |

|

€ 1.0 |

|

223.6% |

|

€ 1.0 |

|

€ 2.5 |

|

146.4% |

| Income tax expense |

|

€ (0.7) |

|

€ 2.5 |

|

(462.2%) |

|

€ 11.7 |

|

€ 6.6 |

|

(43.8%) |

| Depreciation and amortization |

|

€ 2.4 |

|

€ 3.2 |

|

34.5% |

|

€ 9.1 |

|

€ 11.7 |

|

28.2% |

| thereof

depreciation of right-of use assets |

|

€ 1.5 |

|

€ 2.4 |

|

57.7% |

|

€ 5.7 |

|

€ 8.5 |

|

50.1% |

| EBITDA |

|

€ 3.6 |

|

€ 0.9 |

|

(75.5%) |

|

€ 13.9 |

|

€ 5.6 |

|

(59.8%) |

| Other transaction-related, certain

legal and other expenses (3) |

|

€ 1.2 |

|

€ 1.8 |

|

53.2% |

|

€ 2.5 |

|

€ 5.4 |

|

118.4% |

| Share-based compensation(4) |

|

€ 9.6 |

|

€ 4.7 |

|

(50.9%) |

|

€ 52.3 |

|

€ 30.0 |

|

(42.6%) |

| Adjusted EBITDA |

|

€ 14.4 |

|

€ 7.4 |

|

(48.7%) |

|

€ 68.7 |

|

€ 41.1 |

|

(40.3%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation to Adjusted EBITDA Margin |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Sales |

|

€ 174.8 |

|

€ 203.8 |

|

16.5% |

|

€ 689.8 |

|

€ 768.6 |

|

11.4% |

| Adjusted EBITDA margin |

|

8.2% |

|

3.6% |

|

(460 BPs) |

|

10.0% |

|

5.3% |

|

(470 BPs) |

| |

|

Three

Months Ended |

|

Twelve

months Ended |

| (in

millions) |

|

June

30,

2022 |

|

June

30,

2023 |

|

Change

in % |

|

June

30,

2022 |

|

June

30,

2023 |

|

Change

in % |

| Operating Income (loss) |

|

€ 1.3 |

|

€ (2.3) |

|

(281.2%) |

|

€ 4.8 |

|

€ (6.1) |

|

(225.4%) |

| Other transaction-related, certain

legal and other expenses (1) |

|

€ 1.2 |

|

€ 1.8 |

|

53.2% |

|

€ 2.5 |

|

€ 5.4 |

|

118.4% |

| Share-based compensation(2) |

|

€ 9.6 |

|

€ 4.7 |

|

(50.9%) |

|

€ 52.3 |

|

€ 30.0 |

|

(42.6%) |

| Adjusted Operating Income |

|

€ 12.0 |

|

€ 4.2 |

|

(65.0%) |

|

€ 59.6 |

|

€ 29.4 |

|

(50.7%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation to Adjusted Operating Income Margin |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Sales |

|

€ 174.8 |

|

€ 203.8 |

|

16.5% |

|

€ 689.8 |

|

€ 768.6 |

|

11.4% |

| Adjusted Operating Income margin |

|

6.9% |

|

2.1% |

|

(480 BPs) |

|

8.6% |

|

3.8% |

|

(480 BPs) |

| |

|

Three

Months Ended |

|

Twelve

months Ended |

| (in

millions) |

|

June

30,

2022 |

|

June

30,

2023 |

|

Change

in % |

|

June

30,

2022 |

|

June

30,

2023 |

|

Change

in % |

| Net loss |

|

€ 1.6 |

|

€ (5.7) |

|

(447.0%) |

|

€ (7.9) |

|

€ (15.1) |

|

91.4% |

| Other transaction-related, certain

legal and other expenses (1) |

|

€ 1.2 |

|

€ 1.8 |

|

53.2% |

|

€ 2.5 |

|

€ 5.4 |

|

118.4% |

| Share-based compensation(2) |

|

€ 9.6 |

|

€ 4.7 |

|

(50.9%) |

|

€ 52.3 |

|

€ 30.0 |

|

(42.6%) |

| Adjusted Net Income |

|

€ 12.4 |

|

€ 0.8 |

|

(93.8%) |

|

€ 46.9 |

|

€ 20.3 |

|

(56.6%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation to Adjusted Net Income Margin |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Sales |

