false

0001771910

00-0000000

0001771910

2024-03-05

2024-03-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

March 5, 2024

ADC Therapeutics SA

(Exact Name of Registrant as Specified in Its Charter)

|

Switzerland

(State or Other Jurisdiction of Incorporation) |

001-39071

(Commission File Number) |

N/A

(IRS Employer Identification Number) |

| |

|

|

|

Biopôle

Route de la Corniche 3B

1066 Epalinges

Switzerland

(Address of Principal Executive Offices) (Zip Code)

|

+41 21 653 02 00

(Registrant’s Telephone Number) |

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

| Common Shares, par value CHF 0.08 per share |

ADCT |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 C.F.R. §230.405) or Rule 12b-2 of the Securities Exchange Act of

1934 (17 C.F.R. §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On March 5, 2024, ADC Therapeutics SA (the “Company”) made

available a presentation expected to be used in connection with certain industry conferences and investor meetings. A copy of the presentation

is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

The information contained in this Item 7.01 and Exhibit 99.1 shall

not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ADC Therapeutics SA |

| Date: March 5, 2024 |

|

| |

By: |

/s/ Peter J. Graham |

| |

Name: |

Peter J. Graham |

| |

Title: |

Chief Legal Officer |

Exhibit 99.1

ADC Therapeutics Business Overview Cowen Conference March 5, 2024

2 Forward - Looking Statements This presentation and any accompanying oral presentation have been prepared by ADC Therapeutics SA ("ADC Therapeutics“, “we” or “us”) for informational purposes only and not for any other purpose. Nothing contained in this presentation is, or should be construed as, a recommendation, promise or representation by the presenter or ADC Therapeutics or any officer, director, employee, agent or advisor of ADC Therapeutics. This presentation does not purport to be all-inclusive or to contain all of the information you may desire. Information provided in this presentation an d a ny accompanying oral presentation speak only as of the date hereof. This presentation contains forward - looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In some cases you can identify forward - looking statements by terminology such as “may”, “assumes”, “will”, “should”, “would”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estima te” , “predict”, “potential”, “seem”, “seek”, “future”, “continue”, or “appear” or the negative of these terms or similar expressions, although not all forward - looking statements contain these identifying words. Forward - looking state ments are subject to certain risks and uncertainties that can cause actual results to differ materially from those described. Factors that may cause such differences include, but are not limited to: the actual Zynlonta revenue for 4Q 2023, the success of the Company’s updated corporate strategy; the expected cash runway into the beginning of Q4 2025, the effectiveness of the new commercial go - to - market strategy, competition from new technologies, the Comp any’s ability to grow ZYNLONTA® revenue in the United States; Swedish Orphan Biovitrum AB (Sobi®) ability to successfully commercialize ZYNLONTA® in the European Economic Area and market acceptance, adequate reimbur sem ent coverage, and future revenue from the same; approval by the NMPA of the BLA for ZYNLONTA® in China submitted by Overland ADCT BioPharma and future revenue from the same, our strategic partners’, including Mit subishi Tanabe Pharma Corporation, ability to obtain regulatory approval for ZYNLONTA® in foreign jurisdictions, and the timing and amount of future revenue and payments to us from such partnerships; the timing and res ults of the Company’s or its partners’ research and development projects or clinical trials including LOTIS 5 and 7, ADCT 601 and 602 as well as IITs in FL and MZL and early research in certain solid tumors with different targe ts, linkers and payloads; the timing and outcome of regulatory submissions for the Company’s products or product candidates; actions by the FDA or foreign regulatory authorities; projected revenue and expenses; the Company’s indeb ted ness, including Healthcare Royalty Management and Blue Owl and Oaktree facilities, and the restrictions imposed on the Company’s activities by such indebtedness, the ability to comply with the terms of the various ag ree ments and repay such indebtedness and the significant cash required to service such indebtedness; and the Company’s ability to obtain financial and other resources for its research, development, clinical, and commercial activit ies . Additional information concerning these and other factors that may cause actual results to differ materially from those anticipated in the forward - looking statements is contained in the “Risk Factors” section of the Company's Annual Report on Form 20 - F and in the Company's other periodic and current reports and filings with the U.S. Securities and Exchange Commission. These statements involve known and unknown risks, uncertainties and other factor s t hat may cause actual results, performance, achievements or prospects to be materially different from any future results, performance, achievements or prospects expressed in or implied by such forward - looking statements. The Company cautions investors not to place undue reliance on the forward - looking statements contained in this document. Forward - looking statements are based on our management’s beliefs and assumptions and on information currently available to our m anagement. No assurance can be given that such future results will be achieved. Such forward - looking statements contained in this presentation speak only as of the date of this presentation. The Company expressly discl aim any obligation or undertaking to update these forward - looking statements contained in this presentation to reflect any change in our expectations or any change in events, conditions, or circumstances on which such st ate ments are based unless required to do so by applicable law. No representations or warranties (expressed or implied) are made about the accuracy of any such forward - looking statements. Certain information contained in this presentation relates to or is based on studies, publications, surveys, and other data d eri ved from third - party sources and our own internal estimates and research. While we believe these third - party sources to be reliable as of the date of this presentation, we have not independently verified, and we make no represen tat ion as to the adequacy, fairness, accuracy or completeness of, any information obtained from third - party sources. In addition, all of the market data included in this presentation involve a number of assumptions and limitati ons , and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, although we believe our own internal research is reliable, such research has not been verified by any independent source.

