0000882184false00008821842025-01-212025-01-210000882184us-gaap:CommonStockMember2025-01-212025-01-210000882184us-gaap:SeniorNotesMember2025-01-212025-01-21

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 21, 2025

______________________________

D.R. Horton, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-14122 | | 75-2386963 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1341 Horton Circle, Arlington, Texas 76011

(Address of principal executive offices)

(817) 390-8200

(Registrant’s telephone number, including area code)

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $.01 per share | | DHI | | New York Stock Exchange |

| 5.000% Senior Notes due 2034 | | DHI 34 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On January 21, 2025, D.R. Horton, Inc. issued a press release announcing its results and related information for its first quarter ended December 31, 2024 and declaring its quarterly dividend. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference in its entirety into this Item 2.02.

The information furnished in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibits | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document contained in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | D.R. Horton, Inc. |

Date: | January 21, 2025 | | By: | /S/ BILL W. WHEAT |

| | | | Bill W. Wheat |

| | | | Executive Vice President and |

| | | | Chief Financial Officer |

Exhibit 99.1

D.R. HORTON, INC., AMERICA’S BUILDER, REPORTS FISCAL 2025 FIRST QUARTER EARNINGS AND DECLARES QUARTERLY DIVIDEND OF $0.40 PER SHARE

ARLINGTON, Texas (Business Wire) - January 21, 2025

Fiscal 2025 First Quarter Highlights

•Net income attributable to D.R. Horton of $844.9 million or $2.61 per diluted share

•Consolidated pre-tax income of $1.1 billion, with a pre-tax profit margin of 14.6%

•Consolidated revenues of $7.6 billion

•Homes sales revenues of $7.1 billion on 19,059 homes closed

•Net sales orders of 17,837 homes with an order value of $6.7 billion

•Rental operations pre-tax income of $11.9 million on $217.8 million of revenues from sales of 311 single-family rental homes and 504 multi-family rental units

•Repurchased 6.8 million shares of common stock for $1.1 billion and paid cash dividends of $128.5 million

D.R. Horton, Inc. (NYSE:DHI), America’s Builder, today reported that net income per common share attributable to D.R. Horton for its first fiscal quarter ended December 31, 2024 decreased 7% to $2.61 per diluted share compared to $2.82 per diluted share in the same quarter of fiscal 2024. Net income attributable to D.R. Horton in the first quarter of fiscal 2025 decreased 11% to $844.9 million compared to $947.4 million in the same quarter of fiscal 2024. Consolidated revenues in the first quarter of fiscal 2025 decreased 1% to $7.6 billion compared to $7.7 billion in the same quarter of fiscal 2024.

The Company's return on equity (ROE) was 19.1% for the trailing twelve months ended December 31, 2024, and return on assets (ROA) was 13.4% for the same period. ROE is calculated as net income attributable to D.R. Horton for the trailing twelve months divided by average stockholders' equity, where average stockholders' equity is the sum of ending stockholders' equity balances of the trailing five quarters divided by five. ROA is calculated as net income attributable to D.R. Horton for the trailing twelve months divided by average consolidated assets, where average consolidated assets is the sum of total asset balances for the trailing five quarters divided by five.

During the three months ended December 31, 2024, net cash provided by operations was $646.7 million. The Company's consolidated cash balance at December 31, 2024 was $3.0 billion and available capacity on its credit facilities was $3.5 billion, for total liquidity of $6.5 billion. Debt at December 31, 2024 totaled $5.1 billion, with $500 million of senior notes maturing in the next twelve months. The Company's debt to total capital ratio at December 31, 2024 was 17.0%. Debt to total capital ratio consists of notes payable divided by stockholders' equity plus notes payable.

David Auld, Executive Chairman, said, “The D.R. Horton team delivered strong results in our first fiscal quarter of 2025, highlighted by earnings per diluted share of $2.61 on consolidated revenues of $7.6 billion. Consolidated pre-tax income was $1.1 billion with a pre-tax profit margin of 14.6%, enabling us to return $1.2 billion to shareholders through share repurchases and dividends during the quarter.

“Although the level of new and existing home inventories has increased from historically low levels, the supply of homes at affordable price points is generally still limited, and demographics supporting housing demand remain favorable. Despite continued affordability challenges and competitive market conditions, incentives such as mortgage rate buydowns have helped to address affordability and spur demand. Additionally, given our focus on affordable product offerings, we have continued to start and sell more of our homes with smaller floor plans to meet homebuyer demand.

“Our strong liquidity, low leverage, substantial cash flows, tenured operators and national scale provide us with significant financial and operational flexibility. We are well-positioned with our affordable product offerings and flexible lot supply, and we are focused on maximizing returns in each of our communities. We are maintaining our disciplined approach to capital allocation to enhance the long-term value of D.R. Horton, including consistent and increasing capital returns to our shareholders through share repurchases and dividends.”

