Mohawk Industries, Inc. (NYSE: MHK) today announced first quarter

2024 net earnings of $105 million and earnings per share (“EPS”) of

$1.64; adjusted net earnings were $119 million, and adjusted EPS

was $1.86. Net sales for the first quarter of 2024 were $2.7

billion, a decrease of 4.5% as reported and 5.5% on a legacy and

constant basis versus the prior year. During the first quarter of

2023, the Company reported net sales of $2.8 billion, net earnings

of $80 million and EPS of $1.26; adjusted net earnings were $112

million, and adjusted EPS was $1.75.

Commenting on the Company’s first quarter results, Chairman and

CEO Jeff Lorberbaum stated, “Though economic headwinds are

impacting industry sales, margins and mix, our first quarter

results reflected the positive effect of actions we are taking to

enhance our performance. Our earnings per share rose year over year

as a result of restructuring, productivity initiatives and benefits

from lower cost raw materials and energy, partially offset by

weaker pricing and mix.

Across our regions, market conditions remained similar to the

prior quarter, with significant pricing and mix pressure due to

industry competition for volume. Though slowing, the commercial

channel continues to outperform residential. Residential remodeling

remains soft due to low housing sales and the impact of inflation

on discretionary spending. Retailers have reported that consumers

are reluctant to initiate higher ticket projects, with flooring

facing greater pressure since most replacements can be readily

deferred.

Our teams remain focused on managing through the near-term

environment, realizing sales opportunities, reducing controllable

costs and completing restructuring initiatives. We continue to

manage our production levels to align inventories with market

demand. To stimulate sales, we are investing in new product

introductions with enhanced features and merchandising that conveys

the value of our collections. Given inflationary pressures in

labor, benefits and other items, we continue to take additional

actions to reduce our cost structure and improve productivity.

For the first quarter, the Global Ceramic Segment reported a

1.4% decline in net sales as reported, or a 5.0% decline on a

legacy and constant basis, versus the prior year. The Segment’s

operating margin was 4.7% as reported, or 5.0% on an adjusted

basis, as a result of the unfavorable impact of price and product

mix and foreign exchange headwinds, partially offset by lower input

costs and productivity gains. Across the segment, our investments

in new printing, polishing and rectifying technologies are

delivering higher value styles and formats to improve our mix. We

are introducing decorative innovations with new glazes,

three-dimensional surfaces and updated artisanal mosaics. In the

U.S., weather caused the suspension of operations at a number of

our manufacturing facilities and service centers in January,

impacting our cost and revenue. In addition, the U.S. ceramic tile

industry has filed a petition against India in response to

widespread dumping of ceramic tile in the U.S. market and expects

tariffs between 400-800% plus additional duties for subsidies.

Other countries where we operate are considering similar actions

against India. In Europe, we are seeing robust growth in porcelain

panel sales after our recent capacity expansion, and sales have

also benefited from our new premium products. In Mexico and Brazil,

we are optimizing our sales and improving our operations. We are

implementing new distribution and product strategies in each

country, so our brands complement each other in the

marketplace.

During the first quarter, our Flooring Rest of the World

Segment’s net sales decreased by 7.4% as reported, or 5.9% on a

constant basis, versus the prior year. The Segment’s operating

margin was 9.7% as reported, or 10.1% on an adjusted basis, as a

result of the unfavorable impact of price and product mix,

partially offset by lower input costs, less restructuring, higher

sales volume and productivity gains. Our markets remained soft

despite declining inflation. In the quarter, our volumes increased

from the prior year’s low levels, which may be an indication of

improving trends in our categories. Our results were impacted by

pricing pressures as we passed through lower input costs in highly

competitive markets. We have completed the restructuring of our

residential LVT program with the savings we anticipated. The change

is delivering substantial growth in sales of our rigid LVT, which

is replacing our discontinued flexible products. In insulation, we

have recently experienced material increases and are raising our

prices accordingly. In our panels business, margins have declined

from cyclically high comparisons due to the underutilization of

industry capacity, partially offset by mix improvement in our

decorative collections. We have announced selective price increases

in panels to reflect rising material costs.

