- Acquisition Provides Additional Scale to Engineered Structures

in Attractive Infrastructure Markets and is Accretive to Overall

Arcosa Margin

- Marks Entry into Complementary Concrete and Steel Pole Lighting

Market

- Expands Position in Traffic and Telecommunication

Structures

- $180 Million Purchase Price to be Funded with Cash and

Available Revolver Capacity

Arcosa, Inc. (NYSE: ACA) (“Arcosa,” the “Company,” “We,” or

“Our,”), a provider of infrastructure-related products and

solutions, today announced that it has entered into a definitive

agreement to acquire Ameron Pole Products, LLC (“Ameron”) from NOV

Inc. (NYSE: NOV) for $180 million in cash.

Founded in 1970, Ameron is a leading manufacturer of highly

engineered, premium concrete and steel poles for a broad range of

infrastructure applications, including lighting, traffic, electric

distribution, and small-cell telecom. With four manufacturing

facilities strategically located in Alabama, California, and

Oklahoma, Ameron serves its customers with a nationwide presence.

For the year ended December 31, 2023, Ameron had revenues of

approximately $94 million and Adjusted EBITDA of approximately $20

million, implying a 9.0x EBITDA acquisition multiple.

Commenting on the transaction, Antonio Carrillo, Arcosa’s

President and Chief Executive Officer, noted, “As we continue to

effectively deploy capital into Arcosa’s growth businesses, we

believe Ameron is an excellent strategic fit. It provides entry

into the complementary steel and concrete lighting pole market

while expanding our product offerings in traffic and telecom. The

acquisition bolsters our Engineered Structures segment and

increases our exposure to growing infrastructure end markets at an

attractive valuation. We look forward to welcoming the Ameron team

to Arcosa and combining our strengths to accelerate growth.”

The Company expects to fund the $180 million purchase price with

a combination of cash on-hand and borrowings available under its

revolving credit facility. The transaction, which has been approved

by the Company’s Board of Directors, is subject to customary

closing conditions and regulatory provisions under the

Hart-Scott-Rodino Act and is expected to close in the second

quarter of 2024.

For supplemental information on the transaction, please refer to

materials located on our website at

https://ir.arcosa.com/news-events/events-presentations.

Non-GAAP Financial Measures

This press release contains financial measures that have not

been prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”). Reconciliations of non-GAAP financial measures

to the closest GAAP measure are included in the accompanying table

to this release.

About Arcosa

Arcosa, Inc., headquartered in Dallas, Texas, is a provider of

infrastructure-related products and solutions with leading

positions in construction, engineered structures, and

transportation markets. Arcosa reports its financial results in

three principal business segments: Construction Products,

Engineered Structures, and Transportation Products. For more

information, visit www.arcosa.com.

About NOV

NOV delivers technology-driven solutions to empower the global

energy industry. For more than 150 years, NOV has pioneered

innovations that enable its customers to safely produce abundant

energy while minimizing environmental impact. The energy industry

depends on NOV’s deep expertise and technology to continually

improve oilfield operations and assist in efforts to advance the

energy transition towards a more sustainable future. NOV powers the

industry that powers the world. Visit www.nov.com for more

information.

Some statements in this release, which are not historical facts,

are “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include statements about Arcosa’s estimates,

expectations, beliefs, intentions or strategies for the future.

Arcosa uses the words “anticipates,” “assumes,” “believes,”

“estimates,” “expects,” “intends,” “forecasts,” “may,” “will,”

“should,” “guidance,” “outlook,” “strategy,” “plans,” and similar

expressions to identify these forward-looking statements.

Forward-looking statements speak only as of the date of this

release, and Arcosa expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein, except as required by

federal securities laws. Forward-looking statements are based on

management’s current views and assumptions and involve risks and

uncertainties that could cause actual results to differ materially

from historical experience or our present expectations, including

but not limited to assumptions, risks and uncertainties regarding

the completion of the Ameron acquisition; the impact of pandemics

on Arcosa’s business; failure to successfully integrate

acquisitions or divest any business, or failure to achieve the

expected benefits of acquisitions or divestitures; market

conditions and customer demand for Arcosa’s business products and

services; the cyclical nature of, and seasonal or weather impact

on, the industries in which Arcosa competes; competition and other

competitive factors; governmental and regulatory factors; changing

technologies; availability of growth opportunities; market

recovery; ability to improve margins; the impact of inflation and

costs of materials; assumptions regarding achievements of the

expected benefits from the Inflation Reduction Act; the delivery or

satisfaction of any backlog or firm orders; and Arcosa’s ability to

execute its long-term strategy, and such forward-looking statements

are not guarantees of future performance. For further discussion of

such risks and uncertainties, see “Risk Factors” and the

“Forward-Looking Statements” section of “Management's Discussion

and Analysis of Financial Condition and Results of Operations” in

Arcosa's Form 10-K for the year ended December 31, 2023 and as may

be revised and updated by Arcosa's Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K.

Reconciliation of Ameron Pro Forma Adjusted EBITDA (in

millions) (unaudited)

“EBITDA” is defined as net income plus interest, taxes,

depreciation, depletion, and amortization. “Pro-Forma Adjusted

EBITDA” is defined as Ameron's EBITDA plus pro forma adjustments

for non-recurring items. GAAP does not define Pro-Forma Adjusted

EBITDA and it should not be considered as an alternative to

earnings measures defined by GAAP, including net income. We believe

Pro-Forma Adjusted EBITDA assists investors in comparing a

company's performance on a consistent basis without regard to

depreciation, depletion, amortization, and other items which can

vary significantly depending on many factors.

Year Ended

December 31, 2023

Net income, before intercompany

adjustments

$

14.9

Add:

Interest expense, net

—

Provision for income taxes(1)

—

Depreciation and amortization expense

4.9

EBITDA

19.8

Add:

Inventory revaluation

(0.4

)

Other non-recurring

0.4

Pro Forma Adjusted EBITDA

$

19.8

(1) Pass through entity and not subject to federal income

taxes

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240311388934/en/

MEDIA CONTACT: media@arcosa.com

INVESTOR CONTACTS

Gail M. Peck Chief Financial Officer

Erin Drabek Director of Investor Relations

T 972.942.6500 InvestorResources@arcosa.com

David Gold ADVISIRY Partners

T 212.661.2220 David.Gold@advisiry.com

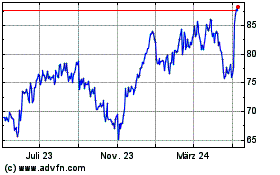

Arcosa (NYSE:ACA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

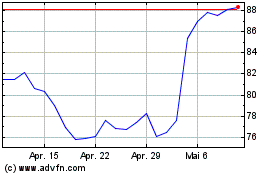

Arcosa (NYSE:ACA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025