Homebuilding Operations

Homebuilding revenue for the first quarter of fiscal 2025 decreased 2% to $7.2 billion compared to $7.3 billion in the same quarter of fiscal 2024. Homes closed in the quarter decreased 1% to 19,059 homes compared to 19,340 homes closed in the same quarter of fiscal 2024.

Homebuilding pre-tax income in the first quarter of fiscal 2025 decreased 8% to $1.0 billion with a pre-tax profit margin of 14.1% compared to $1.1 billion of pre-tax income and a 15.0% pre-tax profit margin in the same quarter of fiscal 2024. The Company’s homebuilding return on inventory (ROI) was 26.7% for the trailing twelve months ended December 31, 2024. Homebuilding ROI is calculated as homebuilding pre-tax income for the trailing twelve months divided by average inventory, where average inventory is the sum of ending homebuilding inventory balances for the trailing five quarters divided by five.

During the three months ended December 31, 2024, net cash provided by homebuilding operations was $552.0 million.

Net sales orders for the first quarter ended December 31, 2024 decreased 1% to 17,837 homes and 2% in value to $6.7 billion compared to 18,069 homes and $6.8 billion in the same quarter of fiscal 2024. The Company’s cancellation rate (cancelled sales orders divided by gross sales orders) for the first quarter of fiscal 2025 was 18% compared to 19% in the prior year quarter. The Company's sales order backlog of homes under contract at December 31, 2024 decreased 21% to 11,003 homes and 21% in value to $4.3 billion compared to 13,965 homes and $5.4 billion at December 31, 2023.

At December 31, 2024, the Company had 36,200 homes in inventory, of which 25,700 were unsold. 10,400 of the Company’s unsold homes at December 31, 2024 were completed, of which 1,300 had been completed for greater than six months. The Company’s homebuilding land and lot portfolio totaled 639,800 lots at the end of the quarter, of which 24% were owned and 76% were controlled through land and lot purchase contracts. Of the Company’s homes closed during the three months ended December 31, 2024, 65% were on lots developed by Forestar or third parties.

Rental Operations

The Company's rental operations generated $11.9 million of pre-tax income on revenues of $217.8 million in the first quarter of fiscal 2025 compared to $31.3 million of pre-tax income on revenues of $195.3 million in the same quarter of fiscal 2024.

During the first quarter of fiscal 2025, the Company sold 311 single-family rental homes for $88.1 million compared to 379 homes sold for $116.1 million in the prior year quarter. At December 31, 2024, the consolidated balance sheet included $728.3 million of single-family rental property inventory consisting of 3,140 homes, of which 2,750 were completed, and 1,500 lots, of which 640 were finished.

During the first quarter of fiscal 2025, the Company sold 504 multi-family rental units for $129.7 million compared to 300 units sold for $79.2 million in the prior year quarter. At December 31, 2024, the consolidated balance sheet included $2.3 billion of multi-family rental property inventory consisting of 12,220 units, of which 7,010 units were under active construction and 5,210 units were completed.

Forestar

Forestar Group Inc. (NYSE:FOR) (“Forestar”) is a publicly traded residential lot development company that is a majority-owned subsidiary of D.R. Horton. Forestar’s results of operations for the periods presented are fully consolidated in the Company’s financial statements with the percentage not owned by the Company reported as noncontrolling interests.

For the first quarter ended December 31, 2024, Forestar sold 2,333 lots and generated $250.4 million of revenue compared to 3,150 lots and $305.9 million of revenue in the prior year quarter. Forestar’s pre-tax income in the first quarter of fiscal 2025 was $21.9 million with a pre-tax profit margin of 8.7% compared to $51.2 million of pre-tax income and a 16.7% pre-tax profit margin in the same quarter of fiscal 2024.

Financial Services

For the first quarter ended December 31, 2024, financial services revenues were $182.3 million compared to $192.6 million in the same quarter of fiscal 2024. Financial services pre-tax income for the quarter was $48.6 million with a pre-tax profit margin of 26.7% compared to $66.0 million of pre-tax income and a 34.3% pre-tax profit margin in the prior year quarter.

Dividends

During the first quarter of fiscal 2025, the Company paid cash dividends of $128.5 million. Subsequent to quarter end, the Company declared a quarterly cash dividend of $0.40 per common share that is payable on February 14, 2025 to stockholders of record on February 7, 2025.

