UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-21756

FIRST TRUST STRATEGIC HIGH INCOME FUND

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

WHEATON, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

WHEATON, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code: 630-765-8000

Date of fiscal year end: OCTOBER 31

Date of reporting period: JULY 31, 2009

Form N-Q is to be used by management investment companies, other than small

business investment companies registered on Form N-5 (ss.ss. 239.24 and 274.5 of

this chapter), to file reports with the Commission, not later than 60 days after

the close of the first and third fiscal quarters, pursuant to rule 30b1-5 under

the Investment Company Act of 1940 (17 CFR 270.30b1-5). The Commission may use

the information provided on Form N-Q in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-Q, and

the Commission will make this information public. A registrant is not required

to respond to the collection of information contained in Form N-Q unless the

Form displays a currently valid Office of Management and Budget ("OMB") control

number. Please direct comments concerning the accuracy of the information

collection burden estimate and any suggestions for reducing the burden to the

Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC

20549. The OMB has reviewed this collection of information under the clearance

requirements of 44 U.S.C. ss. 3507.

ITEM 1. SCHEDULE OF INVESTMENTS.

The Schedule(s) of Investments is attached herewith.

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (a)

JULY 31, 2009 (UNAUDITED)

PRINCIPAL STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

--------------- -------------------------------------------------------------------------- ------ -------- ---------------

ASSET-BACKED SECURITIES - 38.3%

ABCLO, Ltd.

$ 1,788,696 Series 2007-1A, Class D (b) (c) ....................................... 4.41% 04/15/21 $ 109,218

ACE Securities Corp., Home Equity Loan Trust

270,675 Series 2003-OP1, Class B .............................................. 6.00% 12/25/33 82,583

Aircraft Finance Trust

768,863 Series 1999-1A, Class A2 (b) (d) ...................................... 0.79% 05/15/24 384,431

Atherton Franchisee Loan Funding

348,495 Series 1999-A, Class A2 (d) ........................................... 7.23% 03/15/21 327,959

BNC Mortgage Loan Trust

57,469 Series 2007-2, Class B1 (b) (d) ....................................... 2.79% 05/25/37 461

Bombardier Capital Mortgage Securitization Corp.

327,668 Series 1999-B, Class A1B .............................................. 6.61% 09/15/10 146,446

838,917 Series 1999-B, Class A3 ............................................... 7.18% 12/15/15 395,901

Conseco Finance Securitizations Corp.

3,456,942 Series 2000-6, Class M1 ............................................... 7.72% 09/01/31 961,109

EMAC Owner Trust, LLC

1,155,469 Series 1998-1, Class A3 (d) ........................................... 6.63% 01/15/25 693,282

828,273 Series 2000-1, Class A1 (d) ........................................... 7.06% 01/15/27 271,682

1,061,014 Series 2000-1, Class A2 (d) ........................................... 7.06% 01/15/27 348,023

Falcon Franchise Loan Trust

4,905,000 Series 2000-1, Class E (d) ............................................ 6.50% 04/05/16 1,039,811

4,231,000 Series 2003-1, Class E (c) ............................................ 6.00% 01/05/25 0

FFCA Secured Lending Corp.

5,000,000 Series 1999-2, Class B1 (c) ........................................... 8.27% 05/18/26 500,756

FMAC Loan Receivables Trust

703,829 Series 1997-B, Class A (d) ............................................ 6.85% 09/15/19 563,063

Green Tree Financial Corp.

323,949 Series 1997-4, Class B1 ............................................... 7.23% 02/15/29 60,760

956,103 Series 1998-4, Class M1 ............................................... 6.83% 04/01/30 337,492

3,000,000 Series 1998-8, Class M1 ............................................... 6.98% 09/01/30 1,216,051

5,556,293 Series 1999-3, Class M1 ............................................... 6.96% 02/01/31 813,956

GSAMP Trust

508,937 Series 2004-AR2, Class B4 (c) ......................................... 5.00% 08/25/34 2,382

985,032 Series 2006-S3, Class A2 .............................................. 5.77% 05/25/36 74,311

862,203 Series 2006-S5, Class A1 (b) .......................................... 0.38% 09/25/36 17,046

Halyard Multi Asset CBO I, Ltd.

1,641,391 Series 1A, Class B (b) (c) ............................................ 3.20% 03/24/10 98,484

Independence lll CDO, Ltd.

