Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 November 2024 - 3:44PM

Edgar (US Regulatory)

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

—

99.1%

Financial

Services

—

13.5%

24,500

Aegon

Ltd.

......................

$

157,306

250

Affiliated

Managers

Group

Inc.

........

44,450

7,295

Ally

Financial

Inc.

.................

259,629

228,500

American

Express

Co.

..............

61,969,200

11,000

Apollo

Global

Management

Inc.

.......

1,374,010

4,950

Axis

Capital

Holdings

Ltd.

...........

394,069

12,000

Banco

Bilbao

Vizcaya

Argentaria

SA

....

129,678

75,000

Banco

Santander

SA,

ADR

...........

382,500

60,000

Bank

of

America

Corp.

..............

2,380,800

58,000

Barclays

plc

.....................

174,123

92

Berkshire

Hathaway

Inc.,

Cl. A†

.......

63,588,560

3,250

Berkshire

Hathaway

Inc.,

Cl. B†

.......

1,495,845

41,500

Blackstone

Inc.

...................

6,354,895

130,000

Blue

Owl

Capital

Inc.

...............

2,516,800

2,270

Capital

One

Financial

Corp.

...........

339,887

30,000

Cipher

Mining

Inc.†

................

116,100

97,920

Citigroup

Inc.

....................

6,129,792

27,500

Commerzbank

AG

.................

505,857

24,245

Credit

Agricole

SA

.................

370,415

5,000

Cullen/Frost

Bankers

Inc.

............

559,300

192,400

Dah

Sing

Banking

Group

Ltd.

.........

172,505

128,800

Dah

Sing

Financial

Holdings

Ltd.

......

410,067

35,200

Daiwa

Securities

Group

Inc.

..........

246,137

30,000

Deutsche

Bank

AG

................

519,300

1,586

Diamond

Hill

Investment

Group

Inc.

....

256,313

67,560

DigitalBridge

Group

Inc.

............

954,623

518

E-L

Financial

Corp.

Ltd.

.............

484,506

3,000

EXOR

NV

.......................

321,088

481

Farmers

&

Merchants

Bank

of

Long

Beach

2,573,350

5,000

Federated

Hermes

Inc.

..............

183,850

5,601

First

American

Financial

Corp.

........

369,722

217

First

Citizens

BancShares

Inc.,

Cl. A

....

399,486

23,526

Flushing

Financial

Corp.

.............

343,009

1,150,000

GAM

Holding

AG†

.................

264,146

5,000

ING

Groep

NV

....................

90,577

42,700

Interactive

Brokers

Group

Inc.,

Cl. A

....

5,950,672

7,000

Intercontinental

Exchange

Inc.

........

1,124,480

62,500

Janus

Henderson

Group

plc

..........

2,379,375

12,800

Japan

Post

Bank

Co.

Ltd.

............

119,161

81,300

Jefferies

Financial

Group

Inc.

.........

5,004,015

34,150

JPMorgan

Chase

&

Co.

.............

7,200,869

6,000

Julius

Baer

Group

Ltd.

..............

360,844

900,000

Just

Group

plc

...................

1,674,931

28,000

Kinnevik

AB,

Cl. A

.................

228,530

4,190

KKR

&

Co.

Inc.

...................

547,130

14,000

Loews

Corp.

.....................

1,106,700

1,000

LPL

Financial

Holdings

Inc.

..........

232,630

50,000

Marsh

&

McLennan

Companies

Inc.

....

11,154,500

3,200

Moelis

&

Co.,

Cl. A

................

219,232

9,640

Moody's

Corp.

...................

4,575,048

Shares

Market

Value

29,500

Morgan

Stanley

..................

$

3,075,080

45,535

NatWest

Group

plc

................

209,360

9,096

NN

Group

NV

....................

453,407

32,000

Polar

Capital

Holdings

plc

...........

229,314

13,077

Prosus

NV

......................

571,495

47,500

S&P

Global

Inc.

..................

24,539,450

10,900

Shinhan

Financial

Group

Co.

Ltd.,

ADR

..

461,833

1,100

Silvercrest

Asset

Management

Group

Inc.,

Cl. A

.........................

18,964

1,523

Southern

First

Bancshares

Inc.†

.......

51,904

15,987

Standard

Chartered

plc

.............

169,494

101,650

State

Street

Corp.

.................

8,992,975

5,000

StoneCo

Ltd.,

Cl. A†

...............

56,300

72,700

T.

Rowe

Price

Group

Inc.

............

7,919,211

750

Texas

Capital

Bancshares

Inc.†

........

53,595

139,300

The

Bank

of

New

York

Mellon

Corp.

....

10,010,098

10,000

The

Charles

Schwab

Corp.

...........

648,100

6,300

The

Goldman

Sachs

Group

Inc.

.......

3,119,193

10,000

The

PNC

Financial

Services

Group

Inc.

..

1,848,500

37,500

The

Westaim

Corp.†

...............

110,355

17,000

Truist

Financial

Corp.

...............

727,090

13,000

TrustCo

Bank

Corp.

NY

.............

429,910

3,100

UniCredit

SpA

....................

135,839

37,500

W.

R.

Berkley

Corp.

................

2,127,375

1,900

Webster

Financial

Corp.

.............

88,559

186,300

Wells

Fargo

&

Co.

.................

10,524,087

25,348

Westwood

Holdings

Group

Inc.

.......

359,942

275,641,442

Food

and

Beverage

—

9.3%

3,000

Ajinomoto

Co.

Inc.

................

115,763

2,100

Anheuser-Busch

InBev

SA/NV

........

138,808

147,500

BellRing

Brands

Inc.†

..............

8,956,200

91,300

Brown-Forman

Corp.,

Cl. A

..........

4,389,704

153,500

Campbell

Soup

Co.

................

7,509,220

130,000

ChromaDex

Corp.†

................

474,500

15,000

Coca-Cola

Europacific

Partners

plc

.....

1,181,250

18,700

Constellation

Brands

Inc.,

Cl. A

........

4,818,803

25,000

Crimson

Wine

Group

Ltd.†

...........

157,750

173,000

Danone

SA

......................

