Akoya Biosciences, Inc. (Nasdaq: AKYA) (“Akoya”), The Spatial

Biology Company®, today announced its financial results for the

third quarter ending September 30, 2024.

“Our third-quarter results came in below expectations, largely

due to ongoing capital equipment purchase constraints seen across

the life science tools market. We remain optimistic about the

long-term growth outlook of our industry, but we recognize the

current environment will pose temporary challenges. We proactively

anticipated this with our recent organizational restructuring,

which, while difficult and temporarily disruptive this quarter, was

the right decision and enhanced our readiness to absorb the

headwinds we are facing,” said Brian McKelligon, CEO of Akoya

Biosciences. “We remain confident that Akoya’s technologies will

continue to be the preferred platform in the spatial biology market

from discovery to diagnostics, supporting a return to topline

growth in 2025, and beyond, and achievement of our profitability

goals.”

Third Quarter 2024 Financial Results

- For the third quarter of 2024,

revenue was $18.8 million, a 25% year-over-year decrease from $25.2

million in the third quarter of 2023.

- For the third quarter of 2024,

gross margin was 62.3%, an improvement on the gross margin of 60.6%

in the third quarter of 2023.

- For the third quarter of 2024,

operating expenses were $20.1 million, a 25% year-over-year

improvement on operating expenses of $26.8 million in the third

quarter of 2023.

- For the third quarter of 2024,

loss from operations was $8.3 million, a 28% year-over-year

improvement on loss from operations of $11.6 million in the third

quarter of 2023.

- $39.3 million of cash, cash equivalents and marketable

securities as of September 30, 2024.

Third Quarter 2024 Business Updates

- Ended the third quarter of 2024

with an instrument installed base of 1,299 (388 PhenoCyclers, 911

PhenoImagers), a year-over-year increase of 15% compared to an

installed base of 1,132 in the prior year period (327 PhenoCyclers,

805 PhenoImagers).

- As of September 30, 2024, there

were 1,578 total publications citing Akoya’s technology, compared

to 1,070 total publications in the prior year period, a 47%

increase.

- At the Society for Immunotherapy

of Cancer Conference (SITC) which took place November 6-10, Akoya

announced three new product offerings enabled by our Manufacturing

Center of Excellence that we believe will drive continued growth in

reagent revenue.

- First, Akoya introduced the

PhenoCode™ Discovery IO60 Panel, an ultra-high-plex panel for

immune-oncology research targeting 60 biomarkers using

off-the-shelf antibodies.

- Additionally, Akoya unveiled a

new mouse FFPE IO panel, optimized for pre-clinical immune-oncology

applications to drive translational research insights.

- Lastly, Akoya expanded our

PhenoCode catalogue of molecular barcodes to enable routine

ultra-high-plex of 100-biomarker spatial experiments.

- Akoya announced the selection of

its spatial proteomics platforms, PhenoCycler-Fusion and

PhenoImager HT, for the UK-wide MANIFEST program, a

multi-million-dollar initiative led by the Francis Crick Institute

and the Royal Marsden NHS Foundation Trust, focused on evaluating

thousands of patient samples to better understand responses to

cancer immunotherapy.

- On October 2, 2024, Scott Mendel

was appointed as Chairman of the Board of Directors. Mr. Mendel has

served as a member of Akoya’s Board of Directors since June 2021

and brings with him over 30 years of financial and operational

management experience.

YTD 2024 Financial Results

- YTD 2024 revenue was $60.3 million, compared to $70.1 million

in the prior year period; a 14% decrease.

- YTD 2024 reported gross margin was 55.5% while non-GAAP

adjusted gross margin was 58.9% when excluding the write-off from

discontinued legacy products in the first quarter of 2024. Both

GAAP and non-GAAP gross margin were 56.6% in the prior year period

of 2023.

- YTD 2024 operating expenses were $74.5 million while non-GAAP

operating expenses were $68.4 million when excluding the impairment

charge for facility consolidation and restructuring associated with

a reduction in force in the first quarter and third quarter of

2024. Both GAAP and non-GAAP operating expenses were $87.9 million

in the prior year period of 2023.

- YTD 2024 loss from operations was

$41.0 million while non-GAAP loss from operations was $32.9 million

excluding the items noted above. Both GAAP and non-GAAP loss from

operations were $48.2 million in the prior year period of

2023.