5,146,226 Series 3A, Class C1 (b) (c) ........................................... 3.09% 10/03/37 331,674

Indymac Residential Asset Backed Trust

2,375,000 Series 2005-B, Class M10 (b) .......................................... 3.79% 08/25/35 16,494

Long Beach Mortgage Loan Trust

1,934,955 Series 2006-A, Class A2 ............................................... 5.55% 05/25/36 135,447

Longhorn CDO, Ltd.

2,920,880 Series 1, Class C (b) (c) ............................................. 7.21% 05/10/12 29

Merit Securities Corp.

1,960,910 Series 13, Class B1 (c) ............................................... 7.97% 12/28/33 75,926

2,602,000 Series 13, Class M2 ................................................... 7.97% 12/28/33 962,531

|

See Notes to Quarterly Portfolio of Investments

Page 1

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (a) - (CONTINUED)

JULY 31, 2009 (UNAUDITED)

PRINCIPAL STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

--------------- -------------------------------------------------------------------------- ------ -------- ---------------

ASSET-BACKED SECURITIES - CONTINUED

Park Place Securities, Inc.

$2,677,641 Series 2004-WCW1, Class M8 (b) ........................................ 3.79% 09/25/34 $ 33,111

1,301,976 Series 2004-WCW2, Class M10 (b) (c) ................................... 3.04% 10/25/34 17,589

2,179,209 Series 2005-WCW3, Class M11 (b) (c) ................................... 2.79% 08/25/35 10,112

Rosedale CLO, Ltd.

3,500,000 Series I-A, Class II (c) .............................................. (f) 07/24/21 35,000

Signature 5, Ltd.

1,129,120 Series 5A, Class C (c) ................................................ 12.56% 10/27/12 146,684

Soundview Home Equity Loan Trust

1,634,000 Series 2007-OPT3, Class M10 (b) (c) ................................... 2.79% 08/25/37 28,350

Summit CBO I, Ltd.

4,705,734 Series 1A, Class B (b) (c) ............................................ 2.17% 05/23/11 85,268

---------------

TOTAL ASSET-BACKED SECURITIES

(Cost $32,921,844) .................................................... 10,323,422

---------------

COLLATERALIZED MORTGAGE OBLIGATIONS - 3.2%

Bear Stearns Alt-A Trust

1,999,672 Series 2006-8, Class 2A2 .............................................. 5.33% 08/25/46 339,106

Countrywide Alternative Loan Trust

3,267,748 Series 2005-56, Class M4 (b) .......................................... 1.21% 11/25/35 178,550

Deutsche Alt-A Securities, Inc. Mortgage Loan Trust

3,691,244 Series 2007-OA4, Class M10 (b) ........................................ 3.29% 08/25/47 57,473

HarborView Mortgage Loan Trust

3,858,652 Series 2005-9, Class B10 (b). ......................................... 2.04% 06/20/35 282,260

---------------

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost $9,442,365) ..................................................... 857,389

---------------

COMMERCIAL MORTGAGE-BACKED SECURITIES - 20.9%

Banc of America Commercial Mortgage, Inc.

1,171,422 Series 2000-1, Class M (c) ............................................ 6.00% 11/15/31 12

Banc of America Large Loan, Inc.

2,000,000 Series 2005-MIB1, Class L (b) (c) ..................................... 3.29% 03/15/22 200,314

Banc of America Structural Securities Trust

2,878,166 Series 2002-X1, Class O (d) ........................................... 7.00% 10/11/33 2,077,174

2,878,166 Series 2002-X1, Class P (d) ........................................... 7.00% 10/11/33 1,391,624

Bear Stearns Commercial Mortgage Securities

1,776,400 Series 2000-WF1, Class K .............................................. 6.50% 02/15/32 152,980

GE Capital Commercial Mortgage Corp.

700,000 Series 2000-1, Class G (c) ............................................ 6.13% 01/15/33 168,229

GMAC Commercial Mortgage Securities, Inc.

1,000,000 Series 1999-C3, Class G (d) ........................................... 6.97% 08/15/36 650,000

GS Mortgage Securities Corp. II

7,000,000 Series 1998-C1, Class H (c) ........................................... 6.00% 10/18/30 388,995

LB-UBS Commercial Mortgage Trust

3,025,000 Series 2001-C7, Class Q (c) ........................................... 5.87% 11/15/33 151,413

2,083,703 Series 2001-C7, Class S (c) ........................................... 5.87% 11/15/33 14,398

|

See Notes to Quarterly Portfolio of Investments

Page 2

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (a) - (CONTINUED)

JULY 31, 2009 (UNAUDITED)

PRINCIPAL STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

--------------- -------------------------------------------------------------------------- ------ -------- ---------------

COMMERCIAL MORTGAGE-BACKED SECURITIES - CONTINUED

Morgan Stanley Capital I, Inc.

