0001018963false00010189632024-01-192024-01-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 19, 2024

______________________

ATI Inc.

(Exact name of registrant as specified in its charter)

______________________

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 1-12001 | | 25-1792394 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| | | | |

| 2021 McKinney Avenue, | Dallas, | Texas | | 75201 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (800) 289-7454

N/A

(Former name or former address, if changed since last report).

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, par value $0.10 per share | | ATI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

7.01 Regulation FD Disclosure.

ATI Inc.'s ("the Company") Q4 2023 and full year 2023 guidance released on November 2, 2023 did not reflect the change in accounting policy discussed below. There is no significant difference between our expectations regarding Adjusted Earnings Per Share (EPS) for Q4 2023, which reflect the change in accounting policy, and the Adjusted EPS that we anticipated for the quarter without giving effect to the change in accounting policy, largely due to pension annuitization transactions executed in Q4 2023. Therefore, the Adjusted Q4 2023 EPS guidance range of $0.57 - $0.67 previously presented on page 7 of the Q3 Earnings Presentation, released on November 2, 2023, remains unchanged. However, the Company's change in accounting policy does require an adjustment to the full year Adjusted EPS range estimate, as previously released on November 2, 2023. Adjusting for the accounting policy change, Adjusted EPS for year-to-date September 2023 increases from $1.63 to $1.92. Accordingly, the full year 2023 Adjusted EPS range estimate increases from $2.20 - $2.30 to $2.49 to $2.59, with the new midpoint of the range at $2.54. This revised range incorporates no additional changes in estimates associated with Q4 2023 and full year 2023.

| | | | | | | | | | | | | | | | | |

| Guidance | Q3 2023 Earnings Presentation | | Impact of Accounting Policy Change | | Q3 2023 Earnings Presentation (Adjusted for Accounting Policy Change) |

| | | | | |

| Q4 2023 Adjusted Earnings Per Share | $0.57 - $0.67 | | nil | | $0.57 - $0.67 |

| | | | | |

| Full Year 2023 Adjusted Earnings Per Share | $2.20 - $2.30 | | $0.29 | | $2.49 - $2.59 |

Item 8.01. Other Events.

During the fourth quarter of 2023, the Company voluntarily changed the method of accounting for recognizing actuarial gains and losses for its defined benefit pension plans. Under the accounting method change, remeasurement of the projected benefit obligation and plan assets for defined benefit pension plans are immediately recognized in earnings through net periodic pension benefit cost within nonoperating retirement benefit expense on the consolidated statements of operations, with pension plans to be remeasured annually in the fourth quarter or on an interim basis as triggering events require remeasurement. Prior to this accounting method change, the Company deferred the recognition of these gains and losses in accumulated other comprehensive loss on the consolidated balance sheet. The accumulated actuarial gains/losses were then amortized into net periodic benefit costs within nonoperating retirement benefit expense on the consolidated statement of operations over the average expected remaining life of plan participants. While the historical accounting principle was acceptable, we believe that the current accounting policy is preferable because it provides a better representation of the operating results of the Company and the economic performance of plan assets in relation to the measurement of its benefit obligations for the period. The change in accounting will more clearly reflect the current period impact of the Company’s pension asset investment strategy to readers of the financial statements.

Beginning with the fourth quarter and fiscal year ended December 31, 2023, the Company's financial information will reflect the impact of the change in accounting principle, with prior periods retrospectively adjusted. As of January 1, 2021, this change resulted in a cumulative effect decrease to retained earnings of $1.07 billion with a corresponding offset to accumulated other comprehensive loss.

As a result of the new accounting policy and to enable a comparison between the information to be presented in the Company's fourth quarter and full year 2023 earnings release with prior periods, the Company has furnished herewith as Exhibit 99.1 unaudited financial statements and associated footnote information that reflects the effects of the accounting principle change for the fiscal year ended December 31, 2021, fourth quarter and fiscal year ended December 31, 2022 and the quarterly periods for the nine months ended September 30, 2023.

Item 9.01. Exhibit.

| | | | | | | | |

| (d) | Exhibit 99.1 | |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | | ATI Inc. |

| | | | By: | /s/ Donald P. Newman |

| | | | | Donald P. Newman |

| | | | | Executive Vice President, Finance and Chief Financial Officer |

| | | | | |

| Dated: | January 19, 2024 | | | |

ATI Inc. and Subsidiaries

Consolidated Balance Sheets (unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31 | | December 31 | | March 31 | | June 30 | | September 30 | |

| 2021 | | 2022 | | 2023 | | 2023 | | 2023 | |

| ASSETS | | | | | | | | | | |

| | | | | | | | | | |

| Current Assets: | | | | | | | | | | |

| Cash and cash equivalents | $ | 687.7 | | | $ | 584.0 | | | $ | 196.2 | | | $ | 267.1 | | | $ | 432.9 | | |

| Accounts receivable, net of allowances for doubtful accounts | 470.0 | | | 579.2 | | | 725.6 | | | 710.1 | | | 683.0 | | |

| Short-term contract assets | 53.9 | | | 64.1 | | | 52.7 | | | 51.8 | | | 56.6 | | |

| Inventories, net | 1,046.3 | | | 1,195.7 | | | 1,293.8 | | | 1,380.4 | | | 1,353.9 | | |

| Prepaid expenses and other current assets | 48.8 | | | 53.4 | | | 48.0 | | | 49.2 | | | 73.3 | | |

| Total Current Assets | 2,306.7 | | | 2,476.4 | | | 2,316.3 | | | 2,458.6 | | | 2,599.7 | | |

| | | | | | | | | | |

| Property, plant and equipment, net | 1,528.5 | | | 1,549.1 | | | 1,551.8 | | | 1,568.1 | | | 1,626.3 | | |

| Goodwill | 227.9 | | | 227.2 | | | 227.2 | | | 227.2 | | | 227.2 | | |

| Other assets | 222.1 | | | 192.9 | | | 192.0 | | | 180.8 | | | 277.9 | | |

| | | | | | | | | | |

| Total Assets | $ | 4,285.2 | | | $ | 4,445.6 | | | $ | 4,287.3 | | | $ | 4,434.7 | | | $ | 4,731.1 | | |

| | | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | | | |

| | | | | | | | | | |

| Current Liabilities: | | | | | | | | | | |

| Accounts payable | $ | 375.5 | | | $ | 553.3 | | | $ | 447.5 | | | $ | 467.7 | | | $ | 435.0 | | |

| Short-term contract liabilities | 116.2 | | | 149.1 | | | 149.7 | | | 137.8 | | | 110.2 | | |

| Short-term debt and current portion of long-term debt | 131.3 | | | 41.7 | | | 24.9 | | | 73.9 | | | 37.5 | | |

| Other current liabilities | 233.4 | | | 219.8 | | | 201.9 | | | 218.1 | | | 246.6 | | |

| Total Current Liabilities | 856.4 | | | 963.9 | | | 824.0 | | | 897.5 | | | 829.3 | | |

| | | | | | | | | | |

| Long-term debt | 1,711.6 | | | 1,706.3 | | | 1,702.1 | | | 1,699.9 | | | 2,147.7 | | |