2024 Financial Outlook

Due to persistent macro challenges during the year, Akoya

expects revenue for the full year 2024 to now be in the range of

$80 million to $85 million versus a prior range of $96 million to

$104 million. As part of our ongoing commitment to maximizing

shareholder value, the company is also actively evaluating a range

of strategic alternatives to identify the best path forward for

sustainable growth, profitability and long-term success.

Webcast and Conference Call Details

Akoya will host a conference call today, November 14, 2024, at

5:00 p.m. Eastern Time to discuss its third quarter 2024 financial

results. Investors interested in listening to the conference call

are required to register online. A live webcast of the conference

call will be available on the “Investors” section of the Company's

website at https://investors.akoyabio.com/. The webcast will be

archived on the website following the completion of the call for

three months.

Non-GAAP Financial Measures

In addition to reporting financial measures in accordance with

generally accepted accounting principles (“GAAP”), Akoya is

including in this press release “non-GAAP adjusted gross profit,”

“non-GAAP adjusted gross margin,” “non-GAAP operating expense,” and

“non-GAAP loss from operations,” all of which are non-GAAP

financial measures. Akoya defines non-GAAP adjusted gross profit as

gross profit margin adjusted for certain excess and obsolete

inventory charges. Non-GAAP adjusted gross margin is defined as

non-GAAP adjusted gross profit divided by total revenue. Akoya

defines non-GAAP operating expense as operating expense adjusted

for impairment and restructuring charges. Akoya defines non-GAAP

loss from operations as loss from operations adjusted for certain

excess and obsolete inventory charges, impairment, and

restructuring charges.

Akoya includes these non-GAAP financial measures because it

believes they allow investors to understand and evaluate the

Company’s core operating performance and trends. In particular, the

exclusion of certain items in calculating non-GAAP adjusted gross

profit, non-GAAP adjusted gross margin, non-GAAP operating expense,

and non-GAAP loss from operations can provide useful measures for

period-to-period comparisons of the Company’s core business. These

non-GAAP financial measures have limitations as analytical tools,

including the fact that such non-GAAP financial measures may not be

comparable to similarly titled measures presented by other

companies because other companies may calculate non-GAAP adjusted

gross profit, non-GAAP adjusted gross margin, non-GAAP operating

expense, and non-GAAP loss from operations differently than Akoya

does. For more information regarding these non-GAAP financial

measures, see the tables included at the end of this press

release.

Forward-Looking Statements

This press release contains forward-looking statements that are

based on management’s beliefs and assumptions and on information

currently available to management. All statements contained in this

release other than statements of historical fact are

forward-looking statements, including statements regarding our

expectations for full year 2024 revenue, our ability to achieve

market acceptance of our current and planned products and services,

our growth prospects, and other statements regarding our business

strategies, use of capital, results of operations, financial

performance and plans and objectives for future operations.

In some cases, you can identify forward-looking statements by

the words “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing” or the negative of

these terms or other comparable terminology, although not all

forward-looking statements contain these words. These statements

involve risks, uncertainties and other factors that may cause

actual results, levels of activity, performance, or achievements to

be materially different from the information expressed or implied

by these forward-looking statements. These risks, uncertainties and

other factors are described under "Risk Factors," "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" and elsewhere in the documents we file with the

Securities and Exchange Commission from time to time. We caution

you that forward-looking statements are based on a combination of

facts and factors currently known by us and our projections of the

future, about which we cannot be certain. As a result, the

forward-looking statements may not prove to be accurate. The

forward-looking statements in this press release represent our

views as of the date hereof. We undertake no obligation to update

any forward-looking statements for any reason, except as required

by law.

About Akoya Biosciences

As The Spatial Biology Company®, Akoya Biosciences’ mission is

to bring context to the world of biology and human health through

the power of spatial phenotyping. The Company offers comprehensive

single-cell imaging solutions that allow researchers to phenotype

cells with spatial context and visualize how they organize and

interact to influence disease progression and response to therapy.

Akoya offers a full continuum of spatial phenotyping solutions to

serve the diverse needs of researchers across discovery,

translational and clinical research: PhenoCode™ Panels and

PhenoCycler®, PhenoImager® Fusion and PhenoImager HT Instruments.

To learn more about Akoya, visit www.akoyabio.com.