$ 968,400 Series 1999-WF1, Class M (c) .......................................... 5.91% 11/15/31 $ 257,328

2,787,919 Series 2003-IQ5, Class O (c) .......................................... 5.24% 04/15/38 197,916

---------------

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(Cost $17,842,199) .................................................... 5,650,383

---------------

CORPORATE BONDS AND NOTES - 3.6%

1,500,000 Lexington Precision Corp., Units (e) (g) ................................. (f) 08/01/10 964,950

---------------

TOTAL CORPORATE BONDS

(Cost $1,200,000) ..................................................... 964,950

---------------

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES - 60.6%

3,875,000 FannieMae, September (h) ................................................. 5.50% TBA 4,002,755

2,250,000 FannieMae, September (h) ................................................. 6.00% TBA 2,350,899

FannieMae-ACES

6,218,137 Series 1998-M7, Class N, IO ........................................... 0.45% 05/25/36 90,519

3,875,000 Government National Mortgage Association,

September (h) ......................................................... 5.00% TBA 3,963,408

Government National Mortgage Association

88,984,674 Series 2003-47, Class XA, IO .......................................... 1.24% 06/16/43 4,378,696

23,141,560 Series 2003-59, Class XA, IO .......................................... 2.06% 06/16/34 1,571,333

---------------

TOTAL U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES

(Cost $16,594,387) .................................................... 16,357,610

---------------

STRUCTURED NOTES - 1.2%

Bacchus Ltd.

1,225,000 Series 2006-1I, Subordinated Bond (c) ................................. (f) 01/20/19 245,000

InCaps Funding II Ltd./InCaps Funding II Corp.

2,000,000 Subordinated Note (c) ................................................. (f) 01/15/34 80,000

3,750,000 Preferred Term Securities XXV, Ltd. (c) .................................. (f) 06/22/37 375

---------------

TOTAL STRUCTURED NOTES

(Cost $824,566) ....................................................... 325,375

---------------

|

SHARES DESCRIPTION VALUE

--------------- ---------------------------------------------------------------------------------------------- ---------------

PREFERRED SECURITIES - 0.4%

1,450 Ajax Two Ltd., Series 2A (c) (f) ............................................................. 21,750

2,000 Ajax Two Ltd., Series 2X (c) (f) ............................................................. 20,000

4,000 Pro Rata Funding, Ltd., Inc. (c) (f) ......................................................... 40,000

2,000 Soloso CDO, Ltd., Series 2005-1 (c) (f) ...................................................... 20,000

3,000 White Marlin CDO, Ltd., Series AI (c) (e) (f) ................................................ 15,000

---------------

TOTAL PREFERRED SECURITIES

(Cost $2,044,459) ......................................................................... 116,750

---------------

TOTAL INVESTMENTS - 128.2%

(Cost $80,869,820) (i) .................................................................... 34,595,879

NET OTHER ASSETS AND LIABILITIES - (28.2%) ................................................... (7,603,900)

---------------

NET ASSETS - 100.0% .......................................................................... $ 26,991,979

===============

|

See Notes to Quarterly Portfolio of Investments

Page 3

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (a) - (CONTINUED)

JULY 31, 2009 (UNAUDITED)

(a) All percentages shown in the Portfolio of Investments are based on net

assets.

(b) Floating rate security. The interest rate shown reflects the rate in effect

at July 31, 2009.

(c) This security, sold within the terms of a private placement memorandum, is

exempt from registration under Rule 144A under the Securities Act of 1933,

as amended (the "1933 Act"), and may be resold in transactions exempt from

registration, normally to qualified institutional buyers (see Note 1C -

Restricted Securities in the Notes to Quarterly Portfolio of Investments).

(d) This security, sold within the terms of a private placement memorandum, is

exempt from registration under Rule 144A under the 1933 Act and may be

resold in transactions exempt from registration, normally to qualified

institutional buyers. Pursuant to procedures adopted by the Fund's Board of

Trustees, this security has been determined to be liquid by Hyperion

Brookfield Asset Management, Inc., the Fund's investment sub-advisor.

Although recent instability in the markets has resulted in periods of

increased overall market illiquidity, liquidity for each security is

determined based on security specific factors and assumptions, which

require subjective judgment. At July 31, 2009, securities noted as such

amounted to $7,747,510 or 28.7% of net assets.