12,582,847

800,000

Davide

Campari-Milano

NV

..........

6,767,952

4,250

Diageo

plc

......................

147,904

140,000

Diageo

plc,

ADR

..................

19,647,600

96,083

Farmer

Brothers

Co.†

..............

190,244

90,000

Flowers

Foods

Inc.

................

2,076,300

85,500

Fomento

Economico

Mexicano

SAB

de

CV,

ADR

.........................

8,439,705

12,000

General

Mills

Inc.

.................

886,200

1,818,400

Grupo

Bimbo

SAB

de

CV,

Cl. A

........

6,253,117

3,500

Heineken

Holding

NV

...............

264,151

42,550

Heineken

NV

....................

3,772,111

4,000

Ingredion

Inc.

....................

549,720

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Food

and

Beverage

(Continued)

97,200

ITO

EN

Ltd.

.....................

$

2,308,183

55,700

Kerry

Group

plc,

Cl. A

..............

5,487,217

2,000

Kerry

Group

plc,

Cl. A

..............

207,380

8,000

Keurig

Dr

Pepper

Inc.

..............

299,840

1,100

Laurent-Perrier

...................

131,018

9,550

LVMH

Moet

Hennessy

Louis

Vuitton

SE

..

7,319,156

40,000

Maple

Leaf

Foods

Inc.

..............

655,107

35,000

Molson

Coors

Beverage

Co.,

Cl. B

......

2,013,200

194,000

Mondelēz

International

Inc.,

Cl. A

......

14,291,980

28,000

Morinaga

Milk

Industry

Co.

Ltd.

.......

684,390

20,000

Nestlé

SA

.......................

2,007,680

13,000

Nomad

Foods

Ltd.

................

247,780

104,500

PepsiCo

Inc.

.....................

17,770,225

38,000

Pernod

Ricard

SA

.................

5,735,839

39,000

Post

Holdings

Inc.†

................

4,514,250

40,000

Remy

Cointreau

SA

................

3,110,141

6,000

The

Boston

Beer

Co.

Inc.,

Cl. A†

.......

1,734,840

70,000

The

Coca-Cola

Co.

................

5,030,200

15,000

The

Hain

Celestial

Group

Inc.†

........

129,450

2,000

The

Hershey

Co.

..................

383,560

23,000

The

J.M.

Smucker

Co.

..............

2,785,300

147,000

The

Kraft

Heinz

Co.

................

5,161,170

10,000

The

Simply

Good

Foods

Co.†

.........

347,700

43,000

Tootsie

Roll

Industries

Inc.

...........

1,331,710

8,000

TreeHouse

Foods

Inc.†

.............

335,840

40,000

Tyson

Foods

Inc.,

Cl. A

.............

2,382,400

646,000

Yakult

Honsha

Co.

Ltd.

.............

14,917,892

190,643,297

Equipment

and

Supplies

—

7.9%

318,200

AMETEK

Inc.

....................

54,638,122

28,000

Amphenol

Corp.,

Cl. A

..............

1,824,480

10,000

Ardagh

Group

SA†

................

48,150

48,000

Ardagh

Metal

Packaging

SA

..........

180,960

1,500

Crown

Holdings

Inc.

...............

143,820

500

Danaher

Corp.

...................

139,010

283,000

Donaldson

Co.

Inc.

................

20,857,100

22,000

DS

Smith

plc

....................

135,829

3,000

Federal

Signal

Corp.

...............

280,380

173,300

Flowserve

Corp.

..................

8,957,877

36,000

Franklin

Electric

Co.

Inc.

............

3,773,520

8,500

Hubbell

Inc.

.....................

3,640,975

112,400

IDEX

Corp.

......................

24,109,800

20,000

Ilika

plc†

.......................

6,417

15,525

Kimball

Electronics

Inc.†

............

287,368

172,000

Mueller

Industries

Inc.

..............

12,745,200

61,000

Mueller

Water

Products

Inc.,

Cl. A

.....

1,323,700

8,000

Sealed

Air

Corp.

..................

290,400

20,000

Tenaris

SA,

ADR

..................

635,800

80,000

The

Timken

Co.

...................

6,743,200

Shares

Market

Value

59,000

The

Weir

Group

plc

................

$

1,708,542

92,500

Watts

Water

Technologies

Inc.,

Cl. A

....

19,165,075

161,635,725

Diversified

Industrial

—

6.5%

1,000

Agilent

Technologies

Inc.

............

148,480

412,000

Ampco-Pittsburgh

Corp.†

...........

824,000

41,500

AZZ

Inc.

........................

3,428,315

13,000

Barnes

Group

Inc.

.................

525,330

156,300

Crane

Co.

.......................

24,739,164

20,000

Crane

NXT

Co.

...................

1,122,000

910

Eaton

Corp.

plc

...................

301,610

4,999

Esab

Corp.

......................

531,444

37,400

General

Electric

Co.

................

7,052,892

120,700

Greif

Inc.,

Cl. A

...................

7,563,062

12,000

Greif

Inc.,

Cl. B

...................

837,960

19,100

Griffon

Corp.

....................

1,337,000

113,700

Honeywell

International

Inc.

..........

23,502,927

29,000

Ingersoll

Rand

Inc.

................

2,846,640

85,500

ITT

Inc.

........................

12,783,105

35,000

Kennametal

Inc.

..................

907,550

50,000

Myers

Industries

Inc.

..............

691,000

23,000

nVent

Electric

plc

.................

1,615,980

101,000

Park-Ohio

Holdings

Corp.

...........

3,100,700

9,454

Proto

Labs

Inc.†

..................

277,664

600

Rheinmetall

AG

...................

324,862

500

Roper

Technologies

Inc.

............

278,220

900

Siemens

AG

.....................

181,673

390,000

Steel

Partners

Holdings

LP†

..........

15,970,500

5,307

Stratasys

Ltd.†

...................

44,101

10,500

Sulzer

AG

.......................

1,717,020

74,000

Textron

Inc.

.....................

6,554,920

2,500

The

Eastern

Co.

..................

81,125

100,000

Toray

Industries

Inc.

...............

586,676

21,000

Trane

Technologies

plc

.............