AKOYA BIOSCIENCES, INC. AND

SUBSIDIARYCondensed Consolidated Balance

Sheets (unaudited)(in

thousands)

|

|

|

|

|

|

|

|

| |

|

September 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

12,557 |

|

$ |

83,125 |

|

Marketable securities |

|

|

23,339 |

|

|

— |

|

Accounts receivable, net |

|

|

12,786 |

|

|

16,994 |

|

Inventories, net |

|

|

25,212 |

|

|

17,877 |

|

Prepaid expenses and other current assets |

|

|

2,967 |

|

|

3,794 |

| Total current assets |

|

|

76,861 |

|

|

121,790 |

| Property and equipment,

net |

|

|

7,546 |

|

|

10,729 |

| Marketable securities, net of

current portion |

|

|

3,399 |

|

|

— |

| Demo inventory, net |

|

|

792 |

|

|

893 |

| Intangible assets, net |

|

|

15,272 |

|

|

17,412 |

| Goodwill |

|

|

18,262 |

|

|

18,262 |

| Operating lease right of use

assets, net |

|

|

4,664 |

|

|

8,365 |

| Financing lease right of use

assets, net |

|

|

1,763 |

|

|

1,562 |

| Other non-current assets |

|

|

1,414 |

|

|

1,356 |

| Total assets |

|

$ |

129,973 |

|

$ |

180,369 |

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other current

liabilities |

|

$ |

18,128 |

|

$ |

25,209 |

|

Current portion of operating lease liabilities |

|

|

2,651 |

|

|

2,681 |

|

Current portion of financing lease liabilities |

|

|

1,026 |

|

|

767 |

| Deferred revenue |

|

|

6,188 |

|

|

6,688 |

| Total current liabilities |

|

|

27,993 |

|

|

35,345 |

| Deferred revenue, net of

current portion |

|

|

3,093 |

|

|

3,193 |

| Long-term debt, net |

|

|

75,902 |

|

|

75,254 |

| Contingent consideration

liability, net of current portion |

|

|

3,859 |

|

|

5,765 |

| Operating lease liabilities,

net of current portion |

|

|

4,562 |

|

|

6,238 |

| Financing lease liabilities,

net of current portion |

|

|

778 |

|

|

766 |

| Other long-term

liabilities |

|

|

153 |

|

|

38 |

| Total liabilities |

|

|

116,340 |

|

|

126,599 |

| Total stockholders'

equity |

|

|

13,633 |

|

|

53,770 |

| Total liabilities and

stockholders' equity |

|

$ |

129,973 |

|

$ |

180,369 |

| |

|

|

|

|

|

|

AKOYA BIOSCIENCES, INC. AND

SUBSIDIARYConsolidated Statements of

Operations (unaudited)(in

thousands, except share and per share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue |

|

$ |

12,298 |

|

|

$ |

18,048 |

|

|

$ |

40,364 |

|

|

$ |

50,719 |

|

|

Service and other revenue |

|

|

6,516 |

|

|

|

7,167 |

|

|

|

19,964 |

|

|

|

19,427 |

|

| Total revenue |

|

|

18,814 |

|

|

|

25,215 |

|

|

|

60,328 |

|

|

|

70,146 |

|

| Cost of goods sold: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product revenue |