| Accrued postretirement benefits | 258.1 | | | 184.9 | | | 180.0 | | | 176.7 | | | 173.2 | | |

| Pension liabilities | 415.4 | | | 225.6 | | | 173.8 | | | 172.0 | | | 39.7 | | |

| Other long-term liabilities | 211.0 | | | 207.7 | | | 193.1 | | | 179.4 | | | 185.3 | | |

| Total Liabilities | 3,452.5 | | | 3,288.4 | | | 3,073.0 | | | 3,125.5 | | | 3,375.2 | | |

| Equity: | | | | | | | | | | |

| ATI Stockholders’ Equity: | | | | | | | | | | |

| Preferred stock | — | | | — | | | — | | | — | | | — | | |

| Common stock | 12.7 | | | 13.1 | | | 13.2 | | | 13.2 | | | 13.2 | | |

| Additional paid-in capital | 1,596.7 | | | 1,668.1 | | | 1,675.1 | | | 1,682.0 | | | 1,689.5 | | |

| Retained loss | (777.7) | | | (480.9) | | | (396.4) | | | (306.0) | | | (215.8) | | |

| Treasury stock | (4.8) | | | (87.0) | | | (107.8) | | | (107.9) | | | (153.6) | | |

| Accumulated other comprehensive loss, net of tax | (141.3) | | | (67.4) | | | (87.6) | | | (87.3) | | | (94.4) | | |

| Total ATI stockholders’ equity | 685.6 | | | 1,045.9 | | | 1,096.5 | | | 1,194.0 | | | 1,238.9 | | |

| Noncontrolling interests | 147.1 | | | 111.3 | | | 117.8 | | | 115.2 | | | 117.0 | | |

| Total Equity | 832.7 | | | 1,157.2 | | | 1,214.3 | | | 1,309.2 | | | 1,355.9 | | |

| Total Liabilities and Equity | $ | 4,285.2 | | | $ | 4,445.6 | | | $ | 4,287.3 | | | $ | 4,434.7 | | | $ | 4,731.1 | | |

ATI Inc. and Subsidiaries

Consolidated Statements of Operations (unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Fiscal Year Ended | | Three Months Ended | | Fiscal Year Ended | |

| December 31 | | December 31 | | December 31 | |

| 2021 | | 2022 | | 2022 | |

| | | | | | |

| Sales | $ | 2,799.8 | | | $ | 1,010.4 | | | $ | 3,836.0 | | |

| | | | | | |

| Cost of sales | 2,466.6 | | | 824.7 | | | 3,121.8 | | |

| Gross profit | 333.2 | | | 185.7 | | | 714.2 | | |

| | | | | | |

| Selling and administrative expenses | 226.9 | | | 76.8 | | | 297.5 | | |

| Restructuring charges (credits) | (11.3) | | | 0.2 | | | (4.8) | | |

| Loss on asset sales and sales of businesses, net | — | | | — | | | 105.4 | | |

| Operating income | 117.6 | | | 108.7 | | | 316.1 | | |

| Nonoperating retirement benefit income | 260.0 | | | 109.6 | | | 138.4 | | |

| Interest expense, net | (96.9) | | | (19.6) | | | (87.4) | | |

| Debt extinguishment charge | (65.5) | | | — | | | — | | |

| Other income (expense), net | 18.2 | | | 2.8 | | | (12.5) | | |

| Income before income taxes | 233.4 | | | 201.5 | | | 354.6 | | |

| Income tax provision | 26.8 | | | 4.2 | | | 15.5 | | |

| Net income | $ | 206.6 | | | $ | 197.3 | | | $ | 339.1 | | |

| Less: Net income attributable to noncontrolling interests | 22.0 | | | 4.3 | | | 15.6 | | |

| Net income attributable to ATI | $ | 184.6 | | | $ | 193.0 | | | $ | 323.5 | | |

| | | | | | |

| Basic net income attributable to ATI per common share | $ | 1.45 | | | $ | 1.49 | | | $ | 2.54 | | |

| | | | | | |

| Diluted net income attributable to ATI per common share | $ | 1.32 | | | $ | 1.30 | | | $ | 2.23 | | |

| | | | | | |

ATI Inc. and Subsidiaries

Consolidated Statements of Operations (unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Three Months Ended | | Three Months Ended | | Six Months Ended | | Three Months Ended | | Nine Months Ended |

| March 31 | | June 30 | | June 30 | | September 30 | | September 30 |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 |

| | | | | | | | | |

| Sales | $ | 1,038.1 | | | $ | 1,046.0 | | | $ | 2,084.1 | | | $ | 1,025.6 | | | $ | 3,109.7 | |

| | | | | | | | | |

| Cost of sales | 844.9 | | | 836.9 | | | 1,681.8 | | | 831.0 | | | 2,512.8 | |

| Gross profit | 193.2 | | | 209.1 | | | 402.3 | | | 194.6 | | | 596.9 | |

| | | | | | | | | |

| Selling and administrative expenses | 80.6 | | | 85.4 | | | 166.0 | | | 69.8 | | | 235.8 | |

| Restructuring charges (credits) | — | | | 2.7 | | | 2.7 | | | (0.5) | | | 2.2 | |

| Loss on asset sales and sales of businesses, net | — | | | 0.7 | | | 0.7 | | | 0.1 | | | 0.8 | |

| Operating income | 112.6 | | | 120.3 | | | 232.9 | | | 125.2 | | | 358.1 | |

| Nonoperating retirement benefit expense | (2.4) | | | (2.5) | | | (4.9) | | | (2.4) | | | (7.3) | |

| Interest expense, net | (19.9) | | | (21.3) | | | (41.2) | | | (23.8) | | | (65.0) | |

| Other income, net | 0.6 | | | 0.7 | | | 1.3 | | | — | | | 1.3 | |

| Income before income taxes | 90.9 | | | 97.2 | | | 188.1 | | | 99.0 | | | 287.1 | |

| Income tax provision | 4.3 | | | 3.7 | | | 8.0 | | | 4.9 | | | 12.9 | |

| Net income | $ | 86.6 | | | $ | 93.5 | | | $ | 180.1 | | | $ | 94.1 | | | $ | 274.2 | |

| Less: Net income attributable to noncontrolling interests | 2.1 | | | 3.1 | | | 5.2 | | | 3.9 | | | 9.1 | |

| Net income attributable to ATI | $ | 84.5 | | | $ | 90.4 | | | $ | 174.9 | | | $ | 90.2 | | | $ | 265.1 | |

| | | | | | | | | |

| Basic net income attributable to ATI per common share | $ | 0.66 | | | $ | 0.70 | | | $ | 1.36 | | | $ | 0.70 | | | $ | 2.06 | |

| | | | | | | | | |

| Diluted net income attributable to ATI per common share | $ | 0.58 | | | $ | 0.62 | | | $ | 1.20 | | | $ | 0.62 | | | $ | 1.82 | |

| | | | | | | | | |

ATI Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income (Loss) (unaudited)

