Current Report Filing (8-k)

10 September 2021 - 11:14PM

Edgar (US Regulatory)

0001750106

false

0001750106

2021-09-03

2021-09-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 3, 2021

|

ALSET

EHOME INTERNATIONAL INC.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Delaware

|

|

001-39732

|

|

83-1079861

|

|

(State

of incorporation

or

organization)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

4800

Montgomery Lane, Suite 210

Bethesda,

Maryland 20814

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code (301) 971-3940

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol(s)

|

|

Name

of Each Exchange on Which Registered

|

|

Common

Stock, $0.001 par value

|

|

AEI

|

|

The

Nasdaq Stock Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Subscription

Agreement to Purchase Shares of Document Security Systems, Inc.

On

September 3, 2021, Alset EHome International Inc. (the “Company”), entered into a subscription agreement (the “Subscription

Agreement”) to purchase 12,155,591 shares

of the common stock of Document Security Systems, Inc. (“DSS”) for a price of $1.234 per share for an aggregate purchase

price of approximately $15 Million. This transaction closed on September 8, 2021.

Prior

to this transaction, the Company indirectly held a significant investment in DSS through majority-owned subsidiaries. The Company’s

Chairman and CEO, Chan Heng Fai, and a member of the Company’s Board of Directors, Wu Wai Leung William, each serve on both the

Company’s Board and the Board of DSS. Each of Mr. Chan and Mr. Wu recused themselves from any deliberation or vote regarding this

investment in DSS. The Audit Committee of the Company’s Board of Directors reviewed, approved and determined that it is advisable

and in the best interests of the Company to complete the transaction described above. The Company’s Board of Directors approved

the Subscription Agreement and the transaction in connection therewith.

The

foregoing description of the Subscription Agreement does not purport to be complete and is qualified in its entirety by reference to

the complete text of the Subscription Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

DSS

Investment into American Pacific Bancorp, Inc.

On

September 8, 2021, the Company’s subsidiary American Pacific Bancorp, Inc. (“APB”) entered into a purchase agreement

(the “Purchase Agreement”) for APB to sell DSS 6,666,700 shares of the Class A Common Stock of APB for $6.00 per share, for

an aggregate purchase price of $40,000,200. This transaction closed on September 9, 2021. Following this transaction, DSS has become

the majority owner of APB.

Each

of Mr. Chan and Mr. Wu recused themselves from any deliberation or vote regarding the transactions between APB and DSS. The Audit Committee

of the Company’s Board of Directors reviewed, approved and determined that it is advisable and in the best interests of the Company

for APB to complete the sale of APB Class A Common Stock to DSS. The Company’s Board of Directors approved the Purchase Agreement

and the transaction in connection therewith. The Board of Directors of APB also approved this transaction.

The

foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the

complete text of the Purchase Agreement, a copy of which is filed as Exhibit 10.2 to this Current Report on Form 8-K.

Item

2.01 Completion of Acquisition or Disposition of Assets.

The

disclosures set forth in Item 1.01 of this Current Report are incorporated by reference herein.

Item

7.01 Regulation FD Disclosure.

September

8, 2021 and September 9, 2021 Press Releases

On

September 8, 2021, the Company issued a press release (the “DSS Press Release”) describing the closing of the Company’s

investment in DSS as described in Item 1.01, above. On September 9, 2021, the Company issued a press release (the “APB Press Release”)

describing the closing of DSS’ investment in the Company’s subsidiary APB.

A

copy of the DSS Press Release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K. A copy of the APB Press Release

is being furnished as Exhibit 99.2 to this Current Report on Form 8-K. The information contained in either the DSS Press

Release or the APB Press Release shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange

Act, except as shall be expressly set forth by specific reference in such a filing. The furnishing of the information in the DSS Press

Release and the APB Press Release is not intended to, and does not, constitute a representation that such furnishing is required by Regulation

FD or that the information contained in either the DSS Press Release or APB Press Release constitutes material investor information that

is not otherwise publicly available.

This

Current Report on Form 8-K and exhibits may contain these types of statements, which are “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995, and which involve risks, uncertainties and reflect the Registrant’s

judgment as of the date of this Current Report on Form 8-K. Forward-looking statements may relate to, among other things, operating results

and are indicated by words or phrases such as “expects,” “should,” “will,” and similar words or phrases.

These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated

at the date of this Current Report on Form 8-K. The Company disclaims any obligation to, and will not, update any forward-looking statements

to reflect events or circumstances after the date hereof. Investors are cautioned not to rely unduly on forward-looking statements when

evaluating the information presented within.

Item

9.01 Financial Statements and Exhibits.

|

Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Subscription Agreement by and among Document Security Systems, Inc. and Alset EHome International, Inc., dated as of September 3, 2021.

|

|

10.2

|

|

Class A Common Stock Purchase Agreement, dated as of September 8, 2021 among American Pacific Bancorp, Inc. and Document Security Systems, Inc.

|

|

99.1

|

|

Press Release dated September 8, 2021

|

|

99.2

|

|

Press Release dated September 9, 2021

|

|

104

|

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

ALSET

EHOME INTERNATIONAL INC.

|

|

|

|

|

|

Date:

September 10, 2021

|

By:

|

/s/

Rongguo Wei

|

|

|

Name:

|

Rongguo

Wei

|

|

|

Title:

|

Co-Chief

Financial Officer

|

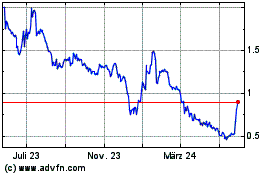

Alset (NASDAQ:AEI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

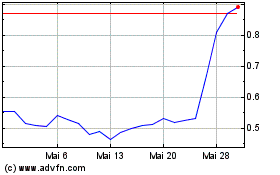

Alset (NASDAQ:AEI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025