|

|

4,430 |

|

|

|

6,208 |

|

|

|

17,620 |

|

|

|

19,747 |

|

|

Cost of service and other revenue |

|

|

2,660 |

|

|

|

3,731 |

|

|

|

9,219 |

|

|

|

10,714 |

|

| Total cost of goods sold |

|

|

7,090 |

|

|

|

9,939 |

|

|

|

26,839 |

|

|

|

30,461 |

|

| Gross profit |

|

|

11,724 |

|

|

|

15,276 |

|

|

|

33,489 |

|

|

|

39,685 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

14,672 |

|

|

|

20,251 |

|

|

|

53,629 |

|

|

|

67,281 |

|

|

Research and development |

|

|

4,474 |

|

|

|

6,314 |

|

|

|

15,316 |

|

|

|

19,614 |

|

|

Change in fair value of contingent consideration |

|

|

(763 |

) |

|

|

262 |

|

|

|

(496 |

) |

|

|

1,019 |

|

|

Impairment |

|

|

— |

|

|

|

— |

|

|

|

2,971 |

|

|

|

— |

|

|

Restructuring |

|

|

1,690 |

|

|

|

— |

|

|

|

3,087 |

|

|

|

— |

|

|

Total operating expenses |

|

|

20,073 |

|

|

|

26,827 |

|

|

|

74,507 |

|

|

|

87,914 |

|

| Loss from operations |

|

|

(8,349 |

) |

|

|

(11,551 |

) |

|

|

(41,018 |

) |

|

|

(48,229 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(2,625 |

) |

|

|

(2,239 |

) |

|

|

(7,843 |

) |

|

|

(6,468 |

) |

|

Interest income |

|

|

521 |

|

|

|

1,074 |

|

|

|

2,126 |

|

|

|

2,576 |

|

|

Other expense, net |

|

|

(36 |

) |

|

|

(185 |

) |

|

|

(277 |

) |

|

|

(338 |

) |

| Loss before provision for

income taxes |

|

|

(10,489 |

) |

|

|

(12,901 |

) |

|

|

(47,012 |

) |

|

|

(52,459 |

) |

| Provision for income

taxes |

|

|

(44 |

) |

|

|

(15 |

) |

|

|

(154 |

) |

|

|

(62 |

) |

| Net loss |

|

$ |

(10,533 |

) |

|

$ |

(12,916 |

) |

|

$ |

(47,166 |

) |

|

$ |

(52,521 |

) |

| Net loss per share

attributable to common stockholders, basic and diluted |

|

$ |

(0.21 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.96 |

) |

|

$ |

(1.23 |

) |

| Weighted-average shares

outstanding, basic and diluted |

|

|

49,503,272 |

|

|

|

48,975,432 |

|

|

|

49,370,959 |

|

|

|

42,686,065 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AKOYA BIOSCIENCES, INC. AND

SUBSIDIARYGross Profit to Non-GAAP Adjusted Gross

Profit Reconciliation and Calculation of Gross Margin and Non-GAAP

Adjusted Gross Margin

(unaudited)(in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Total revenue |

|

$ |

18,814 |

|

|

$ |

25,215 |

|

|

$ |

60,328 |

|

|

$ |

70,146 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

11,724 |

|

|

|

15,276 |

|

|

|

33,489 |

|

|

|

39,685 |

|

| Provision for excess and

obsolete inventories - product discontinuation and lease exit

inventory charges |

|

|

— |

|

|

|

— |

|

|

|

2,045 |

|

|

|

— |

|

| Non-GAAP adjusted gross

profit |

|

$ |

11,724 |

|

|

$ |

15,276 |

|

|

$ |

35,534 |

|

|

$ |

39,685 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

62 |

% |

|

|

61 |

% |

|

|

56 |

% |

|

|

57 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjusted gross

margin |

|

|

62 |

% |

|

|

61 |

% |

|

|

59 |

% |

|

|

57 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AKOYA BIOSCIENCES, INC. AND

SUBSIDIARYOperating Expense to Non-GAAP Operating

Expense Reconciliation

(unaudited)(in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Operating expenses |

|

$ |

20,073 |

|

|

$ |

26,827 |

|

$ |

74,507 |

|

|

$ |

87,914 |

| Impairment |

|

|

— |

|

|

|

— |

|

|

(2,971 |

) |

|

|

— |

| Restructuring |

|

|

(1,690 |

) |

|

|

— |

|

|

(3,087 |

) |

|

|

— |

| Non-GAAP operating

expenses |

|

$ |

18,383 |

|

|

$ |

26,827 |

|

$ |

68,449 |

|

|

$ |

87,914 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AKOYA BIOSCIENCES, INC. AND

SUBSIDIARYLoss From Operations to Non-GAAP Loss

From Operations Reconciliation

(unaudited)(in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Loss from operations |

|

$ |

(8,349 |

) |

|

$ |

(11,551 |

) |

|

$ |

(41,018 |

) |

|

$ |

(48,229 |

) |

| Provision for excess and

obsolete inventories - product discontinuation and lease exit

inventory charges |

|

|

— |

|

|

|

— |

|

|

|

2,045 |

|

|

|

— |

|

| Impairment |

|

|

— |

|

|

|

— |

|

|

|

2,971 |

|

|

|

— |

|

| Restructuring |

|

|

1,690 |

|

|

|

— |

|

|

|

3,087 |

|

|

|

— |

|

| Non-GAAP loss from

operations |

|

$ |

(6,659 |

) |

|

$ |

(11,551 |

) |

|

$ |

(32,915 |

) |

|

$ |

(48,229 |

) |

Investor Contact:

Priyam Shah

investors@akoyabio.com

Media Contact:

Christine Quern

media@akoyabio.com

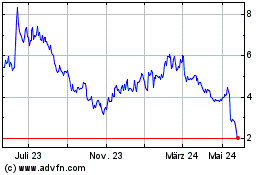

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

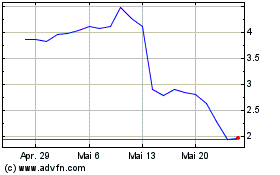

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025