|

€ 174.8 |

|

€ 203.8 |

|

16.5% |

|

€ 689.8 |

|

€ 768.6 |

|

11.4% |

| Adjusted Net Income margin |

|

7.1% |

|

0.4% |

|

(670 BPs) |

|

6.8% |

|

2.6% |

|

(420 BPs) |

| (1) | Other

transaction-related, certain legal and other expenses represent (i) professional fees,

including advisory and accounting fees, related to potential transactions, (ii) certain

legal and other expenses incurred outside the ordinary course of our business and (iii) other

non-recurring expenses incurred in connection with the costs of establishing our new central

warehouse in Leipzig, Germany. |

| (2) | Certain

members of management and supervisory board members have been granted share-based compensation

for which the share-based compensation expense will be recognized upon defined vesting schedules

in the future periods. Our methodology to adjust for share-based compensation and subsequently

calculate Adjusted EBITDA, Adjusted Operating Income and Adjusted Net Income includes both

share-based compensation expenses connected to the IPO and share-based compensation expenses

recognized in connection with grants under the Long-Term Incentive Plan (LTI) for the Mytheresa

Group key management members and share-based compensation expenses due to Supervisory Board

Members Plans. We do not consider share-based compensation expenses to be indicative of our

core operating performance. For further information about how we calculate these measures

and limitations of its use including a reconciliation of amounts under our former methodology

to our current methodology, see page 68 of our annual report. |

MYT Netherlands Parent B.V.

Consolidated Statements of Profit or Loss and

Comprehensive Income

(Amounts in € thousands, except share

and per share data)

| |

|

|

Three

Months Ended |

|

Twelve

months Ended |

| (in € thousands) |

|

|

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

| Net sales |

|

|

174,836 |

|

203,756 |

|

689,750 |

|

768,621 |

| Cost of sales, exclusive of depreciation and amortization |

|

|

(80,042) |

|

(103,870) |

|

(334,758) |

|

(386,027) |

| Gross profit |

|

|

94,794 |

|

99,886 |

|

354,992 |

|

382,594 |

| Shipping and payment cost |

|

|

(27,075) |

|

(30,975) |

|

(97,697) |

|

(114,785) |

| Marketing expenses |

|

|

(26,558) |

|

(32,116) |

|

(96,093) |

|

(112,001) |

| Selling, general and administrative expenses |

|

|

(36,820) |

|

(34,769) |

|

(148,172) |

|

(147,691) |

| Depreciation and amortization |

|

|

(2,360) |

|

(3,173) |

|

(9,088) |

|

(11,653) |

| Other income (loss), net |

|

|

(721) |

|

(1,137) |

|

892 |

|

(2,527) |

| Operating income (loss) |

|

|

1,261 |

|

(2,284) |

|

4,834 |

|

(6,063) |

| Finance income |

|

|

0 |

|

13 |

|

0 |

|

358 |

| Finance costs |

|

|

(296) |

|

(972) |

|

(998) |

|

(2,818) |

| Finance income (costs), net |

|

|

(296) |

|

(959) |

|

(998) |

|

(2,460) |

| Income before income taxes |

|

|

965 |

|

(3,243) |

|

3,836 |

|

(8,523) |

| Income tax expense |

|

|

683 |

|

(2,475) |

|

(11,734) |

|

(6,597) |

| Net loss |

|

|

1,648 |

|

(5,718) |

|

(7,898) |

|

(15,120) |

| Foreign currency translation |

|

|

(35) |

|

(35) |

|

(74) |

|

(19) |

| Other comprehensive loss |

|

|

1,207 |

|

(793) |

|

(74) |

|

(19) |

| Comprehensive loss |

|

|

2,855 |

|

(6,511) |

|

(7,972) |

|

(15,139) |

| |

|

|

|

|

|

|

|

|

|

| Basic and diluted earnings per share |

|

|

€

0.02 |

|

€

(0.07) |

|

€

(0.09) |

|

€

(0.17) |

| Weighted average ordinary shares outstanding (basic and diluted) –

in millions (1) |

|

|

86.3 |

|

86.6 |

|

86.3 |

|

86.6 |

| (1) | In accordance with IAS 33, includes

contingently issuable shares that are fully vested and can be converted at any time for no

consideration. For further details, refer to note 27 in our annual report. |

MYT Netherlands Parent B.V.

