false

0001522860

0001522860

2023-11-06

2023-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 6, 2023

____________________________

Acutus

Medical, Inc.

(Exact name of

Registrant as Specified in Its Charter)

____________________________

| Delaware |

001-39430 |

45-1306615 |

(State

or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS

Employer

Identification

No.) |

|

2210

Faraday Ave., Suite 100

Carlsbad, CA |

|

92008 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s

Telephone Number, Including Area Code: (442) 232-6080

Not Applicable

(Former Name

or Former Address, if Changed Since Last Report)

____________________________

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title

of Each Class |

Trading

Symbol(s) |

Name of Each Exchange on Which

Registered |

| Common

Stock, par value $0.001 |

AFIB |

The

Nasdaq Stock Market LLC

(Nasdaq Capital

Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02 Results of Operations and Financial Condition.

On November 8, 2023,

Acutus Medical, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended September

30, 2023. A copy of this press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The

information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, and it shall not be deemed incorporated by reference in any filing under the

Securities Act of 1933, as amended (the “Securities Act”), or under the Exchange Act, whether made before or after the date

hereof, except as expressly set forth by specific reference in such filing to Item 2.02 of this Current Report on Form 8-K.

Item

2.05 Costs Associated with Exit or Disposal Activities.

On November 6, 2023,

the Board approved a strategic realignment of resources and corporate restructuring (the “Restructuring”) designed to reallocate

capital from its mapping and ablation businesses to its left-heart access distribution relationship with Medtronic, Inc. (“Medtronic”).

The Company will wind down the mapping and ablation businesses and will no longer manufacture or distribute the AcQMap Mapping System,

the AcQMap 3D Mapping Catheter, the AcQBlate Force-Sensing Ablation Catheter, the AcGuide Max 2.0 steerable sheath, and associated accessories,

and will explore strategic alternatives for these businesses (including a potential sale of related assets). Following the Restructuring,

the Company will focus exclusively on the manufacturing and distribution of left-heart access products to Medtronic to continue to generate

revenue from such sales and potentially earn the associated earnout payments it may become eligible to receive under the Asset Purchase

Agreement dated April 26, 2022, between the Company and Medtronic.

As part of the Restructuring, the Company announced

a workforce reduction of approximately 160 employees, representing approximately 65% of the Company’s employees, that is expected

to be completed by the first quarter of 2024. In compliance with the Worker Adjustment and Retraining Notification Act, the Company has

provided pre-termination notices to affected employees and government authorities where required. The Company plans to enter into retention

arrangements with certain employees who are expected to remain with the Company to assist with the Restructuring and operation of its

left-heart access distribution business.

The Company estimates it will incur approximately

$21 million to $32 million of pre-tax restructuring and exit-related charges, of which $2 million to $3 million represents future cash

expenditures for the payment of severance and related benefit costs, $3 million to $4 million represents future cash expenditures for

the payment of retention bonuses to certain employees that will assist with the Restructuring, $2 million to $5 million represents future

cash expenditures for other restructuring costs, and approximately $14 million to $20 million represents non-cash pre-tax impairment

charges in connection with the disposition of certain assets, including inventory, fixed assets and intangibles. The Company expects

that a majority of the non-cash charges will be incurred in the fourth quarter of 2023, while the majority of the future cash charges

will be incurred in the first quarter of 2024, and that the Restructuring will be substantially complete in the first quarter of 2024.

Potential position

eliminations in each country are subject to local law and consultation requirements, which may extend the Restructuring implementation

beyond the first quarter of 2024 in certain countries. The charges that the Company expects to incur are subject to a number of assumptions,

including local law requirements in various jurisdictions, and actual expenses may differ from the estimates disclosed above. The Company

may also incur other charges or cash expenditures not currently contemplated due to events that may occur as a result of, or associated

with, the Restructuring.

Item

2.06 Material Impairments.

The information set

forth under Item 2.05 of this Current Report on Form 8-K is incorporated by reference herein.

Item 5.02 Departure of Directors

or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Planned Departure of President

and Chief Executive Officer; Chief Administrative Officer, General Counsel and Secretary; and Senior Vice President, Commercial

As part of the reduction in workforce described

above, (i) David Roman, the Company’s President and Chief Executive Officer, and Kevin Mathews, the Company’s Senior Vice

President, Commercial, are expected to separate from the Company, effective January 7, 2024 and (ii) Tom Sohn, the Company’s Chief

Administrative Officer, General Counsel and Secretary, is expected to separate from the Company, effective February 6, 2024. The separations

of Mr. Roman, Mr. Mathews, and Mr. Sohn are not due to any disagreement with the Company on any matter relating to the Company’s

operations, policies or practices. This event meets the definition of a Qualifying Termination pursuant to the employment agreements

of each of Mr. Roman, Mr. Mathews and Mr. Sohn entered into with the Company effective March 2021 (amended July 2022), May 2022, and

August 2020, respectively. As a result, each of Mr. Roman, Mr. Mathews, and Mr. Sohn are eligible to receive certain payments and benefits

following their separation in accordance with such agreements, each as described in the Company’s Proxy Statement on Schedule 14A

filed with the Securities and Exchange Commission (the “SEC”) on April 27, 2023 (the “Proxy Statement”) or included

with the Company’s Form 10-Q filed with the SEC on May 11, 2023.

