Saba Capital Issues Letter Sent to Chair of European Opportunities Trust Board Regarding its Opposition to Insufficient Conditional Tender

20 Oktober 2023 - 2:00PM

Business Wire

Affirms Opposition to the Fund’s Continuation

Resolution Unless a Full Liquidity Option at NAV is Provided to

Shareholders

Saba Capital Management, L.P. (“Saba” or “we”), one of the

largest shareholders of the European Opportunities Trust PLC (LSE:

EOT) (the "Fund" or the "Trust"), today issued a letter it sent to

the Chairman of the Fund’s Board of Directors (the “Board”) making

clear its opposition to the Board’s recommendation that

shareholders vote in favor of the conditional tender and a

continuation resolution at the Fund’s Annual General Meeting

scheduled to be held on November 15, 2023.

The full text of the letter is below.

October 19, 2023

Matthew Frederick Dobbs Chairman of the Board European

Opportunities Trust 12 Victoria Street London SW1E 6DE

Re: European Opportunities Trust

Dear Chairman Dobbs,

I appreciate your response to my email and the continued

dialogue on the path forward for the Fund. After careful

consideration, it is our view that the Board’s conditional tender

is woefully insufficient.

The Fund has underperformed its benchmark by 40% over the last

five years. The idea that an investment advisor should only provide

an option for shareholders to redeem 25% of their investment, if

the Fund underperforms for another three years, puts the interest

of the Fund’s manager ahead of shareholders.

There is no reason to keep investors in this Fund trapped for

the benefit of the manager. While I appreciate your confidence in

the manager’s investment thesis, shareholders who share the same

confidence should remain, and shareholders who do not should have

an opportunity to exit at NAV. This is a fund of liquid holdings

imminently capable of providing liquidity to its shareholders.

We affirm our position against continuation, unless a full

liquidity option at NAV is provided to shareholders, and would

encourage other shareholders to vote against continuation.

Best Regards,

Paul Kazarian Saba Capital

About Saba Capital

Saba Capital Management, L.P. is a global alternative asset

management firm that seeks to deliver superior risk-adjusted

returns for a diverse group of clients. Founded in 2009 by Boaz

Weinstein, Saba is a pioneer of credit relative value strategies

and capital structure arbitrage. Saba is headquartered in New York

City. Learn more at www.sabacapital.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231020265010/en/

Longacre Square Partners Greg Marose / Kate Sylvester,

646-386-0091 gmarose@longacresquare.com /

ksylvester@longacresquare.com

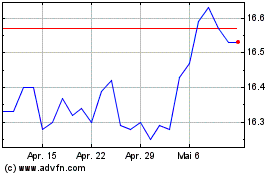

Eaton Vance National Mun... (NYSE:EOT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

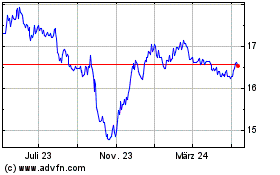

Eaton Vance National Mun... (NYSE:EOT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024