(e) The issuer is in default. Income is not being accrued.

(f) Zero coupon bond.

(g) Security is fair valued in accordance with procedures adopted by the Fund's

Board of Trustees.

(h) Security purchased on a forward commitment basis.

(i) Aggregate cost for financial reporting purposes, which approximates the

aggregate cost for federal income tax purposes. As of July 31, 2009, the

aggregate gross unrealized appreciation for all securities in which there

was an excess of value over tax cost was $8,411,336 and the aggregate gross

unrealized depreciation for all securities in which there was an excess of

tax cost over value was $54,685,277.

ACES Alternative Credit Enhancement Securities

CBO Collateralized Bond Obligation

CDO Collateralized Debt Obligation

CLO Collateralized Loan Obligation

IO Interest Only Security

TBA To be announced, maturity date not yet been established. Upon settlement

and delivery of the mortgage pools, maturity dates will be assigned.

|

See Notes to Quarterly Portfolio of Investments

Page 4

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (a) - (CONTINUED)

JULY 31, 2009 (UNAUDITED)

VALUATION INPUTS

A summary of the inputs used to value the Fund's total investments as of July

31, 2009 is as follows (see Note 1A - Portfolio Valuation in the Notes to

Quarterly Portfolio of Investments):

LEVEL 2 LEVEL 3

TOTAL MARKET LEVEL 1 SIGNIFICANT SIGNIFICANT

VALUE AT QUOTED OBSERVABLE UNOBSERVABLE

07/31/09 PRICE INPUTS INPUTS

------------ ------- ----------- ------------

Asset-Backed Securities ............................... $10,323,422 $-- $ 8,413,715 $1,909,707

Collateralized Mortgage Obligations ................... 857,389 -- 857,389 --

Commercial Mortgage-Backed Securities ................. 5,650,383 -- 5,650,383 --

Corporate Bonds ....................................... 964,950 -- -- 964,950

U.S. Government Agency Mortgage-Backed Securities ..... 16,357,610 -- 16,357,610 --

Structured Notes ...................................... 325,375 -- 375 325,000

Preferred Securities .................................. 116,750 -- -- 116,750

----------- --- ----------- ----------

TOTAL INVESTMENTS ..................................... $34,595,879 $-- $31,279,472 $3,316,407

=========== === =========== ==========

|

The following table presents the Fund's investments measured at fair value on a

recurring basis using significant unobservable inputs (Level 3) for the period

presented.

INVESTMENTS AT FAIR VALUE USING SIGNIFICANT

UNOBSERVABLE INPUTS (LEVEL 3) INVESTMENTS

------------------------------------------- ------------

Balance as of October 31, 2008 ........................ $ 23,044,686

Net realized gains (losses) ........................... (15,522,681)

Net unrealized appreciation (depreciation) ............ 1,574,691

Net purchases (sales) ................................. (2,874,375)

Transfers in (out) of Level 3 ......................... (2,905,914)

------------

Balance as of July 31, 2009 ........................... $ 3,316,407

============

|

See Notes to Quarterly Portfolio of Investments

Page 5

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS

FIRST TRUST STRATEGIC HIGH INCOME FUND

JULY 31, 2009 (UNAUDITED)

1. VALUATION AND INVESTMENT PRACTICES

A. PORTFOLIO VALUATION:

The net asset value ("NAV") of the Common Shares of First Trust Strategic High

Income Fund (the "Fund") is determined daily as of the close of regular trading

on the New York Stock Exchange ("NYSE"), normally 4:00 p.m. Eastern time, on

each day the NYSE is open for trading. Domestic debt securities and foreign

securities are priced using data reflecting the earlier closing of the principal

markets for those securities. The NAV per Common Share is calculated by dividing

the value of all assets of the Fund (including accrued interest and dividends),

less all liabilities (including accrued expenses, dividends declared but unpaid

and any borrowings of the Fund) by the total number of Common Shares

outstanding.