In the first quarter, our Flooring North America Segment sales

declined 5.6% versus the prior year. The Segment’s operating margin

was 5.0% as reported, or 5.3% on an adjusted basis, as a result of

lower input costs and productivity gains, partially offset by the

unfavorable impact of price and product mix. Sales improved through

the quarter, though many retailers and some of our facilities were

temporarily closed in January due to weather. Based on builder

optimism, new single-family home sales should improve through the

year, positively impacting our flooring business. Commercial sales

continue to outperform residential, led by the specified

hospitality, retail and government channels. Retailers are

embracing our new residential product launches, including

PetPremier carpet and our award-winning PureTech resilient planks.

We are optimizing sales of our coordinated accessories and rubber

trim business, and we are growing our non-woven business with new

customers and product expansions. Our West Coast LVT facility is

increasing production, and our Georgia LVT restructuring

initiatives are being implemented.

The flooring industry appears to be at the bottom of this cycle,

and we are managing the controllable aspects of our business to

improve our results. We continue to reduce our costs through

ongoing restructuring actions and additional productivity

initiatives. We are aligning production with market demand to

control working capital, which increases our unabsorbed overhead.

To enhance sales and margins, we are upgrading our product offering

with unique features and investing in new merchandising. This year

we are completing our LVT, quartz countertop and premium laminate

expansion projects to support our products with the greatest growth

potential when the market recovers. Our other capital investments

are focused on reducing cost, delivering product innovation or

maintaining the business. Due to European vacation schedules, our

second quarter sales are seasonally higher than the third quarter.

Given these factors, we anticipate our second quarter adjusted EPS

to be between $2.68 and $2.78, excluding any restructuring or other

one-time charges.

Residential flooring sales should lead the recovery as consumer

confidence improves, the housing market strengthens, and postponed

remodeling projects are initiated. Existing home sales will

normalize and are a meaningful catalyst for flooring since

homeowners replace it more often before listing a property or soon

after completing a purchase. Across our geographies, housing has

not kept pace with household formations, and substantial home

construction will be required for many years to satisfy those

needs. Additionally, as homes age, increased remodeling investments

are required to maintain property values. As the world’s largest

flooring manufacturer, we expect to significantly benefit from our

brand leadership, investments in new capabilities and recent

acquisitions as the flooring market recovers. We have the products

to inspire consumers, the infrastructure to deliver superior

service and the balance sheet strength to invest in opportunities

for the business.”

ABOUT MOHAWK INDUSTRIES

Mohawk Industries is the leading global flooring manufacturer

that creates products to enhance residential and commercial spaces

around the world. Mohawk’s vertically integrated manufacturing and

distribution processes provide competitive advantages in the

production of carpet, rugs, ceramic tile, laminate, wood, stone and

vinyl flooring. Our industry leading innovation has yielded

products and technologies that differentiate our brands in the

marketplace and satisfy all remodeling and new construction

requirements. Our brands are among the most recognized in the

industry and include American Olean, Daltile, Durkan, Eliane,

Elizabeth, Feltex, GH Commercial, Godfrey Hirst, Grupo Daltile, IVC

Commercial, IVC Home, Karastan, Marazzi, Mohawk, Mohawk Group,

Mohawk Home, Pergo, Quick-Step, Unilin and Vitromex. During the

past two decades, Mohawk has transformed its business from an

American carpet manufacturer into the world’s largest flooring

company with operations in Australia, Brazil, Europe, Malaysia,

Mexico, New Zealand, Russia and the United States.

Certain of the statements in the immediately preceding

paragraphs, particularly anticipating future performance, business

prospects, growth and operating strategies and similar matters and

those that include the words “could,” “should,” “believes,”

“anticipates,” “expects,” and “estimates,” or similar expressions

constitute “forward-looking statements.” For those statements,

Mohawk claims the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995. There can be no assurance that the forward-looking

statements will be accurate because they are based on many

assumptions, which involve risks and uncertainties. The following

important factors could cause future results to differ: changes in

economic or industry conditions; competition; inflation and

deflation in freight, raw material prices and other input costs;

inflation and deflation in consumer markets; currency fluctuations;

energy costs and supply; timing and level of capital expenditures;

timing and implementation of price increases for the Company’s

products; impairment charges; identification and consummation of

acquisitions on favorable terms, if at all; integration of

acquisitions; international operations; introduction of new

products; rationalization of operations; taxes and tax reform;

product and other claims; litigation; geopolitical conflict;

regulatory and political changes in the jurisdictions in which the

Company does business; and other risks identified in Mohawk’s SEC

reports and public announcements.