In connection with

their departures, on November 6, 2023, the Board approved the acceleration of vesting of certain restricted stock units of the Company

(“RSUs”) granted to (i) certain terminated employees, in connection with the reduction in workforce and (ii) each of Mr.

Roman, Mr. Mathews, and Mr. Sohn, on March 1, 2023 under the Company’s 2020 Equity Incentive Plan, representing 67,500 RSUs, 21,250

RSUs and 21,250 RSUs, respectively, for the officers, which were originally scheduled to vest on March 1, 2024 pursuant to the terms

of such grants. Such RSUs will now fully vest on each such officer’s scheduled last day of employment with the Company on either

January 7, 2024, or February 6, 2024, as applicable, subject to their continued employment with the Company through such date.

In addition, on November

6, 2023, the Board approved a one-time retention bonus of $300,000 for Mr. Roman, $38,000 for Mr. Mathews, and $188,000 for Mr. Sohn,

provided that each such officer remains employed by the Company on January 7, 2024 or February 6, 2024, as applicable.

Appointment of Takeo Mukai as

Chief Executive Officer

On November 6, 2023,

the Board approved the appointment of Takeo Mukai as the Company’s Chief Executive Officer, effective January 8, 2024, subject

to the completion of the Restructuring, including the transition of executive management as described above. Mr. Mukai will also retain

his position as the Company’s Chief Financial Officer.

Mr. Mukai has served

as the Company’s Chief Financial Officer since January 2023. Mr. Mukai’s biographical information is described in the Proxy

Statement. There are no family relationships, as defined in Item 401 of Regulation S-K, between Mr. Mukai and any of the Company’s

executive officers or directors or persons nominated or chosen to become directors or executive officers. There is no arrangement or

understanding between Mr. Mukai and any other person pursuant to which Mr. Mukai was appointed as Chief Executive Officer or a member

of the Board. There are no transactions requiring disclosure under Item 404(a) of Regulation S-K.

In connection with

Mr. Mukai’s appointment as the Company’s Chief Executive Officer, effective January 8, 2024, subject to the completion of

the Restructuring, the Board approved a one-time retention bonus of $231,000 for Mr. Mukai.

Termination of Employee Stock

Purchase Plan

On November 6, 2023,

the Board terminated the 2020 Employee Stock Purchase Plan (“2020 ESPP”), effective November 8, 2023, and resolved to return

to the respective contributors all contributions made during the purchase period ending November 14, 2023. No new purchase periods under

the 2020 ESPP will commence as of the date of termination.

Item 7.01 Regulation FD Disclosure.

On

November 8, 2023, the Company issued a press release announcing the Restructuring. A copy of the press release is furnished as Exhibit

99.2 hereto and incorporated by reference herein.

The

information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 attached hereto, is being furnished and shall not

be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section,

and it shall not be deemed incorporated by reference in any filing under the Securities Act, or under the Exchange Act, whether made

before or after the date hereof, except as expressly set forth by specific reference in such filing to Item 7.01 of this Current Report

on Form 8-K.

Cautionary Note Regarding Forward-Looking

Statements

This Current Report

on Form 8-K and certain information incorporated herein by reference contain forward-looking statements within the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995. All statements included or incorporated by reference in this Current

Report on Form 8-K, other than statements that are purely historical, are forward-looking statements. Words such as “anticipate,”

“expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,”

“should,” “would,” “could,” “may” and similar expressions also identify forward-looking

statements. The forward-looking statements include, without limitation, statements regarding the Restructuring, including the estimated

timing and cost savings; whether the Restructuring will be successfully completed; the benefits of the Restructuring; the anticipated

timing and details of the reduction in workforce; the expected charges and costs associated with the Restructuring; the Company’s

plans to retain certain individuals as employees or consultants to assist in the Restructuring; the potential for and timing of the consummation

of sales of the Company’s assets or other strategic alternatives; and the Company’s business plans and objectives.

Our expectations,

beliefs, objectives, intentions and strategies regarding future results are not guarantees of future performance and are subject to risks

and uncertainties that could cause actual results to differ materially from results contemplated by our forward-looking statements. Factors

that may affect the actual results achieved by the Company include, without limitation, the risk that the Company may not be able to

implement the Restructuring or the exploration of strategic alternatives as currently anticipated or within the timing currently anticipated;

the risk that the Company may not be successful in identifying one or more strategic alternatives or ultimately pursuing a strategic

alternative that delivers the anticipated benefits; the impact of the workforce reduction on the Company’s remaining left-heart

access distribution business; the possibility that executives or other employees may resign or be terminated; the Company’s ability

to collaborate successfully with its strategic partners; the willingness of Medtronic to purchase the Company’s left-heart access

products and the timing of such purchases; the risk that the Company’s remaining left-heart access distribution business does not

advance or result in anticipated revenue; unexpected costs, charges or expenses that reduce the Company’s capital resources; the

Company’s ability to continue to pay its obligations in the ordinary course of business as they come due; unanticipated difficulties

in terminating certain contracts and arrangements; the Company’s ability to maintain its listing on Nasdaq; and the risk factors

listed from time to time in the Company’s filings with the SEC, as further described below.

