Fiscal Second Quarter 2025 Financial Highlights:

- Net sales of $452.5 million

- Net income of $27.7 million; 6.1% of net sales

- GAAP EPS of $1.79; adjusted EPS of $2.081

- Adjusted EBITDA of $60.2 million; 13.3% of net sales

- Cash provided by operating activities of $11.9 million; free

cash flow of $0.7 million

- Repurchased 348,877 shares for $32.5 million

- Board approved an additional $125 million authorization for

future share repurchases

Fiscal 2025 Year to Date Financial Highlights:

- Net sales of $911.6 million

- Net income of $57.3 million; 6.3% of net sales

- GAAP EPS of $3.68; adjusted EPS of $4.221

- Adjusted EBITDA of $123.1 million; 13.5% of net sales

- Cash provided by operating activities of $52.7 million; free

cash flow of $30.1 million

- Repurchased 620,337 shares for $56.5 million

American Woodmark Corporation (NASDAQ: AMWD) (the "Company")

today announced results for its second fiscal quarter ended October

31, 2024.

“Our team delivered net sales and Adjusted EBITDA performance

that was in-line with the expectations we shared last quarter. The

quarter was impacted by continued softer demand in the remodel

market along with the slowdown in new construction single family

starts over the summer,” said Scott Culbreth, President and CEO.

“We expect the demand trends to remain challenging but are

reaffirming our outlook for a low single-digit decline in net sales

for the full fiscal year and have tightened our Adjusted EBITDA

range to $225 million to $235 million.”

Second Quarter Results

Net sales for the second quarter of fiscal 2025 decreased $21.4

million, or 4.5%, to $452.5 million compared with the same quarter

last fiscal year. Net income was $27.7 million ($1.79 per diluted

share and 6.1% of net sales) compared with $30.3 million ($1.85 per

diluted share and 6.4% of net sales) last fiscal year. Net income

decreased $2.7 million due to lower net sales, increasing supply

chain costs, an unfavorable mark-to-market adjustment on our

foreign currency hedging instruments, and restructuring charges

related to a reduction in force during the quarter, partially

offset by the roll-off of acquisition-related intangible asset

amortization, which ended in the third quarter of the prior fiscal

year, and lower year-over-year incentive compensation. Adjusted EPS

per diluted share was $2.08 for the second quarter of fiscal 2025

compared with $2.50 last fiscal year. Adjusted EBITDA for the

second quarter of fiscal 2025 decreased $12.1 million, or 16.8%, to

$60.2 million, or 13.3% of net sales, compared with $72.3 million,

or 15.3% of net sales, last fiscal year.

1During the second quarter of fiscal 2025,

the Company changed its definition of Adjusted EPS per diluted

share to exclude the change in fair value of foreign exchange

forward contracts to be consistent with its definition of Adjusted

EBITDA. Prior period amounts have been adjusted to conform to

current period presentation.

Fiscal Year to Date Results

Net sales for the first six months of fiscal 2025 decreased

$60.5 million, or 6.2%, to $911.6 million compared with the same

period of the prior fiscal year. Net income was $57.3 million

($3.68 per diluted share and 6.3% of net sales) compared with $68.2

million ($4.13 per diluted share and 7.0% of net sales) in the same

period of the prior fiscal year. Net income for the first six

months of fiscal 2025 decreased $10.9 million due to lower net

sales, manufacturing volume deleverage in our new locations in

Hamlet, North Carolina, and Monterrey, Mexico, increasing supply

chain costs, unfavorable mark-to-market adjustment on our foreign

currency hedging instruments, and restructuring charges related to

a reduction in force during the second fiscal quarter, partially

offset by the roll-off of acquisition-related intangible asset

amortization, which ended in the third quarter of the prior fiscal

year, non-recurring pre-tax charge related to the plywood case last

fiscal year, and lower year-over-year incentive compensation.

Adjusted EPS per diluted share was $4.22 for the first six months

of fiscal 2025 compared with $5.24 in the same period of the prior

fiscal year. Adjusted EBITDA for the first six months of fiscal

2025 decreased $24.4 million, or 16.5%, to $123.1 million, or 13.5%

of net sales, compared to $147.5 million, or 15.2% of net sales,

for the same period of the prior fiscal year.