3 ADC Therapeutics at a Glance Solid Tumors Advancing ADCT - 601 targeting AXL in the clinic and multiple investigational ADCs Hematology Maximizing ZYNLONTA® in 3L+ DLBCL and seeking to expand into earlier lines of DLBCL and indolent lymphomas; advancing ADCT - 602 targeting CD22 Corporate Cash runway into 4Q 2025 with multiple catalysts in 2024 Platform Pioneering ADC field with robust technology toolbox and specialized end - to - end capabilities ADC: Antibody Drug Conjugate; DLBCL: Diffuse Large B - Cell Lymphoma

4 Key Business Updates DLT: Dose - Limiting Toxicity; MTD: Maximum Tolerated Dose. Note: Financials are unaudited. ▪ Balance sheet with ~$ 278.5M cash at end of FY 2023 ▪ Cash runway expected to extend into 4Q 2025 ; double - digit Opex reduction in 2023 compared to 2022 ▪ LOTIS - 7 (ZYNLONTA with bispecifics ): Cleared first two dosing cohort with no DLT and early signs of antitumor activity ▪ LOTIS - 5 (ZYNLONTA with rituximab): Accelerated enrollment in 2023, over 2/3rd enrollment completed ▪ ADCT - 601 (Targeting AXL): R eached MTD and currently in dose optimization; e arly signs of anti - tumor activity in both monotherapy and in combination in sarcoma ▪ ADCT - 901 (Targeting KAAG1): Discontinuing due to limited signs of efficacy in dose escalation, reallocating capital to prioritized programs ▪ 4Q 2023 revenues expected to be ~$16.5M , a double - digit percentage increase compared to 3Q 2023 Pipeline Corporate ZYNLONTA (loncastuximab tesirine - lpyl) Note: update as of March 4 th , 2024