We urge you to carefully

consider risks and uncertainties and review the additional disclosures we make concerning risks and uncertainties that may materially

affect the outcome of our forward-looking statements and our future business and operating results, including those made under the captions

“Risk Factors” contained in our most recently filed Form 10-K and Form 10-Q and subsequent filings with the SEC, as well

as the press releases attached as Exhibits 99.1 and 99.2 hereto. We assume no obligation to update any forward-looking statements, whether

as a result of new information, future events or otherwise, except as required by applicable law. You are cautioned not to place undue

reliance on forward-looking statements, which speak only as of the date of the filing of this Current Report on Form 8-K.

Item 9.01 Financial Statements and

Exhibits.

* Furnished herewith, not

filed.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly

authorized.

| |

Acutus Medical, Inc. |

| |

|

|

| |

|

|

| Date: November 8, 2023 |

By: |

/s/ Tom Sohn |

| |

|

Tom Sohn |

| |

|

Chief Administrative Officer, General Counsel and Secretary |

Exhibit 99.1

Acutus

Medical Reports Third Quarter 2023 Financial Results

CARLSBAD, Calif., November 8, 2023 (GLOBE NEWSWIRE) — Acutus

Medical, Inc. (“Acutus” or the “Company”) (Nasdaq: AFIB) today reported results for the third quarter of 2023.

Recent Highlights:

| • | Third quarter revenue of $5.2 million grew 44% year-over-year, led by strong growth in distribution revenue from sales of left-heart

access products to Medtronic |

| • | Registered significant year-over-year reductions in both GAAP and non-GAAP operating expenses and cash burn, resulting from disciplined

focus on expense management |

| • | Announced strategic realignment of resources and corporate restructuring with the objective of optimizing financial position and maximizing

free cash flow |

Third Quarter 2023 Financial Results

Revenue was $5.2 million for the third quarter of 2023, an increase of 44% compared to $3.6 million for the third quarter of 2022. The

improvement over the same quarter last year was primarily driven by sales through the Company’s distribution agreement with Medtronic,

higher capital sales, and increases in service, rent and other revenue.

Gross margin on a GAAP basis was negative 64% for the third quarter

of 2023 compared to negative 91% for the same quarter last year. Non-GAAP gross margin was negative 60% for the third quarter of 2023

compared to negative 109% for the same quarter last year. The improvement on both a GAAP and non-GAAP basis was driven by higher production

volumes primarily related to left-heart access manufacturing, lower manufacturing variances, and reduced manufacturing overhead expenses.

Operating expenses, consisting of research and development and selling,

general and administrative expenses on a GAAP basis were $12.2 million for the third quarter of 2023 compared to $15.6 million for the

same quarter last year. Non-GAAP operating expenses were $11.1 million for the third quarter of 2023 compared to $15.2 million for the

same quarter last year. The decrease in operating expenses on both a GAAP and Non-GAAP basis resulted from reduced discretionary spend,

and the reprioritization of certain research and development programs.

Net loss on a GAAP basis was $13.2 million for the third quarter of

2023 and net loss per share was $0.45 on a weighted average basic and diluted outstanding share count of 29.3 million, compared to a net

loss of $20.4 million and a net loss per share of $0.72 on a weighted average basic and diluted outstanding share count of 28.4 million

for the same quarter last year. Non-GAAP net loss for the third quarter of 2023 was $15.2 million, or $0.52 per share, compared to non-GAAP

net loss of $20.0 million, or $0.70 per share, for the third quarter of 2022.

Cash, cash equivalents, marketable securities and restricted cash were

$45.5 million as of September 30, 2023.

Outlook

Due to the announced plan to realign resources to support the left-heart access distribution business and exit from the electrophysiology

mapping and ablation businesses, the Company will no longer provide financial guidance.

Non-GAAP Financial Measures

This press release includes references to non-GAAP gross margin, non-GAAP operating expenses, non-GAAP net loss and non-GAAP basic and

diluted net loss per share, which are non-GAAP financial measures, to provide information that may assist investors in understanding the

Company’s financial results and assessing its prospects for future performance. The Company believes these non-GAAP financial measures

are important indicators of its operating performance because they exclude items that are primarily non-cash accounting line items unrelated

to,

and may not be indicative of, the Company’s core operating results.

