Avery Dennison Prices €500 Million Senior Notes Offering

31 Oktober 2024 - 1:00AM

Business Wire

Avery Dennison Corporation (NYSE: AVY) announced today that it

has priced an underwritten public offering of €500 million

aggregate principal amount of 3.750% Senior Notes due 2034. The

Senior Notes were priced at 99.672% of their principal amount. The

offering is expected to close on November 4, 2024, subject to

customary closing conditions.

Avery Dennison intends to use the net proceeds from the offering

to repay in full the €500 million aggregate principal amount of its

1.250% senior notes due 2025 when they mature on March 3, 2025 and

for general corporate purposes.

The joint book-running managers for this offering are Merrill

Lynch International, Mizuho International plc, SMBC Bank

International plc, Citigroup Global Markets Limited, Goldman Sachs

& Co. LLC, HSBC Continental Europe, J.P. Morgan Securities plc

and PNC Capital Markets LLC, with Academy Securities, Inc., ING

Bank N.V., Belgian Branch, Loop Capital Markets LLC and Standard

Chartered Bank as co-managers.

The offering is being made pursuant to an effective registration

statement (containing a prospectus) that has been filed with the

Securities and Exchange Commission (the “SEC”). A preliminary

prospectus supplement related to the offering has been filed with

the SEC and is available on the SEC’s website at

http://www.sec.gov. A copy of the preliminary prospectus supplement

and accompanying prospectus may also be obtained by calling Merrill

Lynch International toll-free at +1-800-294-1322, Mizuho

International plc at +44-207-248-3920 and SMBC Bank International

plc toll-free at +44-204-507-1000.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any jurisdiction in which such

an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. Any offer, solicitation or sale of these securities

will be made only by means of the prospectus supplement and the

accompanying prospectus.

About Avery Dennison

Avery Dennison Corporation (NYSE: AVY) is a global materials

science and digital identification solutions company that provides

a wide range of branding and information solutions that optimize

labor and supply chain efficiency, reduce waste, advance

sustainability, circularity and transparency, and better connect

brands and consumers. Our products and solutions include labeling

and functional materials, radio frequency identification (RFID)

inlays and tags, software applications that connect the physical

and digital, and a variety of products and solutions that enhance

branded packaging and carry or display information that improves

the customer experience. Serving an array of industries worldwide —

including home and personal care, apparel, general retail,

e-commerce, logistics, food and grocery, pharmaceuticals and

automotive — we employ approximately 35,000 employees in more than

50 countries. Our reported sales in 2023 were $8.4 billion.

“Safe Harbor” Statement under the Private Securities

Litigation Reform Act of 1995:

Certain statements contained in this document are

“forward-looking statements” intended to qualify for the safe

harbor from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements,

and financial or other business targets, are subject to certain

risks and uncertainties. Forward-looking statements also include

those related to the closing of this offering.

Actual results and trends may differ materially from historical

or anticipated results depending on a variety of factors, including

but are not limited to, risks and uncertainties relating to our

ability to satisfy the conditions to closing the offering.

For a more detailed discussion of these and other factors, see

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” in our 2023 Form

10-K, filed with the SEC on February 21, 2024, and subsequent

quarterly reports on Form 10-Q.

The forward-looking statements included in this document are

made only as of the date of this document, and we undertake no

obligation to update these statements to reflect new, changed or

unanticipated events or circumstances, other than as may be

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030008558/en/

John Eble Vice President, Finance and Investor Relations

investorcom@averydennison.com

Kristin Robinson Vice President, Global Communications

kristin.robinson@averydennison.com

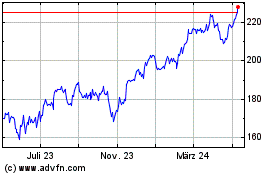

Avery Dennison (NYSE:AVY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

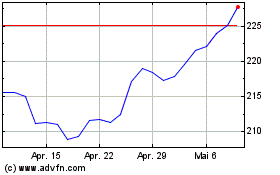

Avery Dennison (NYSE:AVY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024