00010967529/302024FYFALSEiso4217:USDxbrli:shares00010967522023-10-012024-09-3000010967522024-03-3100010967522024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 10-K/A

(Amendment No. 1)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File Number 001-15401

EDGEWELL PERSONAL CARE COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Missouri | 43-1863181 |

| (State or other jurisdiction of incorporation or organization) | (I. R. S. Employer Identification No.) |

| | | |

| 6 Research Drive | (203) | 944-5500 |

| Shelton, | CT | 06484 | (Registrant’s telephone number, including area code) |

| (Address of principal executive offices and zip code) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Stock symbol | Name of each exchange on which registered |

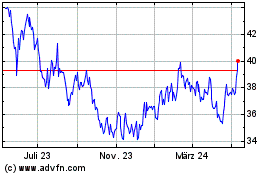

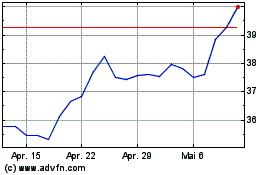

| Common Stock, par value $0.01 per share | EPC | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | ☐ | (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

| | | | |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of March 31, 2024, the last day of the registrant’s most recently completed second fiscal quarter, was $1,871,912,250.

The number of shares of the registrant’s common stock outstanding as of October 31, 2024 was 48,721,170.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s definitive proxy statement for its 2024 annual meeting of shareholders, to be filed with the Securities and Exchange Commission within 120 days after September 30, 2024, are incorporated by reference into Part III of this report.

Explanatory Note

Edgewell Personal Care Company (which may be referred to as “the Company,” “we,” “us,” and “our”) is filing this Amendment No. 1 to its Annual Report on Form 10-K/A (this “Amendment”) to amend Item 15 and the Exhibit Index of our Annual Report on Form 10-K for the fiscal year ended September 30, 2024, as originally filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 14, 2024 (the “Original Form 10-K”), solely to include Exhibits 10.44, 19.1, 97.1 and 104, which were inadvertently omitted from the Original Form 10-K, and to file new certifications of our Chief Executive Officer and Chief Financial Officer as Exhibits 31.3 and 31.4, pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (“Exchange Act”).

Except as otherwise indicated herein, this Amendment continues to speak as of the date of the Original Form 10-K, and the Company has not updated the disclosures contained therein to reflect any events that occurred subsequent to the date of the Original Form 10-K. Accordingly, this Amendment should be read in conjunction with the Original Form 10-K and with our subsequent filings with the SEC. All capitalized terms used but not defined herein shall have the meanings ascribed to them in the Original Form 10-K.

Item 15. Exhibits, Financial Statement Schedules.

Documents filed as part of this report:

1)Financial Statements.

The following are included within Item 8. Financial Statements and Supplementary Data of the Original Form 10-K.

◦Report of Independent Registered Public Accounting Firm by PricewaterhouseCoopers LLP in Stamford, Connecticut (PCAOB ID 238).

◦Consolidated Statements of Earnings and Comprehensive Income for the fiscal years ended September 30, 2024, 2023 and 2022.

◦Consolidated Balance Sheets as of September 30, 2024 and 2023.

◦Consolidated Statements of Cash Flows for the fiscal years ended September 30, 2024, 2023 and 2022.

◦Consolidated Statements of Changes in Shareholders’ Equity for the period from October 1, 2021 to September 30, 2024.

◦Notes to Consolidated Financial Statements.

2)Financial Statement Schedules.

Schedule II - Valuation and Qualifying Accounts is included within Item 15. Financial Statements and Supplementary Data of the Original Form 10-K.

3)Exhibits.

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Exhibit |

| 2.1**** | |

| |

| 2.2**** | |

| |

| 2.3**** | |

| |

| 2.4**** | |

| |

| 2.5**** | |

| |

| 2.6 | |

| |

| 2.7 | |

| |

| 3.1 | |

| |

| 3.2 | |

| |

| 3.3 | |

| |

| 4.1 | |

| | |

| 4.2 | |

| | |

| 4.3 | |

| | |

| 10.1 | Credit Agreement, dated June 1, 2015, by and among the Company, as borrower, JPMorgan Chase Bank, N.A., as administrative agent, and Bank of America, N.A., The Bank of Tokyo-Mitsubishi UFJ, Ltd., and Citibank, N.A., as co-syndication agents (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed June 1, 2015). |

| | |

| 10.2 | Omnibus Amendment No. 1 dated as of September 25, 2015 to Credit Agreement and Subsidiary Guaranty by and among Edgewell Personal Care Company, as borrower, Edgewell Personal Care Brands, LLC, as new subsidiary borrower, certain other subsidiaries of Edgewell, as subsidiary guarantors, JPMorgan Chase Bank, N.A., as administrative agent, Bank of America, N.A., The Bank of Tokyo-Mitsubishi UFJ, Ltd., and Citibank, N.A., as co-syndication agents, and the various lenders who are a party thereto (incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed September 29, 2015). |

| |

| 10.3 | Amendment No. 2 to Credit Agreement by and among Edgewell Personal Care Company, as borrower, Edgewell Personal Care Brands, LLC, as subsidiary borrower, certain other subsidiaries of Edgewell Personal Care Company, as subsidiary guarantors, JPMorgan Chase Bank, N.A., as administrative agent, and the various lenders who are a party thereto (incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed April 29, 2016). |

| |

| 10.4 | Amendment No. 3 to Credit Agreement dated as of March 13, 2017, by and among Edgewell Personal Care Company, as borrower, Edgewell Personal Care Brands, LLC, as subsidiary borrower, certain other subsidiaries of Edgewell Personal Care Company, as subsidiary guarantors, JPMorgan Chase Bank, N.A., as administrative agent, Bank of America, N.A., as syndication agent, and the various lenders who are a party thereto (incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed March 14, 2017). |

| |

| 10.5 | Increasing Lender Supplement dated as of March 13, 2017, by and among The Bank of Tokyo-Mitsubishi UFJ, Ltd., as increasing lender, Edgewell Personal Care Company, as borrower, and JPMorgan Chase Bank, N.A., as administrative agent (incorporated by reference to Exhibit 10.2 to the Company's Current Report on Form 8-K filed March 14, 2017). |

| |

| | | | | |

| 10.6 | |

| | |

| 10.7 |

|

| |

| 10.8 | Master Accounts Receivable Purchase Agreement dated as of September 15, 2017 among Edgewell Personal Care, LLC, as the Seller, Edgewell Personal Care Company, as Guarantor, and The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch, as the Purchaser (incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed September 19, 2017). |

| |

| 10.9 | |

| |

| 10.10 | |

| |

| 10.11 | Credit Agreement, dated as of March 28, 2020, by and among, inter alia, the Company, the subsidiaries of the Company from time to time parties thereto, the lenders from time to time parties thereto, MUFG, as syndication agent, TD as joint lead arranger and BofA, as administrative agent and collateral agent (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed April 2, 2020). |

