UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of April 2023

Commission File Number 001-36433

GasLog Partners LP

(Translation of registrant’s name into English)

c/o GasLog LNG Services Ltd.

69 Akti Miaouli 18537

Piraeus, Greece

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F þ Form 40-F o

| Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): |

¨ |

| |

|

| Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): |

¨ |

Merger Agreement

On April 6, 2023, GasLog Partners LP (the “Partnership”)

entered into an Agreement and Plan of Merger (the “Merger Agreement”) with GasLog Partners GP LLC, the general partner of

the Partnership (the “General Partner”), GasLog Ltd. (“GasLog”), and Saturn Merger Sub LLC, a wholly owned

subsidiary of GasLog (“Merger Sub”). Pursuant to the Merger Agreement, Merger Sub will merge with and into the Partnership,

with the Partnership surviving as a direct subsidiary of GasLog (the “Merger”).

The conflicts committee (the “Conflicts Committee”) of

the Board of Directors of the Partnership (the “Board”) has unanimously (a) determined that the Merger Agreement and the transactions

contemplated thereby are fair to and in the best interests of the Partnership and the holders of common units (the “Common Unitholders”)

other than GasLog and its affiliates (the “Unaffiliated Unitholders”), (b) approved the Merger Agreement and the transactions

contemplated thereby (the foregoing constituting Special Approval (as defined in the Seventh Amended and Restated Agreement of Limited

Partnership of the Partnership (the “Partnership Agreement”))) and (c) recommended to the Board that the Board (i) approve

the Merger Agreement and the transactions contemplated thereby and (ii) recommend approval of the Merger Agreement and the transactions

contemplated thereby to the Common Unitholders.

The Board, acting upon the recommendation of the Conflicts Committee,

has unanimously (a) determined that the Merger Agreement and the transactions contemplated thereby are fair to and in the best interests

of the Partnership and the Unaffiliated Unitholders, (b) approved the Merger Agreement and the transactions contemplated thereby, (c)

directed that the Merger Agreement and the transactions contemplated thereby be submitted to a vote of the Common Unitholders and (d)

resolved to recommend approval of the Merger Agreement and the transactions contemplated thereby to the Common Unitholders.

Upon completion of the Merger, each common unit representing limited

partner interests in the Partnership (the “Common Units”) outstanding immediately prior to the effective time of the Merger

(the “Effective Time”), other than those Common Units held by GasLog or its affiliates (the “Sponsor Units”),

will be converted into the right to receive $5.37 per Common Unit in cash, without interest. In addition, as soon as reasonably practicable

following the affirmative vote of the holders of at least a majority of the Common Units in favor of the approval of the Merger Agreement

(the “Unitholder Approval”), pursuant to the terms of the Merger Agreement, the Board will declare a special distribution

of $3.28 per Common Unit (with a corresponding amount distributed in respect of each General Partner Unit (as defined in the Partnership

Agreement)) (the “Special Distribution”) with a record date on a business day prior to the anticipated closing date of the

Merger and a payment date occurring on or prior to the closing date of the Merger. Accordingly, holders of Common Units (other than the

Sponsor Units) will, assuming that such holders hold Common Units both on the record date of the Special Distribution and at the Effective

Time, receive overall consideration of $8.65 per Common Unit. The Sponsor Units and the General Partner Units will remain outstanding

after the Merger and will receive the Special Distribution concurrently with the Unaffiliated Unitholders.

The Partnership will hold a special meeting (the “Special Meeting”)

of the Common Unitholders to obtain the Unitholder Approval. As described further below, pursuant to the Support Agreement (as defined

below), GasLog has agreed to appear at the Special Meeting and either vote in person or by proxy to adopt and approve the Merger Agreement

and transactions contemplated thereby. Unless the Merger Agreement is validly terminated in accordance with its terms, the Partnership

will submit the Merger Agreement to the Common Unitholders at the Special Meeting, even if the Conflicts Committee shall have effected

an Adverse Recommendation Change (as defined in the Merger Agreement).