These non-GAAP financial measures, as Acutus calculates them, may not necessarily be comparable to similarly titled measures of other

companies and may not be appropriate measures for comparing the performance of other companies relative to the Company. These non-GAAP

financial results are not intended to represent and should not be considered to be more meaningful measures than, or alternatives to,

measures of operating performance as determined in accordance with GAAP. Non-GAAP net loss is defined as net loss before income taxes,

and all non-GAAP figures provided herein adjust for stock-based compensation, amortization of acquisition-related intangibles, employee

retention credit, restructuring charges, changes in the fair value of contingent consideration, gain on sale of business, and change in

fair value of warrant liability (as applicable). To the extent such non-GAAP financial measures are used in the future, the Company expects

to calculate them using a consistent method from period to period. A reconciliation of the most directly comparable GAAP financial measure

to the non-GAAP financial measure has been provided under the heading “Reconciliation of GAAP Results to Non-GAAP Results”

in the financial statement tables attached to this press release.

About Acutus

Acutus is focused on the production of left-heart access products under its distribution agreement with Medtronic, Inc. Founded in 2011,

Acutus is based in Carlsbad, California.

Caution Regarding Forward-Looking Statements

This press release includes statements that may constitute “forward-looking” statements, usually containing the words

“believe,” “estimate,” “project,” “expect” or similar expressions. Forward-looking statements

inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Factors

that would cause or contribute to such differences include, but are not limited to, the Company’s ability to continue to manage

expenses and cash burn rate at sustainable levels, successful completion of the Company’s restructuring plan, continued acceptance

of the Company’s left-heart access products in the marketplace, the effect of global economic conditions on the ability and willingness

of Medtronic to purchase the Company’s left-heart access products and the timing of such purchases, competitive factors, changes

resulting from healthcare policy in the United States and globally including changes in government reimbursement of procedures, dependence

upon third-party vendors and distributors, timing of regulatory approvals, the Company’s ability to maintain its listing on Nasdaq,

and other risks discussed in the Company’s periodic and other filings with the Securities and Exchange Commission. By making these

forward-looking statements, Acutus undertakes no obligation to update these statements for revisions or changes after the date of this

release, except as required by law.

| Investor Contact: |

| Chad Hollister |

| Acutus Medical, Inc. |

| investors@acutus.com |

ACUTUS MEDICAL, INC.

Condensed Consolidated Balance Sheets

(in thousands, except per share amounts)

| | |

September

30, 2023 | |

December

31, 2022 |

| | |

| (unaudited) | | |

| | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 24,100 | | |

$ | 25,584 | |

| Marketable securities, short-term | |

| 14,375 | | |

| 44,863 | |

| Restricted cash, short-term | |

| 7,015 | | |

| 5,764 | |

| Accounts receivable | |

| 8,952 | | |

| 21,085 | |

| Inventory | |

| 15,728 | | |

| 13,327 | |

| Employer retention credit receivable | |

| — | | |

| 4,703 | |

| Prepaid expenses and other

current assets | |

| 2,467 | | |

| 2,541 | |

| Total current assets | |

| 72,637 | | |

| 117,867 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 6,611 | | |

| 9,221 | |

| Right-of-use asset, net | |

| 3,359 | | |

| 3,872 | |

| Intangible assets, net | |

| 1,433 | | |

| 1,583 | |

| Other assets | |

| 688 | | |

| 897 | |

| Total assets | |

$ | 84,728 | | |

$ | 133,440 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 4,754 | | |

$ | 4,721 | |

| Accrued liabilities | |

| 7,438 | | |

| 9,686 | |

| Contingent consideration, short-term | |

| — | | |

| 1,800 | |

| Operating lease liabilities, short-term | |

| 707 | | |

| 319 | |

| Warrant liability | |

| 1,868 | | |

| 3,346 | |

| Total current liabilities | |

| 14,767 | | |

| 19,872 | |

| | |

| | | |

| | |

| Operating lease liabilities, long-term | |

| 3,462 | | |

| 4,103 | |

| Long-term debt | |

| 34,761 | | |

| 34,434 | |

| Other long-term liabilities | |

| 32 | | |

| 12 | |

| Total liabilities | |

| 53,022 | | |

| 58,421 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' equity | |

| | | |

| | |

| Preferred stock, $0.001 par value;

5,000,000 shares authorized as of September 30, 2023 and December 31, 2022; 6,666 shares of the preferred stock, designated

as Series A Common Equivalent Preferred Stock, are issued and outstanding as of September 30, 2023 and December 31, 2022 | |

| — | | |

| — | |

| Common stock, $0.001 par value; 260,000,000 shares

authorized as of September 30, 2023 and December 31, 2022; 29,289,934 and 28,554,656 shares issued and outstanding as of

September 30, 2023 and December 31, 2022, respectively | |

| 29 | | |

| 29 | |

| Additional paid-in capital | |

| 598,842 | | |

| 594,173 | |

| Accumulated deficit | |

| (566,212 | ) | |

| (518,314 | ) |

| Accumulated other comprehensive loss | |

| (953 | ) | |

| (869 | ) |

| Total stockholders' equity | |

| 31,706 | | |

| 75,019 | |

| Total liabilities and stockholders'

equity | |

$ | 84,728 | | |

$ | 133,440 | |

ACUTUS MEDICAL, INC.