| |

| 10.12 | |

| |

| 10.13 | |

| |

| 10.14 | |

| |

| 10.15 | |

| | |

| 10.16 | |

| | |

| 10.17 | |

| | |

| 10.18*** | |

| |

| 10.19*** | |

| |

| 10.20*** | |

| |

| 10.21*** | |

| |

| |

| 10.22*** | |

| |

| |

| 10.23*** | |

| |

| 10.24*** | |

| |

| 10.25*** | |

| |

| 10.26*** | |

| |

| | | | | |

| 10.27*** | |

| |

| 10.28*** | |

| |

| 10.29*** | |

| |

| 10.30*** | |

| |

| 10.31*** | |

| |

| 10.32*** | |

| |

| 10.33*** | |

| |

| 10.34*** | |

| |

| 10.35*** | |

| |

| 10.36*** | |

| |

| 10.37*** | |

| |

| 10.38*** | |

| | |

| 10.39*** | |

| |

| 10.40*** | |

| |

| 10.41*** | |

| |

| 10.42*** | |

| |

| 10.43*** | |

| |

| 10.44*/*** | |

| |

| 19.1* | |

| |

| 21.1 | |

|

|

| 23.1 | |

| | |

| 31.1 | |

| | |

| 31.2 | |

| | |

| | | | | |

31.3* | |

31.4* | |

| |

| 32.1 | |

| | |

| 32.2 | |

| |

| 97.1* | |

| |

| 101* | The following materials from the Edgewell Personal Care Company Annual Report on Form 10-K formatted in inline eXtensible Business Reporting Language (iXBRL): (i) the Consolidated Statements of Earnings and Comprehensive Income for the years ended September 30, 2022, 2023 and 2024, (ii) the Consolidated Balance Sheets at September 30, 2023 and 2024, (iii) the Consolidated Statements of Cash Flows for the years ended September 30, 2022, 2023 and 2024, (iv) Consolidated Statements of Changes in Shareholders’ Equity for the period from October 1, 2021 to September 30, 2024, and (v) Notes to Consolidated Financial Statements for the year ended September 30, 2024. |

| |

| 104* | Cover Page Interactive Data File (cover page XBRL tags are embedded within the Inline XBRL document). |

*Filed herewith.

**Furnished herewith.

***Denotes a management contract or compensatory plan or arrangement.

****The Company hereby undertakes to furnish supplementally a copy of any omitted schedule or exhibit to such agreement to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| EDGEWELL PERSONAL CARE COMPANY |

| | | |

| | By: | /s/ Rod R. Little | |

| | | Rod R. Little |

| | | President and Chief Executive Officer |

Date: November 21, 2024

EDGEWELL PERSONAL CARE COMPANY

2ND AMENDED AND RESTATED 2018 STOCK INCENTIVE PLAN

(As Amended and Restated Effective February 3, 2023)

SECTION 1. PURPOSE

The purpose of the Edgewell Personal Care Company 2nd Amended and Restated 2018 Stock Incentive Plan (the “Plan”) is to promote shareholder value and the future success of Edgewell Personal Care Company (the “Company”) by providing appropriate retention and performance incentives to the employees and non-employee directors of the Company and its Affiliates, and any other individuals who perform services for the Company or any of its Affiliates.

SECTION 2. DEFINITIONS

2.1 “Affiliate” means any entity in which the Company has a direct or indirect equity interest of 50 percent or more, and any other entity in which the Company has a substantial ownership interest and which has been designated as an Affiliate for purposes of the Plan by the Committee in its sole discretion.

2.2 “Award” means any form of incentive or performance award granted under the Plan to a Participant by the Committee pursuant to any terms and conditions that the Committee may establish and set forth in the applicable Award Agreement. Awards granted under the Plan may consist of: (a) Stock Options granted pursuant to Section 7; (b) Stock Appreciation Rights granted pursuant to Section 8; (c) Restricted Stock granted pursuant to Section 9; (d) Restricted Stock Equivalents granted pursuant to Section 9; (e) Other Stock-Based Awards granted pursuant to Section 10; and (f) Performance Grants granted pursuant to Section 11.

2.3 “Award Agreement” means the written or electronic document(s) evidencing the grant of an Award to a Participant.

2.4 “Board” shall mean the Board of Directors of the Company.

2.5 “Change of Control” means the occurrence of a change of control of a nature that would be required to be reported in response to Item 6(e) of Schedule 14A of Regulation 14A promulgated under the Exchange Act, whether or not the Company is then subject to such reporting requirement; provided that, without limitation, such a Change of Control shall be deemed to have occurred if a Section 409A Change of Control occurs.

2.6 “Code” means the Internal Revenue Code of 1986, as amended, and the Treasury Regulations promulgated and other official guidance issued thereunder.

2.7 “Committee” means the Human Capital & Compensation Committee of the Board, or any successor committee that the Board may designate to administer the Plan, provided such Committee consists of two or more individuals. Each member of the Committee shall be (a) a “Non- Employee Director” within the meaning of Rule 16b-3 under the Exchange Act, and (b) a non- employee director meeting the independence requirements for Human Capital & Compensation Committee members under the rules and regulations of the Exchange on which the shares of Common Stock are traded. References to “Committee” shall include persons to whom the Committee has delegated authority pursuant to Section 3.4.

2.8 “Common Stock” means the common stock, par value $.01 per share, of the Company, and stock of any other class or company into which such shares may thereafter be changed.

2.9 “Company” means Edgewell Personal Care Company, a Missouri corporation.

2.10 “Defined Event” means the death, Disability, retirement or involuntary termination of a Participant other than for cause, or, subject to Section 6.7, in connection with a Change of Control of the Company.

2.11 “Delay Period” has the meaning given such term in Section 13.2(c).

2.12 “Disability” with respect to a Participant, has the meaning assigned to such term under the long-term disability plan maintained by the Company or an Affiliate in which such Participant is covered at the time the determination is made, and if there is no such plan, means the permanent inability as a result

of accident or sickness to perform any and every duty pertaining to such Participant’s occupation or employment for which the Participant is suited by reason of the Participant’s previous training, education and experience; provided that, to the extent an Award subject to Section 409A shall become payable upon a Participant’s Disability, a Disability shall not be deemed to have occurred for such purposes unless the circumstances would also result in a “disability” within the meaning of Section 409A, unless otherwise provided in the Award Agreement.

2.13 “Effective Date” means the date on which the Plan, as amended and restated, is approved by the shareholders of the Company pursuant to Section 19.

2.14 “Exchange” means the New York Stock Exchange, or such other principal securities market on which the shares of Common Stock are traded.

2.15 “Exchange Act” means the Securities Exchange Act of 1934, as amended, and the regulations and interpretations thereunder.

2.16 “Fair Market Value” of a share of Common Stock as of any specific date means (a) the per share closing price reported by the Exchange on such date, or, if there is no such reported closing price on such date, then the per share closing price reported by the Exchange on the last previous day on which such closing price was reported, or (b) such other value as determined by the Committee in accordance with applicable law. The Fair Market Value of any property other than shares of Common Stock means the market value of such property as determined by the Committee using such methods or procedures as it shall establish from time to time.

2.17 “Incentive Stock Option” means a Stock Option that qualifies as an incentive stock option under Section 422 of the Code.

2.18 “Nonqualified Stock Option” means a Stock Option that does not qualify as an Incentive Stock Option or which is designated a Nonqualified Stock Option.

2.19 “Other Stock-Based Award” means an Award denominated in shares of Common Stock that is granted subject to certain terms and conditions pursuant to Section 10.

2.20 “Participant” means an individual who has been granted an Award under the Plan, or in the event of the death of such individual, the individual’s beneficiary under Section 15.

2.21 “Performance Grant” means an Award subject to the terms, conditions and restrictions described in Section 11, pursuant to which the Participant may become entitled to receive cash, shares of Common Stock or other property, or any combination thereof, as determined by the Committee.

2.22 “Plan” has the meaning given such term in Section 1.

2.23 “Prior Plan” means the Edgewell Personal Care Company Amended and Restated 2018 Stock Incentive Plan.

2.24 “Qualifying Award” means an Award described in Section 12 granted under the Plan with the intent that such Award qualify as “performance-based compensation” for purposes of Section 162(m) of the Code.

