UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant |

x |

| Filed by Party other than the Registrant |

¨ |

Check the appropriate box:

| x |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Material |

| ¨ |

Soliciting Material Pursuant to Rule 14a-12 |

EAGLE POINT CREDIT COMPANY INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, If

Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

EAGLE POINT CREDIT COMPANY INC.

600 Steamboat Road, Suite 202

Greenwich, CT 06830

January [ ], 2024

Dear Stockholder:

You

are cordially invited to attend a Special Meeting of Stockholders (the “Meeting”) of Eagle Point Credit Company Inc. (the

“Company”) to be held on [ ], 2024 at 8:00 a.m., Eastern Time, at 600 Steamboat Road, Suite 202, Greenwich,

CT 06830.

The

Notice of the Special Meeting of Stockholders and the Proxy Statement accompanying this letter describe the business to be conducted at

the Meeting. At the Meeting, holders of the outstanding shares of the Company’s common stock and the outstanding shares of the Company’s

preferred stock, voting together as a single class, and the holders of the outstanding shares of the Company’s common stock, voting

separately as a single class, will be asked to approve a proposal to increase the number of authorized shares of the Company’s common

stock.

It

is important that your shares be represented at the Meeting. If you are unable to attend the Meeting in person, please complete, date

and sign the enclosed proxy card and promptly return it in the envelope provided. Your vote is important.

| Sincerely yours, |

|

| |

|

| /s/ Thomas P. Majewski |

|

| Thomas P. Majewski, Chief Executive Officer |

|

IMPORTANT NOTICE REGARDING

THE AVAILABILITY OF PROXY MATERIALS FOR

THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON [ ], 2024

The

Proxy Statement and the Annual Report to Stockholders for the fiscal year ended December 31, 2022 are available at www.eaglepointcreditcompany.com.

In

addition, copies of the Company’s most recent annual and semi-annual report, including financial statements, have previously been

transmitted to the Company’s stockholders. The Company will furnish to any stockholder upon request, without charge, an additional

copy of the Company’s most recent annual report and semi-annual report to stockholders. Annual reports and semi-annual reports to

stockholders may be obtained by writing to Courtney Fandrick, Secretary, Eagle Point Credit Company Inc., 600 Steamboat Road, Suite 202,

Greenwich, CT 06830, by calling toll-free (844) 810-6501 or by visiting the Company’s website at www.eaglepointcreditcompany.com.

The

following information applicable to the Meeting is found in the Proxy Statement and accompanying proxy card:

| |

· |

The date, time and location of the meeting; |

| |

· |

A list of the matters intended to be acted on and the recommendation of the Company’s Board of Directors regarding those matters; and |

| |

· |

Any control/identification numbers that you need to access your proxy card, as applicable. |

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [ ], 2024

EAGLE POINT CREDIT COMPANY INC.

600 Steamboat Road, Suite 202

Greenwich, CT 06830

To the Stockholders of Eagle Point Credit Company Inc. (the “Company”):

Notice is hereby given that

a Special Meeting of Stockholders of the Company (the “Meeting”) will be held at the offices of the Company at 600 Steamboat

Road, Suite 202, Greenwich, CT 06830, on [ ], 2024 at 8:00 a.m., Eastern Time.

At the Meeting, you will

be asked to, as more fully described in the accompanying Proxy Statement, approve and adopt an amendment to the Company’s Certificate

of Incorporation to increase the number of authorized shares of the Company’s common stock from 100,000,000 to 200,000,000, which

will have the effect of increasing the total number of authorized shares of common stock and preferred stock from 120,000,000 to 220,000,000

in the aggregate, to be voted on by:

| 1. | holders of the outstanding shares of the Company’s

common stock and preferred stock, voting together as a single class; and |

| 2. | holders of the outstanding shares of the Company’s

common stock, voting separately as a single class. |

The Board of Directors of

the Company has fixed the close of business on January 5, 2024 as the record date for the determination of stockholders of the Company

entitled to receive notice of, and to vote at, the Meeting or any adjournment(s) or postponement(s) thereof. The enclosed proxy

is being solicited on behalf of the Board of Directors of the Company. This Notice of Special Meeting of Stockholders, this Proxy Statement

and the enclosed proxy card are first being sent to stockholders on or about January [ ], 2024.

| |

By order of the Board of Directors of the Company |

| |

|

| |

/s/ Courtney B. Fandrick |

| |

Courtney B. Fandrick |

| |

Secretary |

Greenwich, CT

January [ ], 2024

It is important that your shares be represented

at the Meeting in person or by proxy, no matter how many shares you own. If you do not expect to attend the Meeting, please complete,

date, sign and return the enclosed proxy in the accompanying envelope, which requires no postage if mailed in the United States. Please

mark and mail your proxy promptly in order to save any additional costs of further proxy solicitations and in order for the Meeting to

be held as scheduled. If you have any questions regarding the proxy materials please call (844) 810-6501.

