Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 Februar 2024 - 4:33PM

Edgar (US Regulatory)

The

Gabelli

Convertible

and

Income

Securities

Fund

Inc.

Schedule

of

Investments

—

December

31,

2023

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

—

82.8%

Automotive

—

1.9%

$

1,250,000

Rivian

Automotive

Inc.,

3.625%,

10/15/30(a)

.............

$

1,541,375

Broadcasting

—

3.1%

865,000

fuboTV

Inc.,

3.250%,

02/15/26

...............

635,775

1,820,000

Liberty

Media

Corp.-Liberty

Formula

One,

2.250%,

08/15/27

...............

1,855,357

2,491,132

Business

Services

—

4.0%

1,000,000

BigBear.ai

Holdings

Inc.,

6.000%,

12/15/26(a)

.............

677,500

3,000,000

Perficient

Inc.,

0.125%,

11/15/26

...............

2,499,300

3,176,800

Computer

Software

and

Services

—

15.8%

1,265,000

8x8

Inc.,

0.500%,

02/01/24

...............

1,252,254

875,000

Akamai

Technologies

Inc.,

1.125%,

02/15/29(a)

.............

950,687

1,750,000

Bandwidth

Inc.,

0.250%,

03/01/26

...............

1,456,963

1,350,000

CSG

Systems

International

Inc.,

3.875%,

09/15/28(a)

.............

1,362,690

1,550,000

Edgio

Inc.,

3.500%,

08/01/25

...............

1,375,245

1,992,000

i3

Verticals

LLC,

1.000%,

02/15/25

...............

1,868,745

Lumentum

Holdings

Inc.

1,250,000

0.500%,

12/15/26

...............

1,120,000

750,000

1.500%,

12/15/29(a)

.............

747,375

1,050,000

PagerDuty

Inc.,

1.500%,

10/15/28(a)

.............

1,143,240

1,000,000

PAR

Technology

Corp.,

1.500%,

10/15/27

...............

888,000

100,000

Rapid7

Inc.,

1.250%,

03/15/29(a)

.............

111,630

1,118,000

Veritone

Inc.,

1.750%,

11/15/26

...............

337,823

12,614,652

Consumer

Services

—

4.1%

1,000,000

Live

Nation

Entertainment

Inc.,

3.125%,

01/15/29(a)

.............

1,138,100

900,000

Marriott

Vacations

Worldwide

Corp.,

3.250%,

12/15/27

...............

800,550

972,000

NCL

Corp.

Ltd.,

1.125%,

02/15/27

...............

892,393

Principal

Amount

Market

Value

$

400,000

Uber

Technologies

Inc.,

Ser.

2028,

0.875%,

12/01/28(a)

.............

$

437,000

3,268,043

Energy

and

Utilities

—

15.5%

500,000

Alliant

Energy

Corp.,

3.875%,

03/15/26(a)

.............

498,750

1,308,000

Array

Technologies

Inc.,

1.000%,

12/01/28

...............

1,291,323

400,000

Bloom

Energy

Corp.,

3.000%,

06/01/28(a)

.............

428,000

1,500,000

CMS

Energy

Corp.,

3.375%,

05/01/28(a)

.............

1,491,000

750,000

Duke

Energy

Corp.,

4.125%,

04/15/26(a)

.............

753,750

500,000

Nabors

Industries

Inc.,

1.750%,

06/15/29(a)

.............

363,450

1,925,000

NextEra

Energy

Partners

LP,

2.500%,

06/15/26(a)

.............

1,734,425

775,000

Northern

Oil

and

Gas

Inc.,

3.625%,

04/15/29

...............

917,600

950,000

Ormat

Technologies

Inc.,

2.500%,

07/15/27

...............

979,450

1,345,000

PG&E

Corp.,

4.250%,

12/01/27(a)

.............

1,416,285

700,000

PPL

Capital

Funding

Inc.,

2.875%,

03/15/28(a)

.............

681,450

800,000

Stem

Inc.,

4.250%,

04/01/30(a)

.............