The Merger Agreement contains customary representations and warranties

from the parties and each party has agreed to customary covenants, including, among others, covenants relating to (a) the conduct of the

Partnership’s business during the interim period between the execution of the Merger Agreement and the Effective Time and (b) the

obligation of the parties to use commercially reasonable efforts to cause the Merger to be consummated.

Completion of the Merger is subject to certain conditions, including:

(a) Unitholder Approval; (b) there being no law or injunction prohibiting consummation of the transactions contemplated under

the Merger Agreement; (c) subject to specified materiality standards, the accuracy of certain representations and warranties of the

other party; (d) compliance by the other party in all material respects with its covenants and obligations under the Merger Agreement

and (e) the declaration by the Board of the Special Distribution and payment thereof in accordance with the Merger Agreement.

The Merger Agreement provides for certain termination rights for both

GasLog and the Partnership, including (a) by the mutual written agreement of the Partnership and GasLog (duly authorized by the Conflicts

Committee and the Board of Directors of GasLog, respectively); (b) by either GasLog or the Partnership (following authorization by

the Conflicts Committee) under certain circumstances, if (i) the Merger has not been consummated on or before October 6, 2023 (the “Outside

Date”), (ii) the Merger is prevented by certain final and non-appealable legal restraints or a governmental agency is seeking any

such legal restraints or (iii) the Unitholder Approval is not obtained; (c) by GasLog (i) if an Adverse Recommendation Change has

occurred, or (ii) under certain conditions, if the Partnership materially breached any of its representations or warranties, or failed

to perform any of its covenants or agreements, set forth in the Merger Agreement (or if any of the representations or warranties of the

Partnership set forth in the Merger Agreement shall fail to be true), and such breach or failure is not reasonably capable of being cured

by the Outside Date or is not cured within 30 days following receipt of written notice of such breach or failure; or (d) by the Partnership

(following authorization of the Conflicts Committee) under certain conditions, if GasLog or Merger Sub materially breached any of its

representations or warranties, or failed to perform any of its covenants or agreements, set forth in the Merger Agreement (or if any of

the representations or warranties of GasLog or Merger Sub set forth in the Merger Agreement shall fail to be true), and such breach

or

failure is not reasonably capable of being cured by the Outside Date or is not cured within 30 days following receipt of written notice

of such breach or failure.

The foregoing description of the Merger Agreement and the transactions

contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of

the Merger Agreement, a copy of which is filed as Exhibit 2.1 hereto and is incorporated by reference in its entirety herein.

Promptly after completion of the Merger and related transactions, the

Common Units of the Partnership will be delisted from the New York Stock Exchange.

Support Agreement

On April 6, 2023, in connection with the execution of the Merger Agreement,

GasLog and the Partnership entered into a Voting and Support Agreement (the “Support Agreement”), pursuant to which and subject

to the terms and conditions thereof, GasLog agreed, among other things, to vote all of its Common Units in favor of the Merger Agreement

and the transactions contemplated thereby at the Special Meeting. GasLog has also agreed not to transfer any Common Units it beneficially

owns or purchase any additional Common Units other than in accordance with the Support Agreement.

The foregoing description of the Support Agreement does not purport

to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Support Agreement, a copy of which

is filed as Exhibit 10.1 hereto and is incorporated by reference in its entirety herein.

EXHIBIT LIST

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: April 7, 2023 |

|

|

|

|

|

| |

|

|

|

|

|

| |

GASLOG PARTNERS LP, |

| |

|

|

|

|

|

| |

|

by |

/s/ Paolo Enoizi |

|

| |

|

|

Name: |

Paolo Enoizi |

|

| |

|

|

Title: |

Chief Executive Officer |

|

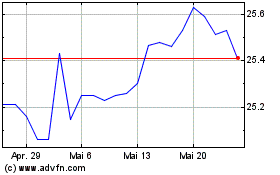

Gaslog Partners (NYSE:GLOP-C)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Gaslog Partners (NYSE:GLOP-C)

Historical Stock Chart

Von Jun 2023 bis Jun 2024