Share Repurchases

The Company repurchased 6.8 million shares of common stock for $1.1 billion during the first quarter of fiscal 2025. The Company’s number of common shares outstanding at December 31, 2024 was 317.7 million, down 4% from 332.2 million shares outstanding at December 31, 2023. The Company’s remaining stock repurchase authorization at December 31, 2024 was $2.5 billion.

Guidance

Based on current market conditions and the Company’s results for the first quarter of the year, D.R. Horton is reiterating its guidance for fiscal 2025 as follows:

•Consolidated revenues of approximately $36.0 billion to $37.5 billion

•Homes closed by homebuilding operations of 90,000 homes to 92,000 homes

•Consolidated cash flow provided by operations greater than fiscal 2024

•Dividend payments of approximately $500 million

The Company is updating its fiscal 2025 guidance as follows:

•Income tax rate of approximately 24.0%

•Share repurchases in the range of $2.6 billion to $2.8 billion

The Company plans to also provide guidance for its second quarter of fiscal 2025 on its conference call today.

Conference Call and Webcast Details

The Company will host a conference call today (Tuesday, January 21) at 8:30 a.m. Eastern Time. The dial-in number is 888-506-0062 (reference entry code 163261), and the call will also be webcast from the Company’s website at investor.drhorton.com.

About D.R. Horton, Inc.

D.R. Horton, Inc., America’s Builder, has been the largest homebuilder by volume in the United States since 2002 and has closed more than 1,100,000 homes in its over 46-year history. D.R. Horton has operations in 126 markets in 36 states across the United States and is engaged in the construction and sale of high-quality homes through its diverse product portfolio with sales prices generally ranging from $200,000 to over $1,000,000. The Company also constructs and sells both single-family and multi-family rental properties. During the twelve-month period ended December 31, 2024, D.R. Horton closed 89,409 homes in its homebuilding operations, in addition to 3,902 single-family rental homes and 2,406 multi-family rental units in its rental operations. D.R. Horton also provides mortgage financing, title services and insurance agency services for its homebuyers and is the majority-owner of Forestar Group Inc., a publicly traded national residential lot development company.

Forward-Looking Statements

Portions of this document may constitute “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Although D.R. Horton believes any such statements are based on reasonable assumptions, there is no assurance that actual outcomes will not be materially different. All forward-looking statements are based upon information available to D.R. Horton on the date this release was issued. D.R. Horton does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Forward-looking statements in this release include that although the level of new and existing home inventories has increased from historically low levels, the supply of homes at affordable price points is generally still limited, and demographics supporting housing demand remain favorable; we have continued to start and sell more of our homes with smaller floor plans to meet homebuyer demand; our strong liquidity, low leverage, substantial cash flows, tenured operators and national scale provide us with significant financial and operational flexibility; we are well-positioned with our affordable product offerings and flexible lot supply, and we are focused on maximizing returns in each of our communities; and we are maintaining our disciplined approach to capital allocation to enhance the long-term value of D.R. Horton, including consistent and increasing capital returns to our shareholders through share repurchases and dividends. The forward-looking statements also include all metrics in the Guidance section.

Factors that may cause the actual results to be materially different from the future results expressed by the forward-looking statements include, but are not limited to: the cyclical nature of the homebuilding, rental and lot development industries and changes in economic, real estate or other conditions; adverse developments affecting the capital markets and financial institutions, which could limit our ability to access capital, increase our cost of capital and impact our liquidity and capital resources; reductions in the availability of mortgage financing provided by government agencies, changes in government financing programs, a decrease in our ability to sell mortgage loans on attractive terms or an increase in mortgage interest rates; the risks associated with our land, lot and rental inventory; our ability to effect our growth strategies, acquisitions, investments or other strategic initiatives successfully; the impact of an inflationary, deflationary or higher interest rate environment; risks of acquiring land, building materials and skilled labor and challenges obtaining regulatory approvals; the effects of public health issues such as a major epidemic or pandemic on the economy and our businesses; the effects of weather conditions and natural disasters on our business and financial results; home warranty and construction defect claims; the effects of health and safety incidents; reductions in the availability of performance bonds; increases in the costs of owning a home; the effects of information technology failures, data security breaches, and the failure to satisfy privacy and data protection laws and regulations; the effects of governmental regulations and environmental matters on our land development and housing operations; the effects of governmental regulations on our financial services operations; the effects of competitive conditions within the industries in which we operate; our ability to manage and service our debt and comply with related debt covenants, restrictions and limitations; the effects of negative publicity; the effects of the loss of key personnel; and the effects of actions by activist stockholders. Additional information about issues that could lead to material changes in performance is contained in D.R. Horton’s annual report on Form 10-K, which is filed with the Securities and Exchange Commission.

Contact

D.R. Horton, Inc.