8,163,330

75,000

Tredegar

Corp.†

..................

546,750

86,500

Trinity

Industries

Inc.

...............

3,013,660

4,000

Valmont

Industries

Inc.

.............

1,159,800

132,759,460

Automotive:

Parts

and

Accessories

—

4.8%

4,500

Aptiv

plc†

......................

324,045

2,500

Atmus

Filtration

Technologies

Inc.

.....

93,825

88,600

BorgWarner

Inc.

..................

3,215,294

368,400

Dana

Inc.

.......................

3,890,304

350,000

Dowlais

Group

plc

.................

273,039

2,500

Ducommun

Inc.†

.................

164,575

210,000

Garrett

Motion

Inc.†

...............

1,717,800

184,500

Genuine

Parts

Co.

.................

25,770,960

140,000

Modine

Manufacturing

Co.†

..........

18,590,600

33,150

O'Reilly

Automotive

Inc.†

............

38,175,540

10,000

Phinia

Inc.

......................

460,300

105,000

Standard

Motor

Products

Inc.

........

3,486,000

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Automotive:

Parts

and

Accessories

(Continued)

26,400

Strattec

Security

Corp.†

.............

$

1,126,224

100,000

Superior

Industries

International

Inc.†

...

304,000

97,592,506

Health

Care

—

4.5%

1,000

AbbVie

Inc.

.....................

197,480

14,000

Alcon

Inc.

......................

1,400,980

24,500

Amgen

Inc.

.....................

7,894,145

1,000

Avantor

Inc.†

....................

25,870

3,000

Axogen

Inc.†

....................

42,060

12,000

Bausch

+

Lomb

Corp.†

.............

231,480

15,000

Baxter

International

Inc.

.............

569,550

1,000

Becton

Dickinson

&

Co.

.............

241,100

7,000

Biogen

Inc.†

.....................

1,356,880

10,000

BioMarin

Pharmaceutical

Inc.†

........

702,900

2,500

Bio-Rad

Laboratories

Inc.,

Cl. A†

......

836,450

68,600

Boston

Scientific

Corp.†

............

5,748,680

88,700

Bristol-Myers

Squibb

Co.

............

4,589,338

6,200

Cencora

Inc.

.....................

1,395,496

400

Charles

River

Laboratories

International

Inc.†

........................

78,788

1,300

Chemed

Corp.

...................

781,261

1,500

Cutera

Inc.†

.....................

1,183

6,000

CVS

Group

plc

...................

90,806

240,000

Demant

A/S†

....................

9,375,574

100

Elevance

Health

Inc.

...............

52,000

820

Eli

Lilly

&

Co.

....................

726,471

80

Embecta

Corp.

...................

1,128

2,000

Enovis

Corp.†

....................

86,100

7,000

Evolent

Health

Inc.,

Cl. A†

...........

197,960

11,990

Exact

Sciences

Corp.†

..............

816,759

400

Fortrea

Holdings

Inc.†

..............

8,000

3,100

Fresenius

SE

&

Co.

KGaA†

...........

118,120

1,390

Gerresheimer

AG

.................

123,782

2,000

Gilead

Sciences

Inc.

...............

167,680

3,000

Glaukos

Corp.†

...................

390,840

33

GRAIL

Inc.†

.....................

454

25,000

Haleon

plc

......................

131,322

300

HCA

Healthcare

Inc.

...............

121,929

60,000

Henry

Schein

Inc.†

................

4,374,000

1,400

Hologic

Inc.†

....................

114,044

200

Illumina

Inc.†

....................

26,082

6,217

Incyte

Corp.†

....................

410,944

9,360

Indivior

plc†

.....................

92,165

555

Intuitive

Surgical

Inc.†

..............

272,655

200

iRhythm

Technologies

Inc.†

..........

14,848

24,100

Johnson

&

Johnson

...............

3,905,646

400

Labcorp

Holdings

Inc.

..............

89,392

78,500

Merck

&

Co.

Inc.

..................

8,914,460

200

Moderna

Inc.†

...................

13,366

Shares

Market

Value

1,000

Neogen

Corp.†

...................

$

16,810

4,000

NeoGenomics

Inc.†

................

59,000

72,500

Novartis

AG,

ADR

.................

8,338,950

62,500

Option

Care

Health

Inc.†

............

1,956,250

5,000

OraSure

Technologies

Inc.†

..........

21,350

130

Organon

&

Co.

...................

2,487

34,000

Perrigo

Co.

plc

...................

891,820

111,500

Pfizer

Inc.

......................

3,226,810

1,455

QIAGEN

NV

.....................

66,304

500

Quest

Diagnostics

Inc.

..............

77,625

7,900

QuidelOrtho

Corp.†

................

360,240

300

Repligen

Corp.†

..................

44,646

800

Roche

Holding

AG,

Genusschein

.......

255,781

15,500

Sandoz

Group

AG,

ADR

.............

644,877

2,100

Sanofi

SA

.......................

240,541

1,000

Siemens

Healthineers

AG

............

59,954

8,250

Smith

&

Nephew

plc

...............

127,725

490

Stryker

Corp.

....................

177,017

3,000

Teva

Pharmaceutical

Industries

Ltd.,

ADR†

54,060

2,700

The

Cigna

Group

..................

935,388

15,700

Tristel

plc

.......................

83,121

21,800

UnitedHealth

Group

Inc.

............

12,746,024

11,996

Valeritas

Holdings

Inc.†(a)

...........

0

300

Vertex

Pharmaceuticals

Inc.†

.........

139,524

4,000

Waters

Corp.†

...................

1,439,560

16,600

Zimmer

Biomet

Holdings

Inc.

.........

1,791,970

20,060

Zimvie

Inc.†

.....................

318,352

6,300

Zoetis

Inc.

......................

1,230,894

608

Zosano

Pharma

Corp.†(a)

...........

0

92,037,248

Entertainment

—

4.5%

118,000

Atlanta

Braves

Holdings

Inc.,

Cl. A†

....

4,973,700

228,662

Atlanta

Braves

Holdings

Inc.,

Cl. C†

....

9,100,748

10,000

Charter

Communications

Inc.,

Cl. A†

....