Consolidated Statements of Financial Position

(Amounts in € thousands)

| (in € thousands) | |

June 30,

2022 | | |

June 30,

2023 | |

| Assets | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Intangible assets and goodwill | |

| 155,223 | | |

| 155,283 | |

| Property and equipment | |

| 17,691 | | |

| 37,227 | |

| Right-of-use assets | |

| 21,677 | | |

| 54,797 | |

| Deferred tax assets | |

| 6,090 | | |

| 59 | |

| Other non-current assets | |

| 294 | | |

| 6,573 | |

| Total non-current assets | |

| 200,975 | | |

| 253,939 | |

| Current assets | |

| | | |

| | |

| Inventories | |

| 230,144 | | |

| 360,262 | |

| Trade and other receivables | |

| 8,276 | | |

| 7,521 | |

| Other assets | |

| 61,874 | | |

| 42,113 | |

| Cash and cash equivalents | |

| 113,507 | | |

| 30,136 | |

| Total current assets | |

| 413,801 | | |

| 440,031 | |

| Total assets | |

| 614,776 | | |

| 693,971 | |

| | |

| | | |

| | |

| Shareholders’ equity and liabilities | |

| | | |

| | |

| Subscribed capital | |

| 1 | | |

| 1 | |

| Capital reserve | |

| 498,872 | | |

| 529,775 | |

| Accumulated Deficit | |

| (68,734 | ) | |

| (83,855 | ) |

| Accumulated other comprehensive income | |

| 1,528 | | |

| 1,509 | |

| Total shareholders’ equity | |

| 431,667 | | |

| 447,430 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Provisions | |

| 758 | | |

| 2,646 | |

| Lease liabilities | |

| 16,817 | | |

| 49,518 | |

| Deferred income tax liabilities | |

| 3,661 | | |

| 726 | |

| Total non-current liabilities | |

| 21,237 | | |

| 52,889 | |

| Current liabilities | |

| | | |

| | |

| Tax liabilities | |

| 25,892 | | |

| 24,073 | |

| Lease liabilities | |

| 5,189 | | |

| 8,155 | |

| Contract liabilities | |

| 10,746 | | |

| 11,414 | |

| Trade and other payables | |

| 45,156 | | |

| 71,085 | |

| Other liabilities | |

| 74,889 | | |

| 78,924 | |

| Total current liabilities | |

| 161,872 | | |

| 193,652 | |

| Total liabilities | |

| 183,109 | | |

| 246,541 | |

| Total shareholders’ equity and liabilities | |

| 614,776 | | |

| 693,971 | |

MYT Netherlands Parent B.V.

Consolidated Statements of Changes in Equity

(Amounts in € thousands)

| (in € thousands) | |

Subscribed

capital | | |

Capital

reserve | | |

Accumulated

deficit | | |

Foreign

currency

translation

reserve | | |

Total

shareholders’

equity | |

| Balance as of July 1, 2020 | |

| 1 | | |

| 91,008 | | |

| (28,234 | ) | |

| 1,602 | | |

| 64,377 | |

| Net loss | |

| - | | |

| - | | |

| (32,604 | ) | |

| - | | |

| (32,604 | ) |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Comprehensive loss | |

| - | | |

| - | | |

| (32,604 | ) | |

| - | | |

| (32,604 | ) |

| Capital increase - initial public offering | |

| - | | |

| 283,224 | | |

| - | | |

| - | | |

| 283,224 | |

| IPO related transaction costs | |

| - | | |

| (4,550 | ) | |

| - | | |

| - | | |

| (4,550 | ) |

| Share-based compensation | |

| - | | |

| 75,270 | | |

| - | | |

| - | | |

| 75,270 | |

| Balance as of June 30, 2021 | |

| 1 | | |

| 444,951 | | |

| (60,837 | ) | |

| 1,602 | | |

| 385,718 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of July 1, 2021 | |