5 Unlocking Value of Robust ADC Portfolio in Hematology and Solid Tumors DLBCL: Diffuse Large B - Cell Lymphoma; FL: Follicular Lymphoma; MZL: Marginal Zone Lymphoma; NSCLC: Non Small - Cell Lung Cancer; ALL: Acute Lymphoblastic Leukemia. Short - Mid Term Mid - long Term Hematology Portfolio Solid Tumor Portfolio ZYNLONTA ▪ Maximize ZYNLONTA in 3L+ DLBCL ▪ Seek to expand ZYNLONTA to earlier lines of DLBCL and other indolent lymphomas (e.g., FL, MZL) as single agent and combination agent of choice ‒ ZYNLONTA ‒ ZYNLONTA + rituximab (LOTIS - 5) ‒ ZYNLONTA + bispecifics (LOTIS - 7) ADCT - 602 (CD22) ▪ Escalating and expanding Phase 1 dose in r/r ALL ADCT - 601 (AXL) ▪ Optimizing dose for expansion as single agent and / or in combination in sarcoma, pancreatic, and NSCLC Next - generation ADCs ▪ Advancing a portfolio of investigational ADCs ‒ Differentiated exatecan - based payload with novel hydrophilic linker ‒ Targeting Claudin - 6, NaPi2b, PSMA ▪ Continuing research with a range of payloads, linkers, and conjugation technologies against undisclosed targets

6 Proportion of patients by line - of - therapy* DLBCL, FL & MZL account for ~60% of mature B - cell lymphomas 1 * 1L (~70%) 1L (~65%) 1L (~61%) DLBCL FL MZL Key: Current Approval Current Development Areas Advancing ZYNLONTA Development in B - Cell Lymphomas 2L (~24%) 2L (~27%) 3L+ (~11%) 3L+ (~12%) 2023 U.S. Market Value 2 , 5 - year prevalence 3 $3.1b 2 , ~109 K patients $2.6b 2 , ~61 K patients $1.4b 2 , ~38 K patients 1. As per Leukemia & Lymphoma Society data; 2. Clarivate & Global Data used to size US market value; 3. Cerner Enviza CancerMPact database, 2023. Note: Distribution by line of therapy is based on the incident, drug - treated population . ▪ LOTIS - 5 and LOTIS - 7 potential to move ZYNLONTA into 2L+ DLBCL ‒ LOTIS - 5: 20 patient safety run - in data showed ORR of 80%, CR of 50% with no new safety signals; accelerating patient enrollment/completion expected in 2024 ‒ LOTIS - 7: Dose - limiting toxicity period cleared for first two dosing levels of ZYNLONTA (90 µg/kg, 120 µg/kg) in both arms; currently enrolling patients at 150 µg/kg Current Development Areas ▪ IIT suggests ZYNLONTA regimen could provide benefit in 2L+ high - risk FL (96% ORR, 85% CR, N=27); IIT studying ZYNLONTA in 2L+ MZL ‒ Unmet need is significant in these populations ‒ Assessing regulatory path and compendial strategy ▪ ZYNLONTA combination with bispecifics (LOTIS - 7) is currently being studied in r/r FL and r/r MZL

7 Significant opportunity remains for Zynlonta combinations in 2L+, despite a highly evolving market 1.Epcoritamab or Glofitamab . Source: Putnam Associates Primary Research. Key ض Recently approved Shifting to 1L use No standard of care Academic Community 1L (~30 K patients) 2L (~11 K patients) 3L+ (~6 K patients) R - CHOP ~35% ض Polivy + R - CHP R - CHOP ض Polivy + R - CHP CAR - T Clinical Trials Zynlonta ض BsAbs 1 Monjuvi + Len Polivy + BR Zynlonta Monjuvi + Len Polivy + BR R - Based Chemo ~30% ~70% R - Based Chemo Monjuvi + Len Pola - BR ~65% ~60% ~40% CAR - T Clinical Trials Salvage +/ - ASCT ILLUSTRATIVE MARKET EVOLUTION ▪ Despite recent advancements, a true SoC only exists in 1L and in the academic setting in 2L with CAR - T ▪ Aside from CAR - T, the market is evolving towards combinations with off - the - shelf agents as a cornerstone ▪ With polatuzumab moving into 1L, retreatment with pola - based combos in 2L+ may be less likely ▪ Need for novel combinations in the 2L and 3L+ in community centers and 3L+ in academic settings with better efficacy and tolerability ZYNLONTA OPPORTUNITY LOTIS - 5 LOTIS - 7 Zynlonta + Bispecifics combinations may: ▪ Improve efficacy over BsAbs and other combinations in 2L+ academic settings ▪ Improve CRS rates and enable broader accessibility to community centers in 2L+ Zynlonta + R has the potential to: ▪ Provide competitive efficacy with a familiar safety profile ▪ Be a SoC in the 2L+ setting in community centers and 3L+ in academic settings