(Dollars in millions)

| | | | | | | | | | | |

| Fiscal Year Ended | | Fiscal Year Ended |

| | December 31 | | December 31 |

| 2021 | | 2022 |

| | | |

| Net income | $ | 206.6 | | | $ | 339.1 | |

| Currency translation adjustment | | | |

| Unrealized net change arising during the period | (4.6) | | | (43.5) | |

| Reclassification adjustment included in net income | — | | | 20.0 | |

| Total | (4.6) | | -4600000 | (23.5) | |

| Derivatives | | | |

| Net derivatives gain on hedge transactions | 15.5 | | | 53.8 | |

| Reclassification to net income of net realized gain | (11.4) | | | (42.8) | |

| Income taxes on derivative transactions | — | | | — | |

| Total | 4.1 | | 4100000 | 11.0 | |

| Postretirement benefit plans | | | |

| Actuarial loss | | | |

| Amortization of net actuarial loss | 13.9 | | | 13.2 | |

| Net gain arising during the period | 8.7 | | | 54.7 | |

| Prior service cost | | | |

| Amortization to net income of net prior service credits | (1.8) | | | (0.5) | |

| Settlement loss (gain) included in net income | (21.9) | | | 0.7 | |

| Income taxes on postretirement benefit plans | (15.5) | | | — | |

| Total | 14.4 | | | 68.1 | |

| Other comprehensive income, net of tax | 13.9 | | | 55.6 | |

| Comprehensive income | 220.5 | | | 394.7 | |

| Less: Comprehensive income (loss) attributable to noncontrolling interests | 26.8 | | | (2.7) | |

| Comprehensive income attributable to ATI | $ | 193.7 | | | $ | 397.4 | |

| | | |

ATI Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income (Loss) (unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended | | Six Months Ended | | Three Months Ended | | Nine Months Ended |

| | March 31 | | June 30 | | June 30 | | September 30 | | September 30 |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 |

| | | | | | | | | |

| Net income | $ | 86.6 | | | $ | 93.5 | | | $ | 180.1 | | | $ | 94.1 | | | $ | 274.2 | |

| Currency translation adjustment | | | | | | | | | |

| Unrealized net change arising during the period | 3.3 | | | (8.1) | | | (4.8) | | | (9.2) | | | (14.0) | |

| Total | 3.3 | | | (8.1) | | | (4.8) | | | (9.2) | | | (14.0) | |

| Derivatives | | | | | | | | | |

| Net derivatives loss on hedge transactions | (15.0) | | | (2.4) | | | (17.4) | | | (3.2) | | | (20.6) | |

| Reclassification to net income of net realized loss (gain) | (5.5) | | | 3.8 | | | (1.7) | | | 1.8 | | | 0.1 | |

| Income taxes on derivative transactions | — | | | — | | | — | | | — | | | — | |

| Total | (20.5) | | | 1.4 | | | (19.1) | | | (1.4) | | | (20.5) | |

| Postretirement benefit plans | | | | | | | | | |

| Actuarial loss | | | | | | | | | |

| Amortization of net actuarial loss | 1.5 | | | 1.5 | | | 3.0 | | | 1.5 | | | 4.5 | |

| Prior service cost | | | | | | | | | |

| Amortization to net income of net prior service credits | (0.1) | | | (0.2) | | | (0.3) | | | (0.1) | | | (0.4) | |

| Income taxes on postretirement benefit plans | — | | | — | | | — | | | — | | | — | |

| Total | 1.4 | | 1400000 | 1.3 | | | 2.7 | | | 1.4 | | | 4.1 | |

| Other comprehensive loss, net of tax | (15.8) | | | (5.4) | | | (21.2) | | | (9.2) | | | (30.4) | |

| Comprehensive income | 70.8 | | | 88.1 | | | 158.9 | | | 84.9 | | | 243.8 | |

| Less: Comprehensive income (loss) attributable to noncontrolling interests | 6.5 | | | (2.6) | | | 3.9 | | | 1.8 | | | 5.7 | |

| Comprehensive income attributable to ATI | $ | 64.3 | | | $ | 90.7 | | | $ | 155.0 | | | $ | 83.1 | | | $ | 238.1 | |

| | | | | | | | | |

ATI Inc. and Subsidiaries

Consolidated Statements of Cash Flows (unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended | | Fiscal Year Ended | | Three Months Ended | | Six Months Ended | | Nine Months Ended |

| | December 31 | | December 31 | | March 31 | | June 30 | | September 30 |

| | 2021 | | 2022 | | 2023 | | 2023 | | 2023 |

| | | | | | | | | | |

| Operating Activities: | | | | | | | | | |

| Net income | $ | 206.6 | | | $ | 339.1 | | | $ | 86.6 | | | $ | 180.1 | | | $ | 274.2 | |

| | | | | | | | | | |

| Depreciation and amortization | 143.9 | | | 142.9 | | | 35.1 | | | 71.0 | | | 106.6 | |

| Share-based compensation | 21.1 | | | 26.0 | | | 7.1 | | | 14.1 | | | 21.5 | |

| Deferred taxes | 1.0 | | | (0.1) | | | 0.9 | | | 0.6 | | | 2.2 | |

| Net gain from disposal of property, plant and equipment | (2.9) | | | (0.9) | | | (0.3) | | | (0.3) | | | (0.1) | |

| Loss (gain) on sales of businesses | (13.8) | | | 112.2 | | | — | | | 0.6 | | | 0.6 | |

| Debt extinguishment charge | 65.5 | | | — | | | — | | | — | | | — | |

| Changes in operating assets and liabilities: | | | | | | | | | |

| Inventories | (53.9) | | | (190.8) | | | (98.1) | | | (184.7) | | | (158.2) | |

| Accounts receivable | (126.0) | | | (128.5) | | | (146.4) | | | (131.2) | | | (104.0) | |

| Accounts payable | 88.5 | | | 156.1 | | | (77.8) | | | (66.3) | | | (108.2) | |

| Retirement benefits | (333.5) | | | (210.5) | | | (55.0) | | | (58.5) | | | (284.3) | |

| Accrued liabilities and other | 19.6 | | | (20.6) | | | (37.3) | | | (42.5) | | | (81.6) | |

| Cash provided by (used in) operating activities | 16.1 | | | 224.9 | | | (285.2) | | | (217.1) | | | (331.3) | |

| Investing Activities: | | | | | | | | | |

| Purchases of property, plant and equipment | (152.6) | | | (130.9) | | | (60.4) | | | (103.3) | | | (147.3) | |

| Proceeds from disposal of property, plant and equipment | 20.8 | | | 3.1 | | | 0.9 | | | 1.6 | | | 3.3 | |

| Proceeds from sales of business, net of transaction costs | 53.1 | | | 0.3 | | | — | | | (0.3) | | | (0.3) | |

| Other | 1.4 | | | 0.8 | | | 0.2 | | | 1.2 | | | 1.1 | |

| Cash used in investing activities | (77.3) | | | (126.7) | | | (59.3) | | | (100.8) | | | (143.2) | |