Conference call Friday, April 26, 2024,

at 11:00 AM Eastern Time

To participate in the conference call via the Internet, please

visit

http://ir.mohawkind.com/events/event-details/mohawk-industries-inc-1st-quarter-2024-earnings-call.

To participate in the conference call via telephone, register in

advance at

https://dpregister.com/sreg/10188065/fc2a593c61 to

receive a unique personal identification number. You can also dial

1-833-630-1962 (U.S./Canada) or 1-412-317-1843 (international) on

the day of the call for operator assistance. A replay will be

available until May 24, 2024, by dialing 1-877-344-7529

(U.S./Canada) or 1-412-317-0088 (international) and entering access

code #5217402.

|

MOHAWK INDUSTRIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Unaudited) |

| |

|

Three Months Ended |

| (In

millions, except per share data) |

|

March 30, 2024 |

|

|

April 1, 2023 |

|

|

|

|

|

|

|

|

Net sales |

|

$ |

2,679.4 |

|

|

|

2,806.2 |

|

| Cost of

sales |

|

|

2,029.9 |

|

|

|

2,162.8 |

|

|

Gross profit |

|

|

649.5 |

|

|

|

643.4 |

|

| Selling, general and

administrative expenses |

|

|

502.9 |

|

|

|

517.7 |

|

|

Operating income |

|

|

146.6 |

|

|

|

125.7 |

|

| Interest expense |

|

|

14.9 |

|

|

|

17.1 |

|

| Other

(income) expense, net |

|

|

(1.1 |

) |

|

|

(0.6 |

) |

|

Earnings before income taxes |

|

|

132.8 |

|

|

|

109.2 |

|

| Income tax expense |

|

|

27.8 |

|

|

|

28.9 |

|

|

Net earnings including noncontrolling

interests |

|

|

105.0 |

|

|

|

80.3 |

|

| Net

earnings attributable to noncontrolling interests |

|

|

— |

|

|

|

0.1 |

|

|

Net earnings attributable to Mohawk Industries,

Inc. |

|

$ |

105.0 |

|

|

|

80.2 |

|

|

|

|

|

|

|

|

Basic earnings per share attributable to Mohawk Industries,

Inc. |

|

$ |

1.65 |

|

|

|

1.26 |

|

|

Weighted-average common shares outstanding -

basic |

|

|

63.7 |

|

|

|

63.6 |

|

|

|

|

|

|

|

|

Diluted earnings per share attributable to Mohawk

Industries, Inc. |

|

$ |

1.64 |

|

|

|

1.26 |

|

|

Weighted-average common shares outstanding -

diluted |

|

|

64.0 |

|

|

|

63.8 |

|

| Other Financial

Information |

|

|

|

|

|

|

| |

|

Three Months Ended |

| (In

millions) |

|

March 30, 2024 |

|

|

|

April 1, 2023 |

|

|

Net cash provided by operating activities |

|

$ |

183.7 |

|

|

|

257.3 |

|

| Less:

Capital expenditures |

|

|

86.8 |

|

|

|

128.5 |

|

|

Free cash flow |

|

$ |

96.9 |

|

|

|

128.8 |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

$ |

154.2 |

|

|

|

169.9 |

|

|

MOHAWK INDUSTRIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(Unaudited) |

| (In

millions) |

March 30, 2024 |

|

|

|

April 1, 2023 |

|

|

ASSETS |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

658.5 |

|

|

|

572.9 |

|

|

Short-term investments |

|

— |

|

|

|

150.0 |

|

|

Receivables, net |

|

2,007.2 |

|

|

|

2,052.3 |

|

|

Inventories |

|

2,527.7 |

|

|

|

2,729.9 |

|

|

Prepaid expenses and other current assets |

|

528.3 |

|

|

|

556.0 |

|

|

Total current assets |

|

5,721.7 |

|

|

|

6,061.1 |

|

|

Property, plant and equipment, net |

|

4,885.1 |

|

|

|

4,946.0 |

|

| Right of use operating lease

assets |

|

413.6 |

|

|

|

396.1 |

|

| Goodwill |

|

1,140.2 |

|

|

|

2,022.5 |

|

| Intangible assets, net |

|

853.8 |

|

|

|

893.0 |

|

|

Deferred income taxes and other non-current assets |

|

517.1 |

|

|

|

444.8 |

|

|

Total assets |

$ |

13,531.5 |

|

|

|

14,763.5 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Short-term debt and current portion of long-term debt |