Condensed Consolidated Statements of Operations

and Comprehensive Loss

(in thousands, except per share amounts)

| | |

Three

Months Ended September 30, | |

Nine Months

Ended September 30, |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| | |

(unaudited) |

| Revenue | |

$ | 5,238 | | |

$ | 3,644 | | |

$ | 14,696 | | |

$ | 11,401 | |

| Cost of products sold | |

| 8,595 | | |

| 6,951 | | |

| 23,447 | | |

| 23,589 | |

| Gross profit | |

| (3,357 | ) | |

| (3,307 | ) | |

| (8,751 | ) | |

| (12,188 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses (income): | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 4,795 | | |

| 5,946 | | |

| 17,712 | | |

| 21,884 | |

| Selling, general and administrative | |

| 7,432 | | |

| 9,679 | | |

| 26,280 | | |

| 38,207 | |

| Goodwill impairment | |

| — | | |

| — | | |

| — | | |

| 12,026 | |

| Restructuring | |

| — | | |

| 1,331 | | |

| 475 | | |

| 2,280 | |

| Change in fair value of contingent consideration | |

| — | | |

| 198 | | |

| 123 | | |

| 1,153 | |

| Gain on sale of business | |

| (2,648 | ) | |

| — | | |

| (5,927 | ) | |

| (43,575 | ) |

| Total operating expenses | |

| 9,579 | | |

| 17,154 | | |

| 38,663 | | |

| 31,975 | |

| Loss from operations | |

| (12,936 | ) | |

| (20,461 | ) | |

| (47,414 | ) | |

| (44,163 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Loss on debt extinguishment | |

| — | | |

| — | | |

| — | | |

| (7,947 | ) |

| Change in fair value of warrant liability | |

| 636 | | |

| 904 | | |

| 1,478 | | |

| 904 | |

| Interest income | |

| 547 | | |

| 241 | | |

| 2,223 | | |

| 292 | |

| Interest expense | |

| (1,409 | ) | |

| (1,109 | ) | |

| (4,110 | ) | |

| (3,810 | ) |

| Total other income (expense), net | |

| (226 | ) | |

| 36 | | |

| (409 | ) | |

| (10,561 | ) |

| Loss before income taxes | |

| (13,162 | ) | |

| (20,425 | ) | |

| (47,823 | ) | |

| (54,724 | ) |

| Income tax expense | |

| 75 | | |

| — | | |

| 75 | | |

| — | |

| Net loss | |

$ | (13,237 | ) | |

$ | (20,425 | ) | |

$ | (47,898 | ) | |

$ | (54,724 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | |

| Unrealized gain on marketable securities | |

| 4 | | |

| 39 | | |

| 7 | | |

| — | |

| Foreign currency translation adjustment | |

| (66 | ) | |

| (351 | ) | |

| (91 | ) | |

| (904 | ) |

| Comprehensive loss | |

$ | (13,299 | ) | |

$ | (20,737 | ) | |

$ | (47,982 | ) | |

$ | (55,628 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share, basic and diluted | |

$ | (0.45 | ) | |

$ | (0.72 | ) | |

$ | (1.65 | ) | |

$ | (1.93 | ) |

| Weighted average shares outstanding, basic and diluted | |

| 29,262,768 | | |

| 28,359,516 | | |

| 29,024,353 | | |

| 28,273,207 | |

ACUTUS MEDICAL, INC.

Condensed Consolidated Statements of Cash Flows

(in thousands)

| | |

Nine Months

Ended

September 30, |

| | |

2023 | |

2022 |

| | |

(unaudited) |

| Cash flows from operating activities | |

| | | |

| | |

| Net loss | |

$ | (47,898 | ) | |

$ | (54,724 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation expense | |

