Barclays Appoints Martin Douglass as Head of Financial Sponsors M&A

27 August 2024 - 6:16PM

Business Wire

Mr. Douglass brings to Barclays a deep

understanding of the private equity asset class and extensive

M&A transaction experience that will further strengthen the

firm’s M&A platform and Financial Sponsors business.

Barclays today announces the appointment of Martin Douglass as

Head of Financial Sponsors M&A. Mr. Douglass will be based in

New York, and will report to Dan Grabos, Head of Americas M&A.

Mr. Douglass will work in close partnership with JF Astier, Global

Head of Financial Sponsors Group, and Christian Oberle, Head of

Americas Financial Sponsors Group.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240827339462/en/

Barclays appoints Martin Douglass as Head

of Financial Sponsors M&A. (Photo: Business Wire)

Mr. Douglass has close to 15 years of investment banking

experience and joins Barclays from Morgan Stanley, where he was a

Managing Director in the M&A team in New York. Prior to joining

Morgan Stanley in 2014, Mr. Douglass was on the Healthcare

investment banking team at Jefferies.

During his career Mr. Douglass has executed over $300bn of

transactions advising on mergers, acquisitions, company sales,

divestitures, separations, cross-border transactions, dual-track

processes, and takeover defense assignments. During his tenure at

Morgan Stanley, he played a key role in a number of significant

M&A transactions including the sale of MGM Studios to Amazon,

merger of Baker Hughes and GE Oil & Gas, sale of Culligan by

Advent and Centerbridge to BDT, sale of Champion Petfoods by HOOPP

to Mars, merger of Vantiv and Worldpay and subsequent sale to FIS,

and take-private of Kindred Healthcare by TPG, WCAS and Humana.

In his role at Barclays, Mr. Douglass will be responsible for

identifying new M&A business opportunities with Financial

Sponsor clients, working in close partnership with the Financial

Sponsors Group and the broader Investment Banking industry coverage

and M&A teams. Mr. Douglass will also work in close

coordination with the M&A Sell-Side Advisory team that is

responsible for executing Financial Sponsor sell-side

transactions.

“Financial Sponsors M&A is a critical area of focus within

our Investment Banking business, and one where we see significant

opportunity given our expectation for increased levels of market

activity,” said Dan Grabos, Head of Americas M&A. “Martin’s

addition to our M&A platform will help best position Barclays

to capture a large share of the Advisory opportunity. His

exceptional industry knowledge, deep roster of key relationships,

and extensive transactional experience with Private Equity firms

will generate tremendous value for our clients, and his appointment

is further evidence of our dedication to investing in top-level

talent.”

About Barclays

Our vision is to be the UK-centred leader in global finance. We

are a diversified bank with comprehensive UK consumer, corporate

and wealth and private banking franchises, a leading investment

bank and a strong, specialist US consumer bank. Through these five

divisions, we are working together for a better financial future

for our customers, clients and communities. For further information

about Barclays, please visit our website home.barclays

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240827339462/en/

Oksana Poltavets (US) +1 (732) 889-6747

oksana.poltavets@barclays.com

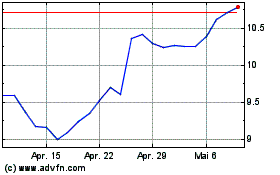

Barclays (NYSE:BCS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Barclays (NYSE:BCS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024