3,240,800

90,000

Genting

Singapore

Ltd.

.............

61,272

1,600,000

Grupo

Televisa

SAB,

ADR

............

4,096,000

71,000

International

Game

Technology

plc

.....

1,512,300

14,573

Liberty

Media

Corp.-Liberty

Live,

Cl. A†

..

721,509

46,927

Liberty

Media

Corp.-Liberty

Live,

Cl. C†

..

2,408,763

15,000

Lions

Gate

Entertainment

Corp.,

Cl. B†

..

103,800

118,974

Madison

Square

Garden

Entertainment

Corp.†

.......................

5,059,964

99,717

Madison

Square

Garden

Sports

Corp.†

..

20,767,062

2,000

Netflix

Inc.†

.....................

1,418,540

390,500

Ollamani

SAB†

...................

736,972

356,000

Paramount

Global,

Cl. A

.............

7,782,160

4,500

Paramount

Global,

Cl. B

.............

47,790

160,974

Sphere

Entertainment

Co.†

..........

7,111,831

11,000

Take-Two

Interactive

Software

Inc.†

....

1,690,810

40,000

TBS

Holdings

Inc.

.................

1,084,571

73,400

The

Walt

Disney

Co.

...............

7,060,346

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Entertainment

(Continued)

8,500

TKO

Group

Holdings

Inc.†

...........

$

1,051,535

60,000

Universal

Entertainment

Corp.

........

584,450

607,000

Vivendi

SE

......................

7,013,580

370,750

Warner

Bros

Discovery

Inc.†

.........

3,058,688

90,687,191

Energy

and

Utilities

—

4.3%

54,062

APA

Corp.

......................

1,322,357

14,000

Avangrid

Inc.

....................

501,060

46,000

Baker

Hughes

Co.

.................

1,662,900

21,000

BP

plc,

ADR

.....................

659,190

16,000

CMS

Energy

Corp.

................

1,130,080

155,600

ConocoPhillips

...................

16,381,568

98,400

Enbridge

Inc.

....................

3,996,024

81,000

Energy

Transfer

LP

................

1,300,050

68,500

Enterprise

Products

Partners

LP

.......

1,994,035

1,500

Eos

Energy

Enterprises

Inc.†

.........

4,455

23,000

Essential

Utilities

Inc.

..............

887,110

40,000

Evergy

Inc.

......................

2,480,400

20,000

Eversource

Energy

................

1,361,000

40,700

Exxon

Mobil

Corp.

................

4,770,854

4,550

GE

Vernova

Inc.†

.................

1,160,159

237,000

Halliburton

Co.

...................

6,884,850

26,000

Innovex

International

Inc.†

...........

381,680

25,000

Kinder

Morgan

Inc.

................

552,250

4,000

Marathon

Oil

Corp.

................

106,520

7,200

Marathon

Petroleum

Corp.

...........

1,172,952

122,500

National

Fuel

Gas

Co.

..............

7,424,725

25,000

New

Fortress

Energy

Inc.

............

227,250

91,000

NextEra

Energy

Inc.

................

7,692,230

93,900

NextEra

Energy

Partners

LP

..........

2,593,518

4,000

Niko

Resources

Ltd.†

..............

0

2,779

Noble

Corp.

plc

...................

100,440

10,000

NOV

Inc.

.......................

159,700

40,000

Occidental

Petroleum

Corp.

..........

2,061,600

70,000

Oceaneering

International

Inc.†

.......

1,740,900

20,000

PG&E

Corp.

.....................

395,400

17,000

Phillips

66

......................

2,234,650

35,000

Portland

General

Electric

Co.

.........

1,676,500

70,000

RPC

Inc.

.......................

445,200

134,500

Schlumberger

NV

.................

5,642,275

2,450

Severn

Trent

plc

..................

86,539

17,000

Southwest

Gas

Holdings

Inc.

.........

1,253,920

106,000

The

AES

Corp.

...................

2,126,360

37,500

TXNM

Energy

Inc.

.................

1,641,375

61,000

UGI

Corp.

.......................

1,526,220

24,850

Vitesse

Energy

Inc.

................

596,897

3,300

Weatherford

International

plc

.........

280,236

88,615,429

Shares

Market

Value

Business

Services

—

3.9%

8,000

Allegion

plc

.....................

$

1,165,920

600,000

Clear

Channel

Outdoor

Holdings

Inc.†

...

960,000

2,500

Edenred

SE

.....................

94,673

16,000

Jardine

Matheson

Holdings

Ltd.

.......

624,960

11,000

Lamar

Advertising

Co.,

Cl. A,

REIT

.....

1,469,600

110,530

Mastercard

Inc.,

Cl. A

..............

54,579,714

105,000

Paysafe

Ltd.†

....................

2,355,150

10,000

Pitney

Bowes

Inc.

.................

71,300

135,000

Resideo

Technologies

Inc.†

..........

2,718,900

133,000

Steel

Connect

Inc.†

................

1,403,150

20,000

The

Brink's

Co.

...................

2,312,800

126,000

The

Interpublic

Group

of

Companies

Inc.

.

3,985,380

29,000

UL

Solutions

Inc.,

Cl. A

.............

1,429,700

60,000

Vestis

Corp.

.....................

894,000

13,500

Visa

Inc.,

Cl. A

...................

3,711,825

17,000

Willdan

Group

Inc.†

...............

696,150

78,473,222

Machinery

—

3.6%

25,000

Astec

Industries

Inc.

...............

798,500

12,800

Caterpillar

Inc.

...................

5,006,336

411,000

CNH

Industrial

NV

.................

4,562,100

107,900

Deere

&

Co.

.....................

45,029,907

24,942

Intevac

Inc.†

....................

84,803

6,688

Regal

Rexnord

Corp.

...............

1,109,405

131,500

Xylem

Inc.

......................

17,756,445

74,347,496

Retail

—

3.2%

135,000

Arko

Corp.

......................

947,700

44,000

AutoNation

Inc.†

..................

7,872,480

45,000

BBB

Foods

Inc.,

Cl. A†

..............

1,350,000

3,500

Beacon

Roofing

Supply

Inc.†

.........