Jessica Hansen, 817-390-8200

Senior Vice President - Communications

InvestorRelations@drhorton.com

D.R. HORTON, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | | | | |

| December 31,

2024 | | September 30,

2024 |

| (In millions) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 3,050.1 | | | $ | 4,516.4 | |

| Restricted cash | 18.9 | | | 27.6 | |

Total cash, cash equivalents and restricted cash | 3,069.0 | | | 4,544.0 | |

| Inventories: | | | |

| Construction in progress and finished homes | 8,701.4 | | | 8,875.8 | |

Residential land and lots — developed, under development, held for development and held for sale | 14,390.2 | | | 13,121.4 | |

| Rental properties | 2,988.9 | | | 2,906.0 | |

| Total inventory | 26,080.5 | | | 24,903.2 | |

| Mortgage loans held for sale | 1,794.4 | | | 2,477.5 | |

Deferred income taxes, net of valuation allowance of $14.9 million at December 31, 2024 and September 30, 2024 | 127.4 | | | 167.5 | |

| Property and equipment, net | 524.2 | | | 531.0 | |

| Other assets | 3,270.7 | | | 3,317.6 | |

| Goodwill | 163.5 | | | 163.5 | |

| Total assets | $ | 35,029.7 | | | $ | 36,104.3 | |

| LIABILITIES | | | |

| Accounts payable | $ | 1,372.6 | | | $ | 1,345.5 | |

| Accrued expenses and other liabilities | 3,096.5 | | | 3,016.7 | |

| Notes payable | 5,097.7 | | | 5,917.7 | |

| Total liabilities | 9,566.8 | | | 10,279.9 | |

| EQUITY | | | |

Common stock, $.01 par value, 1,000,000,000 shares authorized, 403,275,949 shares issued and 317,652,200 shares outstanding at December 31, 2024 and 402,848,342 shares issued and 324,027,360 shares outstanding at September 30, 2024 | 4.0 | | | 4.0 | |

| Additional paid-in capital | 3,508.2 | | | 3,490.7 | |

| Retained earnings | 28,667.4 | | | 27,951.0 | |

Treasury stock, 85,623,749 shares and 78,820,982 shares at December 31, 2024 and September 30, 2024, respectively, at cost | (7,235.7) | | | (6,132.9) | |

| Stockholders’ equity | 24,943.9 | | | 25,312.8 | |

| Noncontrolling interests | 519.0 | | | 511.6 | |

| Total equity | 25,462.9 | | | 25,824.4 | |

| Total liabilities and equity | $ | 35,029.7 | | | $ | 36,104.3 | |

D.R. HORTON, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | |

| | 2024 | | 2023 | | | | |

| (In millions, except per share data) |

| Revenues | $ | 7,613.0 | | | $ | 7,726.0 | | | | | |

| Cost of sales | 5,702.8 | | | 5,719.8 | | | | | |

| Selling, general and administrative expense | 878.1 | | | 835.0 | | | | | |

| Other (income) expense | (77.8) | | | (76.3) | | | | | |

| Income before income taxes | 1,109.9 | | | 1,247.5 | | | | | |

| Income tax expense | 258.0 | | | 291.8 | | | | | |

| Net income | 851.9 | | | 955.7 | | | | | |

| Net income attributable to noncontrolling interests | 7.0 | | | 8.3 | | | | | |

| Net income attributable to D.R. Horton, Inc. | $ | 844.9 | | | $ | 947.4 | | | | | |

| | | | | | | |

| Basic net income per common share attributable to D.R. Horton, Inc. | $ | 2.63 | | | $ | 2.84 | | | | | |

| Weighted average number of common shares | 321.5 | | | 333.3 | | | | | |

| | | | | | | |

| Diluted net income per common share attributable to D.R. Horton, Inc. | $ | 2.61 | | | $ | 2.82 | | | | | |

| Adjusted weighted average number of common shares | 323.3 | | | 335.7 | | | | | |

| | | | | | | |

| Other Consolidated Financial Data | | | | | | | |

| Interest charged to cost of sales | $ | 30.3 | | | $ | 28.0 | | | | | |

| Depreciation and amortization | $ | 24.1 | | | $ | 20.0 | | | | | |

| Interest incurred | $ | 46.7 | | | $ | 42.6 | | | | | |

D.R. HORTON, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | | | |

| | Three Months Ended

December 31, |

| | 2024 | | 2023 |

| (In millions) |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 851.9 | | | $ | 955.7 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 24.1 | | | 20.0 | |

| Stock-based compensation expense | 43.0 | | | 40.9 | |

| Deferred income taxes | 40.1 | | | 11.3 | |

| Inventory and land option charges | 16.6 | | | 6.1 | |

| Changes in operating assets and liabilities: | | | |

| Decrease (increase) in construction in progress and finished homes | 181.7 | | | (466.4) | |