| Financing Activities: | | | | | | | | | |

| Borrowings on long-term debt | 675.7 | | | — | | | — | | | — | | | 425.0 | |

| Payments on long-term debt and finance leases | (515.6) | | | (23.1) | | | (5.7) | | | (11.3) | | | (22.0) | |

| Net proceeds (payments) under credit facilities | 21.7 | | | (5.6) | | | (16.8) | | | 33.2 | | | (7.3) | |

| Debt issuance costs | (9.5) | | | — | | | — | | | — | | | (6.1) | |

| Debt extinguishment charge | (64.5) | | | — | | | — | | | — | | | — | |

| Purchase of treasury stock | — | | | (139.9) | | | (10.1) | | | (10.1) | | | (55.1) | |

| Sale to noncontrolling interests | — | | | 6.4 | | | — | | | — | | | — | |

| Dividends paid to noncontrolling interests | — | | | (34.0) | | | — | | | — | | | — | |

| Taxes on share-based compensation and other | (4.8) | | | (5.7) | | | (10.7) | | | (10.8) | | | (11.1) | |

| Cash provided by (used in) financing activities | 103.0 | | | (201.9) | | | (43.3) | | | 1.0 | | | 323.4 | |

| Increase (decrease) in cash and cash equivalents | 41.8 | | | (103.7) | | | (387.8) | | | (316.9) | | | (151.1) | |

| Cash and cash equivalents at beginning of period | 645.9 | | | 687.7 | | | 584.0 | | | 584.0 | | | 584.0 | |

| Cash and cash equivalents at end of period | $ | 687.7 | | | $ | 584.0 | | | $ | 196.2 | | | $ | 267.1 | | | $ | 432.9 | |

ATI Inc. and Subsidiaries

Statements of Changes in Consolidated Equity (unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ATI Stockholders | | | | |

| Common

Stock | | Additional

Paid-In

Capital | | Retained

Earnings (Loss) | | Treasury

Stock | | Accumulated

Other

Comprehensive

Income (Loss) | | Non-

controlling

Interests | | Total

Equity |

| Balance, December 31, 2020 | $ | 12.7 | | | $ | 1,625.5 | | | $ | 106.5 | | | $ | — | | | $ | (1,223.6) | | | $ | 120.3 | | | $ | 641.4 | |

| Net income | — | | | — | | | 184.6 | | | — | | | — | | | 22.0 | | | 206.6 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 9.1 | | | 4.8 | | | 13.9 | |

| Cumulative effect of adoption of new accounting standard | — | | | (49.8) | | | 4.4 | | | — | | | — | | | — | | | (45.4) | |

| Cumulative effect of change in accounting principle | — | | | — | | | (1,073.2) | | | — | | | 1,073.2 | | | — | | | — | |

| Employee stock plans | — | | | 21.0 | | | — | | | (4.8) | | | — | | | — | | | 16.2 | |

| Balance, December 31, 2021 | $ | 12.7 | | | $ | 1,596.7 | | | $ | (777.7) | | | $ | (4.8) | | | $ | (141.3) | | | $ | 147.1 | | | $ | 832.7 | |

| Net income | — | | | — | | | 323.5 | | | — | | | — | | | 15.6 | | | 339.1 | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | 73.9 | | | (18.3) | | | 55.6 | |

| Purchase of treasury stock | — | | | — | | | — | | | (139.9) | | | — | | | — | | | (139.9) | |

| Conversion of convertible notes | 0.3 | | | 45.4 | | | (26.7) | | | 63.5 | | | — | | | — | | | 82.5 | |

| Dividends paid to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (34.0) | | | (34.0) | |

| Sale of subsidiary shares to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | 0.9 | | | 0.9 | |

| Employee stock plans | 0.1 | | | 26.0 | | | — | | | (5.8) | | | — | | | — | | | 20.3 | |

| Balance, December 31, 2022 | $ | 13.1 | | | $ | 1,668.1 | | | $ | (480.9) | | | $ | (87.0) | | | $ | (67.4) | | | $ | 111.3 | | | $ | 1,157.2 | |

| Net income | — | | | — | | | 84.5 | | | — | | | — | | | 2.1 | | | 86.6 | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (20.2) | | | 4.4 | | | (15.8) | |

| Purchase of treasury stock | — | | | — | | | — | | | (10.1) | | | — | | | — | | | (10.1) | |

| Employee stock plans | 0.1 | | | 7.0 | | | — | | | (10.7) | | | — | | | — | | | (3.6) | |

| Balance, March 31, 2023 | $ | 13.2 | | | $ | 1,675.1 | | | $ | (396.4) | | | $ | (107.8) | | | $ | (87.6) | | | $ | 117.8 | | | $ | 1,214.3 | |

| Net income | — | | | — | | | 90.4 | | | — | | | — | | | 3.1 | | | 93.5 | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | 0.3 | | | (5.7) | | | (5.4) | |

| Employee stock plans | — | | | 6.9 | | | — | | | (0.1) | | | — | | | — | | | 6.8 | |

| Balance, June 30, 2023 | $ | 13.2 | | | $ | 1,682.0 | | | $ | (306.0) | | | $ | (107.9) | | | $ | (87.3) | | | $ | 115.2 | | | $ | 1,309.2 | |

| Net income | — | | | — | | | 90.2 | | | — | | | — | | | 3.9 | | | 94.1 | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | (7.1) | | | (2.1) | | | (9.2) | |

| Purchase of treasury stock | — | | | — | | | — | | | (45.4) | | | — | | | — | | | (45.4) | |

| Employee stock plans | — | | | 7.5 | | | — | | | (0.3) | | | — | | | — | | | 7.2 | |

| Balance, September 30, 2023 | $ | 13.2 | | | $ | 1,689.5 | | | $ | (215.8) | | | $ | (153.6) | | | $ | (94.4) | | | $ | 117.0 | | | $ | 1,355.9 | |

ATI Inc. and Subsidiaries

Statements of Changes in Consolidated Equity (unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ATI Stockholders | | | | |

| Common

Stock | | Additional

Paid-In

Capital | | Retained

Earnings (Loss) | | Treasury

Stock | | Accumulated

Other

Comprehensive

Income (Loss) | | Non-

controlling

Interests | | Total

Equity |

| Balance, December 31, 2022 | $ | 13.1 | | | $ | 1,668.1 | | | $ | (480.9) | | | $ | (87.0) | | | $ | (67.4) | | | $ | 111.3 | | | $ | 1,157.2 | |

| Net income | — | | | — | | | 174.9 | | | — | | | — | | | 5.2 | | | 180.1 | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | (19.9) | | | (1.3) | | | (21.2) | |

| Purchase of treasury stock | — | | | — | | | — | | | (10.1) | | | — | | | — | | | (10.1) | |

| Employee stock plans | 0.1 | | | 13.9 | | | — | | | (10.8) | | | — | | | — | | | 3.2 | |

| Balance, June 30, 2023 | $ | 13.2 | | | $ | 1,682.0 | | | $ | (306.0) | | | $ | (107.9) | | | $ | (87.3) | | | $ | 115.2 | | | $ | 1,309.2 | |

| | | | | | | | | | | | | |

| Balance, December 31, 2022 | $ | 13.1 | | | $ | 1,668.1 | | | $ | (480.9) | | | $ | (87.0) | | | $ | (67.4) | | | $ | 111.3 | | | $ | 1,157.2 | |

| Net income | — | | | — | | | 265.1 | | | — | | | — | | | 9.1 | | | 274.2 | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | (27.0) | | | (3.4) | | | (30.4) | |

| Purchase of treasury stock | — | | | — | | | — | | | (55.5) | | | — | | | — | | | (55.5) | |

| Employee stock plans | 0.1 | | | 21.4 | | | — | | | (11.1) | | | — | | | — | | | 10.4 | |

| Balance, September 30, 2023 | $ | 13.2 | | | $ | 1,689.5 | | | $ | (215.8) | | | $ | (153.6) | | | $ | (94.4) | | | $ | 117.0 | | | $ | 1,355.9 | |

ATI Inc.