302,505

7,500

Casey's

General

Stores

Inc.

..........

2,817,825

3,500

Chipotle

Mexican

Grill

Inc.†

..........

201,670

10,000

Copart

Inc.†

.....................

524,000

30,240

Costco

Wholesale

Corp.

.............

26,808,365

73,900

CVS

Health

Corp.

.................

4,646,832

14,000

Lowe's

Companies

Inc.

.............

3,791,900

110,000

Macy's

Inc.

.....................

1,725,900

77,720

PetIQ

Inc.†

......................

2,391,444

10,000

Pets

at

Home

Group

plc

.............

40,830

19,000

Qurate

Retail

Inc.,

Cl. A†

............

11,592

35,000

Sally

Beauty

Holdings

Inc.†

..........

474,950

7,250

Shake

Shack

Inc.,

Cl. A†

............

748,273

113,000

The

Wendy's

Co.

..................

1,979,760

50,000

Walgreens

Boots

Alliance

Inc.

........

448,000

90,000

Walmart

Inc.

....................

7,267,500

64,351,526

Environmental

Services

—

3.0%

30,000

Pentair

plc

......................

2,933,700

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Environmental

Services

(Continued)

194,200

Republic

Services

Inc.

..............

$

39,003,128

15,620

Veolia

Environnement

SA

............

513,276

166

Veralto

Corp.

....................

18,569

83,000

Waste

Management

Inc.

............

17,230,800

29,000

Zurn

Elkay

Water

Solutions

Corp.

......

1,042,260

60,741,733

Consumer

Products

—

2.8%

34,180

American

Outdoor

Brands

Inc.†

.......

315,140

12,500

Christian

Dior

SE

.................

9,023,472

27,000

Church

&

Dwight

Co.

Inc.

...........

2,827,440

171,000

Edgewell

Personal

Care

Co.

..........

6,214,140

68,000

Energizer

Holdings

Inc.

.............

2,159,680

35,500

Essity

AB,

Cl. B

...................

1,107,731

2,000

Givaudan

SA

....................

10,964,731

54,000

Hanesbrands

Inc.†

................

396,900

23,800

Harley-Davidson

Inc.

...............

917,014

1,170

Hermes

International

SCA

...........

2,873,062

556

HNI

Corp.

.......................

29,935

4,000

Johnson

Outdoors

Inc.,

Cl. A

.........

144,800

25,000

Mattel

Inc.†

.....................

476,250

13,000

National

Presto

Industries

Inc.

........

976,820

12,000

Oil-Dri

Corp.

of

America

.............

827,880

50,000

Philip

Morris

International

Inc.

........

6,070,000

49,500

Reckitt

Benckiser

Group

plc

..........

3,029,014

84,000

Spectrum

Brands

Holdings

Inc.

.......

7,991,760

27,600

Svenska

Cellulosa

AB

SCA,

Cl. B

.......

402,076

2,000

The

Estee

Lauder

Companies

Inc.,

Cl. A

..

199,380

4,280

Unilever

plc

.....................

276,895

5,000

Vista

Outdoor

Inc.†

................

195,900

4,200

Zalando

SE†

.....................

138,480

57,558,500

Electronics

—

2.8%

30,000

Arlo

Technologies

Inc.†

.............

363,300

20,500

Bel

Fuse

Inc.,

Cl. A

................

2,038,315

3,064

Bel

Fuse

Inc.,

Cl. B

................

240,554

2,000

CTS

Corp.

......................

96,760

15,000

Flex

Ltd.†

.......................

501,450

20,000

Hitachi

Ltd.,

ADR

.................

1,060,000

51,500

Intel

Corp.

......................

1,208,190

35,161

Koninklijke

Philips

NV†

.............

1,150,468

1,300

Mettler-Toledo

International

Inc.†

......

1,949,610

230,000

Mirion

Technologies

Inc.†

...........

2,546,100

375,000

Plug

Power

Inc.†

.................

847,500

28,249

Sony

Group

Corp.,

ADR

.............

2,728,006

34,200

TE

Connectivity

plc

................

5,163,858

173,500

Texas

Instruments

Inc.

.............

35,839,895

300

Thermo

Fisher

Scientific

Inc.

.........

185,571

Shares

Market

Value

1,000

Universal

Display

Corp.

.............

$

209,900

56,129,477

Consumer

Services

—

2.7%

11,850

Amazon.com

Inc.†

................

2,208,010

32,000

API

Group

Corp.†

.................

1,056,640

393,500

Bollore

SE

......................

2,621,577

2,000

Deutsche

Post

AG

.................

89,119

1,000

eBay

Inc.

.......................

65,110

35,000

IAC

Inc.†

.......................

1,883,700

58,900

Matthews

International

Corp.,

Cl. A

.....

1,366,480

913,500

Rollins

Inc.

......................

46,204,830

3,200

Travel

+

Leisure

Co.

................

147,456

1,920

Uber

Technologies

Inc.†

............

144,307

55,787,229

Aerospace

and

Defense

—

2.7%

1,000

Airbus

SE

.......................

146,068

1,000

Embraer

SA,

ADR†

................

35,370

23,000

FTAI

Aviation

Ltd.

.................

3,056,700

5,000

Hexcel

Corp.

.....................

309,150

14,000

Howmet

Aerospace

Inc.

.............

1,403,500

500

IQVIA

Holdings

Inc.†

...............

118,485

12,000

Kratos

Defense

&

Security

Solutions

Inc.†

279,600

3,000

L3Harris

Technologies

Inc.

...........

713,610

17,300

Northrop

Grumman

Corp.

...........

9,135,611

3,915,666

Rolls-Royce

Holdings

plc†

...........

27,599,182

15,000

RTX

Corp.

......................

1,817,400

1,100

Thales

SA

......................

174,547

53,600

The

Boeing

Co.†

..................

8,149,344

107,500

Triumph

Group

Inc.†

...............

1,385,675

54,324,242

Building

and

Construction

—

2.0%

3,000

AAON

Inc.

......................

323,520

27,560

Arcosa

Inc.

......................

2,611,585

5,500

Ashtead

Group

plc

................