2.25 “Remaining Number of Available Shares” has the meaning given such term in Section 5.1(a).

2.26 “Reprice” means: (a) the reduction, directly or indirectly, in the per-share exercise price of an outstanding Stock Option or Stock Appreciation Right by amendment, cancellation or substitution; (b) any action that is treated as a repricing under United States generally accepted accounting principles; (c) canceling a Stock Option or Stock Appreciation Right in exchange for another Stock Option, Stock Appreciation Right or other equity security (unless the cancellation and exchange occurs in connection with a merger, acquisition, or similar transaction); and (d) any other action that is treated as a repricing by the rules or regulations of the Exchange.

2.27 “Restricted Period” means the period during which Restricted Stock may not be sold, assigned, transferred, pledged, hypothecated or otherwise disposed of.

2.28 “Restricted Stock” means an Award of shares of Common Stock that is granted subject to certain terms and conditions pursuant to Section 9.

2.29 “Restricted Stock Equivalent” means an Award of a right to receive shares of Common Stock (or an equivalent value in cash or other property, or any combination thereof) that is granted subject to certain terms and conditions pursuant to Section 9.

2.30 “Section 409A” means Section 409A of the Code.

2.31 “Section 409A Change of Control” means:

(a) the acquisition by one person, or more than one person acting as a group, of ownership of stock of the Company that, together with stock held by such person or group, constitutes more than 50 percent of the total fair market value or total voting power of the stock of the Company. Notwithstanding the above, if any person or more than one person acting as a group, is considered to own more than 50 percent of the total fair market value or total voting power of the stock of the Company, the acquisition of additional stock by the same person or persons will not constitute a Change of Control;

(b) the acquisition by one person, or more than one person acting as a group, of ownership of stock of the Company, that together with stock of the Company acquired during the 12-month period ending on the date of the most recent acquisition by such person or group, constitutes 30 percent or more of the total voting power of the stock of the Company. Notwithstanding the above, if any person or more than one person acting as a group is considered to own 30 percent or more of the total fair market value or total voting power of the stock of the Company, the acquisition of additional stock by the same person or persons will not constitute a Change of Control;

(c) a majority of the members of the Company’s Board is replaced during any 12-month period by directors whose appointment or election is not endorsed by a majority of the members of the Company’s Board before the date of the appointment or election; or

(d) one person, or more than one person acting as a group, acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by such person or group) assets from the Company that have a total gross fair market value (determined without regard to any liabilities associated with such assets) equal to or more than 40 percent of the total gross fair market value of all of the assets of the Company immediately before such acquisition or acquisitions.

Persons will not be considered to be acting as a group solely because they purchase or own stock of the same corporation at the same time, or as a result of the same public offering. However, persons will be considered to be acting as a group if they are owners of a corporation that enters into a merger, consolidation, purchase or acquisition of stock, or similar business transaction with the Company. This definition of Change of Control shall be interpreted in accordance with, and in a manner that will bring the definition into compliance with, Section 409A.

2.32 “Stock Appreciation Right” means a right to receive (without payment to the Company) cash, shares of Common Stock or other property, or any combination thereof, as determined by the Committee, based on the increase in the value of a share of Common Stock over the per share exercise price, that is granted subject to certain terms and conditions pursuant to Section 8.

2.33 “Stock Option” means a right to purchase shares of Common Stock at a specified exercise price that is granted subject to certain terms and conditions pursuant to Section 7 and includes both Incentive Stock Options and Nonqualified Stock Options.

2.34 “Treasury Regulations” means the tax regulations promulgated under the Code.

SECTION 3. ADMINISTRATION

3.1 Administration. Except as otherwise specified herein, the Plan shall be administered solely by the Committee.

3.2 Authority.

(a) Subject only to Section 6.3, the Committee has all the powers vested in it by the terms of the Plan set forth herein, such powers to include exclusive authority to select the employees and other individuals to be granted Awards under the Plan, to determine the type, size and terms of the Award to be made to each individual selected, to modify the terms of any Award that has been granted, to determine the time when Awards will be granted, to establish performance objectives, and to prescribe the form of Award Agreement.

(b) The Committee has the power and authority to make any adjustments necessary or desirable as a result of the granting of Awards to eligible individuals located outside the United States, and to adopt, to amend or to rescind rules, procedures or subplans relating to the operation and administration of the Plan in order to accommodate local laws, policies, customs, procedures or practices, and accounting, tax or other regulatory standards, or to facilitate the administration of the Plan, including, but not limited to, the authority to adopt, to amend or to rescind rules, procedures and subplans that limit or vary: the methods available to exercise Awards; the methods available to settle Awards; the methods available for the

payment of income taxes, social insurance contributions and employment taxes; the procedures for withholding on Awards; and the use of stock certificates or other indicia of ownership. The Committee may also adopt rules, procedures or subplans applicable to particular Affiliates or locations.

(c) The Committee is authorized to interpret the Plan and the Awards granted under the Plan, to establish, amend and rescind any rules and regulations relating to the Plan, and to make any other determinations that it deems necessary or desirable for the administration of the Plan. The Committee may correct any defect or supply any omission or reconcile any inconsistency in the Plan or in any Award in the manner and to the extent the Committee deems necessary or desirable to carry it into effect. Any decision of the Committee in the interpretation and administration of the Plan, as described herein, shall lie within its sole and absolute discretion and shall be final, conclusive and binding on all parties concerned.

3.3 Repricing Prohibited Absent Shareholder Approval. Notwithstanding any provision of the Plan, except for adjustments pursuant to Section 14, neither the Board nor the Committee may Reprice, adjust or amend the exercise price of Stock Options or Stock Appreciation Rights previously awarded to any Participant, whether through amendment, cancellation and replacement grant, or any other means, unless such action is approved by the shareholders of the Company. In addition, notwithstanding any other provision in the Plan to the contrary, a Stock Option may not be surrendered in consideration of, or exchanged for cash, other Awards, or a new Stock Option having an exercise price below that of the Stock Option which was surrendered or exchanged, unless the exchange occurs in connection with a merger, acquisition, or similar transaction as set forth in Section 14, or such action is approved by the shareholders of the Company. Any amendment or repeal of this Section 3.3 shall require the approval of the shareholders of the Company.

3.4 Delegation. The Committee may authorize any one or more of its members or any officer of the Company to execute and deliver documents or to take any other action on behalf of the Committee with respect to Awards made or to be made to Participants, subject to the requirements of applicable law, including without limitation, Section 16 of the Exchange Act and Section 162(m) of the Code.

3.5 Indemnification. No member of the Committee and no officer of the Company shall be liable for anything done or omitted to be done by him, by any other member of the Committee or by any officer of the Company in connection with the performance of duties under the Plan, except for his own willful misconduct or gross negligence, or as expressly provided by applicable law, and the Company shall indemnify each member of the Committee and officer of the Company against any such liability.

SECTION 4. PARTICIPATION

Consistent with the purposes of the Plan, subject to Section 6.3, the Committee shall have exclusive power to select the employees of the Company and its Affiliates and other individuals performing services for the Company and its Affiliates who may participate in the Plan and be granted Awards under the Plan.