Increase in residential land and lots – developed, under development, held for development and held for sale | (1,243.5) | | | (937.8) | |

| Increase in rental properties | (86.5) | | | (256.5) | |

| Decrease (increase) in other assets | 65.2 | | | (130.0) | |

| Decrease in mortgage loans held for sale | 683.1 | | | 475.8 | |

| Increase in accounts payable, accrued expenses and other liabilities | 71.0 | | | 127.5 | |

| Net cash provided by (used in) operating activities | 646.7 | | | (153.4) | |

| INVESTING ACTIVITIES | | | |

| Expenditures for property and equipment | (13.3) | | | (47.6) | |

| Proceeds from sale of assets | — | | | 9.9 | |

| Payments related to business acquisitions, net of cash acquired | (51.0) | | | (1.0) | |

| Other investing activities | 7.2 | | | (0.6) | |

| Net cash used in investing activities | (57.1) | | | (39.3) | |

| FINANCING ACTIVITIES | | | |

| Proceeds from notes payable | 660.0 | | | 720.0 | |

| Repayment of notes payable | (755.4) | | | (170.0) | |

| Repayment on mortgage repurchase facilities, net | (746.9) | | | (389.9) | |

| Proceeds from stock associated with certain employee benefit plans | — | | | 1.6 | |

| Cash paid for shares withheld for taxes | (27.6) | | | (37.5) | |

| Cash dividends paid | (128.5) | | | (99.9) | |

Repurchases of common stock | (1,055.7) | | | (376.9) | |

| Net other financing activities | (10.5) | | | (10.2) | |

| Net cash used in financing activities | (2,064.6) | | | (362.8) | |

| Net decrease in cash, cash equivalents and restricted cash | (1,475.0) | | | (555.5) | |

| Cash, cash equivalents and restricted cash at beginning of period | 4,544.0 | | | 3,900.1 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 3,069.0 | | | $ | 3,344.6 | |

| SUPPLEMENTAL DISCLOSURES OF NON-CASH ACTIVITIES: | | | |

| Notes payable issued for inventory | $ | — | | | $ | 21.9 | |

| Stock issued under employee incentive plans | $ | 71.3 | | | $ | 66.5 | |

| Repurchases of common stock not settled | $ | 45.5 | | | $ | 18.3 | |

D.R. HORTON, INC. AND SUBSIDIARIES

SEGMENT INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2024 |

| | Homebuilding | | Rental | | Forestar | | Financial Services | | Eliminations and Other (1) | | Consolidated |

| | (In millions) |

| Assets | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 2,547.9 | | | $ | 113.0 | | | $ | 132.0 | | | $ | 238.6 | | | $ | 18.6 | | | $ | 3,050.1 | |

Restricted cash | | 3.3 | | | 1.6 | | | — | | | 14.0 | | | — | | | 18.9 | |

Inventories: | | | | | | | | | | | | |

| Construction in progress and finished homes | | 8,808.0 | | | — | | | — | | | — | | | (106.6) | | | 8,701.4 | |

| Residential land and lots | | 11,843.4 | | | — | | | 2,736.8 | | | — | | | (190.0) | | | 14,390.2 | |

| Rental properties | | — | | | 2,985.3 | | | — | | | — | | | 3.6 | | | 2,988.9 | |

| | 20,651.4 | | | 2,985.3 | | | 2,736.8 | | | — | | | (293.0) | | | 26,080.5 | |

Mortgage loans held for sale | | — | | | — | | | — | | | 1,794.4 | | | — | | | 1,794.4 | |

Deferred income taxes, net | | 169.2 | | | (14.7) | | | — | | | — | | | (27.1) | | | 127.4 | |

Property and equipment, net | | 492.1 | | | 1.3 | | | 6.8 | | | 3.9 | | | 20.1 | | | 524.2 | |

Other assets | | 2,939.6 | | | 36.4 | | | 85.0 | | | 141.0 | | | 68.7 | | | 3,270.7 | |

Goodwill | | 134.3 | | | — | | | — | | | — | | | 29.2 | | | 163.5 | |

| | $ | 26,937.8 | | | $ | 3,122.9 | | | $ | 2,960.6 | | | $ | 2,191.9 | | | $ | (183.5) | | | $ | 35,029.7 | |

| Liabilities | | | | | | | | | | | | |

Accounts payable | | $ | 1,112.7 | | | $ | 268.6 | | | $ | 78.6 | | | $ | 0.1 | | | $ | (87.4) | | | $ | 1,372.6 | |