584,800

1,910,000

Sunnova

Energy

International

Inc.,

2.625%,

02/15/28

...............

1,273,970

12,414,253

Financial

Services

—

6.6%

400,000

Bread

Financial

Holdings

Inc.,

4.250%,

06/15/28(a)

.............

428,520

1,750,000

HCI

Group

Inc.,

4.750%,

06/01/42

...............

2,170,000

2,000,000

LendingTree

Inc.,

0.500%,

07/15/25

...............

1,670,000

1,250,000

SoFi

Technologies

Inc.,

Zero

Coupon,

10/15/26(a)

.........

1,058,125

5,326,645

Food

and

Beverage

—

3.9%

800,000

Fomento

Economico

Mexicano

SAB

de

CV,

2.625%,

02/24/26

...............

884,423

1,250,000

Post

Holdings

Inc.,

2.500%,

08/15/27

...............

1,269,375

1,000,000

The

Chefs'

Warehouse

Inc.,

2.375%,

12/15/28

...............

954,217

3,108,015

The

Gabelli

Convertible

and

Income

Securities

Fund

Inc.

Schedule

of

Investments

(Continued)

—

December

31,

2023

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

(Continued)

Health

Care

—

10.8%

$

775,000

Amphastar

Pharmaceuticals

Inc.,

2.000%,

03/15/29(a)

.............

$

943,562

750,000

Coherus

Biosciences

Inc.,

1.500%,

04/15/26

...............

425,395

1,000,000

CONMED

Corp.,

2.250%,

06/15/27

...............

1,004,400

2,000,000

Cutera

Inc.,

2.250%,

06/01/28

...............

525,000

400,000

Cytokinetics

Inc.,

3.500%,

07/01/27

...............

704,000

250,000

Dexcom

Inc.,

0.375%,

05/15/28(a)

.............

257,250

200,000

Evolent

Health

Inc.,

3.500%,

12/01/29(a)

.............

234,200

1,000,000

Exact

Sciences

Corp.,

2.000%,

03/01/30(a)

.............

1,204,500

1,500,000

Halozyme

Therapeutics

Inc.,

1.000%,

08/15/28

...............

1,397,250

100,000

Merit

Medical

Systems

Inc.,

3.000%,

02/01/29(a)

.............

111,150

1,600,000

TransMedics

Group

Inc.,

1.500%,

06/01/28(a)

.............

1,814,080

8,620,787

Real

Estate

Investment

Trusts

—

4.7%

1,000,000

Arbor

Realty

Trust

Inc.,

7.500%,

08/01/25

...............

1,019,000

900,000

Pebblebrook

Hotel

Trust,

1.750%,

12/15/26

...............

806,040

750,000

Redwood

Trust

Inc.,

7.750%,

06/15/27

...............

691,406

1,400,000

Summit

Hotel

Properties

Inc.,

1.500%,

02/15/26

...............

1,248,100

3,764,546

Security

Software

—

1.1%

1,440,000

Cardlytics

Inc.,

1.000%,

09/15/25

...............

900,000

Semiconductors

—

7.3%

800,000

Impinj

Inc.,

1.125%,

05/15/27

...............

875,040

1,100,000

indie

Semiconductor

Inc.,

4.500%,

11/15/27(a)

.............

1,327,700

600,000

ON

Semiconductor

Corp.,

0.500%,

03/01/29(a)

.............

640,500

1,800,000

Semtech

Corp.,

1.625%,

11/01/27

...............

1,547,100

Principal

Amount

Market

Value

$

2,100,000

Wolfspeed

Inc.,

1.875%,

12/01/29

...............

$

1,439,025

5,829,365

Telecommunications

—

3.2%

Infinera

Corp.

750,000

2.500%,

03/01/27

...............

688,349

250,000

3.750%,

08/01/28

...............

246,725

1,700,000

Liberty

Latin

America

Ltd.,

2.000%,

07/15/24

...............

1,640,500

2,575,574

Transportation

—

0.8%

700,000

Air

Transport

Services

Group

Inc.,

3.875%,

08/15/29(a)

.............