The Fund's investments are valued daily at market value or, in the absence of

market value with respect to any portfolio securities, at fair value according

to procedures adopted by the Fund's Board of Trustees. Securities for which

market quotations are readily available are valued at market value, which is

currently determined using the last reported sale price on the business day as

of which such value is being determined or, if no sales are reported on such day

(as in the case of some securities traded over-the-counter), the last reported

bid price, except that certain U.S. Government securities are valued at the mean

between the last reported bid and asked prices. The Fund values mortgage-backed

securities and other debt securities not traded in an organized market on the

basis of valuations provided by dealers who make markets in such securities or

by independent pricing services approved by the Fund's Board of Trustees which

use information with respect to transactions in such securities, quotations from

dealers, market transactions for comparable securities, various relationships

between securities and yield to maturity in determining value. The Fund's

Portfolio of Investments includes investments with a value of $3,316,407 (9.6%

of total investments) as of July 31, 2009, whose values have been determined

based on prices supplied by dealers and investments with a value of $31,279,472

(90.4% of total investments), whose values have been determined based on prices

supplied by independent pricing services. These values may differ from the

values that would have been used had a ready market for these investments

existed, and the differences could be material.

Debt securities having a remaining maturity of less than sixty days when

purchased are valued at cost adjusted for amortization of premiums and accretion

of discounts.

In the event that market quotations are not readily available, the pricing

service or dealer does not provide a valuation for a particular security, or the

valuations are deemed unreliable, the Fund's Board of Trustees has designated

First Trust Advisors L.P. ("First Trust") to use a fair value method to value

the Fund's securities and investments. Additionally, if events occur after the

close of the principal markets for particular securities (e.g., domestic debt

and foreign securities), but before the Fund values its assets, that could

materially affect NAV, First Trust may use a fair value method to value the

Fund's securities and other investments. As a general principle, the fair value

of a security is the amount which the Fund might reasonably expect to receive

for the security upon its current sale. A variety of factors may be considered

in determining the fair value of such securities including 1) the fundamental

business data relating to the issuer; 2) an evaluation of the forces which

influence the market in which these securities are purchased and sold; 3) type

of holding; 4) financial statements of the issuer; 5) cost at date of purchase;

6) credit quality and cash flow of the issuer based on external analysis; 7)

information as to any transactions in or offers for the holding; 8) price and

extent of public trading in similar securities of the issuer/borrower, or

comparable companies; and 9) other relevant factors. The use of fair value

pricing by the Fund is governed by valuation procedures adopted by the Fund's

Board of Trustees, and in accordance with the provisions of the Investment

Company Act of 1940, as amended. When fair value pricing of securities is

employed, the prices of securities used by the Fund to calculate its NAV may

differ from market quotations or official closing prices. In light of the

judgment involved in fair valuations, there can be no assurance that a fair

value assigned to a particular security will be the amount which the Fund might

be able to receive upon its current sale.

The Fund invests a significant portion of its assets in below-investment grade

debt securities, including mortgage-backed securities, asset-backed securities,

corporate bonds and collateralized debt obligations. The value and related

income of these securities is sensitive to changes in economic conditions,

including delinquencies and/or defaults. Instability in the markets for fixed

income securities, particularly mortgage-backed and asset-backed securities, has

resulted in increased volatility and periods of illiquidity that have adversely

impacted the valuation of certain securities held by the Fund.

Page 6

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS - (CONTINUED)

FIRST TRUST STRATEGIC HIGH INCOME FUND

JULY 31, 2009 (UNAUDITED)

In September 2006, the Financial Accounting Standards Board ("FASB") issued

Statement of Financial Accounting Standards No. 157 "Fair Value Measurements"

("FAS 157"), effective for fiscal years beginning after November 15, 2007. This

standard clarifies the definition of fair value for financial reporting,

establishes a framework for measuring fair value and requires additional

disclosures about the use of fair value measurements. FAS 157 became effective

for the Fund as of November 1, 2008, the beginning of its current fiscal year.

The three levels of the fair value hierarchy under FAS 157 are described as

follows:

- Level 1 - quoted prices in active markets for identical securities

- Level 2 - other significant observable inputs (including quoted prices

for similar securities, interest rates, prepayment speeds, credit

risk, etc.)

- Level 3 - significant unobservable inputs (including the Fund's own

assumptions in determining the fair value of investments)

In April 2009, FASB issued FASB Staff Position No. 157-4, "Determining Fair

Value when the Volume and Level of Activity for the Asset or Liability Have

Significantly Decreased and Identifying Transactions That Are Not Orderly" ("FSP

157-4"). FSP 157-4 is effective for fiscal years and interim periods ending

after June 15, 2009. FSP 157-4 provides additional guidance for estimating fair

value in accordance with FAS 157, when the volume and level of activity for the

asset or liability have significantly decreased. FSP 157-4 also includes

guidance on identifying circumstances that indicate a transaction is not

orderly. FSP 157-4 requires entities to describe the inputs used in valuation

techniques used to measure fair value and changes in inputs over the period. FSP

157-4 expands the three-level hierarchy disclosure and the Level 3 roll-forward

disclosure for each major security type.