Accrued expenses and other liabilities | | 2,712.3 | | | 25.8 | | | 461.2 | | | 262.9 | | | (365.7) | | | 3,096.5 | |

Notes payable | | 2,448.2 | | | 1,055.8 | | | 806.8 | | | 786.9 | | | — | | | 5,097.7 | |

| | $ | 6,273.2 | | | $ | 1,350.2 | | | $ | 1,346.6 | | | $ | 1,049.9 | | | $ | (453.1) | | | $ | 9,566.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2024 |

| | Homebuilding | | Rental | | Forestar | | Financial Services | | Eliminations and Other (1) | | Consolidated |

| | (In millions) |

| Assets | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 3,623.0 | | | $ | 157.6 | | | $ | 481.2 | | | $ | 242.3 | | | $ | 12.3 | | | $ | 4,516.4 | |

Restricted cash | | 4.8 | | | 2.2 | | | — | | | 20.6 | | | — | | | 27.6 | |

Inventories: | | | | | | | | | | | | |

| Construction in progress and finished homes | | 8,986.1 | | | — | | | — | | | — | | | (110.3) | | | 8,875.8 | |

| Residential land and lots | | 11,044.9 | | | — | | | 2,266.2 | | | — | | | (189.7) | | | 13,121.4 | |

| Rental properties | | — | | | 2,902.4 | | | — | | | — | | | 3.6 | | | 2,906.0 | |

| | 20,031.0 | | | 2,902.4 | | | 2,266.2 | | | — | | | (296.4) | | | 24,903.2 | |

Mortgage loans held for sale | | — | | | — | | | — | | | 2,477.5 | | | — | | | 2,477.5 | |

Deferred income taxes, net | | 211.6 | | | (14.7) | | | — | | | — | | | (29.4) | | | 167.5 | |

Property and equipment, net | | 500.2 | | | 1.1 | | | 7.1 | | | 4.0 | | | 18.6 | | | 531.0 | |

Other assets | | 2,976.5 | | | 74.5 | | | 85.6 | | | 212.3 | | | (31.3) | | | 3,317.6 | |

Goodwill | | 134.3 | | | — | | | — | | | — | | | 29.2 | | | 163.5 | |

| | $ | 27,481.4 | | | $ | 3,123.1 | | | $ | 2,840.1 | | | $ | 2,956.7 | | | $ | (297.0) | | | $ | 36,104.3 | |

| Liabilities | | | | | | | | | | | | |

Accounts payable | | $ | 1,046.1 | | | $ | 474.2 | | | $ | 85.9 | | | $ | 0.8 | | | $ | (261.5) | | | $ | 1,345.5 | |

Accrued expenses and other liabilities | | 2,552.0 | | | 67.8 | | | 452.8 | | | 234.6 | | | (290.5) | | | 3,016.7 | |

Notes payable | | 2,926.8 | | | 750.7 | | | 706.4 | | | 1,533.8 | | | — | | | 5,917.7 | |

| | $ | 6,524.9 | | | $ | 1,292.7 | | | $ | 1,245.1 | | | $ | 1,769.2 | | | $ | (552.0) | | | $ | 10,279.9 | |

_________________

(1)Amounts include the balances of the Company's other businesses and the elimination of intercompany transactions.

D.R. HORTON, INC. AND SUBSIDIARIES

SEGMENT INFORMATION

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2024 |

| | Homebuilding | | Rental | | Forestar | | Financial Services | | Eliminations and Other (1) | | Consolidated |

| | (In millions) |

| Revenues | | | | | | | | | | | | |

Home sales | | $ | 7,146.0 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 7,146.0 | |

Land/lot sales and other | | 21.2 | | | — | | | 250.4 | | | — | | | (204.7) | | | 66.9 | |

| Rental property sales | | — | | | 217.8 | | | — | | | — | | | — | | | 217.8 | |

Financial services | | — | | | — | | | — | | | 182.3 | | | — | | | 182.3 | |

| | 7,167.2 | | | 217.8 | | | 250.4 | | | 182.3 | | | (204.7) | | | 7,613.0 | |

| Cost of sales | | | | | | | | | | | | |

| Home sales (2) | | 5,522.0 | | | — | | | — | | | — | | | (53.3) | | | 5,468.7 | |

| Land/lot sales and other | | 13.8 | | | — | | | 194.2 | | | — | | | (169.9) | | | 38.1 | |

| Rental property sales | | — | | | 179.4 | | | — | | | — | | | — | | | 179.4 | |

| Inventory and land option charges | | 11.8 | | | 3.6 | | | 1.2 | | | — | | | — | | | 16.6 | |