SECTION 5. SHARES SUBJECT TO PLAN AND SHARE LIMITS

5.1 Maximum Number of Shares that May Be Issued.

(a) Available Shares. Subject to adjustment as provided in Section 14, the maximum number of shares of Common Stock reserved and available for grant and issuance pursuant to the Plan as of the Effective Date shall be 5,850,000, plus the number of remaining shares of Common Stock not issued or subject to outstanding grants under the Prior Plan on February 6, 2020 (the “Remaining Number of Available Shares”), plus any shares of Common Stock that are subject to awards granted under the Prior Plan that expire, are forfeited or canceled or terminate for any other reason after February 6, 2020 without the issuance of shares. For the avoidance of doubt, any shares of Common Stock that are subject to outstanding awards granted under the Prior Plan that are used to pay the exercise price of an option or withheld to satisfy the tax withholding obligations related to any award under the Prior Plan after February 6, 2020 shall not become available under the Plan. No awards may be granted under the Prior Plan on or after February 3, 2023.

(b) Assumed or Substituted Awards. Awards granted through the assumption of, or substitution for, outstanding awards previously granted by a company acquired by the Company or any Affiliate, or with

which the Company or any Affiliate combines, shall not reduce the maximum number of shares of Common Stock that may be issued under the Plan as described in Section 5.1(a) or the maximum number of shares of Common Stock authorized for grant to an individual in any calendar year described in Section 5.2.

(c) Share Counting.

(i) For purposes of counting shares against the maximum number of shares of Common Stock that may be issued under the Plan as described in Section 5.1(a), on the date of grant, Awards denominated solely in shares of Common Stock (such as Stock Options and Restricted Stock) and other Awards that may be exercised for, settled in or convertible into shares of Common Stock will be counted against the Plan reserve on the date of grant of the Award based on the maximum number of shares that may be issued pursuant to the Award, as determined by the Committee.

(ii) Any shares of Common Stock granted in connection with Options and Stock Appreciation Rights shall be counted against the maximum number of shares of Common Stock that may be issued under the Plan as described in Section 5.1(a) as one share for every one Option or Stock Appreciation Right granted, and any shares of Common Stock granted in connection with Awards other than Options and Stock Appreciation Rights shall be counted against the maximum number of shares of Common Stock that may be issued under the Plan as described in Section 5.1(a) as 1.95 shares of Common Stock for every one share of Common Stock granted in connection with such Award.

(d) Shares Added Back. Shares of Common Stock related to Awards issued under the Plan that are forfeited, canceled, expired or otherwise terminated without the issuance of shares of Common Stock will again be available for issuance under the Plan. Any shares of Common Stock added back shall be added back as one share if such shares of Common Stock were subject to Stock Options or Stock Appreciation Rights, and as 1.95 shares if such shares of Common Stock were subject to other Awards. The following shares of Common Stock, however, may not again be made available for grant in respect of Awards under the Plan:

(i) shares of Common Stock delivered to, or retained by the Company, in payment of the exercise price of a Stock Option;

(ii) shares of Common Stock delivered to, or retained by the Company, in satisfaction of the tax withholding obligations with respect to an Award;

(iii) shares of Common Stock covered by a stock-settled Stock Appreciation Right or other Award that were not issued upon the settlement of the Stock Appreciation Right or other Award; and

(iv) shares of Common Stock repurchased on the open market with the proceeds from the payment of the exercise price of a Stock Option.

(e) Source of Shares. Shares of Common Stock issued pursuant to the Plan may be authorized but unissued shares, treasury shares, reacquired shares or any combination thereof.

(f) Fractional Shares. No fractional shares of Common Stock may be issued under the Plan, and unless the Committee determines otherwise, an amount in cash equal to the Fair Market Value of any fractional share of Common Stock that would otherwise be issuable shall be paid in lieu of such fractional share of Common Stock. The Committee may, in its sole discretion, cancel, terminate, otherwise eliminate or transfer or pay other securities or other property in lieu of issuing any fractional share of Common Stock.

5.2 Maximum Individual Limits. For awards granted to individuals other than non- employee directors:

(a) subject to adjustment as provided in Section 14, the maximum number of shares of Common Stock that may be granted to any individual during any one calendar year under all Awards shall be 500,000; and

(b) the maximum amount of cash that may be paid to a Participant during any one calendar year under all Performance Grants shall be $20,000,000.

For purposes of Section 5.2(b), the calendar year or years in which amounts under Awards are deemed paid or received shall be as determined by the Committee and any deferral of Award settlement or payment permitted or required by the Committee pursuant to Section 13 of the Plan shall be disregarded for purposes of such limits.

SECTION 6. AWARDS UNDER THE PLAN

6.1 Types of Awards. Awards under the Plan may include one or more of the following types: Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Equivalents, Other Stock-Based Awards and Performance Grants. As provided by Section 3.2(b), the Committee may also grant any other Award providing similar benefits, subject to such terms, conditions and restrictions as it may determine necessary or appropriate to satisfy non-U.S. law or regulatory requirements or avoid adverse consequences under such requirements.

6.2 Dividend Equivalents. Other than with respect to Stock Options or Stock Appreciation Rights, the Committee may choose, at the time of the grant of an Award or any time thereafter up to the time of the Award’s payment, to include or to exclude as part of such Award an entitlement to receive cash dividends or dividend equivalents, subject to such terms, conditions, restrictions or limitations, if any, as the Committee may establish. Dividends and dividend equivalents shall be paid in such form and manner (i.e., lump sum or installments), and at such times as the Committee shall determine; provided, however, dividends or dividend equivalents shall only be paid with respect to any Award if, when and to the extent that the underlying Award vests, and dividends and dividend equivalents shall, at the Committee’s discretion, be held in escrow (with or without the accrual of interest), or be reinvested into additional shares of Common Stock subject to the same vesting or performance conditions as the underlying Award.

6.3 Non-Employee Director Awards. In respect of Awards granted to non-employee directors of the Company or its Affiliates, the Board has all the powers otherwise vested in the Committee by the terms of the Plan set forth herein, including the exclusive authority to select the non-employee directors to be granted Awards under the Plan, to determine the type, size and terms of the Award to be made to each non-employee director selected, to modify the terms of any Award that has been granted to a non-employee director, to determine the time when Awards will be granted to non-employee directors and to prescribe the form of the Award Agreement embodying Awards made under the Plan to non-employee directors. The aggregate maximum Fair Market Value (determined as of the date of grant) of the shares of Common Stock with respect to which Awards are granted under the Plan in any calendar year to any non- employee director in respect of services as a non-employee director shall not exceed $500,000. The maximum amount that may be paid in any calendar year to any non-employee director in property other than shares of Common Stock (including cash) in respect of services as a non- employee director shall not exceed $500,000.

6.4 Transferability. An Award and a Participant’s rights and interest under an Award may not be sold, assigned or transferred, hypothecated or encumbered in whole or in part either directly or by operation of law or otherwise (except in the event of the Participant’s death) including, but not by way of limitation, execution, levy, garnishment, attachment, pledge, bankruptcy or in any other manner; provided, however, that the Committee may allow a Participant to assign or transfer without consideration an Award to one or more members of his immediate family, to a partnership of which the only partners are the Participant or members of the Participant’s immediate family, to a trust established by the Participant for the exclusive benefit of the Participant or one or more members of his immediate family or pursuant to a domestic relations order (as defined in the Code).

6.5 Exclusion from Minimum Vesting Requirements. Awards granted under Section 7, Section 8, Section 9, Section 10, Section 11 and Section 12 shall be subject to the minimum vesting period and continued employment or provision of service requirement specified for the Award by such Section, as applicable, except that:

(a) up to a maximum of five percent of the maximum number of shares of Common Stock that may be issued under the Plan pursuant to Section 5.1(a) may be issued pursuant to Awards granted under Section 7, Section 8, Section 9, Section 10, Section 11 or Section 12 without regard for any minimum vesting period or continued employment or provision of service requirements set forth in such Sections; and

(b) continued employment or provision of service for exercisability or vesting shall not be required (i) as the Committee may determine or permit otherwise in connection with the occurrence of a Defined Event, and (ii) as may be required or otherwise be deemed advisable by the Committee in connection with an Award granted through the assumption of, or substitution for, outstanding awards previously

granted by a company acquired by the Company or any Affiliate or with which the Company or any Affiliate combines.