425,458

18,000

Assa

Abloy

AB,

Cl. B

...............

605,444

44,500

Canfor

Corp.†

....................

560,342

3,000

Carrier

Global

Corp.

...............

241,470

3,000

Cie

de

Saint-Gobain

SA

.............

272,900

39,000

Fortune

Brands

Innovations

Inc.

.......

3,491,670

36,000

Gencor

Industries

Inc.†

.............

750,960

3,000

H&E

Equipment

Services

Inc.

.........

146,040

49,294

Herc

Holdings

Inc.

................

7,858,942

35,200

Ibstock

plc

......................

87,533

198,000

Johnson

Controls

International

plc

.....

15,366,780

6,000

KBR

Inc.

.......................

390,780

31,000

Knife

River

Corp.†

.................

2,771,090

700

Lennar

Corp.,

Cl. B

................

121,058

25,000

Masterbrand

Inc.†

.................

463,500

12,000

Sika

AG

........................

3,971,407

2,000

Toll

Brothers

Inc.

.................

308,980

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Building

and

Construction

(Continued)

3,000

Vulcan

Materials

Co.

...............

$

751,290

41,520,749

Aviation:

Parts

and

Services

—

1.8%

40,000

Astronics

Corp.†

..................

779,200

103,000

Curtiss-Wright

Corp.

...............

33,855,070

4,000

John

Bean

Technologies

Corp.

........

394,040

59,000

Spirit

AeroSystems

Holdings

Inc.,

Cl. A†

.

1,918,090

36,946,400

Telecommunications

—

1.8%

100,000

America

Movil

SAB

de

CV,

ADR

.......

1,636,000

8,200

AT&T

Inc.

.......................

180,400

55,000

BCE

Inc.

........................

1,914,000

765,000

BT

Group

plc,

Cl. A

................

1,512,672

7,040,836

Cable

&

Wireless

Jamaica

Ltd.†(a)

.....

51,942

6,000

Cisco

Systems

Inc.

................

319,320

8,000

Deutsche

Telekom

AG

..............

235,008

125,000

Deutsche

Telekom

AG,

ADR

..........

3,678,750

51,000

GCI

Liberty

Inc.,

Escrow†(a)

.........

1

36,000

Hellenic

Telecommunications

Organization

SA

..........................

620,737

15,000

Hellenic

Telecommunications

Organization

SA,

ADR

......................

128,775

264,732

Koninklijke

KPN

NV

................

1,081,205

130,045

Liberty

Global

Ltd.,

Cl. A†

...........

2,745,250

326,064

Liberty

Global

Ltd.,

Cl. C†

...........

7,046,243

1,100,000

NII

Holdings

Inc.,

Escrow†

...........

385,000

80

Oi

SA,

ADR†

.....................

321

21,000

Telecom

Argentina

SA,

ADR†

.........

158,340

400,000

Telecom

Italia

SpA†

................

111,092

70,000

Telefonica

Brasil

SA,

ADR

...........

718,900

295,000

Telefonica

SA,

ADR

................

1,433,700

301,000

Telephone

and

Data

Systems

Inc.

......

6,998,250

50,000

TELUS

Corp.

....................

838,848

46,075

TIM

SA,

ADR

....................

793,411

3,040

VEON

Ltd.,

ADR†

.................

92,477

56,000

Verizon

Communications

Inc.

.........

2,514,960

174,000

Vodafone

Group

plc

...............

174,565

98,000

Vodafone

Group

plc,

ADR

...........

981,960

36,352,127

Hotels

and

Gaming

—

1.7%

14,500

Accor

SA

.......................

629,486

124,500

Bally's

Corp.†

....................

2,147,625

14,000

Better

Collective

A/S†

..............

310,855

63,500

Caesars

Entertainment

Inc.†

..........

2,650,490

162,500

Entain

plc

.......................

1,658,086

4,000

Flutter

Entertainment

plc†

...........

939,876

13,000

Gambling.com

Group

Ltd.†

..........

130,260

1,000

GAN

Ltd.†

......................

1,770

Shares

Market

Value

41,000

Genius

Sports

Ltd.†

...............

$

321,440

6,500

Hyatt

Hotels

Corp.,

Cl. A

............

989,300

30,000

Inspired

Entertainment

Inc.†

.........

278,100

5,000

Las

Vegas

Sands

Corp.

.............

251,700

4,038,500

Mandarin

Oriental

International

Ltd.

....

6,865,450

5,500

Marriott

International

Inc.,

Cl. A

.......

1,367,300

70,000

MGM

China

Holdings

Ltd.

...........

111,657

80,000

MGM

Resorts

International†

.........

3,127,200

14,000

Penn

Entertainment

Inc.†

............

264,040

103,700

Ryman

Hospitality

Properties

Inc.,

REIT

.

11,120,788

80,000

Super

Group

SGHC

Ltd.

.............

290,400

200,000

The

Hongkong

&

Shanghai

Hotels

Ltd.

..

147,417

4,000

Wyndham

Hotels

&

Resorts

Inc.

.......

312,560

8,400

Wynn

Resorts

Ltd.

................

805,392

34,721,192

Computer

Software

and

Services

—

1.7%

20,000

3D

Systems

Corp.†

................

56,800

1,000

Akamai

Technologies

Inc.†

...........

100,950

20,000

Alphabet

Inc.,

Cl. A

................

3,317,000

28,280

Alphabet

Inc.,

Cl. C

................

4,728,133

1,500

Backblaze

Inc.,

Cl. A†

..............

9,585

1,600

Check

Point

Software

Technologies

Ltd.†

.

308,496

300

Cloudflare

Inc.,

Cl. A†

..............

24,267

470

CrowdStrike

Holdings

Inc.,

Cl. A†

......

131,821

4,866

Edgio

Inc.†

......................

487

8,000

Fiserv

Inc.†

.....................

1,437,200

2,000

Fortinet

Inc.†

....................

155,100

100,000

Hewlett

Packard

Enterprise

Co.

........

2,046,000

41,000

I3

Verticals

Inc.,

Cl. A†

.............

873,710

270

Intuit

Inc.

.......................

