BlackRock® Canada Announces Change to the iShares Convertible Bond Index ETF

28 Januar 2025 - 11:02PM

BlackRock Asset Management Canada Limited (“

BlackRock

Canada”), an indirect, wholly-owned subsidiary of

BlackRock, Inc. (“

BlackRock”) (NYSE: BLK), is

announcing that the iShares Convertible Bond Index ETF (the

“

iShares ETF”) is expected to experience higher

than normal portfolio turnover as a result of upcoming changes to

the composition of the FTSE Canada Convertible Bond Index (the

“

Index”). The iShares ETF seeks to replicate the

performance of the Index, net of expenses. The composition of the

Index will be changing as part of its regularly scheduled rebalance

on January 31, 2025 (the “

Rebalance”). As a result

of the Rebalance, the iShares ETF may experience higher than normal

transaction costs. The iShares ETF is not expected to realize any

net capital gains as a result of the Rebalance.

On November 7, 2024, FTSE Global Debt Capital

Markets Inc. (“FTSE”), the index provider of the

Index, announced that (1) the sector classification schema used for

the sector weight capping at each rebalance of the Index will

follow the Refinitiv Business Classification, and (2) the Index

will follow the holiday calendar as published by the Toronto Stock

Exchange. FTSE published the official Index proforma on January 24,

2025, confirming the impact of the Index changes.

For more information about the iShares Fund,

please visit www.blackrock.com/ca.

About BlackRock

BlackRock’s purpose is to help more and more

people experience financial well-being. As a fiduciary to investors

and a leading provider of financial technology, we help millions of

people build savings that serve them throughout their lives by

making investing easier and more affordable. For additional

information on BlackRock, please visit

www.blackrock.com/corporate.

About iShares

iShares unlocks opportunity across markets to

meet the evolving needs of investors. With more than twenty years

of experience, a global line-up of 1500+ exchange traded funds

(ETFs) and US$4.2 trillion in assets under management as of

December 31, 2024, iShares continues to drive progress for the

financial industry. iShares funds are powered by the expert

portfolio and risk management of BlackRock.

iShares® ETFs are managed by BlackRock Asset

Management Canada Limited.

Commissions, trailing commissions, management

fees and expenses all may be associated with investing in iShares

ETFs. Please read the relevant prospectus before investing. The

funds are not guaranteed, their values change frequently and past

performance may not be repeated. Tax, investment and all other

decisions should be made, as appropriate, only with guidance from a

qualified professional.

The ETF is not in any way sponsored, endorsed,

sold or promoted by the London Stock Exchange Group plc and its

group undertakings (collectively, the “LSE

Group”). The LSE Group does not accept any liability

whatsoever to any person arising out of the use of the ETF or the

underlying data.

“FTSE®” and “FTSE Russell®” are trademarks of

the relevant LSE Group company and are used by any other LSE Group

company under license.

Contact for Media: Sydney

Punchard Email: Sydney.Punchard@blackrock.com

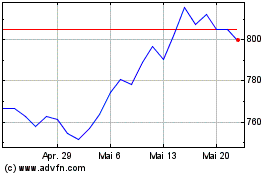

BlackRock (NYSE:BLK)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

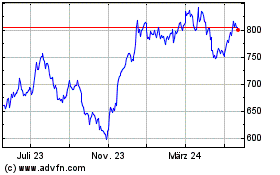

BlackRock (NYSE:BLK)

Historical Stock Chart

Von Jan 2024 bis Jan 2025