PRELIMINARY

PROXY STATEMENT – SUBJECT TO COMPLETION

Dated:

December 22, 2023

EAGLE POINT CREDIT COMPANY INC.

600 Steamboat Road, Suite 202

Greenwich, CT 06830

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [ ], 2024

January [ ], 2024

This Proxy Statement is furnished

in connection with the solicitation by the Board of Directors (the “Board,” and each member, a “Director”) of

the holders of the capital stock (the “Stockholders”) of Eagle Point Credit Company Inc. (the “Company,” “we,”

“us” or “our”) of proxies to be voted at a Special Meeting of Stockholders (the “Meeting”) and any

adjournment(s) or postponement(s) thereof. The Meeting will be held at our offices, which are located at 600 Steamboat Road,

Suite 202, Greenwich, CT 06830, on [ ], 2024 at 8:00 a.m., Eastern Time. The Notice of Special Meeting of Stockholders

(the “Notice”), this Proxy Statement and the enclosed proxy card are first being sent to Stockholders on or about January [

], 2024. A copy of the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2022 (the “Annual

Report”) was previously transmitted to the Stockholders and is also available to Stockholders, without charge, upon request by writing

to Courtney Fandrick, Secretary, Eagle Point Credit Company Inc., 600 Steamboat Road, Suite 202, Greenwich, CT 06830, by calling

(844) 810-6501 or by visiting the Company’s website at www.eaglepointcreditcompany.com.

The Board has fixed the close

of business on January 5, 2024 as the record date (the “Record Date”) for the determination of Stockholders entitled

to receive notice of, and to vote at, the Meeting. The Meeting is scheduled as a meeting of all Stockholders. As of the Record Date, [

] shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), were issued and outstanding,

[ ] shares of the Company’s 6.50% Series C Term Preferred Stock due 2031, par value $0.001 per share (the “Series C

Preferred Stock”), were issued and outstanding and [ ] shares of the Company’s 6.75% Series D Preferred Stock, par value

$0.001 per share (the “Series D Preferred Stock” and together with the Series C Preferred Stock, the “Preferred

Stock”), were issued and outstanding.

Stockholders of record may

vote by mail by returning a properly executed proxy card or in person by attending the Meeting. Shares of Common Stock and Preferred Stock

represented by duly executed and timely delivered proxies will be voted as instructed on the proxy. If you execute and return the enclosed

proxy and no vote is indicated, your proxy will be voted “FOR” the proposal described in this Proxy Statement (as applicable).

At any time before it has

been voted, your proxy may be revoked in one of the following ways: (1) by a signed, written letter of revocation delivered on any

business day before the date of the Meeting to the Secretary of the Company at 600 Steamboat Road, Suite 202, Greenwich, CT 06830,

(2) by properly completing and executing a later-dated proxy and returning it in time to be received before the Meeting, or (3) by

attending the Meeting and voting in person. Please call (844) 810-6501 for information on how to obtain directions to attend the Meeting

and vote in person.

Purpose of Meeting

At

the Meeting, holders of the outstanding shares of the Company’s Common Stock and Preferred Stock, voting together as a single class,

and holders of the outstanding shares of the Company’s Common Stock, voting separately as a single class, will be asked to vote

on a proposal to approve and adopt an amendment to the Company’s Certificate of Incorporation to increase the number

of authorized shares of the Company’s Common Stock from 100,000,000 to 200,000,000, which will have the effect of increasing the

total number of authorized shares of Common Stock and Preferred Stock from 120,000,000 to 220,000,000 in the aggregate (the “Share

Authorization Proposal”).