| 3,498 | | |

| 4,653 | |

| AcQMap Systems converted to sales | |

| 238 | | |

| 266 | |

| Sales-type lease gain | |

| (310 | ) | |

| (87 | ) |

| Amortization of intangible assets | |

| 150 | | |

| 370 | |

| Non-cash stock-based compensation expense | |

| 4,915 | | |

| 7,497 | |

| (Accretion of discounts) amortization of premiums

on marketable securities, net | |

| (1,318 | ) | |

| 237 | |

| Amortization of debt issuance cost | |

| 325 | | |

| 741 | |

| Amortization of operating lease right-of-use assets | |

| 513 | | |

| 480 | |

| Loss on debt extinguishment | |

| — | | |

| 7,947 | |

| Goodwill impairment | |

| — | | |

| 12,026 | |

| Gain on sale of business, net | |

| (5,927 | ) | |

| (43,575 | ) |

| Direct costs paid related to sale of business | |

| — | | |

| (2,917 | ) |

| Change in fair value of warrant liability | |

| (1,478 | ) | |

| (904 | ) |

| Loss on disposal of property and equipment | |

| 268 | | |

| — | |

| Change in fair value of contingent consideration | |

| 123 | | |

| 1,153 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 1,244 | | |

| 420 | |

| Inventory | |

| (2,401 | ) | |

| 1,812 | |

| Employer retention credit receivable | |

| 4,703 | | |

| — | |

| Prepaid expenses and other current assets | |

| 420 | | |

| (4,296 | ) |

| Other assets | |

| 495 | | |

| 386 | |

| Accounts payable | |

| (2 | ) | |

| (2,929 | ) |

| Accrued liabilities | |

| (2,430 | ) | |

| (179 | ) |

| Operating lease liabilities | |

| (253 | ) | |

| (390 | ) |

| Other long-term liabilities | |

| 20 | | |

| (40 | ) |

| Net cash used in operating activities | |

| (45,105 | ) | |

| (72,053 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Proceeds from sale of business | |

| 17,000 | | |

| 50,000 | |

| Purchases of available-for-sale marketable securities | |

| (38,521 | ) | |

| (33,235 | ) |

| Sales of available-for-sale marketable securities | |

| — | | |

| 18,599 | |

| Maturities of available-for-sale marketable securities | |

| 70,250 | | |

| 59,642 | |

| Purchases of property and equipment | |

| (1,394 | ) | |

| (2,473 | ) |

| Net cash provided by investing activities | |

| 47,335 | | |

| 92,533 | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Repayment of debt | |

| — | | |

| (44,550 | ) |

| Penalty fees paid for early prepayment of debt | |

| — | | |

| (1,063 | ) |

| Borrowing under new debt | |

| — | | |

| 34,825 | |

| Payment of debt issuance costs | |

| — | | |

| (626 | ) |

| Proceeds from the exercise of stock options | |

| 4 | | |

| 66 | |

| Repurchase of common shares to pay employee withholding

taxes | |

| (275 | ) | |

| (62 | ) |

| Proceeds from employee stock purchase plan | |

| 25 | | |

| 182 | |

| Payment of contingent consideration | |

| (1,923 | ) | |

| (873 | ) |

| Net cash used in financing activities | |

| (2,169 | ) | |

| (12,101 | ) |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash, cash equivalents

and restricted cash | |

| (294 | ) | |

| (447 | ) |

| | |

| | | |

| | |

| Net change in cash, cash equivalents and restricted cash | |

| (233 | ) | |

| 7,932 | |

| Cash, cash equivalents and restricted cash, at the

beginning of the period | |

| 31,348 | | |

| 24,221 | |

| Cash, cash equivalents and restricted

cash, at the end of the period | |

$ | 31,115 | | |

$ | 32,153 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 3,731 | | |

$ | 3,101 | |

| | |

Nine Months

Ended

September 30, |

| | |

2023 | |

2022 |

| | |

(unaudited) |

| Supplemental disclosure of noncash investing and financing activities: | |

| |

|

| Accounts receivable from sale of business | |

$ | 6,111 | | |

$ | — | |

| Change in unrealized (gain) loss on marketable securities | |

$ | (7 | ) | |

$ | — | |

| Change in unpaid purchases of property and equipment | |

$ | 35 | | |

$ | 48 | |

| Contingent consideration escrow release | |

$ | — | | |

$ | 380 | |

| Net book value on AcQMap system sales-type leases | |

$ | 238 | | |

$ | 244 | |

| Amount of debt proceeds allocated to warrant liability | |

$ | — | | |

$ | 3,379 | |

ACUTUS MEDICAL, INC.

Reconciliation of GAAP Results to Non-GAAP Results

(in thousands)

(unaudited)

| Three Months Ended September 30, 2023 | |

Cost of

Products Sold | |

Research

and Development | |

Selling,

General and Administrative | |

Loss from

Operations | |

Other

Expense, Net | |

Net Loss | |

Basic

and Diluted EPS |

| Reported | |

$ | 8,595 | | |

$ | 4,795 | | |

$ | 7,432 | | |

$ | (12,936 | ) | |

$ | (226 | ) | |

$ | (13,237 | ) | |

$ | (0.45 | ) |

| Amortization of acquired intangibles | |

| (50 | ) | |

| — | | |

| — | | |

| 50 | | |

| — | | |

| 50 | | |

| — | |

| Stock-based compensation | |

| (146 | ) | |

| (317 | ) | |

| (815 | ) | |

| 1,278 | | |

| — | | |

| 1,278 | | |

| 0.04 | |

| Change in fair value of warrant liability | |

| — | | |

| — | | |

| — | | |

| — | | |

| (636 | ) | |

| (636 | ) | |

| (0.02 | ) |

| Change in fair value of contingent consideration | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 0.00 | |

| Gain on sale of business | |

| — | | |

| — | | |

| — | | |

| (2,648 | ) | |

| — | | |

| (2,648 | ) | |

| (0.09 | ) |

| Adjusted | |

$ | 8,399 | | |

$ | 4,478 | | |

$ | 6,617 | | |

$ | (14,256 | ) | |

$ | (862 | ) | |

$ | (15,193 | ) | |

$ | (0.52 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Three Months Ended September 30, 2022 | |