$ |

931.5 |

|

|

|

1,056.5 |

|

|

Accounts payable and accrued expenses |

|

2,079.3 |

|

|

|

2,155.4 |

|

|

Current operating lease liabilities |

|

109.3 |

|

|

|

106.5 |

|

|

Total current liabilities |

|

3,120.1 |

|

|

|

3,318.4 |

|

| Long-term debt, less current

portion |

|

1,694.5 |

|

|

|

2,265.1 |

|

| Non-current operating lease

liabilities |

|

321.8 |

|

|

|

304.1 |

|

|

Deferred income taxes and other long-term liabilities |

|

747.3 |

|

|

|

770.2 |

|

|

Total liabilities |

|

5,883.7 |

|

|

|

6,657.8 |

|

|

Total stockholders' equity |

|

7,647.8 |

|

|

|

8,105.7 |

|

|

Total liabilities and stockholders' equity |

$ |

13,531.5 |

|

|

|

14,763.5 |

|

| Segment

Information |

|

|

|

|

| |

|

As of or for the Three Months Ended |

| (In

millions) |

|

March 30, 2024 |

|

|

|

April 1, 2023 |

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

Global Ceramic |

|

$ |

1,044.8 |

|

|

|

1,059.3 |

|

|

Flooring NA |

|

|

900.2 |

|

|

|

953.4 |

|

|

Flooring ROW |

|

|

734.4 |

|

|

|

793.5 |

|

|

Consolidated net sales |

|

$ |

2,679.4 |

|

|

|

2,806.2 |

|

|

|

|

|

|

|

| Operating income (loss): |

|

|

|

|

|

Global Ceramic |

|

$ |

48.8 |

|

|

|

63.3 |

|

|

Flooring NA |

|

|

45.0 |

|

|

|

(2.0 |

) |

|

Flooring ROW |

|

|

70.9 |

|

|

|

75.2 |

|

|

Corporate and intersegment eliminations |

|

|

(18.1 |

) |

|

|

(10.8 |

) |

|

Consolidated operating income |

|

$ |

146.6 |

|

|

|

125.7 |

|

|

|

|

|

|

|

| Assets: |

|

|

|

|

|

Global Ceramic |

|

$ |

4,978.1 |

|

|

|

5,499.4 |

|

|

Flooring NA |

|

|

3,939.9 |

|

|

|

4,265.1 |

|

|

Flooring ROW |

|

|

3,894.6 |

|

|

|

4,314.8 |

|

|

Corporate and intersegment eliminations |

|

|

718.9 |

|

|

|

684.2 |

|

|

Consolidated assets |

|

$ |

13,531.5 |

|

|

|

14,763.5 |

|

|

Reconciliation of Net Earnings Attributable to Mohawk

Industries, Inc. to Adjusted Net Earnings Attributable to Mohawk

Industries, Inc. and Adjusted Diluted Earnings Per Share

Attributable to Mohawk Industries, Inc. |

| |

|

Three Months Ended |

| (In

millions, except per share data) |

|

March 30, 2024 |

|

|

|

April 1, 2023 |

|

|

Net earnings attributable to Mohawk Industries, Inc. |

|

$ |

105.0 |

|

|

|

80.2 |

|

| Adjusting items: |

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

|

7.9 |

|

|

|

32.0 |

|

|

Inventory step-up from purchase accounting |

|

|

— |

|

|

|

3.3 |

|

|

Legal settlements, reserves and fees |

|

|

8.8 |

|

|

|

1.0 |

|

|

Adjustments of indemnification asset |

|

|

2.4 |

|

|

|

(0.9 |

) |

|

Income taxes - adjustments of uncertain tax position |

|

|

(2.4 |

) |

|

|

0.9 |

|

|

Income tax effect of adjusting items |

|

|

(2.9 |

) |

|

|

(4.6 |

) |

|

Adjusted net earnings attributable to Mohawk Industries, Inc. |

|

$ |

118.8 |

|

|

|

111.9 |

|

|

|

|

|

|

|

|

Adjusted diluted earnings per share attributable to Mohawk

Industries, Inc. |

|

$ |

1.86 |

|

|

|

1.75 |

|

|

Weighted-average common shares outstanding - diluted |

|

|

64.0 |

|

|

|

63.8 |

|

| Reconciliation of

Total Debt to Net Debt |

|

| (In

millions) |

March 30, 2024 |

|

|

Short-term debt and current portion of long-term debt |

$ |

931.5 |

|

|

Long-term debt, less current portion |

|

1,694.5 |

|

|

Total debt |

|

2,626.0 |

|

| Less:

Cash and cash equivalents |

|

658.5 |

|

|

Net debt |

$ |

1,967.5 |

|

|

Reconciliation of Net Earnings (Loss) to Adjusted

EBITDA |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Trailing Twelve |

|

| |

Three Months Ended |

|

Months Ended |

|

| (In

millions) |

July 1,2023 |

|

|

September 30,2023 |

|

|

December 31,2023 |

|

|

March 30,2024 |

|

March 30,2024 |

|

|

Net earnings (loss) including noncontrolling interests |

$ |

101.2 |

|

|

(760.3 |

) |

|

139.4 |

|

|

105.0 |

|

(414.7 |

) |

|

Interest expense |

|

22.9 |

|

|

20.1 |

|

|

17.4 |

|

|

14.9 |

|

75.3 |

|

|

Income tax expense |

|

26.8 |

|

|

15.0 |

|

|

14.2 |

|

|

27.8 |

|

83.8 |

|

|

Net (earnings) loss attributable to noncontrolling interests |

|

— |

|

|

(0.2 |

) |

|

0.1 |

|

|

— |

|

(0.1 |

) |

|

Depreciation and amortization(1) |

|

156.6 |

|

|

149.6 |

|

|

154.2 |

|

|

154.2 |

|

614.6 |

|

|

EBITDA |

|

307.5 |

|

|

(575.8 |

) |

|

325.3 |

|

|

301.9 |

|

358.9 |

|

|

Restructuring, acquisition and integration-related and other

costs |

|

33.7 |

|

|

47.6 |

|

|

6.0 |

|

|

5.4 |

|

92.7 |

|

|

Inventory step-up from purchase accounting |

|

1.3 |

|

|

(0.1 |

) |

|

— |

|

|

— |

|

1.2 |

|

|

Impairment of goodwill and indefinite-lived intangibles |

|

— |

|

|

876.1 |

|

|

1.6 |

|

|

— |

|

877.7 |

|

|

Legal settlements, reserves and fees |

|

48.0 |

|

|

43.5 |

|

|

(4.7 |

) |

|

8.8 |

|

95.6 |

|

|

Adjustments of indemnification asset |

|

(0.1 |

) |

|

(1.9 |

) |

|

(0.1 |

) |

|

2.4 |

|

0.3 |

|

|

Adjusted EBITDA |

$ |

390.4 |

|

|

389.4 |

|

|

328.1 |

|

|

318.5 |

|

1,426.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

Net debt to adjusted EBITDA |

|

|

|

|

|

|

|

|

1.4 |

|

(1)Includes accelerated depreciation of $8.0 for Q2 2023, ($0.5)

for Q3 2023, $2.6 for Q4 2023 and $2.4 for Q1 2024.