Sales and EBITDA by Business Segment (unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | |

| Fiscal Year Ended | | Three Months Ended | | Fiscal Year Ended | |

| December 31 | | December 31 | | December 31 | |

| 2021 | | 2022 | | 2022 | |

| Sales: | | | | | | |

| High Performance Materials & Components | $ | 1,155.1 | | | $ | 445.9 | | | $ | 1,641.2 | | |

| Advanced Alloys & Solutions | 1,644.7 | | | 564.5 | | | 2,194.8 | | |

| Total external sales | $ | 2,799.8 | | | $ | 1,010.4 | | | $ | 3,836.0 | | |

| | | | | | |

| EBITDA: | | | | | | |

| High Performance Materials & Components | $ | 170.3 | | | $ | 83.6 | | | $ | 303.4 | | |

| % of Sales | 14.7 | % | | 18.7 | % | | 18.5 | % | |

| Advanced Alloys & Solutions | 246.8 | | | 84.0 | | | 375.3 | | |

| % of Sales | 15.0 | % | | 14.9 | % | | 17.1 | % | |

| Total segment EBITDA | 417.1 | | | 167.6 | | | 678.7 | | |

| % of Sales | 14.9 | % | | 16.6 | % | | 17.7 | % | |

| Corporate expenses | (53.7) | | | (14.0) | | | (60.3) | | |

| Closed operations and other income (expense) | 3.1 | | | 2.3 | | | (5.6) | | |

| ATI Adjusted EBITDA | $ | 366.5 | | | $ | 155.9 | | | $ | 612.8 | | |

| | | | | | |

| Depreciation & amortization | (143.9) | | | (35.8) | | | (142.9) | | |

| Interest expense, net | (96.9) | | | (19.6) | | | (87.4) | | |

| Restructuring and other credits (charges) | 10.5 | | | (0.2) | | | (23.7) | | |

| Strike related costs | (63.2) | | | — | | | — | | |

| Retirement benefit settlement gain | 64.9 | | | — | | | — | | |

| Pension remeasurement gain | 147.2 | | | 100.3 | | | 100.3 | | |

| Debt extinguishment charge | (65.5) | | | — | | | — | | |

| Joint venture restructuring credits | — | | | 0.9 | | | 0.9 | | |

| Gain (loss) on asset sales and sales of businesses, net | 13.8 | | | — | | | (105.4) | | |

| Income before income taxes | $ | 233.4 | | | $ | 201.5 | | | $ | 354.6 | | |

| | | | | | |

ATI Inc.

Sales and EBITDA by Business Segment (unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended | | Six Months Ended | | Three Months Ended | | Nine Months Ended |

| March 31 | | June 30 | | June 30 | | September 30 | | September 30 |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 |

| Sales: | | | | | | | | | |

| High Performance Materials & Components | $ | 471.1 | | | $ | 527.1 | | | $ | 998.2 | | | $ | 539.5 | | | $ | 1,537.7 | |

| Advanced Alloys & Solutions | 567.0 | | | 518.9 | | | 1,085.9 | | | 486.1 | | | 1,572.0 | |

| Total external sales | $ | 1,038.1 | | | $ | 1,046.0 | | | $ | 2,084.1 | | | $ | 1,025.6 | | | $ | 3,109.7 | |

| | | | | | | | | |

| EBITDA: | | | | | | | | | |

| High Performance Materials & Components | $ | 81.6 | | | $ | 109.7 | | | $ | 191.3 | | | $ | 117.2 | | | $ | 308.5 | |

| % of Sales | 17.3 | % | | 20.8 | % | | 19.2 | % | | 21.7 | % | | 20.1 | % |

| Advanced Alloys & Solutions | 83.7 | | | 74.1 | | | 157.8 | | | 61.5 | | | 219.3 | |

| % of Sales | 14.8 | % | | 14.3 | % | | 14.5 | % | | 12.7 | % | | 14.0 | % |

| Total segment EBITDA | 165.3 | | | 183.8 | | | 349.1 | | | 178.7 | | | 527.8 | |

| % of Sales | 15.9 | % | | 17.6 | % | | 16.8 | % | | 17.4 | % | | 17.0 | % |

| Corporate expenses | (16.9) | | | (17.7) | | | (34.6) | | | (12.5) | | | (47.1) | |

| Closed operations and other expense | (1.3) | | | (1.9) | | | (3.2) | | | (3.6) | | | (6.8) | |

| ATI Adjusted EBITDA | $ | 147.1 | | | $ | 164.2 | | | $ | 311.3 | | | $ | 162.6 | | | $ | 473.9 | |

| | | | | | | | | |

| Depreciation & amortization | (35.1) | | | (35.9) | | | (71.0) | | | (35.6) | | | (106.6) | |

| Interest expense, net | (19.9) | | | (21.3) | | | (41.2) | | | (23.8) | | | (65.0) | |

| Restructuring and other charges | (1.2) | | | (9.2) | | | (10.4) | | | (4.2) | | | (14.6) | |

| Loss on asset sales and sales of businesses, net | — | | | (0.6) | | | (0.6) | | | — | | | (0.6) | |

| Income before income taxes | $ | 90.9 | | | $ | 97.2 | | | $ | 188.1 | | | $ | 99.0 | | | $ | 287.1 | |

| | | | | | | | | |

ATI Inc.