Quorum

A quorum must be present

at the Meeting for any business to be conducted. The presence at the Meeting, in person or by proxy, of the holders of a majority of the

Company’s capital stock entitled to vote at the Meeting will constitute a quorum. Proxies that reflect abstentions will be treated

as shares present for quorum purposes. In addition, shares held of record by brokers or nominees as to which voting instructions have

not been received from the beneficial owners or the persons entitled to vote, and the broker or nominee does not otherwise have discretionary

power to vote on non-routine matters, will be entitled to vote at the Meeting and will be treated as shares present for quorum purposes.

If a quorum is not present

at the Meeting, the presiding officer shall have power to adjourn the Meeting from time to time, without notice other than announcement

at the Meeting, until a quorum shall be present or represented. At such adjourned Meeting at which a quorum shall be present or represented,

any business may be transacted which might have been transacted at the Meeting as originally noticed. If the adjournment is for more than

thirty (30) days, or if after the adjournment a new record date is fixed for the adjourned Meeting, a notice of the adjourned Meeting

shall be given to each Stockholder entitled to vote at the Meeting.

Vote Required

The Stockholders of record

on the Record Date will be entitled to one vote per share on each matter to which they are entitled to vote and that is to be voted on

by Stockholders, and a fractional vote with respect to fractional shares. Votes cast by proxy or in person at the Meeting will be counted

by the Company’s proxy tabulation firm.

The proposal to approve and

adopt an amendment to the Company’s Certificate of Incorporation to increase the number of authorized shares of the Company’s

Common Stock requires both (i) the affirmative vote of a majority of the votes cast by holders of Preferred Stock and holders of

Common Stock, voting together as a single class, present in person or by proxy at the Meeting and entitled to vote on the Share Authorization

Proposal, and (ii) a majority of the votes cast by holders of Common Stock, voting separately as a single class, present in person

or by proxy at the Meeting and entitled to vote on the Share Authorization Proposal. Abstentions will be counted as shares present for

quorum purposes, but will not be treated as votes cast. Brokers, banks and other nominees may have discretionary authority to vote on

the approval of the Share Authorization Proposal and therefore no “broker non-votes” are anticipated with respect to this

proposal. However, any “broker non-votes” received will be treated as abstentions as described above. If you execute and

return the enclosed proxy and no vote is indicated, your proxy will be voted “FOR” the Share Authorization Proposal described

in this Proxy Statement.

Adjournment

The Meeting may be adjourned

for such periods as the presiding officer of the Meeting or the Stockholders present in person or by proxy and entitled to vote shall

direct.

Additional Information

The Company will bear the

expense of the solicitation of proxies for the Meeting, including the cost of preparing, printing and mailing this Proxy Statement, the

accompanying Notice and the enclosed proxy card. The Company intends to use the services of Equiniti Trust Company, LLC, its transfer

agent, and Broadridge Financial Solutions, Inc., a provider of investor communications solutions, to aid in the distribution and

collection of proxy votes. The Company expects to pay market rates for such services. We have requested that brokers, nominees, fiduciaries

and other persons holding shares of Common Stock or Preferred Stock in their names, or in the name of their nominees, which are beneficially

owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners. We will reimburse such persons for their

reasonable expenses in so doing. In addition, proxies may be solicited in person and/or by telephone, mail or facsimile transmission by

Directors or officers of the Company, officers or employees of Eagle Point Credit Management LLC, our investment adviser (the “Adviser”),

Eagle Point Administration LLC, our administrator (the “Administrator”), and/or by a retained solicitor. No additional compensation

will be paid to such Directors, officers or regular employees for such services. If the Company retains a solicitor, the Company has estimated

that it would pay approximately $15,000 for such services. If the Company engages a solicitor, you could be contacted by telephone on

behalf of the Company and urged to vote. The solicitor will not attempt to influence how you vote your shares, but will only ask that

you take the time to cast a vote. If engaged, the solicitor may also ask if you would like to vote over the telephone and to have your

vote transmitted to our proxy tabulation firm.

As of the date of this Proxy

Statement, the Board, the Company’s officers and the Adviser know of no business to come before the Meeting other than as set forth

in the Notice. If any other business is properly brought before the Meeting, the persons named as proxies will vote in their sole discretion.

PROPOSAL: SHARE AUTHORIZATION

PROPOSAL

Description of the Proposed Amendment

The

Board has unanimously approved, and has recommended that the holders of the Company’s Common Stock and Preferred Stock approve,

an amendment to the Company’s Certificate of Incorporation to increase the number of the Company’s authorized shares of Common

Stock from 100,000,000 shares to 200,000,000 shares. A form of the proposed amendment is attached as Appendix A to this

Proxy Statement.

