Lexmark to Buy PACSGEAR - Analyst Blog

05 Oktober 2013 - 12:05AM

Zacks

Renowned imaging and printing solutions provider Lexmark

International Inc. (LXK) has announced the acquisition of

PACSGEAR, a leading provider of connectivity solutions for

hospitals and healthcare facilities, for a cash consideration of

$54 million.

PACSGEAR solutions, used to capture, manage and share medical

images and other relevant documents, will be incorporated into

Lexmark’s picture archiving and communication systems (PACS) and

electronic medical records (EMR) systems.

Post-acquisition, PACSGEAR will be a part of Perceptive Software,

an operating segment of Lexmark. The acquisition will help Lexmark

to evolve as a software and solutions provider and add to its

capabilities in the healthcare segment.

Healthcare organizations and clinicians are struggling with

incomplete patient records both on account of the increasing volume

of this data and the heterogeneous nature of this data (videos,

scans, other records). With the acquisition of PACSGEAR technology,

Perceptive Software will be able to bridge the content gaps within

the system through an EMR delivering a vendor-neutral,

standards-based clinical content platform to create a more

comprehensive patient record.

PACSGEAR is a leader in PACS/EMR connectivity solutions for

hospitals and healthcare facilities. It integrates documents, film,

video, visible light and other images from various departments to

any PACS/EMR, thus improving patient care and enabling better

health information exchange.

Lexmark’s acquisitions have strengthened its Perceptive Software

revenues. These revenues (excluding acquisition-related

adjustments) grew 34.0% year over year to $62.0 million in

2Q13.

Apart from this, Lexmark recently acquired a German enterprise firm

Saperion, a leading developer of enterprise content management

(ECM) for a purchase consideration of $72 million in cash.

We see good growth prospects for Lexmark in the software sector

although the company is also trying its luck in new hardware

solutions. But the overall macro uncertainty could have an effect

on product demand. Lexmark has a strong market position, but

reduced demand for traditional printing hardware has impacted

pricing in the computer peripherals market.

Lexmark is doing really well in the MPS (managed print services)

market and is winning deals continuously. It has been declared a

leader in this market by research firms IDC and Gartner

Inc. (IT).

Though constant pricing pressure from competitors such as Canon

Inc., Xerox Corp. (XRX) and

Hewlett-Packard Co. (HPQ) and a high debt burden

remain concerns, we expect Lexmark to turn the tables with an

increased focus on software and services.

Currently, Lexmark has a Zacks Rank #3 (Hold).

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

GARTNER INC -A (IT): Free Stock Analysis Report

LEXMARK INTL (LXK): Free Stock Analysis Report

XEROX CORP (XRX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

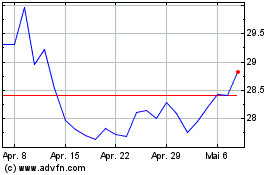

HP (NYSE:HPQ)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

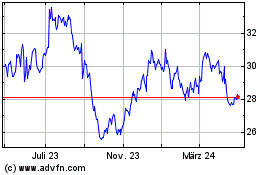

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2023 bis Jul 2024