Retirement Benefits (unaudited)

(Dollars in millions)

| | | | | | | | | | | |

| Pension Benefits |

| Fiscal Year Ended | | Fiscal Year Ended |

| December 31 | | December 31 |

| | 2021 | | 2022 |

| Service cost - benefits earned during the year | $ | 15.1 | | | $ | 11.9 | |

| Interest cost on benefits earned in prior years | 68.4 | | | 69.7 | |

| Expected return on plan assets | (136.4) | | | (128.2) | |

| Amortization of prior service cost | 0.6 | | | 0.4 | |

| Recognized actuarial gain- mark to market | (147.2) | | | (100.3) | |

| Settlement loss | — | | | 0.7 | |

| Total retirement benefit income | $ | (199.5) | | | $ | (145.8) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pension Benefits |

| Three Months Ended | | Three Months Ended | | Six Months Ended | | Three Months Ended | | Nine Months Ended |

| March 31 | | June 30 | | June 30 | | September 30 | | September 30 |

| | 2023 | | 2023 | | 2023 | | 2023 | | 2023 |

| Service cost - benefits earned during the year | $ | 1.6 | | | $ | 1.6 | | | $ | 3.2 | | | $ | 1.5 | | | $ | 4.7 | |

| Interest cost on benefits earned in prior years | 24.0 | | | 24.0 | | | 48.0 | | | 24.0 | | | 72.0 | |

| Expected return on plan assets | (25.7) | | | (25.6) | | | (51.3) | | | (25.7) | | | (77.0) | |

| Amortization of prior service cost | 0.1 | | | 0.1 | | | 0.2 | | | 0.1 | | | 0.3 | |

| Total retirement benefit expense (income) | $ | — | | | $ | 0.1 | | | $ | 0.1 | | | $ | (0.1) | | | $ | — | |

ATI Inc.

Computation of Basic and Diluted Earnings Per Share Attributable to ATI (unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended | | Three Months Ended | | Fiscal Year Ended |

| | December 31 | | December 31 | | December 31 |

| | 2021 | | 2022 | | 2022 |

| Numerator for Basic net income per common share - | | | | | |

| Net income attributable to ATI | $ | 184.6 | | | $ | 193.0 | | | $ | 323.5 | |

| Effect of dilutive securities: | | | | | |

| 4.75% Convertible Senior Notes due 2022 | 4.4 | | | — | | | 2.2 | |

| 3.5% Convertible Senior Notes due 2025 | 11.8 | | | 2.7 | | | 11.3 | |

| Numerator for Diluted net income per common share - | | | | | |

| Net income attributable to ATI after assumed conversions | $ | 200.8 | | | $ | 195.7 | | | $ | 337.0 | |

| | | | | | |

| Denominator for Basic net income per common share - | | | | | |

| Weighted average shares outstanding | 127.1 | | | 129.1 | | | 127.5 | |

| Effect of dilutive securities: | | | | | |

| Share-based compensation | 1.0 | | | 2.5 | | | 2.1 | |

| 4.75% Convertible Senior Notes due 2022 | 5.8 | | | — | | | 2.8 | |

| 3.5% Convertible Senior Notes due 2025 | 18.8 | | | 18.8 | | | 18.8 | |

| Denominator for Diluted net income per common share - | | | | | |

| Adjusted weighted average shares assuming conversions | 152.7 | | | 150.4 | | | 151.2 | |

| | | | | | |

| Basic net income attributable to ATI per common share | $ | 1.45 | | | $ | 1.49 | | | $ | 2.54 | |

| | | | | | |

| Diluted net income attributable to ATI per common share | $ | 1.32 | | | $ | 1.30 | | | $ | 2.23 | |

| | | | | | |

ATI Inc.

Computation of Basic and Diluted Earnings Per Share Attributable to ATI (unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Three Months Ended | | Six Months Ended | | Three Months Ended | | Nine Months Ended |

| | March 31 | | June 30 | | June 30 | | September 30 | | September 30 |

| | 2023 | | 2023 | | 2023 | | 2023 | | 2023 |

| Numerator for Basic net income per common share - | | | | | | | | | |

| Net income attributable to ATI | $ | 84.5 | | | $ | 90.4 | | | $ | 174.9 | | | $ | 90.2 | | | $ | 265.1 | |

| Effect of dilutive securities: | | | | | | | | | |

| 3.5% Convertible Senior Notes due 2025 | 2.6 | | | 2.6 | | | 5.2 | | | 2.7 | | | 7.9 | |

| Numerator for Diluted net income per common share - | | | | | | | | | |

| Net income attributable to ATI after assumed conversions | $ | 87.1 | | | $ | 93.0 | | | $ | 180.1 | | | $ | 92.9 | | | $ | 273.0 | |

| | | | | | | | | | |

| Denominator for Basic net income per common share - | | | | | | | | | |

| Weighted average shares outstanding | 128.5 | | | 128.5 | | | 128.5 | | | 128.1 | | | 128.4 | |

| Effect of dilutive securities: | | | | | | | | | |

| Share-based compensation | 2.8 | | | 2.8 | | | 2.8 | | | 3.3 | | | 2.9 | |

| 3.5% Convertible Senior Notes due 2025 | 18.8 | | | 18.8 | | | 18.8 | | | 18.8 | | | 18.8 | |

| Denominator for Diluted net income per common share - | | | | | | | | | |

| Adjusted weighted average shares assuming conversions | 150.1 | | | 150.1 | | | 150.1 | | | 150.2 | | | 150.1 | |

| | | | | | | | | | |

| Basic net income attributable to ATI per common share | $ | 0.66 | | | $ | 0.70 | | | $ | 1.36 | | | $ | 0.70 | | | $ | 2.06 | |

| | | | | | | | | | |

| Diluted net income attributable to ATI per common share | $ | 0.58 | | | $ | 0.62 | | | $ | 1.20 | | | $ | 0.62 | | | $ | 1.82 | |

| | | | | | | | | | |

ATI Inc.

Accumulated Other Comprehensive Income (Loss) (unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Post-

retirement

benefit plans | | Currency

translation

adjustment | | Derivatives | | Deferred Tax Asset Valuation Allowance | | Total |

| Attributable to ATI: | | | | | | | | | |

| Balance, December 31, 2020 | $ | (1,119.9) | | | $ | (55.5) | | | $ | 2.1 | | | $ | (50.3) | | | $ | (1,223.6) | |

| Cumulative effect of change in accounting principle | 1,030.3 | | | — | | | — | | | 42.9 | | | 1,073.2 | |

| OCI before reclassifications | 6.6 | | | (9.4) | | | 11.7 | | | — | | | 8.9 | |

| Amounts reclassified from AOCI | (3.6) | | | — | | | (8.7) | | | 12.5 | | | 0.2 | |

| Net current-period OCI | 1,033.3 | | | (9.4) | | | 3.0 | | | 55.4 | | | 1,082.3 | |

| Balance, December 31, 2021 | $ | (86.6) | | | $ | (64.9) | | | $ | 5.1 | | | $ | 5.1 | | | $ | (141.3) | |

| OCI before reclassifications | 41.3 | | | (25.2) | | | 41.0 | | | — | | | 57.1 | |

| Amounts reclassified from AOCI | 10.6 | | | 20.0 | | | (32.6) | | | 18.8 | | | 16.8 | |

| Net current-period OCI | 51.9 | | | (5.2) | | | 8.4 | | | 18.8 | | | 73.9 | |

| Balance, December 31, 2022 | $ | (34.7) | | | $ | (70.1) | | | $ | 13.5 | | | $ | 23.9 | | | $ | (67.4) | |

| OCI before reclassifications | — | | | (1.1) | | | (11.4) | | | — | | | (12.5) | |

| Amounts reclassified from AOCI | 1.1 | | | — | | | (4.2) | | | (4.6) | | | (7.7) | |

