Aimco Expands Its Commitment to Governance Enhancements

28 November 2022 - 12:58PM

Business Wire

Apartment Investment and Management Company (NYSE: AIV) (“Aimco”

or the “Company”), today expanded on its commitment to enhance

corporate governance, announcing that its Board has committed to

the following actions:

- Opt Out of MUTA: The Aimco Board will, prior to the 2023

annual meeting, opt out of the provisions of the Maryland

Unsolicited Takeover Act, or MUTA, including those that would

otherwise allow it to re-classify the Board without the approval of

stockholders.

- Declassify the Board in 2023: The Aimco Board will opt

out of MUTA prior to the 2023 annual meeting and take any and all

other actions necessary to ensure that all Aimco directors stand

for election to annual terms at the 2023 annual meeting.

- Transition Timing of the Annual Meeting Date: The Board

will move the date of the Company’s annual meeting so the 2024

annual meeting will be held by the end of the second quarter of

2024. The Board intends to hold the 2023 annual meeting by the end

of the third quarter of 2023.

- Ask Aimco’s stockholders to Approve Certain Charter

Amendments to Eliminate Super-Majority Requirements and Expand

Stockholder Rights to Replace Directors: The Board will ask

Aimco’s stockholders to, and will recommend that they, approve

amendments to Aimco’s charter at the 2023 annual meeting. Once

approved by stockholders this will:

- Lower the threshold required for stockholders to amend all

portions of Aimco’s Bylaws to a simple majority of shares

outstanding; and

- Lower the threshold for stockholders to remove directors to a

simple majority of shares outstanding, eliminate the requirement

that such removal be for “cause”, and allow shareholders to appoint

directors to fill vacancies arising out of removals by

stockholders.

- Amend Aimco’s Bylaws to Lower Threshold for Stockholders to

Call a Special Meeting to 15%: The Board will, effective as of

the 2023 annual meeting, amend Aimco’s Bylaws to lower the

threshold for stockholders to call a special meeting to 15% of

shares outstanding, and also allow stockholders to amend the Bylaws

to set the size or range of the size of the Board (but to no fewer

than three directors).

Dary Stone, Chairman of the Nominating, Environmental, Social,

and Governance Committee, stated, “The Aimco Board is confident in

Aimco’s outstanding performance, and committed to best-in-class

governance. The Board is publicly committing to make additional

governance changes effective as of the 2023 annual meeting. The

Company is proud of its strong track record of stockholder value

creation, demonstrated practice of engaging constructively with

investors and acting on their feedback, and ongoing commitment to

excellence in corporate governance.”

About Aimco

Aimco is a diversified real estate company primarily focused on

value add, opportunistic, and alternative investments, targeting

the U.S. multifamily sector. Aimco’s mission is to make real estate

investments where outcomes are enhanced through its human capital

so that substantial value is created for investors, teammates, and

the communities in which we operate. Aimco is traded on the New

York Stock Exchange as AIV. For more information about Aimco,

please visit its website www.aimco.com.

Forward Looking Statements

This document contains forward-looking statements within the

meaning of the federal securities laws. Forward-looking statements

include all statements that are not historical statements of fact

and those regarding our intent, belief, or expectations, including,

but not limited to, the statements in this document regarding

future financing plans, including the Company’s expected leverage

and capital structure; business strategies, prospects, and

projected operating and financial results (including earnings),

including facts related thereto, such as expected costs; future

share repurchases; expected investment opportunities; and our 2022

pipeline investments and projects. We caution investors not to

place undue reliance on any such forward-looking statements.

Words such as “anticipate(s),” “expect(s),” “intend(s),”

“plan(s),” “believe(s),” “plan(s),” “may,” “will,” “would,”

“could,” “should,” “seek(s),” “forecast(s),” and similar

expressions, or the negative of these terms, are intended to

identify such forward-looking statements. These statements are not

guarantees of future performance, condition or results, and involve

a number of known and unknown risks, uncertainties, assumptions and

other important factors, among others, that may affect actual

results or outcomes include, but are not limited to: (i) the risk

that the 2023 preliminary plans and goals may not be completed in a

timely manner or at all, (ii) the inability to recognize the

anticipated benefits of pipeline investments and projects, (iii)

changes in general economic conditions, including as a result of

the COVID-19 pandemic. Although we believe that the assumptions

underlying the forward-looking statements, which are based on

management’s expectations and estimates, are reasonable, we can

give no assurance that our expectations will be attained.

These forward-looking statements reflect management’s judgment

as of this date, and the Company assumes no (and disclaims any)

obligation to revise or update them to reflect future events or

circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221128005196/en/

Matt Foster Sr. Director, Capital Markets and Investor Relations

(303) 793-4661 investor@aimco.com

MacKenzie Partners, Inc. Dan Burch 212-929-5748

Dburch@mackenziepartners.com

Andrew Siegel / Greg Klassen / Adam Pollack Joele Frank,

Wilkinson Brimmer Katcher 212-355-4449

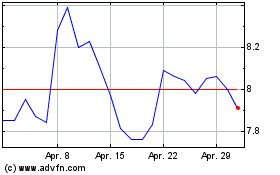

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

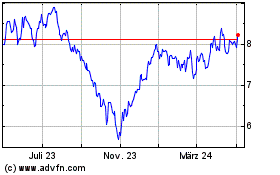

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Mai 2023 bis Mai 2024