The inputs or methodology used for valuing securities are not necessarily an

indication of the risk associated with investing in those securities. A summary

of the inputs used to value the Fund's investments as of July 31, 2009 is

included in the Fund's Portfolio of Investments.

B. SECURITIES TRANSACTIONS:

Securities transactions are recorded as of the trade date. Realized gains and

losses from securities transactions are recorded on the identified cost basis.

Securities purchased or sold on a when-issued or delayed-delivery basis may be

settled a month or more after the trade date; interest income on such securities

is not accrued until settlement date. The Fund maintains liquid assets of the

Fund with a current value at least equal to the amount of its when-issued or

delayed-delivery purchase commitments. At July 31, 2009, the Fund had no

when-issued or delayed-delivery purchase commitments.

C. RESTRICTED SECURITIES:

The Fund invests in restricted securities, which are securities that may not be

offered for public sale without first being registered under the 1933 Act. Prior

to registration, restricted securities may only be resold in transactions exempt

from registration under Rule 144A under the 1933 Act, normally to qualified

institutional buyers. As of July 31, 2009, the Fund held restricted securities

as shown in the table below that the sub-advisor, Hyperion Brookfield Asset

Management, Inc., has deemed illiquid pursuant to procedures adopted by the

Fund's Board of Trustees. Although recent instability in the markets has

resulted in periods of increased overall market illiquidity, liquidity for each

security is determined based on security specific factors and assumptions, which

require subjective judgment. The Fund does not have the right to demand that

such securities be registered. These securities are valued according to the

valuation procedures as stated in the Portfolio Valuation footnote (Note 1A) and

are not expressed as a discount to the carrying value of a comparable

unrestricted security. There are no unrestricted securities with the same

maturity dates and yields for these issuers.

CARRYING % OF

ACQUISITION PRINCIPAL VALUE CARRYING NET

SECURITY DATE VALUE/SHARES PER SHARE COST VALUE ASSETS

-------- ----------- ------------ --------- ---------- -------- ------

ABCLO, Ltd.

Series 2007-1A, Class D, 4.41%, 04/15/21 04/25/07 $1,788,696 $ 6.11 $1,756,608 $109,218 0.41%

Ajax Two Ltd., Series 2A 11/30/05 1,450 1.50 558,175 21,750 0.08

Ajax Two Ltd., Series 2X 11/30/05 2,000 1.00 762,973 20,000 0.07

Bacchus Ltd.

Series 2006-1I, Subordinated Bond, Zero Coupon,

01/20/19 05/15/07 $1,225,000 20.00 188,228 245,000 0.91

Banc of America Commercial Mortgage, Inc.

Series 2000-1, Class M, 6.00%, 11/15/31 08/22/05 $1,171,422 0.00 44,371 12 0.00

Banc of America Large Loan, Inc.

Series 2005-MIB1, Class L, 3.29%, 03/15/22 08/26/06 $2,000,000 10.02 2,008,557 200,314 0.74

|

Page 7

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS - (CONTINUED)

FIRST TRUST STRATEGIC HIGH INCOME FUND

JULY 31, 2009 (UNAUDITED)

CARRYING % OF

ACQUISITION PRINCIPAL VALUE CARRYING NET

SECURITY DATE VALUE/SHARES PER SHARE COST VALUE ASSETS

-------- ----------- ------------ --------- ----------- ---------- ------

Falcon Franchise Loan Trust

Series 2003-1, Class E, 6.00%, 01/05/25 08/09/05 $ 4,231,000 $ 0.00 $ 4,174,579 $ 0 0.00%

FFCA Secured Lending Corp.

Series 1999-2, Class B-1, 8.27%, 05/18/26 05/18/05 $ 5,000,000 10.02 0 500,756 1.86

GE Capital Commercial Mortgage Corp.

Series 2000-1, Class G, 6.13%, 01/15/33 06/27/07 $ 700,000 24.03 688,910 168,229 0.62

GSAMP Trust

Series 2004-AR2, Class B4, 5.00%, 08/25/34 08/17/05 $ 508,937 0.47 0 2,382 0.01

GS Mortgage Securities Corp. II

Series 1998-C1, Class H, 6.00%, 10/18/30 08/02/05 $ 7,000,000 5.56 3,967,964 388,995 1.44

Halyard Multi Asset CBO I, Ltd

Series 1A, Class B, 3.20%, 03/24/10 03/26/06 $ 1,641,391 6.00 306,488 98,484 0.37

InCaps Funding II Ltd./InCaps Funding II Corp.