Balance Sheet & Cash Flow

As of October 31, 2024, the Company had $56.7 million in cash

plus access to $313.2 million of additional availability under its

revolving credit facility. Also, as of October 31, 2024, the

Company had $200.0 million in term loan debt and $173.4 million

drawn on its revolving credit facility. On October 10, 2024, the

Company refinanced its senior secured debt facility. The new

agreement provides for a $500 million revolving loan facility and a

$200 million term loan facility.

Cash provided by operating activities for the first six months

of fiscal 2025 was $52.7 million and free cash flow totaled $30.1

million. During the second fiscal quarter, the Company purchased

$17.7 million of transferable renewable energy tax credits to

offset its corporate income tax liability. These credits will be

utilized to offset corporate income tax payments in the fourth

fiscal quarter of fiscal 2025.

The Company repurchased 348,877 shares, or approximately 2.3% of

shares outstanding, for $32.5 million during the second quarter of

fiscal 2025, and 620,337 shares, or approximately 4.1% of shares

outstanding, for $56.5 million during the first six months of

fiscal 2025. As of October 31, 2024, $33.0 million remained

available from the amount authorized by the Board to repurchase the

Company's common stock.

On November 20, 2024, the Board of Directors authorized an

additional stock repurchase program of up to $125 million of the

Company's outstanding common shares. This authorization is in

addition to the stock repurchase program authorized on November 29,

2023. Any repurchases under the stock repurchase program are

subject to market conditions, the Company’s cash requirements for

other purposes, compliance with applicable laws and regulations and

contractual covenants and any other factors management may deem

relevant at the time of such repurchases. The Company is not

obligated to make any stock repurchases in the future.

Fiscal 2025 Financial Outlook

For fiscal 2025 (which includes the now completed first six

months) the Company expects:

- Low single-digit decline in net sales year-over-year

- Adjusted EBITDA in the range of $225 million to $235

million

“During the first half of the fiscal year, we achieved an

Adjusted EBITDA of $123.1 million, representing 13.5% of net sales.

Despite macro-economic housing headwinds, our teams remain

dedicated and focused on controlling our discretionary spend and

focusing on operational improvements. When the macro-housing

conditions improve, we’ll be strongly positioned in the

marketplace,” stated Paul Joachimczyk, Senior Vice President and

Chief Financial Officer. “We have been, and continue to remain,

committed to investment back in the business and continued returns

to our shareholders as shown by repurchasing 4.1% of our shares

outstanding during the first six months of fiscal 2025.”

Our Adjusted EBITDA outlook excludes the impact of certain

income and expense items that management believes are not part of

underlying operations. These items may include restructuring costs,

interest expense, stock-based compensation expense, and certain tax

items. Our management cannot estimate on a forward-looking basis

the impact of these income and expense items on its reported net

income, which could be significant, are difficult to predict, and

may be highly variable. As a result, the Company does not provide a

reconciliation to the closest corresponding GAAP financial measure

for its Adjusted EBITDA outlook.

About American Woodmark

American Woodmark celebrates the creativity in all of us. With

over 8,600 employees and more than a dozen brands, we’re one of the

nation’s largest cabinet manufacturers. From inspiration to

installation, we help people find their unique style and turn their

home into a space for self-expression. By partnering with major

home centers, builders, and independent dealers and distributors,

we spark the imagination of homeowners and designers and bring

their vision to life. Across our service and distribution centers,

our corporate office, and manufacturing facilities, you’ll always

find the same commitment to customer satisfaction, integrity,

teamwork, and excellence. Visit americanwoodmark.com to learn more

and start building something distinctly your own.

Use of Non-GAAP Financial Measures

We have presented certain financial measures in this press

release which have not been prepared in accordance with U.S.

generally accepted accounting principles (GAAP). Definitions of our

non-GAAP financial measures and a reconciliation to the most

directly comparable financial measure calculated in accordance with

GAAP are provided below following the financial highlights under

the heading "Non-GAAP Financial Measures."

Safe harbor statement under the Private Securities Litigation

Reform Act of 1995: All forward-looking statements made by the

Company involve material risks and uncertainties and are subject to

change based on factors that may be beyond the Company's control.