|

Reconciliation of Net Sales to Adjusted Net

Sales |

| |

|

Three Months Ended |

| (In

millions) |

|

March 30, 2024 |

|

|

|

April 1, 2023 |

|

| Mohawk

Consolidated |

|

Net sales |

|

$ |

2,679.4 |

|

|

|

2,806.2 |

|

| Adjustment for constant

shipping days |

|

|

16.8 |

|

|

|

— |

|

| Adjustment for constant

exchange rates |

|

|

4.4 |

|

|

|

— |

|

|

Adjustment for acquisition volume |

|

|

(47.8 |

) |

|

|

— |

|

|

Adjusted net sales |

|

$ |

2,652.8 |

|

|

|

2,806.2 |

|

| |

|

Three Months Ended |

|

|

|

March 30, 2024 |

|

|

|

April 1, 2023 |

|

| Global

Ceramic |

|

Net sales |

|

$ |

1,044.8 |

|

|

|

1,059.3 |

|

| Adjustment for constant

shipping days |

|

|

5.4 |

|

|

|

— |

|

| Adjustment for constant

exchange rates |

|

|

3.8 |

|

|

|

— |

|

|

Adjustment for acquisition volume |

|

|

(47.8 |

) |

|

|

— |

|

|

Adjusted net sales |

|

$ |

1,006.2 |

|

|

|

1,059.3 |

|

| Flooring

ROW |

|

|

|

|

|

|

|

Net sales |

|

$ |

734.4 |

|

|

|

793.5 |

|

| Adjustment for constant

shipping days |

|

|

11.4 |

|

|

|

— |

|

| Adjustment for constant

exchange rates |

|

|

0.6 |

|

|

|

— |

|

|

Adjusted net sales |

|

$ |

746.4 |

|

|

|

793.5 |

|

|

Reconciliation of Gross Profit to Adjusted Gross

Profit |

| |

|

Three Months Ended |

| (In

millions) |

|

March 30, 2024 |

|

|

|

April 1, 2023 |

|

|

Gross Profit |

|

$ |

649.5 |

|

|

|

643.4 |

|

| Adjustments to gross

profit: |

|

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

|

5.5 |

|

|

|

29.1 |

|

|

Inventory step-up from purchase accounting |

|

|

— |

|

|

|

3.3 |

|

|

Adjusted gross profit |

|

$ |

655.0 |

|

|

|

675.8 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted gross profit as a percent of net sales |

|

|

24.4 |

% |

|

|

24.1 |

% |

|

Reconciliation of Selling, General and Administrative

Expenses to Adjusted Selling, General and Administrative

Expenses |

| |

|

Three Months Ended |

| (In

millions) |

|

March 30, 2024 |

|

|

April 1, 2023 |

|

|

Selling, general and administrative expenses |

|

$ |

502.9 |

|

|

|

517.7 |

|

| Adjustments to selling,

general and administrative expenses: |

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

|

(2.4 |

) |

|

|

(3.1 |

) |

|

Legal settlements, reserves and fees |

|

|

(8.8 |

) |

|

|

(1.0 |

) |

|

Adjusted selling, general and administrative expenses |

|

$ |

491.7 |

|

|

|

513.6 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted selling, general and administrative expenses as a percent

of net sales |

|

|

18.4 |

% |

|

|

18.3 |

% |

|

Reconciliation of Operating Income (Loss) to Adjusted

Operating Income (Loss) |

| |

|

Three Months Ended |

| (In

millions) |

|

March 30, 2024 |

|

|

|

April 1, 2023 |

|

| Mohawk

Consolidated |

|

|

|

|

|

|

|

Operating income |

|

$ |

146.6 |

|

|

|

125.7 |

|

| Adjustments to operating

income: |

|

|

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

|

7.9 |

|

|

|

32.2 |

|

|

Inventory step-up from purchase accounting |

|

|

— |

|

|

|

3.3 |

|

|

Legal settlements, reserves and fees |

|

|

8.8 |

|

|

|

1.0 |

|

|

Adjusted operating income |

|

$ |

163.3 |

|

|

|

162.2 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted operating income as a percent of net sales |

|

|

6.1 |

% |

|

|

5.8 |

% |

| Global

Ceramic |

|

|

|

|

|

|

|

Operating income |

|

$ |

48.8 |

|

|

|

63.3 |

|

| Adjustments to segment

operating income: |

|

|

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

|

3.9 |

|

|

|

0.7 |

|

|

Inventory step-up from purchase accounting |

|

$ |

— |

|

|

|

2.9 |

|

|

Adjusted segment operating income |

|

$ |

52.7 |

|

|

|

66.9 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted segment operating income as a percent of net sales |

