Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 November 2023 - 6:47PM

Edgar (US Regulatory)

Nuveen

Corporate

Income

2023

Target

Term

Fund

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

LONG-TERM

INVESTMENTS

-

76.1%

(75.9%

of

Total

Investments)

X

–

CORPORATE

BONDS

-

75

.2

%

(

75

.0

%

of

Total

Investments)

X

55,866,638

Automobiles

&

Components

-

8.8%

$

2,550

Ford

Motor

Credit

Co

LLC

5.584%

3/18/24

$

2,533,776

2,000

Ford

Motor

Credit

Co

LLC

3.370%

11/17/23

1,988,145

2,000

General

Motors

Financial

Co

Inc

5.100%

1/17/24

1,993,625

Total

Automobiles

&

Components

6,515,546

Commercial

&

Professional

Services

-

2.9%

2,200

Prime

Security

Services

Borrower

LLC

/

Prime

Finance

Inc,

144A

5.250%

4/15/24

2,184,974

Total

Commercial

&

Professional

Services

2,184,974

Consumer

Services

-

3.7%

2,750

Yum!

Brands

Inc

3.875%

11/01/23

2,738,097

Total

Consumer

Services

2,738,097

Consumer

Staples

Distribution

&

Retail

-

2.0%

1,500

Kroger

Co/The

4.000%

2/01/24

1,491,071

Total

Consumer

Staples

Distribution

&

Retail

1,491,071

Energy

-

7.4%

1,000

Continental

Resources

Inc/OK

3.800%

6/01/24

983,882

1,600

Enbridge

Inc

0.550%

10/04/23

1,599,739

250

Energy

Transfer

LP

5.875%

1/15/24

249,844

1,000

Energy

Transfer

LP

/

Regency

Energy

Finance

Corp

4.500%

11/01/23

998,478

500

Kinder

Morgan

Inc,

144A

5.625%

11/15/23

499,641

1,000

Petroleos

Mexicanos

4.875%

1/18/24

991,309

192

Sabine

Pass

Liquefaction

LLC

5.750%

5/15/24

191,594

Total

Energy

5,514,487

Equity

Real

Estate

Investment

Trusts

(Reits)

-

3.7%

1,000

American

Tower

Corp

5.000%

2/15/24

995,937

1,750

Starwood

Property

Trust

Inc,

144A

5.500%

11/01/23

1,746,430

Total

Equity

Real

Estate

Investment

Trusts

(Reits)

