Form 424B3 - Prospectus [Rule 424(b)(3)]

08 März 2024 - 11:03PM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

Registration No. 333-253996

WESTERN ASSET MORTGAGE OPPORTUNITY FUND INC.

SUPPLEMENT DATED MARCH 8, 2024 TO

THE PROSPECTUS

AND STATEMENT OF ADDITIONAL INFORMATION

DATED MAY 4, 2021

Effective March 1, 2024, the following changes

are made to the Fund’s Prospectus and Statement of Additional Information (“SAI”):

Portfolio Management Update

I. Effective March 1, 2024, the section entitled “Management of the Fund – Investment

Management Team” in the Fund’s Prospectus is deleted in its entirety and replaced with the following:

Investment Management

Team

Set forth below is information regarding the team of professionals at Western Asset responsible for overseeing the day-to-day operations of the Fund. Western Asset utilizes a team approach, with decisions derived from interaction among various investment management sector specialists. The

sector teams are comprised of Western Asset’s senior portfolio managers, research analysts and an in-house economist. Under this team approach, management of client fixed income portfolios

will reflect a consensus of interdisciplinary views.

|

|

|

| Name, Address and Title |

|

Principal Occupation(s)

During Past 5 Years |

|

|

| Michael C. Buchanan Western Asset

385 East Colorado Blvd. Pasadena, CA 91101 |

|

Responsible for the day-to-day management with other members of the Fund’s portfolio management team; employed by Western Asset as an investment

professional for at least the past five years. |

|

|

| Greg E. Handler Western Asset

385 East Colorado Blvd. Pasadena, CA 91101 |

|

Responsible for the day-to-day management with other members of the Fund’s portfolio management team; research analyst/portfolio manager at Western

Asset since 2002. |

|

|

| Simon Miller Western Asset

385 East Colorado Blvd. Pasadena, CA 91101 |

|

Responsible for the day-to-day management with other members of the Fund’s portfolio management team; employed by Western Asset as an investment

professional since 2021; prior to joining Western Asset, Mr. Miller was a Portfolio Manager for CMBS/CRE at Doubleline Capital; Assistant Vice President, CRE Credit and Asset Management at Torchlight Investors; and Associate Director, CRE

Originations at GE Capital. |

Additional information about the portfolio managers’ compensation, other accounts managed by them and other information

is provided in the SAI.

II. Effective March 1, 2024, the following changes

are made to the Fund’s SAI.

a) The table on page 42 in the Fund’s SAI in the section entitled “Portfolio Managers”

is deleted in its entirely and replaced with the following:

|

|

|

|

|

|

|

|

|

|

|

| Name of PM |

|

Type of Account |

|

Number of

Accounts

Managed |

|

Total Assets

Managed |

|

Number of

Accounts

Managed for

which

Advisory

Fee is

Performance-

Based |

|

Assets

Managed for

which

Advisory Fee

is

Performance-

Based |

| Michael C. Buchanan‡* |

|

Other Registered Investment Companies |

|

37 |

|

$17.34 billion |

|

None |

|

None |

| |

Other Pooled Vehicles |

|

266 |

|

$50.58 billion |

|

23 |

|

$2.60 billion |

| |

Other Accounts |

|

570 |

|

$170.69 billion |

|

21 |

|

$12.68 billion |

| Greg E. Handler‡ |

|

Other Registered Investment Companies Other

Pooled Vehicles Other Accounts |

|

4

13

8 |

|

$3.02 billion

$3.75 billion

$2.96 billion |

|

None

2

2 |

|

None

$165 million

$840 million |

| Simon Miller‡* |

|

Other Registered Investment Companies |

|

None |

|

None |

|

None |

|

None |

| |

Other Pooled Vehicles |

|

10 |

|

$921 million |

|

2 |

|

$169 million |

| |

Other Accounts |

|

1 |

|

$243 million |

|

None |

|

None |

| ‡ |

The numbers above reflect the overall number of portfolios managed by employees of Western Asset Management

Company, LLC (“Western Asset”). Western Asset’s investment discipline emphasizes a team approach that combines the efforts of groups of specialists working in different market sectors. They are responsible for overseeing

implementation of Western Asset’s overall investment ideas and coordinating the work of the various sector teams. This structure ensures that client portfolios benefit from a consensus that draws on the expertise of all team members.

|

| * |

The information is as of March 1, 2024 and does not reflect the Fund. |

b) The section entitled “Portfolio Managers – Securities Ownership of Portfolio Managers” in the Fund’s SAI is deleted in its entirety

and replaced with the following:

Portfolio Manager Securities Ownership

The portfolio managers held the following amounts of securities of the Fund as of December 31, 2023.

|

|

|

| Portfolio Manager |

|

Dollar Range of Securities

Beneficially Owned ($) |

| Michael C. Buchanan* |

|

A |

| Greg E. Handler |

|

D |

| Simon Miller* |

|

A |

| * |

The information is as of March 1, 2024. |

Dollar Range ownership is as follows:

A: none

B: $1 - $10,000

C: 10,001 - $50,000

D: $50,001 - $100,000

E: $100,001 - $500,000

F: $500,001 - $1 million

G: over $1 million

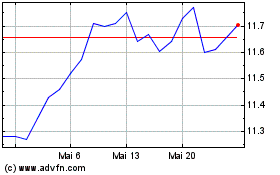

Western Asset Mortgage O... (NYSE:DMO)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

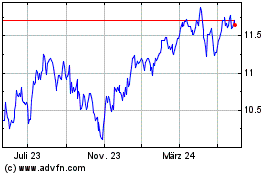

Western Asset Mortgage O... (NYSE:DMO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024