|

|

5.0 |

% |

|

|

6.3 |

% |

| Flooring

NA |

|

|

|

|

|

Operating income (loss) |

|

$ |

45.0 |

|

|

|

(2.0 |

) |

| Adjustments to segment

operating income (loss): |

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

|

0.9 |

|

|

|

7.0 |

|

|

Legal settlements, reserves and fees |

|

|

1.9 |

|

|

|

— |

|

|

Adjusted segment operating income |

|

$ |

47.8 |

|

|

|

5.0 |

|

| |

|

|

|

|

|

Adjusted segment operating income as a percent of net sales |

|

|

5.3 |

% |

|

|

0.5 |

% |

| Flooring

ROW |

|

|

|

|

|

|

|

Operating income |

|

$ |

70.9 |

|

|

|

75.2 |

|

| Adjustments to segment

operating income: |

|

|

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

|

3.1 |

|

|

|

24.5 |

|

|

Acquisitions purchase accounting, including inventory step-up |

|

|

— |

|

|

|

0.4 |

|

|

Adjusted segment operating income |

|

$ |

74.0 |

|

|

|

100.1 |

|

| |

|

|

|

|

|

|

|

Adjusted segment operating income as a percent of net sales |

|

|

10.1 |

% |

|

|

12.6 |

% |

|

Corporate and intersegment eliminations |

|

|

|

|

Operating (loss) |

$ |

(18.1 |

) |

|

|

(10.8 |

) |

| Adjustments to segment

operating (loss): |

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

— |

|

|

|

— |

|

|

Legal settlements, reserves and fees |

|

6.9 |

|

|

|

1.0 |

|

|

Adjusted segment operating (loss) |

$ |

(11.2 |

) |

|

|

(9.8 |

) |

|

Reconciliation of Earnings Before Income Taxes to Adjusted

Earnings Before Income Taxes |

| |

|

Three Months Ended |

| (In

millions) |

|

March 30, 2024 |

|

|

April 1, 2023 |

|

Earnings before income taxes |

|

$ |

132.8 |

|

|

|

109.2 |

|

| Net earnings attributable to

noncontrolling interests |

|

|

— |

|

|

|

(0.1 |

) |

| Adjustments to earnings

including noncontrolling interests before income taxes: |

|

|

|

|

|

Restructuring, acquisition and integration-related and other

costs |

|

|

7.9 |

|

|

|

32.0 |

|

|

Inventory step-up from purchase accounting |

|

|

— |

|

|

|

3.3 |

|

|

Legal settlements, reserves and fees |

|

|

8.8 |

|

|

|

1.0 |

|

|

Adjustments of indemnification asset |

|

|

2.4 |

|

|

|

(0.9 |

) |

|

Adjusted earnings before income taxes |

|

$ |

151.9 |

|

|

|

144.5 |

|

|

Reconciliation of Income Tax Expense to Adjusted Income Tax

Expense |

| |

|

Three Months Ended |

| (In

millions) |

|

March 30, 2024 |

|

|

|

April 1, 2023 |

|

|

Income tax expense |

|

$ |

27.8 |

|

|

|

28.9 |

|

| Income taxes - adjustments of

uncertain tax position |

|

|

2.4 |

|

|

|

(0.9 |

) |

| Income

tax effect of adjusting items |

|

|

2.9 |

|

|

|

4.6 |

|

|

Adjusted income tax expense |

|

$ |

33.1 |

|

|

|

32.6 |

|

| |

|

|

|

|

|

Adjusted income tax rate |

|

|

21.8 |

% |

|

|

22.6 |

% |

The Company supplements its condensed

consolidated financial statements, which are prepared and presented

in accordance with US GAAP, with certain non-GAAP financial

measures. As required by the Securities and Exchange Commission

rules, the tables above present a reconciliation of the Company’s

non-GAAP financial measures to the most directly comparable US GAAP

measure. Each of the non-GAAP measures set forth above should

be considered in addition to the comparable US GAAP measure, and

may not be comparable to similarly titled measures reported by

other companies. The Company believes these non-GAAP measures, when

reconciled to the corresponding US GAAP measure, help its investors

as follows: Non-GAAP revenue measures that assist in identifying

growth trends and in comparisons of revenue with prior and future

periods and non-GAAP profitability measures that assist in

understanding the long-term profitability trends of the Company's

business and in comparisons of its profits with prior and future

periods.

The Company excludes certain items from its

non-GAAP revenue measures because these items can vary dramatically

between periods and can obscure underlying business trends. Items

excluded from the Company’s non-GAAP revenue measures include:

foreign currency transactions and translation; more or fewer

shipping days in a period and the impact of acquisitions.

The Company excludes certain items from its

non-GAAP profitability measures because these items may not be

indicative of, or are unrelated to, the Company's core operating

performance. Items excluded from the Company's non-GAAP

profitability measures include: restructuring, acquisition and

integration-related and other costs, legal settlements, reserves

and fees, impairment of goodwill and indefinite-lived intangibles,

acquisition purchase accounting, including inventory step-up from

purchase accounting, adjustments of indemnification asset,

adjustments of uncertain tax position and European tax

restructuring.

|

Contact: |

|

James Brunk, Chief Financial Officer(706)

624-2239 |

|

|

|

|

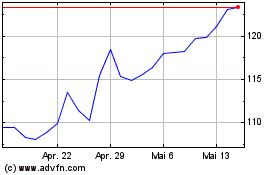

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024