6.6 Award Agreement. Unless otherwise determined by the Committee, each Award shall be evidenced by an Award Agreement in such form as the Committee shall prescribe from time to time in accordance with the Plan, including a written agreement, contract, certificate or other instrument or document containing the terms and conditions of an individual Award granted under the Plan which may, in the discretion of the Company, be transmitted electronically. Each Award and Award Agreement shall be subject to the terms and conditions of the Plan.

6.7 Change of Control. The Committee may include in an Award Agreement provision related to a Change of Control, including without limitation the acceleration of the exercisability, vesting or settlement of, or the lapse of restrictions or deemed satisfaction of performance objectives with respect to, an Award; provided that, in addition to any other conditions provided for in the Award Agreement:

(a) any acceleration of the exercisability, vesting or settlement of, or the lapse of restrictions or deemed satisfaction of performance objectives with respect to, an Award in connection with a Change of Control may occur only if (i) the Change of Control occurs and (ii) either (A) the employment of the Participant is terminated (as set forth in the Award Agreement) (i.e., “double-trigger”) or (B) the acquirer does not agree to the assumption or substitution of outstanding Awards; and

(b) with respect to any Award granted under the Plan that is earned or vested based upon achievement of performance objectives (including but not limited to Performance Grants), any amount deemed earned or vested in connection with a Change of Control or associated termination of employment shall be based upon the degree of performance attainment and/or the period of time elapsed in the performance period as of the applicable date.

6.8 Forfeiture Provisions. The Committee may, in its discretion, provide in an Award Agreement that an Award shall be canceled if the Participant, without the consent of the Company, while employed by or providing services to the Company or any Affiliate or after termination of such employment or service, violates a non-competition, non-solicitation or non- disclosure covenant or agreement, or otherwise engages in activity that is in conflict with or adverse to the interest of the Company or any Affiliate, including fraud or conduct contributing to any financial restatements or irregularities, as determined by the Committee in its sole discretion. Notwithstanding the foregoing, none of the non-disclosure restrictions in this Section 6.8 or in any Award Agreement shall, or shall be interpreted to, impair the Participant from exercising any legally protected whistleblower rights (including under Rule 21F under the Exchange Act).

6.9 Recoupment Provisions. Notwithstanding anything in the Plan or in any Award Agreement to the contrary, the Company will be entitled to the extent required by applicable law (including, without limitation, Section 10D of the Exchange Act and any regulations promulgated with respect thereto) or Exchange listing conditions, in each case as in effect from time to time, to recoup compensation of whatever kind paid under the Plan by the Company at any time.

SECTION 7. STOCK OPTIONS

7.1 Grant of Stock Options. The Committee may grant Awards of Stock Options. The Committee may grant Incentive Stock Options to any employee provided the terms of such grants comply with the provisions of Section 422 of the Code, and that any ambiguities in construction shall be interpreted in order to effectuate that intent. Each Stock Option granted under the Plan shall comply with the following terms and conditions, and with such other terms and conditions, including, but not limited to, restrictions upon the Stock Option or the shares of Common Stock issuable upon exercise thereof or the attainment of performance objectives as the Committee may determine, including but not limited to such performance objectives described in Section 12.2, as the Committee, in its discretion, shall establish.

7.2 Exercise Price; Expiration Date. Except for Stock Options granted through the assumption of, or substitution for, outstanding awards previously granted by a company acquired by the Company or any Affiliate, or with which the Company or any Affiliate combines, the exercise price shall be equal to or greater than the Fair Market Value of the shares of Common Stock subject to such Stock Option on the date that the Stock Option is granted. The Committee in its discretion shall establish the expiration date of a Stock Option; provided that in no event shall the expiration date be later than 10 years from the date that the Stock Option is granted.

7.3 Number of Shares of Common Stock. The Committee shall determine the number of shares of Common Stock to be subject to each Stock Option.

7.4 Minimum Vesting Period. Except as otherwise permitted by Section 6.5, Stock Options shall not vest for at least one year after the date of grant.

7.5 Exercisability. The Stock Option shall not be exercisable unless the Stock Option has vested, and payment in full of the exercise price for the shares of Common Stock being acquired thereunder at the time of exercise is made in such form as the Committee may determine in its discretion, including, but not limited to:

(a) cash;

(b) if permitted by the Committee, by instructing the Company to withhold a number of shares of Common Stock that would otherwise be issued having a Fair Market Value equal to the applicable portion of the exercise price being so paid;

(c) if permitted by the Committee, by tendering (actually or by attestation) to the Company a number of previously acquired shares of Common Stock that have been held by the Participant for at least six months (or such short period, if any, determined by the Committee in consideration of applicable accounting standards) and that have a Fair Market Value equal to the applicable portion of the exercise price being so paid;

(d) if permitted by the Committee, by authorizing a third party to sell, on behalf of the Participant, the appropriate number of shares of Common Stock otherwise issuable to the Participant upon the exercise of the Stock Option and to remit to the Company a sufficient portion of the sale proceeds to pay the entire exercise price and any tax withholding resulting from such exercise; or

(e) any combination of the foregoing.

7.6 Limitations for Incentive Stock Options. The terms and conditions of any Incentive Stock Options granted hereunder shall be subject to and shall be designed to comply with the provisions of Section 422 of the Code. To the extent that the aggregate Fair Market Value (determined as of the date of grant) of the shares of Common Stock with respect to which Incentive Stock Options are exercisable for the first time by any individual during any calendar year (under all plans of the Company and its Affiliates) exceeds $100,000 (or such other limit that applies at the time the Incentive Stock Options are granted), such Incentive Stock Options or portions thereof which exceed such limit (according to the order in which they were granted) shall be treated as Nonqualified Stock Options. If, at the time an Incentive Stock Option is granted, the employee recipient owns (after application of the rules contained in Section 424(d) of the Code) shares of Common Stock possessing more than 10 percent of the total combined voting power of all classes of stock of the Company or its subsidiaries, then: (a) the exercise price for such Incentive Stock Option shall be at least 110 percent of the Fair Market Value of the shares of Common Stock subject to such Incentive Stock Option on the date of grant; and (b) such Incentive Stock Option shall not be exercisable after the date five years from the date such Incentive Stock Option is granted. The maximum number of shares of Common Stock that may be issued under the Plan pursuant to Incentive Stock Options may not exceed, in the aggregate, the Remaining Number of Available Shares.

SECTION 8. STOCK APPRECIATION RIGHTS

8.1 Grant of Stock Appreciation Rights. The Committee may grant Awards of Stock Appreciation Rights. Each Award of Stock Appreciation Rights granted under the Plan shall comply with the following terms and conditions, and with such other terms and conditions, including, but not limited to, restrictions upon the Stock Appreciation Rights or the shares of Common Stock issuable upon exercise thereof or the attainment of performance objectives as the Committee may determine, including but not limited to such performance objectives described in Section 12.2, as the Committee, in its discretion, may establish.