624,750

TOTAL

CONVERTIBLE

CORPORATE

BONDS

....................

66,255,937

Shares

MANDATORY

CONVERTIBLE

SECURITIES(b)

—

2.9%

Diversified

Industrial

—

1.0%

15,000

Chart

Industries

Inc.,

Ser.

B,

6.750%,

12/15/25

...............

833,700

Energy

and

Utilities

—

1.9%

40,000

NextEra

Energy

Inc.,

6.926%,

09/01/25

...............

1,524,800

TOTAL

MANDATORY

CONVERTIBLE

SECURITIES

................

2,358,500

COMMON

STOCKS

—

5.4%

Aerospace

—

0.1%

400

The

Boeing

Co.†

..................

104,264

Automotive:

Parts

and

Accessories

—

0.0%

2,000

Dana

Inc.

.......................

29,220

Broadcasting

—

0.1%

30,000

Grupo

Televisa

SAB,

ADR

............

100,200

Computer

Hardware

—

0.1%

400

International

Business

Machines

Corp.

..

65,420

Diversified

Industrial

—

0.6%

1,000

General

Electric

Co.

................

127,630

800

ITT

Inc.

........................

95,456

3,300

Textron

Inc.

.....................

265,386

488,472

Energy

and

Energy

Services

—

0.1%

1,200

Halliburton

Co.

...................

43,380

The

Gabelli

Convertible

and

Income

Securities

Fund

Inc.

Schedule

of

Investments

(Continued)

—

December

31,

2023

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Financial

Services

—

2.1%

1,200

American

Express

Co.

..............

$

224,808

1,000

Citigroup

Inc.

....................

51,440

500

JPMorgan

Chase

&

Co.

.............

85,050

1,200

Julius

Baer

Group

Ltd.

..............

67,273

300

Morgan

Stanley

..................

27,975

6,200

State

Street

Corp.

.................

480,252

13,000

The

Bank

of

New

York

Mellon

Corp.

....

676,650

300

The

PNC

Financial

Services

Group

Inc.

..

46,455

1,659,903

Food

and

Beverage

—

0.2%

600

Pernod

Ricard

SA

.................

105,814

600

Remy

Cointreau

SA

................

76,172

181,986

Health

Care

—

0.7%

400

Johnson

&

Johnson

...............

62,696

1,300

Merck

&

Co.

Inc.

..................

141,726

1,500

Perrigo

Co.

plc

...................

48,270

8,000

Roche

Holding

AG,

ADR

............

289,840

542,532

Real

Estate

Investment

Trusts

—

1.0%

7,205

Crown

Castle

Inc.

.................

829,944

Retail

—

0.2%

200

Costco

Wholesale

Corp.

.............

132,016

Telecommunications

—

0.2%

200

Swisscom

AG

....................

120,326

TOTAL

COMMON

STOCKS

.........

4,297,663

Principal

Amount

U.S.

GOVERNMENT

OBLIGATIONS

—

8.9%

$

7,175,000

U.S.

Treasury

Bills,

5.302%

to

5.335%††,

02/01/24

to

06/06/24

......................

7,093,268

TOTAL

INVESTMENTS

—

100.0%

....

(Cost

$84,853,286)

..............

$

80,005,368

(a)

Securities

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

may

be

resold

in

transactions

exempt

from

registration,

normally

to

qualified

institutional

buyers.

(b)

Mandatory

convertible

securities

are

required

to

be

converted

on

the

dates

listed;

they

generally

may

be

converted

prior

to

these

dates

at

the

option

of

the

holder.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

ADR

American

Depositary

Receipt

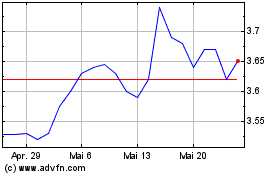

Gabelli Converitble and ... (NYSE:GCV)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Gabelli Converitble and ... (NYSE:GCV)

Historical Stock Chart

Von Mai 2023 bis Mai 2024