Cost of

Products Sold | |

Research

and Development | |

Selling,

General and Administrative | |

Loss from

Operations | |

Other

Income (Expense), Net | |

Net Loss | |

Basic

and Diluted EPS |

| Reported | |

$ | 6,951 | | |

$ | 5,946 | | |

$ | 9,679 | | |

$ | (20,461 | ) | |

$ | 36 | | |

$ | (20,425 | ) | |

$ | (0.72 | ) |

| Amortization of acquired intangibles | |

| (50 | ) | |

| — | | |

| — | | |

| 50 | | |

| — | | |

| 50 | | |

| — | |

| Stock-based compensation | |

| (93 | ) | |

| (349 | ) | |

| (1,442 | ) | |

| 1,884 | | |

| — | | |

| 1,884 | | |

| 0.07 | |

| Change in fair value of warrant liability | |

| — | | |

| — | | |

| — | | |

| — | | |

| (904 | ) | |

| (904 | ) | |

| (0.03 | ) |

| Change in fair value of contingent consideration | |

| — | | |

| — | | |

| — | | |

| 198 | | |

| — | | |

| 198 | | |

| 0.01 | |

| Restructuring | |

| — | | |

| — | | |

| — | | |

| 1,331 | | |

| — | | |

| 1,331 | | |

| 0.05 | |

| Employee retention credit | |

| 813 | | |

| 414 | | |

| 919 | | |

| (2,146 | ) | |

| — | | |

| (2,146 | ) | |

| (0.08 | ) |

| Adjusted | |

$ | 7,621 | | |

$ | 6,011 | | |

$ | 9,156 | | |

$ | (19,144 | ) | |

$ | (868 | ) | |

$ | (20,012 | ) | |

$ | (0.70 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

ACUTUS MEDICAL, INC.

Key Business Metrics

(unaudited)

Installed Base and Procedure Volumes

The total installed base which includes AcQMap Systems as of September 30,

2023 and 2022 are as follows:

| | |

As of

September 30, |

| | |

2023 | |

2022 |

| Acutus | |

| |

|

| U.S. | |

| 26 | | |

| 32 | |

| Outside the U.S. | |

| 56 | | |

| 42 | |

| Total Acutus net system placements | |

| 82 | | |

| 74 | |

Procedure volumes for the three and nine months ended September 30,

2023 and 2022 are as follows:

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September

30, | |

September

30, |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| Procedure volumes | |

| 531 | | |

| 441 | | |

| 1,566 | | |

| 1,389 | |

Revenue

The following table sets forth the Company’s revenue for disposables,

systems and service/other for the three and nine months ended September 30, 2023 and 2022 (in thousands):

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September

30, | |

September

30, |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| Disposables | |

$ | 4,069 | | |

$ | 2,857 | | |

$ | 11,409 | | |

$ | 9,402 | |

| Systems | |

| 563 | | |

| 476 | | |

| 1,254 | | |

| 823 | |

| Service / other | |

| 606 | | |

| 311 | | |

| 2,033 | | |

| 1,176 | |

| Total revenue | |

$ | 5,238 | | |

$ | 3,644 | | |

$ | 14,696 | | |

$ | 11,401 | |

The following table presents revenue by geographic location for the

three and nine months ended September 30, 2023 and 2022 (in thousands):

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September

30, | |

September

30, |

| | |

2023 | |

2022 | |

2023 | |

2022 |

| United States | |

$ | 3,347 | | |

$ | 1,925 | | |

$ | 8,720 | | |

$ | 5,985 | |

| Outside the United States | |

| 1,891 | | |

| 1,719 | | |

| 5,976 | | |

| 5,416 | |

| Total revenue | |

$ | 5,238 | | |

$ | 3,644 | | |

$ | 14,696 | | |

$ | 11,401 | |

Exhibit 99.2

| Press Release |

|

Acutus Medical Announces Strategic Realignment of

Resources and Corporate Restructuring

CARLSBAD, Calif., November 8, 2023 (GLOBE NEWSWIRE) – Acutus Medical,

Inc. (“Acutus” or the “Company”) (Nasdaq: AFIB), today announced a realignment of resources and corporate restructuring.

Scott Huennekens, Chairman of Acutus, commented, “Following an

extensive strategic review by the Company’s Board of Directors, we are taking the hard but necessary steps to streamline our operations.

In light of the current financing environment and the capital investments required to achieve leadership in the electrophysiology (EP)

market, we have concluded that the optimal use of the Company’s resources is to reallocate capital from our mapping and ablation

business to the manufacturing of left-heart access products for Medtronic, which we believe will maximize the potential for future earnouts

and cash flow.”

