Barclays Appoints Three Senior Leaders in its Industrials Investment Banking Team

18 September 2024 - 7:48PM

Business Wire

Barclays appoints Derek McNulty as Global Co-Head of Chemicals,

Derek Davidson as Head of Americas Commercial, Residential and

Industrials Services, and Jared Itkowitz as Head of Americas

Transportation and Logistics within Industrials Investment

Banking

Barclays today announces the appointments of Derek McNulty as

Global Co-Head of Chemicals Investment Banking, Derek Davidson as

Head of Americas Commercial, Residential and Industrials Services,

and Jared Itkowitz as Head of Americas Transportation and Logistics

within Industrials Investment Banking. All three are based in New

York and report to Spyros Svoronos, Global Head of Industrials

Investment Banking.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240918115978/en/

From left to right, Derek McNulty, Derek

Davidson and Jared Itkowitz. (Photo: Business Wire)

Mr. McNulty joins Barclays with close to 30 years of experience

in Investment Banking, most recently as Head of North America

Chemicals at Citigroup in New York. He joined Citigroup in July

2022, having previously been a Managing Director at Jefferies in

New York since the beginning of 2019. From 2006 to 2019, Mr.

McNulty was with Barclays, covering strategic and financial sponsor

backed chemical companies, and at the time of his departure was the

Head of Americas Chemicals. Throughout his career, he has executed

more than $75bn in strategic advisory mandates as well as equity

and debt transactions for blue chip clients including Dow, Eastman

Chemical, LyondellBasell, Westlake, Element Solutions, Chemours.

Air Products and Axalta. In addition, he has extensive deal

experience with top tier sponsors including Carlyle, Blackstone,

Bain, HIG, New Mountain, Cerberus and American Securities. In his

new role at Barclays, Mr. McNulty will work in partnership with

Gabriel Gruber, Global Co-Head of Chemicals Investment Banking.

Mr. Davidson will join Barclays from Morgan Stanley, where he

was a Managing Director based in New York leading coverage of

companies providing commercial, residential and professional

services. He has also spent time across large cap diversified

industrials and building products coverage. Mr. Davidson joined

Morgan Stanley in 2010, spending his first 11 years with the firm

in the global services group and the last 3 years as part of the

global industrials group. Throughout his career, he has experience

advising corporate and financial sponsor clients on strategy,

transformative M&A, defense, as well as equity and debt capital

raising. During his time at Morgan Stanley, he executed

transactions for notable clients including Rollins, Iron Mountain,

Allied Universal, CBRE, ADP, Brightview, 3M, Divisions Maintenance

Group, Hunter Douglas, Service Logic, and BGIS. In addition, he has

extensive experience working with leading financial sponsors

including Carlyle, Blackstone, Bain, KKR, HIG, New Mountain,

Warburg Pincus, Roark, and Leonard Green.

Mr. Itkowitz has been with Barclays for over 15 years, and began

his career in Equity Linked & Hybrid Solutions working in both

New York and Hong Kong. In 2014, he relocated back to New York and

joined the Industrials Group where he has spent the past decade

covering transportation and automotive clients on a range of

strategic and capital raising assignments. Mr. Itkowitz has played

a leading role on a number of high profile transactions across the

transportation and mobility sectors, including Rivian’s $12bn IPO,

EQT Infrastructure’s $6.4bn LBO of First Student and First Transit

and its subsequent sale of First Transit to Transdev, General

Motors’ $10bn ASR and KAR Auction Services’ spin-off of IAA.

“We at Barclays have a leading Global Industrials franchise,

which forms a key pillar within our broader investment banking

business,” commented Spyros Svoronos, Global Head of Industrials

Investment Banking. “These appointments demonstrate our continued

investment in our platform as we work to most effectively serve our

clients with best-in-class strategic advice and execution.”

Barclays has played key roles in a number of recent transactions

of note in the Industrials space. These include serving as sole

financial advisor to Koch on its $3.6 cash acquisition of IFCO from

OCI Global; joint financial advisor and providing committed

financing to TDR Capital and I Squared Capital in relation to the

take-private transaction of Applus; serving as Joint Global

Coordinator on LATAM Airlines Group’s $456mm IPO; and serving as

Lead Left Arranger and Joint Structuring Agent on the Term Loan B,

Joint Lead Bookrunner and Joint Structuring Agent on the Notes and

Active Bookrunner on the Convertible Notes for JetBlue Airways’

$3.2bn Financing. Barclays’ Industrials franchise has a

year-to-date global ranking of number six across all products,

according to Dealogic data. This includes a ranking of number five

in Industrials Leveraged Finance globally, up one place from

2023.

About Barclays Investment Bank

Our vision is to be the UK-centred leader in global finance. We

are a diversified bank with comprehensive UK consumer, corporate

and wealth and private banking franchises, a leading global

investment bank and a strong, specialist US consumer bank. Through

these five divisions, we are working together for a better

financial future for our customers, clients and communities. The

Investment Bank helps money managers, financial institutions,

governments, supranational organisations and corporate clients

manage their funding, investing, financing, and strategic and risk

management needs. www.barclays.com/ib

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240918115978/en/

Andrew Smith +1 (212) 412 7521 andrew.smith@barclays.com

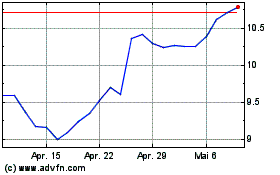

Barclays (NYSE:BCS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Barclays (NYSE:BCS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024