Article IV

of the Company’s Certificate of Incorporation currently provides that the total number of shares of Common Stock and Preferred Stock

that the Company has authority to issue is 120,000,000 shares of which 100,000,000 shares are Common Stock and 20,000,000 shares are Preferred

Stock. If the Share Authorization Proposal is approved, the Company will be authorized to issue a total of 220,000,000 shares of capital

stock.

Potential Benefits of the Proposed Amendment

The

proposed amendment to the Company’s Certificate of Incorporation authorizing an increase in the number of authorized shares of Common

Stock to 200,000,000 shares will provide the Company with sufficient shares of authorized Common Stock to continue issuing new shares

under its currently effective shelf registration statement on Form N-2 (the “Shelf Registration Statement”), including

in connection with the Company’s ongoing at-the-market (“ATM”) offering program. This amendment will therefore afford

the Company the flexibility to make future issuances of stock in furtherance of its investment objective without the necessity of delaying

such activities for further stockholder approval (except to the extent that stockholder approvals may be required in particular cases

by the Company’s organizational documents, applicable laws, or the rules of any stock exchange on which the Company’s

securities are listed).

Pursuant

to the Company’s Shelf Registration Statement, the Company may issue and sell, from time to time, new shares of Common Stock, Preferred

Stock, subscription rights and debt securities with an aggregate value of up to $1,000,000,000. The Company is currently engaged in an

ATM offering of up to $225,000,000 of shares of Common Stock pursuant to the Shelf Registration Statement. Under the ATM offering program,

the sale shares of the Company may be made in negotiated transactions or transactions that are deemed to be “at the market,”

as defined in Rule 415 under the Securities Act. Any proceeds raised through the ATM offering program will be used to acquire investments

in accordance with our investment objectives and strategies and to make distributions to our Stockholders and for general working capital

purposes. Importantly, consistent with Section 23(b) of the Investment Company Act of 1940, the Company may only issue and sell

shares of its common stock at a price that is equal to or above its current net asset value per share (exclusive of any distributing commission

or discount). Accordingly, any issuances of Common Stock by the Company would generally be accretive or neutral to the book value per

share of existing Stockholders of Common Stock.

The

current limit on the number of authorized shares of Common Stock in the Company’s Certificate of Incorporation could prevent the

Company from fully offering the securities registered under the Shelf Registration Statement and from increasing the amount of Common

Stock offered pursuant to the ATM offering program. New shares of Common Stock issued and sold through the ATM offering program or otherwise

under the Shelf Registration Statement in excess of the currently authorized number of shares under the Company’s Certificate of

Incorporation would need to be separately authorized under the Company’s Certificate of Incorporation. If the existing authorized

shares are exhausted before the Certificate of Incorporation is amended to increase the number of authorized shares of Common Stock, the

Company will be unable to continue issuing and offering new shares of Common Stock, including through an ATM program or otherwise. If

the Certificate of Incorporation amendment is approved, the Company intends to issue shares of Common Stock in one or more offerings.

Potential Risks of the Proposed Amendment

Any

future issuances of additional shares of Common Stock would have the effect of diluting the voting rights of existing Stockholders, and

could have the effect of diluting earnings per share over time. In addition, the availability for issuance of additional shares of Common

Stock could discourage and make more difficult efforts to obtain control of the Company. For example, the Company’s authorized but

unissued Common Stock could be issued in one or more transactions that could delay, defer or prevent a transaction or change in control

of the Company that might involve a premium price for its Stockholders or otherwise be in their best interest. As of the date of this

proxy statement, the Company and the Board are not aware of any attempt or plan to obtain control of the Company, and anti-takeover considerations

are not part of the Board’s rationale for recommending the proposed amendment.

Board Approval of the Proposed Amendment

On

November 8, 2023, the Company’s Board, based on its review and evaluation of the materials it received from the Adviser and

the Company’s administrator, unanimously adopted resolutions setting forth the foregoing amendment to the Company’s Certificate

of Incorporation, declaring the amendment to be advisable, directing that the amendment be submitted for consideration at a special meeting

of the Company’s Stockholders and recommending that Stockholders vote for the approval of the amendment. The Board took both the

potential benefits and the potential risk factors into account when making its determination that increasing the number of authorized

shares of the Company’s Common Stock is in the best interests of the Company and its Stockholders.

