Form N-PX - Annual Report of proxy voting record of management investment companies

23 August 2023 - 8:10PM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, DC 20549

FORM N-PX

ANNUAL REPORT OF PROXY VOTING RECORD OF REGISTERED MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number: 811-22724

PGIM Global High Yield Fund, Inc.

(Exact name of registrant as specified in charter)

655 Broad Street

6th Floor

Newark, NJ 07102

(Address of principal executive offices) (Zip code)

Patrick McGuinness, Esquire

655 Broad Street

6th Floor

Newark, NJ 07102

(Name and address of agent for service)

Registrant’s telephone number, including area code: 973-802-6469

Date of fiscal year end: July 31

Date of reporting period: 7/1/2022 through 6/30/2023

Item 1. Proxy Voting Record.

In determining votes against management, any ballot that management did not make a recommendation is considered to be "FOR" regardless of the vote cast. Any "Abstain" vote cast is considered as voted, and to be against the management recommendation.

FORM N-PX

ICA File Number: 811-22724

Registrant Name: PGIM Global High Yield Fund, Inc.

Reporting Period: 07/01/2022 - 06/30/2023

PGIM Global High Yield Fund, Inc. - Subadviser: PGIM Fixed Income, a business unit of PGIM Inc.

| |

|---|

CHESAPEAKE ENERGY CORPORATION

Meeting Date: JUN 08, 2023

Record Date: APR 10, 2023

Meeting Type: ANNUAL

|

Ticker: CHK

Security ID: 165167735

|

| Proposal No |

Proposal |

Proposed By |

Management Recommendation |

Vote Cast |

| 1a. |

Election of Director: Domenic J. Dell'Osso, Jr. |

Management |

For |

For |

| 1b. |

Election of Director: Timothy S. Duncan |

Management |

For |

For |

| 1c. |

Election of Director: Benjamin C. Duster, IV |

Management |

For |

For |

| 1d. |

Election of Director: Sarah A. Emerson |

Management |

For |

For |

| 1e. |

Election of Director: Matthew M. Gallagher |

Management |

For |

For |

| 1f. |

Election of Director: Brian Steck |

Management |

For |

For |

| 1g. |

Election of Director: Michael Wichterich |

Management |

For |

For |

| 2. |

To approve on an advisory basis our named executive officer compensation. |

Management |

For |

For |

| 3. |

To approve on an advisory basis the frequency of shareholder votes on named executive officer compensation. |

Management |

1 Year |

1 Year |

| 4. |

To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. |

Management |

For |

For |

| |

|---|

CODERE FINANCE 2 (LU) SA

Meeting Date: JUL 29, 2022

Record Date:

Meeting Type: EXTRAORDINARY GENERAL MEETING

|

Ticker: CDRSM

Security ID: B8A9YTHZ6

|

| Proposal No |

Proposal |

Proposed By |

Management Recommendation |

Vote Cast |

| 1 |

Acknowledgement of the resignation of Ms. Sandra Ann Egan from her position as a class B director of the Company effective as of 6 April 2022 and grant a full discharge to Ms. Sandra Ann Egan in respect of the performance of her duties as a class B direct |

Management |

For |

Do Not Vote |

| 2 |

Acknowledgement of the co-optation of Mr. Michael Bruno P. Goose as a class B director of the Company as of 6 April 2022 until the next annual general meeting of the shareholders of the Company that will take place in 2025 by the board of directors of the |

Management |

For |

Do Not Vote |

| 3 |

Amendment of articles 24.3 and 26.3 of the Articles as well as article 26.5 of the Articles to address a clerical error inserted in the previous version of the Articles without substantially amending such article. |

Management |

For |

Do Not Vote |

| 4 |

Amendment of the definition of "Corporate Director" under article 43 "Definitions" of the Articles. |

Management |

For |

Do Not Vote |

| 5 |

Amendment of the definition of "Opco Group CEO" under article 43 "Definitions" of the Articles. |

Management |

For |

Do Not Vote |

| 6 |

Creation of the definition of "Shareholders' Agreement Deed of Amendment" under article 43 "Definitions" of the Articles |

Management |

For |

Do Not Vote |

| |

|---|

CODERE FINANCE 2 (LU) SA

Meeting Date: DEC 07, 2022

Record Date:

Meeting Type: EXTRAORDINARY GENERAL MEETING

|

Ticker: CDRSM

Security ID: B8A9YTHZ6

|

| Proposal No |

Proposal |

Proposed By |

Management Recommendation |

Vote Cast |

| 1 |

To consider and, if thought fit, to approve, and ratify a special report on transactions in which the Class A directors of the Company had a conflict of interest for a period from January 1st, 2022 until the present date |