167,670

18,659

Kyndryl

Holdings

Inc.†

.............

428,784

12,900

Meta

Platforms

Inc.,

Cl. A

...........

7,384,476

4,000

Micron

Technology

Inc.

.............

414,840

4,670

Microsoft

Corp.

..................

2,009,501

12,000

MKS

Instruments

Inc.

..............

1,304,520

25,000

Movella

Holdings

Inc.†

.............

400

73,400

N-able

Inc.†

.....................

958,604

6,700

NVIDIA

Corp.

....................

813,648

145,000

Oxford

Metrics

plc

................

116,315

30,000

PAR

Technology

Corp.†

.............

1,562,400

4,700

PSI

Software

SE†

.................

116,669

18,100

Rockwell

Automation

Inc.

...........

4,859,126

550

Salesforce

Inc.

...................

150,540

251

ServiceNow

Inc.†

.................

224,492

21,000

SolarWinds

Corp.

.................

274,050

2,600

Temenos

AG

.....................

181,863

4,500

Unity

Software

Inc.†

...............

101,790

400

Veeva

Systems

Inc.,

Cl. A†

...........

83,948

20,800

Vimeo

Inc.†

.....................

105,040

34,448,225

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Broadcasting

—

1.4%

2,000

Cogeco

Inc.

.....................

$

88,462

20,000

Corus

Entertainment

Inc.,

OTC,

Cl. B†

....................

2,454

90,000

Fox

Corp.,

Cl. A

...................

3,809,700

94,000

Fox

Corp.,

Cl. B

...................

3,647,200

16,000

Gray

Television

Inc.

................

85,760

16,750

Liberty

Broadband

Corp.,

Cl. A†

.......

1,286,735

56,000

Liberty

Broadband

Corp.,

Cl. C†

.......

4,328,240

36,250

Liberty

Media

Corp.-Liberty

Formula

One,

Cl. A†

........................

2,592,963

36,250

Liberty

Media

Corp.-Liberty

Formula

One,

Cl. C†

........................

2,806,837

17,500

Nexstar

Media

Group

Inc.

...........

2,893,625

100,000

Sinclair

Inc.

.....................

1,530,000

162,475

Sirius

XM

Holdings

Inc.

.............

3,842,523

159,000

TEGNA

Inc.

.....................

2,509,020

60,000

Television

Broadcasts

Ltd.†

..........

26,936

29,450,455

Cable

and

Satellite

—

1.2%

173,980

Comcast

Corp.,

Cl. A

...............

7,267,145

2,500

EchoStar

Corp.,

Cl. A†

..............

62,050

150,000

Liberty

Latin

America

Ltd.,

Cl. A†

......

1,437,000

369,000

Rogers

Communications

Inc.,

Cl. B

.....

14,837,490

55,000

WideOpenWest

Inc.†

...............

288,750

23,892,435

Real

Estate

—

1.1%

16,750

American

Tower

Corp.,

REIT

..........

3,895,380

40,000

Blackstone

Mortgage

Trust

Inc.,

Cl. A,

REIT

760,400

8,000

Bresler

&

Reiner

Inc.†(a)

............

200

10,000

Gaming

and

Leisure

Properties

Inc.,

REIT

514,500

17,000

Rayonier

Inc.,

REIT

................

547,060

59,000

Seritage

Growth

Properties,

Cl. A†

.....

274,350

1,000

Simon

Property

Group

Inc.,

REIT

......

169,020

12,000

Tejon

Ranch

Co.†

.................

210,600

259,000

The

St.

Joe

Co.

...................

15,102,290

25,000

VICI

Properties

Inc.,

REIT

...........

832,750

9,000

Weyerhaeuser

Co.,

REIT

............

304,740

22,611,290

Specialty

Chemicals

—

0.9%

8,000

AdvanSix

Inc.

....................

243,040

60,725

Arcadium

Lithium

plc†

.............

173,066

2,500

DSM-Firmenich

AG

................

344,102

40,000

DuPont

de

Nemours

Inc.

............

3,564,400

5,500

FMC

Corp.

......................

362,670

15,000

H.B.

Fuller

Co.

...................

1,190,700

29,500

International

Flavors

&

Fragrances

Inc.

..

3,095,435

2,800

Johnson

Matthey

plc

...............

56,938

7,600

Rogers

Corp.†

...................

858,876

Shares

Market

Value

99,400

Sensient

Technologies

Corp.

.........

$

7,973,868

13,000

SGL

Carbon

SE†

..................

77,854

12,500

Treatt

plc

.......................

74,953

18,015,902

Transportation

—

0.9%

10,000

FTAI

Infrastructure

Inc.

.............

93,600

130,200

GATX

Corp.

.....................

17,244,990

500

Union

Pacific

Corp.

................

123,240

17,461,830

Metals

and

Mining

—

0.8%

33,000

Agnico

Eagle

Mines

Ltd.

............

2,658,480

200

Alliance

Resource

Partners

LP

........

5,000

38,000

Barrick

Gold

Corp.

................

755,820

28,000

Cleveland-Cliffs

Inc.†

...............

357,560

110,000

Freeport-McMoRan

Inc.

.............

5,491,200

2,500

Materion

Corp.

...................

279,650

60,000

Metallus

Inc.†

....................

889,800

50,000

New

Hope

Corp.

Ltd.

...............

180,097

117,000

Newmont

Corp.

..................

6,253,650

10,000

Vale

SA,

ADR

....................

116,800

16,988,057

Automotive

—

0.8%

19,550

Daimler

Truck

Holding

AG

...........

731,859

7,500

Daimler

Truck

Holding

AG,

ADR

.......

139,875

29,200

General

Motors

Co.

................

1,309,328

179,750

Iveco

Group

NV

..................

1,804,400

3,500

Mercedes-Benz

Group

AG

...........

226,125

103,500

PACCAR

Inc.

....................

10,213,380

90,000

Piaggio

&

C

SpA

..................

263,683

25,000

Stellantis

NV

....................

351,250

1,150

Toyota

Motor

Corp.,

ADR

............

205,355

52,000

Traton

SE

.......................

1,701,784

16,947,039

Wireless

Communications

—

0.8%

15,000

Anterix

Inc.†

.....................