Accordingly, the Company's future performance and financial results

may differ materially from those expressed or implied in any such

forward-looking statements. Such factors include, but are not

limited to, those described in the Company's filings with the

Securities and Exchange Commission, including our Annual Report on

Form 10-K. The Company does not undertake to publicly update or

revise its forward-looking statements even if experience or future

changes make it clear that any projected results expressed or

implied therein will not be realized.

AMERICAN WOODMARK

CORPORATION

Unaudited Financial

Highlights

(in thousands, except share

data)

Operating Results

Three Months Ended

Six Months Ended

October 31,

October 31,

2024

2023

2024

2023

Net sales

$

452,482

$

473,867

$

911,610

$

972,122

Cost of sales & distribution

366,771

370,708

733,033

759,354

Gross profit

85,711

103,159

178,577

212,768

Sales & marketing expense

21,738

22,685

46,075

47,045

General & administrative expense

20,237

35,036

41,739

70,630

Restructuring charges, net

1,133

(26

)

1,133

(198

)

Operating income

42,603

45,464

89,630

95,291

Interest expense, net

2,448

1,953

4,738

4,390

Other expense, net

4,702

3,050

9,942

1,975

Income tax expense

7,767

10,120

17,631

20,735

Net income

$

27,686

$

30,341

$

57,319

$

68,191

Earnings Per Share:

Weighted average shares outstanding -

diluted

15,435,311

16,420,760

15,557,210

16,505,266

Net income per diluted share

$

1.79

$

1.85

$

3.68

$

4.13

Condensed Consolidated Balance

Sheet

(Unaudited)

October 31,

April 30,

2024

2024

Cash & cash equivalents

$

56,717

$

87,398

Customer receivables, net

123,225

117,559

Inventories

183,978

159,101

Income taxes receivable

12,343

14,548

Prepaid expenses and other

26,380

24,104

Total current assets

402,643

402,710

Property, plant and equipment, net

255,853

272,461

Operating lease right-of-use assets

138,502

126,383

Goodwill, net

767,612

767,612

Other long-term assets, net

45,265

24,699

Total assets

$

1,609,875

$

1,593,865

Current maturities of long-term debt

$

7,831

$

2,722

Short-term lease liability - operating

32,365

27,409

Accounts payable & accrued

expenses

168,372

165,595

Total current liabilities

208,568

195,726

Long-term debt, less current

maturities

367,981

371,761

Deferred income taxes

—

5,002

Long-term lease liability - operating

113,949

106,573

Other long-term liabilities

4,315

4,427

Total liabilities

694,813

683,489

Stockholders' equity

915,062

910,376

Total liabilities & stockholders'

equity

$

1,609,875

$

1,593,865

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

Six Months Ended

October 31,

2024

2023

Net cash provided by operating

activities

$

52,733

$

143,722

Net cash used by investing activities

(22,587

)

(33,837

)

Net cash used by financing activities

(60,827

)

(55,236

)

Net (decrease) increase in cash and cash

equivalents

(30,681

)

54,649

Cash and cash equivalents, beginning of

period

87,398

41,732

Cash and cash equivalents, end of

period

$

56,717

$

96,381

Non-GAAP Financial Measures

We have reported our financial results in accordance with U.S.

generally accepted accounting principles (GAAP). In addition, we

have discussed our financial results using the non-GAAP measures

described below.

Management believes all of these non-GAAP financial measures

provide an additional means of analyzing the current period's

results against the corresponding prior period's results. However,

these non-GAAP financial measures should be viewed in addition to,

and not as a substitute for, the Company's reported results

prepared in accordance with GAAP. Our non-GAAP financial measures

are not meant to be considered in isolation or as a substitute for

comparable GAAP measures and should be read only in conjunction

with our consolidated financial statements prepared in accordance

with GAAP.

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin

We use EBITDA, Adjusted EBITDA and Adjusted EBITDA margin in

evaluating the performance of our business, and we use each in the

preparation of our annual operating budgets and as indicators of

business performance and profitability. We believe EBITDA, Adjusted

EBITDA, and Adjusted EBITDA margin allow us to readily view

operating trends, perform analytical comparisons and identify

strategies to improve operating performance. Additionally, Adjusted

EBITDA is a key measurement used in our Term Loans to determine

interest rates and financial covenant compliance.