8.2 Exercise Price; Expiration Date. Except for Stock Appreciation Rights granted through the assumption of, or substitution for, outstanding awards previously granted by a company acquired by the Company or any Affiliate, or with which the Company or any Affiliate combines, the exercise price shall be equal to or greater than the Fair Market Value of the shares of Common Stock subject to such Stock Appreciation Right on the date that the Stock Appreciation Right is granted. The Committee in its

discretion shall establish the expiration date of a Stock Appreciation Right; provided that in no event shall the expiration date be later than 10 years from the date that the Stock Appreciation Right is granted.

8.3 Number of Shares of Common Stock. The Committee shall determine the number of shares of Common Stock to be subject to each Award of Stock Appreciation Rights.

8.4 Minimum Vesting Period. Except as otherwise permitted by Section 6.5, Stock Appreciation Rights shall not vest for at least one year after the date of grant.

8.5 Exercisability. Stock Appreciation Rights shall not be exercisable unless the Stock Appreciation Rights have vested.

8.6 Exercise and Settlement. An Award of Stock Appreciation Rights shall entitle the Participant to exercise such Award and to receive from the Company in exchange therefore, without payment to the Company, that number of shares of Common Stock having an aggregate Fair Market Value equal to (or, in the discretion of the Committee, less than) the excess of the Fair Market Value of one share of Common Stock, at the date of such exercise, over the exercise price per share, times the number

of shares of Common Stock for which the Award is being exercised. The Committee shall be entitled in its discretion to elect to settle the obligation arising out of the exercise of a Stock Appreciation Right by the payment of cash or other property, or any combination thereof, as determined by the Committee, equal to the aggregate Fair Market Value of the shares of Common Stock it would otherwise be obligated to deliver.

SECTION 9. RESTRICTED STOCK; RESTRICTED STOCK EQUIVALENTS

9.1 Grant of Restricted Stock and Restricted Stock Equivalents. The Committee may grant Awards of Restricted Stock or Restricted Stock Equivalents. Each Award of Restricted Stock or Restricted Stock Equivalents under the Plan shall comply with the following terms and conditions, and with such other terms and conditions as the Committee, in its discretion, shall establish.

9.2 Number of Shares of Common Stock. The Committee shall determine the number of shares of Common Stock to be issued to a Participant pursuant to the Award, and the extent, if any, to which they shall be issued in exchange for cash, other consideration or a combination thereof.

9.3 Restricted Stock Issuance. Shares of Common Stock issued to a Participant in accordance with the Award of Restricted Stock may be issued in certificate form or through the entry of an uncertificated book position on the records of the Company’s transfer agent and registrar. The Company may impose appropriate restrictions on the transfer of such shares of Common Stock, which shall be evidenced in the manner permitted by law as determined by the Committee in its discretion, including but not limited to (a) causing a legend or legends to be placed on any certificates evidencing such Restricted Stock, or (b) causing “stop transfer” instructions to be issued, as it deems necessary or appropriate.

9.4 Vesting Conditions. The vesting of an Award of Restricted Stock or Restricted Stock Equivalents may be conditioned upon the attainment of specific performance objectives as the Committee may determine, including but not limited to such performance objectives described in Section 12.2.

9.5 Minimum Vesting Period. Except as otherwise permitted by Section 6.5, Restricted Stock and Restricted Stock Equivalents shall not vest for at least one year after the date of grant.

9.6 Shareholder Rights. Unless otherwise determined by the Committee in its discretion, prior to the expiration of the Restricted Period, a Participant to whom an Award of Restricted Stock has been made shall have ownership of such shares of Common Stock, including the right to vote the same and to receive dividends or other distributions made or paid with respect to such shares of Common Stock, subject, however, to the restrictions and limitations imposed thereon pursuant to the Plan or Award Agreement.

SECTION 10. OTHER STOCK-BASED AWARDS

10.1 Grant of Other Stock-Based Awards. The Committee may grant Other Stock-Based Awards. Each Other Stock-Based Award granted under the Plan shall comply with the following terms and conditions, and with such other terms and conditions as the Committee, in its discretion, shall establish.

10.2 Vesting Conditions. The vesting of Other Stock-Based Awards may be conditioned upon the attainment of specific performance objectives as the Committee may determine, including but not limited to such performance objectives described in Section 12.2.

10.3 Minimum Vesting Period. Except as otherwise permitted by Section 6.5, Other Stock-Based Awards shall not vest for at least one year after the date of grant.

10.4 Settlement. The Committee shall be entitled in its discretion to settle the obligation under an Other Stock-Based Award by the payment of cash, shares of Common Stock or other property, or any combination thereof.

SECTION 11. PERFORMANCE GRANTS

11.1 Grant of Performance Grants. The Committee may grant Awards of Performance Grants. The Award of a Performance Grant to a Participant will entitle the Participant to receive an amount in cash, shares of Common Stock or other property, or any combination thereof, determined by the Committee if the terms and conditions in the Plan and the Award Agreement are satisfied. The Award of a Performance Grant shall be subject to the following terms and conditions, and to such other terms and conditions, including but not limited to, restrictions upon any cash, shares of Common Stock or other property, or any combination thereof, issued in respect of the Performance Grant, as the Committee, in its discretion, shall establish.

11.2 Award Terms. The Committee shall determine the value or the range of values of a Performance Grant to be awarded to each Participant selected for an Award of a Performance Grant and the performance objectives (which may but need not include the performance objectives described in Section 12.2) upon which the vesting, payment or settlement of the Performance Grant is conditioned. Performance Grants may be issued in different classes or series having different names, terms and conditions.

11.3 Minimum Vesting Period. Except as otherwise permitted by Section 6.5, the vesting period shall be for a minimum of one year.

SECTION 12. QUALIFYING AWARDS

12.1 Grant of Qualifying Awards.

(a) The Committee may, in its sole discretion, grant a Qualifying Award under the Plan to any key employee. The provisions of this Section 12, as well as all other applicable provisions of the Plan not inconsistent with this Section 12, shall apply to all Qualifying Awards granted under the Plan, and any ambiguities in construction shall be interpreted to effectuate that intent. Qualifying Awards shall be of the type set forth in Section 12.1(b). However, nothing in the Plan shall be construed to require the Committee to grant any Qualifying Award and the Committee may, subject to the terms of the Plan, amend or take any other action with respect to previously granted Qualifying Awards in a way that disqualifies them as “performance-based compensation” under Section 162(m) of the Code.

(b) Qualifying Awards may be issued as Performance Grants granted under Section 11 or as any other Award whose vesting or payment is conditioned upon the achievement of the performance objectives described in Section 12.2, and Qualifying Awards shall be subject to the terms and conditions otherwise applicable to such Award, including, for the avoidance of doubt, a minimum vesting or performance period of one year, except as otherwise permitted by Section 6.5.

12.2 Performance Objectives. Amounts earned under Qualifying Awards shall be based upon the attainment of performance objectives established by the Committee in accordance with Section 162(m) of the Code. Such performance objectives may vary by Participant and by Award, and may be based upon the attainment of specific or per-share amounts of, or changes in, one or more, or a combination of two or more, of the following:

(a) earnings per share, net earnings per share or growth in such measures;

(b) revenue, net revenue, income, net income or growth in revenue or income (all either before or after taxes);

(c) return measures (including, but not limited to, return on assets, capital, investment, equity, revenue or sales);

(d) cash flow return on investments which equals net cash flows divided by owner’s equity;

(e) controllable earnings (a division’s operating profit, excluding the amortization of goodwill and intangible assets, less a charge for the interest cost for the average working capital investment by the division);

(f) operating earnings or net operating earnings;

(g) costs or cost control;

(h) share price (including, but not limited to, growth measures);

(i) total shareholder return (stock price appreciation plus dividends);

(j) economic value added;

(k) EBITDA;

(l) operating margin or growth in operating margin;

(m) market share or growth in market share;

(n) cash flow, cash flow from operations or growth in such measures;

(o) sales revenue or volume or growth in such measures, including total Company, divisional, or product line sales or net sales figures;

(p) gross margin or growth in gross margin;

(q) productivity;

(r) brand contribution;

(s) product quality;

(t) corporate value measures;

(u) goals related to acquisitions, divestitures or customer satisfaction;

(v) diversity;

(w) index comparisons;

(x) debt-to-equity or debt-to-stockholders’ equity ratio;

(y) working capital,

(z) risk mitigation;

(aa) sustainability and environmental impact; or

(bb) employee retention.