When the Proposed Amendment Would Become

Effective

If

approved by the Company’s Stockholders, the proposed amendment to the Company’s Certificate of Incorporation would become

effective as of the date when the amendment is filed with the Secretary of State of Delaware or as of such other date as set forth in

the amendment. It is expected that the amendment, if the proposed amendment is approved by the Stockholders, would be filed as soon as

practicable following the special meeting. The exact timing of the filing, however, would be determined by the Company, which reserves

the right to delay the filing following stockholder approval until such time as determined by the Board in its sole discretion. In addition,

the Board reserves the right to abandon the Share Authorization Proposal amendment without further action by the Stockholders of the Company.

In

the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy “FOR”

the Share Authorization Proposal.

THE BOARD UNANIMOUSLY

RECOMMENDS THAT YOU VOTE “FOR” THE SHARE AUTHORIZATION PROPOSAL.

ADDITIONAL INFORMATION

Stockholder Communications

with the Board

Stockholders

may communicate with the Directors as a group or individually. Stockholder communications must (1) be in writing and be signed by

the Stockholder and (2) identify the class and number of shares of Common Stock or Preferred Stock held by the Stockholder. Any such

communication should be sent to the Board or an individual Director c/o the Secretary at the following address: 600 Steamboat Road, Suite 202,

Greenwich, CT 06830. The Secretary or her designee is responsible for reviewing properly submitted Stockholder communications. The Secretary

shall either (1) provide a copy of each properly submitted Stockholder communication to the Board at its next regularly scheduled

meeting or (2) forward the communication to the Director(s) promptly after receipt if the Secretary determines that the communication

requires more immediate attention. The Secretary may, in good faith, determine that a Stockholder communication should not be provided

to the Board or Director(s) because it does not reasonably relate to the Company or its operations, management, activities, policies,

service providers, Board, officers, Stockholders or other matters relating to an investment in the Company or otherwise is routine or

ministerial in nature.

These

procedures do not apply to (1) any communication from a Director or an officer of the Company, (2) any communication from an

employee or agent of the Company, unless such communication is made solely in such employee’s or agent’s capacity as a Stockholder,

or (3) any Stockholder proposal submitted pursuant to Rule 14a-8 under the Exchange Act or any communication made in connection

with such a proposal. The Directors are not required to make themselves available to Stockholders for communications, other than by the

aforementioned procedures.

Security Ownership of Certain Beneficial

Owners and Management

The

following table sets forth, as of the Record Date, certain information regarding the beneficial ownership of Common Stock and Preferred

Stock by each current Director (including the nominees), the Company’s officers and each person known to us to beneficially own

5% or more of the outstanding shares of Common Stock or Preferred Stock, as applicable.

| | |

Common Stock

Beneficially Owned(2) | | |

Preferred Stock

Beneficially Owned(2) | |

| Name and Address(1) | |

Number | | |

%(3) | | |

Number | | |

%(3) | |

| 5% Owners | |

| | | |

| | | |

| | | |

| | |

| [ ] | |

| [ ] | | |

| [ ] | % | |

| — | | |

| — | |

| [ ] | |

| [ ] | | |

| [ ] | % | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Interested Directors | |

| | | |

| | | |

| | | |

| | |

| Thomas P. Majewski | |

| [ ] | | |

| * | | |

| — | | |

| * | |

| James R. Matthews | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Independent Directors | |

| | | |

| | | |

| | | |

| | |

| Scott W. Appleby | |

| [ ] | | |

| * | | |

| — | | |

| — | |

| Kevin F. McDonald | |

| [ ] | | |

| * | | |

| — | | |

| * | |

| Paul E. Tramontano | |

| [ ] | | |

| * | | |

| — | | |

| * | |

| Jeffrey L. Weiss | |

| [ ] | | |

| * | | |

| — | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Officers | |

| | | |

| | | |

| | | |

| | |

| Kenneth P. Onorio | |

| [ ] | | |

| * | | |

| — | | |

| — | |

| Nauman S. Malik | |

| [ ] | | |

| * | | |

| — | | |

| — | |

| Courtney B. Fandrick | |

| [ ] | | |

| * | | |

| — | | |

| — | |

All Directors and officers as a group

(9 persons) | |

| [ ] | | |

| * | | |

| — | | |

| * | |

| * |

Represents less than 1.0% |

| (1) |

The address for each officer and Director is c/o Eagle Point Credit Company Inc., 600 Steamboat Road, Suite 202, Greenwich, CT 06830. |