| | 5,547.6 | | | 183.0 | | | 195.4 | | | — | | | (223.2) | | | 5,702.8 | |

Selling, general and administrative expense | | 636.6 | | | 46.4 | | | 36.0 | | | 154.2 | | | 4.9 | | | 878.1 | |

| Other (income) expense | | (29.9) | | | (23.5) | | | (2.9) | | | (20.5) | | | (1.0) | | | (77.8) | |

| Income before income taxes | | $ | 1,012.9 | | | $ | 11.9 | | | $ | 21.9 | | | $ | 48.6 | | | $ | 14.6 | | | $ | 1,109.9 | |

| Summary Cash Flow Information | | | | | | | | | | | | |

| Cash provided by (used in) operating activities | | $ | 552.0 | | | $ | (283.3) | | | $ | (449.9) | | | $ | 813.3 | | | $ | 14.6 | | | $ | 646.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| | Homebuilding | | Rental | | Forestar | | Financial Services | | Eliminations and Other (1) | | Consolidated |

| | (In millions) |

| Revenues | | | | | | | | | | | | |

Home sales | | $ | 7,276.4 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 7,276.4 | |

Land/lot sales and other | | 20.3 | | | — | | | 305.9 | | | — | | | (264.5) | | | 61.7 | |

| Rental property sales | | — | | | 195.3 | | | — | | | — | | | — | | | 195.3 | |

Financial services | | — | | | — | | | — | | | 192.6 | | | — | | | 192.6 | |

| | 7,296.7 | | | 195.3 | | | 305.9 | | | 192.6 | | | (264.5) | | | 7,726.0 | |

| Cost of sales | | | | | | | | | | | | |

| Home sales (2) | | 5,608.0 | | | — | | | — | | | — | | | (54.2) | | | 5,553.8 | |

| Land/lot sales and other | | 13.2 | | | — | | | 232.8 | | | — | | | (222.6) | | | 23.4 | |

| Rental property sales | | — | | | 141.3 | | | — | | | — | | | (4.8) | | | 136.5 | |

| Inventory and land option charges | | 5.5 | | | 0.4 | | | 0.2 | | | — | | | — | | | 6.1 | |

| | 5,626.7 | | | 141.7 | | | 233.0 | | | — | | | (281.6) | | | 5,719.8 | |

Selling, general and administrative expense | | 603.4 | | | 47.4 | | | 28.0 | | | 151.5 | | | 4.7 | | | 835.0 | |

| Other (income) expense | | (29.5) | | | (25.1) | | | (6.3) | | | (24.9) | | | 9.5 | | | (76.3) | |

| Income before income taxes | | $ | 1,096.1 | | | $ | 31.3 | | | $ | 51.2 | | | $ | 66.0 | | | $ | 2.9 | | | $ | 1,247.5 | |

| Summary Cash Flow Information | | | | | | | | | | | | |

| Cash provided by (used in) operating activities | | $ | 31.2 | | | $ | (516.2) | | | $ | (156.7) | | | $ | 464.7 | | | $ | 23.6 | | | $ | (153.4) | |

_____________________

(1)Amounts include the results of the Company's other businesses and the elimination of intercompany transactions.

(2)Amount in the Eliminations and Other column represents the recognition of profit on lots sold from Forestar to the homebuilding segment. Intercompany profit is eliminated in the consolidated financial statements when Forestar sells lots to the homebuilding segment and is recognized in the consolidated financial statements when the homebuilding segment closes homes on the lots to homebuyers.

D.R. HORTON, INC. AND SUBSIDIARIES

SALES, CLOSINGS AND BACKLOG

HOMEBUILDING SEGMENT

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NET SALES ORDERS |

| | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | |

| | 2024 | | 2023 | | | | |

| | Homes | | Value | | Homes | | Value | | | | | | | | |

| Northwest | | 1,019 | | $ | 533.7 | | | 1,179 | | $ | 595.8 | | | | | | | | | |

| Southwest | | 2,174 | | 1,049.5 | | | 2,163 | | 1,034.9 | | | | | | | | | |

| South Central | | 4,559 | | 1,430.7 | | | 4,832 | | 1,554.7 | | | | | | | | | |

| Southeast | | 4,422 | | 1,501.9 | | | 4,801 | | 1,705.1 | | | | | | | | | |

| East | | 3,587 | | 1,239.4 | | | 3,301 | | 1,175.2 | | | | | | | | | |

| North | | 2,076 | | 898.3 | | | 1,793 | | 723.8 | | | | | | | | | |

| | 17,837 | | $ | 6,653.5 | | | 18,069 | | $ | 6,789.5 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HOMES CLOSED |

| | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | |

| | 2024 | | 2023 | | | | |

| | Homes | | Value | | Homes | | Value | | | | | | | | |

| Northwest | | 1,056 | | $ | 533.1 | | | 1,134 | | $ | 573.7 | | | | | | | | | |

