Roy Jacobs & Associates Investigating Alphatec Holdings, Inc. for Possible Securities Law Violations ("ATEC")

09 August 2010 - 4:32PM

Business Wire

Roy Jacobs & Associates announces that it is investigating

possible claims for the violation of the federal securities laws on

behalf of purchasers of the common stock of Alphatec Holdings, Inc.

(“ATEC” or the “Company”) (NASDAQ: ATEC) during the period between

December 18, 2009 and August 5, 2010. ATEC is a medical device

company that designs, develops, manufactures and markets products

for the surgical treatment of spine disorders, with a focus on

treating conditions affecting the aging spine. On August 5 2010,

after the close of trading, the Company announced disappointing

revenues and earnings for the Second Quarter 2010, and markedly

lower revised revenue and earnings guidance for fiscal 2010. As a

result of the Company’s poor financial performance for the reasons

discussed below, the Company’s shares declined on August 6, 2010 by

46%, to close at $2.39, wiping out tens of millions of dollars in

shareholder value.

For further information, please contact Roy L. Jacobs, Esq.

toll-free at 1-888-884-4490 or by e-mail at

rjacobs@jacobsclasslaw.com.

On December 17, 2009 the Company announced that it was going to

acquire Scient’x, S.A. (“Scient’x”), a company owned by

HealthpointCapital Partners and affiliates (“HealthpointCapital”),

which also held 38% of the Company’s shares, in an all stock

transaction. Five of the nine ATEC directors are affiliated with

HealthpointCapital. The Company praised the acquisition by touting

the anticipated increase in scale, the global presence in all major

markets, and the cost synergies to be realized. Also on December

17, 2009, the Company disseminated very positive and aggressive

full year 2010 financial guidance, stating that the Company

anticipated annualized pro forma revenues of $220.0 million to

$225.0 million, and $32.0 million to $35.0 million in annualized

adjusted gross earnings. ATEC shares rose over 8% on this news. The

2010 guidance was reiterated on February 23, 2010, April 12, 2010

and May 10, 2010. The guidance was a major factor in causing ATEC’s

share price to trade at high prices, so that ATEC could sell shares

in a follow-on offering and so that HealthpointCapital could sell

off a substantial part of its shares in that same offering, as

discussed below.

On March 26, 2010 the Company closed the Scient’x acquisition.

On April 12, ATEC announced a follow-on public offering wherein the

Company would sell 8 million shares and HealthpointCapital would

also sell an additional 8 million shares. The offering was priced

at $5.00. The offering closed on April 21, 2010. The offering

allowed HealthpointCapital to sell off a significant number of its

ATEC shares.

Then on August 6, 2010, ATEC shares crashed upon the revelation

of facts suggesting that the repeated aggressive projections lacked

a reasonable basis, in that they appear to have been based on

unrealistic calculations as to the speed of integration and the

benefits to be achieved by the Scient’x acquisition; as to the

ability to offset negative pricing trends in the industry; and as

to the ability to replace revenue lost when it divested its Asian

distributor at the time of the Scient’x acquisition.

If you (i) purchased ATEC shares during the period from December

18, 2009 through August 5, 2010, and have a loss, whether or not

you still hold your shares; or (ii) if your bought in the April

2010 offering; or (iii) held ATEC shares prior to December 18 ,

2009, and still hold your shares and, you are interested in

discussing your rights free of charge, please contact Roy L.

Jacobs. Mr. Jacobs will be glad to personally speak with you.

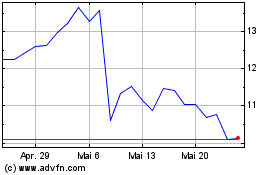

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

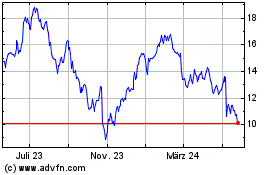

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024