| (2) |

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Ownership information for those persons who beneficially own 5% or more of our shares of Common Stock or Preferred Stock is based upon filings by such persons with the SEC and other information obtained from such persons, if available. |

| (3) |

Based on [ ] shares of Common Stock and [ ] shares of Preferred Stock issued and outstanding as of the Record Date. |

| (4) |

[ ]. |

| (5) |

[ ]. |

Certain Related Party Transactions

Investment Adviser and Investment Advisory

Agreement

The Adviser, located at 600

Steamboat Road, Suite 202, Greenwich, CT 06830, manages the Company’s investments, subject to the supervision of the Board,

pursuant to an amended and restated investment advisory agreement (the “Advisory Agreement”) between us and the Adviser, dated

May 16, 2017. The Adviser is registered as an investment adviser with the SEC and, collectively with certain of its affiliates, had

approximately $[ ] billion of assets under management for investment, including capital commitments that were undrawn as of November 30,

2023. The Adviser was established in November 2012 by Mr. Majewski and Stone Point Capital LLC (“Stone Point”),

as investment manager of the Trident Funds and related investment vehicles (collectively, the “Trident Funds”). The Adviser

is indirectly wholly owned by Eagle Point Holdings LP (“EP Holdings”). EP Holdings, in turn, is primarily owned by certain

of the Trident Funds through intermediary holding companies. Additionally, certain of the Adviser’s employees also hold indirect

ownership interests in the Adviser. The Adviser is ultimately governed through holding companies by a board of managers, which includes

Mr. Majewski and certain principals of Stone Point.

Administrator and Administration Agreement

The Administrator, located

at 600 Steamboat Road, Suite 202, Greenwich, CT 06830, furnishes the Company with office facilities, equipment and clerical, bookkeeping

and record-keeping services at such facilities. Under the administration agreement (the “Administration Agreement”) between

us and the Administrator, the Administrator performs, or arranges for the performance of, our required administrative services, which

include being responsible for the financial records which we are required to maintain and preparing reports to Stockholders.

Single Delivery of Proxy Statement to Shared

Address

Please

note that only one copy of this Proxy Statement and accompanying documents may be delivered to two (2) or more Stockholders who share

an address. We will deliver promptly, upon request, a separate copy of any of these documents to Stockholders at a shared address to which

a single copy of such document(s) was delivered. Stockholders who wish to receive a separate copy of any of these documents, or to

receive a single copy of such documents if multiple copies were delivered, now or in the future, should submit their request by writing

to us or by calling us at (844) 810-6501. Please direct your written requests to Courtney Fandrick, Secretary, Eagle Point Credit Company

Inc., 600 Steamboat Road, Suite 202, Greenwich, CT 06830.

Stockholder Proposals

for the Annual Meeting for the 2024 Fiscal Year

It

is currently anticipated that the Company’s next annual meeting of Stockholders after the Meeting will be held in May 2024.

Proposals of Stockholders intended to be presented at that annual meeting of the Company must have been received by the Company no earlier

than December 14, 2023 and no later than January 13, 2024 for inclusion in the Company’s proxy statement and proxy cards

relating to that meeting. The submission by a Stockholder of a proposal for inclusion in the proxy materials does not guarantee that it

will be included. Stockholder proposals are subject to certain requirements under the federal securities laws. To the extent the Company

wishes to exclude a proposal, potential exclusion will be analyzed based upon both the procedural and substantive bases for exclusion

set forth in Rule 14a-8 under the Exchange Act.

Stockholders

submitting any other proposals (including proposals to elect Director nominees) for the Company intended to be presented at the annual

meeting for the 2024 fiscal year (i.e., other than those to be included in the Company’s proxy materials) must ensure that such

proposals are received by the Company, in good order and complying with all applicable legal requirements and requirements set forth in

the Company’s bylaws. The Company’s bylaws provide that any such proposal must be addressed to the attention of the Secretary

and received in writing by the Company not less than ninety (90) days nor more than one hundred twenty (120) days in advance of the anniversary

of the date the Company’s proxy statement was released to the Stockholders in connection with the previous year’s annual meeting

of Stockholders; provided, however, that in the event that no annual meeting was held in the previous year or the date of the annual meeting

has been changed by more than thirty (30) days from the date contemplated at the time of the previous year’s proxy statement, notice

by the Stockholder must be received by the Secretary not later than the close of business on the later of (x) the ninetieth (90th)

day prior to such annual meeting and (y) the seventh (7th) day following the day on which public announcement of the date

of such meeting is first made. A Stockholder’s notice to the Secretary shall set forth (i) as to each matter the Stockholder

proposes to bring before the annual meeting (a) a brief description of the business desired to be brought before the annual meeting

and the reasons for conducting such business at the annual meeting and (b) any material interest of the Stockholder in such business,

and (ii) as to the Stockholder giving the notice (a) the name and record address of the Stockholder and (b) the class,

series and number of shares of capital stock of the Company which are beneficially owned by the Stockholder.