| Net current-period OCI | 1.1 | | | (1.1) | | | (15.6) | | | (4.6) | | | (20.2) | |

| Balance, March 31, 2023 | $ | (33.6) | | | $ | (71.2) | | | $ | (2.1) | | | $ | 19.3 | | | $ | (87.6) | |

| OCI before reclassifications | — | | | (2.4) | | | (1.9) | | | — | | | (4.3) | |

| Amounts reclassified from AOCI | 1.0 | | | — | | | 2.9 | | | 0.7 | | | 4.6 | |

| Net current-period OCI | 1.0 | | | (2.4) | | | 1.0 | | | 0.7 | | | 0.3 | |

| Balance, June 30, 2023 | $ | (32.6) | | | $ | (73.6) | | | $ | (1.1) | | | $ | 20.0 | | | $ | (87.3) | |

| OCI before reclassifications | — | | | (7.1) | | | (2.4) | | | — | | | (9.5) | |

| Amounts reclassified from AOCI | 1.0 | | | — | | | 1.4 | | | — | | | 2.4 | |

| Net current-period OCI | 1.0 | | | (7.1) | | | (1.0) | | | — | | | (7.1) | |

| Balance, September 30, 2023 | $ | (31.6) | | | $ | (80.7) | | | $ | (2.1) | | | $ | 20.0 | | | $ | (94.4) | |

ATI Inc.

Accumulated Other Comprehensive Income (Loss) (unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Post-

retirement

benefit plans | | Currency

translation

adjustment | | Derivatives | | Deferred Tax Asset Valuation Allowance | | Total |

| Attributable to ATI: | | | | | | | | | |

| Balance, December 31, 2022 | $ | (34.7) | | | $ | (70.1) | | | $ | 13.5 | | | $ | 23.9 | | | $ | (67.4) | |

| OCI before reclassifications | — | | | (3.5) | | | (13.3) | | | — | | | (16.8) | |

| Amounts reclassified from AOCI | 2.1 | | | — | | | (1.3) | | | (3.9) | | | (3.1) | |

| Net current-period OCI | 2.1 | | | (3.5) | | | (14.6) | | | (3.9) | | | (19.9) | |

| Balance, June 30, 2023 | $ | (32.6) | | | $ | (73.6) | | | $ | (1.1) | | | $ | 20.0 | | | $ | (87.3) | |

| | | | | | | | | |

| Attributable to ATI: | | | | | | | | | |

| Balance, December 31, 2022 | $ | (34.7) | | | $ | (70.1) | | | $ | 13.5 | | | $ | 23.9 | | | $ | (67.4) | |

| OCI before reclassifications | — | | | (10.6) | | | (15.7) | | | — | | | (26.3) | |

| Amounts reclassified from AOCI | 3.1 | | | — | | | 0.1 | | | (3.9) | | | (0.7) | |

| Net current-period OCI | 3.1 | | | (10.6) | | | (15.6) | | | (3.9) | | | (27.0) | |

| Balance, September 30, 2023 | $ | (31.6) | | | $ | (80.7) | | | $ | (2.1) | | | $ | 20.0 | | | $ | (94.4) | |

ATI Inc.

Reclassifications out of Accumulated Other Comprehensive Income (Loss) (unaudited)

(Dollars in millions)

| | | | | | | | | | | |

| Fiscal Year Ended | | Fiscal Year Ended |

| December 31 | | December 31 |

Details about AOCI Components

| 2021 | | 2022 |

| Postretirement benefit plans | | | |

| Prior service credit | $ | 1.8 | | | $ | 0.5 | |

| Actuarial losses | (13.9) | | | (13.2) | |

| Settlement gain (loss) | 21.9 | | | (0.7) | |

| Total before tax (a) | 9.8 | | 9.8 | | (13.4) | |

| Tax expense (benefit) (b) | 6.2 | | | (2.8) | |

| Net of tax | $ | 3.6 | | | $ | (10.6) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended | | Six Months Ended | | Three Months Ended | | Nine Months Ended |

| March 31 | | June 30 | | June 30 | | September 30 | | September 30 |

Details about AOCI Components

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 |

| Postretirement benefit plans | | | | | | | | | |

| Prior service credit | $ | 0.1 | | | $ | 0.2 | | | $ | 0.3 | | | $ | 0.1 | | | $ | 0.4 | |

| Actuarial losses | (1.5) | | | (1.5) | | | (3.0) | | | (1.5) | | | (4.5) | |

| Total before tax (a) | (1.4) | | | (1.3) | | | (2.7) | | | (1.4) | | | (4.1) | |

| Tax benefit (b) | (0.3) | | | (0.3) | | | (0.6) | | | (0.4) | | | (1.0) | |

| Net of tax | $ | (1.1) | | | $ | (1.0) | | | $ | (2.1) | | | $ | (1.0) | | | $ | (3.1) | |

(a) For pre-tax items, positive amounts are income and negative amounts are expense in terms of the impact to net income.

(b) Tax effects are presented in conformity with ATI's presentation in the consolidation statement of operations. These amounts exclude the impact of any deferred tax asset valuation allowances, when applicable.

ATI Inc.

Non-GAAP Financial Measures (unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | |

| Fiscal Year Ended | Three Months Ended | Fiscal Year Ended |

| December 31 | December 31 | December 31 |

| 2021 | 2022 | 2022 |

| | | |

| Net income attributable to ATI | $ | 184.6 | | $ | 193.0 | | $ | 323.5 | |

| Adjustments for special items, pre-tax: | | | |

| Strike related costs (a) | 63.2 | | — | | — | |

| Restructuring and other charges (credits) (b) | (10.5) | | — | | 23.5 | |

| Retirement benefit settlement gain (c) | (64.9) | | — | | — | |

| Pension remeasurement gain (d) | (147.2) | | (100.3) | | (100.3) | |

| Loss (gain) on sale of business (e) | (13.8) | | — | | 105.4 | |

| Debt extinguishment charge (f) | 65.5 | | — | | — | |

| Total pre-tax adjustments | (107.7) | | (100.3) | | 28.6 | |

| | | |

| Income tax on pre-tax adjustments for special items | 15.5 | | — | | (0.9) | |

| | | |

| Net income attributable to ATI excluding special items | $ | 92.4 | | $ | 92.7 | | $ | 351.2 | |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended | Three Months Ended | Fiscal Year Ended |

| | December 31, 2021 | | December 31, 2022 | | December 31, 2022 |

| | Reported | Adjusted | | Reported | Adjusted | | Reported | Adjusted |

| Numerator for Basic net income per common share - | | | | | | | | |

| Net income attributable to ATI | $ | 184.6 | | $ | 92.4 | | | $ | 193.0 | | $ | 92.7 | | | $ | 323.5 | | $ | 351.2 | |

| Effect of dilutive securities | 16.2 | | 16.2 | | | 2.7 | | 2.7 | | | 13.5 | | 13.5 | |

| Numerator for Diluted net income per common share - | | | | | | | | |

| Net income attributable to ATI after assumed conversions | $ | 200.8 | | $ | 108.6 | | | $ | 195.7 | | $ | 95.4 | | | $ | 337.0 | | $ | 364.7 | |