564,900

80,000

Millicom

International

Cellular

SA,

SDR†

.

2,172,541

105,000

Operadora

De

Sites

Mexicanos

SAB

de

CV

82,709

36,800

T-Mobile

US

Inc.

..................

7,594,048

118,400

United

States

Cellular

Corp.†

.........

6,470,560

16,884,758

Communications

Equipment

—

0.8%

11,140

Apple

Inc.

......................

2,595,620

3,250

Arista

Networks

Inc.†

..............

1,247,415

223,000

Corning

Inc.

.....................

10,068,450

1,750

Motorola

Solutions

Inc.

.............

786,853

4,500

QUALCOMM

Inc.

.................

765,225

33,000

Telesat

Corp.†

...................

434,610

15,898,173

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Manufactured

Housing

and

Recreational

Vehicles

—

0.4%

680

Cavco

Industries

Inc.†

..............

$

291,203

37,200

Champion

Homes

Inc.†

.............

3,528,420

10,914

Legacy

Housing

Corp.†

.............

298,498

5,000

Martin

Marietta

Materials

Inc.

.........

2,691,250

41,313

Nobility

Homes

Inc.

................

1,569,894

8,379,265

Agriculture

—

0.4%

105,000

Archer-Daniels-Midland

Co.

..........

6,272,700

49,000

Limoneira

Co.

....................

1,298,500

6,500

The

Mosaic

Co.

...................

174,070

7,745,270

Publishing

—

0.3%

1,400

Graham

Holdings

Co.,

Cl. B

..........

1,150,408

90,000

News

Corp.,

Cl. A

.................

2,396,700

92,000

News

Corp.,

Cl. B

.................

2,571,400

55,000

The

E.W.

Scripps

Co.,

Cl. A†

..........

123,475

6,241,983

Semiconductors

—

0.2%

8,000

Advanced

Micro

Devices

Inc.†

........

1,312,640

40,000

Alphawave

IP

Group

plc†

............

55,724

3,000

Applied

Materials

Inc.

..............

606,150

415

ASML

Holding

NV

.................

345,799

1,200

Axcelis

Technologies

Inc.†

...........

125,820

500

Azenta

Inc.†

.....................

24,220

4,430

Broadcom

Inc.

...................

764,175

200

Lam

Research

Corp.

...............

163,216

3,000

nLight

Inc.†

.....................

32,070

2,200

NXP

Semiconductors

NV

............

528,022

23,758

SkyWater

Technology

Inc.†

..........

215,722

3,000

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.,

ADR

.....................

521,010

4,694,568

Computer

Hardware

—

0.1%

11,000

Dell

Technologies

Inc.,

Cl. C

..........

1,303,940

5,500

HP

Inc.

........................

197,285

3,000

NETGEAR

Inc.†

...................

60,180

1,561,405

TOTAL

COMMON

STOCKS

.........

2,022,086,846

CLOSED-END

FUNDS

—

0.3%

245,000

Altaba

Inc.,

Escrow†

...............

349,125

4,285

Royce

Global

Trust

Inc.

.............

49,706

46,158

Royce

Small-Cap

Trust

Inc.

..........

724,680

600,000

SuRo

Capital

Corp.†

...............

2,418,000

82,000

The

Central

Europe,

Russia,

and

Turkey

Fund

Inc.

.............

879,040

Shares

Market

Value

156,500

The

New

Germany

Fund

Inc.

.........

$

1,397,545

5,818,096

TOTAL

CLOSED-END

FUNDS

........

5,818,096

PREFERRED

STOCKS

—

0.1%

Retail

—

0.1%

50,000

Qurate

Retail

Inc.,

8.000%,

03/15/31

....

2,175,000

WARRANTS

—

0.0%

Energy

and

Utilities

—

0.0%

2,504

Occidental

Petroleum

Corp.,

expire

08/03/27†

.....................

74,419

Diversified

Industrial

—

0.0%

379,000

Ampco-Pittsburgh

Corp.,

expire

08/01/25†

38,847

TOTAL

WARRANTS

..............

113,266

Principal

Amount

CONVERTIBLE

CORPORATE

BONDS

—

0.0%

Cable

and

Satellite

—

0.0%

$

200,000

AMC

Networks

Inc.,

4.250%,

02/15/29(b)

.............

184,500

U.S.

GOVERNMENT

OBLIGATIONS

—

0.5%

10,055,000

U.S.

Treasury

Bills,

4.535%

to

4.805%††,

12/12/24

to

12/26/24

......................

9,952,685

TOTAL

INVESTMENTS

—

100.0%

....

(Cost

$1,078,616,298)

............

$

2,040,330,393

(a)

Security

is

valued

using

significant

unobservable

inputs

and

is

classified

as

Level

3

in

the

fair

value

hierarchy.

(b)

Security

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

This

security

may

be

resold

in

transactions

exempt

from

registration,

normally

to

qualified

institutional

buyers.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

ADR

American

Depositary

Receipt

REIT

Real

Estate

Investment

Trust

SDR

Swedish

Depositary

Receipt

The

Gabelli

Equity

Trust

Inc.

Schedule

of

Investments

(Continued)

—

September

30,

2024

(Unaudited)

Geographic

Diversification

%

of

Total

Investments

Market

Value

North

America

......................

85.3

%

$

1,740,711,841

Europe

..............................

11.8

240,474,807

Latin

America

.......................

1.2

25,031,614

Japan

...............................

1.2

24,640,583

Asia/Pacific

.........................

0.5

9,471,548

Total

Investments

...................

100.0%

$

2,040,330,393

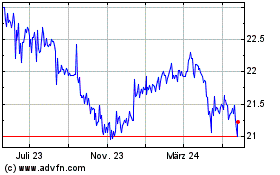

Gabelli Equity (NYSE:GAB-K)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

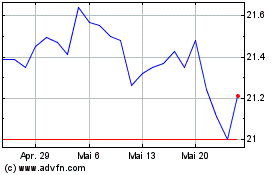

Gabelli Equity (NYSE:GAB-K)

Historical Stock Chart

Von Dez 2023 bis Dez 2024