Subordinated Note, Zero Coupon, 01/15/34 05/01/07 $ 2,000,000 4.00 561,338 80,000 0.30

Independence III CDO, Ltd.

Series 3A, Class C1, 3.09%, 10/03/37 12/27/06 $ 5,146,226 6.45 3,129,798 331,674 1.23

LB-UBS Commercial Mortgage Trust

Series 2001-C7, Class Q, 5.87%, 11/15/33 09/19/05 $ 3,025,000 5.01 2,673,730 151,413 0.56

Series 2001-C7, Class S, 5.87%, 11/15/33 09/29/08 $ 2,083,703 0.69 613,044 14,398 0.05

Longhorn CDO, Ltd.

Series 1, Class C, 7.21%, 05/10/12 03/24/06 $ 2,920,880 0.00 693,503 29 0.00

Merit Securities Corp.

Series 13, Class B1, 7.97%, 12/28/33 02/20/07 $ 1,960,910 3.87 56,083 75,926 0.28

Morgan Stanley Capital I, Inc.

Series 1999-WF1, Class M, 5.91%, 11/15/31 08/03/05 $ 968,400 26.57 674,208 257,328 0.95

Series 2003-IQ5, Class O, 5.24%, 04/15/38 10/19/06 $ 2,787,919 7.10 179,175 197,916 0.73

Park Place Securities, Inc.

Series 2004-WCW2, Class M10, 3.04%, 10/25/34 03/24/06 $ 1,301,976 1.35 313,821 17,589 0.07

Series 2005-WCW3, Class M11, 2.79%, 08/25/35 12/26/07 $ 2,179,209 0.46 201,546 10,112 0.04

Preferred Term Securities XXV, Ltd.

Zero Coupon, 06/22/37 03/22/07 $ 3,750,000 0.01 75,000 375 0.00

Pro Rata Funding, Ltd, Inc. 04/11/06 4,000 1.00 383,311 40,000 0.15

Rosedale CLO, Ltd.

Series I-A, Class II, Zero Coupon, 07/24/21 01/12/07 $ 3,500,000 1.00 713,774 35,000 0.13

Signature 5, Ltd.

Series 5A, Class C, 12.56%, 10/27/12 05/21/07 $ 1,129,120 12,99 1,162,512 146,684 0.54

Soloso CDO, Ltd., Series 2005-1 11/30/05 2,000 1.00 40,000 20,000 0.07

Soundview Home Equity Loan Trust

Series 2007-OPT3. Class M10, 2.79%, 08/25/37 06/21/07 $ 1,634,000 1.74 1,475,464 28,350 0.10

Summit CBO I, Ltd

Series 1A, Class B, 2.17%, 05/23/11 08/03/05 $ 4,705,734 1.81 715,206 85,268 0.32

White Marlin CDO, Ltd., Series AI 06/01/07 3,000 0.50 300,000 15,000 0.06

----------- ----------- ---------- -----

$64,371,973 $28,418,366 $3,262,202 12.09%

=========== =========== ========== =====

|

D. INTEREST ONLY SECURITIES:

An interest only security ("IO Security") is the interest only portion of a

mortgage-backed security ("MBS") that receives some or all of the interest

portion of the underlying MBS and little or no principal. A reference principal

value called a notional value is used to calculate the amount of interest due to

the IO Security. IO Securities are sold at a deep discount to their notional

principal amount. Generally speaking, when interest rates are falling and

prepayment rates are increasing, the value of an IO Security will fall.

Conversely, when interest rates are rising and prepayment rates are decreasing,

generally the value of an IO Security will rise. These investments are

identified on the Portfolio of Investments.

Page 8

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS - (CONTINUED)

FIRST TRUST STRATEGIC HIGH INCOME FUND

JULY 31, 2009 (UNAUDITED)

2. SUBSEQUENT EVENTS

On June 30, 2009, First Trust announced that the Board of Trustees of the Fund

voted to approve Hyperion Brookfield Asset Management, Inc. ("Hyperion") as

investment sub-advisor to the Fund, replacing Valhalla Capital Partners, LLC.

The Fund has entered into an interim investment sub-advisory agreement with

First Trust and Hyperion, as investment sub-advisor, effective June 29, 2009.