Performance may be measured on an individual, corporate group, business unit, subsidiary, division, department, region, function or consolidated basis and may be measured absolutely or relatively to the Company’s peers. In establishing performance objectives, the Committee may account for:

(i) the effects of acquisitions, divestitures, extraordinary dividends, stock split-ups, stock dividends or distributions, recapitalizations, warrants or rights issuances or combinations, exchanges or reclassifications with respect to any outstanding class or series of the Company’s common stock;

(ii) a corporate transaction, such as any merger of the Company with another corporation; any consolidation of the Company and another corporation into another corporation; any separation of the Company or its business units (including a spin-off or other distribution of stock or property by the Company);

(iii) any reorganization of the Company (whether or not such reorganization comes within the definition of such term in Section 368 of the Code), or any partial or complete liquidation by the Company, or sale of all or substantially all of the assets of the Company;

(iv) the impact of changes in tax rates or currency fluctuations or changes in accounting standards or treatments;

(v) advertising or promotional spending or capital expenditures outside of annual business plans;

(vi) events such as plant closings, sales of facilities or operations, and business restructurings; or

(vii) the impact of other extraordinary, unusual, non-recurring or infrequently recurring items.

In addition to the performance objectives, the Committee may also condition payment of any Qualifying Award upon the attainment of conditions, such as completion of a period of employment, notwithstanding that the performance objective specified in such Qualifying Award are satisfied.

12.3 Committee Negative Discretion. The Committee shall have the discretion, by Participant and by Qualifying Award, to reduce (but not to increase) some or all of the amount that would otherwise be payable under a Qualifying Award by reason of the satisfaction of the performance objectives set forth in such Qualifying Award. In making any such determination, the Committee is authorized in its discretion to

take into account any such factor or factors it determines are appropriate, including but not limited to Company, business unit and individual performance.

SECTION 13. PAYMENT OF AWARDS

13.1 Method of Payment. The Committee may, in its discretion, settle any Award through the payment of cash, the delivery of shares of Common Stock or other property, or a combination thereof, as the Committee shall determine or as specified by the Plan or an Award Agreement. Any Award settlement, including payment deferrals, may be subject to conditions, restrictions and contingencies as the Committee shall determine.

13.2 Deferred Compensation. The Committee may, in its discretion, permit the deferral of payment of an employee’s cash bonus, other cash compensation or an Award to a Participant under the Plan in the form of either shares of Common Stock or Common Stock equivalents (with each Common Stock equivalent corresponding to a share of Common Stock), under such terms and conditions as the Committee may prescribe in the Award Agreement relating thereto or a separate election form made available to such Participant, including the terms of any deferred compensation plan under which such Common Stock equivalents may be granted. In addition, the Committee may, in any year, provide for an additional matching deferral to be credited to an employee’s account under such deferred compensation plans. The Committee may also permit hypothetical account balances of other cash or mutual fund equivalents maintained pursuant to such deferred compensation plans to be converted, at the discretion of the Participant, into the form of Common Stock equivalents, or to permit Common Stock equivalents to be converted into account balances of such other cash or mutual fund equivalents, upon the terms set forth in such plans as well as such other terms and conditions as the Committee may, in its discretion, determine. The Committee may, in its discretion, determine whether any deferral in the form of Common Stock equivalents, including deferrals under the terms of any deferred compensation plans of the Company, shall be paid on distribution in the form of cash or in shares of Common Stock. To the extent Section 409A is applicable, all actions pursuant to this Section 13.2 must satisfy the requirements of Section 409A, including but not limited to the following:

(a) a Participant’s election to defer must be filed at such time as designated by the Committee, but in no event later than the December 31 preceding the first day of the calendar year in which the services are performed which relate to the compensation or Award being deferred. An election may not be revoked or modified after such December 31. However, notwithstanding the previous two sentences, if the compensation or Award is subject to a forfeiture condition requiring the Participant’s continued services for a period of at least 12 months from the date the Participant obtains the legally binding right to the compensation or Award, the Committee may permit a Participant to file an election on or before the 30th day after the Participant obtains the legally binding right to the compensation or Award, provided that the election is filed at least 12 months in advance of the earliest date at which the forfeiture condition could lapse;

(b) a Participant’s election to defer must include the time and form of payment, within the parameters made available by the Committee, and such timing of payment must comply with Section 409A; and

(c) if payment is triggered due to the Participant’s termination of employment or separation from service, such termination or separation must be a “separation from service” within the meaning of Section 409A, and, for purposes of any such provision of the Plan or an election, references to a “termination,” “termination of employment” or like terms shall mean such a separation from service. The determination of whether and when a separation from service has occurred for this purpose shall be made in accordance with the presumptions set forth in Section 1.409A-1(h) of the Treasury Regulations, unless the Committee has established other rules in accordance with the requirements of Section 409A. If payment is made due to a Participant’s separation from service, and if at the time of the Participant’s separation from service, the Participant is a “specified employee” (within the meaning of Section 409A(2)(B)), then to the extent any payment or benefit that the Participant becomes entitled to under this provision on account of such separation from service would be considered nonqualified deferred compensation under Section 409A, such payment or benefit shall be paid or provided at the date which is the earlier of (i) six months and one day after such separation from service, and (ii) the date of the

Participant’s death (the “Delay Period”). All payments and benefits delayed pursuant to this provision shall be paid in a lump sum upon expiration of the Delay Period.

SECTION 14. DILUTION AND OTHER ADJUSTMENTS

14.1 Adjustment for Corporate Transaction or Change in Corporate Capitalization. In the event of any change in the outstanding shares of Common Stock of the Company by reason of any corporate transaction or change in corporate capitalization such as a stock split, stock dividend, split-up, split-off, spin-off, recapitalization, merger, consolidation, rights offering, reorganization, combination, consolidation, subdivision or exchange of shares, a sale by the Company of all or part of its assets, any distribution to shareholders other than a normal cash dividend, partial or complete liquidation of the Company or other extraordinary or unusual event, the Committee or Board, as applicable, shall make such adjustment in (a) the class and maximum number of shares of Common Stock that may be delivered under the Plan as described in Section 5.1 and the Award limits under Section 5.2 and Section 6.3, (b) the class, number and exercise price of outstanding Stock Options and Stock Appreciation Rights, and (c) the class and number of shares subject to any other Awards granted under the Plan (provided that the number of shares of any class subject to Awards shall always be a whole number), as may be determined to be appropriate by the Committee or Board, as applicable, and such adjustments shall be final, conclusive and binding for all purposes of the Plan.

14.2 Adjustment for Merger or Consolidation. In the event of any merger, consolidation or similar transaction as a result of which the holders of shares of Common Stock receive consideration consisting exclusively of securities of the surviving entity (or the parent of the surviving entity) in such transaction, the Committee or Board, as applicable, shall, to the extent deemed appropriate by the Committee or Board, as applicable, adjust each Award outstanding on the date of such merger, consolidation or similar transaction so that it pertains and applies to the securities which a holder of the number of shares of Common Stock subject to such Award would have received in such merger, consolidation or similar transaction.