David Roman, President & CEO of Acutus added, “The realignment

of resources and corporate restructuring unfortunately impacts our team. It is undoubtedly difficult to part with our valued and highly

talented colleagues who have made substantial contributions to our Company. I want to thank each one of them for their dedication to Acutus

and our mission.”

Strategic Realignment of Resources and Corporate Restructuring

The Company is implementing a shift in its business model to solely support the manufacturing and distribution of Medtronic’s left-heart

access products and to capture the value associated with potential earnout payments from Medtronic.

Under

this new business model, the Company will wind down the EP mapping and ablation business, including the AcQMap Mapping System, the AcQMap

3D Mapping Catheter, the AcQBlate Force-Sensing Ablation Catheter, the AcGuide Max 2.0 steerable sheath, and associated accessories. The

Company will support AcQMap procedures with a small group of therapy managers through November 30, 2023.

Acutus has begun implementation of a corporate restructuring

to realign resources to support the left-heart access distribution business, which will result in reducing the Company’s workforce

by approximately 65%. Restructuring actions are expected to meaningfully reduce cash burn as well as ongoing operating expenses and are

expected to be completed in the first quarter of 2024.

Post restructuring, Acutus will become a contract manufacturing business

with the potential to generate positive cash flow over the next several years. Further, the Company will continue to work with its strategic

and financial advisors with the goal of maximizing the benefits of this new business model.

Financial Impact

Going forward, the Company’s exclusive sources of revenue will come from the sale of left-heart access products at transfer prices

specified in Acutus’ existing distribution agreement with Medtronic and any fee-bearing transition services, with the Company’s

operating expenses and working capital utilized to support manufacturing, quality, and supply chain related activities as well as general

and administrative functions.

Under the Asset Purchase Agreement dated April 26, 2022, between Acutus

and Medtronic, Acutus is eligible to receive net-sales earnouts under the following terms: 100% of total net end-user sales in year 1;

75% of total net end-user sales in year 2; and 50% of total net end-user sales in years 3 and 4. The annual measurement period for net

sales earnouts began on January 30, 2023, and any such earnout payments would begin in April 2024 and continue annually each year thereafter

until 2027.

As of September 30, 2023, the Company had $45.5 million in cash, cash

equivalents, marketable securities, and restricted cash. Once restructuring actions are completed, the Company expects that cash

| Press Release |  |

on hand, distribution revenue from left-heart access products to Medtronic,

and future earn-outs will be sufficient to service the Company’s outstanding debt and fund the remaining business.

WARN Act

The WARN Act requires employers to provide sixty days advance notice to employees and certain government entities before conducting any

mass layoff, relocation, or termination that affects more than fifty full-time employees and equivalents. The Company has notified affected

employees and required government authorities.

About Acutus Medical

Acutus is focused on the production of left-heart access products under

its distribution agreement with Medtronic, Inc. Founded in 2011, Acutus is based in Carlsbad, California.

Caution Regarding Forward-Looking Statements

This press release includes statements that may constitute “forward-looking”

statements, usually containing the words “believe,” “estimate,” “project,” “expect” or

similar expressions. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially

from the forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, the Company’s

ability to continue to manage expenses and cash burn rate at sustainable levels, successful completion of the Company’s restructuring

plan on the expected timeline and within the expected cost range, continued acceptance of the Company’s left-heart access products

in the marketplace, the effect of global economic conditions on the ability and willingness of Medtronic to purchase the Company’s

left-heart access products and the timing of such purchases, competitive factors, changes resulting from healthcare policy in the United

States and globally, including changes in government reimbursement of procedures, dependence upon third-party vendors and distributors,

timing of regulatory approvals, the Company’s ability to maintain its listing on Nasdaq, and other risks discussed in the Company’s

periodic and other filings with the Securities and Exchange Commission. By making these forward-looking statements, Acutus undertakes

no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Follow Acutus Medical on: X (Formerly Twitter), LinkedIn,

and YouTube.

| Investor Contact: |

| Chad Hollister |

| Acutus Medical, Inc. |

| investors@acutus.com |

v3.23.3

Cover

|

Nov. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 06, 2023

|

| Entity File Number |

001-39430

|

| Entity Registrant Name |

Acutus

Medical, Inc.

|

| Entity Central Index Key |

0001522860

|

| Entity Tax Identification Number |

45-1306615

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2210

Faraday Ave.

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Carlsbad

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92008

|

| City Area Code |

442

|

| Local Phone Number |

232-6080

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001

|

| Trading Symbol |

AFIB

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

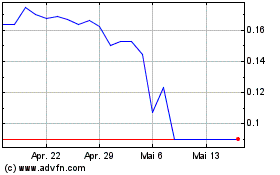

Acutus Medical (NASDAQ:AFIB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Acutus Medical (NASDAQ:AFIB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024