| 1 | | |

| 444,951 | | |

| (60,837 | ) | |

| 1,602 | | |

| 385,718 | |

| Net loss | |

| - | | |

| - | | |

| (7,898 | ) | |

| - | | |

| (7,898 | ) |

| Other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (74 | ) | |

| (74 | ) |

| Comprehensive loss | |

| - | | |

| - | | |

| (7,898 | ) | |

| (74 | ) | |

| (7,972 | ) |

| IPO related transaction costs | |

| - | | |

| 1,249 | | |

| - | | |

| - | | |

| 1,249 | |

| Share options exercised | |

| - | | |

| 369 | | |

| - | | |

| - | | |

| 369 | |

| Share-based compensation | |

| - | | |

| 52,303 | | |

| - | | |

| - | | |

| 52,303 | |

| Balance as of June 30, 2022 | |

| 1 | | |

| 498,872 | | |

| (68,734 | ) | |

| 1,528 | | |

| 431,667 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of July 1, 2022 | |

| 1 | | |

| 498,872 | | |

| (68,734 | ) | |

| 1,528 | | |

| 431,667 | |

| Net loss | |

| - | | |

| - | | |

| (15,120 | ) | |

| - | | |

| (15,120 | ) |

| Other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (19 | ) | |

| (19 | ) |

| Comprehensive loss | |

| - | | |

| - | | |

| (15,120 | ) | |

| (19 | ) | |

| (14,842 | ) |

| Share options exercised | |

| - | | |

| 1,077 | | |

| - | | |

| - | | |

| 1,077 | |

| Share-based compensation | |

| - | | |

| 29,825 | | |

| - | | |

| - | | |

| 29,825 | |

| Balance as of June 30, 2023 | |

| 1 | | |

| 529,775 | | |

| (83,855 | ) | |

| 1,509 | | |

| 447,430 | |

MYT Netherlands Parent B.V.

Consolidated Statements of Cash Flows

(Amounts in € thousands)

| | |

Twelve

months ended June 30, | |

| (in € thousands) | |

2022 | | |

2023 | |

| Net loss | |

| (7,898 | ) | |

| (15,120 | ) |

| Adjustments for | |

| | | |

| | |

| Depreciation and amortization | |

| 9,088 | | |

| 11,653 | |

| Finance (income) costs, net | |

| 998 | | |

| 2,460 | |

| Share-based compensation | |

| 52,303 | | |

| 29,963 | |

| Income tax expense | |

| 11,734 | | |

| 6,597 | |

| Change in operating assets and liabilities | |

| | | |

| | |

| (Increase) decrease in inventories | |

| 16,910 | | |

| (130,118 | ) |

| (Increase) decrease in trade and other

receivables | |

| (3,246 | ) | |

| 755 | |

| Decrease (increase) in other assets | |

| (47,501 | ) | |

| 14,077 | |

| (Decrease) increase in other liabilities | |

| 24,665 | | |

| 4,047 | |

| Increase (decrease) in contract liabilities | |

| (229 | ) | |

| 669 | |

| Increase (decrease) in trade and other

payables | |

| 1,598 | | |

| 25,886 | |

| Income taxes paid | |

| (3,623 | ) | |

| (5,918 | ) |

| Net cash provided by (used in) operating activities | |

| 54,799 | | |

| (55,050 | ) |

| Expenditure for property and equipment and intangible assets | |

| (11,923 | ) | |

| (22,760 | ) |

| Proceeds from sale of property and equipment | |

| - | | |

| 2 | |

| Net cash (used in) investing activities | |

| (11,923 | ) | |

| (22,758 | ) |

| Interest paid | |

| (998 | ) | |

| (2,460 | ) |

| Proceeds from exercise of option awards | |

| 369 | | |

| 1,077 | |

| Lease payments | |

| (5,425 | ) | |

| (4,059 | ) |

| Net cash (used in) provided by financing activities | |

| (6,054 | ) | |

| (5,442 | ) |

| Net increase (decrease) in cash and cash equivalents | |

| 36,822 | | |

| (83,249 | ) |

| Cash and cash equivalents at the beginning of the period | |

| 76,760 | | |

| 113,507 | |

| Effects of exchange rate changes on cash and cash equivalents | |

| (74 | ) | |

| (122 | ) |

| Cash and cash equivalents at end of the period | |

| 113,507 | | |

| 30,135 | |

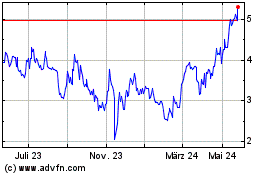

MYT Netherlands Parent BV (NYSE:MYTE)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

MYT Netherlands Parent BV (NYSE:MYTE)

Historical Stock Chart

Von Mai 2023 bis Mai 2024