14.3 Assumption or Substitution of Awards. In the event of a dissolution or liquidation of the Company; a sale of all or substantially all of the Company’s assets (on a consolidated basis); or a merger, consolidation or similar transaction involving the Company in which the holders of shares of Common Stock receive securities and/or other property, including cash, other than shares of the surviving entity in such transaction (or the parent of such surviving entity), the Committee or Board, as applicable, shall, to the extent deemed appropriate by the Committee or Board, as applicable, have the power to provide for the exchange of each Award (whether or not then exercisable or vested) for an Award with respect to: (a) some or all of the property which a holder of the number of shares of Common Stock subject to such Award would have received in such transaction; or (b) securities of the acquirer or surviving entity (or parent of such acquirer or surviving entity) and, incident thereto, make an equitable adjustment as determined by the Committee or Board, as applicable, in the exercise price of the Award, or the number of shares or amount of property subject to the Award or provide for a payment (in cash or other property) to the Participant to whom such Award was granted in partial consideration for the exchange of the Award; provided, however, that in the event that the acquirer does not agree to the assumption or substitution of Awards in the foregoing manner, the Committee shall, to the extent deemed appropriate by the Committee or Board, as applicable, have the power to cancel, effective immediately prior to the occurrence of such event, each Award (whether or not then exercisable or vested), and, in full consideration of such cancellation, pay to the Participant to whom such Award was granted an amount in cash, for each share of Common Stock subject to such Award, equal to the value, as determined by the Committee or Board, as applicable, of such Award, provided that with respect to any outstanding Stock Option or Stock Appreciation Right such value shall be equal to the excess of (i) the value, as determined by the Committee or Board, as applicable, of the property (including cash) received by the holder of shares of Common Stock as a result of such event, over (ii) the exercise price of such Stock Option or Stock Appreciation Right, provided further that the value of any outstanding Stock Option or Stock Appreciation Right shall be zero where the exercise price of such Stock Option or Stock Appreciation Right is greater than the value, as determined by the Committee or Board, as applicable, of the property

(including cash) received by the holder of shares of Common Stock as a result of such event; and that no change to the original timing of payment will be made to the extent it would violate Section 409A.

SECTION 15. DESIGNATION OF BENEFICIARY BY PARTICIPANT

A Participant may designate a beneficiary to exercise, or to receive any payment or settlement to which he may be entitled in respect of, any Award under the Plan in the event of his death in a manner determined by the Committee in its discretion. If a Participant did not designate a beneficiary under this Section 15, or if no designated beneficiary survives the Participant and is living on the date on which any amount becomes payable to such Participant, the term “beneficiary” as used in the Plan and any Award Agreement shall be deemed to be the legal representatives of the Participant’s estate. If there is any question as to the legal right of any beneficiary to receive a settlement or payment of (or to exercise) an Award under the Plan, the Committee in its discretion may determine that the Award in question be settled or paid to (or exercised by) the legal representatives of the Participant’s estate, in which event the Company, the Board and the Committee and the members thereof will have no further liability to anyone with respect to such Award.

SECTION 16. AMENDMENT OF PLAN OR AWARDS

The Plan may be amended in whole or in part at any time and from time to time by the Board, and the terms of any outstanding Award under the Plan may be amended from time to time by the Committee or Board, as applicable, in its discretion in any manner that it deems necessary or appropriate; provided however, that no amendment may be made without shareholder approval if such amendment would:

(a) increase the number of shares available for grant specified in Section 5.1 (other than pursuant to Section 14);

(b) decrease the minimum Stock Option exercise price set forth in Section 7.2 or the minimum Stock Appreciation Rights exercise price set forth in Section 8.2 (in each case, other than changes made pursuant to Section 14);

(c) reduce the minimum vesting or performance periods set forth in Section 7.4, Section 8.4, Section 9.5, Section 10.3, Section 11.3 and Section 12.1(b);

(d) change the Award limits set forth in Section 5.2 or Section 6.3 (other than pursuant to Section 14); or

(e) amend or repeal the prohibition against repricing or exchange set forth in Section 3.3.

No such amendment shall adversely affect in a material manner any right of a Participant under an Award without his written consent. Any shareholder approval requirement under the Plan will be met if such approval is obtained in accordance with applicable law. Notwithstanding the foregoing, any amendment to the Plan or any outstanding Award under the Plan shall be made in a manner as to ensure that an Award intended to be exempt from Section 409A will continue to be exempt from Section 409A and that an Award intended to comply with Section 409A will continue to comply with Section 409A.

SECTION 17. PLAN TERMINATION

17.1 Suspension. The Plan may be suspended in whole or in part at any time and from time to time by the Board

17.2 Termination. The Plan shall terminate upon the adoption of a resolution of the Board terminating the Plan. No Award may be granted under the Plan after the date that is 10 years from the date the Plan was last approved and adopted by the shareholders of the Company. No termination of the Plan shall materially alter or impair any of the rights or obligations of any person, without his consent, under any Award theretofore granted under the Plan, except that subsequent to termination of the Plan, the Committee may make amendments permitted under Section 16.

SECTION 18. MISCELLANEOUS PROVISIONS

18.1 Loans. No loans from the Company or any Affiliate to a Participant shall be permitted in connection with the Plan.

18.2 Reservation of Rights of Company. No employee or other person shall have any claim or right to be granted an Award under the Plan. Neither the Plan nor any action taken hereunder shall be construed as giving any employee or other person any right to continue to be employed by or perform services for the Company or any Affiliate, and the right to terminate the employment of or performance of services by any Participant at any time and for any reason is specifically reserved.

18.3 Non-Uniform Treatment. Determinations made by the Committee under the Plan need not be uniform and may be made selectively among eligible individuals under the Plan, whether or not such eligible individuals are similarly situated.

18.4 General Conditions of Awards. No Participant or other person shall have any right with respect to the Plan, the shares of Common Stock reserved for issuance under the Plan or in any Award, contingent or otherwise, until written evidence of the Award shall have been delivered to the recipient and all the terms, conditions and provisions of the Plan and the Award applicable to such recipient (and each person claiming under or through him) have been met.

18.5 Rights as a Shareholder. Unless otherwise determined by the Committee in its discretion, a Participant holding Stock Options, Stock Appreciation Rights, Restricted Stock Equivalents, Other Stock-Based Awards, Performance Grants or other Awards shall have no rights as a shareholder with respect to any shares of Common Stock (or as a holder with respect to other securities), if any, issuable pursuant to any such Award until the date of the issuance of a stock certificate to him or the entry on his behalf of an uncertificated book position on the records of the Company’s transfer agent and registrar for such shares of Common Stock or other instrument of ownership, if any. Except as provided in Section 14, no adjustment shall be made for dividends, distributions or other rights (whether ordinary or extraordinary, and whether in cash, securities, other property or other forms of consideration, or any combination thereof) for which the record date is prior to the date such book entry is made or a stock certificate or other instrument of ownership, if any, is issued.

18.6 Compliance with Applicable Laws. No shares of Common Stock or other property shall be issued or paid hereunder with respect to any Award unless counsel for the Company shall be satisfied that such issuance will be in compliance with applicable federal, state, local and foreign legal, securities exchange and other applicable requirements. The Company shall be under no obligation to effect the registration pursuant to the Securities Act of 1933, as amended, of any shares of Common Stock to be issued hereunder or to effect similar compliance under any state or local laws.