| | | | | | | | | |

| Denominator for Basic net income per common share - | | | | | | | | |

| Weighted average shares outstanding | 127.1 | 127.1 | | 129.1 | 129.1 | | 127.5 | 127.5 |

| Effect of dilutive securities | 25.6 | | 25.6 | | | 21.3 | | 21.3 | | | 23.7 | | 23.7 | |

| Denominator for Diluted net income per common share - | | | | | | | | |

| Adjusted weighted average shares assuming conversions | 152.7 | 152.7 | | 150.4 | 150.4 | | 151.2 | 151.2 |

| | | | | | | | | |

| Diluted net income attributable to ATI per common share | $ | 1.32 | | $ | 0.71 | | | $ | 1.30 | | $ | 0.63 | | | $ | 2.23 | | $ | 2.41 | |

| | | | | | | | | | | |

| Three Months Ended |

| March 31 | June 30 | September |

| 2023 | 2023 | 2023 |

| | | |

| Net income attributable to ATI | $ | 84.5 | | $ | 90.4 | | $ | 90.2 | |

| Adjustments for special items, pre-tax: | | | |

| Restructuring and other charges (b) | 1.2 | | 10.0 | | 4.2 | |

| Loss on sale of business (e) | — | | 0.6 | | — | |

| Total pre-tax adjustments | 1.2 | | 10.6 | | 4.2 | |

| | | |

| Income tax on pre-tax adjustments for special items | (0.1) | | (0.4) | | (0.2) | |

| | | |

| Net income attributable to ATI excluding special items | $ | 85.6 | | $ | 100.6 | | $ | 94.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | Three Months Ended | Three Months Ended |

| | March 31, 2023 | | June 30, 2023 | | September 30, 2023 |

| | Reported | Adjusted | | Reported | Adjusted | | Reported | Adjusted |

| Numerator for Basic net income per common share - | | | | | | | | |

| Net income attributable to ATI | $ | 84.5 | | $ | 85.6 | | | $ | 90.4 | | $ | 100.6 | | | $ | 90.2 | | $ | 94.2 | |

| Effect of dilutive securities | 2.6 | | 2.6 | | | 2.6 | | 2.6 | | | 2.7 | | 2.7 | |

| Numerator for Diluted net income per common share - | | | | | | | | |

| Net income attributable to ATI after assumed conversions | $ | 87.1 | | $ | 88.2 | | | $ | 93.0 | | $ | 103.2 | | | $ | 92.9 | | $ | 96.9 | |

| | | | | | | | | |

| Denominator for Basic net income per common share - | | | | | | | | |

| Weighted average shares outstanding | 128.5 | 128.5 | | 128.5 | 128.5 | | 128.1 | 128.1 |

| Effect of dilutive securities | 21.6 | | 21.6 | | | 21.6 | | 21.6 | | | 22.1 | | 22.1 | |

| Denominator for Diluted net income per common share - | | | | | | | | |

| Adjusted weighted average shares assuming conversions | 150.1 | 150.1 | | 150.1 | 150.1 | | 150.2 | 150.2 |

| | | | | | | | | |

| Diluted net income attributable to ATI per common share | $ | 0.58 | | $ | 0.59 | | | $ | 0.62 | | $ | 0.69 | | | $ | 0.62 | | $ | 0.64 | |

| | | | | | | | | |

(a) Full year 2021 results include $63.2 million of pre-tax strike related costs primarily consisting of overhead costs recognized in the period due to below-normal operating rates, higher costs for outside conversion activities, and signing bonuses for represented employees.

(b) Full year 2021 results include $10.5 million of pre-tax net credits for restructuring charges, primarily related to lowered severance-related reserves based on changes in planned operating rates and revised workforce reduction estimates. Full year 2022 results includes a $28.5 million pre-tax litigation reserve, partially offset by a $5.0 million pre-tax credit for restructuring charges, primarily related to lowered severance-related reserves based on changes in planned operating rates and revised workforce reduction estimates. First quarter 2023 includes a $1.2 million pre-tax charge for costs to restart our titanium operations in Albany, OR. Second quarter 2023 includes pre-tax charges totaling $10.0 million, which include $4.5 million for start-up costs, $2.7 million of severance-related restructuring charges, and $2.8 million primarily for asset write-offs related to the closure of our Robinson, PA operation. Third quarter 2023 includes pre-tax charges totaling $4.2 million, which include $2.8 million for start-up costs and $1.9 million of costs associated with an unplanned outage at our Lockport, NY melt facility, partially offset by $0.5 million pre-tax credit for restructuring charges, primarily related to lowered severance-related reserves based on changes in planned operating rates and revised workforce reduction estimates.

(c) Full year 2021 results include a $64.9 million pre-tax retirement benefit settlement gain associated with the new collective bargaining agreement that was ratified on July 14, 2021 with the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied & Industrial Service Workers International Union, AFL-CIO, CLC involving approximately 1,100 active full-time represented employees located primarily within the AA&S segment operations, as well as a number of inactive employees.

(d) Full year 2021 results include a $147.2 million gain and the fourth quarter and full year 2022 results include a $100.3 million gain for actuarial gains arising from the remeasurement of the Company’s pension plans.

(e) Full year 2021 results include a $13.8 million pre-tax gain on the sale of its Flowform Products business, which uses flowforming process technologies to produce thin-walled components in net or near-net shapes across multiple alloy systems for use in the aerospace & defense and energy markets. Full year 2022 results include a $112.2 million loss on the sale of our Sheffield, UK operations, which was completed in the second quarter 2022. This loss includes $26.8 million related to the UK defined benefit pension plan, of which $26.1 million was reported as a net pension asset and $0.7 million in accumulated other comprehensive loss, and $20.0 million of cumulative translation adjustment foreign exchange losses. This loss was offset by $6.8 million pre-tax gain on the sale of our small Pico Rivera, CA operations as part of the strategy to exit standard stainless products. Second quarter 2023 includes a $0.6 million loss on the sale of our Northbrook, IL operation.

(f) Full year 2021 results include a $65.5 million pre-tax debt extinguishment charge for the redemption of the $500 million, 5.875% Notes due 2023.

v3.23.4

Cover

|

Jan. 19, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 19, 2024

|

| Entity Registrant Name |

ATI Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-12001

|

| Entity Tax Identification Number |

25-1792394

|

| Entity Address, Address Line One |

2021 McKinney Avenue,

|

| Entity Address, City or Town |

Dallas,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| City Area Code |

800

|

| Local Phone Number |

289-7454

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.10 per share

|

| Trading Symbol |

ATI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001018963

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

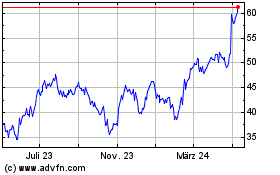

ATI (NYSE:ATI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

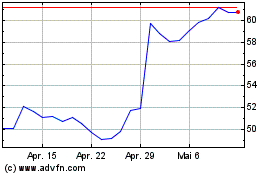

ATI (NYSE:ATI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024