Management |

For |

Do Not Vote |

| 2 |

To consider and, if thought fit, to approve the appointment of Mr. Michel LECOQ, domiciliated at 27 rue de la Concorde, 4800 Verviers, Grand Duchy of LU, as statutory auditor of the Company and its Group of Companies |

Management |

For |

Do Not Vote |

| 3 |

To consider and, if thought fit, to approve the appointment of Ernst & Young, S.L. domiciliated at C. de Raimundo Fernandez Villaverde, 65, 28003 Madrid, Kingdom of Spain as an independent auditor of the Company and its Group of Companies |

Management |

For |

Do Not Vote |

| 4 |

To consider and, if thought fit, to approve the payment of the amount of EUR 26,220.24- (twenty-six thousand two hundred twenty Euros and twenty-four Eurocents) to Mr. Borja FERNANDEZ ESPEJEL, an independent non-executive director of the Company, accordin |

Management |

For |

Do Not Vote |

| 5 |

To consider and, if thought fit, to approve the increase of the remuneration for Mr. Antonio MOYA-ANGELER LINARES, "Preferred Candidate" of the Qualifying Shareholder Group as defined in the shareholders agreement dated November 19, 2021, as amended from |

Management |

For |

Do Not Vote |

| 6 |

To consider and, if thought fit, to approve (i) the appointment of Mr. Leslie OTTOLENGHI, born on 22 February 1962, in North Carolina, US of America, residing at 5740 FOREST ST, GREENWOOD VILLAGE, 80121-21 Colorado, US of America as an independent non-exe |

Management |

For |

Do Not Vote |

| 7 |

To consider and, if thought fit, to approve the appointment of Ms. Silvana PUTO, born 02 February 1981, in Durres, Albania, professionally residing at 6, rue Eugene Ruppert, L-2453 LU as a class B director of the Company, for a period of 2 years started o |

Management |

For |

Do Not Vote |

| 8 |

To consider and, if thought fit, to confirm (i) resignation of Mr. Aidan DE BRUNNER as class A director of the Company, also acting as INED of the Company with effect from 07 August 2022 and (ii) grant full and entire discharge to Mr. Aidan DE BRUNNER as |

Management |

For |

Do Not Vote |

| 9 |

To consider and, if thought fit, to confirm (i) resignation of RCS MGMT (LU) S.a r.l., a private limited liability company (societe a responsabilite limitee) incorporated under the laws of the Grand Duchy of LU, having its registered office at 6, rue Euge |

Management |

For |

Do Not Vote |

| 10 |

To consider and, if thought fit, subject to the terms and conditions of section 30.5 of the Shareholders' Agreement, to authorize the payment of a maximum amount of gross EUR 1,400,000 (one million four hundred thousand Euros) per annum by the Company as |

Management |

For |

Do Not Vote |

| 11 |

To consider and, if thought fit, to authorize any employee of Intertrust (LU) S.a r.l. to undertake the necessary action(s) required to file and register the changes mentioned in the above resolutions with the LU Trade and Companies' Register |

Management |

For |

Do Not Vote |

| |

|---|

CODERE NEW TOPCO SA

Meeting Date: APR 13, 2023

Record Date:

Meeting Type: EXTRAORDINARY GENERAL MEETING

|

Ticker: CDRSM

Security ID: B8A9YTHZ6

|

| Proposal No |

Proposal |

Proposed By |

Management Recommendation |

Vote Cast |

| 1 |

Approval of the Transaction, the Company and any other Group Company entering into the Lock-Up Agreement and the Transaction Documents, the incurrence of new debt in the form of the First Priority Notes and the incurrence of new debt in the form of additi |

Management |

For |

For |

| 2 |

Ratification of the Preparatory Actions and Steps which have been taken by the Company and/or any Group Company in relation to the Transaction. Draft resolution: "The Meeting resolved to ratify the Preparatory Actions and Steps which have been taken by th |

Management |

For |

For |

| 3 |

Disapplication of pre-emption rights with respect to the FPN Issuance, issuance of New NSSNs and New SSNs under the Articles and the Shareholders' Agreement, respectively. Draft resolution: "The Meeting resolved to disapply pre-emption rights with respect |

Management |

For |

For |

| 4 |

Disapplication of pre-emption rights with respect to the issuance of additional NSSNs (or, if applicable, New NSSNs) and SSNs (or, if applicable, New SSNs) in respect of fees paid to consenting NSSN and SSN holders under the Articles and the Shareholders' |

Management |

For |

For |

| 5 |

Ratification of the appointment of Mr. Neil Robson, born on 25 February 1969, in Scunthorpe, GB, residing at 42 Curly Hill, Ilkley LS29 0AY, GB, as class A director of the Company by way of co-optation as from 24 March 2023 until the remaining period of t |

Management |

For |

For |

| 7 |

Approval of the entry by (i) the Company, (ii) Codere New Midco S.a r.l., a wholly owned subsidiary of the Company, (iii) Codere New Holdco S.A., a wholly owned indirect subsidiary of the Company, and (iv) the other subsidiaries of the Company as well as |

Management |

For |

For |

| |

|---|

INTELSAT S.A.