We define EBITDA as net income (loss) adjusted to exclude (1)

income tax expense (benefit), (2) interest expense, net, (3)

depreciation and amortization expense, and (4) amortization of

customer relationship intangibles. We define Adjusted EBITDA as

EBITDA adjusted to exclude (1) expenses related to the acquisition

of RSI Home Products, Inc. ("RSI acquisition"), (2) restructuring

charges, net, (3) net gain/loss on debt modification, (4)

stock-based compensation expense, (5) gain/loss on asset disposals,

and (6) change in fair value of foreign exchange forward contracts.

We believe Adjusted EBITDA, when presented in conjunction with

comparable GAAP measures, is useful for investors because

management uses Adjusted EBITDA in evaluating the performance of

our business.

We define Adjusted EBITDA margin as Adjusted EBITDA as a

percentage of net sales.

Adjusted EPS per diluted share

We use Adjusted EPS per diluted share in evaluating the

performance of our business and profitability. Management believes

that this measure provides useful information to investors by

offering additional ways of viewing the Company's results by

providing an indication of performance and profitability excluding

the impact of unusual and/or non-cash items. We define Adjusted EPS

per diluted share as diluted earnings per share excluding the per

share impact of (1) expenses related to the RSI acquisition, (2)

restructuring charges, net, (3) the amortization of customer

relationship intangibles, (4) net gain/loss on debt modification,

(5) change in fair value of foreign exchange forward contracts, and

(6) the tax benefit of RSI acquisition expenses, restructuring

charges, the net gain/loss on debt modification, the amortization

of customer relationship intangibles, and the change in fair value

of foreign exchange forward contracts. The amortization of

intangible assets is driven by the RSI acquisition. Management has

determined that excluding amortization of intangible assets and

change in fair value of foreign exchange forward contracts from our

definition of Adjusted EPS per diluted share will better help it

evaluate the performance of our business and profitability.

During the second quarter of fiscal 2025, the Company changed

its definition of Adjusted EPS per diluted share to exclude the

change in fair value of foreign exchange forward contracts to be

consistent with its definition of Adjusted EBITDA.

Free cash flow

To better understand trends in our business, we believe that it

is helpful to subtract amounts for capital expenditures consisting

of cash payments for property, plant and equipment and cash

payments for investments in displays from cash flows from

continuing operations which is how we define free cash flow.

Management believes this measure gives investors an additional

perspective on cash flow from operating activities in excess of

amounts required for reinvestment. It also provides a measure of

our ability to repay our debt obligations.

Net leverage

Net leverage is a performance measure that we believe provides

investors a more complete understanding of our leverage position

and borrowing capacity after factoring in cash and cash equivalents

that eventually could be used to repay outstanding debt.

We define net leverage as net debt (total debt less cash and

cash equivalents) divided by the trailing 12 months Adjusted

EBITDA.

A reconciliation of these non-GAAP financial measures and the

most directly comparable measures calculated and presented in

accordance with GAAP are set forth on the following tables:

Reconciliation of EBITDA,

Adjusted EBITDA and Adjusted EBITDA margin

Three Months Ended

Six Months Ended

October 31,

October 31,

(in thousands)

2024

2023

2024

2023

Net income (GAAP)

$

27,686

$

30,341

$

57,319

$

68,191

Add back:

Income tax expense

7,767

10,120

17,631

20,735

Interest expense, net

2,448

1,953

4,738

4,390

Depreciation and amortization expense

13,466

11,647

26,268

23,392

Amortization of customer relationship

intangibles

—

11,417

—

22,834

EBITDA (Non-GAAP)

$

51,367

$

65,478

$

105,956

$

139,542

Add back:

Acquisition related expenses (1)

—

20

—

40

Restructuring charges, net (2)

1,133

(26

)

1,133

(198

)

Net loss on debt modification

364

—

364

—

Change in fair value of foreign exchange

forward contracts (3)

4,375

3,116

9,684

2,101

Stock-based compensation expense

2,864

2,155

5,805

4,402

Loss on asset disposal

84

1,586

142

1,593

Adjusted EBITDA (Non-GAAP)

$

60,187

$

72,329

$

123,084

$

147,480

Net Sales

$

452,482

$

473,867

$

911,610

$

972,122

Net income margin (GAAP)

6.1

%

6.4

%

6.3

%

7.0

%

Adjusted EBITDA margin (Non-GAAP)

13.3

%

15.3

%

13.5

%

15.2

%

(1) Acquisition related expenses are

comprised of expenses related to the RSI acquisition.