8 ADCT - 601: A Novel, Potent Approach to Targeting AXL Note: 1. GlycoConnect and HydraSpace are technologies licensed from Synaffix ; TI: therapeutic index; MTD: maximal tolerated dose; GlcNax : N - acetyl - glucosamine; GalNac : N - acetylgalactosamine ; SP: Spacer; PBD: Pyrrolobenzodiazepine . Source: Zammarchi et al., Mol Cancer Ther (2022) ADCT - 601 Structure Anticipated Differentiation ▪ Potential best - in - class ADC against a target expressed across multiple solid tumor types with unmet medical needs ▪ First AXL - targeted ADC conjugated to a PBD dimer cytotoxin ▪ Glycoconnect Ρ ,1 and Hydraspace Ρ ,1 technology enhance the TI of ADCT - 601 three - fold in preclinical models compared to ADCs manufactured by random stochastic conjugation PBD Sp Gal Nac Fuc HydraSpace Ρ cleavable linker and SG3199 (PBD dimer cytotoxin) Anti - human AXL antibody Antibody Linker + payload ADCT - 601 MOA Warhead released after internalization, and binds in minor groove of DNA ▪ PBD dimer creates interstrand cross - links ▪ No DNA distortion ▪ Avoids DNA repair mechanism ADCT - 601

9 ADCT - 601 targeting AXL: Rationale and Differentiation Note: 1 Data as of 02/09/2024. 2 Based on scoring algorithm and cut - off used in trial 601 - 102 to determine high expressing/positive patients: STS = AXL+ tumor ce lls 2+/ 3+ intensity ≥ 75% , PAAD = AXL+ tumor cells 2+/ 3+ intensity ≥ 10% , NSCLC = Membrane AXL+ Tumor cells (any intensity) ≥ 1% . 3 Membrane expression in general correlates with 2+/3+ tumor cells expression. ▪ A Phase 1b study is ongoing including a monotherapy arm enrolling patients with sarcoma, pancreatic cancer and AXL - expressing NS CLC and a combination arm with gemcitabine in patients with sarcoma and pancreatic cancer ▪ Reached recommended dose of 13mg; dose optimization is ongoing o In sarcoma, early signs of anti - tumor activity have been seen in monotherapy and combination with a tolerable safety profile in the dose range tested ▪ In pancreatic cancer, screening was recently initiated in the monotherapy arm CLINICAL STUDY STATUS & NEXT STEPS ▪ AXL is expressed in multiple tumor types - including NSCLC, pancreatic, and sarcoma ▪ High expression of AXL is correlated to worse patient overall survival across these cancer types % of cases with high AXL expression 2 % of cases with any AXL Expression Sarcoma (STS) ~30% ~90% Pancreatic adenocarcinoma ~35% 60 – 70% Non - small cell lung 3 20 – 25% 50 – 60% TARGET RELEVANCE AXL EXPRESSION 1

10 A Growing Toolbox with a Range of Payloads, Linkers and Conjugation Technologies Note: 1 DAR: Drug antibody ratio Antibody ▪ Extensive experience identifying and advancing compelling targets with high unmet need ▪ Focus on masking binding, conditional binding moieties, bispecifics and biparatropics Linker ▪ Proprietary linkers that enable increased plasma stability and controlled payload release with tunable DAR 1 ‒ Cleavable linkers ‒ Reducible linkers ‒ Non - cleavable linkers Payload ▪ Forged next - gen PBDs as novel warheads; first to bring PBD ADC from conception to market ▪ Advancing next - gen payloads to improve selectivity, potency, therapeutic index ‒ Camptothecin derivatives ‒ DNA damaging agents ‒ Immunomodulators ‒ Dual payloads Conjugation Technology ▪ Technologies enabling precise site - specific attachment of diverse payloads ‒ Orthogonal conjugation approaches