2,742,367

Financial

Services

-

4.7%

1,250

Navient

Corp

6.125%

3/25/24

1,243,320

1,300

OneMain

Finance

Corp

8.250%

10/01/23

1,300,000

625

OneMain

Finance

Corp

6.125%

3/15/24

623,018

350

Park

Aerospace

Holdings

Ltd,

144A

5.500%

2/15/24

348,256

Total

Financial

Services

3,514,594

Health

Care

Equipment

&

Services

-

3.4%

1,500

Baxter

International

Inc

0.868%

12/01/23

1,488,082

1,000

HCA

Inc

5.000%

3/15/24

994,834

Total

Health

Care

Equipment

&

Services

2,482,916

Materials

-

19.1%

3,000

Ball

Corp

4.000%

11/15/23

2,986,239

1,000

Berry

Global

Inc

0.950%

2/15/24

972,830

3,857

Celanese

US

Holdings

LLC

3.500%

5/08/24

3,793,255

500

Graphic

Packaging

International

LLC,

144A

0.821%

4/15/24

484,672

2,000

Mosaic

Co/The

4.250%

11/15/23

1,994,955

4,025

NOVA

Chemicals

Corp,

144A

4.875%

6/01/24

3,954,520

Total

Materials

14,186,471

Nuveen

Corporate

Income

2023

Target

Term

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

Media

&

Entertainment

-

3.7%

$

340

AMC

Networks

Inc

5.000%

4/01/24

$

335,305

1,750

CSC

Holdings

LLC

5.250%

6/01/24

1,664,675

750

Warnermedia

Holdings

Inc

3.528%

3/15/24

739,604

Total

Media

&

Entertainment

2,739,584

Pharmaceuticals,

Biotechnology

&

Life

Sciences

-

5.7%

1,500

AbbVie

Inc

3.750%

11/14/23

1,496,279

750

Mylan

Inc

4.200%

11/29/23

747,651

2,000

Teva

Pharmaceutical

Finance

Netherlands

III

BV

6.000%

4/15/24

1,989,871

Total

Pharmaceuticals,

Biotechnology

&

Life

Sciences

4,233,801

Semiconductors

&

Semiconductor

Equipment

-

1.0%

750

Broadcom

Corp

/

Broadcom

Cayman

Finance

Ltd

3.625%

1/15/24

744,504

Total

Semiconductors

&

Semiconductor

Equipment

744,504

Transportation

-

1.3%

1,000

United

Airlines

Holdings

Inc

5.000%

2/01/24

990,000

Total

Transportation

990,000

Utilities

-

7.8%

1,000

NextEra

Energy

Capital

Holdings

Inc

2.940%

3/21/24

985,870

1,500

Pacific

Gas

and

Electric

Co

1.700%

11/15/23

1,491,626

1,341

Public

Service

Enterprise

Group

Inc

0.841%

11/08/23

1,333,610

2,000

Vistra

Operations

Co

LLC,

144A

4.875%

5/13/24

1,977,120

Total

Utilities

5,788,226

Total

Corporate

Bonds

(cost

$56,288,052)

55,866,638

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X

–

CONVERTIBLE

BONDS

-

0

.9

%

(

0

.9

%

of

Total

Investments)

X

688,100

Technology

Hardware

&

Equipment

-

0.9%

$

700

Western

Digital

Corp

1.500%

2/01/24

$

688,100

Total

Technology

Hardware

&

Equipment

688,100

Total

Convertible

Bonds

(cost

$700,238)

688,100

Total

Long-Term

Investments

(cost

$56,988,290)

56,554,738

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

22.0% (24.1%

of

Total

Investments)

X

–

COMMERCIAL

PAPER

-

22

.0

%

(

21

.9

%

of

Total

Investments)

X

16,315,597

$

1,500

Amazon.com

Inc

0.000

11/14/23

$

1,490,375

1,500

Banner

Health

0.000

11/08/23

1,491,371

1,500

Canadian

National

Railway

Co

0.000

11/14/23

1,489,516

1,500

John

Deere

Financial

Services

Inc

0.000

11/13/23

1,490,379

1,400

Koch

Industries

Inc

0.000

11/16/23

1,390,465

1,000

L'Oreal

SA

0.000

11/21/23

992,449

1,500

Microsoft

Corp,

144A

0.000

11/21/23

1,488,674

1,000

Microsoft

Corp,

144A

0.000

11/17/23

993,080

500

NRW

Bank,

144A

0.000

11/22/23

496,100

1,030

Province

of

British

Columbia

Canada

0.000

11/24/23

1,021,764

1,500

Trustees

of

Dartmouth

College

0.000

11/16/23

1,489,746

1,000

Unilever

Finance

Netherlands

BV

0.000

11/27/23

991,450

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

$

1,500

Walmart

Inc,

144A

0.000

11/14/23

$

1,490,228

Total

Commercial

Paper

(cost

$16,315,597)

16,315,597

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X

–

REPURCHASE

AGREEMENTS

-

2

.1

%

(

2

.2

%

of

Total

Investments)

X

1,600,000

$

1,600

Repurchase

Agreement

with

Fixed

Income

Clearing

Corporation,

dated

9/29/23,

repurchase

price

$1,600,704,

collateralized

by

$2,048,600,

U.S.

Treasury

Bond,

3.375%,

due

11/15/48,

value

$1,632,050

5.280%

10/02/23

$

1,600,000

Total

Repurchase

Agreements

(cost

$1,600,000)

1,600,000

Total

Short-Term

Investments

(cost

$17,915,597)

17,915,597

Total

Investments

(cost

$

74,903,887

)

-

100

.2

%

74,470,335

Other

Assets

&

Liabilities,

Net

- (0.2)%

(

179,716

)

Net

Assets

Applicable

to

Common

Shares

-

100%

$

74,290,619

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Corporate

Bonds

$

–

$

55,866,638

$

–

$

55,866,638

Convertible

Bonds

–

688,100

–

688,100

Short-Term

Investments:

Commercial

Paper

–

16,315,597

–

16,315,597

Repurchase

Agreements

–

1,600,000

–

1,600,000

Total

$

–

$

74,470,335

$

–

$

74,470,335

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

Nuveen

Corporate

Income

2023

Target

Term

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

Reg

S

Regulation

S

allows

U.S.

companies

to

sell

securities

to

persons

or

entities

located

outside

of

the

United

States

without

registering

those

securities

with

the

Securities

and

Exchange

Commission.

Specifically,

Regulation

S

provides

a

safe

harbor

from

the

registration

requirements

of

the

Securities

Act

for

the

offers

and

sales

of

securities

by

both

foreign

and

domestic

issuers

that

are

made

outside

the

United

States.

REIT

Real

Estate

Investment

Trust

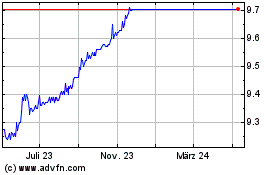

Nuveen Corporate Income ... (NYSE:JHAA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Nuveen Corporate Income ... (NYSE:JHAA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025