Meeting Date: JUN 21, 2023

Record Date: MAY 15, 2023

Meeting Type: ANNUAL

|

Ticker: INTEL

Security ID: L5217E120

|

| Proposal No |

Proposal |

Proposed By |

Management Recommendation |

Vote Cast |

| 1. |

Receive Board and Auditors' Report |

Management |

None |

Do Not Vote |

| 2. |

Approval of the statutory stand-alone financial statements |

Management |

For |

For |

| 3. |

Approval of the consolidated financial statements |

Management |

For |

For |

| 4. |

Approval of discharge (quitus) to directors for proper performance of their duties |

Management |

For |

For |

| 5. |

Approval of carry forward of net results |

Management |

For |

For |

| 6. |

Confirmation of David Wajsgras (co-opted) as director |

Management |

For |

For |

| 7. |

Confirmation of David Mack (co-opted) as director |

Management |

For |

For |

| 8a. |

Re-election of Director: Roy Chestnutt |

Management |

For |

For |

| 8b. |

Re-election of Director: Lisa Hammitt |

Management |

For |

For |

| 8c. |

Re-election of Director: David Mack |

Management |

For |

For |

| 8d. |

Re-election of Director: Marc Montagner |

Management |

For |

For |

| 8e. |

Re-election of Director: Easwaran Sundaram |

Management |

For |

For |

| 8f. |

Re-election of Director: David Wajsgras |

Management |

For |

For |

| 8g. |

Re-election of Director: Jinhy Yoon |

Management |

For |

For |

| 9. |

Ratification of directors' remuneration for 2022 |

Management |

For |

For |

| 10. |

Approval of directors' remuneration for 2023 |

Management |

For |

For |

| 11. |

Approval of re-appointment of KPMG Audit S.a r.l. as approved statutory auditor |

Management |

For |

For |

| 12. |

Approval of share repurchases and treasury share holdings, pursuant to and in line with Article 9 of the articles of association of the Company (relating to communication laws) |

Management |

For |

For |

| |

|---|

KONDOR FINANCE PLC

Meeting Date: JUL 26, 2022

Record Date: JUL 12, 2022

Meeting Type: BOND MEETING

|

Ticker:

Security ID: G5308HAC7

|

| Proposal No |

Proposal |

Proposed By |

Management Recommendation |

Vote Cast |

| 1 |

THE ISSUER, AT THE REQUEST OF THE BORROWER, IS SOLICITING THE APPROVAL OF THE NOTEHOLDERS, BY WAY OF EXTRAORDINARY RESOLUTIONS IN RESPECT OF EACH SERIES OF NOTES TO, AMONG OTHER THINGS: (I) IN RESPECT OF THE 2022 NOTES, TO DEFER THE PAYMENT OF PRINCIPAL U |

Management |

For |

Against |

| |

|---|

KONDOR FINANCE PLC

Meeting Date: AUG 31, 2022

Record Date: AUG 04, 2022

Meeting Type: BOND MEETING

|

Ticker:

Security ID: G5308HAC7

|

| Proposal No |

Proposal |

Proposed By |

Management Recommendation |

Vote Cast |

| 1 |

THAT THIS MEETING (THE MEETING") OF THE HOLDERS (THE "NOTEHOLDERS") OF THE USD 500,000,000 7.625 PER CENT. LOAN PARTICIPATION NOTES DUE 2026 (THE "2026 NOTES") ISSUED BY, BUT WITH LIMITED RECOURSE TO, KONDOR FINANCE PLC (THE "ISSUER") FOR THE SOLE PURPOSE |

Management |

For |

For |

| |

|---|

KONDOR FINANCE PLC

Meeting Date: AUG 31, 2022

Record Date: AUG 03, 2022

Meeting Type: BOND MEETING

|

Ticker:

Security ID: G5308HAA1

|

| Proposal No |

Proposal |

Proposed By |

Management Recommendation |

Vote Cast |

| 1 |

THAT THIS MEETING (THE "MEETING") OF THE HOLDERS (THE "NOTEHOLDERS") OF THE EUR600,000,000 7.125 PER CENT. LOAN PARTICIPATION NOTES DUE 2024 (THE "2024 NOTES") ISSUED BY, BUT WITH LIMITED RECOURSE TO, KONDOR FINANCE PLC (THE "ISSUER") FOR THE SOLE PURPOSE |

Management |

For |

For |

END NPX REPORT

SIGNATURES

Pursuant to the requirements of the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PGIM Global High Yield Fund, Inc.