11 Exatecan has the Potential to be Differentiated over Commercial - Stage Toxins such as DXd Note: 1 PgP : P - glycoprotein; 2 Cell line derived xenograft (CDX) model is a renal leiomyoblastoma model, a ll arms dosed intravenously qdx1 Source: Weng et al., Cancer Discov (2023) EXATECAN V. DXD ▪ Better potency ▪ No PgP 1 transport, enabling enhanced intracellular presence ▪ Increased bystander effect , leading to more cell death and enhancing therapeutic impact over DXd Exatecan DXd Vehicle Isotype (10 mg/kg) Antibody - D Xd (15 mg/kg) Antibody - exatecan (6.6 mg/kg) Antibody - exatecan (10 mg/kg) ▪ ADCT has developed a novel hydrophilic linker that enables efficient conjugation of exatecan ▪ Our exatecan - based ADCs enable traceless release of exatecan after internalization ▪ Superior therapeutic index driven by strong in vivo efficacy and excellent tolerability in cynomolgus monkey without any signs of ILD EXATECAN ADC V. DXD ADC in CDX MODEL 2 EXATECAN ADVANTAGE ADC THERAPEUTICS PLATFORM ADVANTAGE

12 Target description Phosphate transporter Adhesion protein Enzymatic glycoprotein Amino acid transporter Tumor types of interest NSCLC Ovarian cancer Ovarian cancer Endometrial cancer Prostate cancer NSCLC Colorectal cancer Payload Exatecan Exatecan Exatecan Exatecan Validation data in vitro characterization in vivo efficacy NHP toxicology in vitro characterization in vivo efficacy NHP toxicology Ongoing in vitro characterization in vivo efficacy NHP toxicology 2 Candidate selection 1 Complete 2024 2024 2024 Advancing ADC Assets Against Validated Targets in Indications with High Unmet Need Note: 1 IND enabling studies can be completed within 18 months after selection of the candidate ; 2 NHP study done with chimeric candidate NaPi2b Claudin - 6 PSMA Undisclosed target

13 Corporate Business Development Strategy for ADCT Portfolio HEMATOLOGY ZYNLONTA, ADCT - 602 SOLID TUMOR S ADCT - 601, Research Assets Business Development to Unlock Value Business Development Goals: U.S. EX - U.S. Co - development & Co - promote* Royalty & Milestones to ADCT Accelerate & Expand Asset Development 3 Non - dilutive Financing 2 Maximize Deal Value & Value Split 1 Direct Partnership *Flexible for alternative construct depending on economics. OVERLAND JOINT VENTURE

14 Cash Runway to Support Multiple Potential Near - Term Value - Driving Catalysts □ ZYNLONTA: □ Achieve commercial brand profitability in 2024 □ LOTIS - 5: Complete enrollment in 2024 □ LOTIS - 7: Dose escalation and expansion updates throughout 2024 □ FL and MZL IITs: Updates at medical conferences in 2024 / 2025 □ ADCT - 602 (CD22): Additional data updates from Phase 1 study in 2024 ▪ Exploring potential partnerships and licensing agreements ▪ Cash runway to 4Q 2025 to support company through value - generating milestones* Hematology □ ADCT - 601 (AXL): Additional data updates from Phase 1 study in sarcoma, pancreatic and NSCLC throughout 2024 □ Preclinical: Advancing a portfolio of investigational ADCs Solid Tumors * Cash runway assumes receipt of anticipated regulatory milestone payments under the Company’s collaboration agreements and use of the amount it is required to maintain under its loan agreement

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

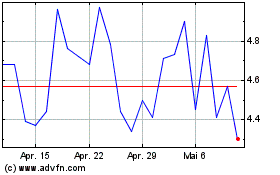

ADC Therapeutics (NYSE:ADCT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

ADC Therapeutics (NYSE:ADCT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024