Unless otherwise terminated in accordance with its terms, the interim

sub-advisory agreement with Hyperion will remain in effect until the earlier of

November 26, 2009 or until a new sub-advisory agreement with Hyperion is

approved by the shareholders of the Fund.

Subject to shareholder approval, the Board of Trustees of the Fund also approved

a change in the Fund's industry concentration policy to provide that the Fund

may not purchase any security if, as a result of the purchase, 25% or more of

the Fund's total assets (taken at current value) would be invested in the

securities of borrowers and other issuers having their principal business

activities in the same industry; provided that this limitation shall not apply

with respect to obligations issued or guaranteed by the U.S. Government or by

its agencies or instrumentalities. Currently, the Fund's industry concentration

policy states that it will invest at least 25% of its total assets in

residential mortgage-backed securities under normal market conditions.

Shareholders of the Fund will be asked to vote on a proposal to approve the new

investment sub-advisory agreement with Hyperion as well as the above-referenced

proposal to change the industry concentration policy for the Fund at a joint

special meeting of shareholders to be held on October 14, 2009. Any solicitation

of proxies made in connection with this shareholder meeting will only be made

pursuant to separate proxy materials filed with the U.S. Securities and Exchange

Commission ("SEC") under applicable federal securities laws. There can be no

assurance that the necessary percentage of the shareholders of the Fund will

vote to approve Hyperion as the new investment sub-advisor or the change in the

industry concentration policy. Proxy materials in connection with the joint

special meeting of shareholders to be held on October 14, 2009 were mailed to

shareholders on or about August 24, 2009, and are available on the Fund's

website at http://www.ftportfolios.com or the SEC's website at

http://www.sec.gov.

On June 29, 2009, the Board of Trustees of the Fund approved a change in

investment policy so that the Fund may invest up to 100% of its managed assets

in below-investment grade debt securities (commonly referred to as "high-yield"

or "junk" bonds). This investment policy is non-fundamental and therefore may be

changed by approval of the Board of Trustees without shareholder approval. The

investment policy became effective on or about September 1, 2009. Previously,

the Fund pursued its investment objectives by investing at least 80% of its

managed assets in a diversified portfolio of high income producing securities

that the investment sub-advisor believes offer attractive yield and capital

appreciation potential. High income producing securities in which the Fund

invests consist of below-investment grade debt securities (high-yield or junk

bonds) and investment grade securities which offer yields comparable to

below-investment grade securities.

Page 9

ITEM 2. CONTROLS AND PROCEDURES.

(a) The registrant's principal executive and principal financial

officers, or persons performing similar functions, have concluded

that the registrant's disclosure controls and procedures (as

defined in Rule 30a-3(c) under the Investment Company Act of 1940,

as amended (the "1940 Act") (17 CFR 270.30a-3(c))) are effective,

as of a date within 90 days of the filing date of the report that

includes the disclosure required by this paragraph, based on their

evaluation of these controls and procedures required by Rule

30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules

13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934,

as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the registrant's internal control over

financial reporting (as defined in Rule 30a-3(d) under the 1940

Act (17 CFR 270.30a-3(d)) that occurred during the registrant's

last fiscal quarter that have materially affected, or are

reasonably likely to materially affect, the registrant's internal

control over financial reporting.

ITEM 3. EXHIBITS.

Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of

the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) FIRST TRUST STRATEGIC HIGH INCOME FUND

By (Signature and Title)* /S/ JAMES A. BOWEN

-------------------------------------------------------

James A. Bowen, Chairman of the Board, President and

Chief Executive Officer

(principal executive officer)

|

Date 9/23/09

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

By (Signature and Title)* /S/ JAMES A. BOWEN

-------------------------------------------------------

James A. Bowen, Chairman of the Board, President and

Chief Executive Officer

(principal executive officer)

|

Date 9/23/09

By (Signature and Title)* /S/ MARK R. BRADLEY

-------------------------------------------------------

Mark R. Bradley, Treasurer, Controller,

Chief Financial Officer and Chief Accounting Officer

(principal financial officer)

|

Date 9/23/09

* Print the name and title of each signing officer under his or her signature.

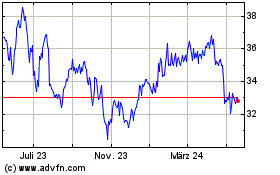

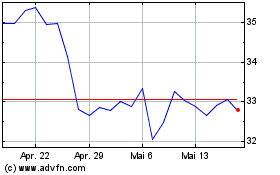

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024