| Southwest | | 2,335 | | 1,140.0 | | | 2,218 | | 1,051.3 | | | | | | | | | |

| South Central | | 4,736 | | 1,486.4 | | | 5,121 | | 1,664.0 | | | | | | | | | |

| Southeast | | 5,031 | | 1,739.2 | | | 5,494 | | 1,990.3 | | | | | | | | | |

| East | | 3,719 | | 1,308.5 | | | 3,581 | | 1,267.9 | | | | | | | | | |

| North | | 2,182 | | 938.8 | | | 1,792 | | 729.2 | | | | | | | | | |

| | 19,059 | | $ | 7,146.0 | | | 19,340 | | $ | 7,276.4 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SALES ORDER BACKLOG |

| | | | | | | | |

| | As of December 31, |

| | 2024 | | 2023 |

| | Homes | | Value | | Homes | | Value |

| Northwest | | 498 | | $ | 284.8 | | | 592 | | $ | 300.1 | |

| Southwest | | 1,053 | | 533.1 | | | 1,352 | | 664.9 | |

| South Central | | 2,577 | | 837.9 | | | 3,338 | | 1,117.2 | |

| Southeast | | 2,486 | | 898.2 | | | 4,123 | | 1,588.5 | |

| East | | 2,612 | | 943.2 | | | 3,101 | | 1,159.7 | |

| North | | 1,777 | | 801.8 | | | 1,459 | | 612.4 | |

| | 11,003 | | $ | 4,299.0 | | | 13,965 | | $ | 5,442.8 | |

D.R. HORTON, INC. AND SUBSIDIARIES

LAND AND LOT POSITION AND HOMES IN INVENTORY

HOMEBUILDING SEGMENT

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LAND AND LOT POSITION |

| | | | | | | | | | | |

| | December 31, 2024 | | September 30, 2024 |

| | Land/Lots

Owned | | Lots Controlled

Through

Land and Lot

Purchase

Contracts (1) | | Total

Land/Lots

Owned and

Controlled | | Land/Lots

Owned | | Lots Controlled

Through

Land and Lot

Purchase

Contracts (1) | | Total

Land/Lots

Owned and

Controlled |

| Northwest | 12,300 | | 17,500 | | 29,800 | | 13,000 | | 18,600 | | 31,600 |

| Southwest | 21,700 | | 32,200 | | 53,900 | | 22,200 | | 29,200 | | 51,400 |

| South Central | 39,000 | | 118,800 | | 157,800 | | 39,000 | | 109,600 | | 148,600 |

| Southeast | 30,300 | | 132,400 | | 162,700 | | 29,500 | | 134,300 | | 163,800 |

| East | 34,100 | | 126,100 | | 160,200 | | 32,500 | | 129,300 | | 161,800 |

| North | 17,000 | | 58,400 | | 75,400 | | 16,300 | | 59,400 | | 75,700 |

| 154,400 | | 485,400 | | 639,800 | | 152,500 | | 480,400 | | 632,900 |

| 24 | % | | 76 | % | | 100 | % | | 24 | % | | 76 | % | | 100 | % |

_____________

(1)Lots controlled at December 31, 2024 included approximately 43,800 lots owned or controlled by Forestar, 24,500 of which our homebuilding divisions had under contract to purchase and 19,300 of which our homebuilding divisions had a right of first offer to purchase. Lots controlled at September 30, 2024 included approximately 37,700 lots owned or controlled by Forestar, 20,500 of which our homebuilding divisions had under contract to purchase and 17,200 of which our homebuilding divisions had a right of first offer to purchase.

| | | | | | | | | | | | | | |

HOMES IN INVENTORY (1) |

| | | | |

| | December 31, 2024 | | September 30, 2024 |

| Northwest | | 2,400 | | 2,100 |

| Southwest | | 3,500 | | 4,200 |

| South Central | | 9,200 | | 9,000 |

| Southeast | | 9,000 | | 9,700 |

| East | | 7,300 | | 7,500 |

| North | | 4,800 | | 4,900 |

| | 36,200 | | 37,400 |

_____________

(1)Homes in inventory exclude model homes and homes related to our rental operations.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeniorNotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

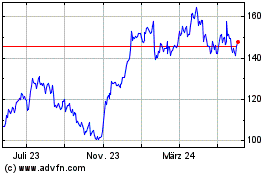

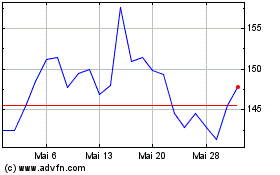

D R Horton (NYSE:DHI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

D R Horton (NYSE:DHI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025