Assuming

the next annual meeting is ultimately scheduled to be within 30 days of the May 11th anniversary of the Meeting, such proposals must

have been received no earlier than December 14, 2023 and no later than January 13, 2024. Stockholder proposals should be addressed

to the attention of Courtney Fandrick, Secretary, Eagle Point Credit Company Inc., 600 Steamboat Road, Suite 202, Greenwich, CT 06830.

If

a Stockholder who wishes to present a proposal fails to notify the Company as set forth above for inclusion of a proposal the Company’s

proxy statement, the proxies solicited for the meeting will be voted on the Stockholder’s proposal, if it is properly brought before

the meeting, in accordance with the judgment of the persons named in the enclosed proxy card(s). If a Stockholder makes a timely notification,

the proxies may still exercise discretionary voting authority under circumstances consistent with the SEC’s proxy rules.

Copies

of the Company’s Annual Report and most recent semi-annual report, including financial statements, have previously been mailed to

Stockholders. The Company will furnish to any Stockholder upon request, without charge, an additional copy of the Company’s Annual

Report and most recent semi-annual report to Stockholders. Annual Reports and semi-annual reports to Stockholders may be obtained by directing

a written request to Courtney Fandrick, Secretary, Eagle Point Credit Company Inc., 600 Steamboat Road, Suite 202, Greenwich, CT

06830, calling toll-free (844) 810-6501 or by visiting the Company’s website at www.eaglepointcreditcompany.com.

PLEASE

EXECUTE AND RETURN THE ENCLOSED PROXY CARD PROMPTLY TO ENSURE THAT A QUORUM IS PRESENT AT THE SPECIAL MEETING. A SELF-ADDRESSED, POSTAGE-PAID

ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE.

January [ ], 2024

APPENDIX A

Form of Proposed Amendment

CERTIFICATE OF AMENDMENT

OF

CERTIFICATE OF INCORPORATION

OF

EAGLE POINT CREDIT COMPANY INC.

Eagle Point Credit Company

Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”),

does hereby certify as follows:

FIRST: The

name of the Corporation is Eagle Point Credit Company Inc. The Certificate of Incorporation was originally filed with the Secretary of

State of the State of Delaware (the “Secretary of State”) on October 6, 2014 (the “Certificate of Incorporation”).

SECOND: Upon

the filing and effectiveness pursuant to the General Corporation Law of the State of Delaware of this Certificate of Amendment of the

Certificate of Incorporation, subsection 4.1 of Article IV of the Certificate of Incorporation be amended and restated in its entirety

as follows:

“Authorized Stock.

The total number of shares of all classes of capital stock which the Corporation shall have authority to issue is 220,000,000 of which

200,000,000 shares shall be common stock having a par value of $0.001 per share (the “Common Stock”) and 20,000,000

shares shall be preferred stock having a par value of $0.001 per share (the “Preferred Stock”).”

THIRD: The

stockholders of the Corporation have duly approved the foregoing amendment in accordance with the provisions of Section 242 of the

General Corporation Law of the State of Delaware.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, the Corporation

has caused this Certificate of Amendment to be duly adopted and executed in its corporate name and on its behalf by its duly authorized

officer as of the _____ day of [ ], 2024.

| |

EAGLE POINT CREDIT COMPANY INC. |

| |

|

|

| |

By: |

|

| |

|

Name: |

| |

|

Title: |

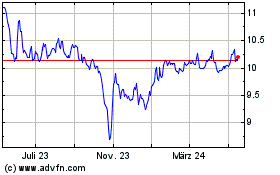

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

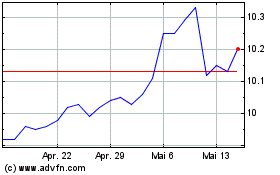

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024