By: Stuart S. Parker*

Stuart S. Parker, President

* By: /s/ Patrick McGuinness

Attorney-in-Fact

Date: August 23, 2023

POWER OF ATTORNEY

for the PGIM Open End Fund Complex

The undersigned, directors/trustees and/or officers of each of the registered investment companies listed in Appendix A hereto, hereby authorize Andrew French, Claudia DiGiacomo, Melissa Gonzalez, Patrick McGuinness and Debra Rubano or any of them, as attorney-in-fact, to sign on his or her behalf in the capacities indicated (and not in such person’s personal individual capacity for personal financial or estate planning), the Registration Statement on Form N-1A, filed for such registered investment company or any amendment thereto (including any pre-effective or post-effective amendments) and any and all supplements or other instruments in connection therewith, including Form N-PX, Forms 3, 4 and 5 for or on behalf of each registered investment company listed in Appendix A or any current or future series thereof, and to file the same, with all exhibits thereto, with the Securities and Exchange Commission.

This Power of Attorney may be executed in multiple counterparts, each of which shall be deemed an original, but which taken together shall constitute one instrument.

|

|

|

/s/ Ellen S. Alberding |

/s/ Laurie Simon Hodrick |

|

Ellen S. Alberding |

Laurie Simon Hodrick |

|

|

|

|

/s/ Kevin J. Bannon |

/s/ Christian J. Kelly |

|

Kevin J. Bannon |

Christian J. Kelly |

|

|

|

|

/s/ Scott E. Benjamin |

/s/ Stuart S. Parker |

|

Scott E. Benjamin |

Stuart S. Parker |

|

|

|

|

/s/ Linda W. Bynoe |

/s/ Brian K. Reid |

|

Linda W. Bynoe |

Brian K. Reid |

|

|

|

|

/s/ Barry H. Evans |

/s/ Russ Shupak |

|

Barry H. Evans |

Russ Shupak |

|

|

|

|

/s/ Keith F. Hartstein |

/s/ Grace C. Torres |

|

Keith F. Hartstein |

Grace C. Torres |

Dated: March 30, 2023

APPENDIX A

Prudential Government Money Market Fund, Inc.

The Prudential Investment Portfolios, Inc.

Prudential Investment Portfolios 2

Prudential Investment Portfolios 3

Prudential Investment Portfolios Inc. 14

Prudential Investment Portfolios 4

Prudential Investment Portfolios 5

Prudential Investment Portfolios 6

Prudential National Muni Fund, Inc.

Prudential Jennison Blend Fund, Inc.

Prudential Jennison Mid-Cap Growth Fund, Inc.

Prudential Investment Portfolios 7

Prudential Investment Portfolios 8

Prudential Jennison Small Company Fund, Inc.

Prudential Investment Portfolios 9

Prudential World Fund, Inc.

Prudential Investment Portfolios, Inc. 10

Prudential Jennison Natural Resources Fund, Inc.

Prudential Global Total Return Fund, Inc.

Prudential Investment Portfolios 12

Prudential Investment Portfolios, Inc. 15

Prudential Investment Portfolios 16

Prudential Investment Portfolios, Inc. 17

Prudential Investment Portfolios 18

Prudential Sector Funds, Inc.

Prudential Short-Term Corporate Bond Fund, Inc.

The Target Portfolio Trust

PGIM ETF Trust

PGIM Global High Yield Fund, Inc.

PGIM High Yield Bond Fund, Inc

PGIM Short Duration High Yield Opportunities Fund

Ms. Alberding does not serve as a Trustee of the PGIM Short Duration High Yield Opportunities Fund.

Ms. Bynoe and Ms. Hodrick do not serve as Directors of PGIM High Yield Bond Fund, Inc. and PGIM Global High Yield Fund, Inc. or as Trustees of PGIM Short Duration High Yield Opportunities Fund.

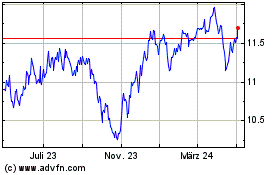

PGIM Global High Yield (NYSE:GHY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

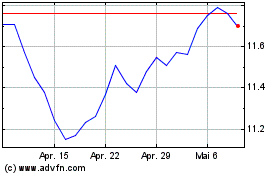

PGIM Global High Yield (NYSE:GHY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024