Caterpillar's Profit Outlook Dims as China Slows and Costs Bite -- 2nd Update

28 Januar 2019 - 4:37PM

Dow Jones News

By Austen Hufford

Caterpillar Inc. set lower-than-expected profit targets for

2019, as China's slowing economy and higher material and

transportation costs weighed on the machinery giant.

A growing number of industrial companies have said they are

making fewer sales in China, threatening a strong three-year run

for U.S. manufacturers. Caterpillar has said that up to 10% of its

sales are made in China.

Like other manufacturers, Caterpillar has also raised prices to

offset rising transportation and material expenses. Some of those

higher costs are a result of U.S. tariffs on foreign goods

including steel and aluminum.

"Material costs and freight were adverse and worse than we were

expecting," Caterpillar Financial Chief Andrew Bonfield said on

Monday in an interview.

Caterpillar's shares fell 5.5% in premarket trading.

The company said it expects to make a profit of $11.75 to $12.75

a share in 2019, below what analysts were expecting. Caterpillar

said it expects a modest increase in revenue.

Caterpillar said that lower demand in China is leading to

declining sales in Asia and that the company expects the overall

market for excavators in China to be largely flat this year.

Caterpillar said costs related to tariffs came in close to the

bottom end of the $100 million to $200 million range it had

expected for 2018.

The company has said it plans to raise prices between 1% and 4%

in 2019 on most of its machines and engines to offset higher costs.

Other manufacturers have also said they raising prices to cover

higher costs. Caterpillar said Monday it benefited from these

higher prices, primarily in its construction machinery

business.

The Deerfield, Ill.-based company said sales of its excavators,

bulldozers and other equipment rose 12% to $13.6 billion in its

fourth quarter.

Caterpillar reported adjusted earnings of $2.55 a share in the

quarter, above last year's $2.16 but below analyst expectations of

$2.99, according to surveys by Refinitiv.

It was the first time Caterpillar fell short of expectations for

its adjusted earnings-per-share since the quarter ended in March

2016, and the largest percentage miss going back to at least 2014,

according to FactSet data.

Total sales, including revenue from financial products, rose 11%

to $14.34 billion, compared with analyst expectations of $14.33

billion.

In all, the company reported a fourth-quarter profit of $1.05

billion, or $1.78 a share, compared with a loss of $1.3 billion, or

$2.18 a share, a year earlier. The losses a year earlier were

driven by the impact of changes to U.S. tax laws.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

January 28, 2019 10:22 ET (15:22 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

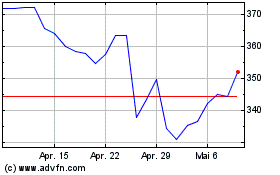

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2024 bis Aug 2024

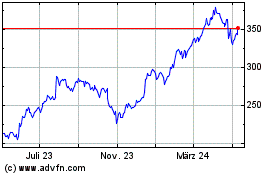

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Aug 2023 bis Aug 2024