Form 8-K - Current report

16 Januar 2024 - 10:29PM

Edgar (US Regulatory)

0000912595falseMAAI0000912595us-gaap:LimitedPartnerMember2024-01-162024-01-160000912595us-gaap:CumulativePreferredStockMember2024-01-162024-01-160000912595us-gaap:CommonStockMember2024-01-162024-01-1600009125952024-01-162024-01-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 16, 2024

MID-AMERICA APARTMENT COMMUNITIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Tennessee |

001-12762 |

62-1543819 |

(State or Other Jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

MID-AMERICA APARTMENTS, L.P.

(Exact name of registrant as specified in its charter)

|

|

|

Tennessee |

333-190028-01 |

62-1543816 |

(State or Other Jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

|

6815 Poplar Avenue, Suite 500 |

|

Germantown, Tennessee |

38138 |

(Address of Principal Executive Offices) |

(Zip Code) |

(901) 682-6600

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $.01 per share (Mid-America Apartment Communities, Inc.) |

MAA |

New York Stock Exchange |

8.50% Series I Cumulative Redeemable Preferred Stock, $.01 par value per share (Mid-America Apartment Communities, Inc.) |

MAA*I |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 7.01 Regulation FD Disclosure.

On January 16, 2024, the registrant issued a press release announcing the taxable composition of its 2023 distributions paid to shareholders. A copy of the press release is furnished as Exhibit 99.1 to this Current Report.

Exhibit 99.1, furnished by the Registrant pursuant to Item 9.01 of Form 8-K, is not to be considered "filed" under the Exchange Act, and shall not be incorporated by reference into any previous or future filing by the Registrant under the Securities Act or the Exchange Act.

ITEM 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

MID-AMERICA APARTMENT COMMUNITIES, INC. |

|

|

|

|

Date: |

January 16, 2024 |

|

/s/Albert M. Campbell, III |

|

|

|

Albert M. Campbell, III |

|

|

|

Executive Vice President and Chief Financial Officer |

|

|

|

(Principal Financial Officer) |

|

|

|

|

|

|

|

MID-AMERICA APARTMENTS, L.P. |

|

|

|

By: Mid-America Apartment Communities, Inc., its general partner |

|

|

|

|

Date: |

January 16, 2024 |

|

/s/Albert M. Campbell, III |

|

|

|

Albert M. Campbell, III |

|

|

|

Executive Vice President and Chief Financial Officer |

|

|

|

(Principal Financial Officer) |

Exhibit 99.1

PRESS RELEASE

MAA Announces Taxable Composition of 2023 Distributions

Germantown, TN, January 16, 2024. Mid-America Apartment Communities, Inc. or MAA (NYSE: MAA) today announced the taxable composition of the 2023 distributions paid to shareholders. The company does not expect any portion of the 2023 distributions paid to shareholders to represent a return of capital. The company did not incur any foreign taxes. The composition presented is applicable to all dividend distributions during 2023. The classifications for 2023 are as follows:

Common Stock (MAA) (CUSIP 59522J103)

|

|

|

|

|

|

|

|

Record Date |

Pay Date |

Cash Distributions Per Share |

Ordinary Taxable Distribution |

Long Term Capital Gain |

Unrecaptured Sec. 1250 Gain |

Section 199A |

Section 897 Capital Gain |

1/13/2023 |

1/31/2023 |

$1.4000 |

100.0000% |

0.0000% |

0.0000% |

100.0000% |

0.0000% |

4/14/2023 |

4/28/2023 |

$1.4000 |

100.0000% |

0.0000% |

0.0000% |

100.0000% |

0.0000% |

7/14/2023 |

7/31/2023 |

$1.4000 |

100.0000% |

0.0000% |

0.0000% |

100.0000% |

0.0000% |

10/13/2023 |

10/31/2023 |

$1.4000 |

100.0000% |

0.0000% |

0.0000% |

100.0000% |

0.0000% |

8.5% Series I Cumulative Redeemable Preferred Stock (MAA/PI) (CUSIP 59522J889)