(2) Restructuring charges, net are

comprised of expenses incurred related to the nationwide

reduction-in-force implemented in the third and fourth quarters of

fiscal 2023 and the reduction in force implemented in the second

quarter of fiscal 2025.

(3) In the normal course of business the

Company is subject to risk from adverse fluctuations in foreign

exchange rates. The Company manages these risks through the use of

foreign exchange forward contracts. The changes in the fair value

of the forward contracts are recorded in other (income) expense,

net in the operating results.

Reconciliation of Net Income

to Adjusted Net Income

Three Months Ended

Six Months Ended

October 31,

October 31,

(in thousands, except share data)

2024

2023

2024

2023

Net income (GAAP)

$

27,686

$

30,341

$

57,319

$

68,191

Add back:

Acquisition and restructuring related

expenses

—

20

—

40

Restructuring charges, net

1,133

(26

)

1,133

(198

)

Net loss on debt modification

364

—

364

—

Change in fair value of foreign exchange

forward contracts (1)

4,375

3,116

9,684

2,101

Amortization of customer relationship

intangibles

—

11,417

—

22,834

Tax benefit of add backs

(1,510

)

(3,767

)

(2,874

)

(6,442

)

Adjusted net income (Non-GAAP)

$

32,048

$

41,101

$

65,626

$

86,526

Weighted average diluted shares (GAAP)

15,435,311

16,420,760

15,557,210

16,505,266

EPS per diluted share (GAAP)

$

1.79

$

1.85

$

3.68

$

4.13

Adjusted EPS per diluted share

(Non-GAAP)

$

2.08

$

2.50

$

4.22

$

5.24

(1) Change in fair value of foreign

exchange forward contracts was excluded from Adjusted EPS per

diluted share in the second quarter of fiscal 2025 to be consistent

with the Company's definition of Adjusted EBITDA. Prior period

amounts have been adjusted to conform to current period

presentation.

Free Cash Flow

Six Months Ended

October 31,

2024

2023

Net cash provided by operating

activities

$

52,733

$

143,722

Less: Capital expenditures (1)

22,592

33,842

Free cash flow

$

30,141

$

109,880

(1) Capital expenditures consist of cash

payments for property, plant and equipment and cash payments for

investments in displays.

Net Leverage

Twelve Months Ended

October 31,

(in thousands)

2024

Net income (GAAP)

$

105,345

Add back:

Income tax expense

32,648

Interest expense, net

8,556

Depreciation and amortization expense

51,213

Amortization of customer relationship

intangibles

7,610

EBITDA (Non-GAAP)

$

205,372

Add back:

Acquisition related expenses (1)

7

Restructuring charges, net (2)

1,133

Net loss on debt modification

364

Change in fair value of foreign exchange

forward contracts (3)

9,127

Stock-based compensation expense

12,084

Loss on asset disposal

292

Adjusted EBITDA (Non-GAAP)

$

228,379

As of

October 31,

2024

Current maturities of long-term debt

$

7,831

Long-term debt, less current

maturities

367,981

Total debt

375,812

Less: cash and cash equivalents

(56,717

)

Net debt

$

319,095

Net leverage (4)

1.40

(1) Acquisition related expenses are

comprised of expenses related to the RSI acquisition.

(2) Restructuring charges, net are

comprised of expenses incurred related to the nationwide

reduction-in-force implemented in the third and fourth quarters of

fiscal 2023 and the reduction in force implemented in the second

quarter of fiscal 2025.

(3) In the normal course of business the

Company is subject to risk from adverse fluctuations in foreign

exchange rates. The Company manages these risks through the use of

foreign exchange forward contracts. The changes in the fair value

of the forward contracts are recorded in other (income) expense,

net in the operating results.

(4) Net debt divided by Adjusted EBITDA

for the twelve months ended October 31, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241126057554/en/

Kevin Dunnigan VP & Treasurer 540-665-9100

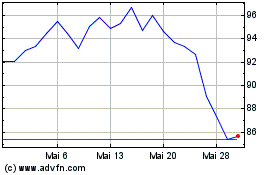

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

Von Apr 2024 bis Apr 2025