|

|

|

|

|

|

|

|

Record Date |

Pay Date |

Cash Distributions Per Share |

Ordinary Taxable Distribution |

Long Term Capital Gain |

Unrecaptured Sec. 1250 Gain |

Section 199A |

Section 897 Capital Gain |

3/15/2023 |

3/31/2023 |

$1.06250 |

100.0000% |

0.0000% |

0.0000% |

100.0000% |

0.0000% |

6/15/2023 |

6/30/2023 |

$1.06250 |

100.0000% |

0.0000% |

0.0000% |

100.0000% |

0.0000% |

9/15/2023 |

10/2/2023 |

$1.06250 |

100.0000% |

0.0000% |

0.0000% |

100.0000% |

0.0000% |

12/15/2023 |

1/2/2024 |

$1.06250 |

100.0000% |

0.0000% |

0.0000% |

100.0000% |

0.0000% |

This release is based on the preliminary work the company has performed on its tax filings and is subject to correction or adjustment based on the completion of those filings. Shareholders are encouraged to consult with their personal tax advisors as to their specific tax treatment of these MAA distributions. The company is releasing information at this time to aid those required to distribute Forms 1099 on the company’s dividends. No material change in the taxable composition is expected.

About MAA

MAA, an S&P 500 company, is a self-administered real estate investment trust (REIT) focused on delivering strong, full-cycle investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States. For further details, please refer to www.maac.com or contact Investor Relations at investor.relations@maac.com.

Certain matters in this press release may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended, with respect to our expectations for future periods. Such statements include those made about the expectation that the company will have no material change in taxable composition

1

Exhibit 99.1

of its 2023 distributions. The expectation is based on preliminary work the company has performed on its year-end filings and on information currently available. Unknown risks, uncertainties and other factors may cause actual results, performance or achievements of the company to differ materially from those on which these calculations were based. Reference is hereby made to the filings of Mid-America Apartment Communities, Inc. with the Securities and Exchange Commission, including quarterly reports on Form 10-Q, reports on Form 8-K, and its annual report on Form 10-K, particularly including the risk factors contained in the latter filing.

2

v3.23.4

Document And Entity Information

|

Jan. 16, 2024 |

| Document And Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 16, 2024

|

| Entity Registrant Name |

MID-AMERICA APARTMENT COMMUNITIES, INC.

|

| Entity Central Index Key |

0000912595

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-12762

|

| Entity Incorporation, State or Country Code |

TN

|

| Entity Tax Identification Number |

62-1543819

|

| Entity Address, Address Line One |

6815 Poplar Avenue

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Germantown

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

38138

|

| City Area Code |

901

|

| Local Phone Number |

682-6600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Common Stock [Member] |

|

| Document And Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $.01 per share

|

| Trading Symbol(s) |

MAA

|

| Security Exchange Name |

NYSE

|

| Cumulative Preferred Stock [Member] |

|

| Document And Entity Information [Line Items] |

|

| Title of 12(b) Security |

8.50% Series I Cumulative Redeemable Preferred Stock, $.01 par value per share

|

| Trading Symbol(s) |

MAAI

|

| Security Exchange Name |

NYSE

|

| Limited Partner [Member] |

|

| Document And Entity Information [Line Items] |

|

| Entity Registrant Name |

MID-AMERICA APARTMENTS, L.P.

|

| Entity File Number |

333-190028-01

|

| Entity Incorporation, State or Country Code |

TN

|

| Entity Tax Identification Number |

62-1543816

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CumulativePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_PartnerTypeOfPartnersCapitalAccountAxis=us-gaap_LimitedPartnerMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

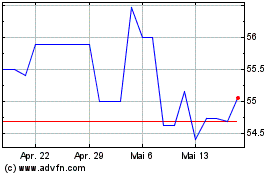

Mid America Apartment Co... (NYSE:MAA-I)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Mid America Apartment Co... (NYSE:MAA-I)

Historical Stock Chart

Von Apr 2023 bis Apr 2024